If it isn’t enough that average Americans are contending with the rising cost of healthcare, education, and daily necessities like food now additional funds are going directly to the banking sector to keep them propped up like a money loving puppet. Since the Great Depression the rise of the middle class has been the envy of many people around the globe. The ability for hard working Americans to have access to an economy that supported them so long as they worked hard and followed an implicit guarantee with their nation. With this implicit guarantee it was assumed that the government would also protect people to a certain degree especially when it came to their financial well being. This did not assure a winning portfolio but it did mean we wouldn’t turn our stock market into a giant game of casino where the connected had a loaded deck. Much of the strong regulatory arm that came from the Great Depression was because of the speculative gambling during the Roaring 1920s. Yet as time went on slowly Wall Street took these structures away and now we are finding ourselves once again with the middle class largely at risk in the United States. It isn’t by accident we are in the situation we are in today.

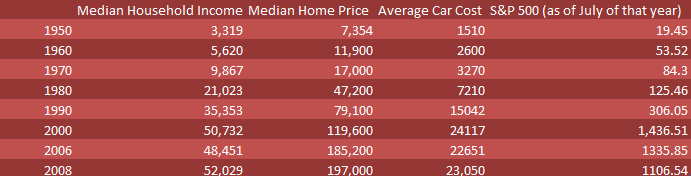

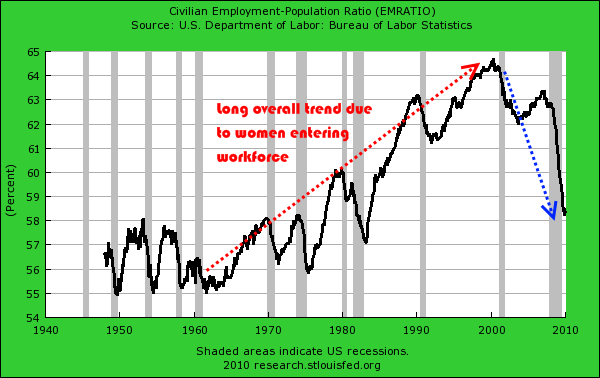

The first important thing to understand is that yes, the income of middle class families has gone up since the 1950s but a large part of this was the rise of the two income households with women entering the workforce:

The above chart is disturbing in many ways because it bucks the nearly 50 year long-term trend of employment. Now, even with two income households many with rising job losses are finding they now have to make it with one income while inflation has eroded their buying power over the decades. In this recession 3 out of 4 job losses have been men. If you have any doubt regarding the insidious nature of inflation I put together a chart looking at various costs over the last few decades:

Part of this is due to the Federal Reserve and U.S. Treasury trashing the U.S. dollar over the decades. For example, in 1950 it took the median household income (which was largely a one income household) about 2 times the annual household income to purchase the median priced home. In 2008, it took the median household income (now largely a two income household) four times annual earnings to purchase the median priced home. In fact, the two income household has hidden a large part of how much the middle class has fallen behind in this country. Now with this recession, the deep cracks are now being exposed in the system.

Income inequality has also risen in this country and a large part of it is due to the financial sector. 1 percent of our population control 42 percent of all financial wealth. In fact, in the last decade the only segment of our population that has seen any sizeable gains in true wealth is the top 1 percent. Every other category has seen a loss of housing net worth, wage stagnation, and higher costs for daily items that consume a larger part of their budget. Just take a look at the chart below showing this change:

Source: CNN

The above is looking at a one income household in 1973 versus the two income household in the 2000s. It is interesting to note that in the 1970s Nixon took the dollar into a purely fiat system and since that time, the dollar has lost much of its actual value. This would be expected. The Federal Reserve with its banking lieutenants has been able to put our country so deep into debt that realistically we are in a position of never paying back all our outstanding obligations. The only way out is via inflation and with a fiat system that is the path we are heading down. This is important because when you look at the charts above prices rise for various reasons and inflation is a hidden tax. No need for higher taxes to bailout the banking sector when you can just destroy the purchasing power of middle class Americans by monetizing enormous amounts of debt as we have done.

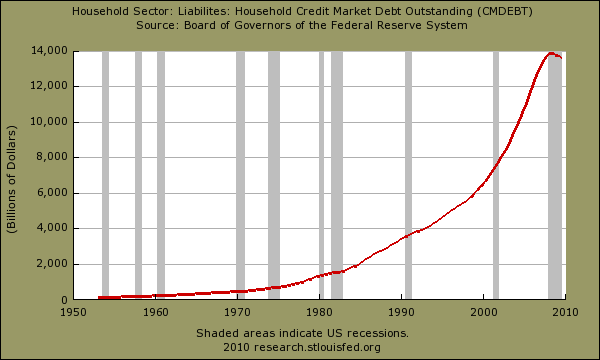

That is why in the next decade, Americans are now working for someone else beyond their immediate household. A large chunk of their money is now going to the banking sector. This can be in absurd payments to credit card companies, loss of purchasing power because of the Fed, or other hidden methods of taxing the public. We are really at a crossroads for the middle class. If we dissect the data further we realize that even though things cost more, much of it has been financed through debt:

Ironically the family in the early 1970s had more discretionary income than the family in the early 2000s even with a dual income. Yet if you look around, it isn’t immediately apparent because of the massive debt bubble financed by the banking sector. Sure people bought bigger homes and newer cars but all this was under a phony veneer of success and was financed with debt. All of it was built around a mountain of debt. Yet here is where the big divide hits. Middle class families are now losing their homes through foreclosure. Many are having their cars repossessed because they can’t make their payments. Bankruptcy filings are soaring because people cannot service their debt. So middle class Americans are paying the price with the rules that are setup. Yet banks are not. They are sucking the American taxpayer for all their horrible bets and are not dealing with the ramifications of their actions. In other words, the bill is going to the middle class as the middle class is dealing with their own bad decisions. This is part of the system built around the corporatacracy model of government. Losses are socialized while gains are privatized.

And don’t kid yourself, this entire game was financed on debt:

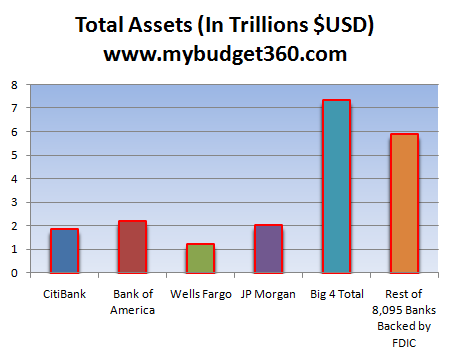

And the small group of banks at the top now control a large portion of all FDIC backed assets in our country:

Source: FDIC, Bank Financial Statements

Forget about the Republican or Democrat parties, we are being governed by the financial sector of this economy. It is amazing how hard it is to get sensible legislation even after this great calamity. To prove this point, in California an insurance company announced they are hiking healthcare premiums by 30 percent in the midst of this recession even though they pulled in billions in profits. The government will sit back and let the middle class get fleeced because they are part of the problem. They speak a good game but are bought by the industry. Prove us wrong if this isn’t the case. Enough talk, time for action. From now on we need to focus on who is delivering results. If you can, take you money out of the big banks and put them in local regional banks. Let your local representatives know that their number one priority should be focusing on protecting our struggling middle class. Time to get some real reform or we really risk losing our middle class.

No comments:

Post a Comment