Wednesday, May 11, 2011

Mississippi Flood May Inundate 3 Million Acres in Louisiana, Governor Says

Three million acres, an area almost the size of Connecticut, may go under water as the Mississippi River flooding moves south and threatens Louisiana.

“Based on inundation maps we are looking at, about 3 million acres in Louisiana will be under water,” Louisiana Governor Bobby Jindal said at a press conference in Baton Rouge yesterday. About 2,500 people inside the floodway may be affected while backwater flooding may impact 22,500, he said.

The river was expected to hold just below 48 feet (14.6 meters) for a day in Memphis before the floods move south toward Louisiana and then empty into the Gulf of Mexico past New Orleans in about two weeks. It was at 47.75 feet at 8:45 p.m. local time yesterday, according to the weather service’s website.

To relieve the threat to New Orleans and Baton Rouge, Louisiana’s capital, the U.S. Army Corps of Engineers may open the Morganza floodway. Opening the floodway halfway would inundate a swath of central Louisiana along the Atchafalaya River with 5 feet to 20 feet of water. The decision to open the floodway may come as soon as May 14, Jindal said.

“The trigger is 1.5 million cubic feet of water a second going past the Red River Landing,” Jindal said. “We are at approximately 1.36 million right now.”

Gasoline futures advanced amid concern that the flooding will disrupt fuel production and distribution. Futures rose 3.1 percent yesterday to $3.3797 a gallon on the New York Mercantile Exchange, adding to a 6.1 percent gain on May 9, the biggest since July 2009. The contract dropped 1.2 percent to $3.3385 today. Crude prices slid 0.1 percent to $103.78 a barrel.

Red River

The Red River Landing is 63 miles north of Baton Rouge, near where the Louisiana state line moves east from the river. The Morganza floodway is between the landing and Baton Rouge.

The Mississippi, the largest river system in the country and the third-largest watershed in the world, drains 41 percent of the continental U.S., according to the Corps.

The opening of the spillway would affect two refineries, according to Jindal’s office. One plant on the river may have capacity cut to 75 percent for two weeks, according to the state’s Department of Natural Resources yesterday. Anna Dearmon, the DNR’s communications director, said she couldn’t release the names of the refineries because of security reasons.

Alon USA Energy Inc. (ALJ)’s Krotz Springs refinery will be affected if the spillway is opened, Lisa Vidrine, director of the St. Landry Parish office of emergency preparedness, said in a telephone interview yesterday. Refinery officials said May 9 that they were doing engineering work on the possible building of a levee to protect the refinery, according to Vidrine.

Potential Destruction

“If the Morganza is not opened and the levees are breached, the downstream destruction would be worse,” Fred Bryan, a professor emeritus of renewable natural resources at Louisiana State University in Baton Rouge, said yesterday in a telephone interview. “Once the river, with that cutting capacity and speed, cuts a hole you better get after it because it’s going to erode away the cut very quickly.”

The rising water has interrupted coal shipments to power plants in Tennessee, flooded more than 100,000 acres of Missouri cropland, forced thousands from their homes and prompted the Corps to open the Bonnet Carre Spillway to reduce the river’s force through New Orleans.

On the Mississippi between New Orleans and Baton Rouge, there are 11 refineries with a combined capacity of 2.5 million barrels a day, or 13 percent of U.S. output, according to Andy Lipow, president of Lipow Oil Associates LLC in Houston.

Valero Energy Corp. (VLO) was forced to reduce operations at its refinery in Memphis to between 80 percent and 85 percent of capacity because of the flooding, according to people familiar with refinery operations.

Barge Movements

Flooding limited movement of products in and out of the plant by barge, said the people, who declined to be identified because they aren’t authorized to speak for the refinery.

Entergy Corp. (ETR) expects “several inches” of water in its gas-fueled Baxter Wilson plant north of Vicksburg, based on a forecast crest on May 19, Jill Smith, a company spokeswoman, said yesterday in an interview. Gear and equipment is being moved to the second floor, and crews are sandbagging a low levee that protects the plant, she said.

NuStar Energy LP (NS) said it will suspend deep draft vessel operations at its St. James, Louisiana, terminal when the Mississippi River stage reaches 32 feet at Donaldsonville.

The river is forecast to reach that level May 13, Greg Matula, a company spokesman, said in an e-mail yesterday. Barge operations will stop when the river stage reaches 33 feet, which is forecast to happen May 15, according to Matula.

“The current forecast indicates marine activity could be suspended for one to two weeks,” Matula said.

