Tuesday, February 8, 2011

Egypt’s Military-Industrial-Bottled Water-Farming Complex

Suppose driving home from the market in your military-made Hyundai Sonata, turning on your military-made range, which runs off a bottle of military-made natural gas, heating up a can on military-made soup (filled with military-grown vegetables) and washing it down with a military-made bottle of water.

It’s more likely than you’d think in Egypt, where the military is literally into every conceivable industry from tourism to hair-care products. With nearly half a million active duty personnel in the nation and no serious prospect of a war with any of its neighbors, Egypt’s military is a major employer and industrial powerhouse in a nation whose command economy has sparked vast unemployment and growing unrest.

It’s more likely than you’d think in Egypt, where the military is literally into every conceivable industry from tourism to hair-care products. With nearly half a million active duty personnel in the nation and no serious prospect of a war with any of its neighbors, Egypt’s military is a major employer and industrial powerhouse in a nation whose command economy has sparked vast unemployment and growing unrest.

It is the ultimate example of mission creep. Faced with a peace deal with Israel and no other enemies to justify their existence, the military faced threats to cut their enormous budget and set about becoming “self-sufficient.” They manufactured much of their own equipment, even grew their own food.

All of this was pretty easy for a nation with such an enormous supply of poorly paid conscripts, and it didn’t stop there. The military-owned company manufacturing their vehicles made deals with Chrysler, Hyundai and others and went into the car-making business. Other factories started making kitchen appliances. The farms kept expanding until they supplied not only all of the food the military made, but were selling excess on the open market. With nothing better to do, the conscripts started installing telephone lines and paving roads for government projects.

It is a sweetheart deal for the military – the Egyptian poor are forced into military service (for years those who could afford it would simply pay a fine instead) and are farmed out into some military-run industry. Better still those military run industries have zero oversight – they pay no taxes, need no licenses, and the profits from their businesses are entirely “off-book,” going into the military’s coffers to pay for whatever.

And while some career military men griped at the notion of the military spending so little time on, well, military stuff, it also paid off extremely well for the top officers, who not only are in an excellent position to collect on these profits without anyone being the wiser that they ever existed, but are provided heavily subsidized living accommodations.

Needless to say, it was less convenient for private industry, which had to compete with a subsidized rival with foreign and domestic funding and cheap, forced labor. Those with the right connections could count on some cushy government contracts, while the rest were left to struggle.

Interestingly, the US military described this entire phenomenon, in excruciating detail, years ago, praising the Egyptian military’s ability to “employ large numbers of soldiers in meaningful activities” and insisting that military organization is an “ideal type for an industrialized and secularized enterprise,” and insisting it benefited the Egyptian economy enormously.

It was perhaps less obvious when that report was written that this was an unsustainable model, but what is being described is clearly a criminal syndicate operating with legal immunity as a “military” and dominating an ever growing portion of the economy to the severe detriment of competition and efficiency.

After decades of this system, Egypt’s economy is a disaster, with the well-connected living comfortably while the vast majority of Egyptian live in abject squalor, either unemployed or conscripted to serve as cheap labor. Egypt has in many ways become the dystopian society portrayed in Kurt Vonnegut’s Player Piano for the poor and uneducated.

Incredibly, however, when the entire crooked system blew up in their face and the massive unemployment and repression led to full on rebellion against Hosni Mubarak, few recognized the deleterious impact the military has had on the situation.

Fewer still realize just how much money the Egyptian military has, as its official budget only includes the $1.3 billion in annual US aid and a few billion dollars in government subsidy. They likely don’t particularly need either, which explains the lack of influence over the Egyptian military’s operations, but just how big this military truly is would be anyone’s guess, as the profits from its assorted businesses are, of course, entirely “off budget.”

AMAGERBANKEN - $2.8 Billion Bank Failure In Denmark: Senior Bondholders Whacked 41%

It may turn out to be the most important bank you've never heard of.

Amagerbanken was taken over by the Danish government today. As with the Irish banks, Amagerbanken suffered huge losses on loans to property developers and investors in commercial real estate. But the rescue comes under new regulations which stipulate steep losses for bondholders. According to Bloomberg, senior bondholders and depositors over the insured limit will face losses of approximately 41%.

Some bondholders, however, still fall under a government guarantee, but expect Amagerbanken to be held up as an example by those who favor haircuts for bondholders rather than bailouts. In particular, we can expect Ireland's Fine Gael party (pronounced feena gail) to point to Denmark when they make their own case for unilaterally restructuring Ireland's bank debt. And when they do, the cat will be out of the bag.

For two years, central bankers and government finance ministers (who know next to nothing) have been claiming that the sky will fall and there will be tanks in the streets if bondholders are forced to take losses. Clearly that is not the case. First Iceland, then Denmark, then Ireland. After that, the race is on.

