Monday, May 10, 2010

Fed Set to Go Nuke to Help Bailout Europe

Further details on these arrangements will be available shortly. It appears, though, that for all practical purposes, the Fed has agreed to bailout the world. Essentially, foreign central banks will print up any amount of money they want in their currency and the Fed will print up an equal amount of dollars that they will then loan to the foreign central banks who will then loan the funds to the banksters who will use as collateral the securities of the PIIGs, to gain the dollars.

Needless to say this is complete and utter madness. It is extremely inflationary on a global scale.What's more, outside of banksters, no one in America will benefit from this move. Every one in America will suffer from the ultimate inflationary consequences.

The size of these swaps must be watched very closely. It does not appear that these funds will be stored as excess reserves. This means they will be out in the system. Every $100 billion added to the system in this manner (unless somehow sterilized by money drains elsewhere) will mean an immediate increase of 1.16% in M2 money supply. But this $100 billion would be high powered money. This means the final impact would be a multiple of the initial Fed money creation.

Given that the U.S. financial situation is delicate, and the Fed is likley to be called on to bailout the Treasury Department within a short-time, for the U.S. to be a major player in the bailout of Europe is sheer madness. It's the taller drunk holding up the shorter, eventually they will both collapse.

Bottom line: The Federal Reserve bank is on the edge of pushing the financial nuclear button, and print money in reckless abandon. Even if this were done for Americans it would be a terrible policy, but to do this for foreigners, where there would be little benefit for Americans reflects the extraordinary madness of the elite bankers.

Gulf of Mexico Oil Spill Observed From the International Space Station

On April 20, 2010, the oil rig Deepwater Horizon suffered an explosion and sank two days later. Shortly thereafter, oil began leaking into the Gulf of Mexico from ruptured pipes deep on the ocean floor. NASA satellites have been tracking the growth of the oil spill as it has spread towards the northern Gulf Coast. This detailed astronaut photograph from May 4 provides a different viewing perspective on the ongoing event. The image is oblique, meaning that it was taken from a sideways viewing angle from the International Space Station (ISS), rather than from a “straight down” (or nadir) view, which is typical of automated satellite sensors. The view in this image is towards the west; the ISS was located over the eastern edge of the Gulf of Mexico when the image was taken.

The Mississippi River Delta and nearby Louisiana coast (image top) appear dark in the sunglint that illuminates most of the image. Sunglint is caused by sunlight reflecting off the water surface—much like a mirror—directly back towards the astronaut observer on the Space Station. The sunglint improves the identification of the oil spill. Oil on the water smoothes the surface texture, and the mirror-like reflection of the Sun accentuates the difference between the smooth, oil-covered water (dark to light gray ) and the rougher water of the reflective ocean surface (colored silver to white). Wind and water currents patterns have modified the oil spill’s original shape into streamers and elongated masses. Among the coastal ecosystems threatened by the spill are the Chandeleur Islands (image right center).

Other features visible in the image include a solid field of low cloud cover at the lower left corner of the image. V-shaped ship or boat wakes are visible in the large image. Wave patterns at image lower right are most likely caused by tidal effects.

DEBORCHGRAVE: Stock market time bomb?

Even the world's most savvy stock-market giants (e.g., Warren E. Buffett) have warned over the past decade that derivatives are the fiscal equivalent of a weapon of mass destruction (WMD) - potentially lethal. And the consequences of such an explosion would make the recent global financial and economic crisis seem like penny ante. But generously lubricated lobbyists for the unrestricted, unsupervised derivatives markets tell congressional committees and government regulators to butt out.

While banks all over the world were imploding and some $50 trillion vanished in global stock markets, the derivatives market grew by an estimated 65 percent, according the Bank for International Settlements. BIS convenes the world's 57 most powerful central bankers in Basel, Switzerland, for periodic secret meetings. Occasionally, they issue a cry of alarm. This time, derivatives had soared from $414.8 trillion at the end of 2006 to $683.7 trillion in mid-2008 - 18 months' time.

The derivatives market is now estimated at $700 trillion (notional, or face, value, not market value). The world's gross domestic product in 2009: $69.8 trillion; America's, $14.2 trillion. The total market cap of all major global stock markets? A mere $30 trillion. And the total amount of dollar bills in circulation, most of them abroad: $830 billion (not trillion).

One of the Middle East's most powerful bankers conceded recently that even after listening to experts explain the drill, he still does not understand derivatives and therefore doesn't trust them and won't have anything to do with them. And when that weapon of mass destruction explodes, he explained, "Our bank's customers, from all over the world, will be saved from the disaster."

What's so difficult to understand about derivatives? Essentially, they are bets for or against the house - red or black at the roulette wheel. Or betting for or against the weather in situations in which the weather is critical (e.g., vineyards). Forwards, futures, options and swaps form the panoply of derivatives. Credit derivatives are based on loans, bonds or other forms of credit. Over-the-counter (OTC) derivatives are contracts that are traded and privately negotiated directly between two parties, outside of a regular exchange.

All of this is unregulated. What happens between two parties - notably hedge funds - is like what happens between two individuals who bet on the final score of a football or baseball game. Congressional committees have been warned time and again about "ticking time bombs" and "financial weapons of mass destruction" - to no avail, demonstrating that both the U.S. government and the U.S. Congress are dysfunctional. The need for constitutional reform comes up frequently in Washington think-tank discussions, only to end with the observation that Democrats and Republicans would never agree on anything that momentous.

On May 16, 2006, for example, Richard T. McCormack, vice chairman of Bank of America's Merrill Lynch and former undersecretary of state for economic and agricultural affairs, told a Senate Banking hearing on derivatives and hedge funds in 2006, when the derivatives industry was in the $300 trillion range, "the increasing internationalization of finance and investment suggests the need for an ever-more-global approach to monitoring potentially dangerous problems."

Derivatives played a key role in camouflaging the multibillion-dollar Enron scam in 2001. Similarly, the Long-Term Capital Management (LTCM) hedge fund debacle of 1998 almost slayed the global monetary system. Yet its trading losses was a mere $5 billion. But this derivative-driven collapse seriously threatened the soundness of financial markets.

When the Russian ruble suddenly nose-dived without warning, LTCM found itself exposed with more than $1 trillion in foreign-exchange derivatives. It couldn't pay. The New York Federal Reserve Bank organized a consortium of companies (Bear Stearns, Merrill Lynch, Lehman Brothers) to buy out LTCM and cover its debts. LTCM shareholders were wiped out, but none of the creditors took losses. LTCM was a hedge fund with just 200 employees, but without the New York Fed's intervention, it would have caused a crash felt around the world.

Mr. McCormack pleaded with congressional banking experts to correct any structural or technical problems that could increase the likelihood of systemic risk in the event of future shock to the financial system, such as the Russian default (i.e., debacle) in 1998. No response.

On Feb. 28, 2006, when he was president of the New York Federal Reserve Bank, Treasury Secretary Timothy F. Geithner outlined challenges to financial stability posed by derivatives. No response.

The 2007 U.S. subprime mortgage global disaster was also derivatives-driven - and provoked the biggest financial and economic disaster since the Great Depression.

Mr. McCormack, then a senior fellow at the Center for Strategic and International Studies, explained to the Banking Committee how Italy had secured entrance into the euro by purchasing exotic derivatives that "obscured the true financial condition of the country until after they were admitted" to the new European common currency. No reaction.

The same thing happened with Japan when some banks "purchased derivative instruments, which disguised the actual catastrophic state of their balance sheets at the time." No action.

Today's massive new derivatives bubble is driving the domestic and global economies, far outstripping the subprime-credit meltdown.

Hopefully not belatedly, Congress is considering legislation to curb the use of derivatives and other methods that artificially boost returns. But 13 members of Congress or their wives used derivatives to magnify their daily moves. And one measure proposed by Sen. Blanche Lincoln, Arkansas Democrat, would bar banks from trading in derivatives. This, in turn, would push almost $300 trillion beyond the reach of regulators. Derivatives would become still more opaque. Some say abolish derivatives trading in the U.S. and push it offshore.

