Dr. Doom Has Some Good News

Image: Bruce Gilden/Magnum Photos

On March 28, 2007, Federal Reserve Chairman Ben Bernanke appeared before the congressional Joint Economic Committee to discuss trends in the U.S. economy. Everyone was concerned about the “substantial correction in the housing market,” he noted in his prepared remarks. Fortunately, “the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.” Better still, “the weakness in housing and in some parts of manufacturing does not appear to have spilled over to any significant extent to other sectors of the economy.” On that day, the Dow Jones industrial average was above 12,000, the S&P 500 was above 1,400, and the U.S. unemployment rate was 4.4 percent.

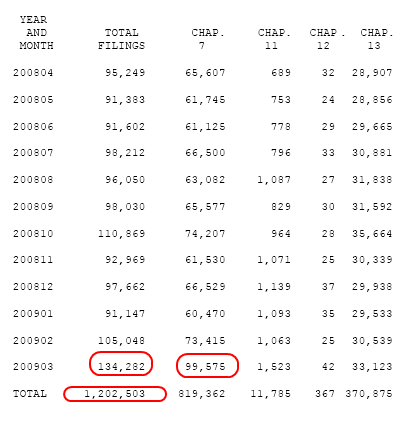

That assurance looks bad in retrospect, as do many of Bernanke’s claims through the rest of the year: that the real-estate crisis was working itself out and that its problems would likely remain “niche” issues. If experts can be this wrong—within two years, unemployment had nearly doubled, and financial markets had lost roughly half their value—what good is their expertise? And of course it wasn’t just Bernanke, though presumably he had the most authoritative data to draw on. Through the markets’ rise to their peak late in 2007 and for many months into their precipitous fall, the dominant voices from the government, financial journalism, and the business and financial establishment under- rather than overplayed the scope of the current disaster.

With the celebrated exception of Nouriel Roubini, an economist from the Stern School of Business of New York University. At just the time Bernanke was testifying about the “contained” real-estate problem, Roubini was publishing a paper arguing that the depressed housing market was nowhere near its bottom, that its contraction would be the worst in many decades, and that its effects would likely hurt every part of the economy. In September 2006, with markets everywhere still on the rise, he told a seminar at the International Monetary Fund’s headquarters that the U.S. consumer was just about to “burn out,” and that this would mean a U.S. recession followed by a global “hard landing.” An economist who delivered a response dismissed this as “forecasting by analogy.” The IMF’s in-house newsletter covered Roubini’s talk as a curiosity, under the headline “Meet Dr. Doom.”

Roubini is thus enjoying his moment as the Man Who Was Right, a position no one occupies forever but which he is entitled to for now. As markets have collapsed, the demand for his views and predictions has soared. He travels constantly, and late this spring I met him in Hong Kong to ask what he was worried about next.

Roubini, who is 50, has a tousled look, from his curly black hair to his rumpled clothing. The initial impression he gave was of total physical exhaustion. When he spoke, at mid-afternoon in Hong Kong, he would scrunch his eyes closed tight, as if forcing himself awake, and shove his suit jacket sleeves and shirt sleeves high up from his wrists to his forearms in the same effort.

You often see this paralyzing fatigue in people who’ve recently made the flight to Asia. What was unusual in Roubini’s case is that even with eyes closed he kept emitting high-speed and complex answers, which proved on transcription to consist of well-formed sentences and logical sequences. They were delivered in an accent that is what you might imagine from someone who spent his first 20-plus years in Turkey, Iran, Israel, and Italy before going to the United States as a graduate student at Harvard. In a few cases, I later realized, the polish of his responses was because he was reciting passages from papers he had written, as if from an invisible teleprompter. But mostly he seemed to be drawing on data points and implications that were so much on his mind they could be processed and expressed even when the rest of him was spent.

The conversation was surprising in three ways: for the relatively high grades Roubini gave Treasury Secretary Timothy Geithner, generally the least-praised member of the Obama economic team; for the overall support (with one significant exception) he expressed for the administration’s response to the economic crisis; and for his willingness to look far enough beyond today’s disaster to speculate about the problems a recovery might bring. He was also full of advice about China’s reaction to the world financial crisis, including the suggestion that its options are narrower than its leaders may grasp.

