Source: The Economic Collapse blog

If the economy is improving, then why aren't things getting better for most average Americans? They

tell us that the unemployment rate is going down, but the percentage

of Americans that are actually working is exactly the same it was three

years ago. They tell us that American families are in better

financial shape now, but real disposable income is falling rapidly.

They tell us that inflation is low, but every time we go shopping at

the grocery store the prices just seem to keep going up. They tell us

that the economic crisis is over, and yet poverty and government

dependence continue to explode to unprecedented heights. There seems to be a disconnect between what the government and the media are telling us and what is actually true.

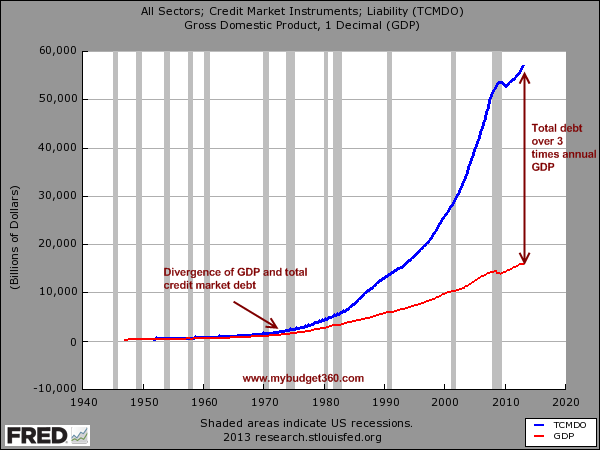

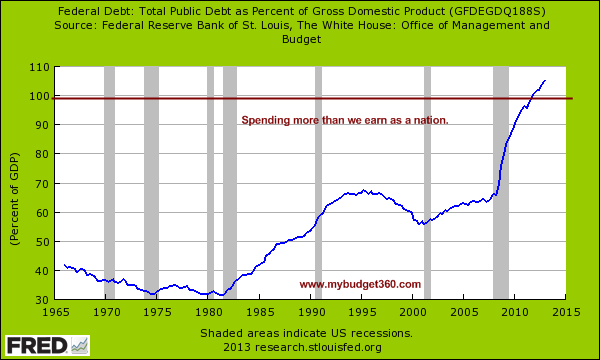

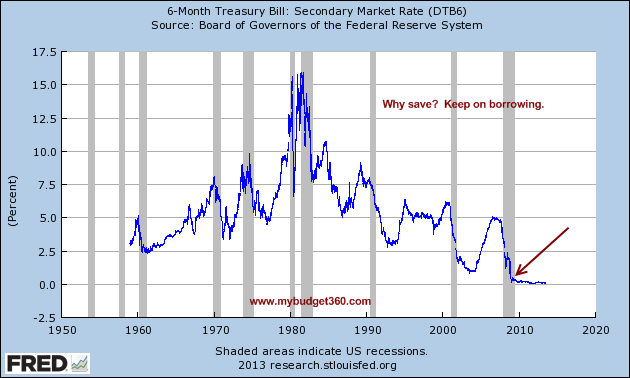

With each passing day the debt of the federal government grows larger,

the financial world become even more unstable and more American

families fall out of the middle class. The same long-term economic

trends that have been eating away at our economy like cancer for decades

continue to ruthlessly attack the foundations of our economic system.

We are rapidly speeding toward an economic cataclysm, and yet

the government and most of the media make it sound like happy days are

here again. The American people deserve better than this.

The American people deserve the truth. The following are 36 hard

questions about the U.S. economy that the mainstream media should be

asking...

#1 If the percentage of working age Americans that have a job is

exactly the same

as it was three years ago, then why is the government telling us that

the "unemployment rate" has gone down significantly during that time?

#2 Why are some U.S. companies allowed to exploit disabled workers by paying them as little as

22 cents an hour?

#3 Why are some private prisons allowed to pay their prisoners

just a dollar a day to do jobs that other Americans could be doing?

#4 Why is real disposable income in the United States falling at the fastest rate that we have seen

since 2008?

#5 Why do

53 percent of all American workers make less than $30,000 a year?

