CLICK

ON CHART TO ENLARGE

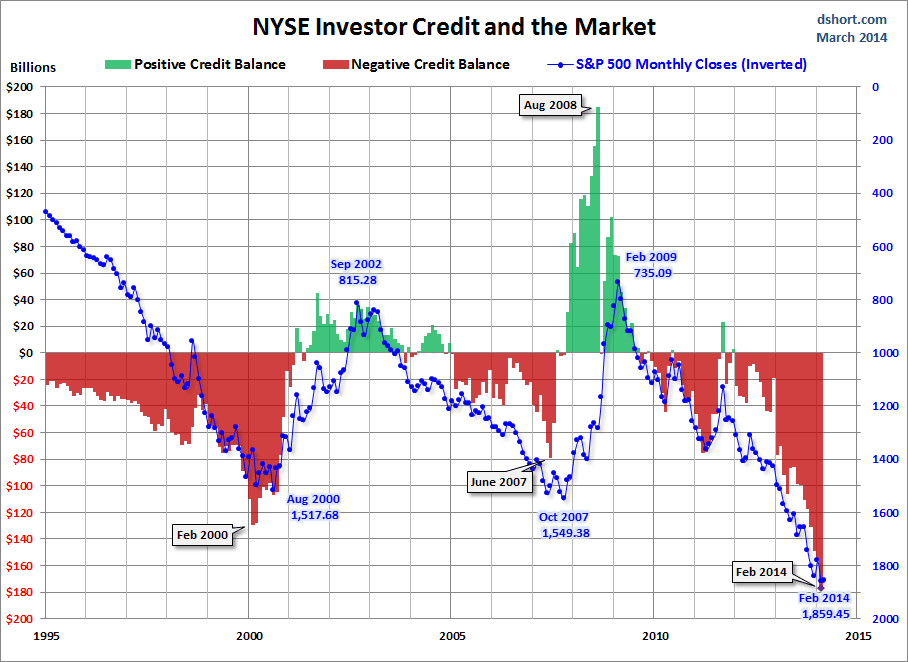

It

doesn’t matter until it matters! Will a decline in margin debt from

all-time highs matter this time? Doug Short each month does an

excellent analysis on margin debt and the latest update is now out.

(see

current info here)

In the past margin debt at historical levels

didn’t seem to matter, until margin debt started decreasing. The

above chart highlights that at each (1), margin debt was at

historical highs and then turned south and the S&P 500 soon

followed.

In my humble opinion one should not look at

margin debt as the holy grail to portfolio construction. It has been

a good tool in helping to know when to overweight and underweight

towards risk assets.

Margin debt has been swiftly pushing higher for

the past 8 months in a row and now slipped a little this past month.

IF….IF margin debt should start decreasing swiftly, history would

suggest something different is taking place in the mind of aggressive

investors.

-

See more at:

http://blog.kimblechartingsolutions.com/2014/05/margin-debt-takes-a-turn-from-all-time-high-levels-be-concerned/#sthash.KEqU8AkG.dpuf

NYSE Margin Debt Slips For The First Time In 8

Months

The

Markets Just Sounded the Death Knell For QE

Globally Central Banks have kept an eye on the

Bank of Japan, which announced the single largest QE program relative

to its GDP in history. That one single QE program announced in April

2013 is equal to over 20% of Japan’s GDP. But things turned sout…

Everyone’s

Q1 GDP Estimates Turn Negative

This afternoon, Wall Street is saying it’s

even worse.

Citing weak

construction spending data,

several firms’ GDP tracking models now show Q1 growth fell

into negative territory.

“Residential

construction was a bright spot, rising 0.7% on the month and standing

15.2% above year-ago levels,” noted Barclays’ Cooper Howes.

“Nonresidential construction fell 0.1%, however, and there were

downward revisions to February and January. On the whole, this

lowered our GDP tracking estimate three-tenths, to -0.2%.”

Macroeconomic

Advisers, a widely cited source for GDP estimates, said its model

fell 10 bps to -0.1%,

also weaker-than-expected construction spending below BEA

assumptions.

If It Wasn’t For Obamacare, Q1 GDP Would Be

Negative

Here

is a shocker: for all the damnation Obamacare, which according to

poll after poll is loathed by a majority of the US population, has

gotten if

it wasn’t for the (government-mandated) spending surge resulting

from Obamacare, which

resulted in the biggest jump in Healthcare Services spending in the

past quarter in history and added 1.1% to GDP …

Treasury

Yields Tumble To 11-Month Lows; Stocks Hold Near Record Highs

It

was not a Tuesday, and it was not a Fed day – so stocks closed red.

Volume was dismal. TheRussell

2000 tested its 200DMA once again (and bounced) but was unable to

sustain that strength.

Once again the biggest news was the continued

collapse in Treasury yieldsas

a combination of massive spec positioning short “because rates have

to go up” and the ugly reality of macro weakness combined to send

rates to 2014 lows (and 11-month lows for 30Y yields). This

is the biggest year-to-date drop in 30Y yields since 2000.

The Dow’s weakness meant it lost its gains for 2014. Despite

ongoing USD weakness (driven by GBP and EUR strength), commodities

traded lower with silver

worst today (red for 2014), copper weak, and gold and oil flat to

modestly lower.

VIX was pummeled down to almost 13 midday (which makes perfect sense

ahead of NFP – why would anyone hedge that?) but leaked higher as

bond market reality set in during the afternoon. The ubiquitous

very-late-day VIX

slam pulled stocks higher in a buying panic but failed to get the

S&P, Dow, or Russell green on the day.

…

Small Caps fell 30%+ twice when this took

place…its back!

CLICK

ON CHART TO ENLARGE

When the Russell has been hot on a 5-year

annualized basis, it has cooled off… to the tune of 30%+ declines

in 1999 and 2007.

Now the Russell has had a higher 5-year

annualized return than the 1999 and 2007 peaks! Also the Russell is

back at the top of its rising channel, where it has found some

resistance.

Will it be different this time? From a 5-year

annualized performance, “it is different this time” as it has

been hotter than the 1999 & 2007 peaks.

What

will the results be? Above my pay grade. Premium

Members shorted

the Russell 2000 several weeks ago due to this situation, with a stop

at resistance.

-

See more at:

http://blog.kimblechartingsolutions.com/2014/04/small-caps-fell-30-twice-when-this-took-place-its-back/#sthash.HmZ4XZeu.dpuf

Stock

Market Headed for a 1987-Style Crash

Like it or not, bad luck is just around the

corner for investors.

After stacking up five years of gains, the

stock market is starting to look awfully wobbly. And the likely

result will be a crash as bad or even worse than what was seen in

1987.

That’s what analyst Marc Faber believes,

anyway: “I think it’s very likely that we’re seeing, in the

next 12 months, an ’87-type of crash,” he recently told CNBC.

“And I suspect it will be even worse.”