Since taking office, Obama shamelessly betrayed his constituents by:

-- ignoring popular needs during America's greatest economic crisis since the Great Depression;

-- giving Wall Street crooks trillions of taxpayer dollars;

-- spending another $1.5 trillion annually on militarism, imperial wars, and related policies at a time America has no enemies;

-- waging war on organized labor and public education, as well as civil and human rights; and

-- claiming "tough choices" demand class warfare through neoliberal austerity for working Americans, mainly middle and lower income ones least able to afford it.

On April 13, he announced his latest plan through $4 trillion in largely social spending budget cuts over the next 12 years. More on them below.

The same day, New York Times writers Mark Landler and Michael Shear headlined, "Obama's Debt Plan Sets Stage for Long Battle Over Spending," saying:

Obama's Wednesday George Washington University speech "propos(ed) a mix of long-term spending cuts, tax increases, and changes to social welfare programs," omitting that they harm working Americans most.

A Times editorial headlined, "President Obama, Reinvigorated," saying:

"The man America elected president has re-emerged." His budget speech "was a reasonable basis for a conversation and is far better than its most prominent competitors. That is because it is grounded in themes of generosity and responsibility....(I)t was a relief to see Mr. Obama standing up for the values that got him to the table."

These aren't surprising comments from a broadsheet long associated with wealth and power interests, now pretending hammering working Americans is fair and just.

A supportive Washington Post editorial headlined, "President Obama's deficit plan: Benefits and drawbacks," saying:

Obama "made an important and welcome contribution to the debate over deficit reduction Wednesday...(S)orely needed presidential engagement on the nation's fiscal crisis has arrived at last."

A Wall Street Journal editorial, however, called Obama "The Presidential Divider," saying:

His speech was "toxic," "dishonest," (and) even worse (for) deficits and debt" by not matching Rep. Ryan's (R. WI) slash and burn plan even more draconian that his own - "in the midst of a fiscal crisis" both parties refuse to address responsibly, nor do major media reports, op-eds, and editorials explain it.

In fact, Obama largely embraces plans proposed by Republicans and his own deficit cutting commission, offering a different mix for the same purpose - protecting America's super-rich while hammering working Americans through "shared sacrifice."

In other words, middle and low income households "sacrifice" to let wealthy ones "share," his agenda since day one in office.

For example, his proposed tax increase plan is a sham, knowing Republicans won't agree. Moreover, since taking office, he broke every major campaign pledge, and twice, since December alone, capitulated to Republicans on taxes and spending:

-- last December, with Democrats controlling both Houses, by extending Bush's tax cuts to the rich after promising to end them; and

-- in April, agreeing to $38 billion in largely vital social services cuts after promising to preserve them, rationalized by arguing for "a willingness to give on both sides."

Representing wealth and power, his promises are empty. His April 8 budget deal includes significant social spending cuts including:

-- $3.5 billion from Children's Health Insurance Program (CHIP) funding;

-- $2.2 billion from nonprofit health insurance cooperatives;

-- $600 million from community healthcare centers;

-- $1 billion from HIV/AIDS, tuberculosis, and other disease prevention programs;

-- $1.6 billion from EPA's clean/safe drinking water and other projects;

-- $950 million from community development grants;

-- $504 million from nutrition aid for poor Women, Infants, and Children (WIC);

-- $500 million from education programs;

-- $390 million from home heating subsidies to the poor, as well as $2.5 billion for the Low Income Energy Assistance Program (LIHEAP) announced in February;

-- $350 million from labor programs, including grants for community service jobs for seniors;

-- other social service cuts;

-- $786 million from FEMA first-responder funding;

-- $407 million from energy efficiency and renewable energy programs;

-- $260 million from National Institutes of Health (NIH) medical research;

-- $127 million from the National Park Service; and

-- billions less for public infrastructure and transportation spending, while increasing war appropriations by multiples more, including for conquering and controlling Libya.

