Monday, January 10, 2011

« Video: Congressional Testimony On MERS - Does It Have Legal Authority To Foreclose? »

Start watching at the 1-minute mark. Includes excellent testimony from foreclosure lawyer Thomas Cox, and Utah professor Dr. Chris Peterson. Detailed article on MERS inside.

Hearing took place Dec. 15, 2010.

---

No, There's No Life At MERS

Mortgage Electronic Registration Systems, Inc (MERS) has a very long history. The beginning stages have remained a mystery until now.

In 1989, Brian Hershkowitz developed the “Whole Loan Book Entry” concept while serving as a director for the Mortgage Bankers Association (MBA). In 1990, he first introduced this concept to seven different industry group; Document Custodian, Originators, Servicers, Title Insurers, County Recorders, Government Sponsored Enterprises (GSE’s) and Warehouse/Interim Lenders. The reception was very positive and it was viewed as a very useful recording system to be used for how equity and debt securities could be identified and managed.

In 1991, Mr. Hershkowtiz published Farming It Out in Mortgage Banking Magazine. His main discussion in this article is primarily about getting the opinion of the experts in the technology outsourcing service industry. In 1992, Mr. Hershkowitz published another article called Cutting Edge Solutions in Mortgage Banking Magazine. In this particular article he mentions the actual meeting that took place at the Mortgage Bankers Association of America (MBA) headquarters with many key players that are known today as some of MERSCORP’s shareholders, such as, Fannie Mae and Freddie Mac. In this meeting they discussed a “System” that will bring changes in mortgage records.

Mr. Hershkowitz went on to become President and COO of LandSafe Credit, a leading settlement service provider that was a subsidiary of Countrywide. Mr. Hershkowitz also spent several years serving Countrywide in the areas of strategic planning and executive management.

In 2001, Mr. Hershkowitz became Executive Vice President at Fidelity National Information Services (FNIS) and President of its mortgage and information services division. His responsibilities included management of the Company’s data offerings, including public records information, credit reporting information, flood hazard compliance data, real estate tax information and collateral valuation services. He left FNIS in November of 2006 to become Chief Executive Officer of Maximum Value Group, a consulting firm focused on providing advice to private equity and other market participants in the area of banking and mortgages.

ENTER THE X-FILES

MERS has evolved into a totally different purpose today.

Mortgage Electronic Registration Systems, Inc. is a wholly owned subsidiary of MERSCORP Inc., located at 1595 Spring Hill Rd Ste 310 Vienna, VA 22182.

MERS was founded by the mortgage industry. MERS tracks “changes” in the ownership of the beneficial and servicing interests of mortgage loans as they are bought and sold among MERS members or others. Simultaneously, MERS acts as the “mortgagee” of record in a “nominee” capacity (a form of agency) for the beneficial owners of these loans.

To ensure widespread acceptance within the industry, MERS sought to have security instruments modified to contain MERS as the original mortgagee (MOM) language. MERS began to change decades of business practices after the two biggest mortgage funders in the U.S. the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Ferderal National Mortgage Association (Fannie Mae) modified their Uniform Security Instruments to include MOM language. Their approval opened the doors to incorporate MERS into loans at origination.

Soon after, U.S. government agencies like the Veterans Administration, Federal Housing administration and Government National Mortgage Association (Ginne Mae), and several state housing agencies followed both Fannie/Freddie to approve MERS.

More than 60 percent of all newly-originated mortgages are registered in MERS. Its mission is to register every mortgage loan in the United States on the MERS System. Since 1997, more than 65 million home mortgages have been assigned a Mortgage Identification Number (MIN) and have been registered on the MERS System.

The mortgage-backed security (MBS) sector tested the viability of MERS because a substantial number of mortgages are securitized in the secondary market. In February 1999, Lehman Brothers was the first company to include MERS registered loans in a MBS.

Moody’s Investor Service issued an independent Structured Finance special report on MERS and it’s impact of MBS transactions and found that where the securitzer used MERS, new assignments of mortgages to the trustee of MBS transactions were not necessary.

Since MERS is a privately owned data system and not public, all mortgages and assignments must be recorded in order to perfect a lien. Since they failed to record assignments when these loans often traded ownership several times before any assignment was created, the legal issue is apparent. MERS may have destroyed the public land records by breaking the chain of title to millions of homes.

