US

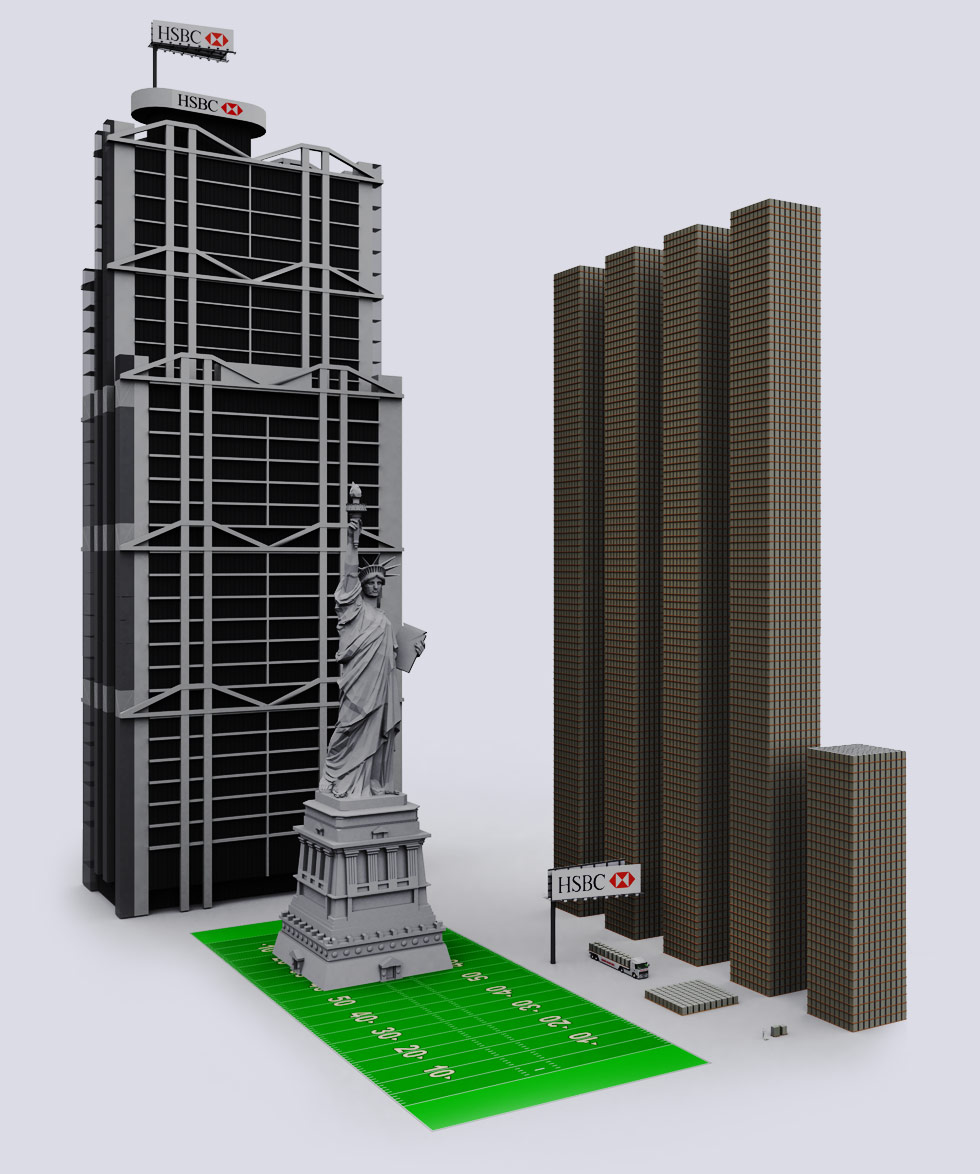

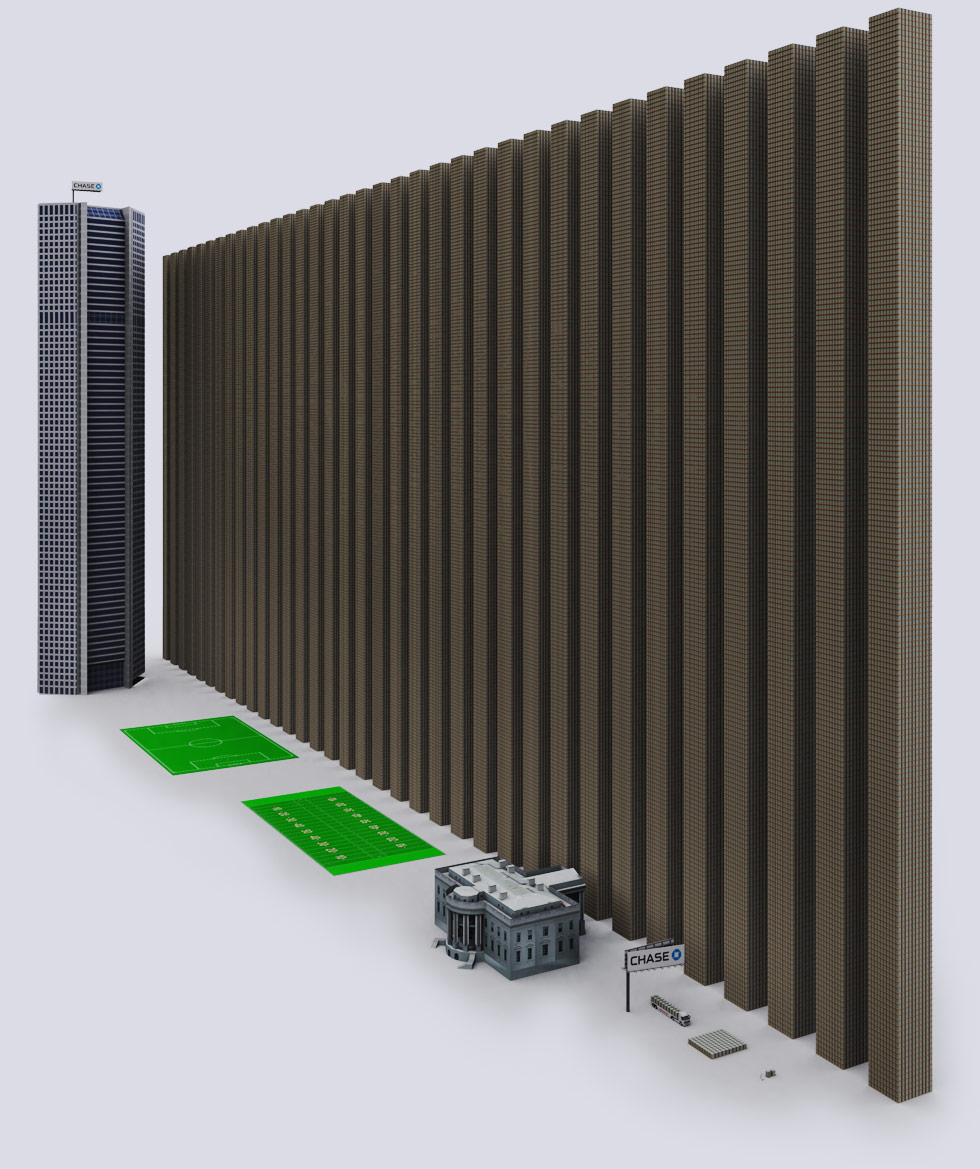

commercial bank loans and leases flat since Lehman, and yet US GDP

higher by $2 trillion since the biggest bankruptcy in history. How does

one reconcile this monetary and growth quandary? Simple.

When it comes to the real measure of a nation’s economic output, one

can rely on “flexible”, constantly changing definitions of what

constitutes the creation of “goods and services” as well as transactions

thereof, goalseeked to meet the propaganda of

”

(just ask the anti-Austerians for whom debt and growth are

interchangeable) which is and has always been a reflection of the

increase (or decrease) in broad and narrow liquidity or money supply,

which in turn means how much money is created through loans, either via

commercial banks or the central monetary authority, also known as the

Federal Reserve.

by Monty Guild, Financial Sense:

There are More Tools in the Kit—We Expect to See them Used in the U.S. and Europe Before the Current Economic Malaise has Ended

