Sunday, May 1, 2011

Big payday for Goldman Sachs team

Six New Zealand-based Goldman Sachs partners are expected to cash in when Goldman Sachs US takes full ownership of its Australian and New Zealand operations, with senior partners expected to clear up to $40 million.

According to the Australian Financial Review, local partners include Byron Pepper in the investment banking division, Duncan Rutherford in the securities division and Rebecca Cottrell in federation legal division.

Local managing director Andrew Barclay is also a partner, and the Star-Times understands other local partners include executive director David Goatley and Bernard Doyle, a New Zealand-based strategist.

Barclay, Cottrell and Rutherford are also listed as directors of the New Zealand business.

The exact shareholdings of each partner is not known and Goldman Sachs was not prepared to comment.

However, the AFR values the entire business at around $1.4 billion and senior partners are understood to have up to a 3% share of that.

Partners may, however, have had to buy their shares when they were appointed. Exactly how that works or the price paid is not known.

The AFR reported there are 133 partners across Australia and New Zealand who will get payouts of about $550 million in total in a combination of cash and scrip.

What is known is that the buyout will see Goldman Sachs rolling out new products and engaging in even bigger deals.

Barclay said under the current joint venture structure, the local business was precluded from bringing trading activities onshore.

"The move to 100% ownership will allow development of a significant Australian dollar and New Zealand dollar trading, commodity trading [and other trading] capability in our business."

He said that makes sense from a client perspective and he sees significant revenue opportunities.

Goldman Sachs NZ will also have better access to the global company balance sheet.

"The move to 100% ownership will mean Australian and New Zealand deals will get more direct access to global balance sheet support, first up," Barclay said.

"The local business has had a relatively modest balance sheet which was the first option for our clients, but we will now access the global balance sheet, which is close to $1 trillion – which significantly enhances the options for clients in their financing considerations."

The buyout represents an investment in the business in Australia and New Zealand, Barclay said, which will allow Goldman Sachs NZ to offer more to clients.

Investment in the local business will see the rollout of new global trading systems that will improve the local business's ability to trade more seamlessly for clients.

The acquisition will require a minimum 75% acceptance by the local shareholders for it to proceed. A vote is expected in the middle of the month.

- Sunday Star Times

America's Terminal Decline

The IMF's 2011 World Economic Outlook shows China overtaking America in five years based on purchasing power parity (PPP) - a criterion for an appropriate exchange rate between currencies as measured by the cost of a representative basket of goods in one country v. another.

IMF's 2016 PPP GDP estimate:

-- China - $18,975.7 trillion

-- America - $18,807.5 trillion

In current dollar terms, America retains its lead, but it's slipping noticeably.

IMF's 2016 dollar GDP estimate:

-- America - $18,807.5 trillion

-- China - $11,220.2 trillion

Economic forecasts, of course, vary. Moreover, long-range ones combine extrapolated trends with reasoned judgments. However, as economist Alec Craincross (1911 - 1998) once observed:

"A trend is a trend is a trend. But the question is, will it bend? Will it alter its course through some unforeseen force and come to a premature end?"

Not China's for over three decades, "growing 17-fold in real (inflation-adjusted) terms since 1980," according to economist Mark Weisbrot. As a result, it's been the world's fastest growth engine, a pace it's maintained during the current global economic crisis in contrast to America in decline.

Economist Henry HK Liu mostly attributes China's sucess to its not freely convertible currency, its closed financial market, and its quasi public-private central bank used for economic growth, not bailouts and speculation. In his January 12, 2010 article titled, "China and a New World Economic Order," he discussed policy initiatives to keep influencing it positively, including:

-- avoiding a deregulated market economy;

-- prioritizing full employment and rising wages;

-- breaking free from dollar hegemony;

-- conducting trade based on mutual development; and

-- not using "green-tech investment" to stimulate growth.

On August 17, 2009, financial writer Ellen Brown's article headlined, "China's Miracle Economy: Have the Chinese Become the World's Greatest Capitalists?" saying:

China "seems to have decoupled from the rest of the world, preserving an 8% growth rate (now higher) while the rest of the world sinks into the worst recession since the 1930s."

Unlike America to this day, in fact, China keeps credit flowing freely for economic growth, though too much of a good thing itself creates problems; notably bubbles that sooner or later burst.

However, Brown explains that China's banks "serve public enterprise and trade" because it controls their operations, unlike America's privatized system serving bankers, not people.

Notably, in fact, Beijing prevented "irresponsible bank speculation and profiteering by keeping a leash on (its) banking sector," as well as focusing on economic growth and job creation, ignored by Washington policy makers.

It's worked for over three decades so why not three more or much longer provided greed doesn't replace good policy, what's headed America down for decades.

As a result, China consumes record volumes of oil, natural gas, coal, copper, iron ore, and other commodities. It's also the world's largest industrial country and producer of gold, rare earth metals, steel, coal, copper, agricultural products, pork, seafood, textiles, electronic products, and more with no end of its growth in sight.

Impressively, China passed Japan in Q II 2010 to become the world's second largest economy. Heading for number one, perhaps Washington policy makers recall what's believed Napoleon once advised to: "Let China sleep, for when the dragon awakens, she will shake the world." IMF analysts apparently took note.

