Sunday, April 24, 2011

Are Obama and Soros Going to Use an Economic Crash to Dismantle the Constitution?

Alan Keyes through The Declaration Alliance has uncovered evidence on May 1,2011 that is May Day.A Holiday in the Communist world. They want to force us into a system of economic slavery forever paying off the Banks a debt we do not owe.The Obama White House and George Soros plan to launch another attack on what is left of the economy and our Constitution to force us into accepting a Marxist Manifesto. By using an economic and banking crash to cause economic pain on us.With such misery inflicted on us. They hope we would accept anything as long the economic hardships stops.They want us to cry uncle to stop the pain game.

Another way they might dismantle the Constitution is a fiscal crisis causing the required states to call a Constitutional convention under the guise of a balanced budget amendment from another direction under the Republican banner in the name of stopping Obama's out of control spending.

We are going into dangerous times because the other side knows their time is short and the window of opportunity is closing. They still have a few tricks up their sleeve to use on us to scare us.They will use class warfare blaming the middle class,They will try to turn the poor on the people who still produce.The will pit young against old,black against white. They will try to shift the blame when it was the Government and the Bankers are the ones to blame. We must be vocal who is to blame and not fall victim to class warfare games of the past turning on each other. This is our Constitution and not theirs to shred. Not matter what crisis we must not surrender our liberties for temporary relief. It has never worked and never will.

Lockdown ends at IRS building in Ogden

OGDEN -- A possible threat forced the IRS building in Ogden to go on lockdown for more than four hours Friday night.

A frightened employee called KSL in the midst of the lockdown, saying she was stuck.

By 10:30 p.m., she and her coworkers were allowed to go home after crews determined there was no threat.

The woman told KSL it began at 6 p.m. By 7:30, Weber County sheriffs and a hazardous materials team were called to the scene to investigate a suspicious substance. Because this is a federal building, FBI personnel were also called to the site.

Around 9:30 p.m., about two dozen people left the building. Since then, people have been trickling out in small groups of two or three.

Local hazmat crews determined the substance was not dangerous not long after 10 p.m. The FBI has backed out of the investigation, saying they don't believe a federal crime was committed.

The Ogden IRS center is one of the largest in the country, employing thousands of Utahns.

This isn't the first scare. Last year hazmat crews searched the area for a white powdery substance believed to be anthrax. Two IRS employees were carried out of the building on stretchers, but their condition was unrelated. Hazmat crews were unable to find any hazardous material on scene.

Local officials will continue to investigate.

------

Story written with contributions from Sarah Dallof.

Americans pessimistic about economy: poll

|

| New York job hopefuls © AFP/Getty Images/File Spencer Platt |

WASHINGTON (AFP) - Americans are more pessimistic about the economy than they have been at almost any time since the start of Barack Obama's presidency, according to a poll released Friday.

As candidates begin to limber up for the 2012 presidential race, a New York Times/CBS News survey showed 80 percent of Americans think the economy is in bad shape and 39 percent think it is getting worse.

That depth of pessimism is similar to levels seen in the first months of Obama's term, when the economy was still in the throes of recession.

The poll offers the White House painful evidence that rising gasoline prices and stubbornly high unemployment is roiling voters, with Obama personally taking lumps for the malaise.

Some 57 percent of people disapprove of his handling of the economy, more than at any time during his presidency.

The poll was conducted between April 15 and 20, with 1,224 adults surveyed across the United States.

© AFP -- Published at Activist Post with license

CHART: Why The United States Is Doomed To Fail

Click HERE to see in full size

--

We're still working our way through Kleiner Perkins' partner Mary Meeker's excellent analysis of the financial condition of the United States.

We'll be breaking out some key sections in the next few days. In the meantime, here's the one chart you need to see to understand why the US is screwed.

This is the "income statement" of the United States in 2010. "Revenue" is on the left. "Expenses" are on the right.

Matt Taibbi On Iowa AG Tom Miller: The Best Way To Raise Massive Campaign Funds? Investigate The Banks

Iowa Attorney General Tom Miller (glasses) increased his campaign contributions from the finance sector this year by a factor of 88!

--

By Matt Taibbi

A hilarious report has come out courtesy of the National Institute of Money in State Politics, showing that Iowa Attorney General Tom Miller – who is coordinating the investigation into the banks’ improper mortgage dealings – increased his campaign contributions from the finance sector this year by a factor of 88! He has raised $261,445 from finance, insurance and real estate contributors since he announced that he was going to be coordinating the investigation into improper foreclosure practices. That is 88 times as much as they gave him not over last year, but over the previous decade.