From Reuters

COPENHAGEN, Feb 7 (Reuters) - Denmark was lumbered with a $2.8 bln bill on Monday as Amagerbanken (AMBA.CO) became the country's tenth bank to fall into the state's hands in the wake of the global financial crisis.

Amagerbanken said on Sunday it would transfer its assets to Finansiel Stabilitet A/S, the state company that administers failed banks, and administrators would close the bank.

Amagerbanken, which was Denmark's eighth biggest bank in terms of lending, said fourth-quarter writedowns wiped out its equity, attributing a large part to failed property investors. [ID:nLDE7150JC]

The failure of Amagerbanken was roughly the same size as the mid-2008 collapse of Roskilde Bank, previously the biggest Danish bank failure.

The bill to the government for taking over Amagerbanken is 15.2 billion Danish crowns ($2.8 billion), which is the price that the state administrating company Finansiel Stabilitet will pay for the remaining assets.

The Danish banking industry will cover 2.2 billion crowns of that cost through the country's depositary guarantee scheme, Amagerbanken Chairman Niels Heering told a news conference.

If total losses from Amagerbanken rise above 15.2 billion crowns, Danish financial institutions would have to bear a larger burden than 2.2 billion, Heering said.

--

This clip is worth the 40 seconds...

Video of the Tsar Bomb -- the 50 Mega-Ton monster in the photo for this story.

- MUST SEE BUST: Mortgage Bankers Association 'Strategic Default' Exposed By Jon Stewart (Daily Show Video)

- John Boehner's 1998 Glass-Steagall Flashback - Would You Like A CD With That Auto Insurance Policy?

- The Essence Of Banking...

- AMAGERBANKEN - $2.8 Billion Bank Failure In Denmark: Senior Bondholders Whacked 41%

- Must Hear Voicemail: Gasparino Harasses Lehman Execs

- FINALLY! - Ireland Issues Threat To Billionaire Bondholders

- Prison For Paulson - Despite Cries For Justice, Wall Street 'Perp Walks' Slow To Develop

- BOMBSHELL REPORT: Goldman Sachs Got Billions From Taxpayers Thru AIG For Its OWN Account, Crisis Panel Finds; Contradicting SWORN Testimony From Execs

- The Hammer Gets Hit By A Tree

- INSIDE JOB -- How Wall Street Became A Criminal Enterprise And Took Over Government (Feature Film Trailer, Winner At Cannes 2010)

- Schultz With Ratigan: How Bernanke's Printing Press Is Causing Global Revolution (Video)

- Obama With Bill O'Reilly: "The United States Can't Dictate What Happens In Egypt" - Super Bowl Interview: Full Video

- Will Bernanke Scoop Up $50 Billion Of Ireland's Toxic Assets? Fine Gael Seeks MASSIVE Loan From U.S. Fed

- Rand Paul Wants To Cut $500 Billion In Federal Spending In JUST One Year - ABC Subway Interview

- Blankfein Says To Paulson: "Ok, Now What?"

The Hammer Gets Hit By A Tree

Editor's Note: In light of the Goldman theft detailed last week, we are reposting this story. This is a brilliant attack. Everything you read about AIG and Goldman yesterday pertains to this. Paulson is annihilated by Congressman Cliff Stearns.

Awesome clip. Please share it anywhere and everywhere across the net. Our only hope to stop the heist will come from greater awareness. Thank you.

---

Video - Cliff Stearns questions Hank Paulson - July 2009

Paulson gets abused in this clip, to the point of stuttering. In a general sense, all pertaining to his role in certain decisions at Treasury that helped Goldman.

Everything is in here: the AIG-Goldman conduit, Lehman's failure, Paulson's tax-free $700 million stock sale, Geithner's role with AIG, various conflicts of interest, political capture, the TARP switcharoo and Goldman's FDIC debt guarantee.

---

From over 15,000 videos on the site this is still one of our favorites. Until the day Paulson is indicted for crimes against humanity, this is the closest we'll see him to a courtroom. Seeking revenge as we do, daily, ritualistically, painfully, we wondered how could we hurt him and move the court date closer. The most effective strategy is an email campaign. Like all campaigns, it requires a few workhorses in the beginning; some adept folks who are willing to send this link to hundreds of others, essentially to everyone in their email address books. Copy/paste and blast away. We thank each and everyone in advance for your help.

Also check out video of Paulson and Marcy Kaptur...

---

Meet Hank the Hammer...

Video: Former Goldman Sachs CEO Henry Paulson has a message for you...

We haven't forgotten the crimes against humanity of former Goldman Sachs CEO Henry Paulson and his tax-free $700 million. We put everything that's important about your former TARP-loving Treasury Secretary into a 90-second comedy short. Take a look!

