Today’s AM fix was USD 1,241.75, EUR 913.11

and GBP 760.45 per ounce.

Yesterday’s AM fix was USD 1,250.75, EUR

923.88 and GBP 773.69 per ounce.

Gold fell $4.10 or 0.33% yesterday, closing at

$1,236.33/oz. Silver slid $0.17 or 0.86% closing at $19.68/oz.

Platinum fell $19.20, or 1.4%, to $1,352.70 an ounce and palladium

fell $2.50, or 0.4%, to $715.95 an ounce.

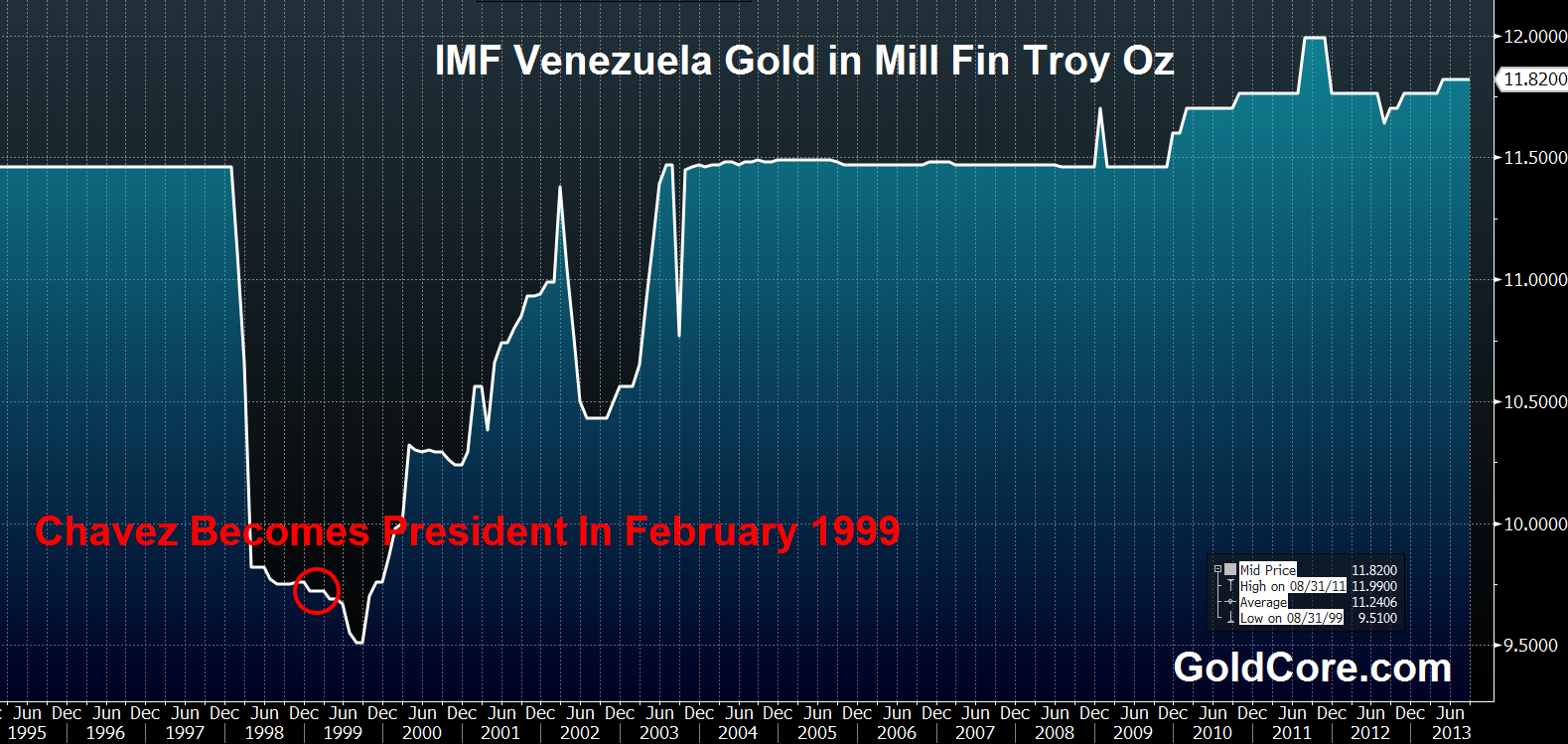

Venezuela

Gold Reserves In Million Fine Troy Ounces (1995 to Today)

Gold is higher today as huge demand from China

is believed to be supporting prices.