A Word on Corrections

Today I’d like to share a couple of thoughts on the matter of the correction in commodities about which we have been so vocally warning, and which has now occurred.

After having written in early April about the possible market response to the end of QE2, specifically about it knocking the legs out from under the overbought precious metals and other commodities, the metals continued higher, causing some readers to express concern that we had led them astray. And any number of analysts opined that the market had already priced in the end of QE2 and thus, even after Bernanke’s press conference, had decided it was go, go, go for higher commodity prices.

Yet, I think it is always a mistake to credit “the market” with any real predictive value. Reactive, yes. Predictive, no. Benjamin Graham had it right when he first penned the profile of Mr. Market as being a maniac, as likely to overpay for an asset as he is to sell too soon.

Put another way, if Mr. Market were actually in possession of a crystal ball, then gold would already be at $2,000 and silver at $75, and higher – because that’s where the underlying fundamentals of the economy will eventually drive them. Just not quite yet.

So, what do I think about the current sell-off? First off, it was way overdue, and anyone who wasn’t leveraged to the wrong side of the sell-off and who had built some cash should be thrilled that it has happened.

Silver, in particular, has been hammered – down over 30% at one point. Now that’s what I call a proper correction. Is it safe to go back into the water? I have to believe that the speed and depth of the sell-off makes it all the more likely that we’ll see a pretty quick bounce back.

While no one can know when, or perhaps because no one can know when (and we still have yet to see the actual economic consequences of the end of QE2), my suggestion would be to start buying in weekly or bi-monthly tranches of somewhere between 25% and 33% of the total cash you intend to reinvest in the metals and related investments. Already, the metals appear to stage something of a comeback, but that doesn’t mean it’s all blue sky from here.

By buying in tranches, you might not hit the exact bottom – but trying to hit the bottom is a fool’s game.

If you didn’t raise cash as the metals spiked higher over the month of April, or even paid up for gold, silver etc., don’t kick yourself (unless you were leveraged to the upside, in which case I can only empathize and wish you luck). Even if you paid $50 an ounce for your last ounce of silver, you will come out just fine in the end, because the monetary system of the U.S., and the world, is corrupt and degraded beyond redemption. It will falter and likely fail, and in time everyone will be scrambling to pick up their precious metals at substantially higher prices.

We’ll have more on this topic, and on what the future holds, in the brand-new edition of The Casey Report, which will be released this week. Renowned financial experts like John Williams of ShadowStats, James G. Rickards, Mike Maloney and others give their take on what to watch for. You can read it fresh off the press with your risk-free 3-month trial, with full money-back guarantee.

China urges US to lift export controls

|

| China-US trade balance © AFP/Graphi |

WASHINGTON (AFP) - China urged Washington to lift export and investment controls directed against Beijing, saying such a move could go a long way towards conquering the steep trade imbalance between the two powers.

But in their annual bilateral dialogue, US officials continued to press Beijing over its allegedly undervalued yuan as a way to redress China's $273 billion trade surplus with the United States.

"The way to resolve this imbalance is to ease the export control regime of the United States towards China and to encourage US exports to China rather than restricting Chinese exports to the United States," Chen Deming, the Chinese trade minister, told reporters.

Chen said Washington's forex argument over the trade issue between the world's two largest economies "is not founded."

Over the past three years, he said, China's overall trade surplus has continued to decline and fell to about $180 billion, or 3.1 percent of gross domestic product.

By international standards, that is "a very healthy share," he said.

"We have a balanced trade with all other countries except the United States," he added.

Earlier US Treasury Secretary Timothy Geithner opened the two-day US-China Strategic and Economic Dialogue by placing China's need for a more flexible exchange rate and more open capital markets top of a list of things to discuss.

Chinese officials said later the yuan was not discussed on Monday. A senior US official said Geithner would raise the issues of currency and economic rebalancing in greater depth on Tuesday.

In his opening remarks, Geithner also listed China's need for banking reforms to boost its private sector, and the need for "a more level playing field" in trade and investment between the two economic superpowers.

Chinese Vice Premier Wang Qishan called addressing economic imbalances "a long process."

"It's not something we can do overnight," he said, speaking through an interpreter. But he noted the country had made progress since last year's talks.

"China has made headway in combating intellectual property infringement, promoting the use of legal software, and improving policies regarding indigenous innovation and government procurement," Wang continued.

He pressed Washington to "take credible steps to relax high-tech export controls vis-a-vis China, recognize China's market economy status, accord fair treatment to Chinese companies investing in the United States and refrain from politicizing economic and trade issues."

