ROAD TO PERDITION

by James Quinn

----------

Christmas is a time when kids tell Santa what they want and adults pay for it. Deficits are when adults tell the government what they want - and their kids pay for it.

Decade after decade, Americans have voted for intellectually and morally bankrupt dullards that promise them more goodies under the tree. Every day is Christmas in Washington DC. Long-term means the next election cycle to these traitors of the Republic. I have written ad nauseum about the impending financial cataclysm that awaits our nation. I have spent countless hours documenting the unsustainable path of our politicians’ financial decisions and lack of courage in addressing the forthcoming tragedy that grows closer by the day. Our political system is so corrupt and dysfunctional that there is absolutely no chance that our path will be altered at the voting booth.

Government programs are fashioned, but never finished. The IRS tax code consists of 3.4 million words covering 7,500 pages of payoffs to business lobbyists. Simplicity is a virtue. The politicians who are bought and sold by corporate interests prefer complexity and obscuring the truth. Everyone knows that the government cannot fulfill the fiscal promises they have already made. Instead of dealing with this reality using intelligence, courage and conviction, the weak kneed politicians that slither the halls of Congress have chosen to add a brand new bloated entitlement program guaranteed to detonate in our faces. This is the existing reality. There is nothing I can do that will change this reality. Instead, I will propose a new model.

Road to Perdition Scenario

“Government ‘help’ to business is just as disastrous as government persecution... the only way a government can be of service to national prosperity is by keeping its hands off.” Ayn Rand

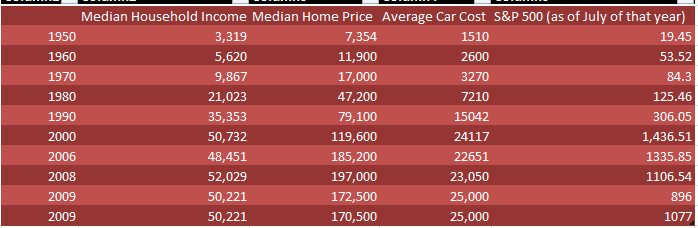

Politicians do not care about budgets, inflation, or the value of the U.S. dollar. They care about power, personal enrichment and being re-elected. In fiscal 2000, the US government had $1.545 trillion of receipts and $1.458 trillion of expenses, resulting in a surplus of $87 billion that year. A mindless government bureaucrat doesn’t conclude that the surge in receipts was due to the internet bubble resulting in billions of one time capital gains revenues. They should have expected reduced revenues in future years. Nine years later government receipts were $1.51 trillion, while expenditures had reached $3.5 trillion. Total government outlays never go down. Obama’s FY10 budget projects $1.649 trillion of receipts and $3.042 trillion of expenditures, resulting in a deficit of $1.393 trillion. Deficits in the range of $1 trillion per year are projected for the next 10 years. Instead of addressing this budget gap that will absolutely lead to economic disintegration, politicians add new entitlements, expand our interventionist foreign wars, and dole out pork to their corporate backers.

