Friday, February 19, 2010

The Future of the Dollar

With a $12.3 trillion national debt and $55 trillion in unfunded obligations for programs such as Social Security, Medicare and Medicaid, with total Federal Reserve and Treasury bailout commitments now at $11.8 trillion, of which $3.6 trillion has already been spent the U.S. need to take steps immediately to protect themselves from the potential loss of the purchasing power of their U.S. Dollars, inflation.us warns.

Although there is still no significant inflation data in the United States international stock and commodity markets grew abnormally within the last eleven months. Analysts called it the “flight from the dollar” or “diversifying risks.”

There are many factors evidencing against the future of the dollar as a global reserve currency. In the present article futureofdollar.com pays attention to the crucial points of analysis after conducting an extensive research on the topic.

Part I

Weak Fundamentals of the U.S. Economy

Nobel Prize winner Paul Krugman states that “a country whose fundamentals are persistently and predictably deteriorating will necessarily have a [currency] crisis at some point.” (1)

1. National Debt

In the middle of February 2010, President Obama signed into law the bill increasing the public debt ceiling from $12.394 trillion to $14.294 trillion. This is a second increase in the upper limit on the national debt in less than two months.

Last time, in December, House Majority Leader Steny Hoyer commented that the Congress simply had no other choice: otherwise the United States would have to default on their debt obligations what would be another catastrophe for financial markets. (2)

The Peterson-Pew Commission on Budget Reform stated that “the United States would almost certainly experience a debt driven crisis,” that “could unfold gradually or it could happen suddenly, but with great costs either way.” “The excessive debt would. . . affect citizens in their everyday lives by harming the American standard of living through slower economic growth and dampening wages, and shrinking the government’s ability to reduce taxes, invest, or provide a safety net.” (3)

2. Unemployment

This past January, the economy lost 20,000 jobs after loosing 150,000 jobs in December, and the unemployment rate was 9.7 percent. (4)

The unemployment rate fell from 10.0 to 9.7 percent in January. According to Reuters “a sharp increase in the number of people giving up looking for work helped to depress the jobless rate. The number of 'discouraged job seekers' rose to 1.1 million in January from 734,000 a year ago.”

3. Budget deficit

IMF’s Managing Director Dominique Strauss-Kahn noted at the 10th Annual Herzliya Conference in Tel Aviv that the global crisis had created a problem of fiscal sustainability for many countries that could take decades to fix because of the huge debts built up during the crisis, especially in developed countries. (5)

The United States reached a record budget deficit of $1.415 trillion in fiscal year 2009 that ended in September. (6) The deficit will probably again exceed one trillion dollars in the current fiscal year as it is already over $400 billion.

The excess of spending over revenue in the United States rose to $91.9 billion in December 2009, as opposed to a deficit of $51.8 billion in December 2008, the Treasury Department announced in its monthly budget statement. The U.S. has posted a record 15 straight monthly deficits. (7)

In the beginning of February 2010 Obama transmitted a $3.8 trillion budget for 2011 to the Congress with a record $1.6 trillion deficit. (8)

During the debate on the national debt the Senate “rejected a proposed bipartisan commission to recommend ways to reduce the U.S. budget deficit,” Bloomberg reported. “The legislation would have required that the panel’s recommendations be voted on by Congress without being amended.” (9)

4. Financial sector

Recent Bank of America’s and Citigroup’s losses for the fourth quarter of 2009 and inability to repay the bailout funds without additional stock offering, Morgan Stanley’s low profits, and J.P. Morgan Chase's retail division loss confirm a suspicion that the U.S. banks’ economic conditions are not very strong putting in doubt health of the financial sector as a whole.

“Loan demand continued to decline or remained weak in most Districts.” (10)

“A number of Districts reported that credit quality continued to deteriorate.” (11)

5. Home Sales

Existing-home sales fell 16.7 percent in December 2009 “after first-time buyers rushed to complete sales before the original November deadline for the tax credit,” the National Association of Realtors reported. (12)

According to the U.S. Bureau of the Census sales of new single-family houses declined 7.6 percent in December 2009, following a drop of 9.3 percent in November. Bloomberg noted that for all of 2009, sales declined 23 percent to 374,000, the lowest level since records began in 1963. (13)

6. Economic impact of U.S. international military operations

The cost of conducting wars in Iraq and Afghanistan pushed the budget into the red during the presidency of George W. Bush. The situation deteriorated after the beginning of the financial crisis when the government adopted measures such as stimulus packages, financial bailouts, the need to support liquidity in Treasuries, etc. Moreover, early in December 2009 it has increased its nonproductive expenses by approving 30,000 troops to be sent to fight in Afghanistan.

All economists agree that one of the basic nonmonetary reasons of inflation is the existence of significant nonproductive government expenses such as military expenses.

Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York, said Obama may have too much on his plate. “You can’t fight a war, a financial crisis, a recession, and add health-care coverage to the uninsured at the same time,” he said. “It is simply the recipe for disaster.” (14)

However important goals of the war could be, military operations are, undoubtedly, very costly for U.S. citizens especially at the time of the financial crisis and growing deficits. Moreover, the situation is not getting better considering that around 40 percent of the war financing has been borrowed from abroad, Joseph Stiglitz, the Nobel Prize Winner, shows in his research “The Three Trillion Dollar War: The Real Cost of the Iraq Conflict.”

Explaining why wars are expensive he points out that military expenditures are not only limited to direct operation costs but also include (the bigger part) human casualties, future disability costs, loss of income, increased oil prices, opportunity costs, veterans’ social welfare, nonproductive spending, loss of confidence in the future economic situation, increase in the national debt, and so on.

