The 7-minute video points to data of breakthrough economic solutions only awaiting a critical mass of public recognition. You literally have nothing more valuable for your attention because three OBVIOUS reforms are conservatively worth $60+ trillion:

Wednesday, June 4, 2014

1 in 5 Children Live in Poverty in USA

One in five children under age 18, or 21.3%, are living in poverty in the United States, according to the latest data from the U.S. Census Bureau.

In 2012, there were 15,437,000 children under 18 years old, or 21.3%, who were classified in the “below poverty” threshold, according to the Census.

“The incidence of poverty rates varies widely across the population according to age, education, labor force attachment, family living arrangements, and area of residence, among other factors. Under the official poverty definition, an average family of four was considered poor in 2012 if its pre-tax cash income for the year was below $23,492,” according to a Congressional Research Service (CRS) report entitled, Poverty in the United States: 2012.

“The Census Bureau’s poverty thresholds form the basis for statistical estimates of poverty in the United States,” reads the report. “The thresholds reflect crude estimates of the amount of money individuals or families, of various size and composition, need per year to purchase a basket of goods and services deemed as ‘minimally adequate,’ according to the living standards of the early 1960s.”

“Persons are considered poor, for statistical purposes, if their family’s countable money income is below its corresponding poverty threshold,” the CRS states.

The Census has been tracking these data since 1959, when the percentage of children under 18 living in poverty was 26.9%. In 1964, when then-President Lyndon B. Johnson announced the War on Poverty, the percentage of children living in poverty was 22.7%. Since then until now, the percentage has decreased by only 6.2%.

“In 2012, over one in five children (21.3%) in the United States, some 15.4 million, were poor – both their poverty rate and estimated number poor were statistically unchanged from 2011,” said the CRS report. “The lowest recorded rate of child poverty was in 1969, when 13.8% of children were counted as poor.”

“Children living in single female-headed families are especially prone to poverty,” says the report. “In 2012, a child living in a single female-headed family was well over four times more likely to be poor than a child living in a married-couple family. In 2012, among all children living in single female-headed families, 47.2 % were poor.”

“In contrast, among children living in married-couple families, 11.1% were poor,” said the CRS report. “The increased share of children who live in single female-headed families has contributed to the high overall child poverty rate.”

LINK GOLD TO DOLLAR or FACE DEPRESSION – STEVE FORBES

Just like many financial conservatives have advised in the past, notably former Reps. Jack Kemp and Ron Paul,

Forbes said that economic prosperity can come only if the dollar is

linked to gold and not printed willy-nilly at inflated rates.

“The best way to achieve

monetary stability: linking the dollar to gold,” he wrote in the book

out today. “The Fed should have only two tasks: keeping the dollar fixed

to gold and dealing quickly and decisively with panics,” he wrote,

according to excerpts provided in advance to Secrets.

…

Among the economic problems Forbes blames on the Fed’s monetary policies:

— The U.S.’s weak economic recovery.

– Slower long-term growth and higher unemployment.

— High food and fuel prices.

— Declining mobility, greater inequality and the destruction of personal wealth.

— Increased volatility and currency crises.

— Larger government with higher debt.

— Lower levels of business innovation and entrepreneurship.

Gold price fixing is a FACT – Ed Steer

Ed Steer, the esteemed editor of Casey

Research’s Gold & Silver Daily and director of GATA (Gold Anti-Trust

Action Committee), chats with Cambridge House Live anchor Vanessa

Collette about the fine levied on Barclays for gold price fixing.

Must-see TV for any gold investor.

Comex Options Expiration: Orchestrated Price Take-Down

In

this episode, we review the options expiration week that was for gold

on the Comex. Predictably, the hits just kept coming. The take down of

gold arrived right on time, which we explain in our unique blow-by-blow

format.

To

avoid beating what is by now a thoroughly dead horse, we thought we’d

dress up one of the criminal cabal’s most hackneyed cliches with some

animation and laughs.

Because laughing is what the thieves are doing–all the way to the vault.

Renminbi (RMB) Yuan Clearing Bank To Open In London

Source: Live Trading

Excerpt:

A RMB Yuan (CNY) clearing bank will be officially appointed in the United Kingdom (UK) in June, said Mark Boleat, policy chairman for the City of London Corp, in an interview at the weekend.

“There will be a clearing bank in London. In due course, there will be an announcement,” Mr. Boleat said. The news will be an endorsement for London’s efforts to become an offshore yuan center. Other European financial centers in the race to become a Yuan center include Frankfurt, Paris, Switzerland and Luxembourg.

An official clearing bank facilitates efficient clearing of offshore Renminbi transactions, achieved through the appointed bank’s direct cooperation with the People’s Bank of China (PBOC) , the country’s central bank.

Mr. Boleat said having a clearing bank in London will act as a signal for London’s growing Yuan activities, although activities are already cleared through many commercial banks’ own channels.

For example, in December Standard Chartered (LO:STAN) teamed up with Agricultural Bank of China to provide their own Yuan clearing platform, making use of the 2 banks’ expertise and client base in the UK and China.

Mr. Boleat’s news follows a memorandum of understanding China and the UK signed in April to work together on a clearing bank for London.

A week before that agreement was reached, China also signed a memorandum with Germany to work on appointing a clearing bank in Frankfurt, highlighting the fierce competition between European financial centers for more yuan activities.

Mr. Boleat said his team has been working on the idea for some time with the People’s Bank of China, Bank of England (BOE), and many banks in London, and the PBOC has now decided to appoint the clearing bank.

“We assume it’s going to be a Chinese bank, because that’s the way the PBOC does things,” Mr. Boleat said.

He said another key announcement is expected on Chinese banks opening new branches, after a long lobbying process to achieve this.

Read More @ Source

Excerpt:

A RMB Yuan (CNY) clearing bank will be officially appointed in the United Kingdom (UK) in June, said Mark Boleat, policy chairman for the City of London Corp, in an interview at the weekend.

“There will be a clearing bank in London. In due course, there will be an announcement,” Mr. Boleat said. The news will be an endorsement for London’s efforts to become an offshore yuan center. Other European financial centers in the race to become a Yuan center include Frankfurt, Paris, Switzerland and Luxembourg.

An official clearing bank facilitates efficient clearing of offshore Renminbi transactions, achieved through the appointed bank’s direct cooperation with the People’s Bank of China (PBOC) , the country’s central bank.

Mr. Boleat said having a clearing bank in London will act as a signal for London’s growing Yuan activities, although activities are already cleared through many commercial banks’ own channels.

For example, in December Standard Chartered (LO:STAN) teamed up with Agricultural Bank of China to provide their own Yuan clearing platform, making use of the 2 banks’ expertise and client base in the UK and China.

Mr. Boleat’s news follows a memorandum of understanding China and the UK signed in April to work together on a clearing bank for London.

A week before that agreement was reached, China also signed a memorandum with Germany to work on appointing a clearing bank in Frankfurt, highlighting the fierce competition between European financial centers for more yuan activities.

Mr. Boleat said his team has been working on the idea for some time with the People’s Bank of China, Bank of England (BOE), and many banks in London, and the PBOC has now decided to appoint the clearing bank.

“We assume it’s going to be a Chinese bank, because that’s the way the PBOC does things,” Mr. Boleat said.

He said another key announcement is expected on Chinese banks opening new branches, after a long lobbying process to achieve this.

Read More @ Source

Russian Roulette – Derivative Style

Russian Roulette: Put one bullet in the cylinder of a revolver, spin

the cylinder, point the gun at YOUR head, and pull the trigger. Most

revolvers have 6 chambers, so your odds of surviving are 5 in 6, IF you

quit after pulling the trigger once.

