By Jim Willie

Editor of

The Hat Trick Letter on

GoldenJackass.com

We were just treated to a fake official rate hike, and it was

cleverly executed. The recent supposed USFed rate hike was a gigantic

fraud, a misdirection, a clever ploy, and an act of extreme desperation.

We were told of an official 25 basis point interest rate hike. But a

hike of 0.25% is nowhere to be seen. The reality is that the USFed is so

strapped, so deeply under siege, so overwhelmed, that it requires

urgent help from the USDept Treasury. So they have expanded QE to become

Double Barreled Hidden QE to Infinity. It has an important feature now,

with national security stamped on it. This is truly the end game for

the USDollar. Big thanks to Rob Kirby and EuroRaj on my colleague team

for leading the way and shining the spotlight. Their abilities to see

through the maze, smoke, mirrors, and din is impressive.

Consider the many points, which can be connected. As they say,

connecting the dots can lead to conclusions more clearly, when the dots

display a recognized picture. The deception was well organized, well

planned, well delivered, and well done generally. Most financial

analysts only read the headline, then gobble the false message like a

dog eating his own vomit. Most traders only read the headline, and look

for quick profit while anticipating the moves by the dullard masses.

Best to look for the reality, and plan for the long run survival. Take a

closer look at the developments within the USTreasury market where

private accounts have emerged in recent months to purchase the

referenced inventory of USTreasurys that China and others are dumping.

NO RATE MOVEMENT & INVERSION SUDDENLY

The effective Fed Funds rate has not risen by 25 basis points. More like

10 to 15 bpts, depending upon the day. In fact, the Fed suddenly finds

itself in an awkward position, with an inversion of the Fed Funds rate

versus the 3-month USTreasury Bill. The inversion has been constant

since the supposed rate hike, and a billboard message of the sham lie.

The proof of the pudding is in its taste, not from the whiff of its

billboard description and advertising. Ooops! In reality, the USFed is

pumping liquidity into the system via temporary expansion of the balance

sheet, using hidden channels and accounts, the propaganda grown as loud

as ever. Remember in 2009, when the august bank cabal hive assured the

near zero percent official rate would last only a few months. The

Jackass forecasted it would be in place forever. Check!

HIDDEN HUGE HAND IN USDEPT TREASURY

The big Wall Street players run the USTreasury Bond market, like

JPMorgan Chase, Goldman Sachs, Citigroup, even to some extent Bank of

America and Morgan Stanley. They must be on the lookout for massive

USTreasury dumping by the cast of creditor characters. Almost nobody is

buying the USGovt debt at a time when the annual deficit continues to

ring in at $1 trillion. Yet the bond yield is steady in the 2.0% to 2.4%

range. When China disposed of $250 billion worth of USTBonds in August,

September, October, it had to be soaked up. Mission Accomplished with

no detectable rise in the TNX 10-year bond yield. Otherwise the USGovt

debt market would resemble Greece, since the fundamentals are just as

wretched. The strong hand doing the purchases en massive volume is the

USDept of Treasury itself, using the Exchange Stabilization Fund. The

ESF was created in 1934 for the expressed purpose of protecting the

USDollar. They buy the USGovt debt securities that foreigners discard,

thus fulfilling their mandate. Their purchases are being made with cash

off the books, hence bearded as private accounts, and not official

reserves. As Rob Kirby points out, “In our capital markets we are coming

to a climax event much like in a magic show. These sociopathic heathens

are and have been conducting stealth QE with direct cash injections

from the Treasury’s ESF. The ESF has the resources, all kept off book.

No one in the banking system will dare talk about it, because anything

connected to the ESF is a matter of National Security. If the world ever

becomes aware of the true size of the off-book elements of the ESF, one

should very likely see a hyper-inflationary event overnight.” It is

worse. The ESFund is involved with its fat fingers in almost every major

financial market in existence, as in currencys, stocks, bonds, and more

like LIBOR and Gold.