China has seen a notable pick up in demand this

week due to lower prices. Traded volumes of 99.99 percent purity gold

on the Shanghai Gold Exchange hit 18.3 tonnes overnight, their

highest since October 8, according to Reuters data.

China’s net gold bullion imports from Hong

Kong climbed to their second highest on record in October as the

country bought more than 100 tonnes of gold for a sixth straight

month to meet unprecedented demand.

VENEZUELA HAS DENIED that it is considering a

proposal from Goldman Sachs Group Inc. that would allow the

government to mortgage its gold reserves to Goldman.

A Venezuelan central bank official, requesting

anonymity in keeping with bank policy, said that she had no

information about the proposal. The nation’s finance ministry

declined to comment according to Bloomberg.

The denial came after media reports of a

peculiar gold deal being hatched by Goldman Sachs. The deal is meant

to provide Venezuela with $1.68 billion in cash, providing they post

$1.85 billion of Venezuela’s gold reserves, documents obtained by

Bloomberg News show.

$1.85 billion is equal to some 47 tonnes of

gold at today’s prices. Venezuela has nearly 366 tonnes of gold.

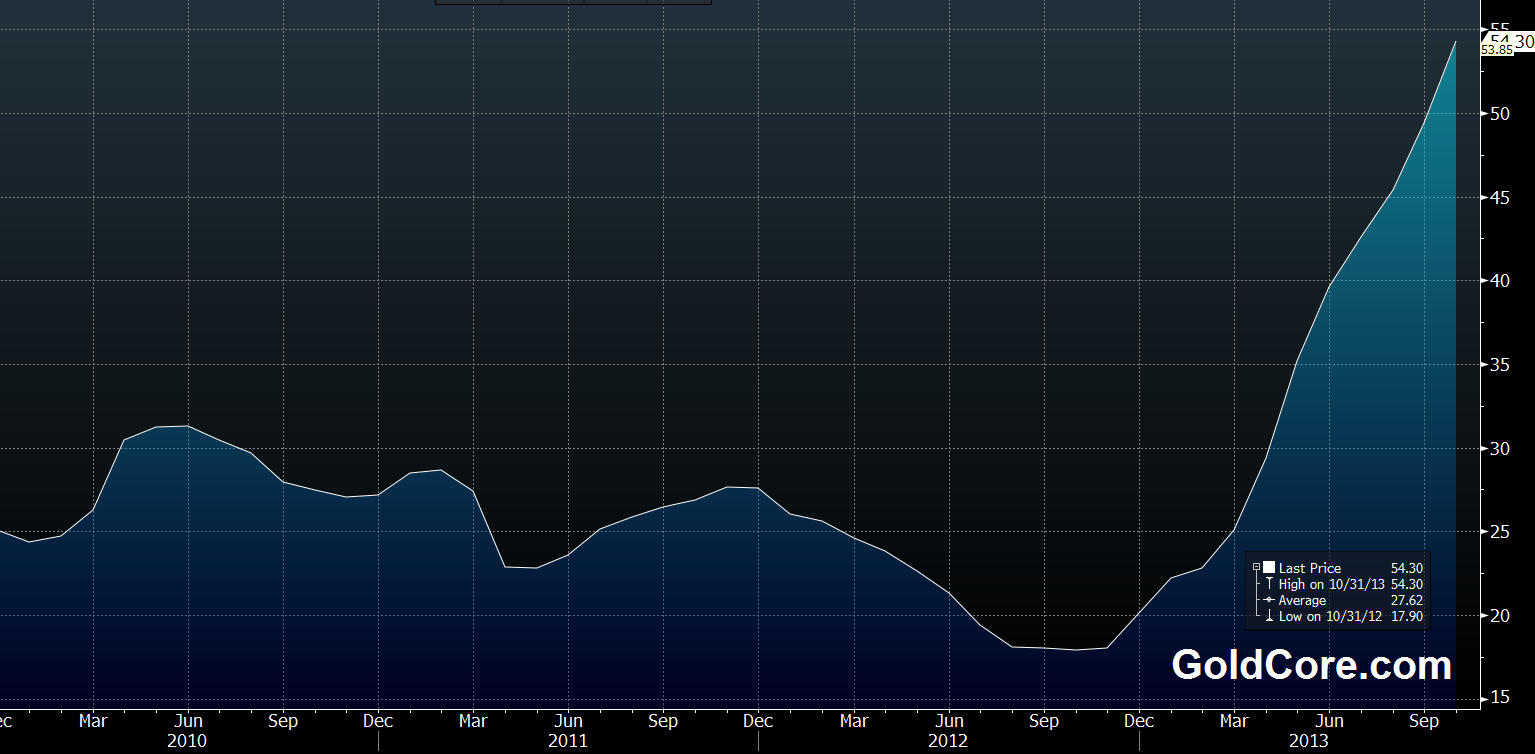

Venezuela’s economy is struggling with low

economic growth and inflation surging to near hyperinflation levels

at over 54%.

Venezuela

National Consumer Price Index (CPI) YoY%

At the very least stagflation appears to be

taking hold in Venezuela as its economy expanded by just 1.1% in the

third quarter, less than half the pace that analysts forecast.

Imports plunged 18%, the central bank said Nov.

26 and its bonds have been sold in recent months resulting in much

higher interest rates on its debt.

Yields on the country’s $4 billion of bonds

due 2027 have jumped 4.15 percentage points this year to 13.48%,

almost three times the average increase in emerging markets.

Venezuela’s foreign reserves sank to a

nine-year low of $20.7 billion this month, limiting the supply of

dollars in a country that imports about 75 % of the goods it

consumes. Some analysts say that the shortage is also exacerbating

inflation that reached 54.3% last month, the fastest in the world.