Press your luck, spin the cylinder, point the gun, and pull the trigger again. It might be okay. Try for a third time?

Read: Bill Holter: Precious Metals 101 with One Obvious Assumption

Read: Michael Snyder: The Size Of The Derivatives Bubble Hanging Over The Global Economy Hits A Record High

Read: SRSrocco Report: Precious Metals Manipulation Isn’t Hidden, It’s Right In Front Of Your Eyes

GE Christenson

aka Deviant Investor

Press your luck, spin the cylinder, point the gun, and pull the trigger again. It might be okay. Try for a third time?

Now play Russian Roulette – Derivative Style

Note: I have no insider knowledge regarding derivatives, so I am merely speculating. But I think we can assume the following:- Total face value of unregulated derivative contracts is something around 1,000 Trillion dollars – depending on who is counting and who is lying.

- Banks (Goldman, JP Morgan, Deutsche Bank, etc.) sell these contracts because they generate huge commissions and probably other long-term profits.

- Wall Street banks poured mega-bucks into DC lobbyists to keep the derivative game running with minimal regulation and oversight. Obscene profits, not the public good, are the reason.

- Except for commissions upfront, derivatives are supposedly a zero sum game. I win, you lose, and the bank gets a fee. It sounds like a bookie in Las Vegas. You put up $1.1 Billion to win $1.0 Billion. Somebody wins, somebody loses, and the casinos (derivative banks) take the $100 Million as a fee – roughly 5% of every dollar bet on either side.

- Let’s be trusting and assume the derivative banks only take 1%, not 5%. If the notional value of derivative contracts is $1,000 Trillion and the fee is only 1%, the cumulative take for the banks writing contracts was $10 Trillion. That is a lot of CEO bonuses.

- Even if the commission was one-tenth of a percent, the take was $1 Trillion in fees.

- Eventually the system must fail, as commissions and fees suck capital out of the system each time a contract is written. More leverage and more indebtedness will not improve an unsustainable system.

- But fees are collected as contracts are written, bonuses are paid, and taxpayers (via bail-outs) or depositors (via bail-ins) might have to cover the losses. Remember TARP and the Cyprus bail-ins!

Another Trigger Pull!

- Nothing goes wrong – no crash, no bank failures, no government default. This is unlikely and more so each day.

- Banks continue writing derivative contracts because… they can and why would they stop? Let’s guess another $1,000 Trillion each decade in new contracts.

- Banks collect a commission that generates perhaps $1 Trillion or more in fees; this is $1 Trillion (or maybe much more) sucked out of the financial system each decade – and it produced nothing. It reminds me of the phrase, “the rich get richer, and the poor get poorer.”

Implications

- In ideal circumstances, there is no crash, no bank failures, and all debts get paid.

- But derivatives suck a huge amount of capital out of the global economies each year, and that makes ideal circumstances increasingly difficult to maintain. Instead of paying banker bonuses, that capital could be used for constructive projects.

- The financial system is unlikely to continue operating under ideal circumstances. When another 2008 crisis arrives, the supposed zero sum game, less commissions of course, becomes a black hole of daisy-chained obligations that might collapse the American, European, and Asian financial systems. It has happened before.

- The resulting financial and social chaos will not be pretty!

Read: Bill Holter: Precious Metals 101 with One Obvious Assumption

Read: Michael Snyder: The Size Of The Derivatives Bubble Hanging Over The Global Economy Hits A Record High

Read: SRSrocco Report: Precious Metals Manipulation Isn’t Hidden, It’s Right In Front Of Your Eyes

GE Christenson

aka Deviant Investor

I-495 bridge closed because of tilting columns

Delaware officials on Monday ordered the

emergency closure of the Interstate 495 bridge over the Christina River

in Wilmington after discovering that four support columns are tilting.

The 4,800-foot bridge normally carries about 90,000 vehicles a day on I-495, which diverts traffic around the city of Wilmington and toward the Port of Wilmington. The route parallels Interstate 95, which runs through downtown Wilmington.

"We understand that there will be a significant impact to the traveling public," said state Transportation Secretary Shailen Bhatt.

He added that he doesn't know how long the bridge will be closed. "It could be a day; it could be significant amount of time," he said.

Officials said the four columns on the south bank of the river are tilted by as much as 2.4 degrees, or 4 percent, from vertical. The bridge will be closed in both directions until officials can determine what caused the shifting of the columns and what needs to be done to address it.

"The whole bridge will be re-inspected," said Rob McCleary, chief engineer for the Delaware Department of Transportation.

Delaware transportation officials said the agency received a report late Friday from an engineering firm working on an unrelated project about a possible problem with the bridge. The department sent out an inspection team Monday morning.

"It didn't come to us as like an emergency call," Bhatt said, explaining why a team wasn't sent earlier.

Officials said I-495 will be closed northbound at Terminal Avenue, which leads to the port, and that local northbound traffic can stay on I-495 to Terminal Avenue. Southbound traffic on I-495 will be closed at the Pennsylvania state line, with traffic diverted onto I-95 southbound. Southbound port traffic is being directed to Interstate 295 east and then to Delaware 9 north to the port.

Officials said the main span of the bridge over the water is considered "fracture critical," meaning that failure of one element could result in failure of the entire bridge, which consists of a concrete deck on steel beams supported by 37 reinforced concrete columns. However, the tilting columns in question support a different area of the 38-span bridge.

"The main span is not what's in question here," McCleary said.

The bridge was built in 1974 and is scheduled to be inspected every two years. It was last inspected in October 2012.

But officials noted that the tilting of the columns has resulted in the shifting of concrete pier caps resting on top of them. That shifting, in turn, has led to a height difference of about a foot between a northbound barrier wall on the bridge deck and the adjacent wall on the southbound side, according to McCleary.

Read more at http://www.philly.com/philly/news/breaking/I-495_bridge_closed_because_of_tilting_columns_.html#qlXppZkXoxBVJcyP.99

The 4,800-foot bridge normally carries about 90,000 vehicles a day on I-495, which diverts traffic around the city of Wilmington and toward the Port of Wilmington. The route parallels Interstate 95, which runs through downtown Wilmington.

"We understand that there will be a significant impact to the traveling public," said state Transportation Secretary Shailen Bhatt.

He added that he doesn't know how long the bridge will be closed. "It could be a day; it could be significant amount of time," he said.

Officials said the four columns on the south bank of the river are tilted by as much as 2.4 degrees, or 4 percent, from vertical. The bridge will be closed in both directions until officials can determine what caused the shifting of the columns and what needs to be done to address it.

"The whole bridge will be re-inspected," said Rob McCleary, chief engineer for the Delaware Department of Transportation.

Delaware transportation officials said the agency received a report late Friday from an engineering firm working on an unrelated project about a possible problem with the bridge. The department sent out an inspection team Monday morning.

"It didn't come to us as like an emergency call," Bhatt said, explaining why a team wasn't sent earlier.

Officials said I-495 will be closed northbound at Terminal Avenue, which leads to the port, and that local northbound traffic can stay on I-495 to Terminal Avenue. Southbound traffic on I-495 will be closed at the Pennsylvania state line, with traffic diverted onto I-95 southbound. Southbound port traffic is being directed to Interstate 295 east and then to Delaware 9 north to the port.

Officials said the main span of the bridge over the water is considered "fracture critical," meaning that failure of one element could result in failure of the entire bridge, which consists of a concrete deck on steel beams supported by 37 reinforced concrete columns. However, the tilting columns in question support a different area of the 38-span bridge.