“If we try to stay the course, we are going to spend more and more money,” Stiglitz stresses. “The fact that we financed the war totally by deficits means that when 10 years from now we decide we want to repay that, which I don’t know if we will, the amount that we will have to raise our taxes will be that much larger because the debt will be that much larger.”

7. China’s peg to the dollar

So far China is enjoying low yuan rate giving its exports competitive advantage in relation to those countries with appreciating currencies against the U.S. dollar.

As the result China is actually “stealing” jobs from many countries since with appreciating currencies their companies are not able to compete with Chinese producers.

In relation to the United States this means that the country should not count on sooner recovery. China’s peg to the dollar makes imports into the U.S. cheaper. This supports high level of unemployment in America. Unemployment prevents the growth of GDP and reduces revenues.

Part II

Lack of Coincidence

Defining major reasons of currency crises Paul Krugman states that the most important is a lack of confidence. The “investor lack of confidence – is a defining feature of a currency crisis,” he argues. (15)

Below are opinions of a number of people from different parts of the world whom many of us know quite well. Their opinions concern the U.S. dollar and the U.S. economy.

Nouriel Roubini, the New York University professor who predicted the financial crisis, said that the greenback may weaken for the next three years. (16)

Warren Buffett, a successful international investor: “There is the likelihood of significant inflation down the road.” (17)

Robert B. Zoellick, the World Bank President: “There is little the United States can do about the sinking value of the dollar except restore growth in its economy.” (18)

George Soros, a successful international investor: “Irrespective of the situation in the stock markets or condition of the economy we shall see further shift from the dollar into real assets in a long run.” (19)

Jim Rogers, a successful international investor: “Printing money to help the U.S. economy will weaken the greenback and Treasuries in a long run.” (20)

Joseph Stiglitz, Nobel Laureate in Economics: The greenback will continue to head downward for the time being, given the huge U.S. trade deficit and global trade imbalance. (21)

Fan Gang, a prominent economist and adviser to China's central bank: "This crisis is a U.S. dollar crisis, which takes a relatively long time to clear up. The problem involves the U.S. currency and U.S. debt; eventually it has to be solved through U.S. dollar depreciation." (22)

Yuri Luzhkov, City of Moscow Mayor, Russia: The world is on the brink of a radical devaluation of the American currency. Therefore, Russia has to abandon its dependency on the dollar as soon as possible. American currency reserves are supported by nothing and industrial production in this country is very low. (23)

The list of well-known people with similar thinking is endless. In its research futureofdollar.com faced a difficulty of finding successful investors, economists or foreign politicians with the opposite thinking. There are just a few of them. Most of them are the U.S. government officials whose job is to restore the confidence in the U.S. economy with a part of this job being speaking in ‘positive’ terms.

People in this group either believe that:

*the recession is over and the U.S. economy will have a sharp rebound, or

*that the dollar will remain the primary reserve currency for a long time because during this last financial crisis investors found the dollar a safe haven, or

*that there is no inflation threat relying on the U.S. government data, or

*simply stating that “we will sink or swim with the dollar.”

For instance, Barack Obama is confident that the dollar is “extraordinarily strong” because investors are confident in the ability of the U.S. to lead a worldwide recovery. (24)

The Chairman of the U.S. Federal Reserve Ben Bernanke believes that U.S. asset prices aren’t out of line with underlying values, and central bank policy will ensure that the “dollar is strong.” (25)

The U.S. Treasury Secretary Timothy Geithner forecasts that the dollar will remain the world's "dominant reserve currency." (26)

Therefore, we came to a conclusion that, unfortunately, the U.S. economy and the dollar are losing confidence. The U.S. government must work even harder now to restore it.

Part III

Diversification Out of the Dollar

It is hard to argue that the future of the dollar nowadays significantly depends on such developing countries as China, India, Brazil, Russia, and others. These countries accumulate very large dollar reserves and the U.S. debt.

Let’s explore their recent positions regarding the U.S. dollar with an attempt to predict its future.

1. China

Already for an extended period of time China was quite aggressive in diversifying its reserves and protecting from weakening dollar, recommending its private sector to do the same.

The Chinese Ministry of Finance said in the beginning of September 2009 that it would issue 6 billion yuan worth of government bonds in Hong Kong, a major step to internationalize its currency at a time of concern about the dollar. (27)

Same month China bought the equivalent of $50 billion of the first bond sale by the International Monetary Fund, a purchase that might raise Beijing’s standing in the fund and help the government’s quiet campaign to expand the reach of its currency. China took the unusual step of paying for the IMF bonds with 341.2 billion yuan — which is not traded on global markets — rather than dollars. (28)

The country signed currency agreement with Argentina and agreed to credit South Korea, Malaysia, Indonesia and Belarus with its own currency. (29)

In the mid-September 2009, the International Monetary Fund announced that it was going to sell 403 tons of gold. Chinese central bank showed its willingness to buy the whole offer. (30)

The People’s Bank of China showed its intention to decrease its dollar reserves. Chinese authorities will increase their euro and yen reserves. (31)

China and Brazil established international payments in national currency of the Republic of China. Zhuhai Geli corporation received a transfer of several million yuan from San Paolo in the fall of 2009. (32)

Foreign investments of Chinese companies rose in the 3d quarter of 2009 reaching $20,5 billion. The number is almost three times higher as opposed to the last year statistics for the same period of time, as data of the Chinese Ministry of Trade showed. (33)

The country was seeking to expand its African oil reserves by bidding for up to a sixth of Nigeria's crude reserves constituting approximately 6 billon barrels. Valuing near $30-50 billion Chinese offer is higher than that of the current owners. China has been buying oil resources around the World for the second year already. (34)