So far, Japanese Prime Minister Shinzo Abe’s aggressive monetary

easing is following pretty closely the prescription laid out in 1999 by a

Princeton economics professor named Ben S.

Bernanke.

Back then, before the dotcom decline of 2000 and the 2008 crisis, Mr.

Bernanke wrote the following in his appraisal how to help Japan regain

its economic footing after 10 years of stagnation:

“Despite the apparent liquidity trap, monetary

policymakers retain the power to increase nominal aggregate demand and

the price level… [and] increased nominal spending and rising prices will

lead to increases in real economic activity.”

…

In a Market Society, everything is for sale

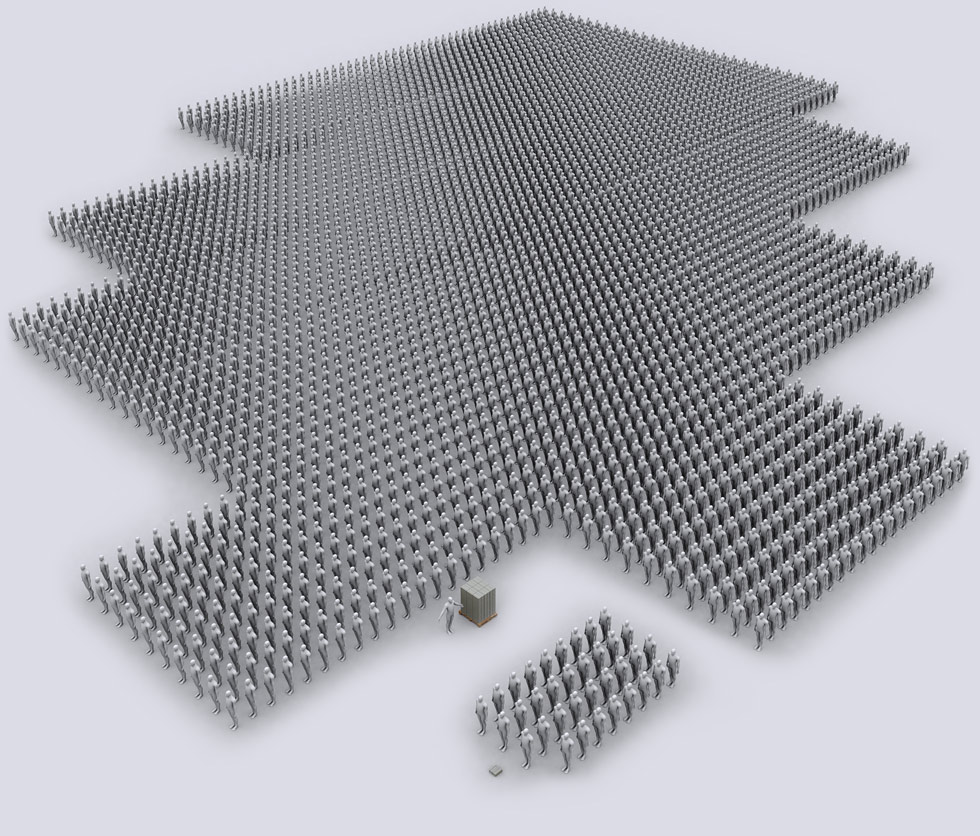

For the rest of the world, capitalism is not working: A billion

live on less than two dollars a day. With global population exploding

to 10 billion by 2050, that inequality gap will grow, fueling

revolutions, wars, adding more billionaires and more folks surviving on

two bucks a day.