| Year | On-Budget |

| Receipts | Outlays | Surplus or Deficit(−) |

| 2000 | $1,544,873 | $1,458,451 | $86,422 |

| 2001 | $1,483,907 | $1,516,352 | -$32,445 |

| 2002 | $1,338,074 | $1,655,491 | -$317,417 |

| 2003 | $1,258,690 | $1,797,108 | -$538,418 |

| 2004 | $1,345,534 | $1,913,495 | -$567,961 |

| 2005 | $1,576,383 | $2,069,994 | -$493,611 |

| 2006 | $1,798,872 | $2,233,366 | -$434,494 |

| 2007 | $1,933,150 | $2,275,303 | -$342,153 |

| 2008 | $1,866,280 | $2,508,130 | -$641,850 |

| 2009 estimate | $1,501,784 | $3,479,621 | -$1,977,837 |

| 2010 estimate | $1,649,422 | $3,041,947 | -$1,392,525 |

In the early 1980’s, before the three decade long debt induced frat party, the National Debt was between $900 billion and $1.6 trillion. Today, the National Debt is $12.3 trillion, up 1,250% in three decades. The US dollar was phenomenally strong in the early 1980’s versus against a trade weighted basket of foreign currencies, reaching 145 in 1985. Today it has sunk to 77, a 50% decrease in 24 years. Enormous deficits and a plunging currency are a precursor of the unavoidable breakdown of a onetime economic powerhouse. A courageous act by our leaders would be to dramatically decrease government spending and increase interest rates to encourage savings, which would result in a strong dollar. The short term pain would be intense, but it would put our country back on a sound fiscal path. Instead, we will throw our children and grandchildren under the bus with continued financial malfeasance. More spending, more debt, and a cheaper dollar are the drugs of choice.

Dying of Debt

“Deficits mean future tax increases, pure and simple. Deficit spending should be viewed as a tax on future generations, and politicians who create deficits should be exposed as tax hikers.” Ron Paul

As the U.S. National Debt has grown from $900 billion to $12.3 trillion since 1980, three month Treasury interest rates have declined from 16% in 1980 to .04% today. The U.S. Treasury has been taking advantage of these artificially low rates to rollover the National Debt and issue new debt on a short-term basis at very low rates. Even with these low rates, interest on the debt was $400 billion in 2009. The government has essentially been able to borrow from foreigners at an overall effective rate of 3.5%. Foreigners are making rational decisions to reduce purchases of long-term US Treasury bonds because they know it is the policy of the United States to inflate away our debt obligations. Buying U.S. Treasury bonds is a recipe for significant losses. The U.S. Treasury is playing Russian roulette at every debt auction. At some point, Timmy Geithner is going to pull the trigger and his pea brains will splatter all over the floor.

Based upon the projected budget deficits over the next ten years, the National Debt will reach $25 trillion by 2019. Interest on the National Debt at various interest rates would be:

Rate Interest Expense

3.5% $875 billion

5.0% $1.25 trillion

7.5% $1.87 trillion

10.0% $2.50 trillion

Total 2008 expenditures of the U.S. government were $2.5 trillion. The law of supply and demand will inevitably lead to much higher interest rates. The market will call the U.S. bluff. It will happen well before 2019. The result will be chaos, upheaval, and social unrest. This is based upon just our current spending. The unfunded commitments made by corrupt myopic politician’s decades into the future cannot be honored. These unfunded liabilities total $106.8 trillion according to the Social Security and Medicare Trustees. The bold faced lies by politicians and mainstream media morons about “bending the cost curve” downward are outrageous in their audacity.

The failure of politicians to address a crisis that has been predictable for decades is truly criminal. The demographic facts are undeniable. In 1950 there were 7 workers per retiree in the U.S. Today, there are 4.5 workers per retiree. By 2030, there will be less than 3 workers per retiree. In the next twenty years retiree benefit payouts will skyrocket as Baby Boomers retire en masse. The confluence of these entitlement payouts with soaring interest on the National Debt and peak oil will floor the U.S. economy. The only way to honor these commitments would be through huge tax increases. During the current healthcare debate, politicians have actually described these government programs as successful. I suppose the executives at GM, Fannie Mae, and Freddie Mac feel they have been running successful companies too. They are fitting in perfectly as government blood sucking entities.

No Political Will

“The moral and constitutional obligations of our representatives in Washington are to protect our liberty, not coddle the world, precipitating no-win wars, while bringing bankruptcy and economic turmoil to our people.” Ron Paul

As disaster draws near, the two crooked political parties that are controlled by corporate and banking interests spout their usual mantras. The Democratic solution is to tax the “rich” and spread the wealth around by squandering our tax dollars on stimulus programs, jobs programs, welfare programs, foreign wars and bailing out their banker masters. The Republican answer is to reduce taxes on the “rich”, boost defense spending, issue tax rebate checks, and frittering away our tax dollars on foreign wars, while bailing out their banker masters. The differences between the two parties are inconsequential. Neither party have ever reduced government spending and neither party will ever take on the military industrial complex or the entitlement system. These dishonest politicians have devastated the American dream. Sound fiscal, monetary and tax policy were discarded in 1913 with the creation of the Federal Reserve and the institution of the income tax. Politicians were given a green light to spend taxpayer money and borrowed money in order to get re-elected. The Federal Reserve has provided the liquidity by inflating away 97% of the value of the USD.

