---

Excerpt from the book The Monster, by Michael W. Hudson.

Bait and Switch

A few weeks after he started working at Ameriquest Mortgage, Mark Glover looked up from his cubicle and saw a coworker do something odd. The guy stood at his desk on the twenty-third floor of downtown Los Angeles's Union Bank Building. He placed two sheets of paper against the window. Then he used the light streaming through the window to trace something from one piece of paper to another. Somebody's signature.

Glover was new to the mortgage business. He was twenty-nine and hadn't held a steady job in years. But he wasn't stupid. He knew about financial sleight of hand—at that time, he had a check-fraud charge hanging over his head in the L.A. courthouse a few blocks away. Watching his coworker, Glover's first thought was: How can I get away with that? As a loan officer at Ameriquest, Glover worked on commission. He knew the only way to earn the six-figure income Ameriquest had promised him was to come up with tricks for pushing deals through the mortgage-financing pipeline that began with Ameriquest and extended through Wall Street's most respected investment houses.

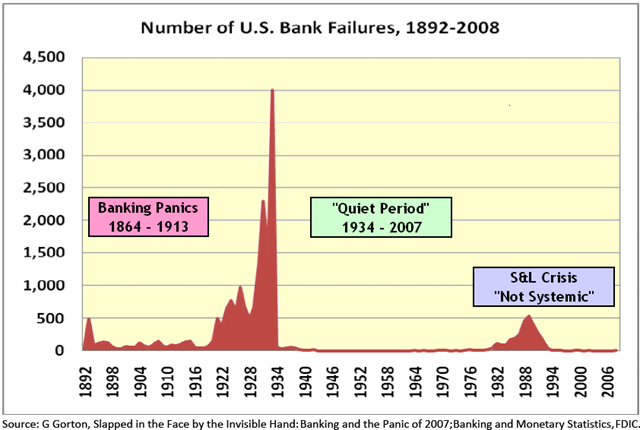

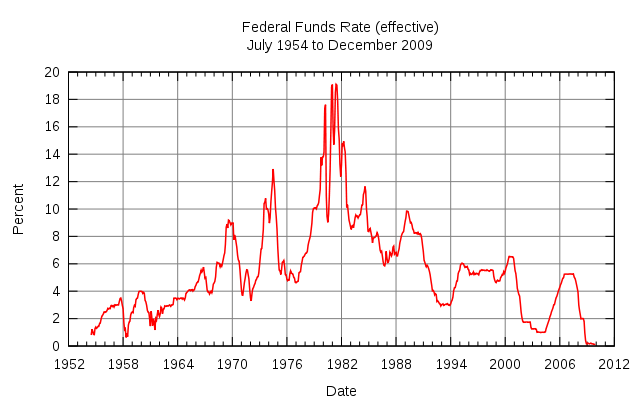

Glover and the other twentysomethings who filled the sales force at the downtown L.A. branch worked the phones hour after hour, calling strangers and trying to talk them into refinancing their homes with high-priced "subprime" mortgages. It was 2003, subprime was on the rise, and Ameriquest was leading the way. The company's owner, Roland Arnall, had in many ways been the founding father of subprime, the business of lending money to home owners with modest incomes or blemished credit histories. He had pioneered this risky segment of the mortgage market amid the wreckage of the savings and loan disaster and helped transform his company's headquarters, Orange County, California, into the capital of the subprime industry. Now, with the housing market booming and Wall Street clamoring to invest in subprime, Ameriquest was growing with startling velocity.

