It is official that the stock market has gone into full casino mode. Since the March low the S&P 500 has rallied to the tune of 60 percent. The only other time you will see such a fierce rally was during the Great Depression. Yet what people fail to see in the current system is the massive amounts of government sponsored juice and housing-roids that are making the system act like it just drank 10 cans of Red Bull. Ultimately after all this partying runs its course, another deep hangover is going to happen. Interestingly enough, if you look at the market sentiment in 1929 you would be hard pressed to find dissenting voices. Those that did make any noise were pushed to the back and the media simply did not cover their warnings. With our current situation, you have the vast majority of those that called it right saying that we need to be cautious of the double-dip recession or to proceed carefully. This is getting a lot of play yet in the midst of all this the market is getting tweaked from the crony banking system. Easy to make lots of money when your biggest trading partner is the U.S. Government.

In a first trial run of the public private investment program, we get a taste of government sponsored juice:

“(FDIC) The FDIC has signed a bid confirmation letter with Residential Credit Solutions (RCS), the winning bidder in a pilot sale of receivership assets that the FDIC is conducting to test the funding mechanism for the Legacy Loans Program (LLP). The pilot sale was conducted on a competitive bid basis, and final bids were received on Monday, August 31, 2009. A total of 12 consortiums bid to purchase an ownership interest in a limited liability company (LLC), to which the FDIC will convey a portfolio of residential mortgage loans with an unpaid principal balance of approximately $1.3 billion owned by the FDIC as Receiver of Franklin Bank, SSB, Houston, Texas. The pilot sale involves financing offered by the receivership to the LLC using an amortizing note guaranteed by the FDIC. Bidders for the pilot sale were given the chance to bid two different leverage options, 6-to-1 or 4-1, or to submit a cash bid for a 20 percent ownership interest.

The bid received from RCS for the financed sale of assets to the LLC using 6-to-1 leverage was determined to be the offer that would result in the greatest return for the receivership of all competing bids. RCS will pay a total of $64,215,000 in cash for a 50 percent equity stake in the LLC, and the LLC will issue a note of $727,770,000 to the FDIC as Receiver. The note will be guaranteed by FDIC in its corporate capacity. Based on the FDIC’s analysis and assumptions, the present value of this bid equals 70.63 percent of the outstanding principal balance of this portfolio. The FDIC received various other bids that were very competitive. The FDIC anticipates selling the note at a future date. After the closing, which is expected to occur later this month, RCS will manage the portfolio and service the loans under the Home Affordable Modification Program (HAMP) guidelines.”

What a mess. I’m not even sure why they are touting this as a success. The loan portfolio has unpaid principal of $1.3 billion. To get a piece of the action, the winning bidder only had to front $64 million! Did you get that? The public private investment program is off to a perfectly stunning crony start. So not only did we give some good financial crack to this bidder, but then we are going to offer the HAMP (hemp?) program on the loans thus costing more money! The other people’s money mentality is alive and well. The PPIP is a mess and it is now being called the Legacy Loans Program. In other words, this is the toxic crap mortgage program. The zombie assets. The sewage filled nuclear mortgage waste.

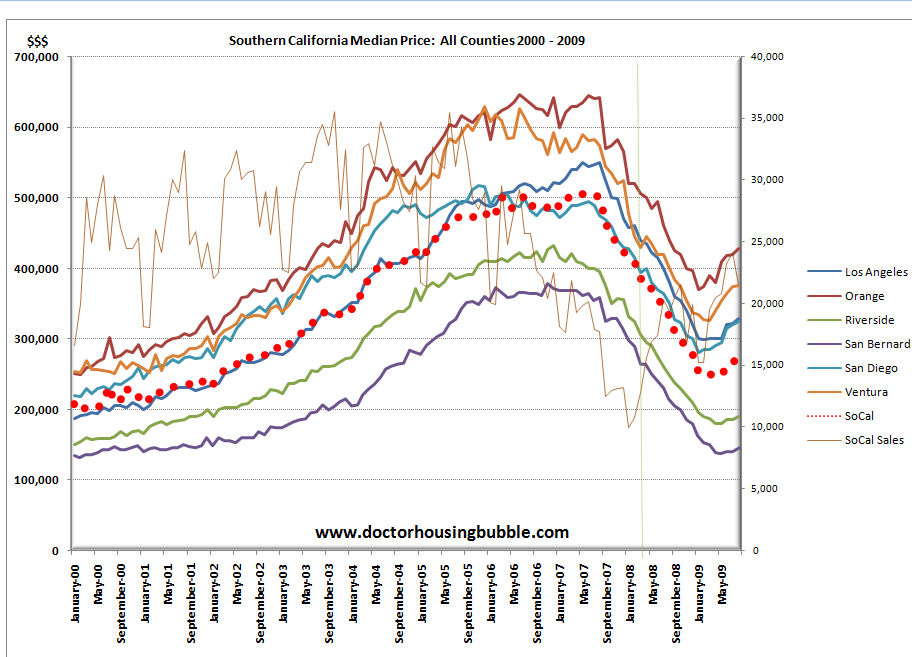

Now coming back to California, there are many reasons for us to be cautious regarding the housing market. Data for August was released and Southern California sales dropped yet the median price moved up a bit. Let us look at the movement:

FHA loans made 37.4 percent of all home purchases. The month to month sales drop was rather significant coming in at 10.8 percent. Foreclosure resales made up 38 percent of all sold homes. What we are seeing is a crossroads of low priced homes being sold through the system while the mid to upper tiers of the market remain stubbornly overpriced. It would appear that the gas at the lower end may be running out. At a certain point you run out of those lower priced areas that made up the bulk of the sales volume for the last year. We are also entering the slower fall and winter selling seasons.

The U.S. Treasury and Federal Reserve have flooded the system with nearly $13 trillion. It is astounding that the banking system has no shame in trying to make a PR campaign from paying back the few billion in TARP dollars. Goldman Sachs is basically using the Federal Reserve as a piggy bank in juicing the system again and bonuses are back up to their boom levels. The current narrative in the MSM is that “things are getting less worse and we’ve avoided financial Armageddon” yet we now have 26 million Americans that are unemployed or underemployed. And companies hiring are at rock bottom rates. Two years into the crisis and these are the things going on.

In what should be an even more popular issue HR 1207 to audit the Fed is garnering support from all camps that actually stand for common sense and what is right. Ron Paul’s bill has the majority of the House support. The bill is strikingly simple:

“Federal Reserve Transparency Act of 2009 – Repeals the authority of the Comptroller General to carry out an onsite examination of an open insured bank or bank holding company only if the appropriate federal regulatory agency has consented in writing. (Retains the authority of the Comptroller General to audit a federal agency.) Directs the Comptroller General to complete, before the end of 2010, an audit of the Board of Governors of the Federal Reserve System and of the federal reserve banks, followed by a detailed report to Congress.”

It should be a shock that this isn’t a law already. Of course the Federal Reserve is fighting this because it has much to hide. It would like to continue on the path of happy TARP repayment talks while the public is obvious to the trillions still backing the crony banking system. It would ruin the TARP repayment lullaby when the public gets to see trillions back stopping the corrupt Wall Street machine. Why else would you have such divergent figures like Ron Paul and Dennis Kucinich backing a similar bill? This strikes at common sense.

In California, the state is teetering yet the housing market is being pumped by the same typical charlatans. Let us examine 5 reasons to have caution with the current “recovery”:

Reason #1 – Tax Credit

The tax credit juice is expensive nonsense and horrible public policy. Recent estimates put the taxpayer cost of each new home acquisition at $40,000 – much more than the touted $8,000 gimmick. The typical cheerleaders are pushing this bill:

“(NY Times) The real estate industry, including the powerful 1.1 million-member National Association of Realtors, wants Congress to extend the credit at least through next summer. The group hopes to expand the program to $15,000 and to allow all buyers, not just those who have been out of the market for at least three years, to qualify. The price tag on that plan: $50 billion to $100 billion.

Joseph and Chassity Myers are among the two million buyers eligible for the credit this year. The newlyweds heard they could get money from the government for something they were tempted to do anyway.

“It was a no-brainer,” said Mr. Myers, a commercial underwriter. “Owning something is the American family dream.”

This kind of lobbyist led legislation is what is fundamentally wrong with our system. The NAR spends a few million to oil up their Congress representatives and all of a sudden you have a bill worth billions. It is money well spent, for the NAR. Yet it does not help the average American. A $15,000 tax credit is pure insanity when the median price of an American home is under $200,000. Plus, removing the three year factor is only going to juice more sales. As the last line highlights, Americans will spend anything they can get their hands on:

“The couple bought a two-bedroom condominium here in the spring for $171,000 and amended their 2008 taxes immediately, receiving their windfall by direct deposit a few weeks later.

Their home is now a monument to the government’s generosity. They bought a leather couch, a kitchen table, a bed, television stand, china cabinet, kitchen table, coffee table, grill and patio set.

“We did exactly what the government wanted us to do,” said Ms. Myers, a third grade teacher. “We stimulated the economy.”