RIGGED USTREASURY BOND MARKET

MASSIVE INCREASE IN LEVERAGE

In the official USFed statement, a strong hint was given about the

Reverse REPO being used more heavily. This is a major clue as to the

real actions taken. RRP is a liquidity drain, when it is the only

monetary operation. The Jackass admits to not fully comprehending the

Reverse REPO, regarding it previously as direct shovel of funds to the

big banks. It is a device used in concert with the USDept Treasury

hidden hands in the massive multi-$trillion fund. A better comprehension

now, after Rob Kirby straightened me out humbly, done with my

gratitude. The USFed takes in cash and puts out USTreasurys. Consider

the perspective of the bank cabal, then the USDept Treasury Exchange

Stabilization Fund. The big banks cannot leverage cash but they can

leverage USTBonds several times over. The Fed feeds the banker cabal/ESF

with collateral (USTBonds) which are leveraged multiple times in order

to support risk assets. This in effect is a gigantic pseudo-QE. When one

factors in that $200bn (for example) in collateral can be safely

leveraged 3x to 10x, the Fed via the cabal/ESF has created liquidity of

$600bn to $2 trillion in a blink of an eye. The clue of excessive

leverage is seen in volatility for the TNX 10-year bond yield. The

candle bars are becoming longer over the last year. Witness a tremendous

increase in leverage starting to shake the Tower of Babel. Since the

London Whale incident in May 2012, the tower has been higher. Now it is

narrower. Thus it is extremely unstable. Keep in mind it serves as the

basis of the USDollar.

BACKFIRE NIGHTMARE ON MAIN STREET

The USFed has until recently been pumping massive volumes of cash into

the system to keep it alive. Consider the point made by John Hussman,

that the Fed just simulated a withdrawal of around $1.7 trillion of

liquidity. With this December move, it is like the Fed has turned the

financial sector into a giant vortex sucking in all liquidity in the

economy, while pumping a sufficient volume of hot (leveraged) money

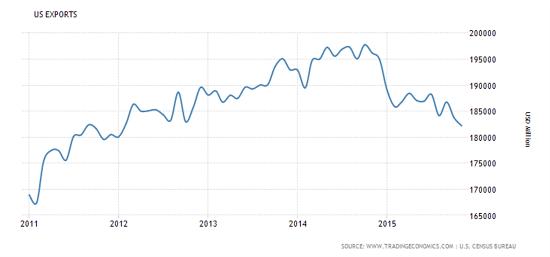

directly into the banks to keep the indices levitated. The United States

in its march to the Third World has begun to resemble a highly

vulnerable hot money zone, marred by Zimbabwe monetary policy in its

hyper monetary inflation. Once more, Wall Street is favored over Main

Street, where the USEconomy continues to accelerate on the downhill. The

fierce but steady recession has turned into a ravaging depression. The

statistical deceptions have become more patently false and openly wrong,

like with the GDP economic growth, like with the labor market jobless

rate.

PONZI SCHEME CLIMAX IN REALITY

The Ponzi Scheme theory dictates that in a very late stage, the monetary

growth must accelerate in a huge way to compensate for the extreme

systemic destruction. An acceleration in funds is required to remain at

even keel. The Jackass believes the recent supposed USFed rate hike

coincided with QE7, as they admitted the Reverse REPO tool was to be

used, balanced by the USDept Treasury Exchange Stabilization Fund being

deployed as a hidden second barrel of Quantitative Easing. The Reverse

REPO tips the hand of Hidden Massive QE from the ESFund itself. There

truly is not much time left before it all breaks, the bond tower to

topple, despite their efforts. The warnings have come from Richard

Fisher, who on CNBC shocked the talking heads with an admission that the

bond and stock markets are lifted, supported, levitated by the USFed

and Wall Street banks. The other warnings have come from Stanley

Fischer, as shadow Fed Head imported from Israel, who has made public

statements that the USFed has exhausted its tools and cannot maintain

any return to normalcy. The diminutive Janet Yellen surely has a smaller

voice than Fischer. Compare to former Treasury Secretary Tim Geithner,

whose voice surely was smaller than Robert Rubin operating in the

background. The White House has its own puppet brand as well.