…

Why should you worry? Capitalism breeds corruption and inequality

But the 2008 crash challenged our faith in free-market

capitalism: “The financial crisis did more than cast doubt on the

ability of markets to allocate risk efficiently. It also prompted a

widespread sense that markets have become detached from morals.”

Then comes the big

question: So what? “Why worry that we are moving toward a society in

which everything is up for sale?” Two big reasons concern Sandel:

First, inequality: “Where

everything is for sale, life is harder for those of modest means.” If

wealth just bought things, yachts, sports cars, and fancy vacations,

inequalities wouldn’t matter much. “But as money comes to buy more and

more, the distribution of income and wealth looms larger.”

Second, corruption: “Putting a price on the good things

in life can corrupt them … markets don’t only allocate goods, they

express and promote certain attitudes toward the goods being exchanged.”

Also “corrupt the meaning of citizenship. Economists often assume that

markets … do not affect the goods being exchanged. But this is untrue.

Markets leave their mark.”

…

Dysfunctional politicians pushing Americans past point of no return

Can we change? “The appeal of using markets to put a price on

public values, is that there’s no judgment on the preferences they

satisfy.” Debate is unnecessary. Markets don’t “ask whether some ways of

valuing goods are higher, or worthier, than others. If someone is

willing to pay for sex, or a kidney … the only question the economist

asks is ‘How much?’ Markets … don’t discriminate between worthy

preferences and unworthy ones.” Markets may never draw the line, but do

politicians, in secret?

What is certain:

Capitalism is eliminating moral values, as Nobel economist Milton

Friedman and capitalism’s philosopher Ayn Rand had been preaching to the

generation. As Sandel puts it: “Each party to a deal decides for him-

or herself what value to place on the things being exchanged. This

nonjudgmental stance toward values lies at the heart of market

reasoning, and explains much of its appeal.”

But unfortunately, market capitalism “has exacted a heavy price … drained public discourse of moral and civic energy.”