"The main span is not what's in question here," McCleary said.

The bridge was built in 1974 and is scheduled to be inspected every two years. It was last inspected in October 2012.

But officials noted that the tilting of the columns has resulted in the shifting of concrete pier caps resting on top of them. That shifting, in turn, has led to a height difference of about a foot between a northbound barrier wall on the bridge deck and the adjacent wall on the southbound side, according to McCleary.

Read more at http://www.philly.com/philly/news/breaking/I-495_bridge_closed_because_of_tilting_columns_.html#qlXppZkXoxBVJcyP.99

Steen Jakobsen: Expect A 30% Stock Market Correction in 2014

Submitted by Adam Taggart of Peak Prosperity,

This week, Chris talks with Steen Jakobsen, Chief Investment Officer

of Saxo Bank. We wanted to see through the eyes of a professional

economist, which Steen kindly allowed us to do.

Steen agrees that central banks have largely failed in their misguided attempts to boost growth via trickle-down programs. Pretty much all the benefits of the recent years of money printing have gone to the upper echelons, with the true engines of growth and jobs -- small to medium sized enterprises (SMEs) -- getting very little.

As a result, financial asset prices have been driven up too high, which Steen anticipates will correct at some point in 2014; likely by 30% or so:

On all the above, we're in agreement with Steen.

In other areas, our predictions differ. But that's why we have guests like him on the program: to hear the rational behind contrasting views, and to learn what those moving large sums of capital in today's markets are thinking.

Despite the near term likelihood of a major correction, Steen remains quite optimistic. He believes that the correction will be a clearing event not just for overly-elevated prices, but also will serve as a wake-up call about the net energy situation that will lead to better policy decisions. We sure hope he's right, but we sadly think it will take a major price shock or supply shortage of key commodities to get the attention of our leaders.

Click the play button below to listen to Chris' interview with Steen (42m:43s):

Steen agrees that central banks have largely failed in their misguided attempts to boost growth via trickle-down programs. Pretty much all the benefits of the recent years of money printing have gone to the upper echelons, with the true engines of growth and jobs -- small to medium sized enterprises (SMEs) -- getting very little.

As a result, financial asset prices have been driven up too high, which Steen anticipates will correct at some point in 2014; likely by 30% or so:

Here is my practical view. Since Q3 of last year I’ve been 70% in fixed income because I do believe, and I continue to believe, that we’ll see new low interest rates. In a world that cannot restart itself, it a world that believes in 'extend and pretend', you will not have any activity. You don’t have any move towards a mandate for change. So that means that history tells us the only way we get change is through the system failing. I’m not talking about a systemic failing; I'm talking about people owning up to the fact that we need to activate the SME. So I think we’ll see a progression towards helping the SMEs.He also agrees that rising energy costs and overall resource scarcity are real threats to future economic growth; threats that he believes most economists and investors are blind to.

But in terms of the market, I have been very on fixed income, an increase in the exposure right now from 70 to 90% taking whatever equity I have down. Not because I’m afraid of 'doom and gloom' but simply because I think you can have a huge amount of leverage into the fixed income market here when everybody seems to believe that interest rates cannot go lower -- now confirmed today by the Q1 data from the US. The world is simply starving because the world is rebalancing. The US current account deficit moved from -800 to -400. The world needs $400 billion worth of new export markets before it gets back to break even.

At the same time, Asia and China certainly are rebalancing their way from nominal growth towards quality growth. Again, the first derivative of that is lower growth, deflation, exported to the rest of the world.

So I think the low comes in economically in Q1 and Q2 in 2015. Every single macro indicator you can find will bottom at Q1/Q2. For the equity market, I think the top is 1900/1950. But you can't both predicted the level and the timing. And I’m more confident about the timing, not the level. So my timing I’m confident, and the timing I am confident on is the fact that the second half of this year is going to see a 30% correction from the top.

On all the above, we're in agreement with Steen.

In other areas, our predictions differ. But that's why we have guests like him on the program: to hear the rational behind contrasting views, and to learn what those moving large sums of capital in today's markets are thinking.

Despite the near term likelihood of a major correction, Steen remains quite optimistic. He believes that the correction will be a clearing event not just for overly-elevated prices, but also will serve as a wake-up call about the net energy situation that will lead to better policy decisions. We sure hope he's right, but we sadly think it will take a major price shock or supply shortage of key commodities to get the attention of our leaders.

Click the play button below to listen to Chris' interview with Steen (42m:43s):

The Fed’s Dilemma: No Wiggle Room

The Volatility Index

(VIX) is a contrarian indicator that gauges whether overall sentiment

in the market is optimistic or fearful. Basically, the VIX is a measure

of market anxiety. When the index is low, as it is now, the sentiment

is optimistic. When it is high, the sentiment is pessimistic. Note the

following chart from the Financial Times:

For over a year now, the VIX,

across a variety of asset classes, has been range-bound at levels last

seen in 2006 and 2007, just prior to the Great Recession. As seen in

the chart above, volatility increased dramatically beginning in the

second half of 2007, as an overheated housing market crashed bringing

the stock market down with it. History seems to be repeating itself, as

investors appear to be put off by the extensive amount of Federal

Reserve interference and the unbridled cupidity of high frequency

traders in our financial markets. These factors, among other concerns,

have led investors to throttle back on market activity and this is

reflected in the low volatility levels we are witnessing. Lillian Gett

of the Financial Times warns that “market tranquility tends to sow the

seeds of its own demise and the longer the period of calm, the worse the

eventual whiplash.”

The Federal Reserve was created

by bankers for bankers one century ago. Consequently, the first thing

the Fed did when the markets nosedived in 2008 was rescue the big banks

and they pulled out all the stops to do so. All else was secondary.

The Fed and U.S. Treasury successfully used the counterfactual argument

that we were at the brink of a financial abyss to spook Congress into

granting them extraordinary powers at the peak of the crisis in 2008.

At the Fed’s urging, the government bailed out the big Wall Street banks

with taxpayer money. The Fed rushed to the rescue of recalcitrant

bankers instead of opting for an orderly bankruptcy consistent with the

principles of a capitalist system. To reverse the slide in the economy,

the Fed also drove the federal funds rate to near zero in 2008, where

it has remained ever since. This Zero Interest Rate Policy (ZIRP) was

later turbo-charged with a series of quantitative easing programs, where

the Fed, on a monthly basis, purchases tens of billions of dollars of

U.S. Treasury securities and toxic assets held by the big banks. That

influx of freshly minted money naturally found its way into equities in a

big way and pushed up asset prices even as the general economy

continued to languish.

The main beneficiaries of the

Fed’s monetary policies have clearly been wealthy investors, whose

considerable financial assets have risen in value as the stock market

has risen relentlessly, without a significant correction for five years

and counting. On the other hand, the middle class has suffered the

brunt of the damage as wages have remained stagnant through either

unemployment, increased part-time instead of full-time work, or minimal

salary increases.

One would think that Wall

Street bankers would be delighted with the outcome as it relates to them

and would act with more magnanimity in the future. Instead, it appears

that being rewarded for failing miserably made them believe in their

invincibility. As any spoiled child will attest, it is unacceptable to

suffer any setback for a prolonged period of time. Hence, we have

arrived at the point where bankers are complaining that Fed policy is

now harming their profitability or, at least, the levels of

profitability to which they have become accustomed over the years. They

contend that normal market fluctuations have been unduly attenuated by

Fed policy and this diminution in the amplitude of the wiggles; i.e. ups

and downs, in asset prices has had a deleterious impact on their

trading revenues.