In the same way that Washington asks Beijing for a schedule on how it will address US complaints, Wang said, China is seeking a timetable on when the US export controls and other issues would be resolved.

Chinese firms seeking to buy sensitive US technologies or invest in US tech firms -- especially those with security- or military-applicable technologies -- must get approval, and denials and delays have angered Beijing.

In the past three years, for example, Chinese mobile network equipment giant Huawei has been stymied in two attempts to buy US technology companies, and was also blocked on national security reasons from selling equipment to top US mobile phone provider Sprint Nextel.

Both sides emphasized the progress they had made on economic relations, and stressed that cooperation will remain crucial for the global recovery from the 2008-2009 economic downturn.

But Geithner called on China to adopt a "new growth model, driven by more domestic demand, with a more market-based economy and a more sophisticated financial system."

Separately, Geithner also highlighted the need for China to strengthen intellectual property rights and to be more welcoming to foreign investors.

Wang suggested the United States needs to do more on its own to strengthen the world economy. "The key to global economic recovery still lies with the United States," he said.

The talks come as the world's two biggest economies grow increasingly intertwined. China is the biggest foreign financier of the yawning US public debt, with US bond holdings of $1.154 trillion in February.

Asked whether China was concerned about ratings agency Standard & Poor's outlook downgrade on US sovereign debt, Zhou Xiaochuan, governor of the People's Bank of China, said only that the Chinese central bank and other major financial authorities "must rely more on the internal assessment that we make and should not just rely on the credit ratings provided by big... firms."

© AFP -- Published at Activist Post with license

Boehner Disappoints Wall Street: "No Debt Ceiling Hike Without TRILLIONS In Spending Cuts" (Video)

Video - Robert Reich on Boehner's speech - May 9, 2011

Highlights of Boehner's speech are in the first 3 minutes.

---

Video - John Boehner's complete speech to Wall Street - May 9, 2011

John Boehner: Cut 'trillions' as debt limit nears (Politico)

Without significant spending cuts and reforms to reduce our debt, there will be no debt limit increase,” Boehner plans to tell the Economic Club of New York here this evening, according to remarks obtained by POLITICO. “And the cuts should be greater than the accompanying increase in debt authority the president is given. We should be talking about cuts of trillions, not just billions.”

Under Boehner’s vision, for example, Republicans would have to find more than $2 trillion in cuts if they wanted to raise the debt ceiling by that amount through 2012 — which is in line with Treasury’s estimates on the debt limit. But Republicans could also go for a more incremental increase in the debt ceiling, coupling that with a smaller offsetting cut in spending. Boehner’s preference is for immediate cuts, not promises to pare back spending in the future.

A Word on Corrections In Commodities

Casey Research

Today I’d like to share a couple of thoughts on the matter of the correction in commodities about which we have been so vocally warning, and which has now occurred.

After having written in early April about the possible market response to the end of QE2, specifically about it knocking the legs out from under the overbought precious metals and other commodities, the metals continued higher, causing some readers to express concern that we had led them astray. And any number of analysts opined that the market had already priced in the end of QE2 and thus, even after Bernanke's press conference, had decided it was go, go, go for higher commodity prices.

Yet, I think it is always a mistake to credit "the market" with any real predictive value. Reactive, yes. Predictive, no. Benjamin Graham had it right when he first penned the profile of Mr. Market as being a maniac, as likely to overpay for an asset as he is to sell too soon.

Put another way, if Mr. Market were actually in possession of a crystal ball, then gold would already be at $2,000 and silver at $75, and higher – because that's where the underlying fundamentals of the economy will eventually drive them. Just not quite yet.

So, what do I think about the current sell-off? First off, it was way overdue, and anyone who wasn't leveraged to the wrong side of the sell-off and who had built some cash should be thrilled that it has happened.

Silver, in particular, has been hammered – down over 30% at one point. Now that's what I call a proper correction. Is it safe to go back into the water? I have to believe that the speed and depth of the sell-off makes it all the more likely that we'll see a pretty quick bounce back.

While no one can know when, or perhaps because no one can know when (and we still have yet to see the actual economic consequences of the end of QE2), my suggestion would be to start buying in weekly or bi-monthly tranches of somewhere between 25% and 33% of the total cash you intend to reinvest in the metals and related investments. Already, the metals appear to stage something of a comeback, but that doesn't mean it's all blue sky from here.

By buying in tranches, you might not hit the exact bottom – but trying to hit the bottom is a fool's game.