The now-bloody Greek tragedy over its debt crisis is echoing through the Federal Reserve and the halls of Congress. Greece's public debt exceeds 100 percent of its economy versus 90 percent (at $13 trillion) for the United States. If you add unfunded U.S. liabilities for Social Security, Medicare and Medicaid, the long-term shortfall is $62 trillion, or about $200,000 for each American. At least that's the estimate of the Peter G. Peterson Foundation. And Peter Peterson himself says he's now in the business of promoting awareness about public borrowing.

With probable trader error plunging the Dow Jones into a 1,000-point tailspin and back up in 16 minutes, economic and financial prognostication made astrology look respectable. Could Greece be a harbinger of ugly things to come for the rest of the world? Prominent investor Marc Faber, hedge fund manager Jim Chanos and Harvard's Kenneth Rogoff told Bloomberg China's economy will slow and possibly "crash" within a year as the nation's property bubble is set to burst.

Arnaud de Borchgrave is editor-at-large of The Washington Times and of United Press International.

EU in monster eurozone aid deal, euro surges

As the official announcement came through, the euro surged to 1.2907 dollars in Asian trade, up from 1.2755 dollars in New York late on Friday.

The fund would be made up of 440 billion euros from eurozone countries and another 60 billion euros of loan funds coming from the European Commission, with another 250-billion-euro facility added into the mix by the IMF.

Salgado and EU economic and monetary affairs commissioner Olli Rehn had initially said that IMF input would be of the order of 220 billion, but later said that the Washington lender would add half as much again as Europe.

The IMF's executive board approved a record 30-billion-euro loan Sunday for Greece, whose debt woes have shaken global financial markets.

The monster bailout "proves that we shall defend the euro whatever it takes," the European Union's commissioner for economic and monetary affairs, Olli Rehn, told a press conference after 11 hours of marathon Brussels talks.

The European Central Bank will also implement exceptional measures in support of a monster euro bailout package, Rehn said.

Japanese share prices also opened slightly higher, with the benchmark Nikkei-225 index gaining 34.46 points, or 0.33 percent, to 10,399.05 in the first minutes of trading.http://www.telegraph.co.uk/news/worldnews/europe/eu/7703034/Taxpayers-face-13-billion-bailout-after-Alistair-Darling-caves-in.html

Taxpayers face £13 billion bailout after Alistair Darling caves in

Alistair Darling has caved in to a demand that British taxpayers underwrite at least £13 billion of debt held by other European governments as EU finance ministers agreed an even bigger bail-out for the euro.

2:05AM BST 10 May 2010

The Chancellor, representing Britain until a new government is formed, was forced to participate in a £95billion "stabilisation mechanism" aimed helping European Union countries that face a debt crisis.

The decision followed a crisis meeting in Brussels to discuss the financial turmoil that has raised doubts about the future of the euro.

It exposes the British taxpayer to £9.6 - £13 billion in liabilities should Spain or Portugal go the way of Greece.

Mr Darling had no choice but to surrender because the decision was taken under a Lisbon Treaty "exceptional occurrences" clause that stripped Britain of its veto.

"I think it’s important that we do everything we can to stabilise the markets to show we’re coming through what is a difficult period," he said.

Britain last night succeeded in staying out of an even larger fund solely for the 13 countries using the euro.

The EU agreed a £624 billion rescue package of bilateral “special purpose vehicle” loans for the 16 euro zone states struggling to finance their debts.

As well as the loans, an extra £52 billion (€60bn) of new cash for a “stabilisation mechanism” will be raised by allowing the European Commission to use the EU budget as collateral on international debt markets.

Britain escaped being sucked into the wider bailout loans but was forced to underwrite the “stabilisation mechanism” which, added to an existing “facility” of £43 billion, makes British taxpayers liable for £13 billion of a new £95 billion (€110bn) fund.

Already indebted euro zone states will be on standby with £382 billion (€440bn) of loans, which will be topped up by an IMF contribution of £191 (€220bn).

As the official announcement came through, the euro surged in Asian trade having risen even in volatile early morning Asia-Pacific trade, hitting 1.2884 dollars in Tokyo, up from 1.2755 dollars in New York late on Friday.

Olli Rehn, the EU's monetary affairs commissioner, said the EU deal "proved that we shall defend the euro whatever it takes".

The measures were rushed through over the weekend to be in place when the markets open today. Yesterday President Barack Obama urged EU leaders to restore confidence in their economies.

European stock markets and the euro have fallen and government bond yields have jumped as investors fear that the large deficits run up by some EU countries will cripple economic growth.

Anders Borg, the Swedish finance minister, warned that the markets could fall even further. He said: "We now see wolf pack behaviours, and if we will not stop these packs they will tear the weaker countries apart."

The £95billion "balance of payments facility" will underwrite loans taken out by vulnerable states and will be supported by all 27 EU members. The European Commission has also tabled a proposal for a fund where states with strong credit ratings would underwrite loans taken out by struggling eurozone members.

Mr Darling said Britain would not provide support for the single currency, but Sweden, another influential non-euro country, called that stance into question, saying it would "not rule out" being part of the wider fund.

Separately, the European Central Bank is later expected to announce that it will buy up Spanish and Portuguese government bonds at premium rates even if they are junked by markets.

http://www.bloomberg.com/apps/news?pid=20601085&sid=ap50DW8IqhBo

EU Crafts $962 Billion Show of Force to Halt Crisis

The ECB will also embark on “very significant operations,” European Union Economic and Monetary Commissioner Olli Rehn told reporters in Brussels after the 14-hour meeting. “The ECB has taken a decision to intervene in the secondary markets of government securities.”

Under pressure from the U.S. and Asia to stabilize markets, the European governments gambled that the show of financial force would prevent a sovereign-debt crisis and muffle speculation that the 11-year-old euro might break apart.

Europe’s failure to contain Greece’s fiscal crisis triggered a 4.1 percent drop in the euro last week, the biggest weekly decline since the aftermath of Lehman Brothers Holdings Inc.’s collapse. It prompted President Barack Obama to call German Chancellor Angela Merkel and French President Nicolas Sarkozy yesterday to urge “resolute steps” in Europe to prevent the crisis from cascading around the world.

Under the loan package, euro-area governments pledged to make 440 billion euros available, with 60 billion euros more from the EU’s budget and as much as 250 billion euros from the International Monetary Fund, said Spanish Economy Minister Elena Salgado.

“We are placing considerable sums in the interests of stability in Europe,” Salgado told reporters after chairing the meeting.

EU approves rescue package for Europe

(CNN) -- Europe's finance ministers approved in an emergency meeting late Sunday a "stabilization mechanism" that could provide at least 440 billion euros (US $560 billion) for a crisis aid package aimed at ensuring financial stability across Europe.

The deal comes after a week of heavy stock market losses for some of the European Union's member states in the wake of a massive bailout for Greece's battered economy.

The ministers, meeting in Brussels, Belgium, sought to ease markets shaken by the Greek economic crisis before they re-opened Monday.

Under the deal announced early Monday, the International Monetary Fund could provide up to 220 billion euros (US $280 billion) to the crisis fund in addition to the EU's contribution of 440 billion euros, Spain's Finance Minister Elena Salgado said.

Another 60 billion euros (US $76 billion) would be available should member states experience "exceptional occurrences" beyond their control, Salgado said.

European Central Bank officials have tried to play down fears that the economic turmoil in Greece could spread to other heavily indebted European countries such as Spain, Portugal and Italy.

Spain saw three straight days of losses in its stock market last week after the country's credit rating was downgraded by the influential rating agency Standard & Poor's.

Olli Rehn, the European commissioner for economic and monetary policy, praised the deal early Monday, saying "the fiscal efforts of European Union member states, the financial assistance by the (European Commission) and member states, and the actions taken today by the (European Central Bank) proves that we shall defend the euro whatever it takes."

Did ‘they’ crash the markets to send a message to Congress?

In Conspiracy Fact or Theory news we ask our readers to consider the possibility that the 1000 point crash and subsequent recovery within a 30 minute time period was not a “fat finger” mistake, but rather, a clear message to our lawmakers that someone else, and not the American people, is in charge of America. This was a $1 trillion dollar move in stock markets, do you really buy that it was an accident as reported by the mainstream?