America's Decline and Fall

In his book titled, "The World in Crisis," historian Gabriel Kolko believes that America's decline "began after the Korean War, was continued in relation to Cuba, and was greatly accelerated in Vietnam - but (GW Bush did) much to exacerbate it further." Obama not only continues Bush policies, he exceeded him with greater recklessness, masquerading as a people's president while waging war on working Americans.

No wonder Kolko thinks US influence is declining everywhere. The world no longer depends on its economic might. Nations like China, India, Brazil and others grow much faster, and after the Soviet Union collapsed, "the absence of identifiable foes has been a disaster, leaving the US aimless. (So) it picks and chooses enemies" globally in Afghanistan, Iraq, Pakistan, Libya, elsewhere in the Middle East and North Africa, and perhaps later China and Russia while other nations increasingly tire of imperial America and its reckless economics counterproductive to their own.

As a result, America's century of dominance is ending. Immanuel Wallerstein agrees, saying it's been fading since the 1970s, accelerating post-9/11. In fact, "the economic, political and military factors that contributed to US hegemony are the same (ones) inexorably produc(ing) the coming US decline."

Chalmers Johnson called it the same dynamic that doomed past empires - "isolation, overstretch, the uniting of local and global forces opposed to imperialism, and in the end bankruptcy," combined with growing authoritarianism and loss of personal freedom.

Calling America's condition dire, he said it's "too late for mere scattered reforms of our government or bloated military to make much difference." History is clear. We can choose democracy and survive or continue as present and perish. Clearly the wrong political, social, military, and economic choices were made, heading US hegemony for the ash heap of history.

Nixon's Council of Economic Advisers chairman, Herb Stein, notably explained, saying, "Things that can't go on forever, won't." Earlier, Johnson said:

The "combination of huge standing armies, almost continuous wars, military Keynesianism, and ruinous military expenses have destroyed our republican structure in favor of an imperial presidency. We are on the cusp of losing our democracy for the sake of keeping our empire."

Moreover, once a nation starts down that path and won't change, its end time is certain. Only its timing is unknown, perhaps coming faster than expected.

America's Dollar Hegemony in Decline

Global plans to replace the dollar metaphorically highlight America's decline, the topic economist Michael Hudson addressed in his June 13, 2009 article titled, "De-Dollarization: Dismantling America's Financial-Military Empire."

For decades, America stayed economically dominant because other nations agreed to a Washington controlled WTO/IMF/World Bank/Bank for International Settlements (the Central Bank of Central Banks in Basel) system, using the dollar as the world's reserve currency.

Other countries, however, now balk. A June 2009 Yekaterinburg, Russia meeting with top officials of the six-nation Shanghai Cooperation Organization (led by China and Russia) took the first step to end dollar supremacy, perhaps replacing it eventually with a single global currency or a basket of major ones.

Today, America remains unchallenged militarily, its economic supremacy, however, weakening as it staggers under growing debt, while nations like China, Brazil, India, Russia and others are rising.

In July, 2009, Russian President Medvedev advocated a supranational currency. In September, the UN Conference on Trade and Development proposed an artificial one to replace the dollar. Other alliances, including nine Latin American countries, support a regional currency. China wants its yuan protected, and Russia plans to begin trading in the ruble and local currencies.

Hudson calls the present system a "sinister dynamic (because) the US payment deficit pumps dollars into foreign economies (that have) little option except to buy US (debt) which the Treasury spends on financing an enormous, hostile (global) military build-up," and its ready-to-unleash-anytime war machine.

Moreover, foreign US Treasury buyers may not only be financing their own endangerment, they're also buying a depreciating asset, what analyst Matthias Chang calls dollar denominated "toilet paper" from a "toilet paper printing press....issu(ing) irredeemable fiat money."

Why else would world demand for gold and silver be strong. They reflect real value, not paper backed solely by the eroding faith and credit of issuing countries. Buyers clearly lack it in America with good reason. As a result, expect further dollar erosion, decline and perhaps crisis if current selling ahead surges.

No wonder other countries seek a new monetary system to avoid funding America's deficit and military. BRIC nations (China, Russia, India and Brazil) took the lead. Others are now following, and the weaker the dollar gets, inevitably they'll be more.

Economist Paul Craig Roberts also believes the dollar's global reserve currency hegemony won't last. Sooner or later wholesale dumping will happen when foreign central banks unload them. As a result, import prices will rise enough to make Wal-Mart shoppers "think they have mistakenly gone into Neiman Marcus."

Domestic prices will also soar "as a growing money supply chases the supply of goods and services still made" domestically. Disruptions will follow. The dollar won't survive. When it goes America's trade deficit can't be financed. Imports will fall sharply. Inflation will rise, and "(p)anic will be the order of the day" because a corporate - government cabal is "strung out on the ecstasy of Empire," and obsessed with destroying the nation's middle class to transfer maximum wealth to America's super-rich already with too much.

A Final Comment

Consider how far America declined and the inevitable consequences. The combination of:

-- military Keynesianism;

-- permanent wars;

-- Washington being corporate occupied territory;

-- banker bailouts;

-- generous handouts to corporate favorites;

-- offshoring the nation's industrial base;

-- neoliberal austerity;

-- class warfare, including against unionism;

-- systemic corruption;

-- increasing repression;

-- sham elections; and

-- democracy in name only, the best money can buy, made America no longer a model for other nations, the engine of world growth, a fit to live in, or able to prevent its inevitable decline, fall, and replacement by China and perhaps other nations one day.

It's a sad testimony to a two centuries old experiment that failed because absolute power corrupted too many with it wanting more.