Roubini’s compliments for Geithner were in the context of the intellectual and policy history of how the crash had developed and why its effects have been so severe. The dot-com and larger tech-industry crash of 2000 eliminated a tremendous amount of stock-market wealth. During the panicky sell-off of 1987, nearly a quarter of the New York Stock Exchange’s total value was lost in one day. By comparison, defaults on subprime mortgages would seem more limited in their capacity to harm the economy. Why, then, had so much gone so deeply wrong?

Roubini said that the difference was partly “debt versus equity.” That is, a loss of stock-market value is damaging, but defaults on loans, which put banks themselves in trouble, had a “multiplier” effect: “When there’s a credit crunch, for every dollar of capital the financial institution loses, the contraction of credit has to be 10 times bigger.” This was the process at work last fall, when banks that were concerned about their own survival cut off working capital to everyone else.

The more important difference between this crash and others, Roubini said, was that the speculative bubble involved so much more of the economy than the term “subprime” could suggest. “It was subprime, it was near-prime, it was prime mortgages,” he said, warming up to rattle off a long list. “It was home-equity-loan lines. It was commercial real estate, it was credit cards, it was auto loans.” The list was just getting started, and he used it to emphasize that almost every form of borrowing had been taken beyond reasonable limits, and that most forms of asset had been bid unreasonably high. And not just in the United States: “People talk about the American subprime problem, but there were housing bubbles in the U.K., in Spain, in Ireland, in Iceland, in a large part of emerging Europe, like the Baltics all the way to Hungary and the Balkans,” and most parts of the world. “That’s why the transmission and the effects have been so severe. It was not just the U.S., and not just ‘subprime.’ It was excesses that led to the risk of a tipping point in many different economies.”

Roubini’s case against Ben Bernanke and his predecessor Alan Greenspan is that they kept interest rates too low for too long—and downplayed the significance of the bubble they helped create. “They kept on arguing that this was a minor housing slump, and this housing slump was going to bottom out,” he said. “They kept repeating this mantra that the subprime problem was a ‘niche’ and ‘contained’ problem.” These were serious analytic errors, he said, of a sort that is common near the end of a bubble. “Bernanke should have known better, but it’s not really about him. It’s in everybody’s interest to let the bubble go on. Instead of the wisdom of the crowd, we got the madness of the crowd.

“So when the proverbial stuff hit the fan in the summer of 2007, [the Fed and the Bush administration] were initially taken by surprise,” he concluded. “Their analysis had been wrong. And they didn’t understand the severity of what was to come. And all along, their policy was two steps behind the curve.” He was much more respectful of the judgment that Timothy Geithner showed.

“You know, when Geithner became president of the New York Fed [late in 2003], the first eight speeches he gave were about systemic risk,” he said. (Most were about the way the growing complexity and interconnectedness of financial systems made it harder to know the real degree of risk the entire financial network was exposed to, and how far regulation was lagging behind the quickly changing realities. Most read well in retrospect.) Behind this difference in tone, according to Roubini, was a deeper contrast in belief about what the government could or should do when it saw a financial bubble beginning to form.

About the response once a bubble collapses, most economists are in agreement. Central banks around the world have been lowering interest rates to near zero and pumping new money into their economies. But could they have done anything to forestall the need to? According to Roubini:

“Bernanke, like Greenspan, had this wrong attitude toward asset bubbles. The official philosophy of the Fed was: on the way up with a bubble, you do nothing. You don’t try to prick it or contain it. Their argument was, How do I really know it’s a bubble? And even if I tried to ‘prick’ a bubble delicately, it would be like performing neurosurgery with a sledgehammer.”

The damage done in these boom-and-bust cycles, Roubini says, is greater than politicians and the media usually acknowledge. Stock-market averages eventually recover, as all buy-and-hold investors now keep telling themselves. (Except in Japan, where the main stock index stood near 39,000 in the late 1980s and is around 9,000 today.) But that doesn’t take into account the damage done to the real economy by the swings up and down. “These asset bubbles are increasingly frequent, increasingly dangerous, increasingly virulent, and increasingly costly,” he said. After the housing bubble of the 1980s came the S&L crisis and the recession of 1991. After the tech bubble of the 1990s came the recession of 2001. “Most likely $10 trillion in household wealth [not just housing value but investments and other assets] has been destroyed in this latest crash. Millions of people have lost their jobs. We will probably add $7 trillion to our public debt. Eventually that debt must be serviced, and that may hamper growth.”