Watch the video below to get a basic understanding of the circumstances that may have been involved. This is not a lone theory and other analysts and financial commentators have similar views, as cited below.

What was the manipulation about?

We believe that it may have been a clear message sent to our elected officials, resulting in major changes to Ron Paul’s Audit the Fed bill, essentially gutting the provisions that we require transparency and disclosure about the Federal Reserve’s global monetary policy.

Ron Paul is not too happy about the changes:

Congressman Ron Paul (TX-14) expressed disappointment that his landmark legislation to audit the Federal Reserve Bank- which passed by a wide margin in the House Financial Services committee and has over 319 House co-sponsors- was threatened by a compromise in the Senate today.

More specifically, Paul’s language (passed by the House) to audit the Federal Reserve has been stripped from the Sanders Amendment to the Senate financial reform bill. Instead, the Sanders Amendment now contains softer compromise language that exempts monetary policy decisions, discount window operations, and agreements with foreign central banks from Government Accounting Office (“GAO”) audit.

So, the new amendment pretty much eliminates transparency where we actually need it.

All of this seems to have occurred AFTER the stock markets made their largest intra-day decline in history. The timing is nothing short of amazing, and we’d suggest that the two events (stock market crash and the subsequent stripping of the bill) or very much related.

The Fed is likely engaged in the largest Ponzi scheme of all time and we’re not talking mere billions like the Bernie Madoff scheme. We’re talking about tens of trillions of dollars across the entire globe shifting hands. Any truly transparent audit bill would threaten those in power, including beneficiaries of trillion dollar swap schemes and bailouts that include massive banking institutions, as well as whole nations.

The Theory: Why Congressional officials may have been blackmailed:

A hypothetical scenario, written by Zero Hedge contributor Cognitive Dissonance, gives us a look at what may have happened on Thursday. The names have been changed, as this is a fictional account:

John [TPTB REPRESENTATIVE]: “We were hoping you’d reconsider your position. Some of your political support is wavering and while the public might think a Fed audit is a good idea, that’s just populist poppycock and you know it. There are a lot of powerful people who’d like to see this problem go away. You might want to think twice before pissing them off.”

Howard [SENATOR WHO INTRODUCED AUDIT BILL IN SENATE]: “Cut the crap John, you’re not talking to some teary eyed freshman here. I’m fully aware of who and what I’m up against and I’m not backing down. You and your puppet masters have gone too far this time and while you might eventually gut me on this one, I’m willing to take that chance. There’s strong support in the House for Paul’s version and while things are still up in the air in the Senate, I’m certain with elections coming I can pull together a super majority to get this passed. Face it John, you’ve lost. Take that back to your people with love from me.”

John: “These are serious people we’re talking about Howard. People who’ll stop at nothing to see their interests furthered. You’ve seen some of their handy work yourself; you know what I’m talking about. Why can’t we compromise on this one? I’m sure we can find some language that will satisfy everyone with no need for blood to be shed.”

…

Without waiting for an answer John reaches across the desk and grabs Howard’s office phone, pulling it over to his side of the desk as he punches in a phone number. Howard notices that it’s well over 15 digits, indicating John is accessing a secure network. John looks up at the TV while waiting for the first ring and Howard, seeing John’s attention shift, does the same. It’s now 2:10 PM and the S&P is down 26. The CNBC repeaters are looking a bit frantic as well. Howard feels a cold chill run down his back. What’s going on here? He knows these people are powerful but is John about to do what Howard thinks he’s about to do?

[source: The Call – A Fictional Look at the 25 Minute Market Crash]

Did it happen like this?

Did The Powers That Be temporarily crash our stock markets as a way to show what they could do if Congress moved forward with the Audit the Fed Bill and the Brown/Kaufman amendment which would have required banks to follow strict guidelines to protect America from a systemic financial crash?

No, they wouldn’t do that - they wouldn’t crash markets or threaten us with martial law and tanks in the streets if they don’t get their way.

If TPTB did manufacture this crash, does anyone believe that they won’t go ahead and bring the system down when they are finished doing whatever it is they are up to? What if the eventual goal is just that - a complete destruction of the US dollar and the United States of America as we know it today?

Whoever these people were have no problem wiping out $1 Trillion in wealth in a single day. If it was your retirement account that got wiped out, do you think they would care that everything you’ve worked for your entire life was gone?

There are conglomerates of interested parties - business, political, personal - that will stop at nothing to achieve their goals. They’ll take everything you have, everything you’ve ever earned. They’ll collapse our economic system and change our political structure, even if it means wiping out millions of lives in the process. And, if necessary they’ll send you or your children to war to do their bidding.

This is serious business. You can feel free to cover your eyes and discount this as conspiracy, but what if….?

The Euro Is Screwed

On April 22, Eurostat, the statistical arm of the European Union, released figures on EU member states’ government deficits and debt for 2006-2009. The European Commission requires member states to report certain data every April.

The timing of the report’s release could not be more problematic for Greece, which has been in discussions with the IMF and other EU states over possible bailout assistance. In a note to the report, Eurostat expressed reservations about Greece’s accuracy in its numbers from last year, saying:

Eurostat is expressing a reservation on the quality of the data reported by Greece, due to uncertainties on the surplus of social security funds for 2009, on the classification of some public entities and on the recording of off-market swaps. Following completion of the investigations that Eurostat is undertaking on these issues in cooperation with the Greek Statistical Authorities, this could lead to a revision for the year 2009 of the order of 0.3 to 0.5 percentage points of GDP for the deficit and 5 to 7 percentage points of GDP for the debt. [emphasis mine]

If these “reservations” prove correct, it will catapult Greece into the debt-to-GDP leader at 122.1%, leap-frogging Italy, which is currently at 115.8%.

But perhaps most telling is the report’s title, “Euro area and EU27 government deficit at 6.3% and 6.8% of GDP, respectively.” Recall that the EU’s Stability and Growth Pact mandates a budget deficit ceiling of 3.0%, and we see that the 16 euro area members are, in aggregate, in gross violation of the pact. Even more alarming is the rate of change in the aggregate budget deficit figure from 2008 to 2009, growing 230%.

And lastly, the aggregate euro area debt-to-GDP ratio climbed from 66.0% in 2007 to 78.7% in 2009, a stunning rise. If this annual rate of growth continues, the euro area debt-to-GDP ratio will zoom past 100% in two years, a level at which many think it begins to exert significant strain on fiscal budgets and spending.

The report, on the whole, paints a picture of an experiment in currency sharing and cross-border “normalization” of fiscal order that has gone terribly wrong. The old saying that a camel is a horse designed by committee seems to be underway here. It will be amusing to watch into what sort of “animal” the EU morphs in the coming years.

As one would expect on reading news that is less than cheery for the eurozone, the U.S. dollar has been moving up, sending gold lower. So, perversely, you have gold and the euro moving together.

While the current rebound in the dollar may be discomfiting to some gold investors, especially in that gold has been facing headwinds again, in our scenario of a broad-based crisis in the global fiat currencies, the major currencies will come under pressure individually before coming under pressure collectively.

Today, safe-haven seekers reflexively run from the euro to the U.S. dollar, which in turn sends a signal to the trading community to sell gold for no better reason than the historical inverse connection between the dollar and gold. This is only temporary, as you can see in the following chart plotting the euro against gold over the last troubled year.

This is all just part and parcel of the secular trend that will lead to the end of the fiat currency experiment as the world wakes up to the full implications of the institutionalized monetary abuse engendered by a fiat system. As is so clearly evidenced in the drama now playing out in Greece, when a government is forced to solve its debt problem by issuing more debt, the end is nigh.

With the global economy still in the tank, concurrently layering on yet more taxes in order to try and keep the whole mountain of cards from blowing its top like Iceland’s Eyjafjallajökull* volcano will only prove counterproductive in the extreme.

This is no time to be complacent, or cavalier, about your financial affairs. Now is the time to be both cautious and, selectively, opportunistic. Because along with risk, big market moves also bring big opportunities.