The good professor is a great teacher, with only one

glaring flaw in his logic: he’s too idealistic, too quixotic. You don’t

have to be a fatalist to know that without a total economic collapse,

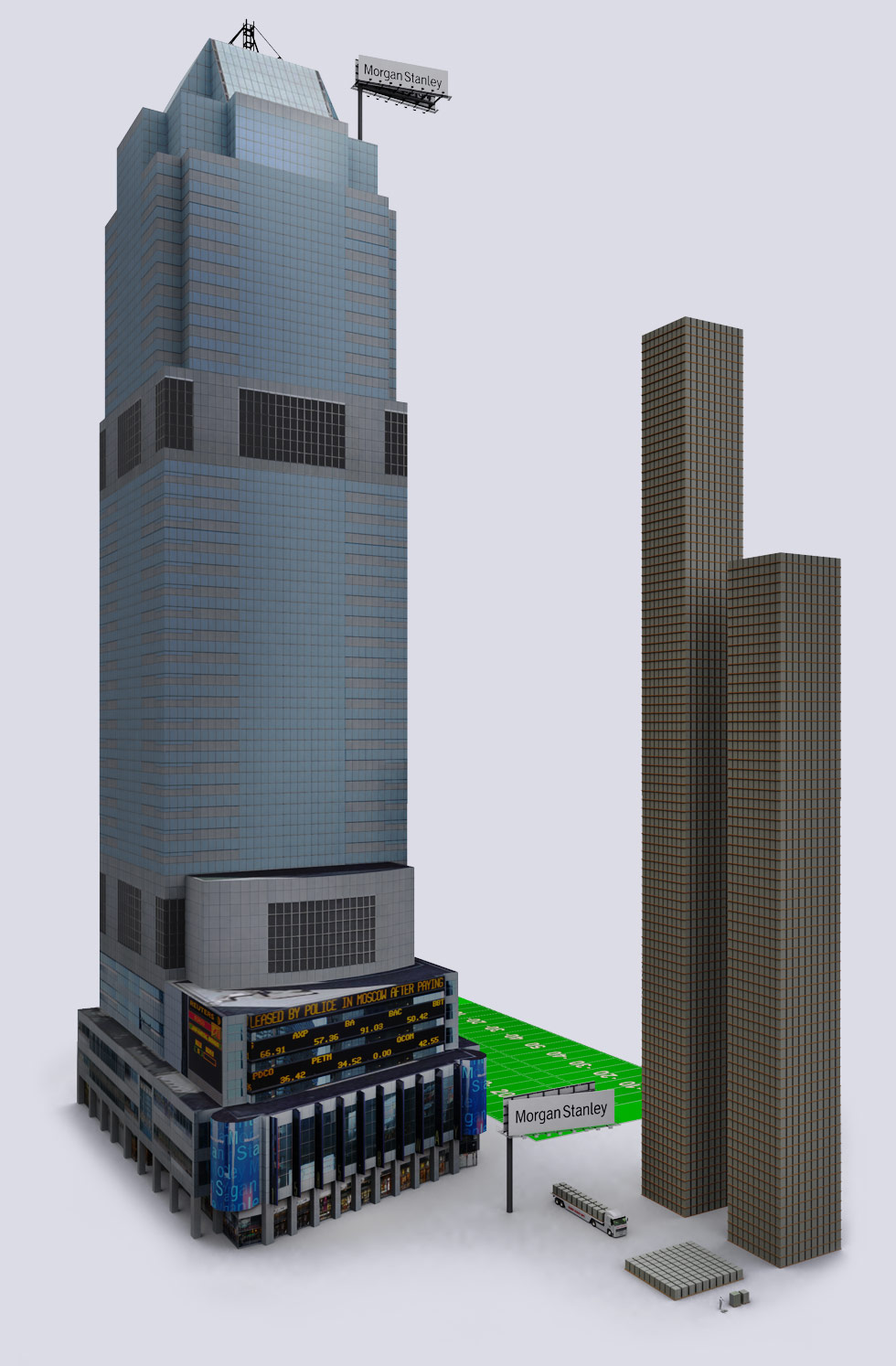

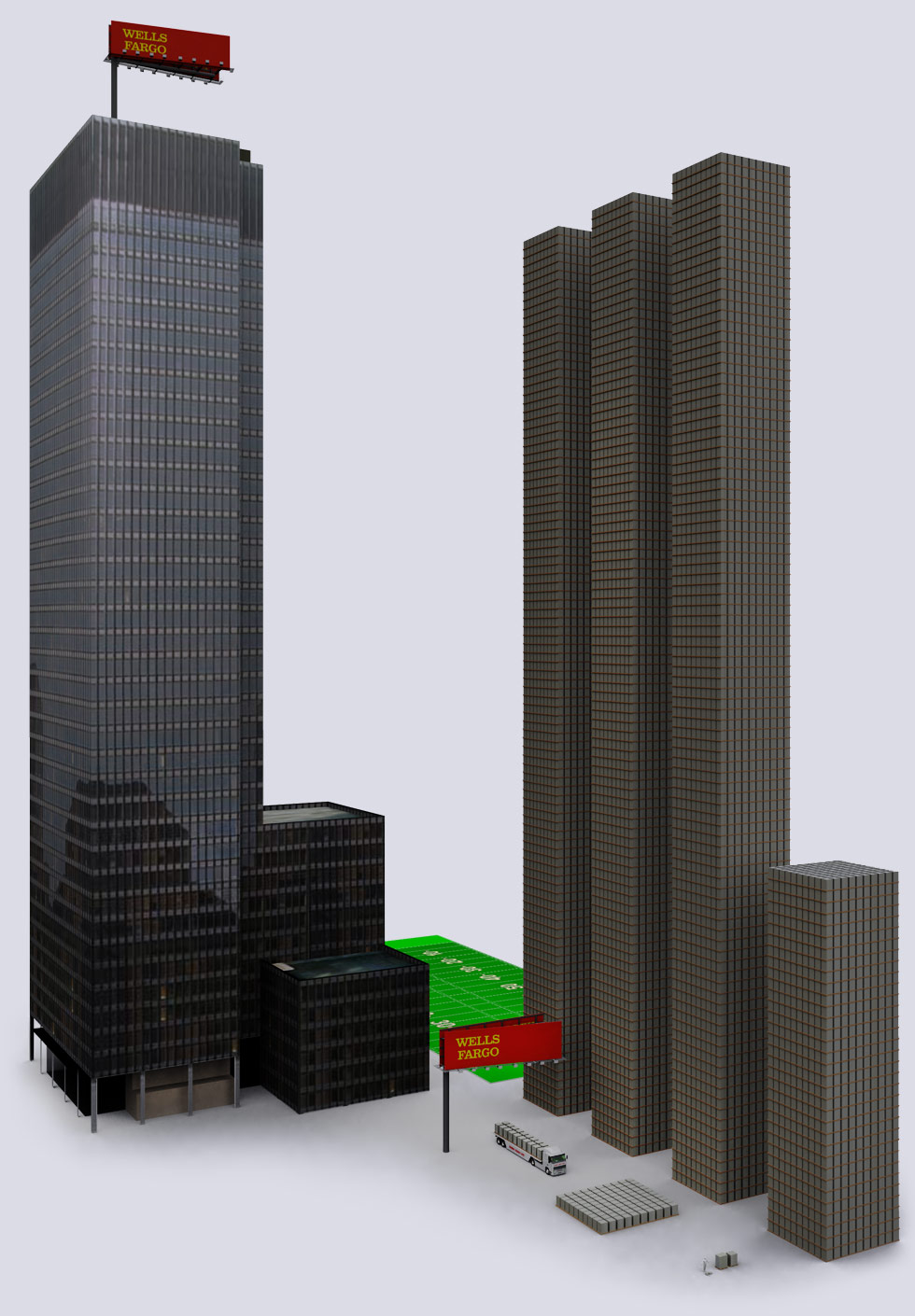

market capitalists — including 1,426 billionaires, Wall Street bankers,

hedgers, lobbyists and every other special interest getting rich off the

new market society — will never voluntarily surrender their control

over the American political system.

Rather, they will blindly continue down their self-destructive

path with an absolute conviction they are divinely guided by the

Invisible Hand of Adam Smith, and perhaps even God.

Meanwhile, we have no choice but wait patiently till the

collapse, anxiously aware that our bizarre political system will just

keep degrading America’s moral values, pricing, buying, selling, trading

morals like commodities, because in the final analysis everything has a

price and everyone has a price in our hot new exciting Market Society.