Spending beyond our means is what got us into this mess. So according to the government spending on crap is going to get us out. Wall Street is all the more willing to sacrifice the long term stability of our nation for short-term Pavlovian consumer happiness. This will be short lived. This isn’t like 2007 when you had the vast majority drinking Kool-Aid. Now, the public realizes something is rotten in Denmark when jobs are disappearing yet they are being told all is well. The consumer hamster is now cognizant of the wheel.

These are one time injections. So what happens when this juice runs out? Are we then going to do a $30,000 tax credit? If you remember, it started out with a $7,500 tax credit that had to be repaid over 15 years. That didn’t intoxicate the market so then it went to the current $8,000 tax credit that was courtesy of the American public who didn’t purchase a home since the credit was enacted. Dean Baker who called the bubble years ago, recently bought a place, and has been on point in many ways had this to say:

“Dean Baker of the Center for Economic and Policy Research called the credit “a questionable redistributive policy” from renters to home buyers, but said that he used it himself when he bought a house.

He wrote on his blog: “Thank you very much, suckers!”

Reason #2 – Supply of Lower Priced Homes

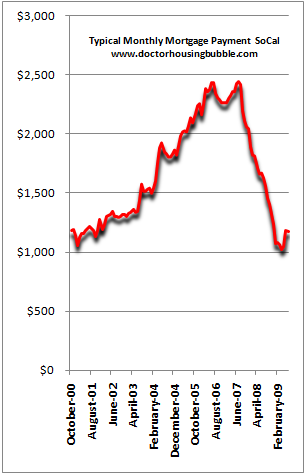

Last month in Southern California the typical monthly mortgage commitment of buyers was $1,200. It is interesting that a year or so ago I had many people in the Inland Empire asking me whether it was time to buy. In many cases it was. Those e-mails are long gone. In some areas rent versus owning your home were virtually the same. It was a no-brainer if you had a stable job to purchase a home. But the recent e-mails reveal a stalemate at the mid-tier of the market. Mini bidding wars. Prices coming over asking price. The typical things of the bubble. Many e-mails are from people itching to buy and are scared that they’ll miss out on another bubble. Stop chasing the herd! It is amazing that people that are mostly rational about everything else in life can be caught up in a mania. Groucho Marx who by many accounts was frugal even after becoming a celebrity, could not resist jumping into the stock market mania right before the Great Depression hit. Even during the good times he knew the gig was a “racket” of epic proportions.

Do the math above. If the typical payment is $1,200 where do you think the bulk of people are buying? And even if they are buying in so-called prime locations, are they buying the most expensive home? Just take a look at some of the Real Homes of Genius examples and you will get a sense of what is occurring.

The drop in sales was largely based on lower priced home sales slowing down. After a furious pace for a year, first time buyers or investors have bought up many places and are running out of fuel. I expect this trend to continue. But wait until you start seeing more foreclosures in the mid to upper tiers of the market. To think a different pattern is going to happen is absurd.

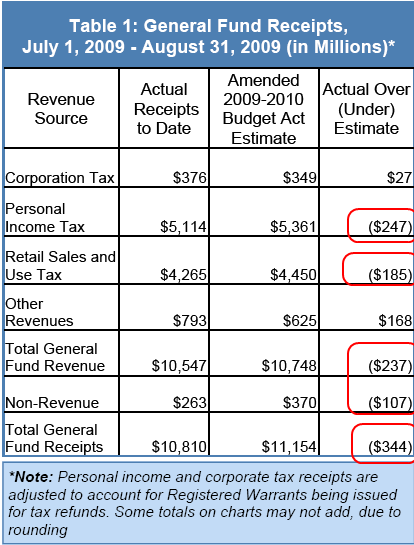

Reason #3 – State Budget

If you have been caught up in bubble mania part two, the state once again is on path to missing budget projections. The state missed estimates again by $237 million in the last estimate. Personal income tax is down and so is sales tax. Keep in mind this is occurring while the tax rate has gone up. Unemployed people have less to spend and obviously won’t be paying any income tax, the biggest revenue line item for the state.

How is this news good for housing? The state is cutting back. There is already projections of more deficits for the next year. Meaning more taxes or more cuts. For example, fees are going up on state colleges and that will take away more discretionary income. Plus, with accounting shenanigans the massive stock market losses can be carried over for years thus negating any casino like jumps of the current 60 percent rise.