Which whore should UK Liberal Democrat leader Clegg jump into bed with?

Britain is left dangling by an indecisive general election while horse trading goes on behind closed doors.

The Liberal Democrats hold the balance of power and their leader, Nick Clegg, is running around meeting negotiators from David "I'm-a-Zionist" Cameron's Conservatives and trying to reach a collaborative agreement so that a new era of government can begin. At the same time he’s having telephone conversations with sad loser Gordon Brown.

While waiting for a result I began drawing up my own parliamentary “dream team”. This is not easy as many people, myself included, regard the top Tory and Labour figures – William Hague, George Osborne, Ed Balls, David Miliband – as just as much a pain in the fundament as their respective leaders.

|

Supposing Clegg resists overtures from the Conservatives and tries for a “rainbow” coalition with Labour under a caretaker prime minister such as Alan Johnson. My fantasy team would likely include the sunny and sensible Caroline Lucas of the Green Party, with Alistair Darling and Vince Cable roped together as a chancellor duo – that job being far too big and important for one man – and somebody sensible (perhaps Ed Davey if Labour won’t bring their rebels in from the cold) as foreign secretary.

Clegg may well feel the hand of destiny momentarily on his shoulder. He has an unprecedented opportunity to stop Britain's slide into the abyss and save us from the idiots who have run our country into the ground. Or he could try to save us from the alternative idiots eager to wreck it completely if unadulterated Toryism is allowed to take over.

But can he save us from both? We can only hope Clegg plays the cards destiny has dealt him with sufficient skill and daring.

Labour, beaten and discredited, could at least be re-moulded into something halfway acceptable. The Tories, however, are arrogant and belligerent and will not be diverted from their insane values and disreputable purpose, which apparently is to act as a preservation society for the privileged and a recruiting ground for those who are willing to stooge for foreign (US and Israeli) exploitative interests.

Would Cameron declare the Foreign Office a Zionist-free zone if Clegg demanded it? Fat chance.

|

On past performance, the Conservatives will back any war, any destruction, as long as it's not their own. The hypocrites want to promote family values and mollycoddle family life with taxpayer funds while they are happy to see innocent families elsewhere – in Iraq, Afghanistan, Palestine - vapourized, shredded or terribly maimed, or starved into submission by sanctions and blockades.

The upper echelons of Labour too are devoted to war and cover-up, as they've demonstrated in spades. All those who were party to the Iraq slaughter, in my view, are not fit to govern and shouldn’t be allowed anywhere near the levers of power again. It's no use their saying "We were misled". Plenty of ordinary citizens were not misled. And there was ample information freely available to contradict the lies the war-crimes scum were telling us.

It was the business of all MPs, in such a serious and irreversible matter, to exercise due diligence and go the extra mile if necessary to make sure of the facts before taking this nation to war against people who posed no threat. If they can’t be trusted to do that, there’s no place for them on any credible team.

Labour and Conservatives are now allowing themselves to be whipped into another lethal frenzy by the same neo-con gang, this time over Iran. How dumb is that?

Such is the poor calibre of the present crop of players that any team, fantasy or real, is almost certain to turn into a nightmare. Besides, I have just checked Alan Johnson's voting record on www.theyworkforyou.com. No, don't look, it’ll make you ill. Johnson, you’re fired.

|

So Clegg is left with an awkward choice. Which whore will he jump into bed with? Or should he remain celibate, avoid the political pox, stay home, carry out urgent repairs to his own party and plan for another election in the near future?

The Liberal Democrats. remember, have their own hill to climb. They sold out to the EU and if given the chance will go even further down that road to perdition. They are feeble on immigration. They opposed the war against Iraq, to their credit, but now seem happy to string along with the Afghan fiasco and back sanctions against Iran. None of that goes down well with voters and it’s why Clegg’s heady surge in popularity didn’t last long enough to translate into more seats in Parliament.

Never before in electoral history were the British public presented with such a rubbish choice. Is there no-one “clean” enough, honourable enough and Britain-first enough to take the helm?

Seymour Hersh on Obama Being "Dominated" by the U.S. Military

Seymour Hersh spoke at the Global Investigative Journalism Conference in Geneva on April 24, 2010

REPORTER: You didn't include Obama in your list of liar presidents. I'm wondering if you would include him also?

HERSH: To use a basketball or a football analogy, American football, fourth quarter – he may have a game plan. At this point he's in real trouble. Because the military are dominating him on the important issues of the world: Iraq, Iran, Afghan and Pakistan. And he's following the policies of Bush and Cheney almost to a fare-thee-well. He talks differently. And he's much brighter, he's much more of the world. So one only hopes he has a game plan that will include doing something, but he's in real trouble, in terms of – he's in real trouble.

In Iraq I don't have to tell anybody the prospects – in the American press they never mention Moqtada Sadr, but look out. He's going to be the kingmaker of that country. He's now studying in Iran. And he's going to be the next ayatollah-to-be. I don't know how he'll work it out with Sistani. But he's going to be the force, the Shia. And so this is going to be very complicated for us because the two men we talk about, Allawi and Maliki, have about as much to do with the average Iraqi – they're both ex-pats. Allawi, let's see, he was certainly an American agent and a British agent, the MI-6, the CIA, the Jordanians ran him probably for Mossad. I'm not telling you anything that is not a fact. So who knows?

So Iraq is very problematical. There's going to be much more violence. Whether it's civil war or not it's going to be much more violence.

He's never going to win, whatever that means, in Afghanistan. The only solution in Afghanistan is a settlement with the Taliban. And the only person to settle with is Mullah Omar, and he's become another Hitler to the American public. So how we're going to do that and survive politically?

And the same in Pakistan. He's got the wrong policy there. So it is – and again for Obama, Iran's not resolved, in terms of, the Iranians have come out of this crisis stronger than ever. We don't want to believe that.

Justice Department Reviewing SEC Case Against Goldman Sachs

It's unclear what specific deals or which Goldman Sachs employees are part of the Justice Department's review and whether criminal charges will ever be filed. The Wall Street Journal reported today that the federal prosecutors were investigating whether Goldman employees committed securities fraud in connection to the firm's mortgage trading.

Goldman spokesman Michael Duvally declined to confirm the Justice Department's involvement, as first reported by the Journal.

"Given the recent focus on the firm, we are not surprised by the report of an inquiry. We would fully cooperate with any requests for information," he said.

The Journal described the department's review as an investigation that is in a "preliminary stage" based out of the Manhattan U.S. Attorney's Office.

The SEC filed a civil lawsuit against Goldman two weeks ago, alleging that the firm defrauded its investors.

Systemic Injustice Against Two Longtime Political Prisoners

They're two of many targeted Panthers, victims of COINTELPRO viciousness, "dirty tricks," after J. Edgar Hoover's orders to infiltrate, disrupt, sabotage, and destroy their activist mission for ethnic justice, racial emancipation, and real economic, social, and political equality across gender and color lines.

In an earlier article, this writer explained that COINTELPRO is the acronym for the FBI's secretive, mostly illegal, counterintelligence program to neutralize political dissidents, including alleged communists; anti-war, human and civil rights activists; the American Indian Movement; Black Panther Party members, and today Muslims for their faith, ethnicity, and activism.

In their book, "Agents of Repression," Ward Churchill and Jim Vander Wall wrote:

"the term came to signify the whole context of clandestine (often illegal) political repression activities (including) a massive surveillance (program via) wiretaps, surreptitious entries and burglaries, electronic devices, live 'tails' and....bogus mail" to induce paranoia and "foster 'splits' within or between organizations."

Other tactics included:

-- "black propaganda through leaflets or other publications "designed to discredit organizations and foster internal tensions;"

-- "disinformation or 'gray propaganda' " for the same purpose;

-- "bad-jacketing (to) creat(e) suspicion - through the spread of rumors, manufacture of evidence, etc. - that bona fide organizational members (usually leaders) were FBI/police informants," to turn some against others violently;

-- "assassinations (of) selected political leaders," like Fred Hampton and Mark Clark on December 4, 1969 by Chicago police while they slept; and

-- "harassment arrests (on bogus) charges."