Stephen Lendman lives in Chicago and can be reached at lendmanstephen@sbcglobal.net. Also visit his blog site at sjlendman.blogspot.com and listen to cutting-edge discussions with distinguished guests on the Progressive Radio News Hour on the Progressive Radio Network Thursdays at 10AM US Central time and Saturdays and Sundays at noon. All programs are archived for easy listening.

The Silver Liberation Army Has Launched Our Official Website!

Today Starts a New Era!

Where the people that function within the “system” will no longer tolerate the corruption that surrounds our every day lives as it is!

We the people are starting to take peaceful action against the corporate banking occupation that stands to hold us down and suppress our well being.

This is no longer acceptable when banksters can take millions of dollars in bonuses while taking away our homes, the food from our families mouths, our assets, our savings and our dignity…

because of a system they designed to destruct!

These banking elite took these bonuses immediately after they took bailouts from our government’s tax dollars that we worked hard to earn and contribute into!

They took these bonuses without concern or regret.

And Yet They Boast They Are Too Big To Fail…

WRONG AGAIN!

No longer can we stand to allow a banking system that is trying to create a,

Criminal New World Order and One World Currency,

under their control without any say from us… the People.

No More!!!

“FIAT MONEY SUCKS!”

We the people will no longer tolerate rapid inflation due to printing of your worthless fiat currencies without protecting ourselves from your global tyranny!

The Silver Liberation is Strong and We Stand United on a Global front…

We Will Beat You at Your Own Game by Purchasing the One Weakness You Have Left Exposed!!!

SILVER

SILVER

We will not be stopped!

We will not coward to your suppressed prices and we will continue buying this precious,

hedge against your inflation

until we have…

WON!

Inflation is a Crime!

Join Max Keiser’s Silver Liberation Army Today!

Take back your wealth and protect your families future against inflation of unmeasurable proportions.

Find out what so few have learnt.

by Joining

You Are Taking Part in the Keiser’s

“MILLION OUNCE MARCH”

Which Will Stop the, Corrupt Banksters in Their Tracks!

To find out what the S.L.A. stands for and learn what less than 2% of the Global population knows,

Sign up Below and Change Your Future Forever!

~The S.L.A. Members Gain Instant Access to the Sale of the new Official M.O.M. Bullion~

Please check your email to confirm you joined the S.L.A.

Has the Fed Decided to Fight Inflation Instead of Unemployment?

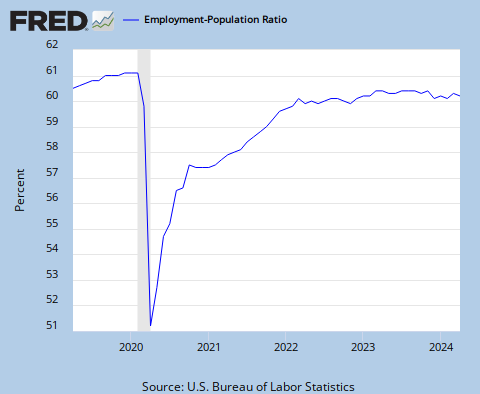

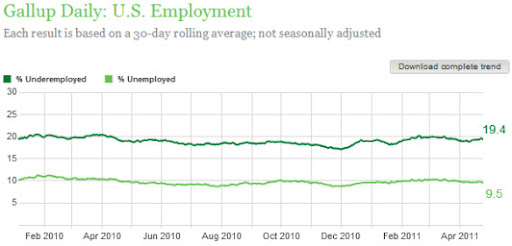

William Alden writes in a Huffington Post liveblog entitled "Inflation Vs. Jobs": And I agree with Mr. Krugman when he writes today: Also, [Bernanke's] assertions that the job market is “gradually improving” are suspect. Yes, the official unemployment rate has fallen. But this is the result less of job creation than of a fall in the labor force participation rate; the employment-population ratio has been flat:The Fed Has Intentionally Discouraged Banks From Lending It's true - as I pointed out in 2009 - that the Fed has purposefully been encouraging banks to deposit their excess reserves at the Fed (for a profit), rather than loan them out to Main Street: The Federal Reserve is mandated by law to maximize employment. The relevant statute states:I explained last year:The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.However, PhD economist Dean Baker says:The country now has almost 25 million people who are unemployed or underemployed as a result of the Fed's disastrous policies. Millions of people are losing their homes and tens of millions are losing their life savings. The country is likely to lose more than $6 trillion in output ($20,000 per person) due to the Fed's inept job performance.The Fed could have stemmed the unemployment crisis by demanding that banks lend more as a condition to the various government assistance programs, but Mr. Bernanke failed to do so. Ben Bernanke has said that the Fed is trying to promote inflation, increase lending, reduce unemployment, and stimulate the economy. Would More Stimulus Help? But I disagree when Krugman writes today: Whatever your take, a robust job recovery this is not. All in all, this is an economy crying out for more stimulus, wherever you can get it.We don't need more stimulus ... at least not the kind we've had to date, which has only stimulated bonuses for the big banksters and big defense contractors. As I wrote last year: I noted in 2009 (footnotes in original):In truth and in fact, the government's policies are not only not working to stem the rising tide of unemployment, they are making it worse.

