In a September 20, 1912 article in the

New York Times titled “The Age of the Superlative,” a writer admired the fact that a French aviator had achieved an altitude of 18,635 feet and that the new Equitable Life Insurance building, erected on the spot where the old one had just burned down, “is sure to be the biggest in the world.” Nothing could be done about the vast amounts of wealth dedicated to breaking such records. “We know well that there are better kinds of glory,” the writer soberly concluded, “but the age of the superlative must take its course.”

We live in an age of the superlatives as well, ironically being touted as the Age of Austerity by the state-capitalist oligarchs. But the superlative qualities of our age mark a world in decline. Consider some of our superlative achievements:

- Scientists have renamed this era the Anthropocene, to denote the unprecedented impact humans are having on the planet, an impact that is driving the sixth mass extinction in the history of the planet.

- The US financial “crisis” of 2008 was the largest private sector theft of public money in history, an estimated $16 trillion, followed by an aggressive global “austerity” push that targets the poor, the middle class, and people of colour to pay for the systemic fraud that caused the crisis.

- The US income disparity gap between rich and poor is the greatest of any industrialized country.

- For the first time in US history, student debt exceeds consumer debt. Never has a young generation of Americans seen this much debt, and consequently they await a life of serfdom in the capitalist order.

- The global 2011 Billionaires List recorded a record number of billionaires and combined wealth.

- There are more slaves today than at any time in human history.

- Worldwide military spending reached a record high in 2011.

And those are just a few records.

Notice a trend?

The world is dying, and capitalists are making record profits as it dies. There are more slaves and billionaires than ever before. The military-industrial complex is the largest it has ever been.

In this context, poor and working people have been asked—well, told—to reduce their expectations for the future and for their quality of life in the present. The

word of the year for 2010 was “austerity.”

The

systemic fraud of 2008—a comma in the run-on sentence of capitalist exploitation—for which the poor are being asked to pony-up was not some hiccup in the benevolent functioning of capitalism: it was fraud, in an economic system predicated on fraud and massive exploitation. They stole trillions from the global poor, in particular from

racialized people in the US. Now they want us to pay for their crisis.

I decided to make a documentary film about austerity, about a year and half ago, because I was perplexed by the absence of a mass rebellion against capitalism in North America, especially in the aftermath of 2008, and because I believe if we don’t stop the austerity agenda we will collectively be

That may sound like hyperbole, but consider the trends in the statistics above and the near-complete control corporatism has over the existing political institutions.

In the US, several states have begun to

repeal workers’ rights (or what’s left of them) and pass laws allowing state governments to default on state pension plans, plans already made venerable by their investments in the same marketplace now trying to destroy them.

President Obama, hailed by some liberals as the progenitor of change, has continued the same policies of economic and military imperialism as his predecessor. His top advisers upon taking office were a collection of silk-suited thugs from the very same investment-banking coterie that pulled off the heist in 2008.

One of the objectives of the capitalist Age of Austerity is to break what remains (and that’s not saying much) of organized labour, most of which exists in public sector unions. In Canada, Harper’s hostile treatment of the postal workers’ union indicates an embrace of the austerity agenda:

workers’ rights, such as they are, will not be respected.

Recent layoffs at Environment Canada, and the regressive agenda of Toronto Mayor Rob Ford, suggest a massive evisceration of public services in Canada is on its way. Some union heads estimate as many as 30,000 civil servants

may be axed.

The bankers and finance capitalists caused the crisis. Now public services such as education, health care, environmental protections, and essential infrastructure are going to pay for it. Unless, of course, we fight back.

I asked academics, activists and authors to define “austerity” and to suggest how we might fight back. The result is

Capitalism Is The Crisis: Radical Politics in the Age of Austerity, a feature documentary that examines the nature of capitalist crisis, and some of the places where people have confronted capitalism including Greece, the G20 summit protest in Toronto, and the exhibition of mass solidarity in Madison, Wisconsin.

In the film, Chris Hedges (author of

Death of the Liberal Class) and Derrick Jensen (author of

Endgame) discuss the pathological character of capitalism. Hedges describes the BP executives as “executioners” at the helm of a system that will “kill most of us” if it is not stopped. I held a conversation with the unlikely pair back in July 2010, during the BP oil spill.