In October 1966, Huey P. Newton co-founded the Black Panther Party for Self Defense (BPP), served as minister of defense with chairman Bobby Seale, and developed a non-violent social agenda for full employment, decent housing and education, an end to police brutality, equity and justice, peace, and other progressive ideals. They believed in the rule of law, preached it, and struggled to overcome generations of injustice and discrimination against blacks, other people of color, and disadvantaged people everywhere.

In his 1980 doctoral dissertation titled, "War Against the Panthers: A Study of Repression in America," Newton:

"analyze(d) certain features of the Party," significant incidents in its history and Washington's response, while "tr(ying) to maintain an objectivity consistent with scholarly standards...."

Most significant was "How many people's lives were ruined in countless ways by a government intent on destroying them as representatives of an 'enemy' political organization." All questions asked, he said, won't be answered, but he hoped his "inquiry" would help toward learning "the truth, the whole truth and nothing but the truth."

Each targeted Panther is part of it, including Conway and Fitzgerald. On August 22, 1989, Newton himself was killed on his home city Oakland streets.

Marshall "Eddie" Conway

Detailed information on him can be found at www.freeeddieconway.org, headlined "Partnership for Social Justice (PSJ): Free Marshall "Eddie" Conway & All Political Prisoners!"

After 40 years of injustice, Conway thanked his supporters for trying to free him through "petition drives, rallies, speaking engagements, fundraisers, government resolutions, and theater and arts projects."

A US Postal Service employee, Conway was arrested at work on April 26, 1970, the day after two Baltimore police officers were shot in their patrol car, one killed, the other wounded. An hour later, two BPP members were arrested, an alleged weapon involved in the shooting was recovered at the scene, and another officer said he saw a third man near where the arrests were made.

Eddie Conway was named after issuance of a warrant based on information supplied by an unidentified informant - the commonly used tactic against innocent activists, targeted for challenging federal or local institutionalized power.

The other men, Jackie Powell and Jack Johnson, were tried and convicted. Powell later died in prison. Johnson is still incarcerated.

The charges came at a time of "considerable media attention focused on (BPP's) Baltimore Chapter." Included was front-page coverage of this case, and "a mass arrest of Baltimore Panthers (for another) purported torture/murder of an informant who participated in local chapter activities."

In that trial, jurors found prosecution witnesses "contradictory and not credible...." Although a mass arrest was made, one defendant was acquitted. None of the others were tried, and all those held were released.

Prior to both incidents, FBI agents had targeted Conway, later discovered through a Freedom of Information Act (FOIA) request. Various letters and other documents identified him as a BPP member through efforts of a "highly sensitive source who is of continuous value to the Bureau" - aka an informant. The same memo confirmed that from November 1969, the Baltimore Police coordinated BPP surveillance activities with the FBI.

Conway's Trial

No physical or other evidence linked him to the officer's killing, and Conway to this day maintains his innocence. Yet at trial, he was denied his choice of counsel and right to defend himself, was forced to use a prosecution appointed attorney, and unwisely chose a political, not a criminal defense that might have acquitted him. In addition, the lawyer spent only 45 minutes with him prior to trial, and during proceedings "often appeared to be intoxicated. (Apparent from the transcript itself is the lawyer's inadequate and inappropriate demeanor in the afternoons, following lunch recess.)"

The prosecution relied mainly on an informant's testimony, Charles Reynolds, "placed....in Conway's cell under suspicious circumstances and against (his) written protests to the guards." He was convicted for assault, and contrary to Conway's claim, said he confessed.

Another officer responding to the shooting provided the only other evidence, saying he "followed a man who seemed to be acting suspiciously" near where the suspects were arrested.

He identified Conway only after being shown photos, at first recognizing no one. When given new ones with only Conway's repeated, he picked him. A more reliable lineup was never used.

Charles Reynolds had been imprisoned in Maryland, but at the time was in Michigan on forgery charges. He had four previous convictions, served earlier as a police informant, and wrote to Baltimore police from Detroit offering his testimony again in return for help with Michigan's Parole Board.

Important also was Conway's trial demeanor - a big man with a "huge Afro" in shackles, using raised-fist salutes to supporters in court, and refusing to sit at the trial table. In addition, inflammatory pre-trial media coverage biased sentiment, at the same time BPP members were getting hostile national coverage.

Documents showed COINTELPRO incitement was behind it as part of the Bureau's scheme to destroy the Panthers. In Baltimore alone, prior to and during trial, malicious stories were planted in daily newspapers. Jurors weren't sequestered, so easily could have seen them and perhaps discuss them with others, regardless of court imposed restrictions.

Incarceration after Conviction

Conway's been imprisoned since April 1970. Though classified as a medium security prisoner, he's being held at the Jessup Correctional Institution, formerly known as the Maryland House of Correction Annex, a maximum security prison, where at times he's been treated harshly.

In 1974, guards severely beat him, broke his shoulder and jaw requiring surgery and three months hospitalization. Although he subsequently filed a civil rights suit, an all-white jury denied him, and the US Court of Appeals refused to hear his case while acknowledging that "The severity of the injuries presents a closer question of whether excessive force was used, amounting to a constitutional deprivation."

Throughout his imprisonment, Conway's conduct and accomplishments have been exemplary. He earned a BS degree in Social Science from Coppin State College, developed computer expertise, and earned an Associate of Arts degree in computer science and business studies from Essex Community College.

He was also Penitentiary Library Inmate Coordinator, and won a $350,000 National Endowment for the Humanities grant, then used to produce 50 videotaped "To Say Their Own Words" discussion sessions with 100 prisoners and various authors, recorded over a one year period.

In addition, he provided inspirational leadership to his fellow inmates by:

-- forming the 500 member Maryland Penitentiary United Prisoner's Labor Union, with labor community support;

-- counseling youths at risk for imprisonment in 10 week prisoner administered sessions;

-- chairing the ACLU-affiliated Prison Committee to Correct Prison Conditions on issues including overcrowding, brutality, and health at the Maryland House of Corrections;

-- forming the Maryland Lifers Association, with chapters in three state prisons;

-- establishing a holiday celebration for black prisoners program with their families;

-- beginning another program to teach prisoners computer usage;

-- forming the first ever prison-based Touchstone Project, involved in weekly classical literature discussions; and

-- most recently starting a Friend of A Friend mentoring project, training prisoners to serve other inmates; and

-- working with a local Baltimore WombWork Productions play for the public titled, "The Birth of Peace."

Current Efforts to Free Conway

Throughout his imprisonment, Maryland's Parole Board denied him on executive orders to keep "lifers" in prison, except the aged or terminally ill. Meanwhile, a habeas petition was sent to Maryland's Supreme Court to let a Clemency Petition be sent to the governor. The Baltimore NAACP chapter, various church leaders, and some members of Maryland's General Assembly, Baltimore City Council, and the community also voiced support.

More recently a federal habeas petition was filed, requesting a review of state rulings and a new trial, "based on the fact that I did not receive a fair trial in accordance with both the 6th and 14th Amendments."

After 40 years, Conway remains imprisoned, but hopeful and grateful to his supporters. In a recent 2010 letter, he reiterated that he was incarcerated "because of what I believe, not for anything that I have done," then said he delayed writing pending release of his book, "The Greatest Threat."

It "examines the plight of the Black Panther Party Political Prisoners/POWs and the role of the FBI's Counter-Intelligence Program in their imprisonment." In 2011, his next book will be released, titled "Marshall Law: The Life and Times of a Baltimore Black Panther."

His new legal team is also researching new ways to win his release, long overdue for an innocent man after 40 years for a crime he didn't commit.

Romaine "Chip" Fitzgerald

Detailed information on him can be found at www.freechip.org, titled "Free Chip Fitzgerald: 40 Years is Enough" for another innocent man, convicted for crime he didn't commit - now a "political prisoner, (a) prisoner of war" for his activism.