The chart below detailing the FY10 Federal budget clearly shows the dire circumstances were are in today. Mandatory spending on Social Security, Medicare, Medicaid, interest on the debt, and other social spending already exceed $2 trillion per year. These mandatory programs are sitting on the launch pad like the space shuttle ready to blast off into the stratosphere. When these costs blast off, with the mass retirement of Baby Boomers, we all know what happens next.

Military spending, and running all the other ineffectual government agencies total $1.5 trillion per year of “discretionary” spending. A rational reality based civil servant would look at this and honestly tell the American people that massive cuts in defense spending and social programs is absolutely necessary to save the country from bankruptcy and decline. If you are waiting for President Barack Obama to go on national TV and speak these words to the American public, you probably believe the new healthcare bill will reduce the National Debt, improve your healthcare, and reduce your premiums. Democrats and Republicans continue to live in their Washington DC fantasy world where increasing taxes will miraculously solve our problems according to Democrats and decreasing taxes to stimulate growth will solve our dilemmas according to Republicans. Both are delusional and dishonest.

Creating a New Model

"You never change the existing reality by fighting it. Instead, create a new model that makes the old one obsolete." R. Buckminster Fuller

There is zero chance that my proposed modifications to our financial system would ever be implemented by either one of the existing political parties. There is a long shot chance that a 3rd party, using this new model as their platform, could get elected and implement these necessary changes. This is highly unlikely given that 50% of the country pays no taxes and sucks off the teat of state. These proposed alterations would require shared sacrifice, a decline in our standard of living, a conclusion to the welfare state, and an end to our colonial empire. Since no one in this “me first” selfish society would willingly vote for such a transformation, the existing corrupt structure will need to give way first. At that point, reasonable people will have a chance to choose a rational sound economic model. We may not have to wait long for our chance.

Taxing Situation

“When the federal government spends more each year than it collects in tax revenues, it has three choices: It can raise taxes, print money, or borrow money. While these actions may benefit politicians, all three options are bad for average Americans.” Ron Paul

The Federal government has chosen all three. A family or business recognizes that it needs to spend less than its income in order to prosper over the long-term. The U.S. government is dependent upon individual income taxes to provide 64% of its receipts. The FY10 budgeted receipts are as follows:

Individual Income Tax $1.051 trillion

Corporate Income Tax $ 179 billion

Social Insurance $ 257 billion

Highway Taxes $ 38 billion

Tobacco & Alcohol Taxes $ 28 billion

Customs & Duties $ 24 billion

Estate Taxes $ 20 billion

Other Excise Taxes $ 52 billion

TOTAL RECEIPTS $1.649 trillion

The 7,500 page Internal Revenue Code has been written to benefit politicians and special interests that pay politicians. This is how politicians repay their financial backers with tax breaks or deductions. The tax code is purposely indecipherable so that the general public is unable to recognize the payoffs for what they are. If the current tax code was scrapped and made so simple a Treasury Secretary could do their tax return properly, influence would be stripped from Congress. They will never willingly consent to this. The truth is that the top 1% of income earners pays 40% of the taxes. The top 10% of income earners pay 71% of all taxes. The bottom 50% of income earners pays virtually no taxes. Still, the rich and powerful are able to hire highly paid tax attorneys to avoid billions in taxes through loopholes provided by their Congressional concubines.