Chinese companies may invest about $ 4,4 billion into Peru’s mining sector within the next three years, said Bloomberg referring to the statement made by the Prime Minister of Peru Javier Velasquez. (35)

Nearly 44% ($14,3 billion) of the total volume of China’s investments within the first nine months of 2009 were coming into mining and production sector. Representative of the Asian Development Bank noted that investing in the mining sector by purchasing stocks corresponded to a long-term strategy of the country to achieve resource security. (36)

China Investment Corporation (CIC), a sovereign wealth fund responsible for managing part of Chinese foreign exchange reserves, “has been quietly accumulating stakes in resource firms including Canada's Kinross Gold Corp. and Potash Corp. of Saskatchewan according to a filing with securities regulators.” (37)

CIC chairman Lou Jiwei “recently said that CIC would focus on investing in emerging markets in 2010. In October, the CIC chairman said the fund had allocated $110-billion for foreign investments and had already deployed about half of that.” (38)

“In addition to its $3.5-billion interest in Teck, CIC has a $652-million stake in Brazilian iron ore and nickel giant Vale SA, a $4.7-million interest in copper miner Freeport-McMoRan, and a $9.1-million holding in steel producer ArcelorMittal.” CIC has also acquired stakes in a number of high-profile brand name companies in North America such as Research In Motion Ltd., Apple Inc., News Corp., and AIG Inc. (39)

2. India

IMF sold 200 metric tons of gold to India in the beginning of November 2009. The $6.7 billion sale is “the biggest single central-bank purchase that we know about for at least 30 years in such a short period,” said Timothy Green, author of “The Ages of Gold.” “The only comparable event was the U.S.’s steady purchases in the 1930s and 1940s.” (40)

3. Brazil

Brazilian Central Bank president Henrique Meirelles said the country is considering the gradual elimination of the U.S .dollar in trade with China, Russia and India. (41)

In October 2009, the Brazilian Central bank announced that an agreement was reached with Uruguayan economic authorities to apply the so called SML system in bilateral trade operations. (42)

Brazilian Finance Minister Guido Mantega said that Brazil would spend 10 billion US dollars on buying International Monetary Fund bonds to boost the fund's resources. This “radical change” will help Brazil to diversify its resources, he added. (43)

4. Russia

The Central Bank of Russia increased the share of Japanese yen and Swiss franc in reserves in the middle of 2008. Japanese yen currently accounts for around 2 percent of Russia's reserves. The franc’s share is smaller because of the limited liquidity.

Russian reserves consist now mainly of the U.S. dollar and the euro. However, it is quite possible that Russia will add Chinese yuan in there, said Alexei Kudrin, Russian Finance Minister. The lack of convertibility of the China’s currency and of the free movement of capital was the main current obstacle. (44)

Brazil and India are interested in settling bilateral trade with Russia in national currencies, said Alexander Potemkin, an advisor to the Russian central bank chairman, echoing Moscow's drive for more use of national currencies and less of the U.S. dollar. "There was an initiative within the framework of the BRIC. These countries intend to create the conditions for direct payment for trade in national currencies," he said. He also said that Russia had a reach experience of reciprocal payments in national currencies with China. He estimated that settlements in yuan and rouble already account for around 2 percent of Russia's trade with China. (45)

Moscow also discusses trade in national currencies with other countries including Turkey and Vietnam. (46)

Russian central bank first deputy chairman Alexei Ulyukayev said in November 2009 that Russia was going to add the Canadian dollar to its gold and forex reserves in the next few months, but its share would be insignificant. (47)

5. Other countries

In April 2009 the Latin American leaders signed into effect a new South American currency, to be called the ‘sucre’. ALBA leaders (representing Venezuela, Cuba, Bolivia, Honduras, Nicaragua, and Dominica) say the sucre is necessary to help defray the regional effects of the world economic crisis by substituting their trade in dollars with a new alternative currency. The ALBA countries and their allies plan to use the virtual sucre by early 2010. (48)

In the second quarter ending in June 2009, central banks around the world invested 63 percent of their new cash reserves into euro and yen, and put only 37 percent into dollars. (49)

Kuwait, Saudi Arabia, Qatar and Bahrain signed in June 2009 an accord to create a joint monetary union council, a prelude to establishing a Gulf central bank and launching a monetary union and single currency. The remaining two members of the Gulf Cooperation Council (GCC), the UAE and Oman, did not sign after deciding to withdraw from the project. The GCC states have set 2010 as the target to launch the monetary union and single currency, but many experts believe that target is too ambitious and unrealistic. (50)

The International Monetary Fund sold 10 metric tons of gold to the central bank of Sri Lanka for about $375 million. The purchase is part of Sri Lanka’s plan to diversify its reserves and it has been gradually accumulating the metal in the past nine months. “Gold is a good anchor and hedge to have in these volatile circumstances,” said Nivard Cabraal, the bank’s governor. “We think it’s a good time to buy.” (51)

In the beginning of January 2010 Canada announced that it might sell about 1 billion euros of 10-year bonds, its first issue of debt in the European currency in more than a decade. This strategy will help attracting new investors, while debt denominated in U.S. dollars is becoming less popular among the creditors given the declining value of the U.S. currency. (52)

It is obvious that the trend of the diversification out of the dollar persisted through the whole year of 2009.

Part IV

Way Out

Peterson-Pew Commission on Budget Reform suggests that “the United States must show its creditors that it is serious about stabilizing the federal debt over a reasonable timeframe. Both spending cuts and tax increases will be necessary.”

