By

Michael Snyder

The more things change, the more things stay the same. The Great

Depression actually started in 1929, but as you will see below, as late

as 1933 the Associated Press was still pumping out lots of news stories

with optimistic economic headlines and many Americans still did not

believe that we were actually in a depression. And of course we are

experiencing a very similar thing today. The United States is in

the worst financial shape that it has ever been in, our economic infrastructure is being

systematically gutted, and poverty is

absolutely exploding.

Since the stock market crash of 2008, the Federal Reserve has been

wildly printing money and the federal government has been running

trillion dollar deficits in a desperate attempt to stabilize things, but

in the process they have made our long-term economic problems far

worse. It would be hard to overstate how dire our situation is, and yet

the mainstream media continues to assure us that everything is just

fine and that happy days are here again.

As I have already noted, the mainstream media was doing the exact

same thing back during the days of the Great Depression. The following

are actual Associated Press headlines from 1933…

“

Decisive Break from Panic Shown in Business Figures”

“

Markets Spurt To New Highs”

“

New Farm Bill to End Depression”

And the following is a headline discovery from 1933 that was made

by Linda Goin…

I was browsing through old newspapers the other day and

discovered a page filled with news about the stock market and banks in

the Daily Capital News from Jefferson City, Missouri. The date

was March 15, 1933, well into the Great Depression, and the news was

cautiously celebratory as a headline read, “Era of Fear is Declared at End Now.”

The Depression-era classic song entitled “Happy Days Are Here Again”

was played at the Democratic National Convention in 1932 and it went on

to be featured by the Democrats for many years after that. The

following is an excerpt from a

Wikipedia article about that song…

Today, the song is probably best remembered as the campaign song for Franklin Delano Roosevelt’ssuccessful

1932 presidential campaign. According to TIME magazine, it gained

prominence after a spontaneous decision by Roosevelt’s advisers to play

it at the 1932 Democratic National Convention, and went on to become the Democratic Party‘s “unofficial theme song for years to come”.

There is only one huge problem.

The election of Roosevelt didn’t end the depression. Years of bitter

economic suffering and dust bowl conditions were still ahead. The

Great Depression continued all the way up to the start of World War II,

and the war years were certainly no picnic for average folks either.

But at least cheery headlines can make people feel better, right?

That is what some believe.

Others believe that giving people false hope is very cruel and that it sets up people for failure.

The following are some actual headlines that were found on mainstream news sites today…

CNBC: “

Recession risk gone in all US states but 1: Moody’s Analytics”

CNN: “

Foreclosure crisis is drawing to a close”

NBC News: “

Stocks close near highs; S&P logs 7-day rally”

Wow, those headlines sound great!

So are happy days here again?

Not quite.

In fact, things continue to get even worse in a whole host of ways. Just consider the following statistics…

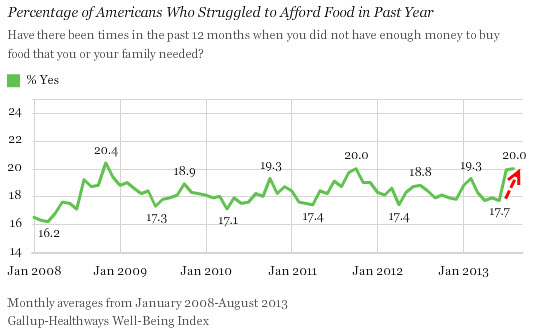

-According to a

brand new Gallup poll that

was just released, 20.0% of all Americans did not have enough money to

buy food that they or their families needed at some point over the past

year. That is just under the record of 20.4% that was set back in

November 2008.

-Gallup

also found that the ability of American families to meet some of their other most basic needs is near an all-time low…

The Basic Access Index, which includes 13 questions about

topics including Americans’ ability to afford food, housing, and

healthcare, was 81.4 in August, on par with the all-time low of 81.2

recorded in October 2011.

-

More than 90 million working age Americans are considered to be “not in the labor force”.

-The labor force participation rate is the lowest that it has been

in 35 years.

-

516,000 Americans ”left the labor force” last month. That was a brand new all-time record high.

-The number of private sector jobs dropped by

278,000 last month.