Read about Paulson's role in the SEC rule change that allowed leverage to explode on Wall Street. This single act played a devastating, but rarely-mentioned role in bringing down the system.

Background reading...

- MUST SEE BUST: Mortgage Bankers Association 'Strategic Default' Exposed By Jon Stewart (Daily Show Video)

- John Boehner's 1998 Glass-Steagall Flashback - Would You Like A CD With That Auto Insurance Policy?

- The Essence Of Banking...

- AMAGERBANKEN - $2.8 Billion Bank Failure In Denmark: Senior Bondholders Whacked 41%

- Must Hear Voicemail: Gasparino Harasses Lehman Execs

- FINALLY! - Ireland Issues Threat To Billionaire Bondholders

- Prison For Paulson - Despite Cries For Justice, Wall Street 'Perp Walks' Slow To Develop

- BOMBSHELL REPORT: Goldman Sachs Got Billions From Taxpayers Thru AIG For Its OWN Account, Crisis Panel Finds; Contradicting SWORN Testimony From Execs

- The Hammer Gets Hit By A Tree

- INSIDE JOB -- How Wall Street Became A Criminal Enterprise And Took Over Government (Feature Film Trailer, Winner At Cannes 2010)

- Schultz With Ratigan: How Bernanke's Printing Press Is Causing Global Revolution (Video)

- Obama With Bill O'Reilly: "The United States Can't Dictate What Happens In Egypt" - Super Bowl Interview: Full Video

- Will Bernanke Scoop Up $50 Billion Of Ireland's Toxic Assets? Fine Gael Seeks MASSIVE Loan From U.S. Fed

- Rand Paul Wants To Cut $500 Billion In Federal Spending In JUST One Year - ABC Subway Interview

- Blankfein Says To Paulson: "Ok, Now What?"

FINALLY! - Ireland Issues Threat To Billionaire Bondholders

See the rest of the photos - 25 pics - all black & white...

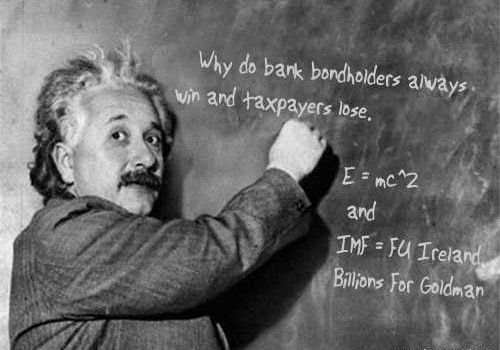

This is the heart of the bailout battle. Taxpayers vs. bank bondholders. In Ireland, the debate is front page news. On Friday, the leading opposition party, Fine Gael (pronounced feena gail), put forth a multi-point plan to deal with Ireland's banking and sovereign debt crisis. This weekend we made note of their plans to secure a $50B loan from the Federal Reserve, but perhaps more significant is their open threat to bank bondholders:

- "Fine Gael ... is committed to forcing certain classes of bond-holders to share in the cost of recapitalising troubled financial institutions. This can be done unilaterally for the most junior bondholders (owners of preference shares, sub-ordinated debt and similar instruments), but should be extended - ideally as part of a European-wide framework - for senior debt for institutions like Anglo Irish and Irish Nationwide that no longer have any systemic economic importance."

In other words, banks will be allowed (forced) to default on debts they owe to some of their creditors, including Goldman Sachs. In the post-bailout world, and outside of Iceland, this simply is not done. Even though, as we pointed out months ago, it's going to happen eventually anyway.

If it isn’t clear yet, Ireland will default on its bank guarantee. The IMF bailout of French, German and British banks is more than the Irish economy can afford, and far more than the Irish people are willing to allow....

Again, the only option -- the only viable option I should say (even if the Cowen’s and Lenihan’s of the world are too thick to see it) -- is to default. We’re not talking, of course, about defaulting on Irish government bonds, but defaulting on the ill-advised bank guarantees that went into place in the fall of 2008.

At the largest banks (Allied Irish Banks, Bank of Ireland, et al.) the plan appears to only threaten junior creditors. But at the notorious Anglo-Irish Bank, they are threatening to whack ALL bondholders (as they should).

Now, Fine Gael is being very careful how they word their ostensible plan. Notice that they include a reference to the debt restructuring occurring in the context of "a European-wide framework." That is because the terms of the EU bailouts of the Irish banks preclude any kind of bondholder haircuts without European approval. If that's the case -- that the EU and the ECB will still have a veto over any moves by the Irish government -- then this is just mamby pamby stuff meant to fool Irish voters. It will never happen.