This is about as perfect an example of how American politics works as you’ll ever see. This foreclosure issue is a monstrous story that is somehow escaping national headlines; essentially, all of the largest banks in the country have been engaged in an ongoing fraud and tax evasion scheme that among other things has resulted in many hundreds of billions in investor losses, and hundreds of thousands of improper foreclosures. Last week, the 14 largest mortgage lenders a group that includes bailout all-stars like Citigroup, Bank of America and Wells Fargo, managed to negotiate a settlement with the federal government that will mandate some financial relief to homeowners who have been victims of improper foreclosure practices. It’s unclear yet exactly what damages and fines will be involved in the federal settlement, or how many homeowners will be affected. But certainly there are some who believe the federal settlement was a political end-run around the states’ efforts to extract their own deal from the banks.

Put it this way. If the banks had to pay what they actually owed – from the registration taxes/fees they avoided by using the electronic registry system MERS to the money taken from investors in toxic mortgage-backed securities to the fees and payments stolen from homeowners via predatory loan practices and illegal foreclosures – they would probably all go out of business. That’s how much money is at stake here: the very future of financial giants like Bank of America and Citi and JP Morgan Chase is hanging to a very significant degree on the decisions of politicians like Miller.

Hence the sudden avalanche of money sent Miller’s way.

The numbers are laughable.

Continue reading at Rolling Stone...

---

Here's the report:

Iowa Attorney General Tom Miller

Campaign Contributions Rise When Foreclosure Investigation Begins

Iowa Attorney General Tom Miller's campaign war chest got a dramatic boost after he announced his leadership of the 50-state attorneys general investigation into foreclosure irregularities. Out-of-state law firms and donors from the finance, insurance, and real estate sector gave $261,445-which is 88 times more than they had given him over the previous decade.

---

How quickly things change for Miller - From just 4 months ago:

Iowa AG Miller vows to put financial criminals in jail

Iowa Attorney General Tom Miller, the lead attorney general in the 50-state foreclosure investigation, told homeowners at risk of foreclosure today that he supports a settlement with the big banks that requires significant principal rate reductions, loan modifications, compensation for citizens defrauded of their homes and criminal prosecutions against big bank executives who broke the law.

“We will put people in jail,” Miller said, in response to questions during a meeting Tuesday with more than 100 people from 15 states representing community, faith, and labor organizations, foreclosure victims and struggling homeowners from across the country.

Carving Up Pakistan: The Balochistan Gambit

Troops will never leave Afghanistan until regional hegemony

Troops will never leave Afghanistan until regional hegemony and its full integration into the "international system" is complete.

When they say "Long War," they mean it. Imperialism 2.0.

Bangkok, Thailand April 22, 2011 - With NATO providing Al Qaeda air cover in Libya as they commit an array of egregious war crimes in their bid to seize the country, the last shred of legitimacy for America's official narrative regarding their war on the Afghan-Pakistani border disappears before our eyes. However, a more rational explanation for the seemingly irrational campaign of frequent General Atomic* Predator drone attacks on Pakistani soil is not only on the table, but has been put there by the global corporate-financier oligarchs themselves.

To understand US-Pakistan relations within the context of the entirely fake "War on Terror" is impossible. Al Qaeda is merely the increasingly tenuous public excuse to justify continued wanton murder within Pakistan as well as occupations and interventions around the globe. In a broader geopolitical context, these constant and seemingly random attacks in western Pakistan serve a more diabolical purpose. With each attack on "suspected militants," the all inclusive term used to describe CIA targets, the authority and stability of Pakistan's establishment is undermined and whittled away. With many of the attacks claiming the lives of civilians, outrage and unrest is purposefully being fanned and spread. The recipients of this outrage and unrest is a national government seemingly bent to the will of the United States as it callously murders Pakistanis.

In particular, Pakistan's Inter-Services Intelligence (ISI) is being intentionally weakened, undermined, and isolated from the whole of Pakistan. The threat of continued CIA operations are usually standing vis-a-vis concessions Pakistan is expected to make. After a recent show of defiance by Pakistan calling on the US to halt all drone operations within its borders, the CIA responded with multiple attacks, the latest of which killed at least 22, including woman and possibly children, seemingly just to spite and incense this reassertion of national sovereignty. The necessary concession expected of Pakistan this time around is their commitment to a military campaign against the Haqqani network, "allegedly based in North Waziristan."