To its dismay, the Fed never

counted on the economy being mired in anemic growth for this long a time

period. By now, according the prior Fed forecasts concerning

anticipated GDP growth, the economy should have recovered its health and

the Fed should have been well on the way to reducing its balance

sheet. Instead, the balance sheet has ballooned to a record four

trillion dollars. Any serious talk about increasing interest rates by

the Fed is met with swift market pullbacks, but these are short-lived as

Fed officials immediately walk back any notion that could be

misinterpreted that they intend to raise rates anytime soon. Investors

have grown accustomed to a stock charts that continue to ascend up and

to the right. It is taken for granted that, as long as the Fed

continues its easy money policy, the market will continue its inexorable

climb. Anyone who thought they knew better over the past several years

and shorted the market got their heads handed to them. All the bears

did was provide fuel to the bull market as they got squeezed and had to

cover their short positions at market prices. Numerous technical

analysts repeatedly called for a market reversal, if not a major market

crash, only to see it not come to fruition. They failed to recognize

that technical analysis does not work very well with a rigged market,

where the data being analyzed is corrupted. Garbage in; garbage out.

See previous article at: http://investmentwatchblog.com/the-bane-of-technical-market-analysis/ .

Having been burned numerous

times, most bears retreated to the sidelines some time ago, leaving

mostly those with a bullish outlook in the market. Hence, it is no

surprise that market sentiment, as reflected in the VIX, is near record

lows. Complacency rules. Fear is missing in action. When sentiment,

whether it is fear or optimism, settles at extreme levels for a

prolonged period of time, the market fails to exhibit the up and down

fluctuations it normally would. The swings in stock prices become

muted and tame compared to what they would typically be. Becalmed

markets are anathema to short-term traders, who need stock prices to

swing up and down in a reasonably fluid manner, if they are to trade

profitability. This is particularly true for high-frequency traders,

who trade at millisecond intervals in huge volume. The trading edge

provided by clever algorithms is dulled as stock volatility declines.

Reinforcing stock market

placidity is the flight of retail investors who have retreated to the

sidelines in large numbers as the market marches into record high

territory. Even the village idiot knows, at some point, that it is

probably not a good long-term strategy to buy high and then sell higher

as the market keeps making new highs on a regular basis. Market volume

is dominated by high frequency traders who use manipulative computer

programs to front-run honest investors 24/7 with impunity. Laughingly,

the SEC claims it has been studying the self-evident scam for years but

can’t quite decide whether stepping in front of stock transactions at

the speed of light to scalp pennies and nickels in huge volume is a

problem or could possibly result in an uneven playing field. But

investors see right through the charade. They are tired of being duped

and juked by high-speed computer algorithms, leading them to curtail or

abandon their trading activity in what they perceive to be a rigged

market.

Therefore, it is more difficult

for market manipulators to earn as much as they usually do since there a

fewer marks to separate from their money. It’s like a sailboat without

strong winds to propel it along. It simply can’t go as fast and travel

as far as it otherwise would under normal trade winds. The same

analogy applies to high frequency traders who cannot haul in as much in

profits as they otherwise would under normal market conditions. In

other words, traders need the market to fluctuate or wiggle in a more

traditional manner and they need a sizeable supply of active market

participants, if they are to make the same level of trading profits to

which they have become accustomed. And the profits to which they have

become accustomed are considerable. Reduced market participation and

reduced market volatility translate into reduced trading revenues.

As a result, several spokesmen

at Goldman, Citigroup, and JPMorgan have voiced concerns that lingering

low volatility is negatively impacting trading revenues. They are

blaming Federal Reserve policies for distorting normal market behavior.

They want the Fed to remove its heavy thumb from the scale so there is

more bounce in the market. It’s time, in their view, for the Fed to

leave market manipulation in the capable hands of the proprietary

trading desks in order to restore profits to their proper levels.

So, what is the Fed to do? Not

only are bank depositors, particularly seniors, sick and tired getting

next to nothing on their savings, but now bankers are starting to

complain that they are not getting the returns they believe they

deserve.

When big bankers squawk, the

Fed listens. If past is prologue, the Fed would normally be inclined to

do whatever favors the big banks. And, if that means increasing

volatility to increase trading gains at proprietary trading desks, the

Fed would normally be disposed to grant the banks their wish. But there

is a problem with making such an accommodation: increasing volatility

is usually accompanied by declining equity prices.

Wall Street firms will position

themselves to stay out of harm’s way, as they usually do, when the

general market declines, but they will also be in a position to profit

by the increase in stock price fluctuations caused by increased

volatility. In other words, market fluctuations, which are conducive to

surefire high frequency trading gains, are more important to them than

which direction the market is heading. The bears will return to the

market making for a choppy trading environment. As far as high

frequency algorithmic traders are concerned, the ripple on the ocean’s

surface is more important than the level of the tide. But the reverse

is true for investors who are primarily concerned with the level of the

tide and don’t want to suffer losses in a sinking market, especially

after the Fed encouraged them to take on more risk.

Hence, the Fed finds itself

caught on the horns of a dilemma. Satisfy the banks and leave market

forces alone, thereby risking a potential market collapse. Or satisfy

investors by keeping the market artificially afloat by continuing the

easy money policy indefinitely.

As a matter of

self-preservation, the Fed does not want to be blamed for setting off a

major market panic. The Fed realizes that any serious market setback

will again hurt those least capable of sustaining the losses and will

provide ammunition to those who want to rein in or end the Fed. As much

as the Fed may want to please Wall Street, they aren’t going to walk

the plank that easily. They are still smarting from their failure to

recognize the housing bubble that crashed around their ears not that

long ago. Instead of doing something they might regret, the Fed is

seeking a middle ground where they gradually return interest rates

closer to a normal range, hoping nothing untoward happens in the

interim. A glacial return to normalcy, however, is likely to distort

market behavior even more in the future and may have other unintended

consequences.

This was the ineluctable

outcome once the Fed embarked on a course of monetary easing over a

protracted period of time because it threw a monkey wrench into the

natural rhythms of our financial markets. The result is an aberrant

market which is showing telltale signs of manipulation. It is behaving

more like a fixed horse race, where the horses leave the starting gates

and line up along the rail in a pre-determined order, like a

merry-go-round, until they cross the finish line.

Sooner or later, the piper must

be paid. Instead of letting our capitalist system work to expunge

excesses and accepting the pain that it engenders over the short or

intermediate term, the Fed decided that it was more important to protect

the worst offenders and distribute the pain over a very long time frame

to those least culpable of causing the problem; i.e., the American

middle class.

This is what happens when a

tiny group of unelected insiders at the Federal Reserve make monetary

policy decisions with little oversight. Perhaps, the Fed initially

thought they could control market forces through monetary machinations.

But, with so many market variables at play, not the least of which is

the fact that we live in a globally interconnected financial system, it

turned out to be a dubious experiment. The forces of supply and demand

tend to seek their own level of equilibrium. Any attempt to manipulate

and alter the natural balance is doomed to failure. It is foolhardy to

think monetary policy can be cleverly managed to avoid the pain

associated with poor financial decisions over the long run. It doesn’t

work that way for an individual with his or her private finances nor

does it work for central bankers on a national or global scale.

The Fed appears to have painted

itself in a corner where they are damned if they do and damned if they

don’t. Sitting on the fence is getting more and more uncomfortable for

the Federal Reserve but jumping off is likely to be much worse.

This leaves the Fed very little

wiggle room in their quixotic quest to suppress and contain normal

market forces, which are stronger than any group of individuals who may

think they are more powerful. In all likelihood, this will not end

well, nor should it.

BREAKING: You now have two weeks to prepare for a massive cyber attack! Also 4 days fearful stocks!