-

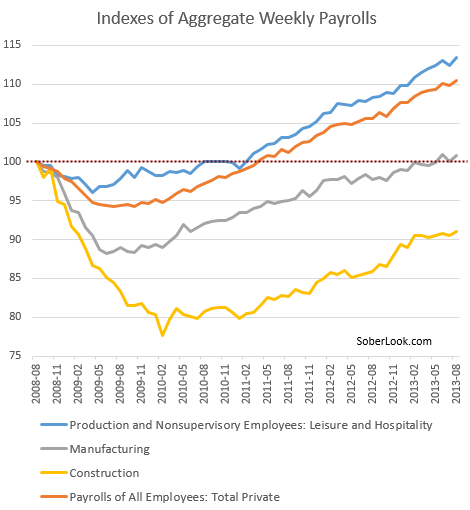

77 percent of the jobs that have been “created” so far this year have been part-time jobs.

-Approximately

one out of every four part-time workers in America is living below the poverty line.

-Right now, 40 percent of all U.S. workers are making less than

what a full-time minimum wage worker made back in 1968.

-The U.S. trade deficit with China has hit

a brand new record high.

-The U.S. trade deficit with the EU has hit

a brand new record high.

-The number of U.S. households on food stamps is at

a brand new record high.

-One of the largest furniture manufacturers in America

was just forced into bankruptcy…

The maker of furniture brands such as Thomasville,

Broyhill, Lane and Drexel Heritage said Monday that it has filed for

Chapter 11 bankruptcy protection.

-Total mortgage activity has dropped to the lowest level that we have seen

since October 2008.

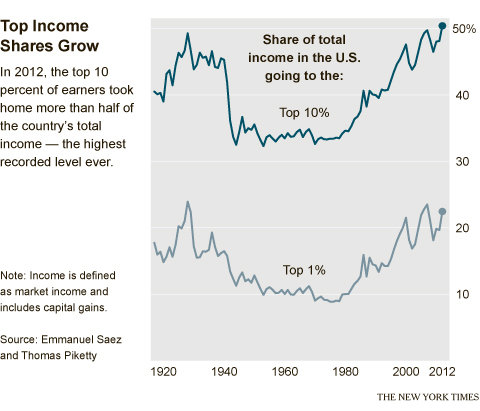

Yes, those in the

top 1 percent are doing very well for the moment thanks to the reckless money printing that the Federal Reserve has been doing.

But for most Americans, the last several years have been a continual

struggle. The following is a list that comes from one of my previous

articles entitled “

44 Facts About The Death Of The Middle Class That Every American Should Know“…

1. According to

one recent survey,

“four out of five U.S. adults struggle with joblessness, near poverty

or reliance on welfare for at least parts of their lives”.

2. The growth rate of real disposable personal income is the lowest that it has been

in decades.

3. Median household income (adjusted for inflation) has fallen

by 7.8 percent since the year 2000.

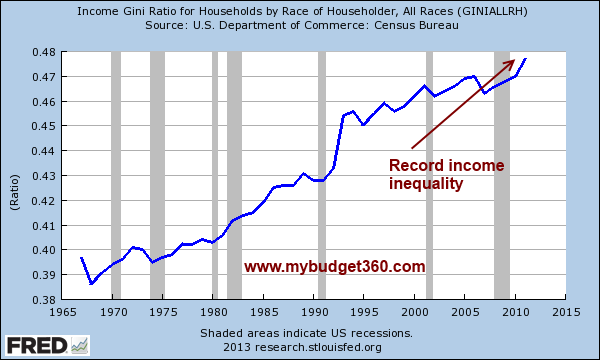

4. According

to the U.S. Census Bureau, the middle class is taking home a smaller share of the overall income pie than has ever been recorded before.

5. The home ownership rate in the United States is the lowest that it has been

in 18 years.

6. It is more expensive to rent a home in America

than ever before. In fact, median asking rent for vacant rental units

just hit a

brand new all-time record high.

7. According to one recent survey,

76 percent of all Americans are living paycheck to paycheck.

8. The U.S. economy actually

lost 240,000 full-time jobs last month, and the number of full-time workers in the United States is now about

6 million below the old record that was set back in 2007.

9. The largest employer in the United States right now is Wal-Mart. The second largest employer in the United States right now

is a temp agency (Kelly Services).

10. One out of every ten jobs in the United States is now filled through a temp agency.

11. According to the Social Security Administration,

40 percent of all workers in the United States make less than $20,000 a year.

12. The ratio of wages and salaries to GDP is

near an all-time record low.

13. The U.S. economy continues to trade

good paying jobs for low paying jobs.

60 percent of the jobs lost during the last recession were mid-wage jobs, but

58 percent of the jobs created since then have been low wage jobs.