According to the International Herald Tribune article, "End to US drone hits if military launches North Waziristan operation," which even at face value smacks of extortion, "Pakistan’s security establishment has long been accused of having links with the Afghan Taliban particularly the influential Haqqani network." Considering that further strikes will put political pressure on the Pakistani government to concede, the US is driving a wedge between them and the ISI which is undoubtedly the "security establishment" the Tribune is referring to. Instability alone benefits the United States in the short-term to extort a myriad of concessions fulfilling a range of ambitions. But perhaps the most overarching theme is to sever permanently yet another link in China's "String of Pearls."

The "String of Pearls" doctrine encapsulated in a 2006 Strategic Studies Institute report, aims at co-opting, destabilizing and otherwise neutralizing nation states cooperating with China and enabling it to project power and influence along its long and vulnerable oil link to the Middle East. Starting in Africa, throughout the Middle East, into Central Asia and terminating in Southeast Asia, the United States has been conducting a widespread campaign of doing just this.

Pakistan in particular has jointly built a new port with China in the coastal city of Gwadar in the southern province of Balochistan. This port serves as a potential terminal for a north-south transit corridor to transport oil and goods directly into Chinese territory via the northern Gilgit-Baltistan region of Pakistan. It also serves the potential to host a Chinese naval presence. The US bid to interfere internally to disrupt this is hardly a conspiracy theory. Globalist scribe Selig Harrison of the Soros funded Center for International Policy has published two pieces regarding the overarching importance of Pakistan in a broader geopolitical context and "suggestions" on how it can be solved.

Harrison's February 2011 piece, "Free Baluchistan," in name alone indicates yet another "freedom movement" contrived and fueled to give a favorable outcome to his corporate-financier patrons. He explicitly calls to "aid the 6 million Baluch insurgents fighting for independence from Pakistan in the face of growing ISI repression." He continues by explaining the various merits of such meddling by stating, "Pakistan has given China a base at Gwadar in the heart of Baluch territory. So an independent Baluchistan would serve U.S. strategic interests in addition to the immediate goal of countering Islamist forces."

The Baluchi ethnic group is in pink. Globalists would like to carve

The Baluchi ethnic group is in pink. Globalists would like to carveout a "Free Baluchistan" in order to disrupt Chinese-Pakistani

relations. Baluchi rebels are already being armed and supported

by the US in terrorist operations against Iran.

Harrison would follow up his frank call to carve up Pakistan by addressing the issue of Chinese-Pakistani relations in a March 2011 piece unimaginatively titled, "The Chinese Cozy Up to the Pakistanis." He begins by stating, "China’s expanding reach is a natural and acceptable accompaniment of its growing power—but only up to a point. " He then reiterates his call for extraterritorial meddling in Pakistan by saying, "to counter what China is doing in Pakistan, the United States should play hardball by supporting the movement for an independent Baluchistan along the Arabian Sea and working with Baluch insurgents to oust the Chinese from their budding naval base at Gwadar. Beijing wants its inroads into Gilgit and Baltistan to be the first step on its way to an Arabian Sea outlet at Gwadar."

Considering that Baluchi rebels are already being funded and armed to wage war inside of Iran, it is more than likely similar aid is being rendered to them to confront the ISI and Pakistan's government. This three-pronged attack on Iranian, Pakistani, and Chinese sovereignty in a region where 3 nuclear armed nations converge and billions call home is beyond reckless, providing us further insight into the deranged, degenerate minds behind "global governance."

Those under the delusion that US troops will ever leave Afghanistan are in for a disappointment. Barring catastrophic economic collapse or an unexpected and grievous tactical defeat on the battlefield for Western forces, troops will only be moved around, replaced, or even bolstered until regional hegemony is established. Even then, the globalist "civil society" underlay and local security forces fully integrated and subservient to global military alliances would need to be built up and reliable before a single boot leaves the region. This will take decades to complete, which is exactly why we are told the US and UK will be in Afghanistan literally for "decades."

* General Atomic also are the makers of TRIGA research reactors found in many universities throughout America and around the world, including UT at Austin, Penn State, and even next to Kasetsart University in Thailand.

Big U.S. Firms Shift Hiring Abroad

Work Forces Shrink at Home, Sharpening Debate on Economic Impact of Globalization

WSJ's David Wessel has the story of the downside of economic globalization: U.S. multinational corporations, that employ 20% of all U.S. workers, are increasingly hiring overseas workers.