If you didn't raise cash as the metals spiked higher over the month of April, or even paid up for gold, silver etc., don't kick yourself (unless you were leveraged to the upside, in which case I can only empathize and wish you luck). Even if you paid $50 an ounce for your last ounce of silver, you will come out just fine in the end, because the monetary system of the U.S., and the world, is corrupt and degraded beyond redemption. It will falter and likely fail, and in time everyone will be scrambling to pick up their precious metals at substantially higher prices.

We'll have more on this topic, and on what the future holds, in the brand-new edition of The Casey Report, which will be released this week. Renowned financial experts like John Williams of ShadowStats, James G. Rickards, Mike Maloney and others give their take on what to watch for. You can read it fresh off the press with your risk-free 3-month trial, with full money-back guarantee.

The financial bubble that is still popping

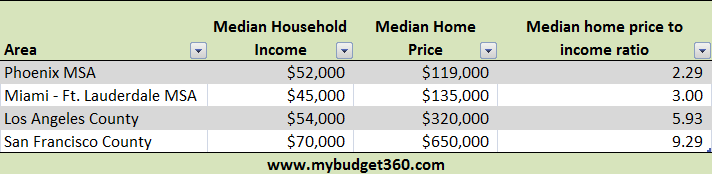

Home prices enter a deep double dip because household incomes are still in a rut. Housing bubbles in Los Angeles and San Francisco persist while Miami and Phoenix metro areas face double digit annual price declines.

Some people are stunned that home prices continue to sink as if a lead weight was placed on the value of housing. The mainstream press never sliced and diced the minor jump in prices we had last year because much of the increase occurred around tax credit gimmicks and the Federal Reserve using artificially low rates to drum up demand where none existed. In the end this has been a vastly expensive proposition that failed to address the main problem with housing. Home prices need to drop or household incomes need to increase. The housing bubble only occurred because of lax credit and massive speculation. Debt filled the gap of non-existent income growth. The housing bubble did not occur because real household incomes went up. It is the case that in the last decade the median household income actually declined for the first time over such a period since the grim days of the Great Depression. Keep in mind the average per capita income in the United States is $25,000 and the median household income is $50,000. How much can you afford with this income? Even areas that looked cheap last year have fallen much deeper in 2011 because of weak employment prospects.

Home prices are reflecting weak income growth

Many investors leapt head first into a real estate world without checking if the financial pool had any water. People bought in areas simply because prices appeared to be cheap after a decade of inflated prices. Everything looks low after returning from the summit on Mount Kilimanjaro. Yet prices in many of these markets were never justified. Let us take a look at two markets that on the surface appear to be cheap and two markets that are fully in housing bubbles as of today:

Source: Census, Data Quick

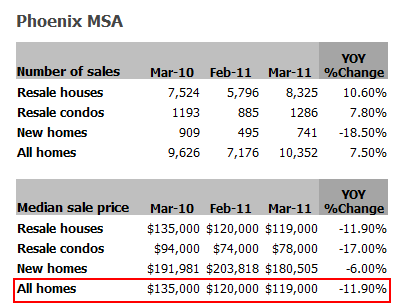

On the surface the Phoenix and Miami markets look affordable. Last year people were clamoring how cheap these markets were and many investors jumped in to pick up properties. In markets like those in Phoenix for nearly an entire year half of all home sales came from investors. Many were looking to do a quick flip or for rentals. Whether a flip or finding a renter you have to find someone living in the immediate area to occupy the home. Those who were led into the market because of the appearance of low prices actually are now dealing with the second phase of the housing correction:

Source: Data Quick

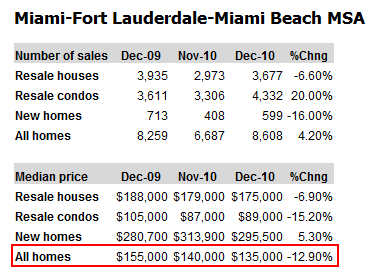

The Phoenix metro area is now down over 11 percent from last year. Keep in mind that you also have many home buyers purchasing homes with FHA insured loans that only require a small amount for a down payment. These people have lost all of their equity and are now underwater. Was the tax credit worth it? Obviously not since the down payment plus additional money has vanished into thin air. The same can be said for the Miami metro area:

Source: Data Quick

I know many were itching to jump in when the Miami-Fort Lauderdale market was showing a median home price of $155,000. Well guess what? It fell over 12 percent in the last year. Many people that dove into the housing market last year are now sitting in a negative equity position. Why? Because the average per capita income in the United States is $25,000. You also have to run the numbers on the median household income:

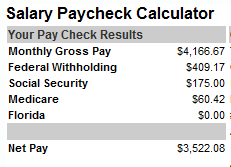

Now assume you purchase that home in Phoenix for $119,000 with 5 percent down:

Down payment: $5,950

PITI: $900

After the house payment this household is left with $2,600. Yet what about the rising cost of fuel? These are largely commuter markets and the average cost of fuel has risen to $500 per month, over half the monthly home payment. What about two car payments at $300 and insurance of $150 per month? Now you are down to $1,350 a month and we have yet to add the rising cost of groceries. Throw in $500 for this and you are down to $850. I think you get the point that even the seemingly cheap price of $119,000 gets eaten away quickly because incomes are losing purchasing power in other areas thanks to the Federal Reserve hammering the dollar down.

What is more troubling is the big bubbles in markets like Los Angeles and San Francisco. Without a doubt these markets are facing drastic housing bubbles. While Miami and Phoenix are quickly coming down to Earth and are facing more nuanced issues like fuel or food cutting into family budgets, markets in L.A. and San Francisco are still fully in housing bubbles. Refer to the chart above and you can see the home price to income ratio and the number is outrageous. Keep in mind the Phoenix MSA market peaked at $264,000 in June of 2006. Prices are down 54 percent since that time yet they are starting to make more sense because they are coming in line with incomes of those areas. Los Angeles and San Francisco still have ratios that signify a bubble that is yet to fully burst. And as we have seen in Miami for example, home prices will go much lower than you expect because our economy is shaky.

It is all about income

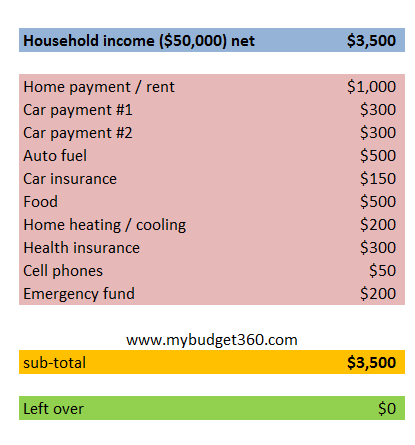

I can’t emphasize how important it is to analyze local area incomes when it comes to housing. It is amazing that every mainstream story ignores household income. This is intentional in the sense that the media just wants to ignore the fact that the middle class is disappearing. Experts on television never bother to even run simple numbers to give people an idea of how quickly money is disappearing. Let us for example show how quickly $50,000 a year can disappear:

I know some will argue about certain line items above but this is merely to show how quickly money can flow out. We are using a modest $1,000 a month line item for your mortgage or rent payment. The above is showing how rising fuel costs, health care costs, and food inflation is hammering the monthly budget of many Americans.

The bottom line is we are facing a double dip housing recession because incomes are not going up. No amount of Federal Reserve hocus pocus is going to make home prices go up without making household incomes go up.

China trade surplus surges, fuel for yuan critics in U.S. talks

BEIJING (Reuters) - China stormed back to post a hefty trade surplus in April as exports hit a record while imports eased more than expected, weighed down by sustained monetary tightening and high commodity prices.

The surplus of $11.4 billion, nearly four times greater than expected, comes as China holds high-level economic and strategic talks in Washington and could fuel U.S. criticism that Beijing limits the yuan's appreciation to support its exports industry.

The trade account swung from a small, rare trade deficit in the first quarter, pushed by a stronger-than-anticipated 29.9 percent rise in exports over a year earlier to a record $155.7 billion.

Imports climbed 21.8 percent, well short of estimates and analysts were at loggerheads whether this should be read as a sign of surprising weakness in the world's fastest-growing economy or simply deferred purchases because of soaring commodity bills.

"Exports are much stronger, that's the basic thing. Global demand is still pretty strong, a bit stronger than many people feared," said Tao Wang, economist with UBS in Beijing.

"On the import side, we think that commodity exports had been very strongly up until February and there has been quite a bit of inventory build-up. So right now we think it's going through some adjustment."

But Xu Biao, an economist with China Merchants Bank in Shenzhen, said the lower-than-expected imports might contain a much more serious warning.

"Concerns about a slowdown have certainly intensified, and the risks of a worst-case scenario for the Chinese economy, namely a relatively low growth rate and a high inflation, are on the rise," he said.

The median forecast of economists polled by Reuters last week was for exports to rise 29.4 percent and imports to grow 28 percent, resulting in a trade surplus of $3 billion.