As I noted in 2008: This is not a question of big government versus small government, or republican versus democrat. It is not even a question of Keynes versus Friedman (two influential, competing economic thinkers).In reality, the entire debate regarding more-versus-less stimulus misses the mark. As painful as it is to think about, the Fed's policies - like those of the Treasury, White House and Congress - have been geared towards redistributing wealth upwards. See this, this, this, this, this and this. | |

Global Research Articles by Washington's Blog | |

Bursting Bubbles. Waning Currency Systems and Insolvent Financial Institutions

We keep searching Congress for leadership and all we see and hear is compromises and moneyed footsteps leading back to their controllers on Wall Street and in banking. We find few willing to stand up to the military industrial complex or the moneyed powers that control our country. Spending restraint is very difficult to find.

The suppression of gold and silver will have ended and the infamous Executive Order, “The President’s Working Group on Financial Markets,” given to us by Ronald Reagan will no longer exist.

Price inflation is already with us and the real rate is close to 10%. Our prediction of 14% by the end of 2011 now appears to be very conservative. Of course, the Fed tells us there is little inflation among many other lies they foist upon the public. Mr. Bernanke doesn’t relate that almost zero interest rates and quantitative easing are largely responsible for current high inflation. He also does not discuss how the Fed’s policies, really those of banking and Wall Street, have caused gas prices to rise and retail sales to rise. They are further manifestations of monetary policy gone wild. Wall Street’s Fed man Bernanke doesn’t like to talk about wages moving higher to offset inflation because those higher wages are inflationary. He wants them to remain where they are and could care less about the purchasing power of consumers. The idea is to keep the economy afloat and not really worry about wages and inflation, not unless it is to low. Like wages and inflation, food and fuel costs are not transitory. They’ll rise or stay high for 3 to 5 more years. | |

Bob Chapman is a frequent contributor to Global Research. Global Research Articles by Bob Chapman | |

91-Year-Old Grandma Sells Suicide Kits To Help Terminally Ill Die With Dignity

LOS ANGELES (CBS) — Meet Sharlotte. Like a lot of grandmothers, she likes to keep busy. But while some grannies sit and knit scarves and afghans, this 91-year-old has a decidedly different hobby.

She makes suicide masks.

Sharlotte started making and selling these suicide kits out of her cozy Southern California home after watching her husband die a slow and painful death from colon cancer. She blames doctors for keeping him alive.

“It was terrible to treat people that way… To make them suffer to the bitter end,” Sharlotte said.

Sharlotte, who sells her controversial kits for $60, demonstrated how they work in front of our cameras.

“To die with this helium just takes you a couple of minutes and [you] die peacefully,” said Sharlotte, who only wants to be identified by her first name. She also didn’t want her face to appear on camera.

A loophole in California law makes selling the kits legal, but the ethical controversy remains heated. (For the record, what Sharlotte does is not illegal because she is not present when the person takes their own life.)

Sharlotte insists she is no Kervorkian-in-the-making. She told CBS2′s Sharon Tay that she just wants the terminally ill to be able to end it … on their terms. When they are ready.

She wants to make sure no one has to suffer like her late husband or the people he left behind.

Sharlotte sells the kits to people all over the world. She insists she is also not doing it for the money. “I do it because I care for people.”

Three states have enacted a “Death with Dignity” law. In California assisted suicide is still illegal, but proponents of the suicide mask are trying to change all that.

Opponents to changing the law point to one of Sharlotte’s clients, a 29-year-old Oregon native. He wasn’t suffering from a terminal illness. He opted out because he was tired of dealing with his chronic depression. His suicide touched off a major controversy.

And now, a group called Californians Against Assisted Suicide wants to stop Sharlotte and her masks.

She is not deterred. “Whatever a person wants to do with their life,” she says, “is their right. They need the right to make that decision.”

"If inflation ever becomes dangerous, I'm going to turn public opinion on it around." Six weeks later, he was dead.

John Maynard Keynes did not believe in inflationary

spending himself - Hayek:

Entitlement Hater Paul Ryan Was A Social Security Baby

When Representative Paul Ryan was 16 years old , tragedy struck his family. His 55 year old father had passed away from a heart attack. Young Paul Ryan found his father’s lifeless body and was burdened by the fact that he had to tell his mother and siblings of this horrible situation.

After his father’s passing, young Paul Ryan started collecting social security benefits until the age of 18 years old. He took this benefit and saved it for his college education. Representative Paul Ryan is one example of the millions of people whose lives have depended on our social contract with the American people. Without this benefit, his mother would have had to make even tougher decisions and Representative Paul Ryan may not have been able to pay for his college education. This social contract lifted him and his entire family out of a tough situation.

Many people do not know that 30% of the social security fund goes directly to widows,orphans and the disabled. It is not solely for the benefit of retirees. Unfortunately this social contract is under a regressive attack by the Republicans, including Paul Ryan.

Under Paul Ryan’s Roadmap for America budget, he wants to take a portion of social security and funnel it to Wall Street to gamble with, rather than having the current program stand as it is, as an insurance program rather than an investment. Paul Ryan’s plan states,

“Initially, workers are allowed to invest 2 percent of their first $10,000 of annual payroll into personal accounts, and 1 percent of annual payroll above that up to the Social Security earnings limit,”

“Eventually, by 2042, workers will be able to invest 8 percent up to the inflation-adjustment level, and 4 percent of payroll above that, for an account averaging 5.1 percent,

Paul Ryan isn’t the only regressive Republican who’s younger years have benefited from our progressive social contract, United States Senator Scott Brown from Massachusetts benefited from welfare programs also.