Up and down the line, from loan officers to regional managers and vice presidents, Ameriquest's employees scrambled at the end of each month to push through as many loans as possible, to pad their monthly production numbers, boost their commissions, and meet Roland Arnall's expectations. Arnall was a man "obsessed with loan volume," former aides recalled, a mortgage entrepreneur who believed "volume solved all problems." Whenever an underling suggested a goal for loan production over a particular time span, Arnall's favorite reply was: "We can do twice that." Close to midnight Pacific time on the last business day of each month, the phone would ring at Arnall's home in Los Angeles's exclusive Holmby Hills neighborhood, a $30 million estate that once had been home to Sonny and Cher.On the other end of the telephone line, a vice president in Orange County would report the month's production numbers for his lending empire. Even as the totals grew to $3 billion or $6 billion or $7 billion a month—figures never before imagined in the subprime business—Arnall wasn't satisfied. He wanted more. "He would just try to make you stretch beyond what you thought possible," one former Ameriquest executive recalled. "Whatever you did, no matter how good you did, it wasn't good enough."

Inside Glover's branch, loan officers kept up with the demand to produce by guzzling Red Bull energy drinks, a favorite caffeine pick-me-up for hardworking salesmen throughout the mortgage industry. Government investigators would later joke that they could gauge how dirty a home-loan location was by the number of empty Red Bull cans in the Dumpster out back. Some of the crew in the L.A. branch, Glover said, also relied on cocaine to keep themselves going, snorting lines in washrooms and, on occasion, in their cubicles.

The wayward behavior didn't stop with drugs. Glover learned that his colleague's art work wasn't a matter of saving a borrower the hassle of coming in to supply a missed signature. The guy was forging borrowers' signatures on government-required disclosure forms, the ones that were supposed to help consumers understand how much cash they'd be getting out of the loan and how much they'd be paying in interest and fees. Ameriquest's deals were so overpriced and loaded with nasty surprises that getting customers to sign often required an elaborate web of psychological ploys, outright lies, and falsified papers. "Every closing that we had really was a bait and switch," a loan officer who worked for Ameriquest in Tampa, Florida, recalled. " 'Cause you could never get them to the table if you were honest." At companywide gatherings, Ameriquest's managers and sales reps loosened up with free alcohol and swapped tips for fooling borrowers and cooking up phony paperwork. What if a customer insisted he wanted a fixed-rate loan, but you could make more money by selling him an adjustable-rate one? No problem. Many Ameriquest salespeople learned to position a few fixed-rate loan documents at the top of the stack of paperwork to be signed by the borrower. They buried the real documents—the ones indicating the loan had an adjustable rate that would rocket upward in two or three years—near the bottom of the pile. Then, after the borrower had flipped from signature line to signature line, scribbling his consent across the entire stack, and gone home, it was easy enough to peel the fixed-rate documents off the top and throw them in the trash.

At the downtown L.A. branch, some of Glover's coworkers had a flair for creative documentation. They used scissors, tape, Wite-Out, and a photocopier to fabricate W-2s, the tax forms that indicate how much a wage earner makes each year. It was easy: Paste the name of a low-earning borrower onto a W-2 belonging to a higher-earning borrower and, like magic, a bad loan prospect suddenly looked much better. Workers in the branch equipped the office's break room with all the tools they needed to manufacture and manipulate official documents. They dubbed it the "Art Department."

At first, Glover thought the branch might be a rogue office struggling to keep up with the goals set by Ameriquest's headquarters. He discovered that wasn't the case when he transferred to the company's Santa Monica branch. A few of his new colleagues invited him on a field trip to Staples, where everyone chipped in their own money to buy a state-of-the-art scanner-printer, a trusty piece of equipment that would allow them to do a better job of creating phony paperwork and trapping American home owners in a cycle of crushing debt.

Carolyn Pittman was an easy target. She'd dropped out of high school to go to work, and had never learned to read or write very well. She worked for decades as a nursing assistant. Her husband, Charlie, was a longshoreman.In 1993 she and Charlie borrowed $58,850 to buy a one-story, concrete block house on Irex Street in a working-class neighborhood of Atlantic Beach, a community of thirteen thousand near Jacksonville, Florida. Their mortgage was government-insured by the Federal Housing Administration, so they got a good deal on the loan. They paid about $500 a month on the FHA loan, including the money to cover their home insurance and property taxes.