The world economy is starting to disintegrate. What we are

entering now is the culmination of a Ponzi scheme of printed money and

credit that started with the creation of the Fed in 1913….

The world is heading into a horrific economic nightmare, and an

inordinate amount of the suffering is going to fall on innocent

children. If you want to get an idea of what America is going to look

like in the not too distant future, just check out what is happening in

Greece. At this point, Greece is experiencing a full-blown economic

depression. As I have written about

previously,

the unemployment rate in Greece has now risen to 27 percent, which is

much higher than the peak unemployment rate that the U.S. economy

experienced during the Great Depression of the 1930s. And as you will

read about below, child hunger is absolutely exploding in Greece right

now. Some families are literally trying to survive on pasta and

ketchup. But don’t think for a moment that it can’t happen here.

Sadly, the truth is that child hunger is already rising very rapidly in

our

poverty-stricken cities.

Never before have we had so many Americans unable to take care of

themselves. Food stamp enrollment and child homelessness have soared to

brand new all-time records, and there are actually thousands of

Americans that are so poor that they

live in tunnels underneath

our cities. But for millions of other Americans, the suffering is not

quite so dramatic. Instead, they just watch their hopes and their

dreams slowly slip away as they struggle to find a way to make it from

month to month. There are millions of parents that lead lives that are

filled with constant

stress and anxietyas

they try to figure out how to provide the basics for their children.

How do you tell a child that you can’t give them any dinner even though

you have been trying as hard as you can? What many families go through

on a regular basis is absolutely heartbreaking. Unfortunately, more

poor families slip through the cracks with each passing day, and these

are supposedly times in which we are experiencing an “economic

recovery”. So what are things going to look like when the next major

economic downturn strikes?

A recent

New York Times article detailed

the horrifying child hunger that we are witnessing in Greece right

now. At some schools there are reports of children actually begging for

food from their classmates…

As an elementary school principal, Leonidas Nikas is used

to seeing children play, laugh and dream about the future. But recently

he has seen something altogether different, something he thought was

impossible in Greece: children picking through school trash cans for

food; needy youngsters asking playmates for leftovers; and an

11-year-old boy, Pantelis Petrakis, bent over with hunger pains.

“He had eaten almost nothing at home,” Mr. Nikas said, sitting in his

cramped school office near the port of Piraeus, a working-class suburb

of Athens, as the sound of a jump rope skittered across the playground.

He confronted Pantelis’s parents, who were ashamed and embarrassed but

admitted that they had not been able to find work for months. Their

savings were gone, and they were living on rations of pasta and ketchup.

Could you imagine that happening to your children or your grandchildren?

Don’t think that it can’t happen. Just a few years ago the Greek middle class was vibrant and thriving.

And we are starting to see hunger explode in other European countries

as well. For example, in the UK the number of people receiving

emergency food rations has increased

by 170 percent over the past year.

This is one of the reasons why I get upset when people say that

“things are getting better”. Yes, the stock market has been setting

record highs lately, but things are

most definitely not getting better.

Even during this false bubble of debt-fueled economic stability that

we are enjoying right now, we continue to see hunger and poverty rise

dramatically in America.

Since Barack Obama has been president, the number of Americans on food stamps has grown from 32 million to more than 47 million.

Will we all be on food stamps eventually?

Will we all become dependent on the government for our survival at some point?

According to

the Boston Herald, even Tamerlan Tsarnaev was receiving government welfare benefits…

Marathon bombings mastermind Tamerlan Tsarnaev was living

on taxpayer-funded state welfare benefits even as he was delving deep

into the world of radical anti-American Islamism, the Herald has

learned.

State officials confirmed last night that Tsarnaev, slain in a raging

gun battle with police last Friday, was receiving benefits along with

his wife, Katherine Russell Tsarnaev, and their 3-year-old daughter. The

state’s Executive Office of Health and Human Services said those

benefits ended in 2012 when the couple stopped meeting income

eligibility limits.

Isn’t that crazy?

And yes, there are some people out there that are abusing the

system. In fact, the cost of food stamp fraud has risen sharply to

approximately $750 million in recent years.

But most of the people on these programs really need the help. Thanks to our

incredibly foolish economic policies,

there are not enough good jobs for everyone and there never will be

again. The percentage of Americans that are unable to take care of

themselves is going to continue to rise, and the suffering that we are

witnessing right now is going to get much, much worse.

Not that things aren’t really, really bad already. Here are some

signs that child hunger in America has already started to explode…

#1 Today, approximately

17 million children in

the United States are facing food insecurity. In other words, that

means that “one in four children in the country is living without

consistent access to enough nutritious food to live a healthy life.”

#2 We are told that we live in the “wealthiest nation” on the planet, and yet more than

one out of every four children in the United States is enrolled in the food stamp program.

#3 The average food stamp benefit breaks down to approximately

$4 per person per day.

#4 It is being projected that

approximately 50 percent of all U.S. children will be on food stamps before they reach the age of 18.

#5 It may be hard to believe, but approximately

57 percent of

all children in the United States are currently living in homes that

are either considered to be either “low income” or impoverished.

#6 The number of children living on $2.00 a day or less in the United States has grown to

2.8 million. That number has increased by 130 percent since 1996.

#7 According to

Feeding America,

“households with children reported food insecurity at a significantly

higher rate than those without children, 20.6 percent compared to 12.2

percent”.

#8 According to a Feeding America hunger study,

more than 37 million Americans are now being served by food pantries and soup kitchens.

