The public option for Obama insurance coverage has been described as just a sliver of the overall proposal. Universal coverage directly by government was not an essential element says Health & Human Services. Of course it was. The program is in retreat and the only way the Democrats can get passage of any kind is to re-craft a toothless passage and ram it through in a party line vote. The public is enraged at what the liberals and socialists have tried to foist on them. Worse yet, the administration has submitted to Wall Street and the insurance giants, which they intended to do from before the beginning. Just look at the line up of campaign contributors. The same goes for the euthanasia section. This could well have been a loss leader to get the rest of this monstrosity passed. The exercise will cost the President and Congress dearly as their approval ratings sink to 41% and 12% respectively. November of 2010 will be the time of reckoning.

We remind you that presidents do not make presidential policies. They are made by the bureaucratic types, who receive their marching orders from the Illuminists above them. This is why you had the seamless transition from the neocon administration to the current decidedly more fascistic one now in power. Team A replaced Team B from the Council on Foreign Relations, Trilateralists and Bilderbergers. Nothing really changed. If you accept the premise that they are all intent on creating world government then you can understand why they all are preparing us for controlled collapse. These planners expected problems, but they were not prepared for the potential of major social unrest displayed at Town Hall meetings nationwide. There is finally growing social unrest and rightly so. All that was initiated by bailing out the rich financial sector to the tune of $23.7 trillion, and then the lying about where funds were going and how they were being used, then more lies, and then the bonuses at AIG and Goldman Sachs and at other Illuminist companies. The public has begun to listen to our story and the elitists cannot let the truth see the light of day. The system is rigged toward the rich insiders and now the public isn’t even getting crumbs and everything is being taken away from them. Those insiders who are dismissive of population and the fairness of the system should check with the ancestors of the 300,000 who lost their heads in France during the revolution.

Government no longer serves the people or the general good and the healthcare and cap & trade are typical issues. It is not what Americans want, but what corporate America and politicians want. All the rewards to the crooks on Wall Street and in banking that have destroyed our financial system. We have just been on the receiving end of dreadful government for 8 years and Americans feel helpless after electing a new president. The result thus far has been disastrous. Still few of their elected representatives listen to anything they have to say and it is no wonder we saw the outpouring of unhappiness displayed at Town Hall meetings. This in part is why people are walking away from debt and not paying their taxes. They believe they have an illegitimate government, which refuses to serve and listen to them. They now only represent corporate America.

Historically about 1/3rd of Americans do not file income tax and only 15% of illegal aliens file. That has cost government about $500 billion a year. Americans are fed up and more are becoming non-filers and more are underestimating or hiding income. It is essentially a tax revolt. Why do you think federal revenues fell so precipitously? People are sick and tired of taxation without representation. They are also outraged at the bailout of banks, Wall Street and insurance companies and a few crumbs for the average American.

They also realize that America’s debt will never be repaid, that they will have hyperinflation and that the dollar is collapsing versus other currencies. In time the public will discover gold, but that will happen as the depression goes further forward.

We have already entered the inflationary spiral again. Its force will depend on the strength of the deflationary undertow and the monetization of monetary aggregates. Make no mistake higher inflation is on the way and probably hyperinflation. It will also be affected by a break down in the tax system as well. The trio leads to economic, financial, social and political dysfunction.

What else should the elitists expect? All the revolving door bureaucrats from the Council on Foreign Relations, The Trilateral Commission and the Bilderberg Group are going to do is give us more of the same, as we had for the previous eight years.

Team A replaced Team B. They are furthering the same financial conditions that brought us the current disaster. We are seven months into the new administration and it has already destroyed any credibility it could have had. Writing blank checks to the financial community, which financed your campaign, does not endear you to the voters, as they are thrown a bone.