LINKS

http://www.msnbc.com/msnbc/white-hous…

http://finance.yahoo.com/news/ism-cor…

http://www.zerohedge.com/news/2014-06…

http://www.marketwatch.com/story/the-…

http://www.zerohedge.com/news/2014-06…

http://beforeitsnews.com/space/2014/0…

http://www.businessinsider.com/18-34-…

http://www.dailymail.co.uk/news/artic…

http://www.reuters.com/article/2014/0…

http://allenbwest.com/2014/06/bombshe…

https://www.uschamber.com/blog/double…

http://www.chicagotribune.com/news/sn…

http://toprightnews.com/?p=3435

http://www.theblaze.com/stories/2014/…

http://rt.com/news/163216-russia-nato…

http://rt.com/news/163168-virus-compu…

http://www.msnbc.com/msnbc/white-hous…

http://finance.yahoo.com/news/ism-cor…

http://www.zerohedge.com/news/2014-06…

http://www.marketwatch.com/story/the-…

http://www.zerohedge.com/news/2014-06…

http://beforeitsnews.com/space/2014/0…

http://www.businessinsider.com/18-34-…

http://www.dailymail.co.uk/news/artic…

http://www.reuters.com/article/2014/0…

http://allenbwest.com/2014/06/bombshe…

https://www.uschamber.com/blog/double…

http://www.chicagotribune.com/news/sn…

http://toprightnews.com/?p=3435

http://www.theblaze.com/stories/2014/…

http://rt.com/news/163216-russia-nato…

http://rt.com/news/163168-virus-compu…

The US Housing Market’s Darkening Data

by Brian Pretti

When looking at residential

real estate, we often tend to focus almost solely on recent price

movements in assessing the health of the housing market at any point in

time. But as both homeowners and income-earners in the larger economy,

of which the housing market is an important component, to really

understand what’s going on, we need clarity into the larger cycle

driving those price movements.

The more we look at today’s

data, the more it looks like that we are in a new type of pricing cycle —

one that homeowners and housing investors have no prior experience

with.

And the more we learn about the

fundamentals underlying the current cycle, the harder it becomes to

justify today’s home prices on any sustained level. Meaning a downward

reversion in home values is very probable in the coming years.

Housing & The Economy

Housing construction has been

meaningfully additive to overall US GDP in virtually every economic

expansion cycle on record. Moreover, sales of home furnishings,

appliances, landscaping and gardening equipment, etc. have contributed

to expansion in consumer spending, the largest singular component of US

GDP. And maybe most importantly, residential real estate investment has

been a key wealth-generation asset for the middle and lower classes for

decades.

Residential housing has

typically been purchased with leverage that has been paid down over time

accompanied by a commensurate increase in household equity as

homeowner’s age and mortgages are paid off. Particularly for the middle

and lower classes, residential real estate investment has been the

single largest contributor to net worth expansion of any household

investment asset class.

With the clarity of hindsight,

we know that the prior 2006-2009 period witnessed the most serious

downturn in residential real estate prices in a generation. Few saw it

coming as it was an event never experienced in their lifetimes. One

would have to travel back to the 1930’s Depression period to find a

similar occurrence. There is an old saying in the markets — People don’t repeat the mistakes of their parents, they repeat the mistakes of their grandparents

— and this was certainly true in residential real estate markets in

the middle of the prior decade, as the buildup of excess and often

reckless leverage was ultimately the key provocateur leading to price

declines, as was the case in the 1930’s.

Recovery At Last (?)

Accompanying the current

economic expansion that began in June of 2009, residential real estate

prices have recovered. In fact, in high-ticket geographic areas such as

many parts of the San Francisco Bay Area, New York, etc, current prices

have well exceeded the prior cycle peaks of 2006.

Indeed, the following chart (using data from the US Census Bureau) shows us that the median price of a single family home in the US has now recovered to a level just above the prior cycle peak:

Remember, this incorporates

meaningful and often anomalistic sales activity in very high priced

areas such as New York and San Francisco, clearly skewing the median

numbers higher.

In one sense, the recovery in

price is at least graphically pleasing and simplistically suggests a

return to longer term normalcy, or trend, in the overall residential

real estate market. But as we look a bit deeper beyond just price into

the important components of housing activity as they relate to the real

economy (GDP) and household balance sheets, we see something very

different: as the prior cycle downturn was a once-in-a-generation event,

so, too, is the character of the current housing recovery. The anomaly

of the current recovery has implications for both the real economy and

investment activity ahead.

In headline fashion, the

contribution of housing to US economic growth is found in new home sales

and housing starts. Demand for new homes drives demand for building

materials and construction work, both important in prior cycles in

driving job growth, the bedrock foundation for consumer spending. Again,

if one only looked at residential real estate price trends, one would

assume a very normal recovery.

The Data Tell A Much Darker Story

But the data below show us that

actual new home sales and housing starts currently rest very near

half-century lows. How can this be? What we see at present with new

home sales and construction starts is what we saw at the depths of every

US recession of the last 50 years. These data points suggest that the

current is anything but a normal housing recovery.

Here are the numbers are current through April of this year:

(Source: US Census Bureau)

Accompanying the dearth of new

home sales and starts is the fact that the number of new mortgage

purchase applications currently rests near the lows seen since 2009.

Just how can prices be ascending so spectacularly when new home sales

are in prior recession territory, new housing starts have not recovered,

and the number of new mortgage purchase applications has not climbed

from the depths seen in 2009-2010?

Accompanying these trends is

the fact that the US homeownership rate post the peak seen in 2004 has

fallen to a near 19-year low. The message is that although total

household formation has marched forward, households are increasingly

choosing to rent their primary residence as opposed to own residential

real estate. Of course, this is the reason that median rents in the US,

seen in the bottom clip of the next chart, have incrementally marched

to new all-time highs:

(Source: US Census Bureau)

How Will This Contradiction Resolve?

The key macro conclusion of the

current cycle is that we are not witnessing a “normal” residential real

estate recovery at all, but rather an investment cycle driven by

actions of central bankers (think the Fed), global flows of capital, and

a new entrant to the residential real estate market from the

institutional investor side.

In Part 2: Get Ready For Falling Home Prices

we identify the new primary drivers of home values in this unfamiliar

pricing cycle and examine their implications for the broader economy,

and household consumers specifically, as we look ahead.

Long story short: price

reversion is coming. If you own housing as either a residence or an

investment, don’t let yourself be caught as vulnerable as you were in

2008.

Click here to access Part 2 of this report (free executive summary, enrollment required for full access)

“Buying Time” Doesn’t Fix Financial Crises, It Makes the Next One Worse

The

strategy of “buying time so the financial system can heal itself” by

protecting a systemically destabilizing financial sector has failed

because it could only fail.

The core strategy of central states and banks to fix the Global Financial Meltdown of 2008 was to buy time: take extraordinary emergency monetary and regulatory measures to save the parasitic too big to fail banking

sector and the rest of the crony-capitalist Wall Street parasites, and

initiate an unprecedented transfer of wealth from savers and Main Street

to the banks and Wall Street via zero-interest rates and credit

funneled to the very players who caused the crisis.

The

idea was that the system would “heal itself” if authorities simply

“bought time” by saving the financial sector from its own predation. The

second phase of “buying time so the financial system can heal itself”

was to institute policies (ZIRP, etc.) that restored the financial

sector’s obscene profits and socialized its losses by transferring them

to the taxpayers.

The

terrible irony in the official strategy of “buying time so the financial

system can heal itself” is the policies prohibit healing and guarantee

the next financial crisis will be greater in magnitude than the last

one.