U.S. multinational corporations, the big brand-name companies that employ a fifth of all American workers, have been hiring abroad while cutting back at home, sharpening the debate over globalization's effect on the U.S. economy.

The companies cut their work forces in the U.S. by 2.9 million during the 2000s while increasing employment overseas by 2.4 million, new data from the U.S. Commerce Department show. That's a big switch from the 1990s, when they added jobs everywhere: 4.4 million in the U.S. and 2.7 million abroad.

Bloomberg News

Bloomberg News A General Electric worker in Belfort, France, examines a component for a gas turbine. These days, GE gets about 60% of its business overseas.

In all, U.S. multinationals employed 21.1 million people at home in 2009 and 10.3 million elsewhere, including increasing numbers of higher-skilled foreign workers.

The trend highlights the growing importance of other economies, particularly in rapidly growing Asia, to big U.S. businesses such as General Electric Co., Caterpillar Inc., Microsoft Corp. and Wal-Mart Stores Inc.

The data also underscore the vulnerability of the U.S. economy, particularly at a time when unemployment is high and wages aren't rising. Jobs at multinationals tend to pay above-average wages and, for decades, sustained the American middle class.

Where the Jobs Are

Multinational companies are creating jobs overseas and cutting their U.S. staffs. See cumulative changes in the U.S. and abroad since 1999.

Corporate Globalization

See the percentage of workers overseas for selected U.S.-based companies, from Caterpillar to Walmart.

Some on the left view the job trend as reason for the U.S. government to keep companies from easily exporting work overseas and importing products back to the U.S. or to more aggressively match job-creating policies used in some foreign markets. More business-friendly analysts view the same data as the sign that the U.S. may be losing its appeal as a place for big companies to invest and hire.

"It's definitely something to worry about," says economist Matthew Slaughter, who served as an adviser to former president George W. Bush. Mr. Slaughter, now at Dartmouth College's Tuck School of Business, is among those who think the U.S. has lost some allure.

A decade ago, Mr. Slaughter, who consults for several big companies and trade associations, drew attention with his observation that "for every one job that U.S. multinationals created abroad...they created nearly two U.S. jobs in their [U.S.-based] parents." That was true in the 1990s, he says. It is no longer.

The Commerce Department's summary of its latest annual survey shows that in 2009, a recession year in which multinationals' sales and capital spending fell, the companies cut 1.2 million, or 5.3%, of their workers in the U.S. and 100,000, or 1.5%, of those abroad.

The growth of their overseas work forces is a sensitive point for U.S. companies. Many of them don't disclose how many of their workers are abroad. And some who do won't talk about it. "We will decline to comment on future hiring or head-count numbers," says Kimberly Pineda, director of corporate public relations for Oracle Corp.

Those who will talk say the trend, in some instances, reflects the rising productivity of U.S. factories and, in general, a world in which the U.S. represents a smaller piece of a bigger whole. "As a greater percentage of our sales have been outside the U.S., we have seen our work force outside the U.S. grow," says Jim Dugan, spokesman for construction-equipment maker Caterpillar, which has added jobs more rapidly abroad than in the U.S.

A Caterpillar assembly line England. The company has added jobs more rapidly abroad than in the U.S.

The Commerce Department's totals mask significant differences among the big companies. Some are shrinking employment at home and abroad while increasing productivity. Others are hiring everywhere. Still others are cutting jobs at home while adding them abroad.

At some companies, hiring to sell or make products abroad means more research or design jobs in the U.S. At others, overseas hiring simply shifts production away from the U.S. The government plans to release details about various industries and countries in November.

While hiring, firing, acquiring and divesting in recent years, GE has been reducing the overall size of its work force both domestically and internationally. Between 2005 and 2010, the industrial conglomerate cut 1,000 workers overseas and 28,000 in the U.S.

Jeffrey Immelt, GE's chief executive, says these cuts don't reflect a relentless search for the lowest wages, or at least they don't any longer. "We've globalized around markets, not cheap labor. The era of globalization around cheap labor is over," he said in a speech in Washington last month. "Today we go to Brazil, we go to China, we go to India, because that's where the customers are."

In 2000, 30% of GE's business was overseas; today, 60% is. In 2000, 46% of GE employees were overseas; today, 54% are.

Mr. Immelt says GE did or will add 16,000 U.S. jobs in manufacturing or high-tech services in 2010 and 2011, including 150 in Erie, Pa., making locomotives for China, and 400 at a smart-grid technology center in Atlanta.