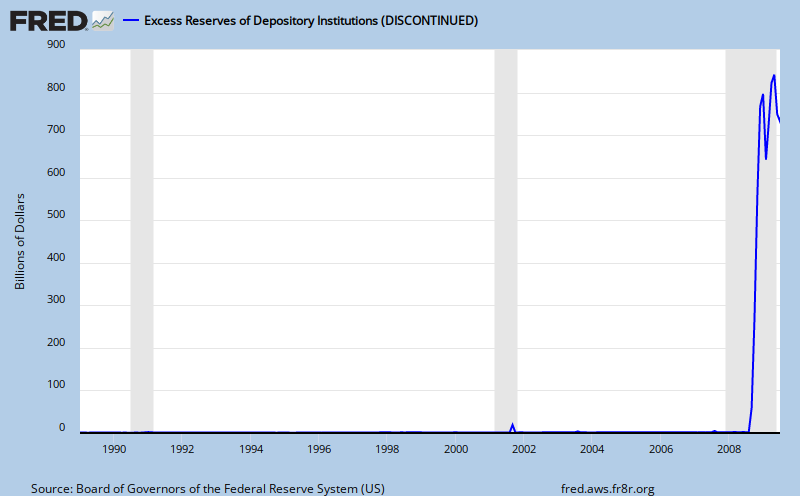

After the announcement, that the president had re-nominated Ben Bernanke as Chairman of the Federal Reserve, we were led to believe he saved us from a fate worse than death. Bernanke created enough money and credit to temporarily overcome the deflationary undertow in the economy. Ben created the problem along with Sir Alan Greenspan and now he wants us to believe he is going to save us by solving the problem. This is the same Ben that gave Greenspan academic cover. He had the temerity to blame the credit crisis on foreigners who created a savings glut, particularly Asians. He said this suppressed bond yields. That was probably true, but he conveniently forgets to mention that the Fed created all those dollars in the first place and were responsible for lower interest rates. Ben believes any slowdown or shock to the system can be easily handled by injecting more money and credit into the system.

Ben is the man who is going to lead us to a federal deficit of 100% of GDP over the next decade, as deficits swell to more than $1 trillion a year.

What must be remembered here is that it is not going to be easy or even possible to pull the punchbowl away. In 1936 they tried to slick up liquidity to prevent speculation. It turned out to be premature as money and credit fell into negative territory. By 1937 fiscal stimulus programs ended. The federal deficit fell, creating a counterforce.

This is the kind of risk Ben faces when and if he decides to withdraw the punchbowl. When Ben believed he saw in November 2002, the danger of deflation, he acted by increasing aggregates. There is no doubt he will see the same thing again if he cuts money and credit and raises interest rates. That means the system is entrapped in an endless cycle of money and credit creation, inflation and a lower dollar. Ben fears deflation far more than inflation and so the course will not be altered.

If we are experiencing a bottom it is accompanied by unprecedented budget deficits, which presents a huge financial problem during a recovery. That will be accompanied by inflation. That is what commodities, such as oil and copper are telling us. This presents us with stagflation. The bottom line is more of the same is not going to work and that is what Ben will give us. He simply doesn’t know any other way out of the maze. This also shows us that the president is totally ignorant of what is going on around him. None of the players believe in sound money and we will pay the price for that.

In September we see a renewal of monetization where officially the Fed will buy more and more Treasuries, Agencies and CD’s from banks, besides what they are doing in secret. A large part of the budget deficit, real estate expansion and banks’ bad debt will be monetized by the Fed, which is very inflationary. This is what went on in Argentina and the Weimer Republic and this is where Ben is headed. This is why you have to have gold and silver related investments; they will be your only protection.

The dollar may weaken through “established lows” as signs of a global economic recovery drive gains in equities and oil, Goldman Sachs Group Inc. said.

“That kind of shift could easily be prompted by continued good news from the macro front and the persistently negative dollar-equity and dollar-oil correlations,” Thomas Stolper, an economist at Goldman Sachs in London, wrote in a report yesterday. “Dollar bulls could well end up disappointed. Even a short-term move beyond our three- and six-month forecasts of $1.45 per euro is getting increasingly likely.”