My proposal to reconstitute our corrupt tax system is a flat tax of 10% on all earned income. There would be absolutely no deductions or credits. Interest, dividends, and capital gains would not be taxed. Savings and investment should not be discouraged. Corporate income taxes would be eliminated. Taxes on corporations are just passed through to customers in higher prices. The biggest change to our tax system would be the implementation of a 15% Value Added Tax on all consumption, excluding food and clothing. Overconsumption is what got us into this predicament. It can help get us out of it. The simplicity of my system would make politicians, tax accountants, and special interest groups foam at the mouth like rabid dogs. Based on figures supplied by the Bureau of Economic Analysis, government receipts would be:

Flat Tax Receipts ($6.3 trillion x 10%) $ 630 billion

Value Added Tax Receipts ($9 trillion x 15%) $1.350 trillion

Social Insurance & Excise Taxes $ 320 billion

TOTAL RECEIPTS $2.300 trillion

Politicians wield immense amounts of power through the use of tax goodies. There is absolutely no reason for this complex system other than to pay back constituents and lobbyists for their votes and contributions. Simplicity would destroy their power base and shift control back to the people.

Don’t Cut My Program

“All initiation of force is a violation of someone else's rights, whether initiated by an individual or the state, for the benefit of an individual or group of individuals, even if it's supposed to be for the benefit of another individual or group of individuals.” Ron Paul

The FY 2010 Federal Budget projects spending of $3.6 trillion. According to the sages that control the government purse strings, $1.4 trillion of this spending is discretionary, while $2.2 trillion is considered mandatory. In FY 2000 total government spending was under $1.9 trillion. Government expenditures have risen 89% in ten years. Over this same time frame receipts have risen 7%. That certainly sounds sustainable. Government spending needs to be slashed with a machete. If we can cut spending back to the levels of 2000, we can achieve a balanced budget. Once the initial slashing of the budget is complete, reinstitution of PAYGO rules would be essential. Politicians cannot be trusted to do what is right for the country. These rules would force them to cut other expenditures in order to institute new spending. The other absolute necessity would be the reinstitution of a sound money policy. A currency backed by a combination of limited metals such as gold, silver, platinum, and palladium would restrict politicians from reckless spending. The Federal Reserve has proven to be a political animal and has destroyed the value of the dollar. They cannot be trusted to act in the best interests of the people.

| 2005 | 2006 | 2007 | 2008 | 2009 estimate | 2010 estimate |

| Total outlays | 2,655,435 | 2,728,940 | 2,982,881 | 3,997,842 | 3,591,076 | 3,614,774 |

| National defense | 521,840 | 551,286 | 616,097 | 690,308 | 712,853 | 658,697 |

| Nondefense: |

|

|

|

|

|

|

| Payments for individuals | 1,591,772 | 1,689,307 | 1,824,596 | 2,090,273 | 2,213,262 | 2,279,522 |

| Direct payments | 1,314,964 | 1,400,936 | 1,519,911 | 1,711,774 | 1,803,769 | 1,883,317 |

| Grants to State and local governments | 276,808 | 288,371 | 304,685 | 378,499 | 409,493 | 396,205 |

| All other grants | 157,289 | 155,426 | 156,631 | 189,324 | 242,708 | 223,248 |

| Net Interest | 226,603 | 237,109 | 252,757 | 142,738 | 135,862 | 254,488 |

| All other | 226,181 | 178,050 | 219,042 | 976,880 | 370,647 | 286,358 |

| Undistributed offsetting receipts | -68,250 | -82,238 | -86,242 | -91,681 | -84,256 | -87,539 |

| Total nondefense | 2,133,595 | 2,177,654 | 2,366,784 | 3,307,534 | 2,878,223 | 2,956,077 |

As far as I’m concerned, the term Mandatory means nothing. Politicians promised people benefits they could never deliver in order to get elected. It is time for a reality check. You will not receive the Social Security, Medicare, and Medicaid benefits you were promised. Al Gore was lying to you. There is no lockbox. The immoral politicians who skulk about the halls of Congress have already spent the Social Security funds that were supposed to be in a lockbox. The sooner Americans learn the truth about these programs, the sooner we can get this country back on a sound fiscal course. The FY 2010 Budget shows that the $3.5 trillion is spread around like Obama stash. We only need to slash the budget by $1.2 trillion in order to balance the Federal books. Do you think a few special interests, neo-cons, socialists, senior citizens, do-gooders, and welfare beneficiaries will be upset?