The attempt of these regressives is not that they want to reform the system, they do not believe the government should be involved in social programs at all. It is purely ideological, even though it was progressives that lifted them out of dire straits.

China May Buy $1 TRILLION of Gold: Bloomberg

In an otherwise quiet article on central banks today, Bloomberg quoted an analyst who says China may use up to a third of their $3 trillion in foreign reserves to purchase gold.

China has been moving away from the dollar, and into alternative stores of wealth for years now.

But $1 trillion in gold? If it plays out, such a move would further threaten the dollar's status as reserve currency. It would provide further buying pressure in gold for years to come, as the dollar crumples into a pitiful heap on the floor.

China’s Gold Reserves

China, which has just 1.6 percent of its reserves in gold, may invest more than $1 trillion in bullion, [Michael Pento of Euro Pacific Capital] said. “China wants to be an international player, and they need to own more gold than they currently have.”

...“China is out to have more gold than America, and Russia is aspiring to the same,” [Robert] McEwen, [the chief executive officer of producer U.S. Gold Corp] said yesterday in an interview in New York. “When you have debt, you don’t have a lot of flexibility. China wants to show its currency has more backing than the U.S.”

...China, with more than $3 trillion in foreign-currency reserves, plans to set up new funds to invest in precious metals, Century Weekly reported this week. Russia purchased 8 tons of gold in the first quarter.

This is a big reason why gold and silver are heading higher. Occasional dips are inevitable, of course. When they happen bears will declare the bubble popped (after a one-week correction).

Then the uptrend will continue, intact. And they'll say, "bubble! bubble bubble bubble bubble, bubble!", again.

And gold bugs will be laughing all the way to the vault.

That's how I see it, anyway. Could be wrong, it's happened before. But, I did say the same thing when gold was $1140 in Why I'm Buying the Gold Dips in December 2009:

"The bottom line is that Bernanke and crew actually want inflation. It's easier than the alternatives: raising taxes or slashing spending. And it will help erase debts. It will also wipe out the savers and reward the borrowers — but that seems to be the path we're on, like it or not.

Besides, do you really think they will allow America's debt to be paid off with dollars worth more rather than less?

Of course not. Devaluing our currency and printing money are part of a strategy. A reckless and morally hazardous one, but still a strategy.

So that's why I still am bullish on precious metals. I'm hoping for a nice pullback in gold and silver. It'll be a great buying opportunity. Once everyone realizes that the Fed's printing presses are just getting warmed up, it'll be off to the races again."

The time will eventually (and sadly) come to sell significant amounts of precious metals, but I just don't see us being close to that point yet. Inning 4 or 5, if this were a ballgame, perhaps? "

Lots more printing ahead, though it's hard to say how much. My view has been that we see at least QE5 (possibly under a different name) and $3,500 gold and $150 silver before things top out.

It all depends on how much inflation the public will take before it declares shenanigans; forcing spending cuts and a tightening of monetary policy.

Then - after a (hopefully brief) adjustment period - America and the world will be on a path to sustainable growth. A time to move from being overweight in metals, and shift into stocks and real estate.

Updated 4/30/2011 for clarity.

5 banks fail in Fla., Ga., Mich.; makes 39 in '11

WASHINGTON (AP) — Regulators on Friday shut down banks in Florida, Georgia and Michigan, a total of five closures that lifted the number of U.S. bank failures this year to 39.

The pace of closures has slowed, however, as the economy improves and banks work their way through piles of bad debt. By this time last year, regulators had closed 64 banks.

The Federal Deposit Insurance Corp. seized First National Bank of Central Florida, based in Winter Park, Fla., with $352 million in assets, and Cortez Community Bank of Brooksville, Fla., with $70.9 million in assets.

The agency also took over First Choice Community Bank of Dallas, Ga., with $308.5 million in assets; Park Avenue Bank, based in Valdosta, Ga., with $953.3 million in assets; and Community Central Bank in Mount Clemens, Mich., with $476.3 million in assets.

Miami-based Premier American Bank agreed to assume the assets and deposits of First National Bank of Central Florida and Cortez Community Bank. Bank of the Ozarks, based in Little Rock, Ark., is acquiring the assets and deposits of First Choice Community Bank and Park Avenue Bank. Talmer Bank & Trust, based in Troy, Mich., agreed to assume the assets and deposits of Community Central Bank.

In addition, the FDIC and Premier American Bank agreed to share losses on $270 million of First National Bank of Central Florida's loans and other assets, and on $51.3 million of Cortez Community Bank's assets.

The agency and Bank of the Ozarks are sharing losses on $260.7 million of First Choice Community Bank's assets and $514.1 million of Park Avenue Bank's assets. Talmer Bank & Trust is sharing with the FDIC $362.4 million of Community Central Bank's assets.

The failure of First National Bank of Central Florida is expected to cost the deposit insurance fund $42.9 million. The failure of Cortez Community Bank is expected to cost $18.6 million; that of First Choice Community Bank $92.4 million; Park Avenue Bank, $306.1 million; and Community Central Bank, $183.2 million.

Florida and Georgia have been the hardest-hit states for bank failures. Twenty-nine banks were shuttered in Florida last year and 16 in Georgia. The four shutdowns in those states on Friday brought to four and 10 the number of bank failures in Florida and Georgia, respectively this year.

California and Illinois also have seen large numbers of bank failures.