However, Fine Gael also says:

- "Should some credible combination of these (above) options prove not to be available from Europe, the next Irish Government [ i.e. the Fine Gael-led government] would -- in order to restore its own credit worthiness -- be left with little choice but to unilaterally restructure the private debts of those Irish banks in greatest need of recapitalisation."

This is an astounding claim. Or maybe it's a threat. Ever since the financial crisis started, only Iceland has actually chosen to allow bank creditors to eat their own losses. Save Iceland, every single government has, in one way or another, protected bank bondholders. And yet, here we find Fine Gael firing a shot across the bow, not just towards Ireland's bank bondholders, but at bondholders around the globe. Until now, Iceland has been an outlier, the exception that proves the rule (the rule that protects bank bondholders at all costs). However, that could change quickly.

If Ireland also moves to force a haircut on bank bondholders, we may see other countries follow suit, with some reneging on their own sovereign debt (think Greece). Haircuts for bondholders are likely to happen because they are both politically popular, and because many nations (like Ireland) are simply unable to service the debt load that has been foist upon them. Writing in the Irish Independent just yesterday, Brendan O'Connor quotes a friend who works in the financial markets who had this to say about the Irish government's plans to pay off their banks' debt:

- "They look like f**king eejits paying it off. This is a game, and they need to start playing it."

O'Connor goes on to say,

- "This is a guy who knows private sector bondholders backwards. He has worked with them for years in mergers and acquisitions and he points out that haircuts are an accepted part of the game when things go wrong. And not only will the big private equity houses like Blackstone and KKR accept a haircut when things don't work out, they'll be back again to fund the next merger or acquisition. Because it's just part of the game. You win some, you lose some, but you don't stop playing just because you lose now and then."

Irish politicians have been way behind the ball on this. The idea of giving haircuts to bank bondholders is a part of the public discourse now in countries like Ireland. And more and more it's becoming a central political issue. When I was there this summer, many people still didn't realize that the bailouts were for the benefit of bank bondholders. At this point, after all the protests and debate over the IMF bailout of European banks, I would venture that things have changed considerably -- most Irish people are now well aware that they are being sacrificed for the likes of Goldman Sachs and Soc. Gen.

Expect more developments in the coming days and weeks.

Further reading...

Egyptian govt to increase salaries and pensions by 15 percent

State administrative employee salaries and military and civilian pensions will be increased by 15 percent beginning in April, said the Egyptian government on Monday.

Egyptian Finance Minister Samir Radwan told reporters that, for the first time ever, increases in pensions will be based on their total values. Radwan said the increase in pensions alone will cost the Treasury an estimated LE6.5 billion.

Radwan went on to say that the Council of Ministers Legislative Committee had approved two bills. The first bill, according to Radwan, exempts those registered under the Sales Tax Act from paying late fines or interest on sales taxes that are due in January and February 2011.

The second bill exempts those with insurance from paying late fines and interest on insurance premiums. The committee also agreed to establish a LE5 billion trust fund for disbursing compensation to those affected by the recent looting and vandalism of commercial and industrial establishments. Car owners affected by looting and vandalism will also receive compensation.

Translated from the Arabic Edition.

Schultz With Ratigan: How Bernanke's Printing Press Is Causing Global Revolution (Video)

Video - Ed Schultz with Dylan Ratigan - Feb. 2, 2011

At the National Press Club last week, Bernanke was asked if Fed money-printing is causing unrest in Egypt, Tunisia and other nations, by spiking commodity and food prices. Bernanke denied it, but we know his history with telling the truth.

The evidence to the contrary is overwhelming...

---

Gold robbery

I have to admit that I was certainly intrigued by the five exclamation points, with the result that my Super Mogambo Senses (SMS) switched to high-alert status, looking for signs of danger, at the sight of them.

And fortuitously so, as I soon found dangerous things! Firstly, he writes of Franklin D Roosevelt in 1933 infamously ordering that

everyone turn in their gold at the nearest bank and receive fiat currency in exchange.

Even then, it was a government Big Screw Job (BSJ) because "At the time," he writes, "a $20 gold coin contained over $20.80 worth of gold, but the citizens got only a $20 bill."

Re-read the previous paragraph, and see if you detect a Big Screw Job (BSJ) in getting a $20 bill in exchange for $20.80 in gold, too.

There is no question that the BSJ continued, as next, Mr Arbutine writes, "Many of the big banking institutions shipped those $20 gold coins to Switzerland and other European banks where they received the full amount", giving the banks an instant 3.9% gain!

Next, as part of the next Big Screw Job (BSJ), "By another executive order seven months later (after all the gold was confiscated) the dollar was revalued in terms of gold, making a $20 gold coin worth $35 in paper dollars," in effect handing Swiss and "other European" banks a nice, instant 68% gain! ($35 - $20.80) / $20.80)! Instantly!

