The

strategy of “buying time so the financial system can heal itself” by

protecting a systemically destabilizing financial sector has failed

because it could only fail.

The core strategy of central states and banks to fix the Global Financial Meltdown of 2008 was to buy time: take extraordinary emergency monetary and regulatory measures to save the parasitic too big to fail banking

sector and the rest of the crony-capitalist Wall Street parasites, and

initiate an unprecedented transfer of wealth from savers and Main Street

to the banks and Wall Street via zero-interest rates and credit

funneled to the very players who caused the crisis.

The

idea was that the system would “heal itself” if authorities simply

“bought time” by saving the financial sector from its own predation. The

second phase of “buying time so the financial system can heal itself”

was to institute policies (ZIRP, etc.) that restored the financial

sector’s obscene profits and socialized its losses by transferring them

to the taxpayers.

The

terrible irony in the official strategy of “buying time so the financial

system can heal itself” is the policies prohibit healing and guarantee

the next financial crisis will be greater in magnitude than the last

one.

There is only one way for any financial system to heal itself: enable the open market to discover the price of capital, credit, assets, collateral and risk. When

participants finally discover the market price of their assets and

collateral are much lower than the valuations claimed in credit bubbles,

the market clears itself of bad credit and overvalued collateral in a market-clearing event in

which overpriced assets are marked down, firms that overleveraged weak

collateral are declared insolvent and liquidated, and creditors who can

no longer afford their loans are declared bankrupt and their remaining

assets liquidated to pay their creditors.

There is no other healing process but this one: enable

transparent, open markets to discover the price of capital, credit,

assets, collateral and risk and let those firms and individuals who

overleveraged and made bets that blew up go bankrupt.

What

“buying time” has done is destroy the market’s ability to price

capital, credit, assets, collateral and risk, stripping the system of

the essential information participants need to make rational, informed

decisions. By crushing the market’s ability to generate accurate

pricing information, central state and banking authorities have insured

the system cannot possibly heal itself while maintaining perverse incentives that guarantee the next financial crisis will dwarf the previous one.

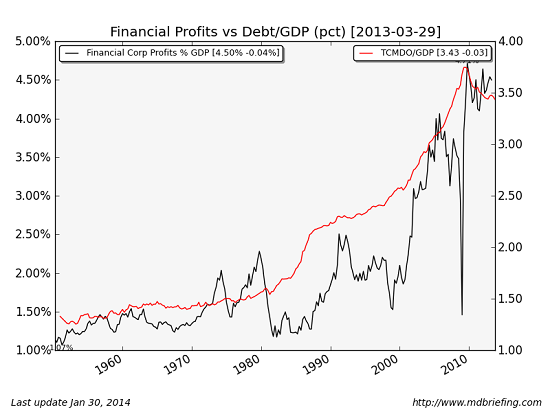

The official policy of “buying time” has another fatal flaw: it

maintains a parasitic financial sector that expanded to a structurally

unhealthy dominance over both the political and economic sectors. Once

financial profits ballooned from a modest share of corporate profits to

dominance, this enabled financiers and bankers to buy political

protection of their skimming and scamming:

The

strategy of “buying time so the financial system can heal itself” by

protecting a systemically destabilizing financial sector has failed

because it could only fail. The policies that “saved the financial

system” only saved it from the healing process of the market discovering

the price of capital, credit, assets, collateral and risk.

No comments:

Post a Comment