Fitzgerald belonged to the BPP's Southern California Chapter where a fellow member, Bruce Richard, called him tireless:

"in various capacities in the Westside office....To be a Panther was a 24/7 commitment, and every single day seemed like weeks due to the volume of activities during (the) explosive (1969, early 1970s) period. We were totally consumed in the Party's Free Breakfast Program (what Hoover most feared because of the community good will it fostered), the tutorial program, selling Panther papers, political education classes and other projects. Chip was a favorite of many in the communities we served, and the children, especially, loved him, reflected in their smiling little faces when he appeared...."

In September 1969, Fitzgerald was wounded and arrested during a police instigated shoot-out, tried for assault and other related charges, including Barge Miller's murder, a security guard at Vons Shopping Center in Los Angeles at 1:42AM.

Two men were seen fleeing, a witness, James Coleman, later identifying Fitzgerald as one of them, even though he said he couldn't see him clearly. In court, he then admitted he looked different from the man he identified, and during the investigation, he was shown photos, including Fitzgerald's, but didn't recognize him.

Because of his head wound, Fitzgerald wore a hard to miss two-inch bandage for close to a month, removing it several days before his October 9, 1969 arrest. Coleman said nothing about it in describing the man he saw. All the time, Fitzgerald denied being in the vicinity of Vons during the incident's early morning hours.

Nonetheless, at age 19, he was arrested, indicted, tried, convicted, and sentenced to death despite his innocence, and remains a political prisoner.

In California v. Anderson (1972), the California Supreme Court declared the death penalty unconstitutional in violation of Eighth Amendment protection against "cruel and unusual punishments" and the state's same constitutional ban. Along with 100 others on death row at the time, his sentence was commuted to life "with" the possibility of parole.

No matter. Unlike most 1972 death row inmates released, Fitzgerald remains incarcerated, still dedicated to black liberation and all oppressed people everywhere - why he's still held, of course. At his July 2008 parole hearing, he was challenged for his political views, past and present, and turned down, the same reason for all his other denials, for his "revolutionary" beliefs for justice he won't renounce after a lifetime of support.

With the help of his new attorney, Keith Wattley, the Committee to Free Chip Fitzgerald filed a habeas petition to challenge the Board's decision. Currently, he's in solitary confinement at Corcoran State Prison, protesting on a hunger strike to be transfered to the general prison population, and threatening to stay on it until death if he's refused. More on that below.

Prison authorities are in violation of the US District Court for the Northern District of California's 2001 order to provide all inmates proper medical care, Judge Thelton E. Henderson saying:

"....it is beyond a reasonable dispute that the State has failed," in transferring authority to a receiver, J. Clark Kelso, at the time. He also stated it's:

"an uncontested fact that, on average, an inmate in one of California's prisons needlessly dies every six to seven days due to constitutional deficiencies in (its) medical delivery system."

In 1998, Fitzgerald suffered a stroke, caused by bleeding in his brain. He became partly paralyzed, required an intense physical therapy regimen, and given the absence of treatment, likely spinal and cervical surgery will be needed.

In confinement, his condition continues to worsen. Without treatment, he risks another stroke, permanent paralysis or death. He reportedly also suffers from depression. As a result, by refusing food, and apparently water, he's very much in jeopardy, another victim of America's war against activism, people of color, and justice.

In his own words, he vows to "remain a revolutionary," at the same time calling the prison system:

"a complex, dysfunctional resource-wasting parasite of social control, political repression and revenge! Human beings are warehoused in these concrete and steel bunkers that destroy human sensibilities and the human spirit. (They're) desensitized, (and become) frustrated, angry and bitter, unprepared to become productive members of society. (It's) why California's recidivism rate is above 75%."

On May 4, the Committee to Free Chip Fitzgerald reported that he ended his hunger strike after prison officials agreed to free him from solitary confinement and transfer him to Kern State Valley Prison's general population where conditions may be better, including access to medical care. Based on past experience, he wrote: "we'll see."

The system is designed to perpetuate itself, to remove political activists from society, cage them like animals, the result of "corruption, criminal mismanagement, thievery, (and) brutality" to deny freedoms and sustain injustice. Fitzgerald and Conway are two of its victims. Many others are in prison hell with them, America's gulag, the shame of the nation.

A Final Word

On December 10, 2008, this writer examined "The Persecution of Syed Fahad Hashmi," saying:

"It's a familiar story. A Muslim American is accused of terrorism for supporting Al Qaeda and conspiracy to provide support for a Foreign Terrorist Organization (FTO)....Once again, an innocent man is arrested, charged, indicted and convicted with no substantiating evidence," bogus charges, much of it classified and withheld from the defense.

Witnesses are enlisted to cooperate. Proceedings are orchestrated, and juries intimidated to convict at the wrong time to be Muslim in America when we're all equally vulnerable.

See the complete article at: http://sjlendman.blogspot.com/2008/12/persecution-of-syed-fa

had-hashmi.html.

Held in solitary confinement for three years, facing 70 years imprisonment if convicted, Hashmi coped a plea for a lesser 15 year sentence, even though he committed no crimes. Like dozens of others, he was targeted for their activism, prominence, faith, race, and ethnicity.

Since first arrested in the UK in June 2006, he been brutally treated, the past three years in merciless solitary confinement at New York's Metropolitan Correctional Center (MCC), the effects of which harmed his health, emotional well-being, and spirit enough to accept 15 years in federal prison despite his innocence.

On April 30, Faisal Hashmi said this about his brother:

"Earlier this week our beloved son and brother Fahad pleaded guilty to a single charge of material support for terrorism. He took the plea after spending four years in prison, three of them in complete isolation. Fahad's lawyer, David Ruhnke, said (he) "made the best deal that was available under the circumstances....the government wanted to lock him up for the rest of his life. They were not successful in that goal."

Though he may be free by age 40, "we are extremely troubled by the process that has brought us to this point. We are troubled not only for our family but by the message a case like Fahad's sends to our community. It disturbs us greatly that a young man known as a pillar of his Queens community, who worked and studied hard and who, in the tumult of growing up Muslim in America, choose a path of religious and political activism, (yet) came to be demonized as an extreme danger to the country he called home."

They bogusly called him a terrorist, tortured him in solitary confinement, and left him no choice than a one count lesser sentence, given his prospect of "going before an anonymous jury based in part on the prosecution's ugly assertion that his friends and family were as dangerous as they alleged he was."

What does this say about a nation that reigns terror on its own?

Given the barbarous treatment of innocent people, charging them with crimes they didn't commit, locking them in federal gulags for political advantage, and denying some of our most dedicated no chance for justice, America is no longer fit place to live in. For blacks, Latinos, Native Americans, the poor and disadvantaged, and today Muslims it never was nor will be as long as wealth and power trump equity, democratic freedoms, and principles that have been desecrated from the beginning.

Stephen Lendman lives in Chicago and can be reached

at lendmanstephen@sbcglobal.net. Also visit his blog site at sjlendman.blogspot.com and listen to cutting-edge discussions with distinguished guests on the Progressive Radio News Hour on the Progressive Radio Network Thursdays at 10AM US Central time and Saturdays and Sundays at noon. All programs are archived for easy listening.

Elitism and Empathy in American Presidents: Who Cares for the Suffering Children?

Who cares that millions of children are suffering and dying around the world, in places like Iraq, Afghanistan, Pakistan, Palestine, Gaza, Sudan, the Congo, Colombia, and Mexico, and in the United States?

Why are American voters only given the choice of voting for members of the political, social and economic elite to be their president, rather than for leaders who care for and identify with the needs of ordinary people?

Do presidential candidates supplant their empathy with loyalty to the ruling elites, or do the elites only select pliable candidates with an absence of empathy?

Elitism and the Seizure of Political Power

Webster’s defines elites as “a group of persons who by virtue of position or education exercise much power or influence.”

Elitism was exemplified by the royals of Europe who sat on the thrones of England, France, Spain, Germany, Austria, Russia and other countries. They intermarried and for hundreds of years controlled the lives of their subjects, while occasionally sending them to die in family squabbles with their cousins.

The royal’s concern for those they ruled was famously illustrated by Queen Maria Antoinette who, when told that the peasants had no bread, exclaimed, “Then, let them eat cake!” The hoi polloi returned the favor during the French Revolution by cutting off her head, along with that of her husband, King Louis XVI.