Most of the economists would suggest that the anti-inflation strategy of the United States should include:

* suppression of inflation expectations and stimulation of savings;

* reaching balance between budget receipts and expenditures;

* increasing the mass of commodities; and

* strengthening national currency by establishing an unconditional priority of inflation targeting over other government programs (such as military expenses, unemployment rate regulation, influencing the national currency market, etc.).

Will the U.S. assume such a pain by reducing spending and fighting the deficits? Probably not, taking into consideration the words of Sir John Templeton, the John Templeton Foundation, who said in 2005: “The psychology all over the world is that people will not re-elect leaders who want them to be thrifty. The voters will elect the government that spends more money.” (53)

Many analysts are pretty sure that the weak dollar policy is beneficial to the U.S. Therefore, whatever the authorities say, there will be no resistance to dollar depreciation on their part.

Most experts already doubt that the solution of the problem depends much on the U.S. and call for global measures. “We must reform the international monetary system,” Yu Yongding, a former Chinese central bank adviser, stated in mid-November 2009. “A good monetary system should make us confident. But we don’t have confidence in the U.S. dollar now,” he added. (54)

George Soros, a global financier, is convinced that we “need a new currency system and actually the Special Drawing Rights do give you the makings of a system," he told the Financial Times.

The Future of the Dollar

The future of the dollar is in jeopardy now as it is evident from the article.

This subject is the primary focus of futureofdollar.com. We follow latest developments in this area and provide our readers information from reliable sources.

This analysis is prepared by http://www.futureofdollar.com

Notes

(1) Paul Krugman, Currency Crises, 1997;

(2) Reuters, December 17, 2009;

(3) budgetreform.org, December 14, 2009;

(4) U.S. Department of Labor, February 5, 2010;

(5) IMF, January 31, 2010;

(6) The Department of the Treasury;

(7) Merco Press, January 13, 2010;

(8) Bloomberg, February 1, 2010;

(9) Bloomberg, January 26, 2010;

(10) Jan 2010 Beige Book;

(11) Ibid.;

(12) NAR, January 25, 2010;

(13) Bloomberg, January 27, 2010;

(14) Bloomberg, January 8, 2010;

(15) Paul Krugman, Currency Crises, 1997;

(16) Bloomberg, February 4, 2010;

(17) FOX Business Network, June 24, 2009;

(18) The Economic Times, November 13, 2009;

(19) Reuters, October 26, 2009;

(20) Bloomberg, October 28, 2009;

(21) The Korea Times, October 28, 2009;

(22) Reuters, December, 2009;

(23) RB.ru Russian Business, September 1, 2009;

(24) Bloomberg, March 24, 2009;

(25) Bloomberg, November 17, 2009;

(26) USA Today, March 25, 2009;

(27) DealBook, September 7, 2009;

(28) The Associated Press, September 3, 2009;

(29) The New York Times, September 4, 2009;

(30) CommodityOnline.com, September 21, 2009;

(31) RosBusinessConsulting, November 6, 2009;

(32) NEWSru.com, October 28, 2009;

(33) Bloomberg, 26 October 2009;

(34) Vedomosti, 28 September, 2009;

(35) Bloomberg, 25 November, 2009;

(36) ChinaPro.ru / Vedomosti, 25 November 2009;

(37) The Globe and Mail, February 8, 2010;

(38) Ibid.;

(39) Ibid.;

(40) Bloomberg, November 3, 2009;

(41) Merco Press, October 29, 2009;

(42) Ibid.;

(43) Bloomberg, October 4, 2009;

(44) Bloomberg, October 24, 2009;

(45) Reuters, November 25, 2009;

(46) Ibid.;

(47) Reuters, November 2009;

(48) Venezuelanalysis.com, April 17, 2009;

(49) CNBC, October 14, 2009;

(50) ArabianBusiness.com, October 11, 2009;

(51) Bloomberg, November 25, 2009;

(52) Bloomberg, January 5, 2010;

(53) NewsMas;

(54) Bloomberg, November 17, 2009.

Real, Uglier American Unemployment

Can you trust national averages? As bad as the jobless data you hear are, you have not been told the whole truth. If you think the terrible impact of America ’s Great Recession is shown by an official unemployment rate of about 10 percent, think again.

Economic inequality and the myth of Reagan trickle down logic are shown by new data from the Center for Labor Market Studies at Northeastern University in Boston . The report noted: “What has been missing from the public debate over the labor market crisis is an honest and detailed analysis of which American workers have been most adversely affected by the deep deterioration in labor markets.” The researchers found a correlation between household income and unemployment rate in the last quarter of 2009: Look carefully at these numbers and see how unemployment rises as income drops:

$150,000 or more, 3.2 percent

$100,000 to 149,999, 8 percent

$75,000 to $99,999, 5 percent

$60,000 to $75,000, 6.4 percent

$50,000 to $59,000, 7.8 percent

$40,000 to $49,000, 9 percent

$30,000 to $39,999, 12.2 percent

$20,000 to $29,999, 19.7 percent

$12,500 to $20,000, 19.1 percent

$12,499 or less, 30.8 percent

Ten times worse unemployment in the lowest class than in the highest class! Truly amazing and disheartening, don’t you think? And you can also infer that in some hard hit geographical areas the poorest people and people of color are being even more adversely impacted. And don’t think for a minute that things have really improved in 2010.

The report summed up the situation: “A true labor market depression faced those in the bottom…of the income distribution; a deep labor market recession prevailed among those in the middle of the distribution, and close to a full employment environment prevailed at the top.” People at the top remain winners no matter how bad the whole economy. Why? The wealthy Upper Class controls so much of the political system and benefit from countless government policies. They may lose something in an economic meltdown but not enough to suffer significantly.