The major expenditures in the FY 2010 budget are as follows:

National Defense Related $822 billion

Social Security $696 billion

Medicare $458 billion

Medicaid $290 billion

Welfare Payments $153 billion

Social Tax Credits $141 billion

Federal Retirement Benefits $128 billion

Education $105 billion

Transportation $104 billion

Unemployment $ 89 billion

Health $ 67 billion

Housing $ 58 billion

International Affairs $ 53 billion

Justice $ 52 billion

Other $399 billion

TOTAL EXPENDITURES $3.615 trillion

In order to balance the budget, America’s far flung empire must be reined in. Overreach has previously bankrupted the Roman Empire and the British Empire. We need to recall the troops from Germany, Japan and every other outpost on the planet. We need to declare victory in Iraq and Afghanistan and withdraw our troops. The military industrial complex must be dismantled. We have enough bombs, fighter jets, bombers, submarines and aircraft carriers to blow up the earth three times over. The military will need to pick the essentials, as their budgets are slashed. Efficiency will be a blessing. These changes would cut $300 billion from the budget and put Defense spending all the way back to 2002 levels.

Social Security was created so that widows and orphans would not starve to death during the Great Depression. It morphed into an entitlement over the decades. The government cannot payout the amount it has committed. Either the tax rate needs to be increased from 6.2% to 8.2% or benefits need to be slashed. My choice is to slash benefits. Immediate means testing based on net worth should be implemented. Anyone over a reasonable threshold would not receive Social Security. The minimum age to receive benefits should be increased to 70 years old and increasing over time. Anyone less than 50 years old would have half their contributions go into their own self managed investment account. They would receive reduced benefits at retirement. New employees into the workforce would not receive any benefits at retirement. Their investment account would be their sole government pension. These changes would immediately save $250 billion per year and save trillions in the future.

Both Democrats and Republicans have harped on the fraud in waste in the Medicare and Medicaid programs. For once, they are right. Fraud, waste, defensive medicine, malpractice lawsuits, and lack of competition combine to cost $400 billion per year in unnecessary expenditures. Instead of adding a new healthcare entitlement to an already bankrupt system, we need to fix the existing system. Medicare needs to be completely reconstituted. It also needs to be means tested. If you can afford your own insurance, you don’t go on Medicare. The insurance portion should only be for catastrophic illness. Each Medicare recipient should receive a fixed amount of funds in a health savings account to use for their basic medical needs. All doctors and hospitals would be required to publish their rates for service, tests, and procedures. Laser eye surgery has not been covered by medical insurance and doctors have had to compete on price and quality. Prices have come down dramatically over time. By limiting malpractice awards, allowing competition across state lines, actually stopping fraud and introducing price competition, we can ring $400 billion out of these costs. Instead, the government will criminalize not having medical insurance.

“The only power any government has is the power to crack down on criminals. Well, when there aren't enough criminals, one makes them. One declares so many things to be a crime that it becomes impossible for men to live without breaking laws.” Ayn Rand

The various tax credits would be eliminated with the new simple tax system. This would eliminate $141 billion of expenditures. The remaining $1.2 trillion of expenditures would need to be cut by 10% in order to save another $120 billion. The cumulative savings would be $1.2 trillion and the Federal Budget would be in balance. Virtually no one in this country would vote for anyone proposing such drastic changes. The implementation of these cuts would surely result in a deep recession. It would be a chosen path back to reality. It would be a courageous and noble act of adults taking the bitter medicine today so that our children and grandchildren will have a tomorrow. I have no hope that anyone in government today would be willing to tell the American public the bitter truth about our economic future and propose anything close to what I have proposed. This leads me to the logical conclusion that we will continue on the current path until our empire collapses under the weight of debt, political corruption and grand illusions.

Another Brick in the Wall

“Throughout the centuries there were men who took first steps, down new roads, armed with nothing but their own vision.” Ayn Rand

I’ve noticed that since the term “liberal” has been discredited liberals call themselves “progressives”. I get it – progress. Any fresh unpaid for entitlement, new social program, environmental tax, stimulus package, or union bailout is considered progress to these visionary do-gooders. Now that “neo-con” has been discredited by the disastrous actions of Bush and Cheney, I anticipate these warmongers to adopt the new Orwellian name “peace through war and invasion guys”. Today, when I hear the degeneratives, I mean progressives, describe the financial crisis as a failure of free market capitalism, I have to laugh.