Two weeks ago, government oil producer

Petroleos de Venezuela SA sold $4.5 billion of debt to fund currency

auctions and food imports from Colombia in the first sale by a

state-owned entity since May 2012.

“When I’m hearing that they might sell gold

to raise cash, that strikes me as pure desperation,” Robert Abad,

who helps oversee $53 billion in emerging-market debt at Western

Asset Management Co., said in a telephone interview from Pasadena,

California. “How bad can it get until I as a foreign investor have

to start worrying about payment capacity?”

Goldman Sachs’s total-return swap would bear

interest of 7.5% plus the three-month London interbank offered rate,

for $818 million in estimated financing costs over seven years, the

documents show.

Michael DuVally, a spokesman at New York-based

Goldman Sachs, declined to comment on the proposal. Analysts

questioned if the deal made sense and one analyst said that “a

seven-year deal does not make any sense, much less at a 7.5% spread

when there is collateral involved.”

Goldman’s proposal re Venezuela’s gold is

interesting as it comes at a time when Goldman have been extremely

vocal about its negative outlook for gold and has predicted loudly

that gold is a “slam dunk” sell today and in 2014. Goldman’s

crystal ball gazing and price predictions have not been particularly

accurate in recent years and many investors have lost money by

following their gold price predictions.

“Dictatorship

Of The Dollar”

About 70% of Venezuela’s foreign reserves are

in gold. Former President Hugo Chavez, who died of cancer in March,

secured Venezuela’s patrimony by repatriating its gold reserves

from the Bank of England. The move was believed to be an effort to

move away from what he called the “dictatorship of the dollar.”

From 1999, Chavez’s first year in office,

through 2012, Venezuela bought 75.3 metric tons of gold, according to

data on the International Monetary Fund’s website. Those purchases

cost $1 billion based on average annual gold prices and would be

valued at $3.03 billion at today’s price of $1,251.96 an ounce,

meaning the additions would have made $2.03 billion. The country also

sold 13.1 tons of bullion during that period, the IMF data show.