On a seasonally adjusted basis, exports rose 35.1 percent in April from a year earlier and rose 12.3 percent from the previous month. Imports gained 27.4 percent year-on-year and 7.4 percent month-on-month, the customs administration said.

China's trade numbers also registered an impact from Japan's earthquake and subsequent nuclear crisis. Imports from Japan were $16 billion in April, down 14.9 percent from March, as production and shipments were interrupted.

WEAK YUAN POLICY

The data showed China's trade surplus with the United States swelled 16 percent to its widest since November.

The data provides fresh ammunition to those U.S. lawmakers who have linked the trade imbalance to China's currency policy, saying a weak yuan gives Chinese manufacturers an unfair advantage in global markets and costs American jobs.

China's overall trade surplus narrowed last year, but that provided little comfort for officials in Washington because the surplus with the United States grew 26 percent to more than $180 billion.

On the first of two days of talks on Monday, the United States pressed China on a range of familiar themes, including that Beijing should push the closely managed yuan up at a faster pace against the dollar.

"This number will likely add to the pressure from Washington for Beijing to allow faster currency appreciation, but more importantly should persuade Chinese policymakers that a stronger yuan can be tolerated by the economy," said Brian Jackson, an economist with the Royal Bank of Canada in Hong Kong.

For its part, China turned aside a chance to openly criticize the loose U.S. monetary and fiscal policies it has argued in the past were weakening the dollar.

China holds about $3 trillion in foreign exchange reserves, of which some two-thirds are estimated to be held in dollar-based assets, so Beijing has a significant stake in the health of the currency.

Higher import costs, along with the government's efforts to rebalance the economy in favor of domestic consumption to reduce reliance on exports, could lead to a smaller trade surplus for 2011 from last year's $183 billion.

Chinese officials hope a smaller trade surplus with the rest of the world could ease criticism from key trade partners over the yuan.

Still, there are plenty of signs that the government is tolerating faster yuan appreciation this year as it seeks to deal with the inflationary impact of rising commodity prices.

China loosened the yuan from a nearly two-year peg to the dollar in June, and this year the People's Bank of China has guided the yuan to record highs. It has now appreciated about 5 percent since June and 1.5 percent since the start of this year.

NO HARD-LANDING

China already is the world's biggest exporter and so has little scope to increase its exports further, while its demand for imports is increasing in leaps and bounds alongside its turbo-charged growth, which last year topped 10 percent.

Investors have long feared an abrupt slowdown in the world's second-largest economy, which could stifle a pivotal source of demand as a global buyer of everything from raw materials to consumer goods as many parts of the world still struggle to emerge from the global financial crisis.

The latest data showed that China, the world's second-largest oil buyer, imported 1.7 percent more oil than a year earlier, bringing in 5.24 million barrels per day in April, the third highest on record on a daily basis.

Imports of copper were much weaker, down nearly 14 percent from March in volume terms. But rather than heralding a sudden drop-off in Chinese economic activity, analysts said the shortfall indicated that firms were shunning high-priced overseas supplies in favor of local producers and stockpiles.

The government sees little sign of a hard-landing in the economy. But it is likely to raise banks' required reserves and interest rates while letting the yuan rise at a faster clip to combat inflation, analysts say.

Inflation hit a 32-month high in March of 5.4 percent, keeping investors expectant of more policy tightening. Figures on Wednesday are expected to show that inflation eased in April to 5.2 percent as food prices, the main pressure behind inflation, are now falling.

"I think over-tightening is the key risk for China. However, it may be too early to call for over-tightening based only on April imports," said Dongming Xie, China economist at OCBC Bank in Singapore.

"Compared with interest rate policy, maybe China may rely more on the currency policy to tackle inflationary pressure now."

(Additional reporting by Zhou Xin, Simon Rabinovitch and Langi Chiang; Editing by Ken Wills and Vidya Ranganathan)

Boehner: ‘Irresponsible’ to Allow Default

Boehner also will say that spending cuts should be greater than any increase in the federal debt limit, according to excerpts released by his office of the Ohio Republican’s planned speech to the Economic Club of New York.

“Without significant spending cuts and reforms to reduce our debt, there will be no debt limit increase,” Boehner will say, according to the speech excerpts. “And the cuts should be greater than the accompanying increase in debt authority the president is given.”

As Boehner spells out Republicans’ conditions for agreeing to raise the debt limit, both sides have been declaring some options off-limits. Boehner has said for weeks that House Republicans won’t accept higher income-tax rates, and Democratic opposition forced House Republicans to put on hold their plan to privatize Medicare. Two days ago, Arizona Senator Jon Kyl, that chamber’s No. 2 Republican, rejected the idea of a tax-code overhaul that eliminates a number of tax breaks.