Even after Charlie died in 1998, Pittman kept up with her house payments. But things were tough for her. Financial matters weren't something she knew much about. Charlie had always handled what little money they had. Her health wasn't good either. She had a heart attack in 2001, and was back and forth to hospitals with congestive heart failure and kidney problems.

Like many older black women who owned their homes but had modest incomes, Pittman was deluged almost every day, by mail and by phone, with sales pitches offering money to fix up her house or pay off her bills. A few months after her heart attack, a salesman from Ameriquest Mortgage's Coral Springs office caught her on the phone and assured her he could ease her worries. He said Ameriquest would help her out by lowering her interest rate and her monthly payments.

She signed the papers in August 2001. Only later did she discover that the loan wasn't what she'd been promised. Her interest rate jumped from a fixed 8.43 percent on the FHA loan to a variable rate that started at nearly 11 percent and could climb much higher. The loan was also packed with more than $7,000 in up-front fees, roughly 10 percent of the loan amount.

Pittman's mortgage payment climbed to $644 a month. Even worse, the new mortgage didn't include an escrow for real-estate taxes and insurance. Most mortgage agreements require home owners to pay a bit extra—often about $100 to $300 a month—which is set aside in an escrow account to cover these expenses. But many subprime lenders obscured the true costs of their loans by excluding the escrow from their deals, which made the monthly payments appear lower. Many borrowers didn't learn they had been tricked until they got a big bill for unpaid taxes or insurance a year down the road.

That was just the start of Pittman's mortgage problems. Her new mortgage was a matter of public record, and by taking out a loan from Ameriquest, she'd signaled to other subprime lenders that she was vulnerable—that she was financially unsophisticated and was struggling to pay an unaffordable loan. In 2003, she heard from one of Ameriquest's competitors, Long Beach Mortgage Company.

Pittman had no idea that Long Beach and Ameriquest shared the same corporate DNA. Roland Arnall's first subprime lender had been Long Beach Savings and Loan, a company he had morphed into Long Beach Mortgage. He had sold off most of Long Beach Mortgage in 1997, but hung on to a portion of the company that he rechristened Ameriquest. Though Long Beach and Ameriquest were no longer connected, both were still staffed with employees who had learned the business under Arnall.

A salesman from Long Beach Mortgage, Pittman said, told her that he could help her solve the problems created by her Ameriquest loan. Once again, she signed the papers. The new loan from Long Beach cost her thousands in up-front fees and boosted her mortgage payments to $672 a month.

Ameriquest reclaimed her as a customer less than a year later. A salesman from Ameriquest's Jacksonville branch got her on the phone in the spring of 2004. He promised, once again, that refinancing would lower her interest rate and her monthly payments. Pittman wasn't sure what to do. She knew she'd been burned before, but she desperately wanted to find a way to pay off the Long Beach loan and regain her financial bearings. She was still pondering whether to take the loan when two Ameriquest representatives appeared at the house on Irex Street. They brought a stack of documents with them. They told her, she later recalled, that it was preliminary paperwork, simply to get the process started. She could make up her mind later. The men said, "sign here," "sign here," "sign here," as they flipped through the stack. Pittman didn't understand these were final loan papers and her signatures were binding her to Ameriquest. "They just said sign some papers and we'll help you," she recalled.

To push the deal through and make it look better to investors on Wall Street, consumer attorneys later alleged, someone at Ameriquest falsified Pittman's income on the mortgage application. At best, she had an income of $1,600 a month—roughly $1,000 from Social Security and, when he could afford to pay, another $600 a month in rent from her son. Ameriquest's paperwork claimed she brought in more than twice that much—$3,700 a month.

