INTRODUCTION

INTRODUCTION

To combat these factors we now have ALPHA LIPID™ LIFELINE™ with Colostrum Powder and Lactobacillus Acidophilus and Bifidobacterium.

ColostrumNature’s miracle product, Colostrum could justifiably be called a medical food. As ‘natures first food’, it is the pre-milk fluid produced from the mother’s mammary glands during the first 36 hours after birth and is nature’s perfect combination of immune factors, growth factors, vitamins and minerals that are designed to promote a vibrant, healthy body and an ability to fight off a host of all types of infections.

Why New Zealand Colostrum?All Colostrum IS NOT the same. From start to finish, Colostrum harvested from cows raised in New Zealand is superior to any other Colostrum in the world. This is all due to the ideal pure climate, pesticide, antibiotic and BSE free pasture-fed cows, highly regulated farming techniques, and a multi-million dollar investment in the equipment necessary to best process Colostrum properly. No other Colostrum can compare.

ColostrumNature’s miracle product, Colostrum could justifiably be called a medical food. As ‘natures first food’, it is the pre-milk fluid produced from the mother’s mammary glands during the first 36 hours after birth and is nature’s perfect combination of immune factors, growth factors, vitamins and minerals that are designed to promote a vibrant, healthy body and an ability to fight off a host of all types of infections.

Why New Zealand Colostrum?All Colostrum IS NOT the same. From start to finish, Colostrum harvested from cows raised in New Zealand is superior to any other Colostrum in the world. This is all due to the ideal pure climate, pesticide, antibiotic and BSE free pasture-fed cows, highly regulated farming techniques, and a multi-million dollar investment in the equipment necessary to best process Colostrum properly. No other Colostrum can compare.

Completely Safe

There are no negative side effects recorded with Colostrum - in fact, the growth factors produce significant positive side effects.

According to the International Institute of Nutritional Research:

“INTENDED BY NATURE AS AN INFANT’S VERY FIRST FOOD: it is hard to imagine any nutritional substance more natural or beneficial than Colostrum”.

There are no negative side effects recorded with Colostrum - in fact, the growth factors produce significant positive side effects.

According to the International Institute of Nutritional Research:

“INTENDED BY NATURE AS AN INFANT’S VERY FIRST FOOD: it is hard to imagine any nutritional substance more natural or beneficial than Colostrum”.

WHY ALPHA LIPID™ LIFELINE™ COLOSTRUM?

1) Natural Antibodies

Colostrum

is nature’s only supplemental source of the antibodies and

immunoglobulins that fight allergens, yeast, bacterial and viral

infections.

Scientific studies report that Colostrum contains all four of the key immunoglobulins: IgG, IgM, IgA and secretory IgA.

PLUS:

The Cytokines: Interleukin 1 and 6, tumour necrosis factor and

interferon y, and Lymphokines, Lactoferrin, Lactalbumins, and other

specific components that have been shown to be effective in killing

invading viruses, bacteria, yeasts, protozoas and pollutants.

Medical

studies indicate that most invading disease enters the body through the

mucus lining of the small intestine. Colostrum has been shown to coat

the mucus lining of the digestive system and other mucus membranes with

antibodies to neutralize the invading bacteria, viruses, yeasts,

pollutants and allergens and their toxins before they can enter the

body. Further, Colostrum’s growth factors stimulate the rapid healing

and regrowth of damaged mucal lining to stop further penetration of

pathogens.

2) Immune System

Scientific

studies have shown that a key component of Colostrum (PRP) is a major

regulator of the immune system. Clinical studies show that PRP can be

effective in activating an under-active immune system to take action

against disease - causing organisms as well as suppressing an

over-active immune system where the body is attacking itself, often seen

in auto-immune diseases such as Lupus, MS and rheumatoid arthritis.

3) The ALPHA LIPID™ Advantage

New

Image has developed ALPHA LIPID™ - a patented exclusive coating made up

of added complex lipids which enhances the solubility of Colostrum -

delivering it much more effectively to the key areas of the body with

positive effects on the liver, gut and brain function. Phospholipids,

components of ALPHA LIPID™ , have been associated with improved memory

and also shown to help elevate mood and reduce the symptoms of

depression.

4) Easily Absorbable Calcium

There

are 1000mg of calcium in each serving of Alpha Lipid Lifeline.

Concentrated calcium from cow’s milk is the most accessible and easily

assimilated form of this mineral. 1000mg of calcium

daily is close to

the RDA and will ensure promotion of healthy bone structure and give

protection against the development of Osteoporosis if taken on a daily

basis over a lifetime.