There is only one way for any financial system to heal itself: enable the open market to discover the price of capital, credit, assets, collateral and risk. When

participants finally discover the market price of their assets and

collateral are much lower than the valuations claimed in credit bubbles,

the market clears itself of bad credit and overvalued collateral in a market-clearing event in

which overpriced assets are marked down, firms that overleveraged weak

collateral are declared insolvent and liquidated, and creditors who can

no longer afford their loans are declared bankrupt and their remaining

assets liquidated to pay their creditors.

There is no other healing process but this one: enable

transparent, open markets to discover the price of capital, credit,

assets, collateral and risk and let those firms and individuals who

overleveraged and made bets that blew up go bankrupt.

What

“buying time” has done is destroy the market’s ability to price

capital, credit, assets, collateral and risk, stripping the system of

the essential information participants need to make rational, informed

decisions. By crushing the market’s ability to generate accurate

pricing information, central state and banking authorities have insured

the system cannot possibly heal itself while maintaining perverse incentives that guarantee the next financial crisis will dwarf the previous one.

The official policy of “buying time” has another fatal flaw: it

maintains a parasitic financial sector that expanded to a structurally

unhealthy dominance over both the political and economic sectors. Once

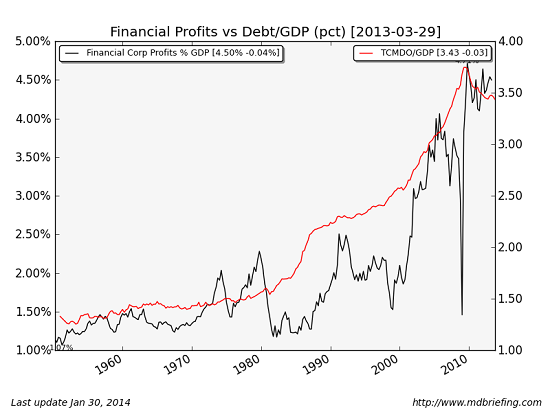

financial profits ballooned from a modest share of corporate profits to

dominance, this enabled financiers and bankers to buy political

protection of their skimming and scamming:

The

strategy of “buying time so the financial system can heal itself” by

protecting a systemically destabilizing financial sector has failed

because it could only fail. The policies that “saved the financial

system” only saved it from the healing process of the market discovering

the price of capital, credit, assets, collateral and risk.

OUR BIGGEST PROBLEM: being eternally in denial about there being no such thing as eternity.

BY JOHN WARD

“What

goes up must come down” is a fundamental and general law with very few

exceptions. But the human race, in almost all of its directions,

metiers, callings and endeavours, seems to think that the “down” part is

an exception so rare as to be homoaeophathic in nature.

Every empire in history has at some point gone stratospheric, and then fallen to earth faster than Icarus.

Every

over-heated stock market has been presented as an infinite rise, but

every ‘new paradigm’ ends up as “Buddy can you spare a dime” when it

obeys the old rule….and collapses.

The mad

Caledonian Gordon Brown boasted that he’d abolished boom and

bust….eighteen months before the greatest Bank bust in history began.

At one

point some four hundred years ago, Christianity looked set to become the

very first globalist business. Now it is in retreat, and the new kid

chopping hands on the block is Islam.

In

1902, the British Empire was something upon which “the sun will never

set”. In 1937, Hitler said the Nazi empire would last a thousand years.

In 1958, Nikita Kruschev said Communism would rule the world forever.

Even ten years ago, Blair’s theorist Lord Gould called ours “the

Socialist century”. Now the neoliberals claim theirs is the only way,

that only they are “correct”. Perhaps they should look back at political

correctness itself, and observe how it has become increasingly

ridiculed and rejected over time.

The

biggest problem we face today as a species is our ability to deny the

inevitable. This odd piece of wiring in our cerebral areas means that,

ultimately everything comes as a shock to us.

Thus

every inability of ClubMed countries to recover from austerity produces

data that “surprised experts”. Nobody expects the United States of

America to collapse under the weight of its obscene debts. China will

forever be a capitalist tiger – a mere thirty years after we all

expected Mao’s creation to be eternally Communist. Britain’s dominance

of financial markets was last week described by one junior ministerial

twerp as “a given”. And our favourite Brussels alien Herman van Rompuy

once described the EU as “Europe’s obvious and perpetual economic

future”.

What a terrible shock the next ten years is going to be. For some people.

ANOTHER WORLD – Occupy Wall St. Documentary with Lauren Saffa

ANOTHER WORLD, the Occupy Wall St.

documentary is shared with the trailer and additional footage and

explanation offered by filmmaker Lauren Saffa. The story of the 99%, the

political dissidents involved, and the continuing production of the

film that addresses the critics and players of the movement against

income inequality is discussed in this BYOD.

Just A Seasonal Low For Gold: Frank Holmes | Kitco News

Frank Holmes kicks off the week on Kitco

News with this latest edition of “Gold Game Film.” Holmes talks about

weaker gold prices and whether he sees this as an opportunity for

investors. “Economic GDP rising in Asia is so important for gold prices

to rise,” he says. “I think the touchdown pass is to get resolution in

South East Asia [...] having their political stability come back in

place, we’ll see an increase in gold consumption.” Looking specifically

at China, Holmes comments on the recent news regarding the Shanghai Gold

Exchange, which he thinks is just a way for the Chinese to show that

they want to become ‘price-makers’ rather than ‘price-takers.’ Holmes

looks at the US dollar as well as gold import restrictions in India as

potential opportunities and threats in the marketplace. Tune in now to

get his latest comments on the gold market and where he expects the

metal is headed. Kitco News, June 2, 2014.

Here’s What 60 Minutes Didn’t Tell You About the F-35

Fortunately, a new video from Brave New Films does just that. The Jet that Ate the Pentagon, released along with a new website, explains how the F-35 became a $1.5 trillion burden on American taxpayers. Winslow Wheeler, the director of the Straus Military Reform Project at the Project On Government Oversight, is featured in the video. He answered a few of our questions about how and why the F-35 program got so out of control.

POGO: Why are you focused on informing the public about the F35?

|

Winslow Wheeler

|

In the 1990s the Pentagon’s aviation bureaucracy in the Clinton administration put together a plan for the Joint Strike Fighter that was bound to fail at great cost. The building’s senior leadership—Secretary of Defense Les Aspin, acquisition Czar William Perry and others--failed to recognize the fundamental problems in both the physical design of the F-35 and its buy-first, test-later acquisition plan. In fact, they willfully advocated those horrendous ideas. Then, both the White House and Congress did nothing but cheer the whole thing on. They were warned by some experts, and they ignored the warnings.

Because the people who claim to be our national security leadership failed so miserably in the Clinton and George W. Bush administrations to recognize the problems, let alone take any appropriate action, it became necessary in the mid-2000s to raise the volume of the complaints and make the public aware.

In a functioning democratic system, public pressure on the politicians in the Pentagon, the White House and Congress should force them to find a solution. It remains to be seen, however, just how functional our system is: the public now is far more fully aware of the many and serious problems in the F-35, but there is no sign yet that any real action will be taken by the national security decision-makers. I fear that Congress is too fixated on the pork the F-35 brings to states and congressional districts; the White House is scared of the tough-minded politics needed to reverse course on the F-35, and most, but not all, Pentagon managers are too happy to keep on drinking—and passing out—the F-35 Kool Aid.

Nonetheless, making the public aware of the issues and its complaining to decision makers in Washington is our only viable way to bring this disaster to an end.

POGO: What are some of the F35s most shocking failures?