Was there any alternative? Yes, if central bankers had taken a “more symmetric approach” to bubbles, trying to control them as they emerged and not just coping with the consequences after they burst. Geithner, he says, was one of those who saw the danger: “While Ben Bernanke was talking about a ‘global savings glut’ as the source of imbalances, Geithner was talking about America’s excesses and deficits. Like the Bank of England and the Bank for International Settlements, he was warning at the New York Fed that we had to be more nuanced in the approach of how you deal with asset bubbles.”

The disagreements about proper bubble management are of more than historical interest, Roubini argues, because he sees the beginnings of another bubble already in view. He was more supportive on the whole than I would have expected about the Obama administration’s financial plans. “I have to give them credit that, less than a month after they came to power, they had achieved three major policy successes,” he said. These were passing the $800 billion stimulus plan, the mortgage-relief plan to reduce foreclosures, and the “toxic asset” plan to help banks clear bad loans from their books. He said that the initial version of the bank-rescue plan was “botched, because it was rushed,” but that the later version was better. “On each of these things, you can criticize specific elements,” he said. “But they did the big things, and those are the main parameters of what is a constructive policy response. For now, you have to deal with the problem you are facing. All in all I think the policy is going in the right direction.”

But someday, the emergency will be over. Then the side effects of today’s deficits-be-damned efforts to spend money and loosen credit will become “the problem you are facing.” Roubini has been tart about the things public officials should have known and the dangers they should have foreseen three or four years ago. What, I asked him, are the decisions of 2009 that we will be regretting in 2012?

For the only time in our conversation, he sat without responding for a measurable interval. “The regrets could be many,” he began. Uh-oh , I thought. “Even the best policies sometimes have unintended consequences.” He then itemized three.

The first involved banks. Like Paul Krugman and others, Roubini had been warning that many banks were weaker than they seemed. Rather than trying to nurse them along, he said, the government should move straightaway to nationalization: “I’m concerned that we’re not going to deal with the bank problem as we should,” he said. “Some banks are insolvent. To prevent them becoming zombie banks, the government should take the problem by the horns and, on a temporary basis, nationalize them. Take over these banks, clean them up, and then sell them back to the private sector. Not doing that is one mistake we may make and regret.”

Next, “monetizing the debt.” This sounds similar to the complaint that the government is spending too much now and will regret it later on, which was the main Republican argument against the stimulus plans. Roubini’s concern is different, and mainly involves the delicate process of turning off the extraordinary stimulus measures now being turned on full force.

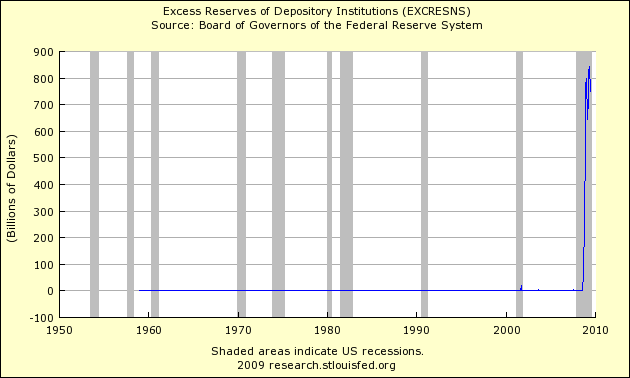

“The Fed is now embarked on a policy in which they are in effect directly monetizing about half of the budget deficit,” he said. The public debt is going up, and the federal government is covering about half of that total by printing new money and sending it to banks. “In the short run,” he said, “that monetization is not inflationary.” Banks are holding much of the money themselves; “they’re not relending it, so that money is not going anywhere and becoming inflationary.”

But at some point—Roubini’s guess is 2011—the recession will end. Banks will want to lend the money; people and businesses will want to borrow and spend it. Then it will be time for what Roubini calls “the exit strategy, of mopping up that liquidity”—pulling some of the money back out of circulation, so it doesn’t just bid up house prices and stock values in a new bubble. And that will be “very, very tricky indeed.”