Capitalism should not be condemned, since we haven't had capitalism.” Ron Paul

We haven’t had true capitalism since 1913. We live in a corporate fascist state dominated by the military industrial complex, the financial banking complex, and now the healthcare industry complex. It is fascinating that the health industry has spent $396 billion in 2009 on lobbying and the financial industry $334 billion while Congressmen debate the future of both industries. These industries surprisingly have received a windfall in the legislation that has been put forth by Congress. The system is so corrupt and rotting from within that elections will never result in necessary reform. Corporations are spending $3 billion per year to bribe (lobby) your elected officials. Whose interest do you think Congress is looking out for?

| 2009 Lobby |

| Sector | Spending |

| Health | $396,240,855 |

| Misc Business | $362,259,396 |

| Finance, Insurance & Real Estate | $334,341,984 |

| Energy & Natural Resources | $300,512,509 |

| Communications/Electronics | $266,103,829 |

| Transportation | $184,606,661 |

| Other | $182,632,267 |

| Ideological/Single-Issue | $112,914,979 |

| Agribusiness | $103,924,231 |

| Defense | $96,174,660 |

| Construction | $40,387,356 |

| Labor | $32,015,440 |

| Lawyers & Lobbyists | $24,617,969 |

Source: Open Secrets

The Defense industry doesn’t need to splurge as much on lobbying because our never ending wars of choice keep the orders flowing in. Our liberal left wing President is spending more on defense than our last neo-con President. There are no plans to scale back our interference in world affairs. The military planners work around the clock preparing for war in Iran and Yemen. The planned domination of the Middle East is the untold truth, as our ruling elite know that Peak Oil is a fact and our sprawling suburban existence depends upon cheap oil. Once it becomes clear that peak oil has set in, panic will result and armed conflict for the remaining supplies will breakout. Instead of planning for this event by preparing the country by shifting our economy to natural gas, nuclear, coal, geothermal, wind, solar, and ocean based sources, we will invest in our military machine to seize the nectar of American life. This will be a tragic choice.

The United States owes foreign countries $3.5 trillion today. Our obligation to foreigners has risen by $500 billion in the last 12 months. The Obama spending plans will require the issuance of $2.2 trillion of new debt this year. We will need foreigners to buy close to $1 trillion of our debt in 2010. The Chinese already own 25% of our outstanding debt, with Japan at 23% and OPEC at 6%. They know our budgets project $13 trillion in deficits over the next 10 years. They know Ben (ameba spine) Bernanke is trying to inflate away this debt through inflation and a lower dollar. They know they are guaranteed to lose billions if they buy Treasuries paying 3%. They are not fools. They will eventually choke on this debt and vomit it back in our face. With mammoth debts, gargantuan unfunded liabilities, massive unemployment, a far flung military empire, multiple wars, and an overconfident, clueless, lethargic population, the surge in interest rates and hyperinflation will topple this bloated crumbling kingdom.

“We are fast approaching the stage of the ultimate inversion: the stage where the government is free to do anything it pleases, while the citizens may act only by permission; which is the stage of the darkest periods of human history, the stage of rule by brute force.” Ayn Rand

When the current economic scheme breaks down and the country dissolves in disarray because there is no courage, truthfulness or morality left in Washington DC, anything is possible. When governments are confronted with intractable domestic problems, they seek a foreign threat to distract the public. Our economic malfeasance and oil shortages will likely spark a World War III scenario with the Muslim world at odds with the Christian world. With nukes in the possession of many countries, terrifying outcomes are easy to imagine. The people of America will have a choice to make. They can put another brick in the wall, or they can try to break free. They can choose to take back their freedom and liberty or relinquish their last vestiges of humanity to a fascist dictatorship. Together we stand, divided we fall.

##