“It’s

The Economic Reserve For Our Kids”

Venezuela’s gold reserves total 367.6 tons,

making it the 14th largest holding by country, according to the World

Gold Council. Gold accounts for 70% of the nation’s foreign

reserves, compared with 7.6% for Argentina and less than 1% for

Brazil.

“It’s our gold,” Chavez, a

self-proclaimed socialist who nationalized hundreds of companies and

imposed curbs on currency trading, said on state television in

November 2011.

“It’s the economic reserve for our kids.

It’s growing and it’s going to keep growing, both gold and

economic reserves.”

Venezuela’s currency board, known as Cadivi,

sells greenbacks at the official exchange rate of 6.3 bolivars per

dollar. The government, which devalued the bolivar by 32% in

February, has failed to stem the currency’s slide on the black

market, where companies and people not authorized to use the official

rate pay about 60 bolivars per dollar.

Average prices of Venezuelan crude exports,

responsible for 95 percent of the nation’s foreign-currency

earnings, fell to a 16-month low this month and ended last week at

$93.98 a barrel.

Each $1 dollar decline in a barrel of oil costs

Venezuela about $700 million per year, according to estimates from

PDVSA, as the state-owned company is known.

President Nicolas Maduro, Chavez’s handpicked

successor, seized electronics retailer Daka and warned other

businesses to cut prices to “fair” levels earlier this month to

tame the highest inflation in 16 years.

“Basic-goods

deficits are starting to affect even the poor population”

“We are very negative on the country’s

debt,” Marco Aurelio de Sa, the head of fixed-income trading at

Credit Agricole SA’s Miami brokerage unit, said in a telephone

interview. “Basic-goods deficits are starting to affect even the

poor population, and when things get to this point, this type of

populist government loses support. You have to analyze the

fixed-income market through the political spectrum.”

Francisco Rodriguez, chief Andean economist at

Bank of America, said that the decline in imports is helping boost

Venezuela’s current-account surplus, bolstering the nation’s

ability to service debt.

The government said Nov. 26 that the

current-account surplus rose by $1.8 billion from a year earlier to

$4.1 billion.

National

Gold Reserves

“The country’s ongoing external adjustment

is leading to a stabilization of its capacity to service external

debt obligations,” Rodriguez said in a report published the same

day.

Goldman is suggesting that the proposal is

meant to allow Venezuela to keep its national gold reserves, with the

nation posting gold bullion or cash to a margin account if the price

falls and Goldman posting dollars if it rises, the documents show.

Gold

in U.S. Dollars – 5 Year

President Maduro is likely to be reluctant to

engage in sales of Venezuela’s gold. He may not want to reverse the

strong pro-gold stance of this mentor Chavez and he may realise the

importance of gold reserves in protecting countries from systemic and

currency collapse.

Venezuela may also be reluctant to do such a

deal after seeing the appalling state that Greece and indeed the EU

has been left in. This is partly due to Goldman’s ‘creative’

financial wizardry which helped disguise Greece’s debt allowing it

to join the European Monetary Union. This action contributed to

Greece’s economic collapse.

An important question is what exactly is

Goldman’s motivation for the peculiar gold deal? Does it wish to

have access to Venezuela’s gold reserves? There are many other

innovative ways that Goldman could help Venezuela with its current

economic travails that do not involve gold. Were Venezuela to default

on the bonds would Goldman become the beneficial owner of Venezuela’s

gold reserves?

Venezuela is suffering from inflation at 54%.

Given the risks posed to the U.S. dollar and other paper currencies

due to currency debasement today, rather than pawning its gold

reserves in some debt deal with Goldman, Venezuela would be better

served adding to its gold reserves at this time as gold will protect

the country from a systemic crisis or currency collapse.

Click Gold

News For This Week’s Breaking Gold And Silver News

Like

Our YouTube Page

For The Latest Insights, Documentaries and Interviews

Like

Our Facebook Page

For Interesting Insights, Blogs, Prizes and Special Offers