York University political scientists David McNally and Leo Panitch discuss the context for the current crisis of capitalism, which Panitch calls the “first great depression of the 21st century.” McNally suggests the Age of Austerity may last for “a generation.”

I talked to a variety of radicals. Michael Hardt, the Duke University professor who co-authored

Empire, Multitude, and Commonwealth with Tony Negri, discusses an autonomist Marxist reading of the Great Depression and FDR. In some sense, we have to see ourselves as the crisis. We have to acknowledge that we have agency, that we can determine the outcome of this ongoing social war.

Max Haiven, a professor from Halifax, talks about the social ways in which debt narrows the radical imagination, leading to a mass forgetting of anti-capitalist movements of the past, and produces gestural and ineffective forms of resistance.

Ajamu Nangwaya, a graduate student at the University of Toronto and a former VP of CUPE Ontario, warns us not to be confused by the apparent resurgence of Keynesian economics in mainstream media discussions. The ruling class, he says, will do whatever it takes to preserve the system. The embrace of Keynesian economics by some capitalists is not an endorsement of socialism.

Queen’s University professor Richard J.F. Day talks about the long history of capitalist accumulation. He also comments on Harper’s probable agenda at the G20 summit crackdown.

I don’t want to give away the entire film here. Actually, I do (below). But I hope you will watch it and join the fight against austerity. This is not a fight that can be won through electoral politics. It requires a mass social movement, and it requires that capitalism be erased from the face of the earth forever.

Now is not the time to “restore the middle class,” the message from Big Labour; now is the time to restore human dignity and prevent the current crisis from being our last, by building an alternative to capitalism. We need a revolution, not a reformation.

It may be their crisis, but it’s our problem.