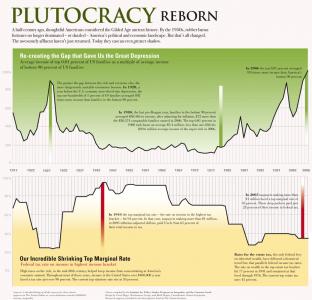

Although the American Revolution was fought to establish a government of the people, the will of the people has often been subverted by wealth and influence. Franklin Roosevelt once said, “The real truth of the matter is … that a financial element … has owned the government ever since the days of Andrew Johnson.” Most critically, over the past 30 years, an ever-more-powerful elite has seized complete control of the U.S. presidency.

Earning millions of dollars a year from salaries, bonuses, investments and fraud, the individuals and their families who control major financial institutions, foundations and corporations are the new royalty and, like the kings and queens of old, they have little care or concern for anyone other than themselves, their own, and their profits.

With little allegiance to the United States or its people, these elites seek a “New World Order” within which to exercise their power, and they meet secretly on Hilton Head Island and in the Bohemian Grove to network and they conspire at the Council on Foreign Relations and the Bilderberg Group to complete their arrangements.

Since 1980, all U.S. presidents, including the current incumbent, have shared an allegiance to the ruling elite, and they have governed with policies that favor the rich and powerful over the poor and disadvantaged.

Three Decades of Elite Presidents

The cast of subservient presidents was led by Ronald Reagan, a “B-grade” movie actor, who was an articulate spokesman for the controlling elite. He not only had the ability to perform the script written by his corporate sponsors, but he had profited handsomely from the association. Reagan lived on Rancho Del Cielo overlooking the Pacific Ocean and vacationed in Palm Springs with his wealthy friends. As president, he elevated greed to a national creed by pursuing politics in “which people still can get rich.”

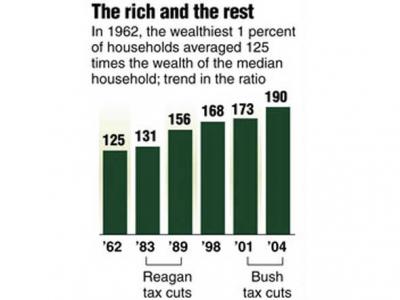

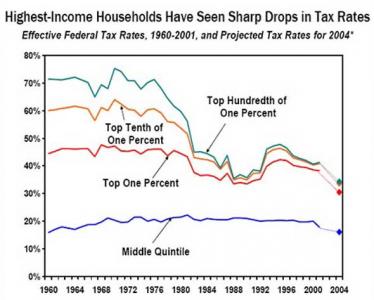

Reagan not only redecorated the White House, ordered new china, and threw glittering parties, he provided tax incentives to corporations to move high-paying jobs out of the U.S., and he organized the transfer of the tax burden to the workers and the fruits of the national bounty to the bosses. In doing so, he made millionaires out of 1.3 million devotees by 1988, including more than a 100,000 decamillionaires.

Reagan cut the personal tax bracket of his wealthy friends from 70% to 28%, and he transformed America from a creditor to a debtor nation, encouraged the creation of massive debt to finance corporate takeovers, mergers, acquisitions and leveraged buyouts, and he promoted wild speculation in the stock and financial markets.

Retiring in senility to fashionable Bel Air, Reagan was succeeded by his vice-president, George H. W. Bush (Sr.), another product of the ruling elite. Both of Bush’s grandfathers earned millions from the First World War as founding members of the “military-industrial complex,” and his father, Senator Prescott Bush was a wealthy banker, who profited from the Second World War by helping Hitler fund his war machine.

Bush Sr. married the daughter of a wealthy publisher, who was a descendant of President Franklin Pierce. Following World War II, Bush Sr. served as a CIA asset in establishing a petroleum company that funneled money and supplies to CIA operations in the Caribbean and Central America. Sponsored by the CIA and supported by Presidents Nixon and Ford, he became a Congressman, Delegate to the United Nations, Chairman of the Republican National Committee, and Director of the CIA, before becoming Reagan’s vice president.

As vice president, Bush Sr. had presided over Reagan’s deregulation and government reduction programs. As president, he inherited the massive deficits provided by Reagan’s “voodoo economics” and the savings and loan collapse caused by his own deregulation efforts. Bush Sr. became increasingly unpopular with republicans when he was forced to raise taxes and with democrats when he failed to reduce the unemployment and poverty resulting from an economic recession and corporate reorganizations.

Bipartisan disenchantment with Bush Sr. resulted in the election of William “Bill” Clinton in 1992, who was from a family of small business owners in Arkansas. Clinton attended the School of Foreign Service at Georgetown University on an academic scholarship and University College, Oxford as a Rhodes Scholar, before obtaining a law degree from Yale University (where he met his wife, Hillary Rodham).

Clinton had been fascinated with politics from a young age and, following his return to Arkansas to teach law, he was elected as the state’s attorney general and to multiple terms as governor. Clinton was a “New Democrat,” who believed in the “Third Way” of governing whereby he advocated free trade, welfare reform, smaller government and financial deregulation. He and his wife made political and professional liaisons with law firms that represented corporate interests and with financial and investment companies doing business in Arkansas.

Although he positioned himself as a “centralist,” Clinton’s failures, particularly health care reform, were on the left, while his successes, such as welfare reform, free trade agreements and financial deregulation, were on the right. Most telling, in light of future events, including the “Great Recession of 2008,” was his support of the Financial Services Modernization act of 1999, which eliminated essential restrictions on the integration of banking, insurance and stock trading.

Since leaving office in 2001, Clinton has earned more than $109 million, including a $15 million advance for My Life, primarily from his speaking engagements. Among the groups paying him up to $450,000 for a one-hour speech are AEG London, Goldman Sachs, and the Chamber of Commerce. He told one audience, “I never had a nickel to my name until I got out of the White house, and now I’m a millionaire, the most favored person for the Washington Republicans.” Senator Hillary Clinton has also profited from corporate sponsors, among which Goldman Sachs and Citigroup have been her most generous benefactors.

With the inauguration of George W. Bush (Jr.), the ruling elite placed its own crown prince on the throne. Not only descended from political royalty, Bush Jr.’s intellectual limitations and business failures made him the most pliable of all recent presidents. He harmed workers and benefitted businesses by eliminating regulations in areas such as on-the-job injuries and overtime compensation, he refused to enforce the regulations he couldn’t change, or he emasculated the enforcement agencies, such as the Mine Safety and Health Administration.

Coming into office, Bush promised that he would sign a tax cut every year. He almost succeeded. With a great fanfare, he signed major tax cuts in 2001 and 2003, and a smaller one in 2002. Bush very quietly signed a major revision of corporate tax law in 2004 that provided billions of additional tax breaks to corporations. In 2008, he signed extensions of tax cuts that were set to expire, and he slipped another $120 billion of “tax relief” into the financial rescue bill.

In combination, these laws lowered the marginal tax rate for high-income household, eliminated estate taxes, and reduced taxation of stock dividends and capital gains. The tax burden of the super rich fell by one third, allowing the amount “earned” by the top 1% of total U.S. personal incomes to more than double from 9.97% in 1979 to 23.5% in 2007. The top 3% of households raked in almost half of the national income!

The Obama Administration

In October 2008, Senator Obama endorsed and voted in the Senate for the economic bailout package prepared in secret by Federal Reserve Board Chairman Ben Bernanke and outgoing Treasury Secretary Henry Paulson and signed by President Bush. Thus, even before commencing his term in office, Senator Obama rewarded a cadre of corrupt international bankers, while failing to include any rescue efforts for the hard-working American people who were facing foreclosure, bankruptcy, unemployment, homelessness or hunger as a result of the bankers’ fraud.

Why would Senator Obama fail to demand consideration for the poor and downtrodden in the bailout bill? One answer can be found by an examination of the political contributions he was receiving at the time. Top securities and investment firms were Obama’s fourth largest source of funds, contributing $7.9 million, even more than for his republican opponent. Of these, Goldman Sachs was responsible for almost one million dollars, closely followed by Citigroup and JPMorgan.