He mentioned cautionary recent examples. The last time the Fed tried to manage this “mopping up” process was after the recovery from the 2001 recession. To minimize the economic impact of the 9/11 attacks, following immediately on the dot-com crash, Alan Greenspan quickly lowered the benchmark interest rate from 3.5 percent, reaching 1 percent in 2003. By 2004 a full recovery was under way, and Greenspan began raising rates at what he called a “measured pace”—25 basis points, or one-fourth of 1 percent, every six weeks. “That implied it would take two and a half years until they normalized the rate,” Roubini said. “And that was one of the important sources of trouble, because at that point money was too cheap for a long time, and it really fed the bubble in the housing base.” So the lesson would be, when a recovery begins, get rates back to normal, faster.

“But that is very tricky,” he continued, “because if you do it too fast, when the economy is not recovered in a robust way, you might end up like Japan and slump back into a recession. But, of course, if you do it too slowly, then you risk creating either inflation or another asset bubble.” The great difficulty of making these fine distinctions is part of the “brain surgery with a sledgehammer” argument against attempting to intervene at all.

In Roubini’s view, there is no choice but to intervene. “We have to do what’s necessary to avoid a real depression,” he said. But he added that it is not too soon to lay plans for avoiding the consequences of too much money flowing rather than too little.

Roubini had recently been in China and met officials there. We talked about the bind that the world economic slowdown had created for China’s leadership—not despite but because of its huge trade surpluses and foreign-currency holdings. Many Chinese commentators have blamed American overborrowing and excess for dragging them into a recession. But even they realize that the very excess of American demand has created a market for Chinese exports. Chinese leaders would love to be less dependent on American customers; they hate having so many of their nation’s foreign assets tied up in U.S. dollars and subject to the volatility of American stock exchanges. But for the moment, they’re more worried about keeping Chinese exporters in business. To do that, they want to prevent their currency from rising. And for reasons laid out in detail in a previous article (“The $1.4 Trillion Question,” January/February 2008 Atlantic), the mechanics of finance require them to keep buying U.S. dollars and entrusting their savings to the United States. “I don’t think even the Chinese authorities have fully internalized the contradictions of their position,” Roubini said.

I agree. But I can report that for these past six months, virtually every economic conference I’ve heard of in China and every special supplement in a Chinese business publication has been devoted to the changes the country would have to make in order to reduce its vulnerabilities.

I asked Roubini whether, similarly, American authorities and the U.S. public appreciated the contradictions in their own position. He answered by returning to the damage caused by boom-and-bust cycles and the need to find a different path.

“We’ve been growing through a period of time of repeated big bubbles,” he said. “We’ve had a model of ‘growth’ based on overconsumption and lack of savings. And now that model has broken down, because we borrowed too much. We’ve had a model of growth in which over the last 15 or 20 years, too much human capital went into finance rather than more-productive activities. It was a growth model where we overinvested in the most unproductive form of capital, meaning housing. And we have also been in a growth model that has been based on bubbles. The only time we are growing fast enough is when there’s a big bubble.

“The question is, can the U.S. grow in a non-bubble way?” He asked the question rhetorically, so I turned it back on him. Can it?

“I think we have to …” He paused. “You know, the potential for our future growth is going to be lower, because of the excesses we’ve had. Sustainable growth may mean investing slowly in infrastructures for the future, and rebuilding our human capital. Renewable resources. Maybe nanotechnology? We don’t know what it’s going to be. There are parts of the economy we can expect to lead to a more sustainable and less bubble-like growth. But it’s going to be a challenge to find a new growth model. It’s not going to be simple.” I took this not as pessimism but as realism.

6/24/09 - Bloomberg - Nouriel Roubini Says U.S. Economy `Sort of Stabilizing' (Click here for Video)

(Bloomberg) -- Nouriel Roubini, professor at New York University's Stern School of Business, talks with Bloomberg's Deirdre Bolton and Tom Keene about the state of the U.S. economy.

Roubini, speaking from London, also discusses Federal Reserve monetary policy, personal savings and the outlook for the U.S. unemployment rate. (Source: Bloomberg)

00:00 U.S. economy "sort of stabilizing"

01:13 Fiscal concerns, deficit, inflation; Fed

06:10 "Most of" Eastern Europe is in "trouble."

12:13 Health-care spending; personal savings rate

16:11 Trade deficit; exit strategy from stimulus

18:31 Unemployment rate to peak at 11 percent

Running time 20:29