Continue reading...there's MUCH more...

http://stopforeclosurefraud.com/2010/09/22/no-theres-no-life-at-mers/

« Chris Whalen On Fannie's BofA Settlement: "This Is A Gift From Tim Geithner, With Politics Written All Over It" »

Videos, links and a decent Geithner cartoon.

---

Is Fannie bailing out the banks?

Financial stocks just caught fire.

Someone must be getting bailed out, right?

Why yes, say critics of the giant banks. They charge that Monday's rally-stoking mortgage-putback deal between Bank of America (BAC) and Fannie Mae and Freddie Mac is nothing more than a backdoor bailout of the nation's largest lender. It comes courtesy, they say, of an administration struggling to find a fix for the housing market while quaking at the prospect of another housing-fueled banking meltdown.

Monday's arrangement, according to this view, will keep the banks standing -- but leave taxpayers on the hook for an even bigger tab should a weak economic recovery falter. Sound familiar?

"The administration is trying to weave a path between two bad alternatives," said Edward Pinto, a resident scholar at the American Enterprise Institute. "They want to bail out the big banks without doing apparent damage" to the sagging U.S. budget position.

Pinto says truly holding BofA responsible for all the mortgage mayhem tied to its 2008 purchase of subprime lender Countrywide would likely drive it into the arms of the Federal Deposit Insurance Corp., which has enough problems to deal with. Though BofA would surely dispute that analysis, it's easy enough to see where the feds don't want that outcome.

But BofA's many problems aren't the only reason for taking Monday's deal with a grain or two of salt. Critics also question the timing of the settlement, which comes on the heels of a court setback for the banks and a new legal challenge from a big investor. They wonder, given the huge sums being spent to prop up Fannie and Freddie, why the companies didn't get better terms.

And you don't need to be a conspiracy theorist to see that austerity talk in Congress means no more upfront support for financial firms. At a time of double-dipping house prices and nearly 10% unemployment, you can see where some people might find themselves devising new ways to prop up BofA and its housing-exposed rivals JPMorgan Chase (JPM), Wells Fargo (WFC) and Citi (C).

- "This looks to me like a gift from Tim Geithner," said Chris Whalen of Institutional Risk Analytics. "There's politics all over this."

---

It's a Wonderful Life for Bank of America in 2011

By Chris Whalen

About a year ago, Arianna Huffington called my friend and colleague Dennis Santiago and asked if my firm could provide a list of “good banks” for an effort she was planning. Along with Rob Johnson from the Roosevelt Institute, Huffington conceived of something called “Move your Money,” which sought to get consumers to move their business from large banks to smaller community institutions.

The effort was modestly successful in terms of increasing awareness of consumers about the alternatives for financial services. But it did not really change the competitive equation between the too big to fail (TBTF) behemoths — Bank of America, JPMorgan, Wells Fargo and Citigroup — and the rest of the industry and the economy. Now that insurgents like Washington Mutual, Countrywide, Lehman Brothers and Bear Stearns & Co. and many others have disappeared, the banking industry is more concentrated than any time during the past century, both financially and in terms of the industry’s icy grip on political power.

One of the themes that motivated the “Move your Money” effort was the image of James Stewart as head of the mutual Building & Loan, who fought to keep his bank open in the Frank Capra film “It’s a Wonderful Life.” His nemesis was Potter played memorably by Lionel Barrymore, the head of the big bank that sought to take over the Building & Loan and thereby gain a monopoly position in the allegorical American town.

But given the state of the U.S. economy and the fact that almost 15% of the banks in the U.S. are considered “troubled” by the FDIC, perhaps we should reconsider this interpretation of the film’s apparent story line. Feldkamp notes that from the Great Depression of the 1930s and again in the 1980s real estate bust, the government played an important role in restructuring the banking industry — and never more so than today.

Look at the just announced settlement between Fannie and Freddie and Bank of America, where the government-sponsored enterprises (GSEs) now controlled by the Obama Administration are providing what appears to be a huge subsidy to Bank of America to the tune of tens of billions of dollars. If you look at the most recent quarterly earnings disclosure to the SEC from Bank of America on future losses from the GSEs, then look at today’s settlement with the GSEs, which was approved by the Geithner Treasury, and it is hard not to conclude that the settlement was a gift.

- The losses hitting Fannie and Freddie will be borne by the American taxpayer and not the bond holders of Bank of America. The single digit billions BofA paid to Fannie and Freddie is less than a quarter of my firm’s estimate of such losses prior to the announcement. And our estimates were by no means the highest.