So, I figure something like that is "in the works" since there is nothing that can be done to save the economy, even by robbing the people with taxes, and/or killing enough old people and poor people so that Social Security, Medicare, Medicaid and all the welfare programs cost less, and/or constantly trying to print enough money to spend our way out of debt by adding to the debt.

Most likely, it will be a little of all three, and more. And under any scenario you can name, including these three, gold, silver and oil will go up mightily in price, not only to match the roaring inflation caused by the Federal Reserve (and the other central banks around the world) creating so staggeringly much new money, but almost certainly with a huge premium because the future is so bleak!

And so if you are NOT buying gold, silver and oil, then I gotta ask, "What in the hell do you want out of an investment besides virtually guaranteed huge gains and zero effort? I mean, you must be very hard to please, because, whee! This investing stuff is easy!"

Richard Daughty is general partner and COO for Smith Consultant Group, serving the financial and medical communities, and the editor of The Mogambo Guru economic newsletter - an avocational exercise to heap disrespect on those who desperately deserve it.

Republished with permission from The Daily Reckoning. Copyright 2011, The Daily Reckoning.

Another Economic 'Martial Law in the Streets' Moment Approaches

In the fall of 2008, during the lead up to the TARP bailout of the financial industry, Treasury Secretary Henry Paulson warned members of Congress that there will be Martial Law in America should they fail to pass the multi-trillion dollar looting of the taxpayer.

Well, despite the American public being overwhelmingly against the bailout, the blackmail worked and the banks got their money. If it worked once, why not try it again?

With the economy no better off for having borrowed trillions to "stabilize" criminal financial institutions, the national debt ceiling is rapidly approaching. As some Republicans begin to float the notion of blocking this extension of credit, the Treasury Department, Democrats in Congress, and Ben Bernanke issued apocalyptic warnings clearly showing how pathetically fragile the U.S. economy is.

These threats, reminiscent of Paulson's 2008 ransom demands, once again appear to be offering two black-and-white choices: Armageddon or more debt. The coordinated pitch for higher debt levels is echoing the same urgency as the TARP looting, as Treasury Secretary Geithner said the government is insolvent and will run out of money in about two months' time unless Congress votes to raise the federal debt ceiling.

The AFP reported Thursday that Senate Democrats warned that the government would "shut down" if the debt ceiling was not raised. Chuck Schumer (D-NY) explained what that would mean if a shutdown were to occur: "citizens couldn't get their checks, veterans couldn't get their benefits, military payments would stop."

Ben Bernanke doubled down on the debt-fear campaign in a rare press conference where he said, "Beyond a certain point . . . the United States would be forced into a position of defaulting on its debt. And the implications of that on our financial system, our fiscal policy and our economy would be catastrophic."

Fiscal conservatives who oppose raising the debt ceiling say it is just delaying necessary belt-tightening and massive spending cuts, and say that raising the debt ceiling further only forestalls needed austerity moves to avoid a more catastrophic collapse in the future. House Republicans presented a plan to cut $32 billion from the budget, which is laughable given the impossible-to-pay-off debt levels.

Ron Paul to Ask Fed Why After Trillions in Free Money, Unemployment Is Still Sky High

Of course, the answer to all of these problems is simple: no debt ceiling raise. If the Fed can't monetize any more debt and make the Primary Dealers ever richer (now that the PD ranks have just been expanded from 18 to 20 to include SocGen and derivative (!) trader MF Global, and its CEO Jon Corzine) from commissions on indirect debt monetization, its power is gone. But that will mean doing something far less theatrical than a few hearings, and far more responsible: such as preventing rampaging inflation across America (see cotton chart posted previously).

Paul Announces Subcommittee Hearing On The Federal Reserve’s Impact on Unemployment

Domestic Monetary Policy and Technology Subcommittee Chairman Ron Paul announced today the Subcommittee will meet for a hearing to examine the impact of Federal Reserve policies on job creation and the unemployment rate. The hearing will be held on Wednesday, February 9th at 10 am in room 2128 Rayburn.

The Federal Reserve has taken unprecedented action to provide liquidity to financial markets and some U.S. corporations; however, unemployment remains above 9 percent. The hearing, entitled Can Monetary Policy Really Create Jobs?, will focus on the Fed’s recent actions, the likelihood those actions will reduce unemployment, and the critical role of the private sector in job creation.

While the Obama administration and Democrats in Congress believe increased government spending will improve the nation’s economy, Republicans on the Financial Services Committee know economic growth depends on providing the private sector, especially small businesses, with the certainty they need to create jobs. The Fed’s policies, as well as the Obama administration’s unsustainable debt and spending, continue to prevent small business owners from growing and hiring because of continued uncertainty over new taxes, higher interest rates, and the expanding role of government in the economy.