It is increasingly difficult to find any differences between the administrations of George W. Bush and Barack Obama. Even though he has increased enforcement of some labor regulations, President Obama has failed to push passage of the Employee Free Choice Act for workers. In all other respects, ranging from enforcement of environmental regulations and approving offshore drilling, to his reappointment of Ben Bernanke as the Federal Reserve Chairman and Robert Gates as the Secretary of Defense, Obama has encouraged continued massive profits and bonuses for Wall Street, followed harmful environmental policies, including allowing off-shore drilling, supported renewal of police-state legislation, and expanded the profitable wars of the military-industrial complex.

Obama’s much touted health care reform bill is proving to be a bonanza for the health care, pharmaceutical and insurance companies. It provided few benefits for working people, while forcing them to buy expensive health insurance from the very companies which are victimizing them.

Rather than marshaling the resources of the government to directly help the people, Obama continues to throw away hundreds of billions of borrowed dollars on the U.S. wars of aggression in Iraq, Afghanistan and Pakistan. Every day, children are being horribly injured and are dying in these countries as a result of the militaristic policies he pursues on behalf of the ruling elite, while denying the suffering children of his own country the food, education and relief the wasted money would otherwise provide.

Commander-in-Chief Obama has appointed a military assassin to command U.S. troops in Afghanistan and has silently endorsed war crimes, including a confirmed report that his Special Forces murdered three gagged and bound women, one of whom was pregnant. The soldiers cut into the women’s bodies to remove evidence of their slaughter, and tried to blame the carnage on their innocent victims.

In other night raids, Obama’s assassins executed eight handcuffed boys, the youngest of whom was 11 years old, and machine gunned another family, including two youths and an infant, on the roof of their home as they tried to escape what they believed to be robbers breaking in. In each case, the military initially claimed that “insurgents” were killed during firefight operations, before admitting their “error.” Meanwhile, President Obama has remained silent on these and a multitude of continuing war crimes committed under his command.

Presidential-elect Obama also failed to condemn Israel’s military attack against the civilian population of Gaza during December 2008 in which hundreds of children were slaughtered, and he has remained silent while Israel has denied humanitarian aid for its Gaza victims. The White House “stood with Israel” and voted against the UN Human Rights Commission report that found Israel to be guilty of war crimes and crimes against humanity.

Today, in the U.S., one out of every six adults is unemployed or underemployed, and one third were without work at some point in 2009. One of every four children in the United States lives in poverty. Yet, the nation is still without a dedicated jobs program.

With one in six children living in a household suffering from food insecurity, the nation is still without a targeted food program. President Obama has promised to eliminate hunger in America by 2015 and to create millions of jobs through his overall economic recovery program; however, all across America, tonight, there are millions of children going to bed hungry with little “hope” for their future.

President Obama promised hope and change for the United States. He is certainly one of the most articulate presidents ever; however, is he merely mouthing words, or does he have real feelings for others?

The Presence or Absence of Empathy

Empathy is a capacity for understanding and sympathizing with the feelings, thoughts and experiences of another person. An empathic person does not have to be poor or to have personally suffered to “feel the pain” of another person; however, empathy does require real feelings and not just an expression of concern.

Franklin Roosevelt was born into a family of wealth and privilege; however, he quickly demonstrated upon being elected president that he truly cared for the well-being of the poor and disadvantaged. He immediately established job and relief programs and directed public spending to put money into the pockets of workers, rather than profits onto the balance sheets of corporations.

Roosevelt did not cater to the ruling elite. Rather, he said “the transmission from generation to generation of vast fortunes by will, inheritance, or gift is not consistent with the ideals and sentiments of the American people.” FDR believed in an essential human right to be free from want, in order to enjoy a healthy peacetime life, and to be free from the fear caused by military armaments.

For Roosevelt, empathy was not a rhetorical device; it was a deeply felt identification with those with the least power and those who suffered the most.

Like Roosevelt, George W. Bush (Jr.) was also raised in great wealth and privilege, and he held himself out as a “compassionate conservative.” However, it was no secret that Bush was anything but. He once bragged to an audience of wealthy New Yorkers, “This is an impressive crowd. The haves, and the have-mores. Some people call you the elite. I call you my base.”

Bush may have spoken these words: “Those who are poor, those who suffer, those who have lost hope are not strangers in our midst; they’re our fellow citizens.” However, when a citizen dared to criticize him during a promotional event for his “faith-based” programs, he snarled, “Who cares what you think?”

Ernest Partridge writes that the “‘absence of empathy’ is ‘the one characteristic that connects’ most of the immoral and misbegotten tenets of Bushism: that dogmatic mix of market absolutism, libertarianism, corporatism and simple greed that falsely describes itself as ‘conservatism,’ and which I choose to call ‘regressivism.’ ‘Absence of empathy’ is the essence of evil which, if unchecked and unreversed, is certain to bring about the demise of the American republic as we know it, just as it led to the advent of the Third Reich.”

One has to ask: has the United States evolved an electoral system that deprives its presidents of empathy, or are presidental candidates selected because they have an absence of that quality?

Is President Obama a Member of the Ruling Elite?

President Obama was not raised with wealth, but by a single mother who, at one time, had to draw upon food stamps. However, he was privileged to receive an upper-class education. He received a scholarship to the exclusive Punahou School at age 10, where he spent the next eight years on the lush hillside campus preparing for college. Following graduation, Obama received scholarships to attend Occidental College in Los Angeles and Columbia University in New York City.

After taking a break to work as a community organizer, Obama received a scholarship to attend Harvard Law School, where he served as editor and president of the law review journal, and he clerked for two prestigious law firms in Chicago during his summer vacations.

Upon graduation in 1991, Obama returned to Chicago where he was employed by the University of Chicago Law School as a visiting fellow in order to complete his book, Dreams from My Father.

In 1992, Obama married Michelle Robinson, who was a graduate of Princeton University and Harvard Law School. Their two daughters have attended the private University of Chicago Laboratory Schools and, after they moved into the White House, the children were enrolled in the private Sidwell Friends School.

Like Clinton, Barack Obama relied upon scholarships to raise himself by education from modest circumstances, but can it be said that his experiences resulted in empathy for other underprivileged children who do not qualify for such assistance, or who do not have the family or community support to take advantage of available opportunities? Does he blame these children for their own failures?

In September 2009, President Obama recorded a message to American students, and the Department of Education suggested that teachers have their students “write letters to themselves about what they can do to help the president” and “to make students accountable to their goals.” The government also recommended that, after listening to the speech, students should discuss what “the President wants us to do.” Obama laid his expectations upon the students, but he failed to mention what they could expect from him.

After a year in office, the evidence is convincing that Obama is willing to make politically advantageous deals on behalf of his corporate sponsors and, in doing so, fail to serve the interests of the voters who elected him, and their children.

The world has seen that President Obama is also willing to sacrifice the lives of innocent civilians, including children, to achieve the objectives of the ruling elite. These lives are simply “collateral damage” in the wars being fought around the globe against “terrorism,” “drugs” and in support of Israel’s program of apartheid in Palestine.

One must conclude that, irrespective of his race, creed, or culture, President Obama is much more a part of the international ruling elite, than the ordinary people of America, who seized upon his message of hope and change and elected him as their president. Sadly, it appears his soul was already spoken for.

Who Cares for the Suffering Children?

Children continue to suffer and die around the world and in the United States because the presidents placed in the White House by the ruling elite have no empathy for those who suffer from the policies they pursue, or the critical problems they ignore, all in response to the dictates of their masters.

By adhering to the “ethics of the marketplace,” by allowing the politics of greed, the culture of militarism, and the pursuit of an empire to dictate his administration’s policies, President Obama has betrayed the American people who believed and trusted in him.

If the President of the United States fails or refuses to take action on behalf of children, the most vulnerable victims of the unlawful wars he continues to fight on behalf of the ruling elites, or the corrupt policies he pursues for their benefit, who shall speak for the children?