Wheeler: The most stunning failure in the F-35 is the level of complexity and contradiction in the basic design. Starting out as a plan to make a short take off and vertical landing (STOVL) aircraft supersonic (two inherently contradictory design characteristics), it only went further downhill after that. They then made it a multi-role aircraft, piling on the additional contradictory characteristics of an air to air fighter and an air to ground bomber; then they made it “stealth” making even fatter the aerodynamic design and making it all more complex by an order of magnitude. And finally, they made it multi-service adding further contradictory complexities demanded separately by the Air Force, Marine Corps and Navy. All this insanity made high cost inherent to the design, just as it also made low performance (performing many roles, all of them poorly) intrinsic.

Thus, the most shocking thing is that some think the solution is to cancel the Marine Corps and or the Navy’s version of this aircraft, but not the Air Force’s: ignoring all the basic characteristics of all three versions, these faux critics opt for a politically convenient non-solution which will mean that our Air Force and any remaining foreign purchasers will be strapped with an incompetent design of an astoundingly expensive aircraft.

That to me is the most shocking thing of all: after all the lessons, some of those pretending to be critics, simply don’t, or refuse to, get it.

POGO: Do you think the story of the F35 is a paradigm of larger issues in the American government?

Wheeler: Absolutely yes! The obsessive complexity of the physical design and the buy-it-then-fly-it acquisition plan are absolutely typical of American weapons acquisition. Those characteristics don’t occur by accident. Technologists who consider combat lessons an afterthought control the beginning design, and advocates in industry, Congress and the Pentagon seek to commit the entire government to the program by spending $billions and $billions before any empirical data becomes available from testing to show what the actual cost and performance are. They call it “concurrency,” but it is really bait and switch political engineering. Chuck Spinney has written about this many times, especially in “Defense Power Games.”

POGO: How has Lockheed Martin been able to continue with the program, despite the cost overruns and delays?

Wheeler: Lockheed-Martin cannot design effectively performing, affordable combat aircraft, but they are without peer in designing a greasy plan to foist the aircraft on the US and multiple foreign buyers. I am in awe of their skill in doing that; they successfully convince otherwise rational people to ignore empirical data, to believe that press releases spout biblical truth and to embrace new promises in the face of scores of broken ones. Those are awesome powers.

POGO: What do you hope the video will add to the F35 conversation?

Wheeler: The video covers a lot of territory in just a few minutes, but people who want to check the data behind the many statements in the video will find there are piles of evidence to back them up. I hope people do exactly that: check on the facts. Then, armed with the data, they may want to make noise—however they so choose—to give the politicians in Congress, the White House and the Pentagon a choice: Do the right thing on the F-35 or be replaced.

See the video from Brave New Films below.

‘Two Weeks’ To Prepare For Cyber Attack On Bank Accounts – UK Government

by GoldCore

Yesterday’s AM fix was USD 1,244.75, EUR 915.26 and GBP 743.49 per ounce.

Gold fell $7.70 or 0.62% yesterday to $1,243.10/oz. Silver slipped $0.06 or 0.32% to $18.75/oz.

Gold fell to the lowest since February 3 and prices completed a sixth day of declines for the longest losing run since August. Gold bullion in Singapore traded sideways around the $1,244/oz level prior to ticking slightly higher to over $1,246/oz at the open in London (0800 BST).

Silver for immediate delivery

rose 0.5% to $18.849 an ounce after sliding to $18.635 on May 30, the

lowest since June 2013. Platinum traded at $1,437.75 an ounce from

$1,435.56 yesterday, when prices fell to a three-week low of $1,433.

Palladium added another 0.2% to

$833.74/oz. The metal climbed to a 34 month high of $845.24 an ounce on

May 28 amid a strike in South Africa and prospects of further sanctions

against Russia, the world’s biggest producers.

Gold held near a four-month low

as risk appetite saw advances in the dollar and global equities. The

Standard & Poor’s 500 Index reached a new record high and the dollar

climbed to a two-month high against 10 major counterparts.

Gold declined 3.3% in May, the

biggest monthly drop this year, despite quite strong fundamentals. The

euro also weakened 1.7% versus the dollar in May and there is

speculation that the European Central Bank will become even more dovish

when policy makers meet this Thursday, June 5. Goldman alumni Draghi

adopting an even loose monetary policy should support gold prices.

On Friday, the U.S. nonfarm

payrolls data will be watched for signs regarding the fragile U.S

recovery. As usual, a good jobs number should see gold sold by traders

and a poor jobs number should see gold buying.

Gold remains 3.6% higher this year partly due to robust global demand and due to heightened geopolitical risk.

Since May 29, the 14 day

relative-strength index has been below the level of 30 that suggests a

potential impending rebound to technical analysts.

‘Two Weeks’ To Prepare For Cyber Attack On Bank Accounts - UK Government

Computer users are being urged to protect their machines from malware which could allow hackers to steal financial data, access banks accounts and withdraw savers funds.

Computer users are being urged to protect their machines from malware which could allow hackers to steal financial data, access banks accounts and withdraw savers funds.

British investigators have been

working with the FBI to trace the hackers behind an attack, which they

expect to take place in the next fortnight.

Between 500,000 and one million machines have so far been infected worldwide, according to court documents.

U.S. officials have accused a

Russian hacker of masterminding the scam – and prosecutors say those

involved have already raked in more than $100 million (£60 million).

The National Crime Agency (NCA)

is now warning of a “powerful computer attack”. It is urging people to

back up important files and make sure their security software and

operating system are up to date.

Two pieces of malware software known as GOZeuS and CryptoLocker are responsible for the alert.

They typically infect a

computer via attachments or links in emails. If a user clicks on GOZeuS,

it silently monitors activity and tries to capture information such as

bank details.

“(The links or attachments) may

look like they have been sent by genuine contacts and may purport to

carry invoices, voicemail messages, or any file made to look innocuous,”

the NCA warned.

“These emails are generated by other victims’ computers, who do not realise they are infected, and are used to send mass emails creating more victims.”

“These emails are generated by other victims’ computers, who do not realise they are infected, and are used to send mass emails creating more victims.”

The Cryptolocker malware is

activated if the first attack is not profitable enough. It locks a user

from their files and threatens to delete them unless a “ransom” of

several hundred pounds is paid.

Some 234,000 machines were hit

by Cryptolocker – bringing in $27m (£16m) in payments – in its first two

months, the US Justice Department said. More than 15,500 computers in

the UK are infected and “many more” are at risk, according to the NCA.

Stewart Garrick, a senior

investigator with the NCA, told Sky News the threat was mainly against

individuals or businesses running Windows-based computers.

We have long warned of the

vulnerability of having all your investments and savings in electronic

format. The nature of our modern financial and banking system exposes

investors and savers to new risks that were not there a generation ago.

Prudent diversification today, involves owning some actual physical gold and

silver coins and bars in your possession or in allocated, segregated

accounts that can be taken delivery of with a phone call.

War Makes Us Poor … And Drags the Economy Down Through the Floor

Top Economists Say War Is Bad for the Economy

Preface: Many Americans – including influential economists and talking heads - stillwrongly assume that war is good for the economy. For example, extremely influential economists like Paul Krugmanand Martin Feldstein promote the myth that war is good for the economy.

Many congressmen assume

that cutting pork-barrel military spending would hurt their

constituents’ jobs. And talking heads like senior Washington Post

political columnist David Broder parrot this idea.

As demonstrated below, it isn’t true.