The Treasury Department says the U.S. will reach the debt limit as early as May 16. Treasury Secretary Timothy Geithner has said he can use “extraordinary measures” to continue borrowing money through Aug. 2.

‘Not Just Billions’

Spending cuts should be in the “trillions, not just billions” of dollars, Boehner will say, according to the text. “They should be actual cuts and program reforms, not broad deficit or debt targets that punt the tough questions to the future.”

“And with the exception of tax hikes -- which will destroy jobs -- everything is on the table,” he will say.

Last week, Republican and Democratic leaders and Vice President Joe Biden began talks on a plan to cut the deficit and to raise the borrowing authority. That group meets again tomorrow. Separately, a bipartisan group of six senators has been negotiating on a plan.

In appearing before Wall Street leaders, Boehner faces a challenge to provide just enough assurance to investors that the U.S. won’t default without undermining his bargaining position.

“What Wall Street wants to hear is that they are going to raise the debt ceiling in a timely way,” said Mark Zandi, chief economist at Moody’s Analytics Inc. in West Chester, Pennsylvania.

‘Remote’ Possibility

In an April 28 speech, Geithner said economic damage could occur if credit markets react to “the possibility, however remote, that the U.S. might default.”

Democrats today challenged the speaker to give Wall Street investors the assurances they are seeking that government’s borrowing authority is extended in time to avoid a default on U.S. debt.

“The stakes are high for Speaker Boehner,” Senator Chuck Schumer, a New York Democrat, told reporters on a conference call. He called on Boehner to provide “unwavering reassurance” to the credit markets that House Republicans won’t allow the U.S. to default on its obligations.

In the speech excerpts, Boehner says, “It’s true that allowing America to default would be irresponsible.” The speaker adds that “it would be more irresponsible to raise the debt ceiling without simultaneously taking dramatic steps to reduce spending and reform the budget process.”

‘Not Serious’

Failure to do so “would send a signal to investors and entrepreneurs everywhere that America still is not serious about dealing with our spending addiction,” Boehner says in the excerpts. “It would erode confidence in our economy and reduce certainty for small businesses. And this would destroy even more American jobs.”

William Galston, a scholar at the Brookings Institution, said lawmakers’ statements taking various options off the table are clouding prospects for a “grand bargain” to reduce the nation’s deficits.

In a May 7 radio interview, Kyl rejected the idea of a tax- code overhaul that eliminates a number of tax breaks.

“When you do that, somebody’s taxes actually go up,” he said in an interview with broadcaster Larry Kudlow on New York’s WABC radio. “And so the focus here is to keep taxes totally off the table.”

“I think it’s becoming increasingly clear that the political stars aren’t in alignment for a large structural deal,” said Galston, formerly a policy adviser to Democratic President Bill Clinton.

Amid debate about the deficit in Washington, bond market yields in the U.S. are lower now than when the government was running a budget surplus a decade ago. The yield on the benchmark 10-year note is below the average of 5.48 percent in 1998 through 2001, the last time the U.S. had a budget surplus, according to Bloomberg Bond Trader prices. Ten-year yields were little changed at 3.16 percent at 5:15 p.m. in New York, according to Bloomberg Bond Trader prices.

--With assistance from Laura Litvan and Catherine Dodge in Washington. Editors: Laurie Asseo, Leslie Hoffecker

To contact the reporter on this story: James Rowley in Washington at jarowley@bloomberg.net

To contact the editor responsible for this story: Laurie Asseo at lasseo1@bloomberg.net

© Copyright 2011 Bloomberg News. All rights reserved.

Read more on Newsmax.com: Boehner: ‘Irresponsible’ to Allow Default

Important: Do You Support Pres. Obama's Re-Election? Vote Here Now!

Wife: We're $14 Trillion In Debt; Husband: We Need More Credit Cards

Excellent work from Nick Gillespie at Reason TV.

Video - Raising the Debt Ceiling: It Just Makes Sense. Not.

More on this clip is here:

Senator: No Debt Ceiling Hike Without A Balanced Budget

Mike Capuano's Bank CEO Beatdown: "I'm Amazed That None Of You Have Been Prosecuted Yet!" (VIDEO)

Video: Rep. Mike Capuano takes on bailed-out bank CEOs - Flashback

Jamie Dimon, Lloyd Blankfein, Ken Lewis, John Thain, Vikram Pandit sit slack-jawed. Start watching at the 1:20 mark. Part of this clip was included in Charles Ferguson's Oscar-winning Inside Job.

