Global investors should be concerned about potential economic turmoil

as the United States is embarking on a recession and the greenback

continues to be unsound, says Jim Rogers, chairman of Rogers Holdings

and bestselling author of “Hot Commodities.”

Rogers spoke with Bloomberg TV India

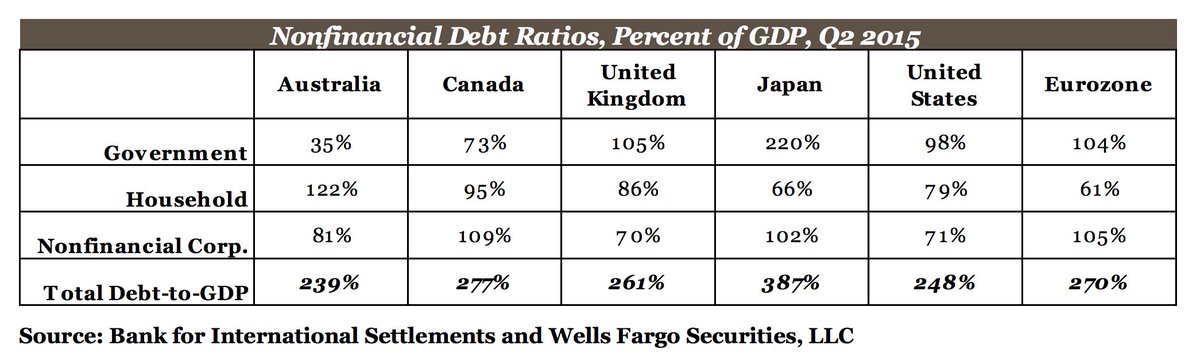

on Tuesday and told the media outlet that the U.S. is “over-indebted”

and maintains the largest amount of debt in the planet’s history.

He further explained that the U.S. dollar is not

sound, and with potential turmoil on the horizon, investors believe

that the U.S. dollar is a safe haven for them. This is wrong, says

Rogers, who thinks the economic downturn will get worse and thus the

dollar will grow and transform into a bubble.

This is when he’ll sell the dollar and perhaps buy more gold or even the Chinese renminbi.

Read more

None of this trillion dollars taken from us is spent to keep us safe, despite what politicians say. In fact, this great rip-off actually makes us less safe and more vulnerable to a terrorist attack thanks to resentment overseas at our interventions and to the blowback it produces.

The money is spent to maintain existing conflicts and to create new areas of conflict overseas that in turn feeds the demands for more military spending. It is an endless cycle of theft and deceit.

Billions were spent not long ago overthrowing an elected government in Ukraine and provoking Russia. A new Cold War is a bonanza for the military industrial complex, the pro-war think tanks, and the politicians. NATO is on the move in eastern Europe, placing heavy weapons right on Russia’s border and then blaming the Russians when they complain about the rising militarism. NATO military exercises on Russia’s border have increased and become more confrontational.

In the Middle East, more billions have been spent attempting to overthrow the secular government of Syria over the past five years. The big winners in this grand scheme have been the Islamist extremists, who are funded directly and indirectly by the US and its allies. NATO is planning to go back into Libya, an admission that its 2011 “liberation” of that country has been a disaster.

In Asia, the US empire challenges and provokes China, sending military ships and aircraft into territory China claims in the South China Sea. How much will they continue to escalate before China gets fed up?

The more money sent to the Pentagon and other parts of the Washington war apparatus, the more danger we are in.

Meanwhile,

almost all of the presidential candidates promise more military

spending and more war if they are elected. Did no one tell them we are

broke and making enemies fast with our interventions? Do they think

Fed-created money will really continue to fuel the US empire

indefinitely?

Meanwhile,

almost all of the presidential candidates promise more military

spending and more war if they are elected. Did no one tell them we are

broke and making enemies fast with our interventions? Do they think

Fed-created money will really continue to fuel the US empire

indefinitely?What are the prospects for a u-turn toward peace and prosperity in 2016? We must be realistic. Presently the numbers are not on our side. But the good news is we do not need a majority to succeed in our fight for peace and liberty. We need only a dedicated and uncompromising critical mass to make great headway.

What can we do to work for peace in 2016? First we must tune out the lying propaganda served up by the US mainstream media. We must educate ourselves so that we can help educate others. We can be sure to tune in and support alternative sources of news and analysis like the Ron Paul Liberty Report, LewRockwell.com, Antiwar.com, and many others. We can tell others about the wealth of truth available to those who seek and question. We must not compromise and never accept the lesser of two evils.

If the people demand peace, the politicians will follow. Let’s demand peace in 2016!