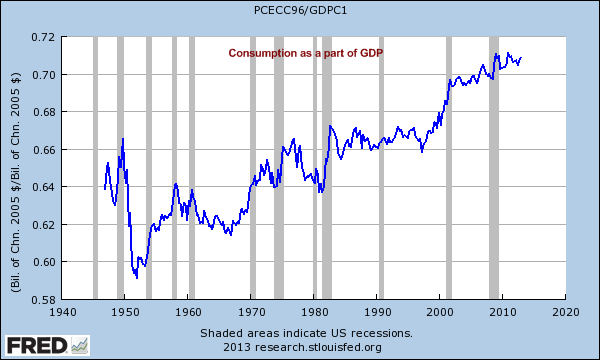

#6 Why are wages as a percentage of GDP

at an all-time low?

#7 Why are

76 percent of all Americans living paycheck to paycheck?

#8 Why are

so many large corporations

issuing negative earnings guidance for this quarter? Does this

indicate that the economy is about to experience a significant downturn?

#9 Why is job growth at small businesses

at about half the level it was at when the year started?

#10 Why are central banks selling off

record amounts of U.S. debt right now?

#11 Why did U.S. mortgage bonds just suffer their

biggest quarterly decline in nearly 20 years?

#12 Why did we just witness the largest weekly increase in mortgage rates

in 26 years?

#13 Why has the number of mortgage applications fallen

by 29 percent over the last eight weeks?

#14 Why has the number of mortgage applications fallen to the lowest level

in 19 months?

#15 If the U.S. economy is recovering, why is the mortgage delinquency rate in the United States still

nearly 10 percent?

#16 Why did the student loan delinquency rate in the United States just hit a

brand new all-time high?

#17 Why is the sale of hundreds of millions of dollars of municipal bonds

being postponed?

#18 What are the central banks of the world going to do when the

441 trillion dollar interest rate derivatives bubble starts to burst?

#19 Why is Barack Obama

secretly negotiating

a new international free trade agreement that will impose very strict

Internet copyright rules on all of us, ban all "Buy American" laws,

give Wall Street banks much more freedom to trade risky derivatives and

force even more domestic manufacturing offshore?

#20 Why don't our politicians seem to care that the United States has run a trade deficit of

more than 8 trillion dollars with the rest of the world since 1975?

#21

Why doesn't the mainstream media talk about how rapidly the U.S.

economy is declining relative to the rest of the planet? According to

the World Bank, U.S. GDP accounted for

31.8 percent of all global economic activity in 2001. That number dropped to

21.6 percent in 2011.

#22 Why is the percentage of self-employed Americans

at a record low?

#23 What are we going to do if dust bowl conditions

continue to return to the western half of the United States? If the drought continues to get even worse, what will that do to our agriculture?

#24 Why is the IRS spending thousands of taxpayer dollars on

kazoos, stove top hats, bathtub toy boats and plush animals?

#25 Why did the NIH spend

$253,800 "to study ways to educate Boston’s male prostitutes on safe-sex practices"?

#26 Why do some of the largest charities in America spend

less than 5 percent of the money that they bring in on actual charitable work?

#27 Now that EU finance ministers have approved a plan that will allow

Cyprus-style wealth confiscation

as part of all future bank bailouts in Europe, is it only a matter of

time before we see something similar in the United States?

#28 Why does approximately

one out of every three children in the United States live in a home without a father?

#29 Why are

more than a million public school students in the United States homeless?

#30 Why are so many cities all over the United States

passing laws that make it illegal to feed the homeless?

#31 Why is government dependence in the U.S.

at an all-time high if the economy is getting better? Back in 1960, the ratio of social welfare benefits to salaries and wages was approximately

10 percent. In the year 2000, the ratio of social welfare benefits to salaries and wages was approximately

21 percent. Today, the ratio of social welfare benefits to salaries and wages is approximately

35 percent.

#32 Why does the number of Americans on food stamps exceed

the entire population of the nation of Spain?

#33

The number of Americans on food stamps has grown from 32 million to 47

million while Barack Obama has been occupying the White House. So why

is Obama

paying recruiters to go out and get even more Americans to join the program?

#34 Today, there are 56 million Americans collecting Social Security benefits. In 2035, there will be

91 million Americans collecting Social Security benefits. Where in the world will we get the money for that?

#35 Why has the value of the U.S. dollar fallen by

over 95 percent since the Federal Reserve was created back in 1913?

#36 Why has the size of the U.S. national debt gotten

more than 5000 times larger since the Federal Reserve was created back in 1913?

SHTF Plan – by Mac Slavo

SHTF Plan – by Mac Slavo