- "Basically you come to us today on your bicycles, after buying Girl Scout cookies and helping out Mother Theresa."

- No Need To Audit The Federal Reserve According To GOP Flavor Of The Month, Idiot Herman Cain

- CFTC Looking At Goldman For Additional Charges, Mortgage Fraud Reaches Record Level, ‘Underwater’ Homeowners Rise to 28 Percent, Ron Paul GOP Debate Clip (LINKS)

- Alyona: FBI Using Warrantless GPS To Track Citizens

- PIMCO's Gross Increases Short Position Against U.S. Debt

- Trump "University" Sued For Fraud

- Bloomberg To Ron Paul: 'You're Running For President And You Want To Abolish The Fed; How's That Playing In Middle America?' (VIDEO)

- How Would You Feel If Your Son Were Captured And Being Held By The Taliban? - Robert Bergdahl's Wrenching Plea For The Release Of His Only Son (VIDEO)

- VIDEO: Secret Message Passed From Obama To General

- Boehner Disappoints Wall Street: "No Debt Ceiling Hike Without TRILLIONS In Spending Cuts" (Video)

- Jim Rogers With The Judge On Economy, Debt, Deficits: "Bernanke Has Never Been Right About ANYTHING!"

- Watch Sheila Bair's Shameless PSA: Skip Starbucks And Give More Money To The Banks

- Sheila Bair To Step Down

- Housing Crash Is Getting Worse, Home Values See Biggest Drop Since 2008, Fannie Mae Wants More, China Frets About U.S. Debt, Greece Suffers New Downgrade (LINKS)

- Bankrupting America: History Of The U.S. Debt Ceiling

- Bank Of America To Start Charging 30% On Credit Cards

PIMCO raises bet against U.S. government debt

William Gross, Manager of the world's biggest bond fund at Pacific Investment Management Co. (PIMCO) participates in the Obama administration's Conference on the Future of Housing Finance in the Cash Room of the Treasury Building in Washington in this August 17, 2010 file photo.

(Reuters) - PIMCO's Bill Gross, the manager of the world's largest bond fund, raised his bet against U.S. government-related debt in April to 4 percent from 3 percent, according to the company's website on Monday.

The increase, albeit small, follows Gross' move to ratchet up his bearishness in March by taking his initial short position in U.S. government-related debt, which includes Treasuries, TIPS, agencies, interest rate swaps, Treasury futures and options and FDIC-guaranteed corporate securities.

The $240 billion Total Return fund also raised its cash position to 37 percent in April from 31 percent in March, added Pacific Investment Management Co, which oversees $1.2 trillion in assets.

The Total Return fund took down its mortgage exposure to 24 percent in April from 28 percent the previous month.

The fund also decreased its allocation in investment-grade credit to 17 percent in April from 18 percent in March and junk bonds to 5 percent in April from 6 percent the previous month.

For their part, emerging markets exposure increased to 11 percent of the Total Return portfolio, up from 10 percent in March, and municipal bonds unchanged at 4 percent month-over-month.

Last Friday, Gross told Reuters that the only way he would purchase Treasuries again is if the United States heads into another recession.

Since the news that Gross had turned more bearish on government debt, reflecting his growing worries over the country's fiscal deficit and debt burden, Treasury prices have been soaring.

Gross told Reuters on Friday: "Treasury yields are currently yielding substantially less than historical averages when compared with inflation. Perhaps the only justification for a further rally would be weak economic growth or a future recession that substantially lowered inflation and inflationary expectations."

(Editing by Andrew Hay, Gary Crosse)

Import Prices Over Last 12 Months Climbed at Double Digit Rate

While energy prices were the main driver of higher prices (Import fuel prices advanced 6.7 percent in April), increases were reported in many other sectors. Foods, feeds, and beverages prices advanced 1.8 percent in April after a 4.2 percent rise in March. The April increase was driven by a 22.8 percent jump in coffee prices....The price index for nonfuel industrial supplies and materials rose 1.7 percent in April following a 2.0 percent rise the previous month. Both increases were led by higher chemical and unfinished metals prices, which increased 2.4 percent and 1.7 percent, respectively, in April. The rise in chemical prices was driven by a 6.6 percent advance in plastics prices, and the largest contributors to the rise in unfinished metals prices were prices for gold and other precious metals.

Prices for import fuel rose 34.8 percent for the year ended in April.