In 2010, authorities seized 157 banks that succumbed to mounting soured loans and the hobbled economy. It was the most in a year since the savings-and-loan crisis two decades ago.

The FDIC has said that 2010 likely would mark the peak for bank failures.

There were 140 bank failures in 2009, costing the insurance fund about $36 billion. The failures last year cost around $21 billion, a lower price tag because the banks that failed in 2010 were smaller on average. Twenty-five banks failed in 2008, the year the financial crisis struck with force; only three were closed in 2007.

From 2008, the year the financial crisis struck, through 2010, bank failures cost the fund $76.8 billion. The deposit insurance fund fell into the red in 2009, and its deficit stood at $7.4 billion as of Dec. 31.

The FDIC expects the cost of resolving failed banks to total around $52 billion from 2010 through 2014.

Depositors' money — insured up to $250,000 per account — is not at risk, with the FDIC backed by the government. That insurance cap was made permanent in the financial overhaul law enacted in July.

The number of banks on the FDIC's confidential "problem" list rose to 884 in the final quarter of last year from 860 three months earlier. The 884 troubled banks is the highest number since 1993, during the savings-and-loan crisis.

Copyright © 2011 The Associated Press. All rights reserved.

Obama, Congress renew push for austerity measures

The Obama administration and leading Democrats and Republicans in the US Congress are preparing the next round of austerity measures directed at slashing public services, jobs and incomes for working people, to pay for the deepening crisis of American and world capitalism.

Treasury Secretary Timothy Geithner signaled the direction of administration policy in a speech Thursday to the Economic Club of Detroit, where he hailed the auto makers’ return to profitability—through drastic cuts in wages and intensified exploitation of labor—and reiterated Obama’s determination to make drastic spending cuts. “Reducing the deficit is a war of necessity,” he declared. “There is no alternative.”

Geithner’s speech was only one of a series of such political signals, given as backroom discussions began over the next stage in the onslaught on federal social programs, following the bipartisan agreement on the fiscal year 2011 budget, reached April 8 between the White House and House Speaker John Boehner.

This involves bipartisan talks on a measure to raise the federal debt ceiling, currently set at $14.3 trillion. The treasury department says it will reach the debt ceiling May 16, but can stave off default on federal debt payments until early July using various financial expedients.

Congressional Republicans have demanded binding measures to cut spending, focused on entitlement programs like Medicare, Medicaid and Social Security, as the price of agreeing to raise the debt ceiling. Formal negotiations are to begin May 5, chaired by Vice President Joseph Biden, but informal talks are ongoing.

Several Senate Democrats announced this week that they were prepared to join the Republicans in demanding spending cuts as part of a bill to lift the debt ceiling. These include Kent Conrad of North Dakota, chairman of the Senate Budget Committee, Joe Manchin of West Virginia, Mark Pryor of Arkansas and Amy Klobuchar of Minnesota. Given the narrow 53-47 Democratic majority in the Senate, the defection of any four Democrats would ensure defeat of the debt ceiling measure, since all the Republicans are expected to oppose it.

Manchin began a statewide campaign swing by announcing his support for a Republican plan to impose legally binding caps on federal spending. The conservative Democrat openly criticized the White House position, which is that the debt ceiling measure should be passed as a stand-alone, without any policy provisions. A statement issued by his office Thursday read: “Only in Washington would people argue that the responsible thing to do is raise the debt ceiling and add trillions of dollars in more debt, without a real and responsible debt fix.”

In the House of Representatives, members of the ultra-right Republican Study Committee said they planned to propose a series of two-month increases in the debt ceiling, each of them requiring additional concessions from the White House on spending, rather than a single multi-year bill, as has been the practice in the past.

In his speech in Detroit, Geithner made no direct reference to the debt ceiling, but he came out forcefully for the kind of “enforcement mechanism” proposed by politicians of both parties in Congress to compel long-term spending cuts.

“You need fail-safe discipline that will force Congress to make choices to live within constraints and make reforms even when they find a hard time agreeing on them,” he said. He called for legislating “a broad framework that locks in reforms over a multi-year period and forces future Congresses and executive branch officials to shrink the deficit.”

The effect of such measures would be to short-circuit democratic processes, even in the extremely attenuated form in which they now exist, and insulate budget decisions from the mass popular opposition they are sure to provoke.

Congressional Republicans were already getting the first glimpses of such opposition at a series of town hall meetings held over the Easter Week recess, where thousands of people, mainly elderly, turned out to protest the plan endorsed by House Republicans to phase out Medicare and Medicaid.

There were press reports of heated exchanges and congressmen being shouted down by angry constituents in New Hampshire, New York, Pennsylvania, Illinois, Wisconsin, North Carolina, California, and in many districts in Florida.

While the congressional Republicans adopt the most openly reactionary posture, the Obama administration is no less hostile to the mounting popular opposition to the policies of austerity embraced by both the big business parties.

Treasury secretary Geithner’s appearance in Detroit was just as provocative, in its own way. He traveled to the most devastated major city in America, a city virtually destroyed by the auto bosses, to declare that the administration’s economic policies were working and to give Obama credit, in particular, for the revival of the auto industry.

“For the first time since 2004, all three American automakers have an operating profit,” he boasted. “And since GM and Chrysler emerged from bankruptcy in 2009, the industry has added nearly 90,000 jobs—the strongest period of job growth in more than 10 years.”