- How can bankers like JPMorgan Chase CEO Jaime Dimon, who settled his own tab with Fannie and Freddie on equally attractive terms last year, complain about Barack Obama when the supposedly liberal President is so generous with public subsidies for the zombie banks?

The truth of the matter is that the federal government, through agencies like Fannie, Freddie, the Federal Home Loan Banks and the FDIC, have been calling the shots in the banking industry since the 1930s.

While American banks have, from time to time, shown a certain degree of independence, this in the form of speculative lawlessness known as “innovation,” all lenders in the U.S. are ultimately appendages of Washington.

- The degree of government support for the financial markets has never been greater in the history of the American republic and the largest players in the industry thereby exercise enormous political power.

This is why calls from observers as disparate as Kansas City Fed President Thomas Hoenig, Vermont Senator Bernard Sanders and Dallas Fed President Richard Fisher to break up the largest banks are entirely on target.

Continue reading at Reuters...

---

Recent Reuters posts from Whalen...

Everything that Americans should ask about home mortgages

http://blogs.reuters.com/christopher-whalen/2010/10/20/everything-that-americans-once-knew-about-home-mortgages-but-should-ask/

---

Triple threat: Fannie, Freddie, and the triumph of the corporate state

http://blogs.reuters.com/christopher-whalen/2010/10/27/triple-threat-fannie-freddie-and-the-triumph-of-the-corporate-state/

---

Bernanke's Disclosure Bombshell - The FED Took Equities As Collateral During Crisis

http://dailybail.com/home/bernankes-disclosure-bombshell-the-fed-took-equities-as-coll.html

---

Will 2011 mark the return of market risk, and the IMF?

http://blogs.reuters.com/christopher-whalen/2010/12/15/will-2011-mark-the-return-of-market-risk-and-the-imf/

---

Memo to Obama: time to break the refinance strike by the big banks

http://blogs.reuters.com/christopher-whalen/2010/08/31/memo-to-obama-time-to-break-the-refinance-strike-by-the-big-banks/

---

Related stories on Fed Governor Richard Fisher...

---

Here's a similar story we covered on Monday...

---

Move your money...

http://moveyourmoneyproject.org/find-a-bank

---

Video - Bank Run

For Bank Of America, It’s A Wonderful Life In 2011

---

Blame it on TurboTax - A clip of Geithner playing the fool...

Congressional Video - Geithner explains why he "accidentally" missed paying taxes on his income from the IMF.

---

The ballad of Timothy Geithner...

She's an accountant from Nashville. This is excellent...

Song - Lady Sings The Blues annihilates Geithner...

---

And the best for last...

Video - Jim Rogers on Tim Geithner's failures...

- "Mr. Geithner's been bombing for 15 years. Mr. Geithner casused this problem. You know Mr. Geithner has been head of the New York Fed for several years. That was the office that was supposed to be supervising Wall Street and the banking system. He caused the problem, and then all last year he came up with TARP. He came up with all these absurd bailouts. Listen Mr. Geithner has never known what he's doing. He doesn't know what he's doing now and pretty soon everybody's gonna find out, including mr. Obama."

Must Read - Geithner was an 'utter failure' at the IMF...

---

« Dylan Ratigan With Rep. Marcy Kaptur: MERS Whitewash & Fraudclosure Cover-Up »

Editor's Note: A repost from last month in honor of this decision by the Massachusetts Supreme Court.

---

Video - Ratigan with Rep. Marcy Kaptur (D-OH) yesterday.

Efforts are underway within House committees to make MERS the industry standard for mortgage securitization, and to create legislation that will absolve all foreclosure fraud sins. This is a must see.

Story background:

---

« MERS SHOWDOWN: Banks' legal right to foreclose is questioned in testimony before House panel »

The system of pooling and selling mortgages around the world has caused widespread confusion about who owns the loans and raises questions about whether banks in some cases have the legal standing to foreclose, a state judge and consumer attorneys testified before Congress on Thursday.

New York State Supreme Court Justice Dana Winslow said that "standing has become such a pervasive issue" in the cases he sees "that I frequently use the term 'presumptive mortgagee' " to describe the entity trying to foreclose.

Winslow, academics and attorneys defending homeowners described a fundamental problem that goes beyond recent revelations of shoddy paperwork and "robo-signing" in foreclosure cases. They said there is a much broader question about the legality of designating a single company, Mortgage Electronic Registration Systems (MERS), as the holder of mortgages and then trading these loans to investors around the world without updating the ownership documents in local clerk offices.