Help Us Transmit This Story

Add to Your Blogger Account

Put it On Facebook

Tweet this post

Print it from your printer

Email and a collection of other outlets

Try even more services

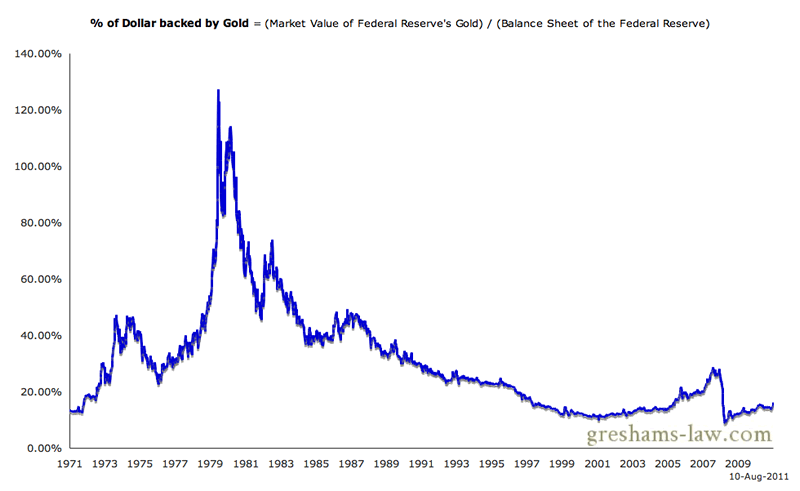

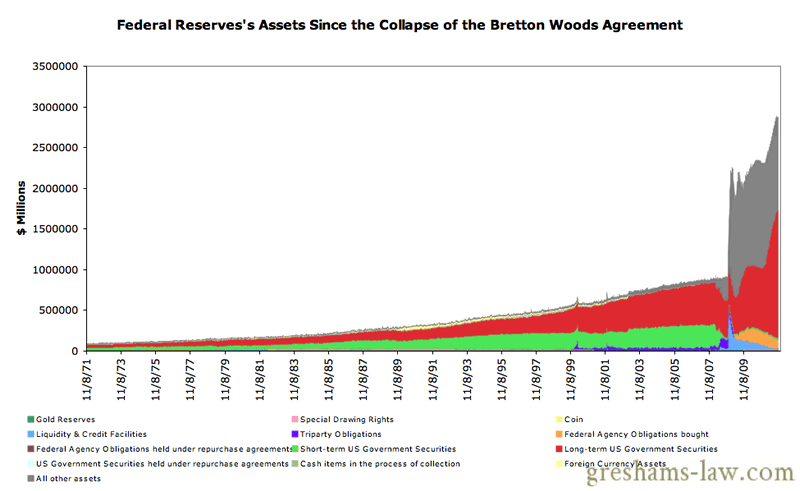

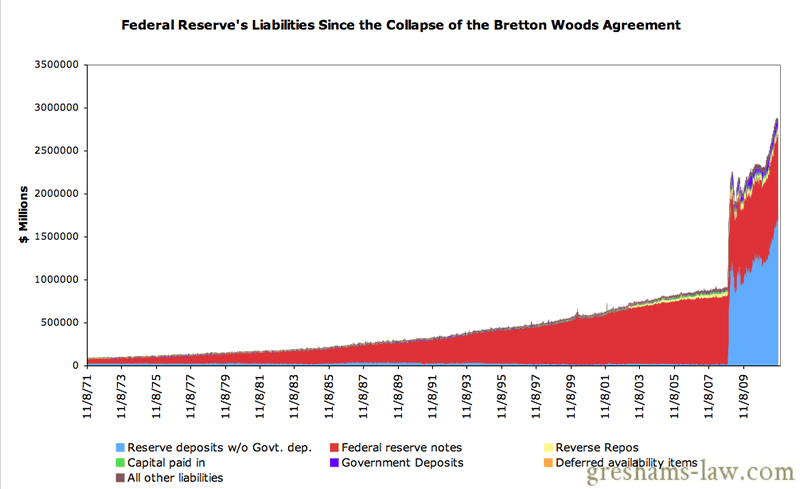

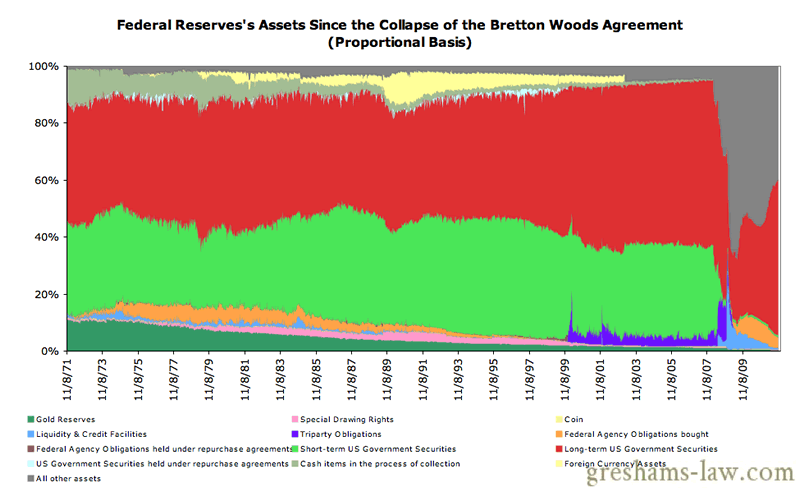

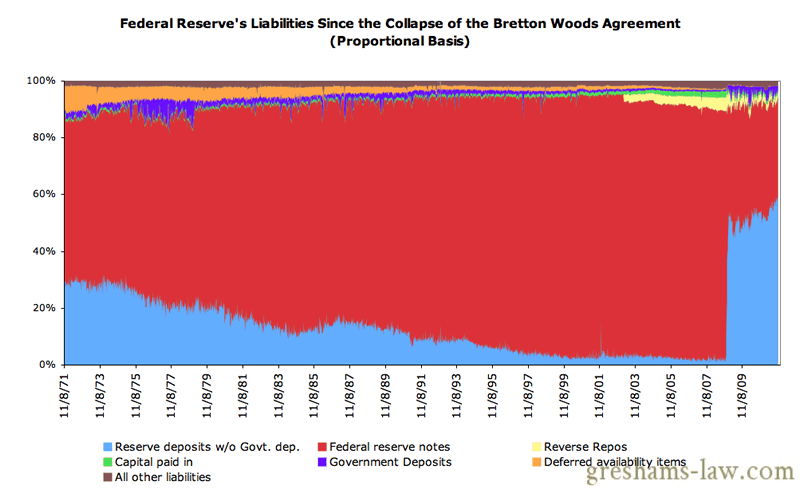