Conversely, those at the bottom of the economic system with no political power are experiencing something as bad as the Great Depression, with no end in sight.

What pundits don’t emphasize is that government policies that do not target lower income groups are a failure and disgrace. Worse than destroying the middle class, we are creating a Lower Class like that found in third world countries. Indeed, compared to places like China and European nations, America ’s poor are suffering about as badly as anyone on the planet, except for a few dismal places like Haiti . Needing food handouts, losing homes, missing health insurance, and lacking jobs mock the American Dream.

Wait; there is even more bad news. When underemployment is factored in — part time workers that want to work full time, and those who have stopped looking but want a job — the picture gets even worse. In the lowest group, the underemployment rate was 20.6 percent, compared with just 1.6 percent in the highest group. So the total in the lowest class is 51.4 percent (3.7 million people) compared to 4.8 percent in the wealthy class (530,000 people). Also consider that last November nearly 20 percent of all men between 25 and 54 did not have jobs, the highest figure since the labor bureau began counting in 1948.

Now you know why the constantly noted official jobless rate for the nation of 10 percent and 17 percent when underemployment is counted are a joke, or is it a purposeful deception, like a truth bubble?

How can jobs be created for the lower economic classes? You hear very, very few new ideas from politicians. It comes down to federal spending that better targets job creation to the lower income groups, and waiting for more general consumer spending, especially by the more affluent, to create more low level jobs, mostly in service areas. But we need specifics and better legislation.

Consider this green energy fiasco. A huge amount of federal stimulus money provided for building wind farms. It is creating jobs in Chine to build wind turbines, not in America . In fact, 80 percent of such federal funding is going overseas. All because Congress and the White House did not ensure a made-in-America requirement. Was a backroom deal made to keep China happy so that they would keep loaning us money?

When the poorest people suffer so disproportionately as compared to the wealthiest, perhaps only violent revolution will fix America ’s dysfunctional, broken and delusional democracy. Will President Obama cite the above frightening data in any public forum to make the case for stronger federal efforts? What do you think?

Man Bulldozes Home After Foreclosure

A man in Ohio grew so angry at his bank for refusing to work with him to keep his home that he bulldozed it. He told WLWT News, "As far as what the bank is going to get, I plan on giving them back what was on this hill exactly (as) it was. I brought it out of the ground and I plan on putting it back in the ground."

Terry Hoskins owed $160,000 on a mortage on the home, which was valued at $350,000. Hoskins says the IRS placed liens on his business property and home after his brother, a former business partner, sued him. He says the bank then claimed his home as collateral and refused to accept a $170,000 buyout offer on the mortgage, telling him they could get more from it at auction.

He says he might bulldoze the commercial property next.

"Frustrated Owner Bulldozes Home Ahead Of Foreclosure" [WLWT.com] (Thanks to Jay!)

Frustrated Owner Bulldozes Home Ahead Of Foreclosure

Two Breadwinners plus Extra Money to support the Banking Industry. How Middle Class Americans are losing Ground by Supporting the Financial Sector.

If it isn’t enough that average Americans are contending with the rising cost of healthcare, education, and daily necessities like food now additional funds are going directly to the banking sector to keep them propped up like a money loving puppet. Since the Great Depression the rise of the middle class has been the envy of many people around the globe. The ability for hard working Americans to have access to an economy that supported them so long as they worked hard and followed an implicit guarantee with their nation. With this implicit guarantee it was assumed that the government would also protect people to a certain degree especially when it came to their financial well being. This did not assure a winning portfolio but it did mean we wouldn’t turn our stock market into a giant game of casino where the connected had a loaded deck. Much of the strong regulatory arm that came from the Great Depression was because of the speculative gambling during the Roaring 1920s. Yet as time went on slowly Wall Street took these structures away and now we are finding ourselves once again with the middle class largely at risk in the United States. It isn’t by accident we are in the situation we are in today.

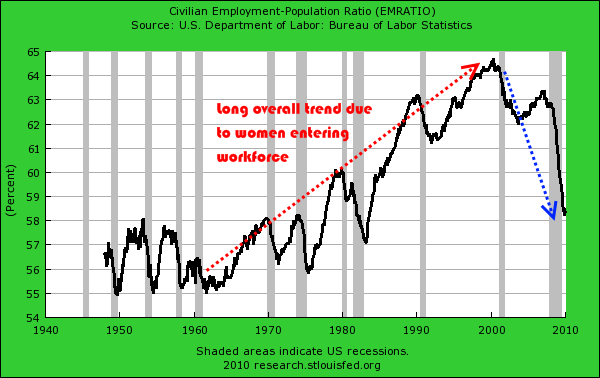

The first important thing to understand is that yes, the income of middle class families has gone up since the 1950s but a large part of this was the rise of the two income households with women entering the workforce:

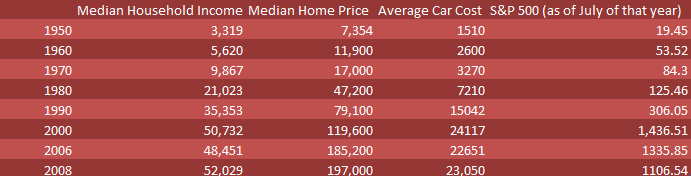

The above chart is disturbing in many ways because it bucks the nearly 50 year long-term trend of employment. Now, even with two income households many with rising job losses are finding they now have to make it with one income while inflation has eroded their buying power over the decades. In this recession 3 out of 4 job losses have been men. If you have any doubt regarding the insidious nature of inflation I put together a chart looking at various costs over the last few decades:

Part of this is due to the Federal Reserve and U.S. Treasury trashing the U.S. dollar over the decades. For example, in 1950 it took the median household income (which was largely a one income household) about 2 times the annual household income to purchase the median priced home. In 2008, it took the median household income (now largely a two income household) four times annual earnings to purchase the median priced home. In fact, the two income household has hidden a large part of how much the middle class has fallen behind in this country. Now with this recession, the deep cracks are now being exposed in the system.

