Source - Muckety Maps

2 related links...

In a speech to a closed gathering at the Lowy Institute in Sydney on Thursday, Paul Keating gave a starkly different account of Geithner's record in handling the Asian crisis: "Tim Geithner was the Treasury line officer who wrote the IMF [International Monetary Fund] program for Indonesia in 1997-98, which was to apply current account solutions to a capital account crisis."

In other words, Geithner fundamentally misdiagnosed the problem. And his misdiagnosis led to a dreadfully wrong prescription.

Geithner thought Asia's problem was the same as the ones that had shattered Latin America in the 1980s and Mexico in 1994, a classic current account crisis. In this kind of crisis, the central cause is that the government has run impossibly big debts.

The solution? The IMF, the Washington-based emergency lender of last resort, will make loans to keep the country solvent, but on condition the government hacks back its spending. The cure addresses the ailment.

But the Asian crisis was completely different. The Asian governments that went to the IMF for emergency loans - Thailand, South Korea and Indonesia - all had sound public finances.

The problem was not government debt. It was great tsunamis of hot money in the private capital markets. When the wave rushed out, it left a credit drought behind.

But Geithner, through his influence on the IMF, imposed the same cure the IMF had imposed on Latin America and Mexico. It was the wrong cure. Indeed, it only aggravated the problem.

Keating continued: "Soeharto's government delivered 21 years of 7 per cent compound growth. It takes a gigantic fool to mess that up. But the IMF messed it up. The end result was the biggest fall in GDP in the 20th century. That dubious distinction went to Indonesia. And, of course, Soeharto lost power."

Exactly who was the "gigantic fool"? It was, obviously, the man who wrote the program, Geithner, although Keating is prepared to put the then managing director of the IMF, the Frenchman Michel Camdessus, in the same category.

Worse, Keating argued, Geithner's misjudgment had done terminal damage to the credibility of the IMF, with seismic geoeconomic consequences: "The IMF is the gun that can't shoot straight. They've been making a mess of things for the last 20-odd years, and the greatest mess they made was in east Asia in 1997-98, so much so that no east Asian state will put its head in the IMF noose."

China, in particular, drew hard conclusions from the IMF's mishandling of the Asian crisis. It decided that it would never allow itself to be dependent on the IMF, or the US, or the West generally, for its international solvency. Instead, it would build the biggest war chest the world had ever seen.

Keating continued: "This has all been noted inside the State Council of China and by the Politburo. And it's one of the reasons, perhaps the principal reason, why convertibility of the renminbi remains off the agenda for China, and it's why through a series of exchange-rate interventions each day that they've built these massive reserves.

"These reserves are so large at $US2 trillion as to equal $US2000 for every Chinese person, and when your consider that the average income of Chinese people is $US4000 to $US5000, it's 50 per cent of their annual income. It's a huge thing for a developing country to not spend its wealth on its own development."

Is this some flight of Keatingesque fancy? The former deputy governor of the Reserve Bank of Australia, Stephen Grenville, doesn't think so: "After the Asian crisis, the countries of east Asia decided that they would never go to the IMF again. The IMF is taboo in east Asia. Look at the evidence. The revealed preference of the region is that no one has gone to the IMF since, even when they needed the money."

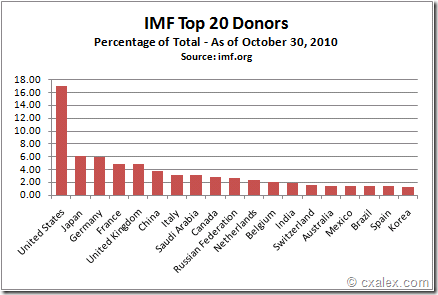

And Asian capitals know that they have no real influence over the IMF - while European governments enjoy 40 per cent of the voting power on the IMF, Japan, China and the rest of east Asia put together have only about 16 per cent. This is an artefact of the immediate postwar power structure, when the IMF was set up.

Keating urges that the fund should be decapitated, with control passing to the governments of the Group of 20 countries whose leaders are to meet in London on April 2. The summit, which is to include China, India and Indonesia as well as Australia, is meeting to consider solutions to the global crisis.

As for The New York Post's claim that Geithner was the hero who cajoled those quarrelsome Asians into agreeing to a $US200 billion rescue, the key fact burned into the minds of Asian elites is that the US was deaf to requests for funds. Washington did not contribute a cent of its own money to any of the emergency packages. Japan and Australia were the only nations that made loans to all three of the stricken Asian countries.

Keating went on to argue that, by frightening the Chinese into building their vast $US2 trillion foreign reserves, Geithner was responsible for the build-up of tremendous imbalance in the world financial system. This imbalance, in turn, according to Keating, contributed to the global financial crisis which has since devastated the world economy.

China invested most of its reserves in US debt markets. Keating again: "So we have this massive recycling of funds into the system by [the former US Federal Reserve chairman Alan] Greenspan's monetary policy so even if you are greedy Dick Fuld [the former head of the collapsed investment bank Lehman Brothers] or you are hopeless Charles Prince at Citibank, you're being told there's an endless supply of money at a low interest rate and no inflation. So of course the system geared up to spend it.

"That is the fundamental cause of the problem - the imbalance is the fundamental cause."

If Keating's opinion of Geithner had circulated in the US, the Americans would not have been so surprised and disappointed with their new Treasury Secretary. They quickly learned that he had failed to pay $43,000 in taxes owing.

Then, when he announced his much-anticipated plan to rescue the US banking system, share prices slumped by 4 per cent immediately and a new round of weakness in the financial sector began. The pundits turned savagely against him: "So much for the saviour-based economy," wrote Maureen Dowd of The New York Times. Senator Shelby changed his mind: "Aggravating economic problems by contributing to marketplace uncertainty about what steps the Government will take - is that what this is?" he fumed.

US bank stocks weakened so much that nationalisation seems to be the only remaining option to put them quickly out of their misery.

Australia's banks, by contrast, are strong, said Keating, because of his decision as Treasurer to create the "Four Pillars" policy. This requires that the four big banks remain separate, barred from taking each other over. This prevented them "cannibalising each other", in Keating's words. As protected species, they had no need to mount risky takeovers to bulk themselves up defensively.

Their strength certainly wasn't due to the brilliance of their managers, whom Keating described as "counterhopping clerks" who had managed to work their way up the bank hierarchies. A further source of the soundness of the Australian banks, he said, was that they had learned well the lessons of risky speculative lending as a result of "the recession we truly did have to have".

In sum, Tim Geithner is a gigantic fool, the IMF the gun that can't shoot straight, Alan Greenspan a bungler. The big US banks were run by the greedy and the hopeless, the Australian banks by counterhopping clerks. It's a world of many villains. And only one hero.