They said it is unclear whether using this system has stripped those investors of the right to foreclose on homeowners who miss their payments.

University of Utah law professor Christopher L. Peterson said MERS has a "problematic legal foundation" because it undermines state recording laws. Peterson called MERS a "deceptive" and "anti-democratic" institution because it also uses thousands of employees who work for mortgage lenders, servicers and law firms to sign mortgage paperwork in the name of MERS. That practice is also clouding the ownership of the loan, he argued.

"How is a homeowner to understand with whom they can negotiate a settlement, or from whom to obtain additional information, or how to distinguish a legitimate employee from the thousands of mortgage-related con artists and charlatans?" Peterson asked.

Continue reading at the Washington Post...

---

Video - Alan Grayson on the foreclosure fraud games that banks play...

After Foreclosure, a Focus on Title Insurance

This moment is often profoundly irritating, mysterious and rushed — just like so much of the home-buying process. Lenders require buyers to have title insurance, but buyers are often not sure who picked the insurance company. And the buyers are so exhausted by the gantlet they’ve already run that they’re not interested in spending any time learning more about the policies and shopping around for a better one.

Besides, does anyone actually know people who have had to collect on title insurance? It ultimately feels like a tax — an extortionate one at that — and not a protective measure.

But all of the sudden, the importance of title insurance is becoming crystal-clear. In recent weeks, big lenders like GMAC Mortgage, JPMorgan Chase and Bank of America have halted many or all of their foreclosure proceedings in the wake of allegations of sloppiness, shortcuts or worse. And a potential nightmare situation has emerged that has spooked not only homeowners but lawyers, title insurance companies and their investors.

What would happen if scores of people who had lost their homes to foreclosure somehow persuaded a judge to overturn the proceedings? Could they somehow win back the rights to their homes, free and clear of any mortgage? But they may not be able to simply move back into their home at that point. Banks, after all, have turned around and sold some of those foreclosed homes to nice young families reaching out for a bit of the American dream. Would they simply be put out on the street? And then what?

The answer to that last question may depend on whether those new homeowners have title insurance, because people who buy a home without a mortgage can choose to go without a policy.

Title insurance covers you in case people turn up months or years after you buy your home saying that they, in fact, are the rightful owners of the house or the land, or at least had a stake in the transaction. (The insurance may cover you in other instances as well, relating to easements and other matters, but we’ll leave those aside for now.)

The insurance companies or their agents begin any transaction by running a title search, sifting through government filings related to the property. They do this before you buy a home or refinance your mortgage to help sort out any problems ahead of time and to reduce the risk of your filing a claim later.

But sometimes they miss things, and new issues can arise later.

For instance, the person doing the title search may not notice that a home equity loan is still outstanding or that a contracting firm filed a lien against the owner years ago. That could create problems for you later, when you try to sell the home.

Then there are the psychodramas that can ensue. The previous owner’s long-lost heirs or a previously unknown love child could show up, saying that they never agreed to the sale of the property. Or perhaps there was fraud against a seller who was elderly or had a mental disability, or forgery of an estranged spouse’s signature. It’s rare, but it happens, and when it does, your title insurance company is supposed to provide legal counsel or settle with whomever is making a claim.

Title insurance companies would like you believe that they are the good guys standing behind you. After all, you are the customer who owns the policy.

In fact, many of the title insurance companies are more concerned about the real estate agents, lawyers and lenders who can steer business their way. The title insurance companies are well aware that most people do not shop around for title insurance, even though it’s possible to do so — say through a Web site like entitledirect.com.

While the title insurers are not supposed to kick back money directly to companies or brokers that send business their way, various government investigations over the years have turned up all sorts of cozy dealings that make you shake your head in disgust.

But since you have to buy the insurance if you need a mortgage, there is not much you can do except hold your nose.

That’s what John Kovalick did in January when he bought a foreclosed house in Deltona, Fla., for $102,000 from Deutsche Bank. But in recent weeks, he’s seen the headlines about other banks halting foreclosures and wondered whether something might have gone wrong with the foreclosure on his new house. A spokesman for Deutsche Bank declined comment.

Mr. Kovalick is not the only one pondering what could go wrong. While the banks were pressing the pause button on many foreclosures, some title insurers were growing concerned as well.