Income inequality has also risen in this country and a large part of it is due to the financial sector. 1 percent of our population control 42 percent of all financial wealth. In fact, in the last decade the only segment of our population that has seen any sizeable gains in true wealth is the top 1 percent. Every other category has seen a loss of housing net worth, wage stagnation, and higher costs for daily items that consume a larger part of their budget. Just take a look at the chart below showing this change:

Source: CNN

The above is looking at a one income household in 1973 versus the two income household in the 2000s. It is interesting to note that in the 1970s Nixon took the dollar into a purely fiat system and since that time, the dollar has lost much of its actual value. This would be expected. The Federal Reserve with its banking lieutenants has been able to put our country so deep into debt that realistically we are in a position of never paying back all our outstanding obligations. The only way out is via inflation and with a fiat system that is the path we are heading down. This is important because when you look at the charts above prices rise for various reasons and inflation is a hidden tax. No need for higher taxes to bailout the banking sector when you can just destroy the purchasing power of middle class Americans by monetizing enormous amounts of debt as we have done.

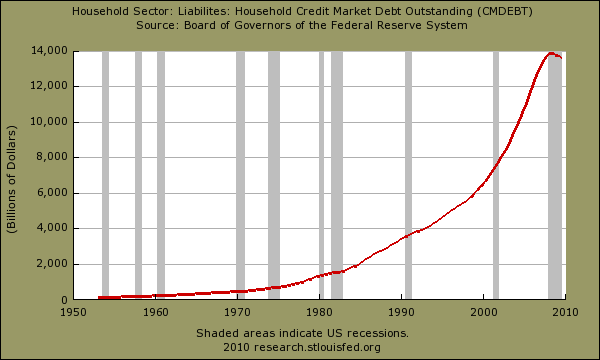

That is why in the next decade, Americans are now working for someone else beyond their immediate household. A large chunk of their money is now going to the banking sector. This can be in absurd payments to credit card companies, loss of purchasing power because of the Fed, or other hidden methods of taxing the public. We are really at a crossroads for the middle class. If we dissect the data further we realize that even though things cost more, much of it has been financed through debt:

Ironically the family in the early 1970s had more discretionary income than the family in the early 2000s even with a dual income. Yet if you look around, it isn’t immediately apparent because of the massive debt bubble financed by the banking sector. Sure people bought bigger homes and newer cars but all this was under a phony veneer of success and was financed with debt. All of it was built around a mountain of debt. Yet here is where the big divide hits. Middle class families are now losing their homes through foreclosure. Many are having their cars repossessed because they can’t make their payments. Bankruptcy filings are soaring because people cannot service their debt. So middle class Americans are paying the price with the rules that are setup. Yet banks are not. They are sucking the American taxpayer for all their horrible bets and are not dealing with the ramifications of their actions. In other words, the bill is going to the middle class as the middle class is dealing with their own bad decisions. This is part of the system built around the corporatacracy model of government. Losses are socialized while gains are privatized.

And don’t kid yourself, this entire game was financed on debt:

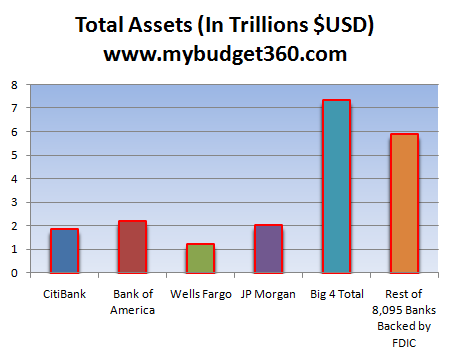

And the small group of banks at the top now control a large portion of all FDIC backed assets in our country:

Source: FDIC, Bank Financial Statements

Forget about the Republican or Democrat parties, we are being governed by the financial sector of this economy. It is amazing how hard it is to get sensible legislation even after this great calamity. To prove this point, in California an insurance company announced they are hiking healthcare premiums by 30 percent in the midst of this recession even though they pulled in billions in profits. The government will sit back and let the middle class get fleeced because they are part of the problem. They speak a good game but are bought by the industry. Prove us wrong if this isn’t the case. Enough talk, time for action. From now on we need to focus on who is delivering results. If you can, take you money out of the big banks and put them in local regional banks. Let your local representatives know that their number one priority should be focusing on protecting our struggling middle class. Time to get some real reform or we really risk losing our middle class.

Has China began economic warfare?

Peter Schiff - Bridgeport, CT - P1

Marc Faber on CNBC 17 Feb 2010

Man Bulldozes Home After Foreclosure

A man in Ohio grew so angry at his bank for refusing to work with him to keep his home that he bulldozed it. He told WLWT News, "As far as what the bank is going to get, I plan on giving them back what was on this hill exactly (as) it was. I brought it out of the ground and I plan on putting it back in the ground."

Terry Hoskins owed $160,000 on a mortage on the home, which was valued at $350,000. Hoskins says the IRS placed liens on his business property and home after his brother, a former business partner, sued him. He says the bank then claimed his home as collateral and refused to accept a $170,000 buyout offer on the mortgage, telling him they could get more from it at auction.