Geithner did not mention that the wages paid to these newly hired auto workers have been slashed by 50 percent, to only $14 an hour, barely above the poverty line. Nor that the strategy of the Obama administration, backed by the auto companies and the United Auto Workers union, is to make the US auto industry a successful low-cost competitor for its overseas rivals, both in Europe and Asia, including China.

The treasury secretary hailed the latest economic figures, although by any objective standard they were dismal: GDP growth of only 1.8 percent in the first quarter of 2011, and a jump in new claims for unemployment insurance.

Geithner said, “The economy is healing and getting stronger. Today’s GDP estimate shows the economy grew for the seventh straight quarter.”

He continued, “And it’s important to note, the private sector is leading this expansion. The private sector continues to boost its investments, purchases and hiring even as government spending continues to drop.”

The truth is that American corporate CEOs are sitting on $2 trillion in cash, which they are refusing to invest in production, let alone hiring, preferring instead the more (personally) lucrative stock buybacks and speculative financial investments.

The cutback in federal, state and local government spending played a major role in the reduction in GDP growth from 3.1 percent in the last quarter of 2010 to the miserable 1.8 percent figure for the past three months.

Geithner held out the prospect that the growth rate could return to the 3-4 percent level over the next two years, although that would barely make a dent in the massive army of unemployed and underemployed workers.

The author recommends:

Death toll from US tornadoes rises to 334

|

| The remains of a tornado-hit mobile home © AFP Les Neuhaus |

Aside from those states, the twisters left 34 dead in Tennessee, 15 in Georgia, and five in Virginia, according to state officials.

Families picked through the remains of homes, businesses and schools, bearing witness to scenes of devastation more common in war zones or after earthquakes.

In a bid to maintain order, Tuscaloosa Mayor Walter Maddox ordered a curfew, lasting from dusk until 8:00 am, for the second night. A police precinct was among the buildings damaged.

A sign on one door bluntly warned potential intruders what awaits them: "I will shoot you."

In addition to the deaths in Alabama, there were more than 2,000 injured and up to a million people left without power. Restoration of electricity could take several days.

States of emergency were declared from central Oklahoma to Georgia on the eastern seaboard, and governors called out the National Guard -- including 2,000 troops in Alabama -- to help with the rescue and clean-up operations.

"We had a major catastrophic event here in Alabama with the outbreak of numerous long-track tornadoes," said Governor Bentley.

Rescue workers battled through the day searching for missing people and trying to rescue survivors still trapped in the rubble.

Many homes looked like they had been blown inside out, with the walls torn down and furniture spilling into the street.

In a parking lot at the University of Alabama in Tuscaloosa, where 36 people were confirmed dead, tornadoes smashed 20 cars, leaving many piled on top of one another.

"I don't want to think now on how much I lost," Robert Mitton told AFP. "I hope we can get some help from the government. I live very close, my house is very damaged, but my family is fine."

Owen Simmons, who works in a furniture store, pointed to a black cross and a zero below painted on the side of his house.

"It means that the rescue team has already checked my home and they found no victims. That's what really matters."

© AFP -- Published at Activist Post with license

I'll take the reactionary over the murderer, thanks

Ron Paul is far from perfect, but I'll say this much for the Texas congressman: He has never authorized a drone strike in Pakistan. He has never authorized the killing of dozens of women and children in Yemen. He hasn't protected torturers from prosecution and he hasn't overseen the torturous treatment of a 23-year-old young man for the “crime” of revealing the government's criminal behavior.

Can the same be said for Barack Obama?

Yet, ask a good movement liberal or progressive about the two and you'll quickly be informed that yeah, Ron Paul's good on the war stuff -- yawn -- but otherwise he's a no-good right-wing reactionary of the worst order, a guy who'd kick your Aunt Beth off Medicare and force her to turn tricks for blood-pressure meds. By contrast, Obama, war crimes and all, provokes no such visceral distaste. He's more cosmopolitan, after all; less Texas-y. He's a Democrat. And gosh, even if he's made a few mistakes, he means well.

Sure he's a murderer, in other words, but at least he's not a Republican!

Put another, even less charitable way: Democratic partisans – liberals – are willing to trade the lives of a couple thousand poor Pakistani tribesman in exchange for a few liberal catnip-filled speeches and NPR tote bags for the underprivileged. The number of party-line progressives who would vote for Ron Paul over Barack Obama wouldn't be enough to fill Conference Room B at the local Sheraton, with even harshest left-leaning critics of the president, like Rolling Stone's Matt Taibbi, saying they'd prefer the mass-murdering sociopath to that kooky Constitution fetishist.

As someone who sees the electoral process as primarily a distraction, something that diverts energy and attention from more effective means of reforming the system, I don't much care if people don't vote for Ron Paul. In fact, if you're going to vote, I'd rather you cast a write-in ballot for Emma Goldman. But! I do have a problem with those who imagine themselves to be liberal-minded citizens of the world casting their vote for Barack Obama and propagating the notion that someone can bomb and/or militarily occupy Afghanistan, Pakistan, Iraq, Somalia, Yemen and Libya and still earn more Progressive Points than the guy who would, you know, not do any of that.

Let's just assume the worst about Paul: that he's a corporate libertarian in the Reason magazine/Cato Institute mold that would grant Big Business and the financial industry license to do whatever the hell it wants with little in the way of accountability (I call this scenario the “status quo”). Let's say he dines on Labradoodle puppies while using their blood to scribble notes in the margins of his dog-eared, gold-encrusted copy of Atlas Shrugged.