Caterpillar increasingly relies on foreign markets for its sales. It has been adding workers world-wide—except for global layoffs in 2009, amid the recession—but is hiring much faster abroad. Between 2005 and 2010, its work force grew by 3,400 workers, or 7.8%, in the U.S. and 15,900, or nearly 39%, overseas.

Mr. Dugan, the company spokesman, says Caterpillar still does most of its research and development in Peoria, Ill., where it is based, and that "a little over half" of its planned $3 billion in capital spending this year is earmarked for facilities in the U.S.

Several high-tech companies have been expanding their work forces both domestically and abroad, but doing much more of their hiring outside the U.S.

Oracle, which makes business hardware and software, added twice as many workers overseas over the past five years as in the U.S. At the beginning of the 2000s, it had more workers at home than abroad; at the end of 2010, 63% of its employees were overseas. The company says it still does 80% of its R&D in the U.S.

Similarly, Cisco Systems Inc., which makes networking gear, has been creating jobs much more rapidly abroad. Over the past five years, it has added 10,900 employees in the U.S. and 21,350 outside it. At the beginning of the decade, 26% of its work force was abroad; at the end, 46% was.

Microsoft is an exception. It cut its head count globally last year, but over the past five years, the software giant has added more jobs in the U.S. (15,300) than abroad (13,000). About 60% of Microsoft's employees are in the U.S.

While small, young companies are vital to U.S. economic growth, big multinationals remain a major force. A report by McKinsey Global Institute, the think-tank arm of the big consulting firm, estimates that multinationals account for 23% of the nation's private-sector output and 48% of its exports of goods.

These companies are more exposed to global competition than many smaller ones, but also more capable of taking advantage of globalization by shifting production, and thus can be a harbinger of things to come.

The economists who advised McKinsey on its report dubbed multinationals "canaries in the coal mine." They include Mr. Slaughter and Clinton White House veterans Laura Tyson, of the University of California, Berkeley, and Martin Baily, of the Brookings Institution.

They warn that a combination of the U.S. tax code, the declining state of U.S. infrastructure, the quality of the country's education system and barriers to the immigration of skilled workers may be making the U.S. less attractive to multinationals. "We can excoriate them" and also listen to them, Mr. Slaughter says of the multinationals. "But we can't just excoriate them."

Other observers see the trend as a failure of U.S. policies to counter aggressive foreign governments. "All the incentives in the global economy—an overvalued U.S. dollar, lower corporate taxes abroad, very aggressive investment incentives abroad, government pressure abroad versus none at home—are such as to steadily move the production of tradable goods and the provision of tradable services out of the U.S.," says Clyde Prestowitz, a former trade negotiator turned critic of U.S. trade policy. "That has been having, and will continue to have, a negative impact on U.S. employment and wages."

—Scott L. Greenberg contributed to this article.Write to David Wessel at capital@wsj.com

Explore The Consequences Of Radiation Fallout From Nuclear Reactor Meltdowns Around The US And The World

Explore The Radioactive Fallout Consequences For Nuclear Reactor Meltdowns Power Plants Around The US and The Entire World Using Google Earth or Google Maps.

Treehugger.com tips us off to a collaboration between Nature News and Google to map the consequences of meltdowns an nuclear power plants around the entire world.

Google Earth Maps Out At-Risk Populations Around Nuclear Power Plants

If a nuclear power plant in the US were to have issues, who would be affected? In a partnership between Nature News and Columbia University, we now have a Google map that tells us the population sizes around plants so we can easily scan and see the number of people that could be affected should anything occur at the plants.

The team Power Reactor Information System (PRIS) database run by the International Atomic Energy Agency (IAEA), and Columbia University’s NASA Socioeconomic Data and Applications Center to map out in an easy-to-read way, the location and size of nuclear power plants as well as population numbers around those plants.On the map, population sizes are illustrated with circle size as well as color. Green circles represent less than 500,000 people and on the other side of the scale, red circles represent populations of over 20 million.

It’s a little scary to see the amount of impact a plant could have should it face troubles. But there’s more than just the US to worry about. The map covers the entire world — check out impacts a potential meltdown could have in India and China:

[...]

Source: Tree Hugger

As Treehugger notes you can find the Google Earth App on Nature News where you can explore the consquences of radioactive fallout at nuclear power plants around the world and the consequences the radiation would have on the populations around the plants.

Here a smaller version of the application. You can view the larger version on the link above.