He says he might bulldoze the commercial property next.

"Frustrated Owner Bulldozes Home Ahead Of Foreclosure" [WLWT.com] (Thanks to Jay!)

Fed rate rise boosts dollar

Equities and commodities shunned as caution returns

- Fed to lift discount rate as 'exit' begins

- Treasuries fall as Fed lifts bank discount rate

- Nikkei hurt by resource-linked shares

Toyota chief agrees to testify

Transport minister says Toyoda’s U-turn ‘regrettable'

Nato casualties heavy in Marjah offensive

Six soldiers killed in drive to rid town of Taliban insurgents

Fed to lift discount rate as 'exit' begins

Asia stocks fall to two-week low

- FT Alphaville Did the discount rate hike leak?

- Money Supply Fed increases discount rate

- Treasuries fall as Fed lifts bank discount rate

World War III is being staged; starting with Israel and Iran

US “leadership” and their corporate media minions are pushing juvenile-level propaganda for war with Iran; lies that anyone can verify with a few moments’ attention. If you haven’t already confirmed the Orwellian-level disinformation, stop and read the above two links now.

- Understand the laws of war. These were legislated after WW2 and are crystal-clear that only self-defense, in a narrow legal meaning, can justify war. The current US wars are not even close to being lawful. Those involved with US military, government, and law enforcement have an oath to protect and defend the US Constitution, not the fascist “always place the mission first.” To fulfill their oath they must immediately refuse and end all orders associated with unlawful wars and military-related constant violation of treaties.

- End the transfer of trillions of American taxpayer money to banksters and admitted as “lost” by our military. End poverty through global cooperation to achieve the UN Millennium Goals by developed countries investing 0.7% of their income. Support global security through cooperation, dignity, justice, and freedom. Create a US Department of Peace to help.

- Communicate. Trust your unique, beautiful, and powerful self-expression to share as you feel appropriate. Understand that while many people are ready to embrace difficult facts, many are not. Anticipate that you will be attacked and prepare your virtuous response in the spirit of competition, just as you do in other fields.

- Prosecute the war leaders for obvious violation of the letter and spirit of US war laws. Because the crimes are so broad and deep, I recommend Truth and Reconciliation (T&R) to exchange full truth and return of stolen US assets for non-prosecution. This is the most expeditious way to understand and end all unlawful and harmful acts. Those who reject T&R are subject to prosecution.

Why the Stimulus Failed

Yet few have explained correctly why the stimulus failed. By blaming the slow pace of stimulus spending (even though it’s ahead of schedule), many conservatives have accepted the premise that government spending stimulates the economy. Their thinking implies that we should have spent much more by now.

History proves otherwise. In 1939, after a doubling of federal spending failed to relieve the Great Depression, Treasury Secretary Henry Morgenthau said that “we have tried spending money. We are spending more than we have ever spent before and it does not work. . . . After eight years of this administration we have just as much unemployment as when we started . . . and an enormous debt to boot!” Japan made the same mistake in the 1990s (building the largest government debt in the industrial world), and the United States is making it today.

This repeated failure has nothing to do with the pace or type of spending. Rather, the problem is found in the oft-repeated Keynesian myth that deficit spending “injects new dollars into the economy,” thereby increasing demand and spurring economic growth. According to this theory, government spending adds money to the economy, taxes remove money, and the budget deficit represents net new dollars injected. Therefore, it scarcely matters how the dollars are spent. John Maynard Keynes famously asserted that a government program paying people to dig and then refill ditches would provide new income for those workers to spend and circulate through the economy, creating even more jobs and income. Today, lawmakers cling to estimates by Mark Zandi of Economy.com that on average, $1 in new deficit spending expands the economy by roughly $1.50.

If that were true, the record $1.6 trillion in deficit spending over the past fiscal year would have already overheated the economy. Yet despite this spending, which is equal to fully 9 percent of GDP, the economy is expected to shrink by at least 3 percent this fiscal year. If the spending constitutes an injection of “new money” into the economy, we may conclude that, without it, the economy would contract 12 percent — hardly a plausible claim.

If $1.6 trillion in deficit spending failed to slow the economy’s slide, there’s no reason to believe that adding $185 billion — the 2009 portion of the stimulus bill — will suddenly do the trick. But if budget deficits of nearly $2 trillion are insufficient stimulus, how much would be enough? $3 trillion? $4 trillion?

This is no longer a theoretical exercise. The idea that increased deficit spending can cure recessions has been tested, and it has failed. If growing the economy were as simple as expanding government spending and deficits, then Italy, France, and Germany would be the global economic kings. And there would be no reason to stop at $787 billion: Congress could guarantee unlimited prosperity by endlessly borrowing and spending trillions of dollars.

The simple reason government spending fails to end recessions is that Congress does not have a vault of money waiting to be distributed. Every dollar Congress “injects” into the economy must first be taxed or borrowed out of the economy. No new income, and therefore no new demand, is created. They are merely redistributed from one group of people to another. Congress cannot create new purchasing power out of thin air.

This is intuitively clear in the case of funding new spending with new taxes. Yet funding new spending with new borrowing is also pure redistribution, since the investors who lend Washington the money will have that much less to invest in the economy. The fact that borrowed funds (unlike taxes) must later be repaid by the government makes them no less of a zero-sum transfer today.

Even during recessions — when total production falls, leaving people with less income to spend — Congress cannot create new demand and income. Any government spending that increases production at factories and puts unemployed individuals to work will be financed by removing funds (and thus idling resources) elsewhere in the economy. This is true whether the unemployment rate is 5 percent or 50 percent.