On November 3, 2010, the Federal Reserve announced that it planned to purchase $600 billion in long-term Treasuries (dubbed “QE2”). This is the second time since the 2008 financial crisis that the Federal Reserve has engaged in quantitative easing. The latest round of quantitative easing, along with the Fed’s action to bailout financial companies, has added trillions of dollars to the government balance sheet.

Everything Needs To Be Abolished

The book does two things. First, it lays bare the true fiscal position of the U.S. government, and shows why some kind of default is not merely possible but inevitable. But this is not a book full of numbers about the impending collapse. The collapse is merely the jumping-off point. By far the more central part of the book is this: the critical first step for reversing this mess and checking the seemingly unstoppable federal advance is to stick a dagger through the heart of the myths by which government has secured the confidence and consent of the people.

We know these myths by heart. Government acts on behalf of the public good. It keeps us safe. It protects us against monopolies. It provides indispensable services we could not provide for ourselves. Without it, America would be populated by illiterates, half of us would be dead from quack medicine or exploding consumer products, and the other half would lead a feudal existence under the iron fist of private firms that worked them to the bone for a dollar a week.

Thus Americans tolerate much government predation because they have bought into the myth that state intervention may be an irritant, but the alternative of a free society would be far worse. They have been conditioned to believe that despite whatever occasional corruption they may observe in politics, the government by and large has their well-being at heart. Schoolchildren in particular learn a version of history worthy of Pravda. Governments, they are convinced, abolished child labor, gave people good wages and decent working conditions; protect them from bad food, drugs, airplanes, and consumer products; have cleaned their air and water; and have done countless other things to improve their well-being. They truly cannot imagine how anyone who isn’t a stooge for industry could think differently, or how free people acting in the absence of compulsion and threats of violence – which is what government activity amounts to – might have figured out a way to solve these problems. The history of regulation is, in this fact-free version of events, a tale of righteous crusaders winning victories for the public against grasping and selfish private interests who care nothing for the common good.

But let’s suppose that the federal government has in fact been an enemy of the people’s welfare, and that the progress in our living standards has occurred quite in spite of its efforts. It pits individuals, firms, industries, regions, races, and age groups against each other in a zero-sum game of mutual plunder. It takes credit for improvements in material conditions that we in fact owe to the private sector, while refusing to accept responsibility for the countless failures and social ills to which its own programs have given rise. Rather than bringing about the "public good," whatever that means, it governs us through a series of fiefdoms seeking bigger budgets and more power. Despite the veneer of public-interest rhetoric by which it camouflages its real nature, it is a mere parasite on productive activity and a net minus in the story of human welfare.

Read Full Article

Obama seeks to make up with big business

Obama hinted at the tenor of his speech in a weekend radio address, saying he would stress the need for big business to invest more in the United States, and that if government and businesses fulfill mutual obligations then all Americans would benefit.

Obama was due to address the US Chamber of Commerce at 11:30 am (1630 GMT). While the chamber -- Washington's most powerful business lobby -- is just a stone's throw from the White House, it has remained at odds with the administration over economic policies.

The president, wounded in November elections which saw a wave of anti-Washington anger sweep Republicans to power in the House of Representatives, has sought to reach out to the business sector.

He has reversed his position on the Bush-era tax cuts and, faced with unemployment levels that remain at a stubbornly high nine percent, has placed business-savvy staff in key positions.

Last year, the chamber opposed Obama's health care reform, his drive to change Wall Street practices as well as other legislative initiatives. The group also gave millions of dollars in campaign donations to Republican candidates.

The White House publicly responded by accusing the chamber of funneling money from overseas to US political candidates.

Last month the powerful lobby, which claims to represent three million businesses, offered qualified backing for key legislative fights ahead but warned it would not walk in "lock-step" with Obama in the second half of his four-year term.

After two years of spats with the White House, the chamber said it would support Obama-backed moves to secure trade deals, tax reform, more infrastructure spending and debt reduction.

Obama's Monday address is expected to build on his State of the Union speech last month, in which he highlighted the need to revitalize US business, create jobs and invest in world-class infrastructure in order to boost American competitiveness.

© AFP

Will Bernanke Scoop Up $50 Billion Of Ireland's Toxic Assets? Fine Gael Seeks MASSIVE Loan From U.S. Fed

The Chairman can't stop stuffing his face his balance sheet.

Will Bernanke Scoop Up $50B of Ireland's Crap Assets?

Ireland's Fine Gael party, which is likely to take control of the government at the next election, has issued a multi-pronged plan to deal with Ireland's banking and sovereign debt crisis. Among other options, they are reserving the right to "unilaterally restructure the private debts of those Irish banks in greatest need of recapitalisation."

In other words, secured and unsecured bondholders are going to get whacked, or at least that's the not-so-subtle threat.