On Oct. 1, Old Republic National Title Insurance Company released a notice forbidding any agents or employees to issue new policies on homes that had been recently foreclosed by GMAC Mortgage or Chase.

Clearly, the title insurer was also worried about a situation in which untold numbers of former homeowners have their foreclosures overturned. At that point, those individuals might claim the right to take back their old homes, but they’d also be responsible for, say, a $400,000 loan on a home that is worth half that.

- 1

- 2

Is the Next Great Awakening at Hand?

The First Great Awakening led after many years to the American and Jeffersonian Revolutions.

The Second Great Awakening led, after many years, to the Civil War and Abolition.

The Third Great Awakening led, after setbacks, to the Populist and then Progressive Movements.

The Fourth Great Awakening led to the New Deal.

The Fifth Great Awakening led to the second Reconstruction, the Great Society, Feminism, and social upheavals.

Is The Sixth Great Awakening now due? What quarter will it come from? Read Mason Gaffney’s extraordinary history and predictions.

Subscribe now! If you find our site useful please: Click here to make a donation. CounterPunch books and t-shirts make great presents. Order CounterPunch By Email For Only $35 a Year!

AMICUS BRIEF FILED FOR LANDMARK MASSACHUSETTES CASES IBANEZ & LaRACE EXPOSES FORECLOSURE FRAUD

BREAKING NEWS: AFFIRMED MASSIVE VICTORY RULING FOR HOMEOWNERS “IBANEZ, LaRACE”

I have personally read this Amicus Brief and seen the exhibits and this is Explosive!!

This is a must read for any defense attorney and judges!

“Marie,

This is without question the most important decision so far in the war against the unlawful and fraudulent conduct of the originators, securitizers, out-source-providers, default servicers, and their so-called lawyers! The Judge articulates the business models we are dealing with better than anyone has done in any opinion, article or brief. I am sure your work contributed greatly to the education of the court and for that you should be highly commended. This Judge really and truly got it! It is the perfect outline of the transactional requirements and debunks every bogus argument that the other side has been advancing for year”.

O. MAX GARNDER III-

Dear Damian,

I have attached a sampling from my Amicus Brief filed on Friday, October 1, 2010 with the Massachusetts Supreme Judicial Court in the landmark cases that are presently on appeal from the Massachusetts Land Court styled: U.S. Bank v. Ibanez and its companion case, Wells Fargo Bank v. LaRace.

My brief reveals groundbreaking evidence that Antonio Ibanez’s loan was most likely securitized twice – a hidden fact unknown until now.

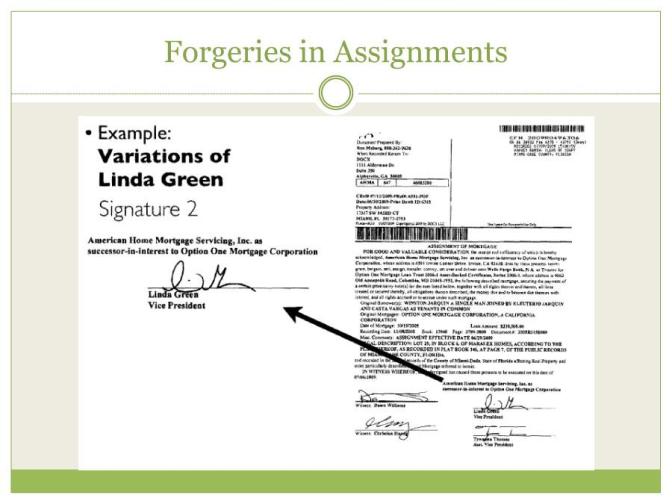

Moreover, the Assignment of Mortgage allegedly conveying the Ibanez loan to U.S. Bank, executed by “robo-signer” Linda Green, violated the Pooling and Servicing Agreement and other Trust documents.

Finally I expose the fact that U.S. Bank, who bought the Ibanez property at foreclosure for $94,350, sold it on December 15, 2008 for $0.00. That’s right, they foreclosed on Ibanez’s property so that they could give it away!

With respect to Mark and Tammy LaRace, I am happy to report that through the efforts of Attorney Glenn F. Russell, Jr. and myself, the LaRaces moved back into their home in January of this year, two and a half years post-foreclosure!

My Amicus Brief reveals that Wells Fargo Bank’s own documents prove that they did not have the authority to foreclose on the LaRaces. Therefore, the Assignment of Mortgage, Power of Attorney, Affidavit, and Foreclosure Deed executed by “robo-signer” Cindi Ellis were all unauthorized.