The new deal left her with a house payment of $1,069 a month—nearly all of her monthly income and twice what she'd been paying on the FHA loan before Ameriquest and Long Beach hustled her through the series of refinancings. She was shocked when she realized she was required to pay more than $1,000 a month on her mortgage. "That broke my heart," she said.

For Ameriquest, the fact that Pittman couldn't afford the payments was of little consequence. Her loan was quickly pooled, with more than fifteen thousand other Ameriquest loans from around the country, into a $2.4 billion "mortgage-backed securities" deal known as Ameriquest Mortgage Securities, Inc. Mortgage Pass-Through Certificates 2004-R7. The deal had been put together by a trio of the world's largest investment banks: UBS, JPMorgan, and Citigroup. These banks oversaw the accounting wizardry that transformed Pittman's mortgage and thousands of other subprime loans into investments sought after by some of the world's biggest investors. Slices of 2004-R7 got snapped up by giants such as the insurer MassMutual and Legg Mason, a mutual fund manager with clients in more than seventy-five countries. Also among the buyers was the investment bank Morgan Stanley, which purchased some of the securities and placed them in its Limited Duration Investment Fund, mixing them with investments in General Mills, FedEx, JC Penney, Harley-Davidson, and other household names.

It was the new way of Wall Street. The loan on Carolyn Pittman's one-story house in Atlantic Beach was now part of the great global mortgage machine. It helped swell the portfolios of big-time speculators and middle-class investors looking to build a nest egg for retirement. And, in doing so, it helped fuel the mortgage empire that in 2004 produced $1.3 billion in profits for Roland Arnall.

In the first years of the twenty-first century, Ameriquest Mortgage unleashed an army of salespeople on America. They numbered in the thousands. They were young, hungry, and relentless in their drive to sell loans and earn big commissions. One Ameriquest manager summed things up in an e-mail to his sales force: "We are all here to make as much fucking money as possible. Bottom line. Nothing else matters." Home owners like Carolyn Pittman were caught up in Ameriquest's push to become the nation's biggest subprime lender.

The pressure to produce an ever-growing volume of loans came from the top. Executives at Ameriquest's home office in Orange County leaned on the regional and area managers; the regional and area managers leaned on the branch managers. And the branch managers leaned on the salesmen who worked the phones and hunted for borrowers willing to sign on to Ameriquest loans. Men usually ran things, and a frat-house mentality ruled, with plenty of partying and testosterone-fueled swagger. "It was like college, but with lots of money and power," Travis Paules, a former Ameriquest executive, said. Paules liked to hire strippers to reward his sales reps for working well after midnight to get loan deals processed during the end-of-the-month rush. At Ameriquest branches around the nation, loan officers worked ten- and twelve-hour days punctuated by "Power Hours"—do-or-die telemarketing sessions aimed at sniffing out borrowers and separating the real salesmen from the washouts. At the branch where Mark Bomchill worked in suburban Minneapolis, management expected Bomchill and other loan officers to make one hundred to two hundred sales calls a day. One manager, Bomchill said, prowled the aisles between desks like "a little Hitler," hounding salesmen to make more calls and sell more loans and bragging he hired and fired people so fast that one peon would be cleaning out his desk as his replacement came through the door.As with Mark Glover in Los Angeles, experience in the mortgage business wasn't a prerequisite for getting hired. Former employees said the company preferred to hire younger, inexperienced workers because it was easier to train them to do things the Ameriquest way. A former loan officer who worked for Ameriquest in Michigan described the company's business model this way: "People entrusting their entire home and everything they've worked for in their life to people who have just walked in off the street and don't know anything about mortgages and are trying to do anything they can to take advantage of them."