From the article:

Reactors, residents and risk

[...]

Map showing the population size living within 75 kilometres of each of the world’s nuclear power plants. Population increases with circle size and with colour, from green (< 0.5 million) to red (> 20 million). You need to download the Google Earth plug-in to view this graphic. See ‘How population sizes were estimated’ for an explanation of how the analysis was carried out.Caution: This embedded version may have limited functionality on some browsers. Download the map file for fully enabled viewing on desktop versions of Google Earth.

Source: Nature News

Introducing the Utah Sound Money Act - An Idea Whose Time Has Come

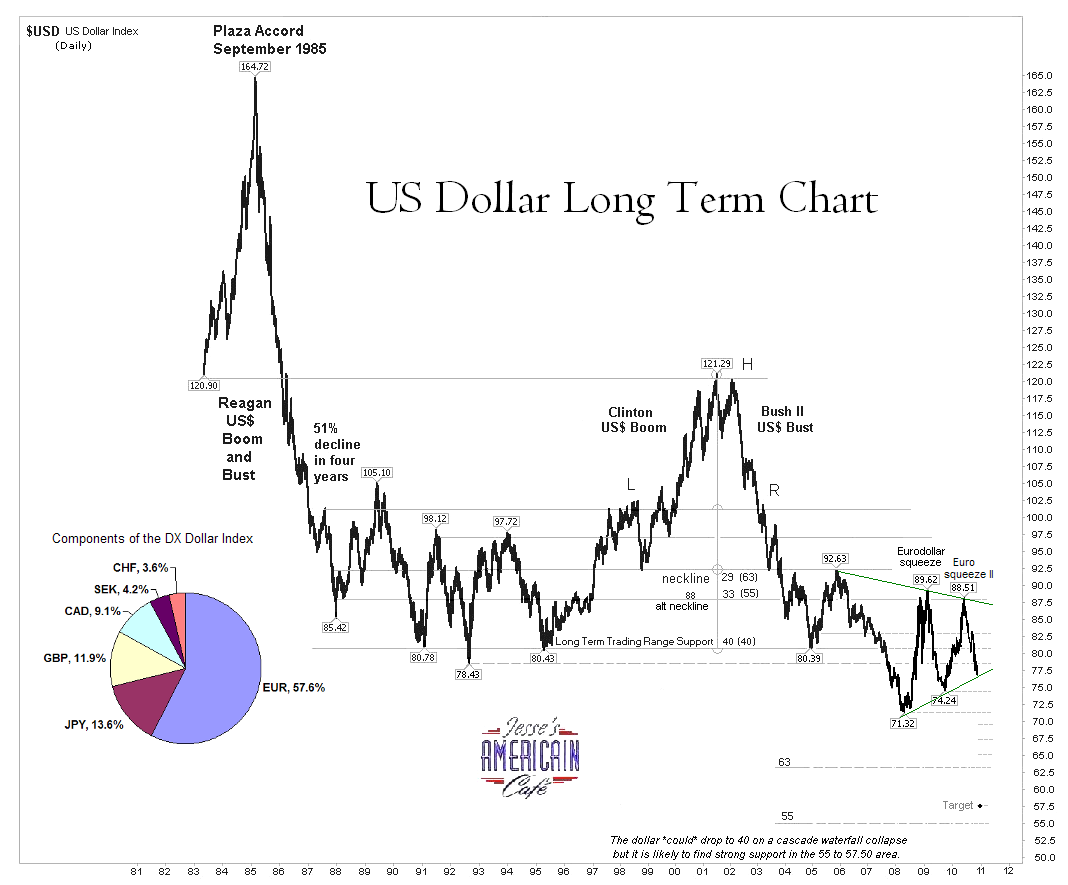

Chart - see in full size at Jesse's Cafe Americain

---

An Idea Whose Time Has Come

Source - 10th Amendment Center

Introducing the Utah Sound Money Act

In 1980, Zimbabwe became a sovereign African nation, gaining its independence from the United Kingdom. At that time, their dollar was valued at a higher rate than the U.S. dollar, at a rate of 1 to 1.25. Earlier this decade, President Mugabe—in power since 1987—began to fulfill a long-standing campaign promise to equalize land ownership, through a campaign called Fast Track Land Reform. While white Zimbabweans constituted less than 1% of the population, they owned around 70% of the land. In 2000, Mugabe began to seize and redistribute land owned by whites to black Zimbabweans.