14. Back in 1980,

less than 30% of all jobs in the United States were low income jobs. Today,

more than 40% of all jobs in the United States are low income jobs.

15. At this point, one out of every four American workers has a job that pays

$10 an hour or less.

16. According to one study, between 1969 and 2009 the median wages earned by American men between the ages of 30 and 50 declined

by 27 percent after you account for inflation.

17. In the year 2000,

about 17 million Americans were employed in manufacturing. Today, only

about 12 million Americans are employed in manufacturing.

18. The United States has lost

more than 56,000 manufacturing facilities since 2001.

19. The average number of hours worked per employed person per year has fallen

by about 100 since the year 2000.

20. Back in the year 2000,

more than 64 percent of all working age Americans had a job. Today, only

58.7 percent of all working age Americans have a job.

21. When you total up all working age Americans that do not have a job, it comes to

more than 100 million.

22. The average duration of unemployment in the United States is

nearly three times as long as it was back in the year 2000.

23. The percentage of Americans that are self-employed has

steadily declined over the past decade and is now at an all-time low.

24. Right now there are

20.2 million Americans that spend more than half of their incomes on housing. That represents a 46 percent increase from 2001.

25. In 1989, the debt to income ratio of the average American family was about

58 percent. Today it is up to

154 percent.

26. Total U.S. household debt grew from just

1.4 trillion dollars in 1980 to a whopping

13.7 trillion dollars in 2007. This played a huge role in the financial crisis of 2008, and the problem still has not been solved.

27. The total amount of student loan debt in the United States recently surpassed

the one trillion dollar mark.

28. Total home mortgage debt in the United States is now

about 5 times larger than it was just 20 years ago.

29. Back in the year 2000, the mortgage delinquency rate was

about 2 percent. Today, it is

nearly 10 percent.

30. Consumer debt in the United States has risen by a whopping

1700%since 1971, and

46% of all Americans carry a credit card balance from month to month.

31. In 1999,

64.1 percent of all Americans were covered by employment-based health insurance. Today, only

55.1 percent are covered by employment-based health insurance.

32. One study discovered that

approximately 41 percent of

all working age Americans either have medical bill problems or are

currently paying off medical debt, and according to a report published

in The American Journal of Medicine medical bills are a major factor in

more than 60 percent of all personal bankruptcies in the United States.

33. Each year, the average American must work

107 days just to make enough money to pay local, state and federal taxes.

34. Today, approximately

46.2 million Americans are living in poverty.

35. The number of Americans living in poverty has increased

by more than 15 million since the year 2000.

36. Families that have a head of household under the age of 30 have a poverty rate

of 37 percent.

37. At this point, approximately

25 million American adults are living with their parents.

38. In the year 2000, there were only

17 million Americans on food stamps. Today, there are more than

47 million Americans on food stamps.

39. Back in the 1970s,

about one out of every 50 Americans was on food stamps. Today, about one out of every 6.5 Americans is on food stamps.

40. Right now, the number of Americans on food stamps exceeds

the entire population of the nation of Spain.

41. According

to one calculation,

the number of Americans on food stamps now exceeds the combined

populations of “Alaska, Arkansas, Connecticut, Delaware, District of

Columbia, Hawaii, Idaho, Iowa, Kansas, Maine, Mississippi, Montana,

Nebraska, Nevada, New Hampshire, New Mexico, North Dakota, Oklahoma,

Oregon, Rhode Island, South Dakota, Utah, Vermont, West Virginia, and

Wyoming.”

42. At this point,

more than a million public

school students in the United States are homeless. This is the first

time that has ever happened in our history. That number has risen by

57 percent since the 2006-2007 school year.

43. According to U.S. Census data,

57 percent of all American children live in a home that is either considered to be “poor” or “low income”.

44. In the year 2000, the ratio of social welfare benefits to salaries and wages was approximately

21 percent. Today, the ratio of social welfare benefits to salaries and wages is approximately

35 percent.

But there is no way that we are actually in another economic depression, right?

If that was the case, the mainstream media certainly would have told us, right?

According

to John Williams of Shadow Government Statistics, if the U.S. government actually used honest numbers, they would show that the U.S. economy has actually

been contracting continually since 2005.

In other words, if the numbers were not being manipulated they would

show that we have had negative GDP growth every single year since 2005.

I don’t know about you, but that sure sounds like a depression to me.

What do you think?