However, in less positive news, Fine Gael also made public their hope to secure funding from the Federal Reserve:

- "To wean Irish banks off their dependence on ECB funding, Fine Gael is also looking at possibly securing funding from the U.S. Federal Reserve using the dollar assets of Irish banks, estimated at around $50 billion, as security."

Ponder that for a minute. Irish politicians are openly planning to use the Federal Reserve, the central bank of the United States, to bail out their own, corrupt, diseased banks. At Bernanke's extra low teaser rate of course.

Makes one wonder what else the Fed might have been involved in these past two years. But, don't worry. The Chairman has it all under control. In fact, there's absolutely no need for any sort of pesky audit of the Fed. He told you that himself on Thursday. And if there's one thing we know for sure, it's that the Great Bernanke would never lie.

WikiFed, anyone...?...

---

Let’s Not Kid Ourselves: It’s All About Leverage

— Moe Green to Michael Corelone, The Godfather

A recap of recent events: First you had a French company, Roquette Freres, announcing to its Keokuk, Iowa employees that management had decided to unilaterally cut benefits (pensions, health coverage, holidays) and slash wages by $4 per hours, despite the fact that its Keokuk corn milling plant was profitable and its workers loyal and efficient.

And when the BCTGM (Bakery, Confectionery, Tobacco Workers and Grain Millers) Local 48G’s 240 members predictably balked at what they saw as a case of plain, old-fashioned extortion, the company immediately locked them out. No talking, no compromising, no second thoughts. They locked the doors on them.

I’ve corresponded by telephone and e-mail with Local 48G’s president, Steve Underwood, and while the stress level in Keokuk is understandably sky-high, Steve and his fellow members are still, somehow, hanging in there — which is remarkable when you consider that these good people have been on the street since September 28, 2010.

Unfortunately, the scabs that Roquette Freres hired as replacement workers are now doing the very jobs that these union members developed and had been competently performing since the plant opened its doors, some 20 years ago.

Summarizing: A French company moves to the Great Midwest — to Iowa of all places, right smack in the middle of America’s heartland — and after setting up shop and getting the lay of the land, proceeds to assault the workers by putting a gun to their heads and issuing an ultimatum: Accept this contract or be prepared to lose your jobs. It doesn’t get much more basic than that.

So much for France. Now let’s do Germany. A German-based company (Jamestown Properties, with headquarters in Cologne) purchases the landmark Madison Hotel in Washington D.C. — right smack in the middle of the nation’s capital, home to its monuments and hallowed institutions, and the seat America’s government — and after taking over on January 19, 2011, proceeds to assault its workforce.

The company announces, on January 31, that it has decided not only to refuse to recognize the existing contract between the previous owners and UNITE-HERE, the union representing 150 workers, but to more or less “fire” everybody and require them to re-apply for their jobs. Simple as that. No talking, no compromising, no second thoughts. The decision was unilateral and final. And it was done in the shadow of the Capitol Dome.

Of course. the irony is staggering. It’s suffocating. Indeed, if it weren’t so tragic, it would be comical. As U.S. companies continue to scan the globe for Third World workers willing to assemble its products for near slave labor wages, European companies continue to move to the U.S. knowing that they can pull stunts here that they could never get away with at home.

Question: Why couldn’t they get away with this stuff at home? Answer: Because there is too much muscle resisting them — muscle in the form of federal labor laws and muscle in the form of union credibility.

No one is suggesting that Europe is a workers’ paradise or that European labor doesn’t have its own set of problems, but let’s be clear: European unions are perceived differently. Not only do France and Germany have stronger labor laws than ours, they have a larger proportion of unionized workers, and these workers are, by and large, more militant and more respected by the public.

Oddly, the U.S. and Europe are now engaged in a sort of economic danse macabre. While we continue to be lured by the Third World, whose weak labor laws make it enticing, Europe continues to be lured by us for the exact same reasons. Ain’t that a kick in the head? Welcome to America, folks, where a workers’ dignity is sold to the lowest bidder.

David Macaray, a Los Angeles playwright and author (It’s Never Been Easy: Essays on Modern Labor), was a former union rep. He can be reached at: dmacaray@earthlink.net. Read other articles by David.

Farmers watch harsh winter crush their livelihoods

Farmers in Connecticut alone have lost at least 136 barns, greenhouses, sheds and other structures as snow measured in feet, not inches, accumulated while January passed without a thaw.

"We've had other challenges," said Joe Greenbacker, a partner at Brookfield Farm in Durham, where a fabric-covered "hoop house" caved in and killed a calf. "But this is the most snow I can remember on the ground and the biggest problem with roof issues I can remember."

Losses still are being totaled by the state Agriculture Department. Commissioner Steven Reviczky says no one can remember a more destructive winter.