Ameriquest was not alone. Other companies, eager to get a piece of the market for high-profit loans, copied its methods, setting up shop in Orange County and helping to transform the county into the Silicon Valley of subprime lending. With big investors willing to pay top dollar for assets backed by this new breed of mortgages, the push to make more and more loans reached a frenzy among the county's subprime loan shops. "The atmosphere was like this giant cocaine party you see on TV," said Sylvia Vega-Sutfin, who worked as an account executive at BNC Mortgage, a fast-growing operation headquartered in Orange County just down the Costa Mesa Freeway from Ameriquest's headquarters. "It was like this giant rush of urgency." One manager told Vega-Sutfin and her coworkers that there was no turning back; he had no choice but to push for mind-blowing production numbers. "I have to close thirty loans a month," he said, "because that's what my family's lifestyle demands."

Michelle Seymour, one of Vega-Sutfin's colleagues, spotted her first suspect loan days after she began working as a mortgage underwriter at BNC's Sacramento branch in early 2005. The documents in the file indicated the borrower was making a six-figure salary coordinating dances at a Mexican restaurant. All the numbers on the borrower's W-2 tax form ended in zeros—an unlikely happenstance—and the Social Security and tax bite didn't match the borrower's income. When Seymour complained to a manager, she said, he was blasé, telling her, "It takes a lot to have a loan declined."

BNC was no fly-by-night operation. It was owned by one of Wall Street's most storied investment banks, Lehman Brothers. The bank had made a big bet on housing and mortgages, styling itself as a player in commercial real estate and, especially, subprime lending. "In the mortgage business, we used to say, 'All roads lead to Lehman,' " one industry veteran recalled.Lehman had bought a stake in BNC in 2000 and had taken full ownership in 2004, figuring it could earn even more money in the subprime business by cutting out the middleman. Wall Street bankers and investors flocked to the loans produced by BNC, Ameriquest, and other subprime operators; the steep fees and interest rates extracted from borrowers allowed the bankers to charge fat commissions for packaging the securities and provided generous yields for investors who purchased them. Up-front fees on subprime loans totaled thousands of dollars. Interest rates often started out deceptively low—perhaps at 7 or 8 percent—but they almost always adjusted upward, rising to 10 percent, 12 percent, and beyond. When their rates spiked, borrowers' monthly payments increased, too, often climbing by hundreds of dollars. Borrowers who tried to escape overpriced loans by refinancing into another mortgage usually found themselves paying thousands of dollars more in backend fees—"prepayment penalties" that punished them for paying off their loans early. Millions of these loans—tied to modest homes in places like Atlantic Beach, Florida; Saginaw, Michigan; and East San Jose, California—helped generate great fortunes for financiers and investors. They also helped lay America's economy low and sparked a worldwide financial crisis.

The subprime market did not cause the U.S. and global financial meltdowns by itself. Other varieties of home loans and a host of arcane financial innovations—such as collateralized debt obligations and credit default swaps—also came into play. Nevertheless, subprime played a central role in the debacle. It served as an early proving ground for financial engineers who sold investors and regulators alike on the idea that it was possible, through accounting alchemy, to turn risky assets into "Triple-A-rated" securities that were nearly as safe as government bonds. In turn, financial wizards making bets with CDOs and credit default swaps used subprime mortgages as the raw material for their speculations. Subprime, as one market watcher said, was "the leading edge of a financial hurricane."

This book tells the story of the rise and fall of subprime by chronicling the rise and fall of two corporate empires: Ameriquest and Lehman Brothers. It is a story about the melding of two financial cultures separated by a continent: Orange County and Wall Street.

Ameriquest and its strongest competitors in subprime had their roots in Orange County, a sunny land of beauty and wealth that has a history as a breeding ground for white-collar crime: boiler rooms, S&L frauds, real-estate swindles. That history made it an ideal setting for launching the subprime industry, which grew in large measure thanks to bait-and-switch salesmanship and garden-variety deception. By the height of the nation's mortgage boom, Orange County was home to four of the nation's six biggest subprime lenders. Together, these four lenders—Ameriquest, Option One, Fremont Investment & Loan, and New Century—accounted for nearly a third of the subprime market. Other subprime shops, too, sprung up throughout the county, many of them started by former employees of Ameriquest and its corporate forebears, Long Beach Savings and Long Beach Mortgage.