#9 For the first time ever,

more than a million public school students in the United States are homeless. That number has risen by

57 percent since the 2006-2007 school year.

…

Fed Debate Moves From Tapering to Extending Bond Buying – 11.7 million Americans remain jobless.

Debate about the Fed ending its bond buying was premature. The US

economy would collapse if it wasn’t on Fed life-support and the Fed

knows it.

Conspiracy theorists of the world, believers in the hidden

hands of the Rothschild’s & the Masons & the Illuminati, we

skeptics owe you an apology. You were right. The players may be a little

different, but your basic premise is correct: The …

This is why we are facing a MAJOR economic upheaval. This is a

GENERATIONAL shift. The youth are coming of age. They have no future

under this economic system. This will explode in everyone’s face.

BBC

BBC

US

commercial bank loans and leases flat since Lehman, and yet US GDP

higher by $2 trillion since the biggest bankruptcy in history. How does

one reconcile this monetary and growth quandary? Simple. Enter the Fed.

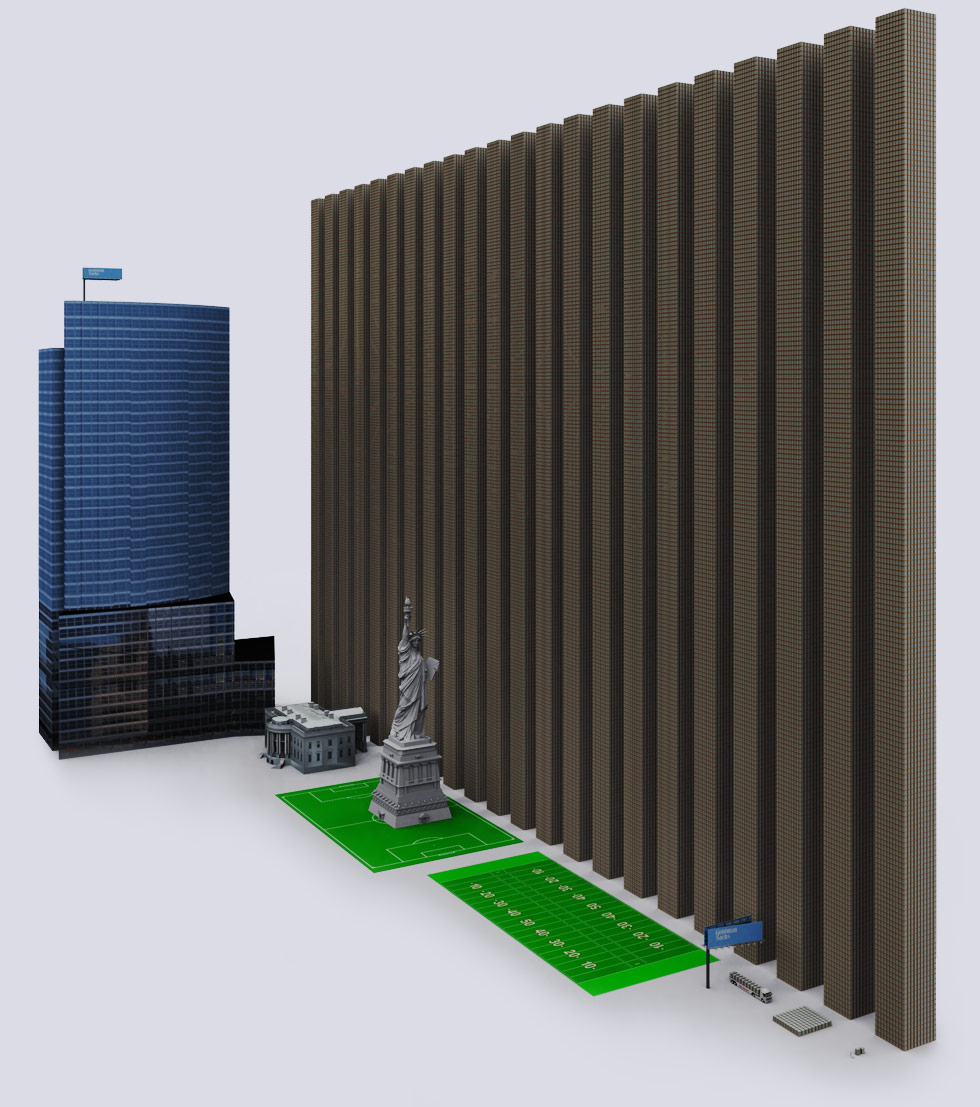

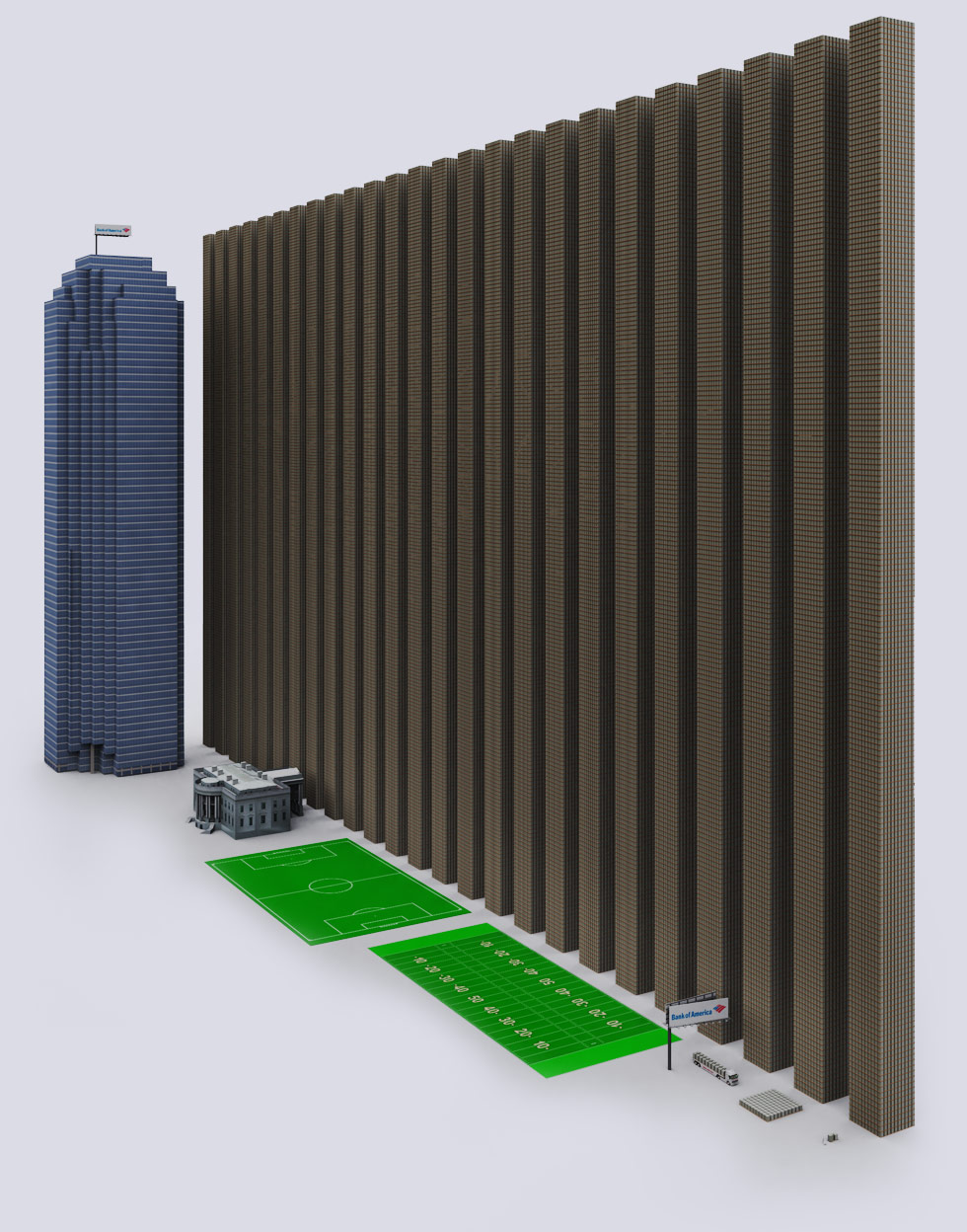

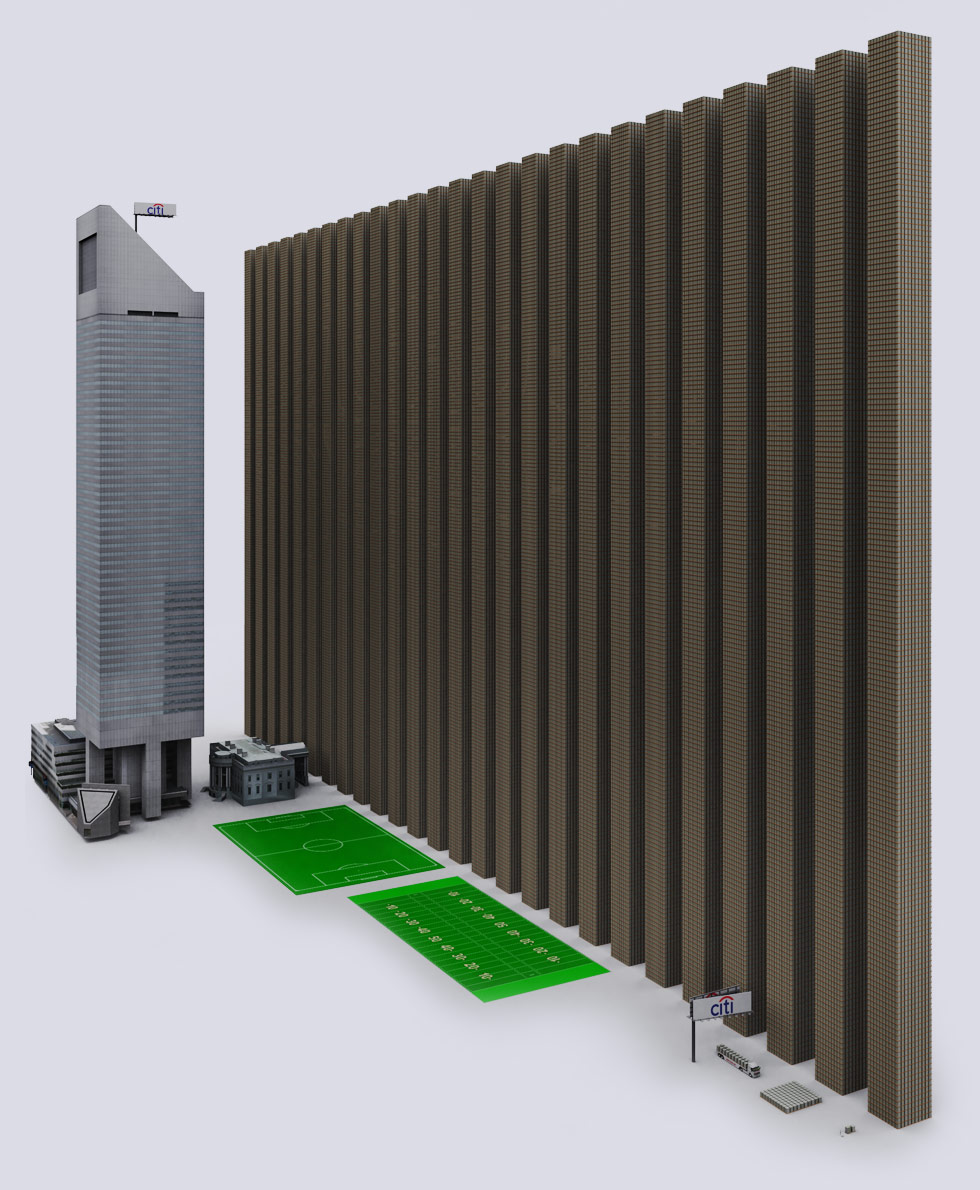

US

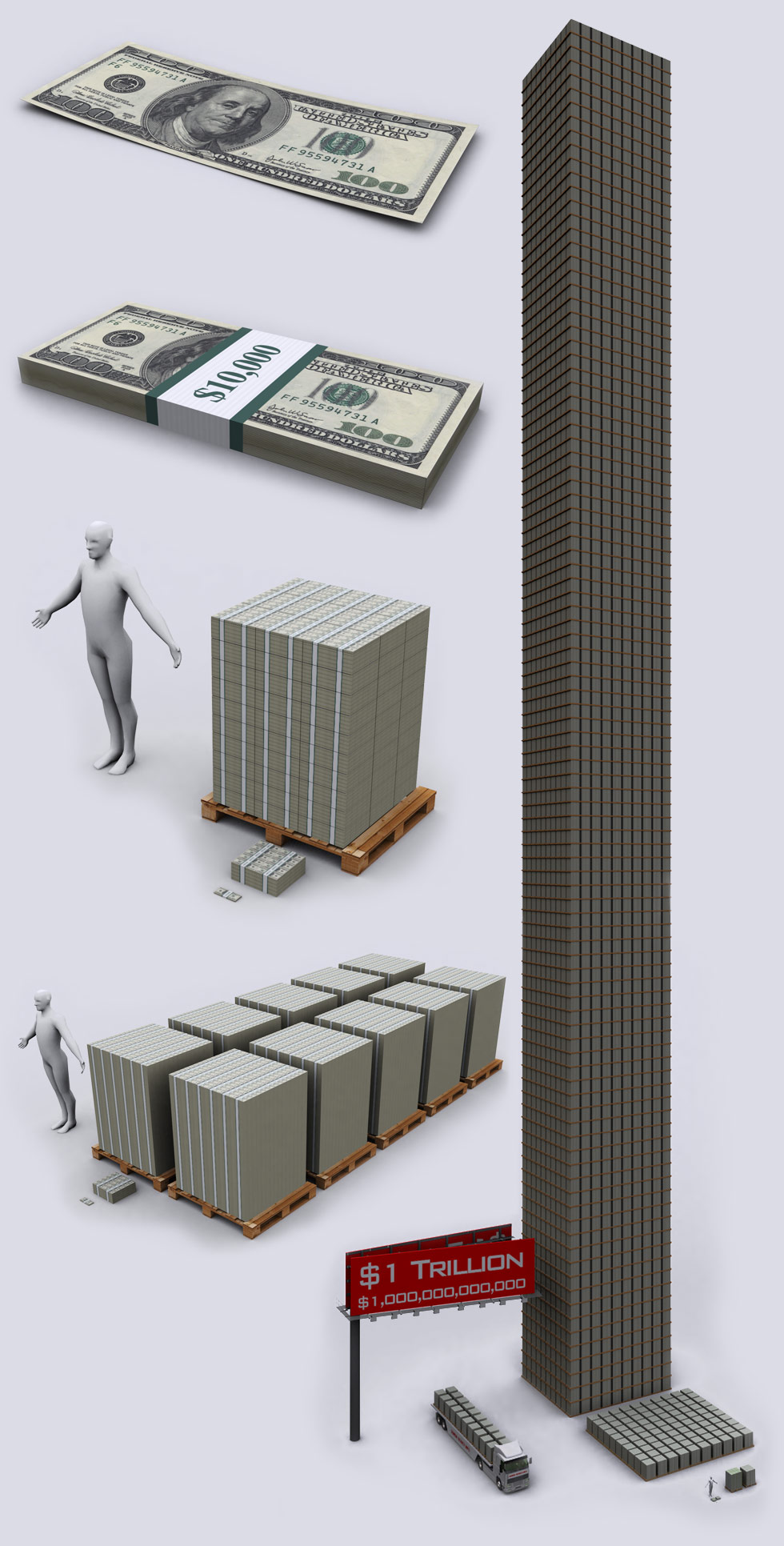

commercial bank loans and leases flat since Lehman, and yet US GDP

higher by $2 trillion since the biggest bankruptcy in history. How does

one reconcile this monetary and growth quandary? Simple. Enter the Fed. See

the surge in central bank holdings, the printing of new money,

beginning in the spring of 2008 with the bank bailouts and the

acquistion of long-term securities to keep interest rates down. (International Monetary Fund)

See

the surge in central bank holdings, the printing of new money,

beginning in the spring of 2008 with the bank bailouts and the

acquistion of long-term securities to keep interest rates down. (International Monetary Fund)