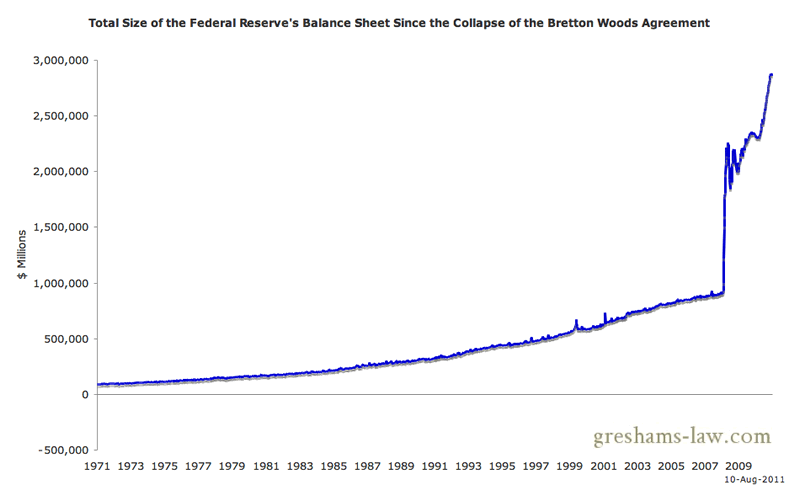

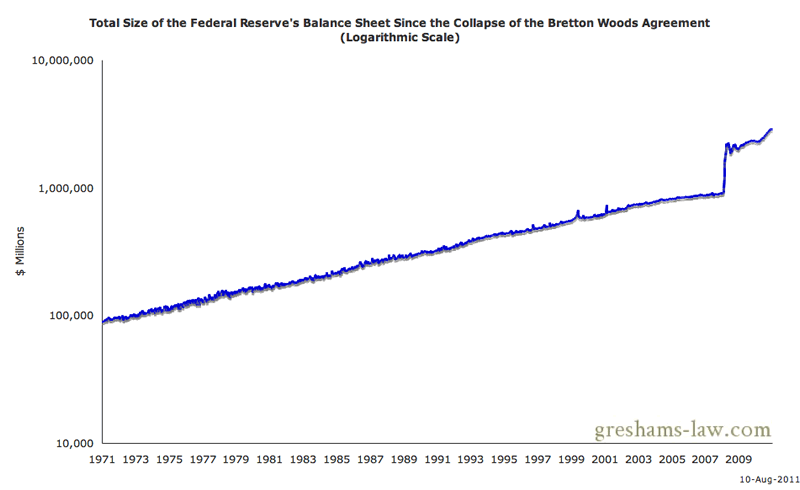

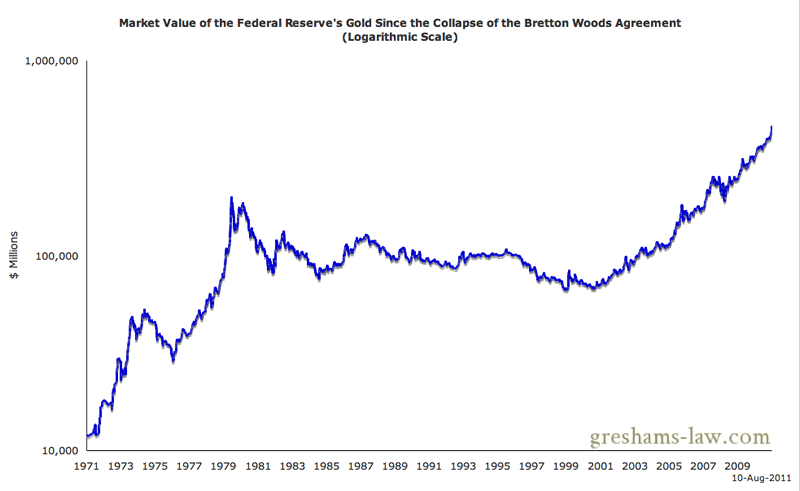

Value of the Federal Reserve's Gold Since the Collapse of the Bretton Woods Agreement - Click to enlarge. Source: St Louis Fed

Value of the Federal Reserve's Gold Since the Collapse of the Bretton Woods Agreement - Click to enlarge. Source: St Louis Fed