Lehman Brothers was, of course, one of the most important institutions on Wall Street, a firm with a rich history dating to before the Civil War. Under its pugnacious CEO, Richard Fuld, Lehman helped bankroll many of the nation's shadiest subprime lenders, including Ameriquest. "Lehman never saw a subprime lender they didn't like," one consumer lawyer who fought the industry's abuses said.Lehman and other Wall Street powers provided the financial backing and sheen of respectability that transformed subprime from a tiny corner of the mortgage market into an economic behemoth capable of triggering the worst economic crisis since the Great Depression.

A long list of mortgage entrepreneurs and Wall Street bankers cultivated the tactics that fueled subprime's growth and its collapse, and a succession of politicians and regulators looked the other way as abuses flourished and the nation lurched toward disaster: Angelo Mozilo and Countrywide Financial; Bear Stearns, Washington Mutual, Wells Fargo; Alan Greenspan and the Federal Reserve; and many more. Still, no Wall Street firm did more than Lehman to create the subprime monster. And no figure or institution did more to bring subprime's abuses to life across the nation than Roland Arnall and Ameriquest.

Among his employees, subprime's founding father was feared and admired. He was a figure of rumor and speculation, a mysterious billionaire with a rags-to-riches backstory, a hardscrabble street vendor who reinvented himself as a big-time real-estate developer, a corporate titan, a friend to many of the nation's most powerful elected leaders. He was a man driven, according to some who knew him, by a desire to conquer and dominate. "Roland could be the biggest bastard in the world and the most charming guy in the world," said one executive who worked for Arnall in subprime's early days. "And it could be minutes apart."He displayed his charm to people who had the power to help him or hurt him. He cultivated friendships with politicians as well as civil rights advocates and antipoverty crusaders who might be hostile to the unconventional loans his companies sold in minority and working-class neighborhoods. Many people who knew him saw him as a visionary, a humanitarian, a friend to the needy. "Roland was one of the most generous people I have ever met," a former business partner said.He also left behind, as another former associate put it, "a trail of bodies"—a succession of employees, friends, relatives, and business partners who said he had betrayed them. In summing up his own split with Arnall, his best friend and longtime business partner said, "I was screwed."Another former colleague, a man who helped Arnall give birth to the modern subprime mortgage industry, said: "Deep down inside he was a good man. But he had an evil side. When he pulled that out, it was bad. He could be extremely cruel." When they parted ways, he said, Arnall hadn't paid him all the money he was owed. But, he noted, Arnall hadn't cheated him as badly as he could have. "He fucked me. But within reason."

Roland Arnall built a company that became a household name, but shunned the limelight for himself. The business partner who said Arnall had "screwed" him recalled that Arnall fancied himself a puppet master who manipulated great wealth and controlled a network of confederates to perform his bidding. Another former business associate, an underling who admired him, explained that Arnall worked to ingratiate himself to fair-lending activists for a simple reason: "You can take that straight out of The Godfather: 'Keep your enemies close.' "

Michael W. Hudson is a staff writer at the Center for Public Integrity, a non-profit journalism organization. He previously worked as a reporter for the Wall Street Journal and as an investigator for the Center for Responsible Lending. The winner of a George Polk Award, Hudson has also written for Forbes, The Big Money, the New York Times, the Los Angeles Times and Mother Jones. He edited the award-winning book Merchants of Misery and appeared in the documentary film Maxed Out. He lives in Brooklyn, New York.

The above is excerpted from THE MONSTER: How a Gang of Predatory Lenders and Wall Street Bankers Fleeced America--and Spawned a Global Crisis by Michael W. Hudson, just published by Times Books, an imprint of Henry Holt and Company, LLC. Copyright (c) 2010 by Michael W. Hudson. All rights reserved.

##