The Dollar Index, which Intercontinental Exchange Inc. uses to track the U.S. currency against the euro, yen, pound, Canadian dollar, Swiss franc and the Swedish krona, has weakened as the Standard & Poor’s 500 Index of U.S. shares gained more than 85 percent of the time since June and more than 50 percent of the time since September as investors sought higher-yielding assets on signs on an economic recovery.

The index fell 11 percent from its high this year on March 4, during which time the S&P 500 gained 44 percent. The index was little changed at 78.592 as of 7:29 a.m. in New York. S&P 500 Index futures were unchanged.

“More and more foreign-exchange players have positioned themselves for a dollar bounce without much impact on the spot market,” Stolper said. Since early June, traders have moved toward favoring contracts that give them the option to buy the dollar against the pound, while “spot remains stuck in the mid- $1.60s,” Stolper said.

The cost of betting that the dollar will rise against the pound in one month’s time are at the highest since July 14, and near the most since March, according to 25 Delta risk reversals.

“All this suggests that the underlying dollar trend is still downward sloping and the risk is that normalization in positioning pushes the dollar through the established lows,” Stolper said.

Sales of newly constructed homes leaped unexpectedly in July to hit their highest level since last September.

New homes sold at an annualized rate of 433,000 during the month, according to a joint report issued by the Census Bureau and Department of Housing and Urban Development.

That far exceeded analysts' forecasts and was up 9.6% from the revised 395,000 rate recorded in June. A consensus of industry experts surveyed by Briefing.com had predicted July sales of 390,000.

U.S. building permits for July were revised to down 1.1% from June to a seasonally adjusted rate of 564,000, the Commerce Department reported Wednesday.

July building permits were originally reported as being down 1.8% at a seasonally adjusted rate of 560,000.

Mortgage applications filed last week increased a seasonally adjusted 7.5% compared with the week before, boosted mainly by filings to refinance existing home loans, the Mortgage Bankers Association said Wednesday.

Refinancing applications rose 12.7% for the week ended Aug. 21 from the prior week -- the third increase for such applications over the last four weeks.

Overall filings had increased a seasonally adjusted 5.6% in the week ended Aug. 14, data compiled by the Washington-based MBA showed. The MBA survey covers about half of all U.S. retail residential mortgage applications.

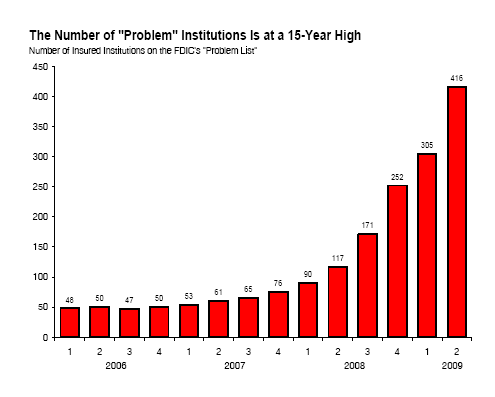

The crisis may be turning out very well for many of the behemoths that dominate U.S. finance. A series of federally arranged mergers safely landed troubled banks on the decks of more stable firms. And it allowed the survivors to emerge from the turmoil with strengthened market positions, giving them even greater control over consumer lending and more potential to profit.

The crisis may be turning out very well for many of the behemoths that dominate U.S. finance. A series of federally arranged mergers safely landed troubled banks on the decks of more stable firms. And it allowed the survivors to emerge from the turmoil with strengthened market positions, giving them even greater control over consumer lending and more potential to profit. Just as the avian flu scare ended up being a dry-run for the current round of medical hysteria, the current panic will likely be most significant as a dry-run for an expansion of the police state and for greater consolidation of the big banks, big insurance, and big pharma. In fact, that's just what Homeland Security adviser Brennan said in remarks to the very influential Center for Strategic and International Studies (CSIS) on August 6, 2009.

Just as the avian flu scare ended up being a dry-run for the current round of medical hysteria, the current panic will likely be most significant as a dry-run for an expansion of the police state and for greater consolidation of the big banks, big insurance, and big pharma. In fact, that's just what Homeland Security adviser Brennan said in remarks to the very influential Center for Strategic and International Studies (CSIS) on August 6, 2009.