5) Natural Intestinal Flora

Antibiotics,

some cortisone-like drugs, birth control pills, alcohol, some food

additives, caffeine, chlorinated or fluoridated drinking water and

stress can destroy the natural intestinal flora. People who have had the

natural balance of flora disturbed need a reinforcement of naturally

occurring lactobacillus acidophilus, as contained in ALPHA LIPID™

LIFELINE™.

6) Growth Factor Hormones

Colostrum

is the only natural supplemental source of the actual growth factors

(hormones) IgF-1, TgF A & B, FgF, EgF, and PDgF, that research has

shown control normal muscle, nerve and cartilage cell growth,

regeneration and repair.

Naturally produced in your youth, they diminish with age. Without them, the body ages and we grow old:

• Anti-aging

• Shown to be effective in building new lean muscle tissue and decreased fat.

• Shown to be effective in increased burning of fat and decreased burning of muscle tissue.

•

Shown to stimulate growth and regeneration of muscle, skin, cartilage

and nerve tissue due to athletic stress, age, injury or trauma.

Scientific

studies show that Colostrum from cows contains more immune and growth

factors than human Colostrum, and is completely assimilable by humans.

7) Cholesterol Reduction

A

number of double blind studies in the USA involving patients with high

serum lipids showed reductions in arteriosclerosis and arterial plaque

of 15%.

8) Anti-Inflammatory Properties

There

is substantial evidence to show that people suffering from rheumatoid

arthritis and offer inflammatory disease have had considerable relief

from using Colostrum-based products.

PRODUCT INFO

Lifeline is a total wellness product. It

not only gives you all the immune-boosting, health-preserving qualities

of top-grade New Zealand colostrum, it also contains vitamins, minerals

and probiotics to ensure a healthy body.

Ingredients:Colostrum

concentrate, Milk powder, Glucose, Vitamin and mineral concentrates,

Vegetable gums, Vanilla flavour, Lactobacillus, Acidophilus

Available in 450g

- Lifeline is the complete wellness package designed for you to take every day. Just make up a delicious shake, or sprinkle it over your favourite food!

- The lactose molecule has been reduced to its simple sugar so that people who are lactose intolerant can also benefit from this product.

- We have added acidophilus, a 'friendly' bacteria which helps promote a healthy intestine and aids the prevention of yeast infections.

- Lifeline is calcium enriched, providing the daily requirement to ensure fit, healthy bones.

Vitamins and minerals are added to give an extra boost - making sure Lifeline truly justifies its name!

Each 18g serving contains:

- Energy 200kJ

- Protein 1.6g

- Fat 0.04g

- Lactose 2.1g

- Glucose 8.7g

- Vitamin A 560mcg

- Vitamin B1 1.6mg

- Vitamin B2 1.6mg

- Niacin (B3) 20mg

- Pantothenic Acid 6mg

- Vitamin B6 2mg

- Vitamin B12 2mcg

- Folic acid 200mcg

- Biotin 60mcg

- Vitamin C 60mg

- Vitamin D 7.5mcg

- Vitamin E 10mg

- Calcium 1125mg

- Iron 2mg

- Magnesium 90mg

- Phosphorus 580mg

- Sodium 20mg

- Potassium 65mg

- Vitamins are 100% of average recommended daily dose for adults.

- Immunoglobulin G 240mg

WHO NEEDS IT? FOR WHAT?

Athlete : Colostrum gives quick muscle recovery.

Sick People: Live antibodies speed up recovery A LOT( trust me, it's A LOOOOOT).

Over-weight people : Growth hormone will dramatically increase your lean muscle, thus increasing your metabolism to burn more calories.

Under-weight people : Growth hormone will help you build up your body.

High Blood Pressure/Diabetic patient : Colostrum helps stabilize blood sugar/pressure level, this is a widely known fact.( you can check from internet)

People taking supplement: because it contains LOTS OF EXTRA GOODIES, TAKE A LOOK AT THE INGREDIENT

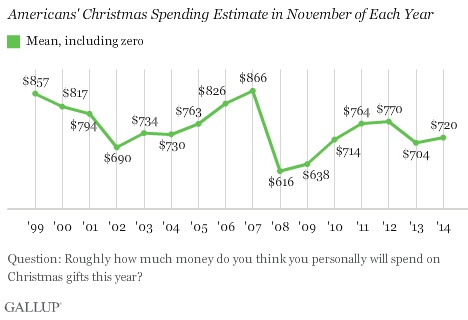

(Source Bloomberg)

(Source Bloomberg)