Wells Fargo Bank’s recent statement that it does not have the same “document” problem that GMAC, JPMorgan Chase, and Bank of America have admitted to is simply not true. I have audited many, many foreclosure files where Wells Fargo Bank employees and their agents have manufactured false documents to prosecute wrongful foreclosures such as in the LaRaces’ case.

Massive Silver Withdrawals From The Comex

It could prove to be a watershed event, or at least an interesting scandal to observe as it unfolds.

Harvery Organ's commentary:"And now for the big silver report.We witnessed a massive withdrawal of silver unprecedented in the history of the comex. First there was a smallish 6507 oz of silver deposited to two customers, one being 497 oz and the other 6010 oz). But just look at the huge withdrawals:

Four customers (not dealers) withdrew a total of 1,019,310 oz from the comex vaults. This is real silver leaving from 4 registered vaults. The individual withdrawals are: 579,081, 30,380, 399,994 and 9855 oz.

The dealer (our bankers) also were involved in the withdrawal of silver to the tune of 769,941 oz (there were 2 dealers involved removing 102,866 and 667,875 ozs). When you see this massive drain of silver, the fire is raging. The total silver withdrawal by both dealer and customer totalled an astronomical 1,789,251. The Brink's trucks must have been very busy yesterday.

The comex folk notified us that an amazing 85 notices were sent down for servicing for a total of 425,000 oz of silver. The total number of silver notices sent down so far total 323 or 1,615,000 oz. To obtain what is left to be served, I take the open interest for January at 153 and subtract 85 deliveries leaving a total of 68 notices or 340,000 oz left to be serviced.

Thus the total number of silver ounces standing in this non delivery month of January is as follows:

1,615,000 oz + 340,000 = 1,955,000 oz (Thursday total = 1,625,000). As promised to you, this number is rising and will continue to rise until the end of the month as our banker cartel scrambles to get any morsel of silver to satisfy the massive demand for this metal. Our bankers are stunned to see such a huge amount of silver options in a traditionally slow month.

I hope everyone caught the Eric Sprott story on Kingworld news that he is having trouble locating silver."

White House Braces for Savage Cuts

|

| Image: Chip Somodevilla/Getty |

Guardian

Dick Armey's black, lizard-skin cowboy boots lay on the floor while he relaxed on the couch in stockinged feet. The former Texas congressman was in a jovial mood in his office just off the Washington Mall – and for good reason. He may no longer be a politician but as chairman of FreedomWorks, one of the main forces behind the conservative Tea Party movement, he is once more a major player in the new Washington DC.

"My wife likes the terminology of a 'paradigm shift'," he said in a western drawl. "And I like to agree with that. It is a paradigm shift. It's a phenomenon."

Democrats might not agree, but it is hard to argue the Congress sworn in last week – now with a Republican-dominated House of Representatives – has not made Washington a very different place from the "New Camelot" hailed by the media when Barack Obama was inaugurated in 2009.

The new influx of GOP politicians that has swaggered into the American capital, represents a massive change in political culture. A staggering 87 new Republican congressmen and six new Republican senators have landed on the banks of the Potomac river.

But it is not just the numbers; it is the way they were elected. The 2010 midterm elections, which sank the Democrats, were propelled by the energy of the right-wing Tea Party movement. Many of those new Republicans are Tea Partiers themselves or beholden to its activists and their conservative agenda.

That's why people such as Armey will shape the new face of the capital. To its critics, FreedomWorks is a corporate-backed front group exploiting the Tea Party. To its fans, it helps to co-ordinate and focus an outpouring of anti-government rage and desire for personal liberty the like of which have not been seen for a generation. Either way, Armey's cheerfulness seems justified given the sudden change of fortunes between Republicans and Democrats.

Read Full Article

Food Stamp Usage Hits New High Of 43.2 Million

Ever wonder where all the money for equity inflows came from? Here's the answer: with all the money saved from participating in the Supplemental Nutrition Assistance Program, better known as foodstamps, which in October hit a brand new record, 43.2 million Americans decided to join in on this "wealth effect" they had been hearing so much about and buy Apple stock. After all 190 hedge funds are doing it: and there is no way that 190 hedge funds can possibly be wrong. As a result, the chart below shows our nation's pending wealth effect in its full glory. Just think: 43.2 millionaire in waiting. Just consider the guaranteed explosion to money velocity...

h/t john lohman