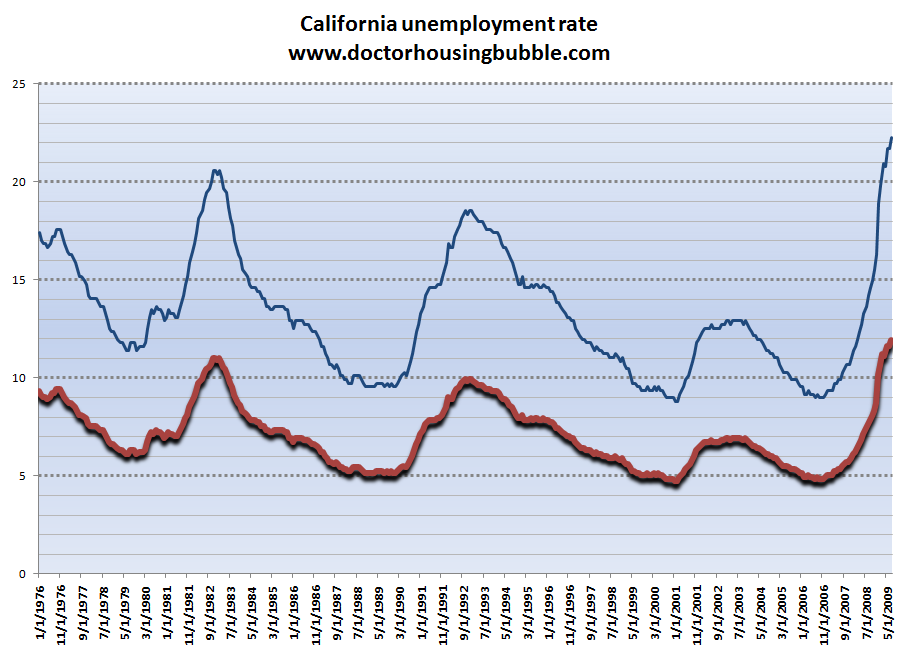

Reason #4 – Unemployment

In more normal times, housing prices reflected actual employment growth and wage growth. Someone claiming housing prices would be going up in the face of growing unemployment would appear to be out of their mind. Now, it is the status quo of snake oil economist and real estate pundits. Just logically think this out. How is a rising unemployment rate good for housing? It isn’t.

And the state has an official unemployment rate of 11.9% and a U-6 rate of 22%. Of those working, wages are stagnant or hours are being cut for many. Yet somehow in the casino calculus this is going to improve the housing market.

Until employment stabilizes talking about a housing bottom is non-sense. In California, housing and employment are basically joined at the hip. The last bubble was built on housing creating employment. So now we are to expect that unemployment is going to create housing? Whatever works to push more over priced homes.

Reason # 5 – Alt-A and Option ARMs

Finally we are left with the Alt-A and option ARM wave that is already here. You might not be seeing it because the inventory is still not being put on the market in any significant numbers. Right now, the banking cronies are dabbling with the Legacy Asset Program crap and the HAMP and trying to figure out how best they can screw the taxpayer for their own benefit. The mark to market accounting suspension is criminal. First, if you are going to trade mortgage backed securities like stocks, then you should value your assets as such. If a bank really was going to hold a home for 30 years then yes, I agree that they should value it for the long term. But right now the only folks buying mortgages in bulk is the U.S. Government. The system is such where banks can basically do whatever they see fit. After this triumphant collapse and having 300,000+ foreclosure filings a month, nothing has fundamentally changed. That is why you are seeing both progressives and even small government advocates finding common ground. Strange bedfellows. Even strong progressive supporters of President Obama are frustrated that the status quo is remaining the same in Wall Street.

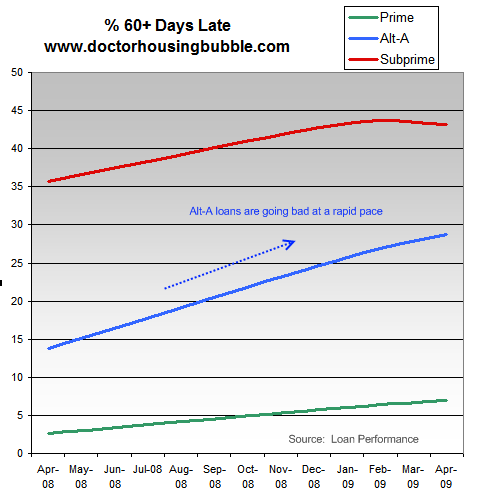

The Alt-A and option ARMs are already going delinquent:

All these circumstances will make for a horrible housing market in California in 2010. Right now it may be hard to see with the government finance goggles on and Wall Street looking more attractive because of the juice.

One simple rule that you should live by is don’t get a mortgage that is 3 times more than your gross household income. If you bring in $100,000 the upper limit of your mortgage should be $300,000. I know this won’t be followed by many because it is too simple. People want archaic acronyms and fancy financial products that in the end, take them for a ride and them leave them sitting on the curb with empty pockets.

No comments:

Post a Comment