Almost A Total Dollar Devaluation By The Fed

International Forecaster

The Euro zone participants who have financial problems, Greece, Ireland, Portugal, Belgium, Spain and Italy are expected to deflate via austerity and at the same time be more competitive. This is supposed to be accomplished quickly so that overhanging debt can be extinguished. This, of course, is an impossible task. You have the IMF demanding austerity and EU members demanding growth.

The problems of the southern European states are similar to those of the states and municipalities in the US. The product of years of living beyond their means, and being accommodated by banks who knew they should have never been making the loans they were making. These entities cannot print money to solve their problems and they cannot grow fast enough to service current levels of debt, never mind service additional debt necessary to spark growth. They cannot manipulate their money supplies, because they have no control over them. They have no control over interest rates as well. They either find a way to pay the debt or they default. The only other alternative is to find someone to lend to them. That usually takes place at higher interest rates, due to the risk to the lender. These conditions are truly a quandary.

Each nation and state had its own set of problems. The most obvious was and is living beyond their means. Some had uncompetitive economies and some had one interest rate fits all, a condition that tricks unsuspecting countries into borrowing more than they can afford. Some had real estate and stock market bubbles; some had slow growth in part caused by lack of increasing productivity. Some had anemic savings or an economy dependent on loans from bankers who used a fractional banking system that they in error over-expanded. That is the way it was and still is.

We ask ourselves how did so many nations do the same stupid things and why would bankers use disastrous levels of leverage and lending? We certainly cannot totally ascribe it to greed or stupidity. Bankers are not stupid people. The policies followed by these nations were promulgated by the Federal Reserve and the City of London to bring about a crisis that would lead to world government. This is what this whole orchestration is all about.

As the Treasury’s debt figure wanders above $14 trillion, the question arises again will the US dollar remain the world’s reserve currency? The Fed says they’ll spend $900 billion by April or is it June? On the other hand a little bird told us they have already spent $1.7 trillion in their quest to fund the Treasury and Agencies.

The municipal market, as we predicted three years ago, is getting killed. Yields are up by .30% in January after having seen yields fall 1.50% since last October. The bond program Build America bonds is now over and that will keep municipalities from selling more bonds. The yields will be substantially higher, so you will see very few issues hit the market.

In California, Governor Moonbeam Jerry Brown, wants to raise taxes like Illinois has, but those terrible Republicans are blocking him from doing so because any tax increases must be approved by the taxpayers. As you are aware Fed Chairman Bernanke has ruled out bailouts for state or local entities. In addition, elitist Newt Gingrich is pushing for legislation to allow states to go bankrupt. That means all or part of pensions and benefits will be wiped out. If such a bill looked like it was being passed, munis and state bonds would again collapse for fear of default or partial default.

In Europe the Chinese have made it clear that they are buying euro debt bonds. As a result yields have fallen and the euro has rallied from $1.30 to $1.38 in a short period of time. The big question is how much are they prepared to buy and will their purchases make a major difference in the sovereign obligations of the problem countries? As we reflect we can now understand why Chancellor Merkle was so vehement when she announced that Germany would defend the euro. She had to have known that the Asian cavalry was on the way.

The Federal Reserve became law in 1913 and has since that time managed to assist the dollar in losing 95% of its value via its profligate issuance of money and credit. The express purpose of the Fed’s creation was to end panics, depression, recession and business cycles. It has failed to accomplish any of those things and as a result the purchasing power of the US dollar has been destroyed.

This experience has been a far cry from stability. We wonder what the House and Senate were thinking about when they passed such legislation in as much as the Constitution says that only gold and silver can be used as legal tender for payment. That is why the dollar had gold backing until August 15, 1971. The departure was caused by growing US debt and the ability of foreign nation dollar holders to redeem their dollars gained in trade for gold. Thus, you can see the Federal Reserve note is a fiat currency, one having no value or backing other than the good word of a bevy of American and foreign bankers.

There has never been any doubt in our minds that the Fed is unconstitutional. Over the past 50 to 100 years there has been little protest regarding its unconstitutionality until the last several years. Polls now show 70% of Americans want it done away with. The natural question is why did it take so long for people to understand that a group of bankers had been issued a license to steal. The answer has to be a lack of education. It has been a long hard struggle to make people understand how the fruits of their labors were being stolen by a band of common criminals. The people still collectively do not understand that these bankers own them and their country. They accomplish this by buying 95% of our legislators via campaign contributions, lobbying and by other illicit means. They also control the corporations that provide jobs in manufacturing and services. As they set out to control financial America so many years ago they also set out to control the educational process. That is one of the reasons nothing is discussed as to the true mission of the Fed. That is to totally control America society.

Read Full Article