Follow the path. The Operation Twist of 2011 was really QE3. The

Chinese traded their long-dated USTreasurys for shorter dated USTBills,

which they could hold more easily into actual maturity. The announced

QE3 last year was really QE4, done after the absurd Taper Talk. The

theft of the $1.2 trillion in Japanese Govt pension funds in late 2014

was really QE5. The deployment of the BLICS nations to conduct equal

volume bond purchases was an exported QE6. The nations of Belgium,

Luxembourg, Ireland, Cayman, and Switzerland dutifully matched the USFed

with over $400 billion in USTBond purchases from 2012 to 2014, with no

publicity given the action. The December Fed Rate hike was really QE7.

Let’s get real!

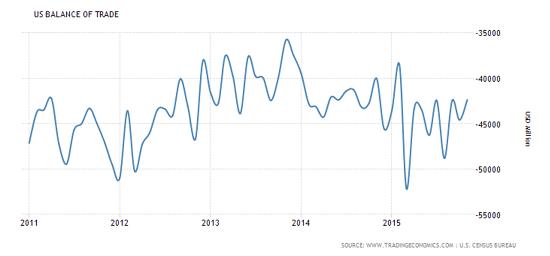

DAMAGED SCORECARD ON TICKERS

It is really amazing. The USFed raised interest rates while the European

Central Bank lowered rates. Widespread promises were made to extend QE.

The USDollar index went lower. The USFed raised rates but the

USTreasury Yield curve flattened, as in 2-year versus 10-year. The USFed

raised rates, but the 3-month USTBill fell below the Fed Funds rate, a

direct inversion. Furthermore, the big bank stocks failed to rally,

which one would expect from relief. The financial sector Credit Default

Swap went wider, signaling more danger ahead at the systemic level. The

High Yield bonds continued to implode, most significantly the energy

sector. The crude oil price continues to drop, near the magic Jackass

$30 trigger point. The USFed and its Wall Street subjects are fast

running out of time, out of tools, and out of public confidence. All the

signals are the opposite of what one would expect, the opposite of a

market confirmation of a correct move been made. This screams policy

mistake and systemic breakdown in acceleration.

CRUDE OIL PRICE AS TRIGGER

Events of the last two or three months could not be more disruptive,

dangerous, or ominous. The Chinese RMB continues to make significant

inroads with trade and financial platforms. However, the oil price is

the flash point. A sub-$30 oil price will lead the banks generally to

quit with the energy sector. They will throw in the towel and end their

support. They will cease with all debt service patches, those additional

bridge loans which enable the firms to continue making debt service

payments on their massive loans. Big covenant violations are in

progress, as dictated by the business flows and the stock prices, even

the bond prices. As the oil price continues to decline, the risk of a

big bank failure is heightened. For the myopic who do not expect further

crude oil price declines, look no further than the Iran Nuclear Deal

which permits Iran to sell a lot more oil. They have a floating

inventory of 100 million barrels. By April they will be selling one

million barrels per day in the open market. Also look no further than

the USGovt, which put aside a 40-year law that bans oil export.

Meanwhile, OPEC refuses to cut back in oil production, fearful of rising

budget deficits. Conclude the US and Iran have indirectly conspired to

push the oil price below $30 per barrel, where it will trigger financial

sector failures. This is unavoidable.

USDOLLAR DYING

After 1971, the USDollar was no longer backed by Gold. Quickly the

USDollar benefited from the defacto Petro-Dollar Standard in 1973,

hastily arranged. No evidence is more clear of a dying USDollar than the

collapse of the oil price, practical foundation of the global reserve

currency. The foundation was affirmed in the mass of derivative

contracts, in addition to the Arab Petro Surplus Recycle practice,

whereby the Saudis and other Arab Emirates agreed to keep their oil

surpluses in USTreasury Bonds. They agreed not to sell out of the

USDollar. They hold a mountain of USTBonds still. They agreed to make

gigantic USMilitary contractor weapons purchases. So observe the crude

oil price down in a death spiral, the USDollar rise in a balloon flight

upward into thin air, and the Gold price kept down by the rising USD.

The negative correlation between the USD currency index and Oil price is

evident. The negative correlation between the USD and Gold is well

known. Notice the competition with new Russian oil benchmark in the St

Pete contract. The game is over, with the music continuing to play. The

chairs on the USS Titanic are not being rearranged. They instead were

given to the Chinese, where they take in sun on the disputed islands.