So. Fucking. What.

Barack Obama isn't exactly Eugene Debs, after all. Hell, he's not even Jimmy Carter. The facts are: he's pushed for the largest military budget in world history, given trillions of dollars to Wall Street in bailouts and near-zero interest loans from the Federal Reserve, protected oil companies like BP from legal liability for environmental damages they cause – from poisoning the Gulf to climate change – and mandated that all Americans purchase the U.S. health insurance industry's product. You might argue Paul's a corporatist, but there's no denying Obama's one.

And at least Paul would – and this is important, I think – stop killing poor foreigners with cluster bombs and Predator drones. Unlike the Nobel Peace Prize winner-in-chief, Paul would also bring the troops home from not just Afghanistan and Iraq, but Europe, Korea and Okinawa. There'd be no need for a School of the Americas because the U.S. wouldn't be busy training foreign military personnel the finer points of human rights abuses. Israel would have to carry out its war crimes on its own dime.

Even on on the most pressing domestic issues of the day, Paul strikes me as a hell of a lot more progressive than Obama. Look at the war on drugs: Obama has continued the same failed prohibitionist policies as his predecessors, maintaining a status quo that has placed 2.3 million – or one in 100 – Americans behind bars, the vast majority African-American and Hispanic. Paul, on the other hand, has called for ending the drug war and said he would pardon non-violent offenders, which would be the single greatest reform a president could make in the domestic sphere, equivalent in magnitude to ending Jim Crow.

Paul would also stop providing subsidies to corporate agriculture, nuclear energy and fossil fuels, while allowing class-action tort suits to proceed against oil and coal companies for the environmental damage they have wrought. Obama, by contrast, is providing billions to coal companies under the guise of “clean energy” – see his administration's policies on carbon capture and sequestration, the fossil fuel-equivalent of missile defense – and promising billions more so mega-energy corporations can get started on that “nuclear renaissance” we've all heard so much about. And if Paul really did succeed in cutting all those federal departments he talks about, there's nothing to prevent states and local governments -- and, I would hope, alternative social organizations not dependent on coercion -- from addressing issues such as health care and education. Decentralism isn't a bad thing.

All that aside, though, it seems to me that if you're going to style yourself a progressive, liberal humanitarian, your first priority really ought to be stopping your government from killing poor people. Second on that list? Stopping your government from putting hundreds of thousands of your fellow citizens in cages for decades at a time over non-violent “crimes” committed by consenting adults. Seriously: what the fuck? Social Security's great and all I guess, but not exploding little children with cluster bombs – shouldn't that be at the top of the Liberal Agenda?

Over half of Americans' income taxes go to the military-industrial complex and the costs of arresting and locking up their fellow citizens. On both counts, Ron Paul's policy positions are far more progressive than those held – and indeed, implemented – by Barack Obama. And yet it's Paul who's the reactionary of the two?

My sweeping, I'm hoping overly broad assessment: liberals, especially the pundit class, don't much care about dead foreigners. They're a political problem at best – will the Afghan war derail Obama's re-election campaign? – not a moral one. And liberals are more than willing to accept a few charred women and children in some country they'll never visit in exchange for increasing social welfare spending by 0.02 percent, or at least not cutting it by as much as a mean 'ol Rethuglican.

Mother Jones' Kevin Drum, for example, has chastised anti-Obama lefties, complaining that undermining – by way of accurately assessing and commenting upon – a warmonger of the Democratic persuasion is “extraordinarily self-destructive" to all FDR-fearing lefties.

“Just ask LBJ,” Drum added. The historical footnote he left out: That LBJ was run out of office by the anti-war left because the guy was murdering hundreds of thousands of Vietnamese. But mass murder is no reason to oppose a Democratic president, at least not if you're a professional liberal.

There are exceptions: Just Foreign Policy's Robert Naiman has a piece in Truth Out suggesting the anti-war left checking out Gary Johnson, the former governor of New Mexico who's something of a Ron Paul-lite. But for too many liberals, it seems partisanship and the promise – not even necessarily the delivery, if you've been reading Obama's die-hard apologists – of infinitesimally more spending on domestic programs is more important than saving the lives of a few thousand innocent women and children who happen to live outside the confines of the arbitrary geopolitical entity known as the United States.

Another reason to root -- if not vote -- for Ron Paul: if there was a Republican in the White House, liberals just might start caring about the murder of non-Americans again.

Gas station 'offers' home refinancing to pay for gas

Credit: KING

The owner of General Brushless Car Wash posted this sign outside his gas station after the price jumped over $4 per gallon.

by KING 5 News

krem.com

Posted on April 29, 2011 at 1:21 PM

EVERETT – A Snohomish County gas station and car wash owner is trying to give his customers something to laugh about as they fill up at over $4 per gallon.

A readerboard outside General Brushless Car Wash at 6101 Evergreen Way, where unleaded is now $4.02 a gallon, reads "We provide on-site home refinancing to help out with gas purchase!"

It was not an original idea. Owner Mark Hoidal said he saw it on the Internet.

"We've had people stop and take pictures of it and ask comments about it and laugh about it. They've actually come in and said, 'Hey. Where to I sign up for on-site financing?'" said Hoidal.

Hoidal said he has always tried to put something comical on the readerboard.

The average price of unleaded in Washington state is $3.98 per gallon. It's $4 in the Seattle-Bellevue-Everett area.