For example, many lawmakers claim that every $1 billion in highway stimulus will create 47,576 new construction jobs. But Congress must first borrow that $1 billion out of the private economy, which will then lose a roughly equivalent number of jobs. As transportation-policy expert Ronald Utt has explained, “the only way that $1 billion of new highway spending can create 47,576 new jobs is if the $1 billion appears out of nowhere as if it were manna from heaven.” Removing water from one end of a swimming pool and dumping it in the other end will not raise the overall water level. Similarly, moving dollars from one part of the economy to the other will not expand the economy. Not even in the short run.

Consider a simpler example. Under normal circumstances, a family might put its $1,000 savings in a certificate of deposit at the local bank. The bank would then lend that $1,000 to the local hardware store. This would have the effect of recycling that spending around the town, supporting local jobs. Now suppose that, induced by an offer of higher interest rates, the family instead buys a $1,000 government bond that funds the stimulus bill. Washington spends that $1,000 in a different town, creating jobs there instead. The stimulus bill has changed only the location of the spending.

The mistaken view of fiscal stimulus persists because we can easily see the people put to work with government funds. We don’t see the jobs that would have been created elsewhere in the economy with those same dollars had they not been lent to Washington.

In his 1848 essay “What Is Seen and What Is Not Seen,” French economist Frédéric Bastiat termed this the “broken window” fallacy, in reference to a local myth that breaking windows would stimulate the economy by creating window-repair jobs. Today, the broken-window fallacy explains why thousands of new stimulus jobs are not improving the total employment picture.

Keynesian economists counter that redistribution can increase demand if the money is transferred from savers to spenders. Yet this “idle savings” theory assumes that savings fall out of the economy, which clearly is not the case. Nearly all individuals and businesses invest their savings or put it in banks (which in turn invest it or lend it out) — so the money is still being spent somewhere in the economy. Even in this recession, with tightened lending standards, banks are performing their traditional role of intermediating between those who have savings and those who need to borrow. They are not building extensive basement vaults to hoard cash.

Since the financial system transfers savings into investment spending, the only savings that drop out of the economy are those dollars literally hoarded in mattresses and safes — and there is no evidence that this is occurring en masse. And even if individuals, businesses, and banks did distrust the financial system enough to hoard their dollars, why would they suddenly lend them to the government to finance a stimulus bill?

Once the idle-savings theory collapses, so does all the intellectual support for government spending as stimulus. If there are no idle savings to acquire, then the government is merely borrowing purchasing power from one part of the economy and moving it into another part of the economy. Washington becomes nothing more than a pricey middleman, redistributing existing demand.

Even foreign borrowing is no free lunch. Before China can lend us dollars, it must acquire them from us. This requires either attracting American investment or raising the Chinese trade surplus (and the American trade deficit). The balance of payments between America and other nations must eventually net out to zero, which means government spending funded from foreign borrowing is zero-sum.

I’ve purposely ignored the Federal Reserve, which actually can inject cash into the economy, but not in a way that constitutes stimulus. Congress can deficit-spend; Treasury can finance the deficit spending by issuing bonds; and the Federal Reserve can buy those bonds by printing money. Any economic boost is then due to the Federal Reserve’s actions, not the deficit spending — and of course the Federal Reserve will have to raise interest rates, slowing the economy again, to bring the resulting inflation under control.

If government spending doesn’t cause economic growth, what does? Growth happens when more goods and services are produced, and the only true source of this is an expanding labor force combined with high productivity. High productivity in turn requires educated and motivated workers, advanced technology, adequate infrastructure, physical capital such as factories and tools, and the rule of law.

Government spending could boost long-run productivity through investments in education and infrastructure — but only if politicians could target those investments better than the private sector would. And it turns out that politicians cannot outsmart the marketplace. Mountains of academic studies show that government spending generally reduces long-term productivity.

Furthermore, most government programs that could increase productivity don’t work fast enough to counteract a recession. Education spending cannot raise productivity until its student beneficiaries graduate and enter the work force. It can take more than a decade to build new highways and bridges.

The only policy proven to increase productivity in the short term is to lower tax rates and reduce regulation. Businesses can grow only through consistent investment and an expanding, skilled workforce. Cutting marginal tax rates promotes these conditions, by creating incentives to work, save, and invest.

It’s happened before. In 1981, President Reagan inherited an economy stagnating under the weight of 70 percent marginal income-tax rates. Under Reagan, the top rate fell to 28 percent, and the subsequent surge in investment and labor supply created the strongest 25-year economic boom in American history.

Such tax-rate reductions are superior to tax rebates designed to “put money in people’s pockets.” Rebates — like government spending — simply redistribute existing dollars. They don’t increase productivity because they don’t change incentives: No one has to work, save, or invest more to get a tax rebate. The 2001 and 2008 rebates failed because Congress borrowed money from investors and foreigners and redistributed it to families. Not surprisingly, any new personal-consumption spending was matched by corresponding declines in investment spending and net exports, and the economy remained stagnant.

If conservatives wish to provide economic leadership, they must get this argument right. The stimulus is not failing because it is too small or because too much of it is being saved. It’s failing because Congress can only redistribute existing demand, not create new demand. This recession will eventually end. The more serious, long-term danger is that President Obama’s Europeanization of the economy will bring the same slow growth, stagnant wages, job losses, high taxes, and lack of competitiveness that have plagued Western Europe, leaving the United States at an ever-growing disadvantage with Asian countries not so afflicted.

To prevent this, conservatives and free marketeers will need to promote policies that support long-term prosperity. The first step will be articulating why big government does not bring economic growth.

Mr. Riedl is a research fellow at the Heritage Foundation.