The economy quickly tanked in response to these moves, as well as the resulting sanctions imposed by several Western nations. That year it declined by five percent, then by eight percent in 2001, then twelve percent in 2002. Inflation quickly surpassed normal percentages and increased into the tens, then hundreds, then thousands, and then like an asymptote, skyrocketed towards infinity. At its highest rate, Zimbabwe’s inflation reached a monthly high of nearly 80 billion percent.

I carry in my wallet one of the most potent objects that can be used in teaching others the nature and importance of sound money: a 100 Trillion Zimbabwe Dollar note—the highest amount ever printed. (Get your own!)

In the months prior to the collapse of their currency, Zimbabweans began using foreign currencies as a more stable medium of exchange. The government was quickly forced to legalize such alternative currencies, first licensing hundreds of businesses to sell their wares in foreign currency, and later suspending their currency altogether, legalizing the foreign currencies themselves for use in the country. Gold has become a coveted commodity as individuals look for a more reliable currency with which to engage in commerce.

Zimbabwe is just the latest of a long string of failed fiat currencies. A currency need not undergo hyperinflation, however, to be rendered worthless. Since its inception in 1913, the Federal Reserve Note (“U.S. Dollar”) has lost 96% of its value through a steady (and sinisterly mis-reported) inflation.

As with Zimbabwe, countries with central banks seek to enforce their monopoly on creation (counterfeiting) of the official currency through legal tender laws. In other words, alternative currencies are outlawed as a medium of payment; the legalization of competing currencies would, through the open market, result in the government losing its monopoly and ending up with a “continental”-like pile of paper with little to no value. (So concerned were the early leaders of the United States with this issue [they had learned from personal experience] that the U.S. Coinage Act of 1792 instituted the death penalty for anybody found counterfeiting the currency.)

Whether hyperinflation is in the future for the Federal Reserve Note or not, its eventual demise is near certain. Positioning ourselves through preparation and wise financial management to proactively respond to such events on the horizon is wise counsel—should not the same apply to our government?

Last year, Rep. Ron Paul (R-TX) introduced the Free Competition in Currency Act which would, in his words, “allow[] for competing currencies [which would] allow market participants to choose a currency that suits their needs, rather than the needs of the government.” Gold, silver, or any other form of currency would be acceptable, under this proposal, for engaging in commerce.

While we wait for the federal government to do nothing to stem the tide of Federal Reserve Notes that will likely soon capsize our ship of state, states can, like individuals, position themselves to proactively prepare for any problem with the dollar, rather than later be forced to react under troublesome circumstances. Article I Section 10 of the U.S. Constitution says that “No State shall… make any Thing but gold and silver Coin a Tender in Payment of Debts…” Additionally, no power was delegated in the Constitution to allow for the federal government to make anything but gold and silver coin a legal tender for commerce. That this limitation has long been ignored is no excuse for its ongoing abuse.

In the 2011 general legislative session, Utahns will have an opportunity to position themselves and their state on better financial footing by infusing the system with sound money—to the degree that willing participants choose to use either gold or silver as alternative currencies. The Utah Sound Money Act will soon be introduced to initiate this opportunity.

This bill is designed to reinstate gold and silver coin as an optional medium of exchange for use in commerce within the state of Utah. It nullifies legal tender laws for intrastate commerce, recognizing the inherent, inalienable right of individuals to engage in specie-based exchanges with each other on mutually agreeable terms. You can read the bill here (PDF).

The bill goes further. Among other things, it:

- exempts gold and silver from sales and capital gains tax when used in intrastate commerce;

- provides standing for Utah court declaratory relief from intrusive federal regulation;

- outlaws searches and seizures, as well as disclosure, of gold and silver coin without a lawful warrant from the county sheriff;

- makes use of the long-defunct Utah State Defense Force to store, safeguard, protect, and transport Utah’s specie holdings;

- allows any Utah taxpayer to discharge his/her financial obligations to the state government in gold or silver coin, should they so choose;

- establishes cooperatives (LLCs) to facilitate and promote intrastate commerce using gold and silver coin; and

- allows for this increase in liberty at no direct nor initial cost to the state of Utah.

This bill does nothing to the federal government’s use of Federal Reserve Notes and monopoly over creating that fiat currency. This bill does not impose a gold standard, nor remove the dollar as a legal tender to be used in commerce. This bill does not do anything, really, other than increase the liberty of each individual to determine how they would like to engage in commerce, and with what currency.

On what rational grounds can an idea like this be opposed?