Moreover, Obama agreed to more draconian FY 2012 cuts and corporate tax breaks as part of a deal to raise the debt ceiling before its limit is reached in mid-May. Appearing on NBC's Meet the Press April 10, senior White House advisor David Plouffe said he'd consider new austerity measures to raise the debt ceiling and reduce the deficit - an oxymoronic compromise, especially with unlimited defense spending and generous corporate handouts instead of major reductions.

Obama Proposes Draconian Cuts on Working Americans

According to White House.gov, Obama's plan over 12 years includes:

-- $4 trillion overall;

-- $770 billion from education, environmental, transportation, and other infrastructure cuts, as well as lower wages and benefits for federal workers when they need more, not less;

-- $480 billion from Medicare and Medicaid, besides another $1 trillion from Obamacare;

-- $360 billion from mandated domestic programs, including food stamps, home heating assistance, income for the poor and disabled, federal pension insurance, and farm subsidies;

-- $400 billion from military-related spending from unneeded weapons, as well as healthcare and other benefits for active service members and veterans - not priority items the Pentagon and war profiteers want to protect generous annual defense spending increases and supplemental add-ons, plus black-hole black budgets for intelligence and other nefarious purposes.

Like all his demagoguery, Obama hypocrically stressed we're broke and have to make shared sacrifices, suppressing how he's served wealth and power interests at the expense of working Americans during the greatest economic crisis since the Great Depression.

The times demand stimulus, job creation, help for the working poor and unemployed, and much more, including:

-- programs to prevent banks from foreclosing on homeowners they defrauded;

-- slashing defense spending;

-- ending imperial wars and occupations;

-- using the funds for vital domestic programs;

-- breaking up the too-big-to-fail banks; prosecuting their officials guilty of grand theft;

-- reinvigorating public education;

-- strengthening Social Security, Medicare and Medicaid, as well as assuring universal healthcare;

-- guaranteeing every qualified student affordable higher education;

-- supporting organized labor;

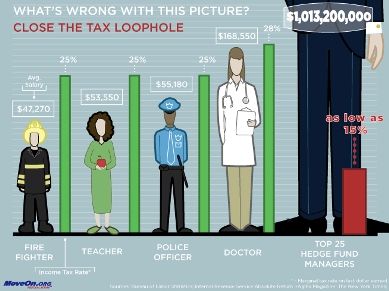

-- instituting tough regulations to end monopoly and oligopoly power, punish corporate theft, curb speculation, end subsidies, and assure they all pay their fair share in taxes;

-- replacing today's dysfunctional tax system with a progressive one, making the rich share the burden they now avoid;

-- making social justice issue one at a time none exists, Democrats as mean-spirited as Republicans; and

-- instituting real government of, by and for the people, what's never existed and doesn't now under corrupted duopoly governance, ignoring people needs to serve Wall Street, war profiteers, and other corporate favorites.

The alternative assures greater militarism, social inequality and decay, growing poverty, eroding freedoms, police state harshness, and overall conditions too dire to imagine because public apathy let elected officials do nothing to change things.

Stephen Lendman lives in Chicago and can be reached at

lendmanstephen [at] sbcglobal.net. Also visit his blog site at sjlendman.blogspot.com and listen to cutting-edge discussions with distinguished guests on the Progressive Radio News Hour on the Progressive Radio Network Thursdays at 10AM US Central time and Saturdays and Sundays at noon. All programs are archived for easy listening.

This is 3420 Boelter Hall in UCLA. Looks cool and decidedly 1970s, right? Long manes, gnarly mustaches and vintage technology cabinets. What were they doing in there? Turns out, this is where the Internet was born.

This is 3420 Boelter Hall in UCLA. Looks cool and decidedly 1970s, right? Long manes, gnarly mustaches and vintage technology cabinets. What were they doing in there? Turns out, this is where the Internet was born.