NEW SCHEISS DOLLAR & GOLD TRADE STANDARD

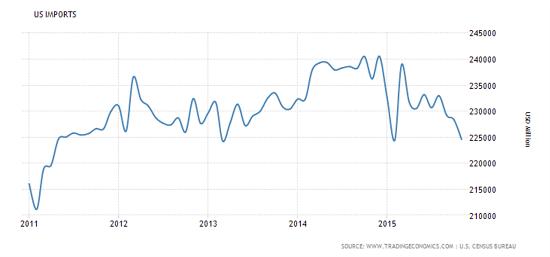

In time, expect an eventual refusal by Eastern manufacturing nations to

accept USTreasury Bills in payment. The IMF reversal decision assures

this USTBill blockade in time, and might accelerate the timetable. The

United States Govt cannot continue on five glaring fronts of gross

violations. These violations have prompted the BRICS & Alliance

nations to hasten their development of diverse non-USD platforms toward

the goal of displacing the USDollar while at the same time take steps

toward the return of the Gold Standard. The violations are:

1) to import finished goods and crude commodities, paying with IOU coupons

2) to commit multi-$trillion bond fraud in its big banks, done without legal prosecution

3) to do QE bond purchases in applied hyper monetary inflation, monetizing debt

4) to rig all major financial markets in favor of the primal USDollar

5) to engage in numerous regional wars to support the USDollar.

The New Scheiss Dollar will arrive in order to assure continued

import supply to the USEonomy. It will be given a 30% devaluation out of

the gate, then many more devaluations of similar variety. The New

Dollar will fail all foreign and Eastern scrutiny. The USGovt will be

forced to react to USTBill rejection at the ports. The USMilitary and

Langley threats will not work much longer, as they are in retreat. The

US must accommodate with the New Scheiss Dollar in order to assure

import supply, and to alleviate the many stalemates to come. The United

States finds itself on the slippery slope that leads to the Third World,

a Jackass forecast that has been presented since Lehman fell (better

described as killed by JPM and GSax).

The Gold price will find its true value and price over $10,000 per

ounce. The Silver price will find its true value and price over $400 per

ounce. In reaching these levels, the ratio will return to the 25-1

range. Several steps have been laid out by the Hat Trick Letter toward

the return of proper price to precious metals. The major upcoming events

will be exciting to watch unfold, one after the other, in an inevitable

sequence away from fascism and concentrated uni-polar power, with a

strong movement toward freedom and equitable systems with distributed

power. The steps will each involve a quantum jump in the Gold &

Silver prices. The process will take a few years, but might be

breath-taking in speed once the process is begun. The steps involve:

~the critical mass of rejected USTBills in trade settlement, citing its corrupt roots and illicit monetary policy as foundation

~the return to the Gold Trade Standard and introduction of Gold Trade

Notes as letters of credit, in replacement for a fair tangible payment

system (no more IOU coupons)

~the recapitalization of the global banking system with Gold as primary

reserve asset, so as to relieve the grotesque stagnation, insolvency,

and dysfunction

~the seeking of equilibrium in Supply vs Demand in the new fair

uninhibited market, with exclusive control removed from London and New

York, and placed elsewhere like in Shanghai, Hong Kong, Dubai, and

Singapore.

~the seeding of BRICS gold & silver backed currencies from

participating nations within the Alliance (likely several with slight

variation in features)

~the re-opening of the gold mine industry with some blue sky, and relief from the Evergreen element at Barrick

~the remedy toward owners of over 40,000 tons of rehypothecated and

stolen gold in bullion banks across the world (primarily in Switzerland.

Prime Minister Malcolm Turnbull and Trade Minister Andrew Robb. Photo: Andrew Meares

Prime Minister Malcolm Turnbull and Trade Minister Andrew Robb. Photo: Andrew Meares

Signatories to the TPP include

Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand,

Peru, Singapore, the US and Vietnam.

Signatories to the TPP include

Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand,

Peru, Singapore, the US and Vietnam.

The

“sleeper” investment award of the year certainly belongs to Bitcoin as

few Wall Street “gurus” enjoyed the 35% ride higher last year.

The

“sleeper” investment award of the year certainly belongs to Bitcoin as

few Wall Street “gurus” enjoyed the 35% ride higher last year.