This is not to say that the language or implementation of the bill is perfect. I’ve had the opportunity to review the draft for several weeks and offer input to the author, and I have to say, the bill is fairly solid. Nonetheless, improvements may yet be suggested and incorporated—and that would be a good thing. But considering the state of the dollar, the liberty-suppressing imposition of legal tender laws, and the stranglehold over commerce (interstate or otherwise), this idea is one whose time is come.

Ayn Rand’s quote on gold speaks many truths about our current situation:

Whenever destroyers appear among men, they start by destroying money, for money is men’s protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims.

This bill seeks to impose a protecting shield around those who wish to voluntarily engage in commerce under its provisions by defending against the destroyers whose counterfeiting operations oppose any competition. For the sake of our liberty—even if you have no desire to use gold or silver—this bill should be supported by all Utahns who have the remotest of concerns about preserving our wealth and staving off financial ruin.

*******

You can download the Constitutional Tender Act template here:

http://www.tenthamendmentcenter.com/legislation/constitutional-tender/

Track Constitutional Tender legislation in the states at this link:

http://www.tenthamendmentcenter.com/nullification/constitutional-tender/

*******

Connor Boyack [send him mail] is the state chapter coordinator for the Utah Tenth Amendment Center. He is a web developer, political economist, and budding philanthropist trying to change the world one byte at a time. He lives in Utah with his wife and son. Read his blog.

Copyright © 2011 by TenthAmendmentCenter.com. Permission to reprint in whole or in part is gladly granted, provided full credit is given.

Survey: 30% of Canadians Can't Afford to Live!

http://ca.finance.yahoo.com/news/Survey-finds-nearly-one-third-capress-886125985.html?x=0

Survey finds nearly one-third of respondents didn't have enough money to live on

The Canadian Press, On Wednesday April 20, 2011, 10:28 am EDT

By The Canadian Press

TORONTO - Nearly one-third of Canadians that responded to a recent survey backed by a major Canadian bank said they didn't have enough money to cover living expenses.

An online survey completed for TD Canada Trust (TSX:TD) also found that 54 per cent of the 1,003 people who answered said it was a real struggle or impossible to save.

The report, released Wednesday, says that 38 per cent of respondents said they had no savings and 30 per cent said they didn't have enough money for their living expenses.

On the flip side, 30 per cent of the respondents said they had enough money saved to cover living expenses for at least four months.

The online survey, based on a representative sample of Canadian adults, was conducted before Christmas from Dec. 2 to 7 by Environics Research for the bank.

TD used the survey results to publicize its services for helping customers with their savings.

The survey found the top goals for the respondents were: saving for retirement (73 per cent), paying off credit cards (72 per cent), and major purchases or vacations (53 per cent each).

On a regional basis:

— 22 per cent of respondents in the Atlantic provinces said they found saving "impossible" and 43 per cent indicated any left-over money was being used to pay down debt.

— 54 per cent of respondents in Ontario said they found it a "real struggle" or impossible to save and 33 per cent said they didn't have enough money to cover living expenses.

— 33 per cent of respondents in Saskatchewan and Manitoba indicated it was a real struggle to save but a larger portion (37 per cent) said they had enough money saved to cover at least four months of living expenses.

— 55 per cent of respondents in Alberta said it was a real struggle or impossible to save but 31 per cent said they had enough money saved to cover at least four months of living expenses.

— 44 per cent of respondents in British Columbia said it was a real struggle or impossible to save; 30 per cent said they didn't have enough money to cover living expenses.

TX - As wildfires burn, Texas lawmakers look to slash firefighting budget

As massive wildfires burn across Texas, lawmakers in Austin are poised to cut the Texas Forest Service's funding for fighting future fires.

The House and Senate have proposed budgets that would slash funding for the agency's Wildfire and Emergency Program by more than 30 percent. Most of the cuts would translate into fewer grants for volunteer fire departments to buy new equipment, according to Robby DeWitt, the agency's associate finance director.

Texas is one of the few states that rely primarily on volunteer fire departments to protect rural areas from wildfires.

"When they get an opportunity to use a new piece of equipment, that does improve their ability" to fight fires, DeWitt said. "These are the folks that are normally out there first for forest fires."

The cuts would reduce the forest service's wildfire funding to its levels from three years ago, when the agency warned the Legislature that it was stretched too thin.

Read more: http://www.star-telegram.com/2011/04/21/3019263/as-wildfires-burn-texas-lawmakers.html#ixzz1KESJK3e4