An empirical look at the DOJ’s policy of non-prosecution.

---

By John Titus, creator of the new documentary Bailout.

Obama Guarantees Next Crisis by Refusing to Prosecute Recidivist Financial Criminals

Bailout is the first documentary to demonstrate the tight linkage between the financial frauds that caused the crisis and the resulting harm to Main Street. The Department of Justice recently ensured that many more will follow.

By announcing that it will not prosecute “systemic” criminal banking enterprises like HSBC, the DOJ has guaranteed (and likely hastened) the arrival of the next fraud-driven crisis.

The DOJ did not even attempt to back up its claim that prosecuting HSBC would "destabilize the global financial system." Indeed, Lanny Breuer, the head of the DOJ's criminal division, said that prosecuting HSBC "could have cost thousands of jobs"--betraying the fact that the DOJ's real concern was the corporate perpetrator rather than its Main Street victims.

Someone should let Breuer in on the fact that white collar criminal prosecutions have a direct and immediate impact on corporate behavior. The only "systemic" risk at work here is the one created by the DOJ itself--by giving financial criminals a free pass.

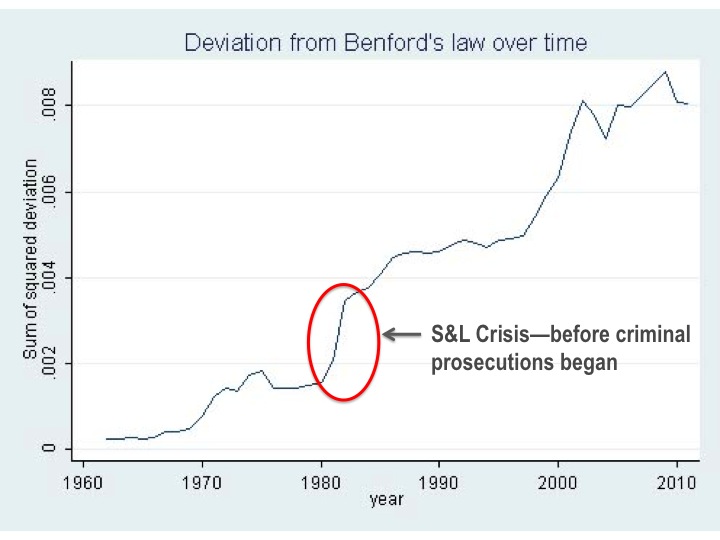

This is at once apparent from a comparison of the 25-year pattern of criminal financial prosecutions from 1985-2010 with accouting deviancy in reported financial data over the same period. The historical data buttress what common sense tells us: that responding to criminal financial enterprises with a formal regime of non-prosecution is guaranteed to end in disaster.

The 25-year period reaching back to the mid-1980s includes the savings and loan crisis, so that the effect of criminal prosecutions can be highlighted in connection with two separate financial crises. It is a tale of two very different law enforcement regimes.

In the S&L crisis, financial criminals across the U.S. engaged in wholesale looting of thrifts, which set off that crisis. In response, banking regulators built cases for criminal prosecutions and referred them to federal prosecutors. The S&L crisis ended with the criminal convictions of over 1000 high-ranking financial executives, which limited losses to American taxpayers to about $125 billion.

In the current crisis, losses to American taxpayers have--thus far--reached $13 trillion. In response, the DOJ has not criminally prosecuted even a single major financial executive for the fraudulent acts and financial transactions that set off the crisis.

The scale of this anomaly is breathtaking: had prosecutors answered the current crisis with the same legal force they mustered in response to the S&L crisis, well over 100,000 senior level financial executives would be in prison. The actual number is zero (0).

The problem is that U.S. law enforcers are obedient to bankers rather than hornbooks.

When confronted with concerns over its prior

bad acts, the financial class inevitably responds with some variation

of “we swear we’ll never do it again” or “that just won’t happen

again.” Neil Barofsky’s Bailout is replete with such accounts:

- On why TARP didn’t need any anti-fraud provisions: “the biggest players in these programs—the big banks and investment firms—would never risk their reputations by trying to rip off the government. The reputational damage they’d suffer would be far greater than any potential profit, they argued, so it just wouldn’t happen.” (p. 88)

- William Dudley, the NY Fed chief, on why the Fed was justified in relying on AAA ratings to support its TALF program, even though they came from the same ratings agencies that put AAA ratings on junk leading into the crisis: “we’re confident they won’t risk being embarrassed again.” (p. 94)

- Tim Geithner and other Treasury officials on why wouldn’t game the many holes in TALF: “they seemed to honestly believe that their Wall Street brothers wouldn’t take advantage of the flaws in the program to profit at the government’s expense.” (p. 131)

Both the S.E.C. (which settles cases with an agreement by the offending firm not to violate the law again) and the DOJ (which enters into non-prosecution agreements to the same effect) bargain away justice by halting cases before a public record of banking improprieties and crimes can ever be made.

But what of it? Does the complete absence of meaningful prosecution (aside from depriving the public of knowledge and information gained from litigation) have any "systemic" effects on corporate malfeasance?

The clear cut answer comes in the form of the chart above, which demonstrates the starkly inverse relationship between the number of criminal referrals by banking regulators and system-wide accounting deviations—a proxy for accounting fraud—from 1985 to 2010.

By “accounting deviations,” we mean deviations by reported corporate financial data from Benford’s law, which is an efficient way to detect prima facie accounting fraud.

According to Benford’s law, the first digit of numbers taken from real-life data sources is not at all a random affair. If it were, the probability of a first-digit 9 would be the same as that for a first-digit 1. In real life (and real data), that’s simply not the case.

Rather, the first digit is 3 times as likely to be 1 than if randomly selected, with 2 slightly less likely, and so on:

Someone trying to cook a company’s books by coming up with numbers out of thin air is highly unlikely to do so in accordance with their natural distribution as taught by Benford. Cooked books, then, can be detected by assessing financial data to the extent they deviate from Benford’s law.

Jialan Wang did exactly this for three decades’ worth of financial data from 20,000 corporations reporting to the S.E.C., which is reflected by the blue line in the graph above.

Wang’s findings are fully consistent with the S&L experience: federal deregulation of savings and loans, which began in 1981, occasioned a massive wave of accounting fraud that set off the S&L crisis—and a massive ramp upward in accounting deviancy as measured by Benford’s law:

Accounting deviancy—and the fraud giving rise to much of it—has continued its ascendancy throughout the current crisis.

The danger inherent in accounting fraud should be obvious enough, but it's worth mentioning with the sudden collapse in 2008 in mind: fraudulent financial data can mask fatally serious problems until reality explodes out from under the surface. It is akin to doctors manipulating their charts to conceal the cancer eating away their patients.

Congress should ask Eric Holder what objective he's serving by encouraging banks like HSBC to engage in and continue their criminal rampages. Like Lanny Breuer and Tim Geithner, of course, Holder will emit a plume of verbiage filled with terms like "systemic."

For once, someone should then ask the real question crackling beneath the surface every story like HSBC: Might it possibly be a very bad mistake to sacrifice the rule of law to appease admitted criminals?

***

John Titus has practiced law in federal courts for more than 15 years.

Watch a Trailer for BAILOUT

Photos by William Banzai7...