Nobel-prize winning economist Joseph Stiglitz says that war is bad for the economy:

Stiglitz wrote in 2003:War is widely thought to be linked to economic good times. The second world war is often said to have brought the world out of depression, and war has since enhanced its reputation as a spur to economic growth. Some even suggest that capitalism needs wars, that without them, recession would always lurk on the horizon. Today, we know that this is nonsense. The 1990s boom showed that peace is economically far better than war. The Gulf war of 1991 demonstrated that wars can actually be bad for an economy.

Former Federal Reserve chairman Alan Greenspan also said in that war is bad for the economy. In 1991, Greenspan said that a prolonged conflict in the Middle East would hurt the economy. And he made this point again in 1999:

Societies need to buy as much military insurance as they need, but to spend more than that is to squander money that could go toward improving the productivity of the economy as a whole: with more efficient transportation systems, a better educated citizenry, and so on. This is the point that retiring Rep. Barney Frank (D-Mass.) learned back in 1999 in a House Banking Committee hearing with then-Federal Reserve Chairman Alan Greenspan. Frank asked what factors were producing our then-strong economic performance. On Greenspan’s list: “The freeing up of resources previously employed to produce military products that was brought about by the end of the Cold War.” Are you saying, Frank asked, “that dollar for dollar, military products are there as insurance … and to the extent you could put those dollars into other areas, maybe education and job trainings, maybe into transportation … that is going to have a good economic effect?”Greenspan agreed.

Economist Dean Baker notes:

It is often believed that wars and military spending increases are good for the economy. In fact, most economic models show that military spending diverts resources from productive uses, such as consumption and investment, and ultimately slows economic growth and reduces employment.

Professor Emeritus of International Relations at the American University Joshua Goldstein notes:

Recurring war has drained wealth, disrupted markets, and depressed economic growth.***War generally impedes economic development and undermines prosperity.

And David R. Henderson –

associate professor of economics at the Naval Postgraduate School in

Monterey, California and previously a senior economist with President

Reagan’s Council of Economic Advisers - writes:

Is military conflict really good for the economy of the country that engages in it? Basic economics answers a resounding “no.”

The Proof Is In the Pudding

Mike Lofgren notes:

Military spending may at one time have been a genuine job creator when weapons were compatible with converted civilian production lines, but the days of Rosie the Riveter are long gone. [Indeed, WWII was different from current wars in many ways, and so its economic effects are not comparable to those of today's wars.] Most weapons projects now require relatively little touch labor. Instead, a disproportionate share is siphoned into high-cost R&D (from which the civilian economy benefits little), exorbitant management expenditures, high overhead, and out-and-out padding, including money that flows back into political campaigns. A dollar appropriated for highway construction, health care, or education will likely create more jobs than a dollar for Pentagon weapons procurement.***During the decade of the 2000s, DOD budgets, including funds spent on the war, doubled in our nation’s longest sustained post-World War II defense increase. Yet during the same decade, jobs were created at the slowest rate since the Hoover administration. If defense helped the economy, it is not evident. And just the wars in Iraq and Afghanistan added over $1.4 trillion to deficits, according to the Congressional Research Service. Whether the wars were “worth it” or merely stirred up a hornet’s nest abroad is a policy discussion for another time; what is clear is that whether you are a Keynesian or a deficit hawk, war and associated military spending are no economic panacea.

The Washington Post noted in 2008:

A recent paper from the National Bureau of Economic Research concludes that countries with high military expenditures during World War II showed strong economic growth following the war, but says this growth can be credited more to population growththan war spending. The paper finds that war spending had only minimal effects on per-capita economic activity.***A historical survey of the U.S. economy from the U.S. State Department reports the Vietnam War had a mixed economic impact. The first Gulf War typically meets criticism for having pushed the United States toward a 1991 recession.

The Institute for Economics & Peace (IEP) shows that

any boost from war is temporary at best. For example, while WWII

provided a temporary bump in GDP, GDP then fell back to the baseline

trend. After the Korean War, GDP fell below the baseline trend:

By examining the state of the economy at each of the major conflict periods since World War II, it can be seen that the positive effects of increased military spending were outweighed by longer term unintended negative macroeconomic consequences. While the stimulatory effect of military outlays is evidently associated with boosts in economic growth, adverse effects show up either immediately or soon after, through higher inflation, budget deficits, high taxes and reductions in consumption or investment. Rectifying these effects has required subsequent painful adjustments which are neither efficient nor desirable. When an economy has excess capacity and unemployment, it is possible that increasing military spending can provide an important stimulus. However, if there are budget constraints, as there are in the U.S. currently, then excessive military spending can displace more productive non-military outlays in other areas such as investments in high-tech industries, education, or infrastructure. The crowding-out effects of disproportionate government spending on military functions can affect service delivery or infrastructure development, ultimately affecting long-term growth rates.***Analysis of the macroeconomic components of GDP during World War II and in subsequent conflicts show heightened military spending had several adverse macroeconomic effects. These occurred as a direct consequence of the funding requirements of increased military spending. The U.S. has paid for its wars either through debt (World War II, Cold War, Afghanistan/Iraq), taxation (Korean War) or inflation (Vietnam). In each case, taxpayers have been burdened, and private sector consumption and investment have been constrained as a result. Other negative effects include larger budget deficits, higher taxes, and growth above trend leading to inflation pressure. These effects can run concurrent with major conflict or via lagging effects into the future. Regardless of the way a war is financed, the overall macroeconomic effect on the economy tends to be negative. For each of the periods after World War II, we need to ask, what would have happened in economic terms if these wars did not happen? On the specific evidence provided, it can be reasonably said, it is likely taxes would have been lower, inflation would have been lower, there would have been higher consumption and investment and certainly lower budget deficits. Some wars are necessary to fight and the negative effects of not fighting these wars can far outweigh the costs of fighting. However if there are other options, then it is prudent to exhaust them first as once wars do start, the outcome, duration and economic consequences are difficult to predict.

We noted in 2011:

This is a no-brainer, if you think about it. We’ve been in Afghanistan for almost twice as long as World War II. We’ve been in Iraq for years longer than WWII. We’ve been involved in 7 or 8 wars in the last decade. And yet [the economy is still unstable]. If wars really helped the economy, don’t you think things would have improved by now? Indeed,the Iraq war alone could end up costing more than World War II. And given the other wars we’ve been involved in this decade, I believe that the total price tag for the so-called “War on Terror” will definitely support that of the “Greatest War”.

Let’s look at the adverse effects of war in more detail …

War Spending Diverts Stimulus Away from the Real Civilian Economy

IEP notes that – even though the government spending soared – consumption and investment were flatduring the Vietnam war:

The New Republic noted in 2009:

Conservative Harvard economist Robert Barro has argued that increased military spending during WWII actually depressed other parts of the economy.

(New Republic also points out that

conservative economist Robert Higgs and liberal economists Larry

Summers and Brad Delong have all shown that any stimulation to the

economy from World War II has been greatly exaggerated.)

How could war actually hurt the economy, when so many say that it stimulates the economy?

Because of what economists call the “broken window fallacy”.

Specifically, if a window in a

store is broken, it means that the window-maker gets paid to make a new

window, and he, in turn, has money to pay others. However, economists

long ago showed that – if the window hadn’t been broken – the

shop-owner would have spent that money on other things, such as food, clothing, health care, consumer electronics or recreation, which would have helped the economy as much or more.

If the shop-owner hadn’t had to

replace his window, he might have taken his family out to dinner, which

would have circulated more money to the restaurant, and from there to

other sectors of the economy. Similarly, the money spent on the war

effort is money that cannot be spent on other sectors of the economy. Indeed, all of the military spending has just created military jobs, at the expense of the civilian economy.

Professor Henderson writes: