Overworld Magazine

You would think that a company that gets bailed out by the government

of the United States of America would have enough dignity to at least

respect its constitution… Think again. In April 2012 Kelly McMillan,

owner of McMillan arms reported that Bank of America began terminating business with them even though they were in good standing. According to bank representative Ray Fox, it was purely political.

One time occurance? No. Just today Bank of America has frozen the account of American Spirit

Arms, a company that legally sells gun parts online. Owner Joe

Sirochman says Bank of America froze his account and later told him they

did not believe he should be selling gun parts on the internet. It is

very obvious that Bank of America has no respect for our right to bear

arms, and has no respect for equality, though they were bailed out by

the very taxpayers those firearms protect. Shame on them.

http://overworldmag.blogspot.com/2013/01/first-mcmillan-then-american-spirit.html

Tuesday, January 8, 2013

Stocks Set To Fall As 4th Quarter Earnings Will Be An Unmitigated Disaster (TZA, FAZ, SDS, SH, SSO, VXX)

EconMatters: Stocks

setup for fall: It is ironic that stocks are at five years highs going

into what is probably going to be the biggest disappointment of an

earning`s season since the 2008 financial crisis . We got a hint of 4th quarter results during the disaster which was the 3rd quarter earning`s season

where most companies missed on the revenue side, and those that beat

EPS guidance, did so barely, and most of that was created through stock

buybacks and creative smoothing techniques.

. We got a hint of 4th quarter results during the disaster which was the 3rd quarter earning`s season

where most companies missed on the revenue side, and those that beat

EPS guidance, did so barely, and most of that was created through stock

buybacks and creative smoothing techniques.

Make no mistake when a public company sets earning`s guidance these are numbers that are very conservative, and they expect to blow these numbers away given a healthy business environment. When a company just barely hits or beats the EPS number, and misses on revenue you know they were buying back stock, and trying any possible financial trick to attain the EPS number. One of the oldest tricks on Wall street, besides giving easy guidance so that when it comes time for earning`s the stock shoots up because they “beat” expectations.

The fact that companies have to struggle so much just to meet expectations tells how bad things are from a corporate profit standpoint. They have cut their operations to the bone for the last three years, and built earnings up from the bottom, and that strategy has reached its point of exhaustion. No more to be squeezed out of that cost cutting strategy.

The Fiscal Cliff

Moreover, with the continual uncertainty coming out of Washington from a policy perspective, code word the Fiscal Cliff, it`s unlikely that CEO`s committed much towards year end discretionary CAP EX purchases which would spur corporate growth during the fourth quarter. So expect to hear the term Fiscal Cliff during Earning`s season quite a lot as the primary excuse for business headwinds by the executive teams during conference calls.

Deja Vu

Last quarter stocks were at these same levels, and companies started missing and no one wanted to sell hoping that they would get better earning`s reports, but firms just kept missing, and getting taken down one by one while the market stayed afloat at elevated levels.

Then more and more firms were missing on the same days, the big boys started missing, and finally the shorts were going to take multiple firms stocks down on the same day, and Wall Street pumpers threw in the proverbial towel on an options expiration Friday of all days, and took prices down to the next level in most stocks.

In other words, they tried to ignore the bad earnings and keep the rally alive, but the shorts are going to punish bad earning`s regardless of bullish sentiment.

Expect the same pattern of behavior as most fund managers are sheep and too stupid to actually get out before earnings season

starts, and buy after the inevitable selloff. They wait and hope and

once one big player unloads they all run for the exits at the same time

leaving quite a carnage in stocks along the way.

are sheep and too stupid to actually get out before earnings season

starts, and buy after the inevitable selloff. They wait and hope and

once one big player unloads they all run for the exits at the same time

leaving quite a carnage in stocks along the way.

One benefit is that short sellers can get some very cheap puts and establish some very attractive entry points for the inevitable ride back below 1400 in the S&P 500.

The Debt Fight

Moreover, with the upcoming fight over increasing the debt limit just around the corner expect quite a sizable selloff in markets which sends everybody back into the comforts of bonds teasing bond vigilantes once again, and reminding everyone including the fed that we really are still in a deflationary, deleveraging cycle that will not turn until true growth based upon sound financial principles are in place in Washington.

Washington is the biggest reason this economy has taken so long to recover from the financial crisis in 2008. And their ineptitude has caused the fed to overcompensate with an unprecedented and borderline extreme monetary solution which remains to be seen what the eventual unintended consequences are of said policy.

As this is new territory for the fed, and a grand experiment which economists will be analyzing for the next 50 years of academic study as to the ultimate costs & benefits to our society.

Cost cutting versus top-line growth

Corporations have had to watch costs the last three years, work their employees longer hours, control costs from an operational standpoint, i.e., operate more efficiency and take advantage of low financing and borrowing costs to manufacture earnings where they can through stock buybacks and creative use of capital.

But the one thing that hasn`t been present for corporations is an environment where the economy is robust and we are adding 500,000 jobs a month to the economy, and they can afford to hire and grow profits from the top line through new growth opportunities.

Expect to see the 4th quarter earning`s season reflective of squeezing all that can be had from the bottom line over the last three years, and the lack of true growth opportunities, which showed its ugly head during the 3rd quarter earnings results, make a pronounced appearance this earning`s season.

Fund Managers are slow learners

Stocks will get hit hard as shorts take down the earning`s misses one by one, until the fund managers get the hint, and start selling before the shorts eat into their profits, and start dumping everything mid-way through this earning`s season.

The excuses will be prevalent, all pointing to a lack of certainty out of Washington, but the real reason is that you can only cut your way to profits for so long before you need actual real growth in the economy, and apart from the slight uptick from the bottom in the housing market, the rest of the economy is just not robust enough to produce earning`s growth that is reflective of top line opportunities.

Related: Direxion Daily Small Cap Bear 3X Shares ETF (NYSEARCA:TZA), Direxion Daily Financial Bear 3X Shares ETF (NYSEARCA:FAZ), ProShares UltraShort S&P500 (NYSEARCA:SDS), ProShares Short S&P500 (NYSEARCA:SH), ProShares Ultra S&P500 (NYSEARCA:SSO), VIX ETN (NYSEARCA:VXX), Direxion Daily Financial Bull 3X Shares ETF (NYSEARCA:FAS).

Written By Dian L. Chu From EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essence of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets. All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium. That’s why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

Make no mistake when a public company sets earning`s guidance these are numbers that are very conservative, and they expect to blow these numbers away given a healthy business environment. When a company just barely hits or beats the EPS number, and misses on revenue you know they were buying back stock, and trying any possible financial trick to attain the EPS number. One of the oldest tricks on Wall street, besides giving easy guidance so that when it comes time for earning`s the stock shoots up because they “beat” expectations.

The fact that companies have to struggle so much just to meet expectations tells how bad things are from a corporate profit standpoint. They have cut their operations to the bone for the last three years, and built earnings up from the bottom, and that strategy has reached its point of exhaustion. No more to be squeezed out of that cost cutting strategy.

The Fiscal Cliff

Moreover, with the continual uncertainty coming out of Washington from a policy perspective, code word the Fiscal Cliff, it`s unlikely that CEO`s committed much towards year end discretionary CAP EX purchases which would spur corporate growth during the fourth quarter. So expect to hear the term Fiscal Cliff during Earning`s season quite a lot as the primary excuse for business headwinds by the executive teams during conference calls.

Deja Vu

Last quarter stocks were at these same levels, and companies started missing and no one wanted to sell hoping that they would get better earning`s reports, but firms just kept missing, and getting taken down one by one while the market stayed afloat at elevated levels.

Then more and more firms were missing on the same days, the big boys started missing, and finally the shorts were going to take multiple firms stocks down on the same day, and Wall Street pumpers threw in the proverbial towel on an options expiration Friday of all days, and took prices down to the next level in most stocks.

In other words, they tried to ignore the bad earnings and keep the rally alive, but the shorts are going to punish bad earning`s regardless of bullish sentiment.

Expect the same pattern of behavior as most fund managers

One benefit is that short sellers can get some very cheap puts and establish some very attractive entry points for the inevitable ride back below 1400 in the S&P 500.

The Debt Fight

Moreover, with the upcoming fight over increasing the debt limit just around the corner expect quite a sizable selloff in markets which sends everybody back into the comforts of bonds teasing bond vigilantes once again, and reminding everyone including the fed that we really are still in a deflationary, deleveraging cycle that will not turn until true growth based upon sound financial principles are in place in Washington.

Washington is the biggest reason this economy has taken so long to recover from the financial crisis in 2008. And their ineptitude has caused the fed to overcompensate with an unprecedented and borderline extreme monetary solution which remains to be seen what the eventual unintended consequences are of said policy.

As this is new territory for the fed, and a grand experiment which economists will be analyzing for the next 50 years of academic study as to the ultimate costs & benefits to our society.

Cost cutting versus top-line growth

Corporations have had to watch costs the last three years, work their employees longer hours, control costs from an operational standpoint, i.e., operate more efficiency and take advantage of low financing and borrowing costs to manufacture earnings where they can through stock buybacks and creative use of capital.

But the one thing that hasn`t been present for corporations is an environment where the economy is robust and we are adding 500,000 jobs a month to the economy, and they can afford to hire and grow profits from the top line through new growth opportunities.

Expect to see the 4th quarter earning`s season reflective of squeezing all that can be had from the bottom line over the last three years, and the lack of true growth opportunities, which showed its ugly head during the 3rd quarter earnings results, make a pronounced appearance this earning`s season.

Fund Managers are slow learners

Stocks will get hit hard as shorts take down the earning`s misses one by one, until the fund managers get the hint, and start selling before the shorts eat into their profits, and start dumping everything mid-way through this earning`s season.

The excuses will be prevalent, all pointing to a lack of certainty out of Washington, but the real reason is that you can only cut your way to profits for so long before you need actual real growth in the economy, and apart from the slight uptick from the bottom in the housing market, the rest of the economy is just not robust enough to produce earning`s growth that is reflective of top line opportunities.

Related: Direxion Daily Small Cap Bear 3X Shares ETF (NYSEARCA:TZA), Direxion Daily Financial Bear 3X Shares ETF (NYSEARCA:FAZ), ProShares UltraShort S&P500 (NYSEARCA:SDS), ProShares Short S&P500 (NYSEARCA:SH), ProShares Ultra S&P500 (NYSEARCA:SSO), VIX ETN (NYSEARCA:VXX), Direxion Daily Financial Bull 3X Shares ETF (NYSEARCA:FAS).

Written By Dian L. Chu From EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essence of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets. All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium. That’s why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

Is There Any Gold In Fort Knox? (GLD, SLV, IAU, SGOL, UGL)

Przemyslaw Radomski, CFA: In the classic 1964 movie Goldfinger, James Bond tries to prevent the main villain, Auric Goldfinger, from detonating a dirty nuclear bomb inside Fort Knox. While in Fort Knox, Bond says:

Well, if you explode it [the bomb] in Fort Knox, the… the entire gold supply of the United States would be radioactive for… fifty-seven years.

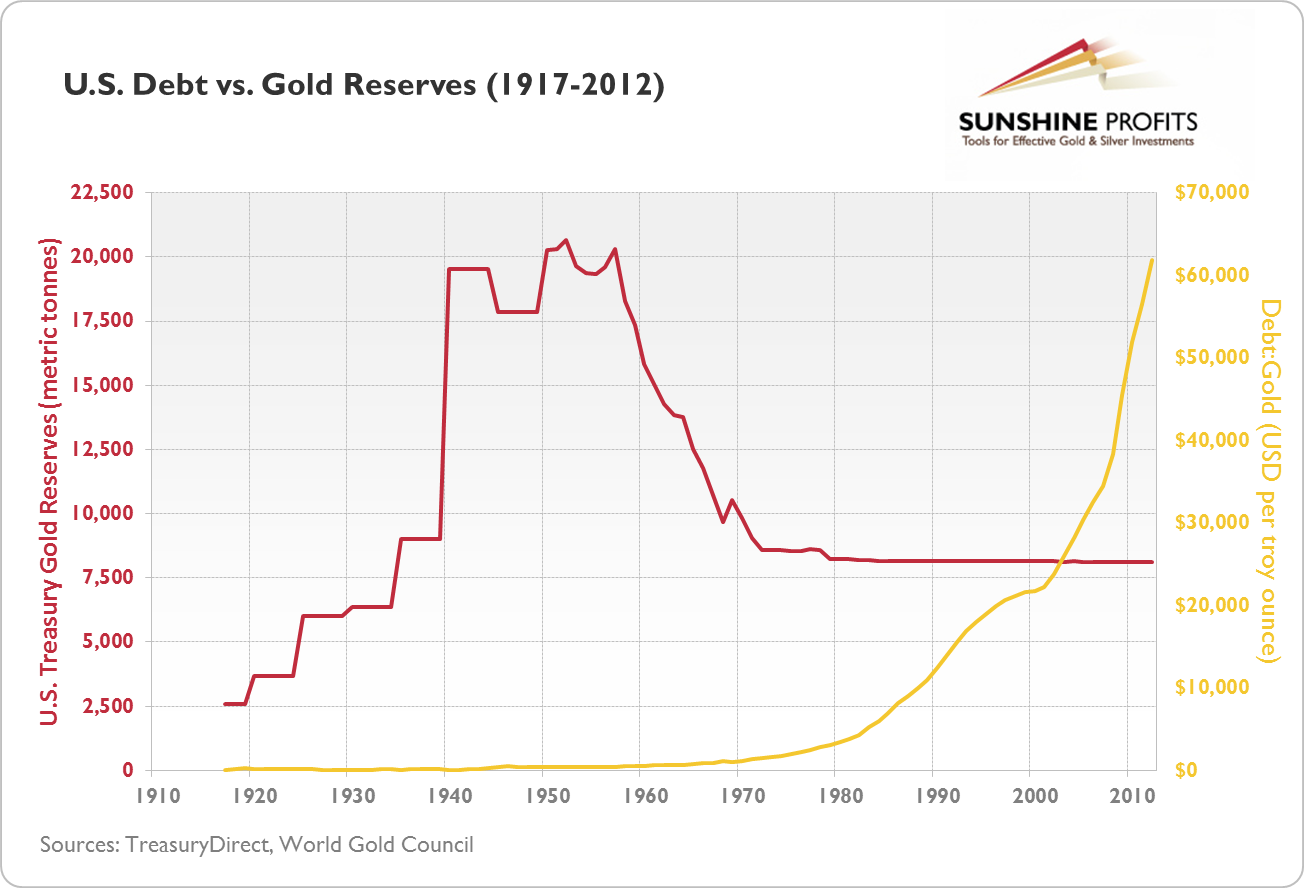

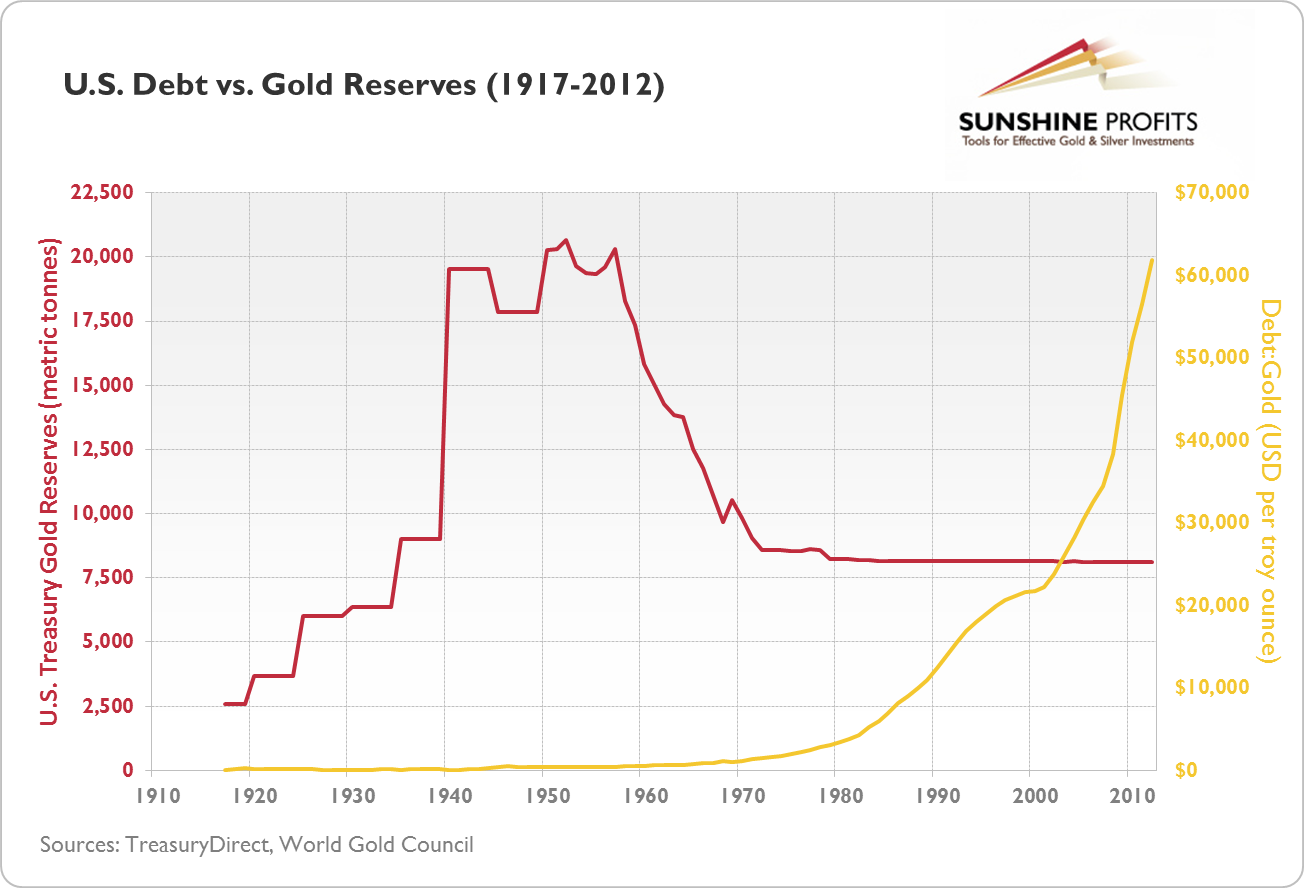

Goldfinger is only a work of fiction. Fort Knox wasn’t under the threat of a nuclear explosion (then again, who knows?). Nonetheless, it has been argued that it wouldn’t really make difference if the gold in the fort were radioactive – nobody has seen much of it since the 1950s. On December 4 and December 12, 2012 in our two-part story on gold and the U.S. dollar, we highlighted two possibilities: the dollar collapses, gold goes up like crazy or the dollar doesn’t collapse, gold still appreciates. In those commentaries, we analyzed the possibilities of gold appreciating and tied possible price levels with a number of factors, for instance with U.S. gold reserves as presented on the chart below.

On December 4, 2012, we wrote the following:

This chart presents the (…) relation of U.S. debt to Treasury gold reserves – the amount of debt per one ounce of gold – up to 2012. The red line represents U.S. Treasury gold reserves in metric tonnes, while the yellow line denotes the amount of U.S. debt in dollars per ounce of gold. The debt per ounce has visibly increased since 1971, accelerating around 2000 and even more around 2008. In 2012, there were $61,796.11 of debt per one ounce of gold owned by the U.S. government.

Now, if a new gold standard is introduced and the agreement works like the Bretton Woods system, the dollar (or whatever other currency) would be tied to gold. As noted earlier in this essay, at the introduction of the Bretton Woods agreement in 1944 the debt coverage for the U.S. stood at 10.9% (or $319.90 of debt per one troy ounce of gold). If the new system were based on similar assumptions with debt coverage at 10%, this would imply a fixed price of $6,179.61 per ounce of gold ($6,179.61 per ounce of gold divided by $61,796.11 of debt per one ounce of gold gives us coverage of 10%).

Since the publication of this essay, we have received a particularly interesting question about the assumptions we used:

Dear Mr. Radomski

Your December 4, 2012 article (…) is exceeding well-written and researched, and I gained a lot of knowledge from reading it. However there is one potential problem I see in all the logic you are applying to the current situation. It seems to me you are assuming the USA actually has gold at Fort Knox and West Point. But there is mounting, but unproven evidence, both places have no gold in them at all, and are rather storage places for nerve gas. (…) An audit of the US gold holdings has been demanded by some for years, but the government will not allow it. The gold belongs to the American people, so why won’t they let us see it? Many think it is because it is no longer there. If that is indeed the case, do we not face a “financial Armageddon?” Thanks for reading this and any response you might have. (I am not a conspiracy freak!) (…)

We always appreciate our readers’ feedback and would like to thank for it here. We also appreciate spot-on questions and see this particular one as intriguing, to say the least. Which brings us back to Fort Knox.

At first it may sound shocking, but the last audit of gold stored in Fort Knox took place in 1953. No typo here, 1953, just after U.S. President Dwight Eisenhower took office. Even though it is the last audit up to date, it can’t be described as satisfying. No outside experts were allowed and the audit team tested only about 5% of gold hoarded in the fort. So, there hasn’t been a comprehensive audit of Fort Knox in at least 60 (!!!) years. This is at least surprising, given the fact that large entities listed on stock exchanges are usually required to undergo an outside audit at least once a year. Of course, the U.S. Bullion Depository is no conventional company. Nonetheless, not auditing it independently for more than half of the century raises questions such as the one posted above.

This is no new topic. One of the first written accounts questioning the amount of gold really stored in Fort Knox appeared in 1974 in a tabloid, the National Tattler. An unnamed informant claimed that there was no gold left in Fort Knox. The sensational nature of the story, and of the newspaper, wouldn’t perhaps contribute to the credibility of the account but it was later revealed that the informant, Louise Auchincloss Boyer, secretary to Nelson Rockefeller, had fallen out of the window of her New York apartment and died three days after the publication in the Tattler. The tragic incident resulted in controversies over the possibility that the U.S. Bullion Depository may have misstated the actual amount of gold held in Fort Knox. Congressman John R. Rarick demanded aCongressional investigation and, on September 23, 1974 six Congressmen, one Senator and the press were allowed to enter Fort Knox to see for themselves if the gold was there or not.

The tour showed that there was gold in Fort Knox but, all the same, it sparked even more controversies. Only a fraction of the gold reserves were available to see. A photo of one Congressman published by Associated Press suggested that gold bars held in the fort may have been less heavy than would be usually expected.

Quite obviously, this has resulted in even more doubt about the fineness of gold in Fort Knox. None of these doubts have been put aside by any of the audits carried out since 1974. When the reserves were audited, the amount of the gold examined was fractional and there has been no comprehensive bar count and weighting. The same goes for assaying – if a fraction of gold bars were examined at all, then a fraction of this fraction were assayed. The methods used in the assaying process were not conventional. Usually, during an assay, gold bars are examined by means of drilling, which is called the core boring method. But the bars in Fort Knox were examined merely by cutting of small chips of the metal from their surface. This method only proved that the outer layer of the bars examined was made of gold.

This difference in assaying methods is important if you consider that counterfeit “gold bars” have been showing up in New York recently and that fake gold bars turned up in LBMA Approved Vaults in Hong Kong. All these bars had one common characteristic: they were made of tungsten, which has similar density as gold, and covered with a gold veneer. The problem here is that such bars can go undetected if they are examined with X-ray fluorescence scans or by means of simply scraping of a bit of the metal from the surface. So, to properly assess the fineness of gold bars in Fort Knox, a full core boring method should be employed.

In 2012, the German federal court ordered that the German central bank, Bundesbank, conduct anaudit of German gold reserves stored abroad, particularly in the U.S., U.K. and in France. The German authorities have never before conducted a comprehensive audit of their foreign gold reserves and the last time they were able to see their gold stored in the New York Federal Reserve vaults was supposedly in 1979/80. The Bundesbank has expressed that it doesn’t doubt the trustworthiness of the U.S. authorities but demands stricter control over its gold reserves. Because of that 150 tons of gold will be shipped from the U.S. to Germany to assess the fineness of the bars.

All of this shows that the measures applied by the U.S. government to gold storage in Fort Knox and the Federal Reserve Bank of New York’s vaults are questionable and that this fact may have

been recognized by German authorities. It’s hardly conceivable that

there is no gold left in Fort Knox or the New York vaults. On the other

hand, the lack of a comprehensive audit of either facility is unnerving.

So are other irregularities associated with Fort Knox:

missing shipments, audits acknowledging the existence of gold based on

seals that were not broken, not on the actual count and examination of

bars and so on.

Bank of New York’s vaults are questionable and that this fact may have

been recognized by German authorities. It’s hardly conceivable that

there is no gold left in Fort Knox or the New York vaults. On the other

hand, the lack of a comprehensive audit of either facility is unnerving.

So are other irregularities associated with Fort Knox:

missing shipments, audits acknowledging the existence of gold based on

seals that were not broken, not on the actual count and examination of

bars and so on.

Of course, a full audit of Fort Knox wouldn’t be an easy task because of the sheer amount of gold to be examined. But it’s feasible. The U.S. Mint estimated the cost of such an audit to stand at $60 million. The Treasury came up with a lower estimate – $15 million. Even if we take the higher value, and compare it to the value of gold stored in Fort Knox (as of December 31, 2012, $240.8 billion) it adds up to about 0.02% of these reserves. In this light the Treasury cannot really claim that this is too expensive.

So, what does all of this mean for the analysis we presented in our essay on gold and the dollar collapse? In short words, not much. Our price target for gold is to be treated as a general indication of where gold might go if the dollar collapses. If the value of the greenback is reduced to paper, we would expect gold to appreciate, but not exactly to $6,179.61. It could appreciate to $5,000 or to $10,000 (in today’s dollars). Nobody really knows that. The point is that if doubts about the amount of gold stored in Fort Knox are just that – unproven doubts – gold could be a lot more expensive (in dollar terms) than it is today. If, however, there’s any substance in these doubts and gold reserves in Fort Knox are lower than officially reported, gold could go even higher, and the price of $6,000 per ounce of gold could be viewed as the lower bound of where it might go.

The bottom line is that if the dollar collapses and the gold reported to be in Fort Knox is really there, gold could appreciate very strongly. If the dollar crashes and Fort Knox is (partially) empty, gold could go sky-high (in dollar terms).

For more information on how to structure your gold and silver portfolio to deal with both the possibility of the dollar collapsing and the possibility that it will endure in spite of the current U.S. debt levels , please consult our essay on gold and silver portfolio. For information on why we use past gold tops as reference points, check our essay on the 1980 top in gold.

, please consult our essay on gold and silver portfolio. For information on why we use past gold tops as reference points, check our essay on the 1980 top in gold.

Thank you for reading. Have a great weekend and profitable week!

Related Tickers: SPDR Gold Trust (NYSEARCA:GLD), iShares Silver Trust (NYSEARCA:SLV), iShares Gold Trust (NYSEARCA:IAU), ETF Securities Swiss Gold Trust (NYSEARCA:SGOL), Ultra Gold Trust (NYSEARCA:UGL).

Well, if you explode it [the bomb] in Fort Knox, the… the entire gold supply of the United States would be radioactive for… fifty-seven years.

Goldfinger is only a work of fiction. Fort Knox wasn’t under the threat of a nuclear explosion (then again, who knows?). Nonetheless, it has been argued that it wouldn’t really make difference if the gold in the fort were radioactive – nobody has seen much of it since the 1950s. On December 4 and December 12, 2012 in our two-part story on gold and the U.S. dollar, we highlighted two possibilities: the dollar collapses, gold goes up like crazy or the dollar doesn’t collapse, gold still appreciates. In those commentaries, we analyzed the possibilities of gold appreciating and tied possible price levels with a number of factors, for instance with U.S. gold reserves as presented on the chart below.

On December 4, 2012, we wrote the following:

This chart presents the (…) relation of U.S. debt to Treasury gold reserves – the amount of debt per one ounce of gold – up to 2012. The red line represents U.S. Treasury gold reserves in metric tonnes, while the yellow line denotes the amount of U.S. debt in dollars per ounce of gold. The debt per ounce has visibly increased since 1971, accelerating around 2000 and even more around 2008. In 2012, there were $61,796.11 of debt per one ounce of gold owned by the U.S. government.

Now, if a new gold standard is introduced and the agreement works like the Bretton Woods system, the dollar (or whatever other currency) would be tied to gold. As noted earlier in this essay, at the introduction of the Bretton Woods agreement in 1944 the debt coverage for the U.S. stood at 10.9% (or $319.90 of debt per one troy ounce of gold). If the new system were based on similar assumptions with debt coverage at 10%, this would imply a fixed price of $6,179.61 per ounce of gold ($6,179.61 per ounce of gold divided by $61,796.11 of debt per one ounce of gold gives us coverage of 10%).

Since the publication of this essay, we have received a particularly interesting question about the assumptions we used:

Dear Mr. Radomski

Your December 4, 2012 article (…) is exceeding well-written and researched, and I gained a lot of knowledge from reading it. However there is one potential problem I see in all the logic you are applying to the current situation. It seems to me you are assuming the USA actually has gold at Fort Knox and West Point. But there is mounting, but unproven evidence, both places have no gold in them at all, and are rather storage places for nerve gas. (…) An audit of the US gold holdings has been demanded by some for years, but the government will not allow it. The gold belongs to the American people, so why won’t they let us see it? Many think it is because it is no longer there. If that is indeed the case, do we not face a “financial Armageddon?” Thanks for reading this and any response you might have. (I am not a conspiracy freak!) (…)

We always appreciate our readers’ feedback and would like to thank for it here. We also appreciate spot-on questions and see this particular one as intriguing, to say the least. Which brings us back to Fort Knox.

At first it may sound shocking, but the last audit of gold stored in Fort Knox took place in 1953. No typo here, 1953, just after U.S. President Dwight Eisenhower took office. Even though it is the last audit up to date, it can’t be described as satisfying. No outside experts were allowed and the audit team tested only about 5% of gold hoarded in the fort. So, there hasn’t been a comprehensive audit of Fort Knox in at least 60 (!!!) years. This is at least surprising, given the fact that large entities listed on stock exchanges are usually required to undergo an outside audit at least once a year. Of course, the U.S. Bullion Depository is no conventional company. Nonetheless, not auditing it independently for more than half of the century raises questions such as the one posted above.

This is no new topic. One of the first written accounts questioning the amount of gold really stored in Fort Knox appeared in 1974 in a tabloid, the National Tattler. An unnamed informant claimed that there was no gold left in Fort Knox. The sensational nature of the story, and of the newspaper, wouldn’t perhaps contribute to the credibility of the account but it was later revealed that the informant, Louise Auchincloss Boyer, secretary to Nelson Rockefeller, had fallen out of the window of her New York apartment and died three days after the publication in the Tattler. The tragic incident resulted in controversies over the possibility that the U.S. Bullion Depository may have misstated the actual amount of gold held in Fort Knox. Congressman John R. Rarick demanded aCongressional investigation and, on September 23, 1974 six Congressmen, one Senator and the press were allowed to enter Fort Knox to see for themselves if the gold was there or not.

The tour showed that there was gold in Fort Knox but, all the same, it sparked even more controversies. Only a fraction of the gold reserves were available to see. A photo of one Congressman published by Associated Press suggested that gold bars held in the fort may have been less heavy than would be usually expected.

Quite obviously, this has resulted in even more doubt about the fineness of gold in Fort Knox. None of these doubts have been put aside by any of the audits carried out since 1974. When the reserves were audited, the amount of the gold examined was fractional and there has been no comprehensive bar count and weighting. The same goes for assaying – if a fraction of gold bars were examined at all, then a fraction of this fraction were assayed. The methods used in the assaying process were not conventional. Usually, during an assay, gold bars are examined by means of drilling, which is called the core boring method. But the bars in Fort Knox were examined merely by cutting of small chips of the metal from their surface. This method only proved that the outer layer of the bars examined was made of gold.

This difference in assaying methods is important if you consider that counterfeit “gold bars” have been showing up in New York recently and that fake gold bars turned up in LBMA Approved Vaults in Hong Kong. All these bars had one common characteristic: they were made of tungsten, which has similar density as gold, and covered with a gold veneer. The problem here is that such bars can go undetected if they are examined with X-ray fluorescence scans or by means of simply scraping of a bit of the metal from the surface. So, to properly assess the fineness of gold bars in Fort Knox, a full core boring method should be employed.

In 2012, the German federal court ordered that the German central bank, Bundesbank, conduct anaudit of German gold reserves stored abroad, particularly in the U.S., U.K. and in France. The German authorities have never before conducted a comprehensive audit of their foreign gold reserves and the last time they were able to see their gold stored in the New York Federal Reserve vaults was supposedly in 1979/80. The Bundesbank has expressed that it doesn’t doubt the trustworthiness of the U.S. authorities but demands stricter control over its gold reserves. Because of that 150 tons of gold will be shipped from the U.S. to Germany to assess the fineness of the bars.

All of this shows that the measures applied by the U.S. government to gold storage in Fort Knox and the Federal Reserve

Of course, a full audit of Fort Knox wouldn’t be an easy task because of the sheer amount of gold to be examined. But it’s feasible. The U.S. Mint estimated the cost of such an audit to stand at $60 million. The Treasury came up with a lower estimate – $15 million. Even if we take the higher value, and compare it to the value of gold stored in Fort Knox (as of December 31, 2012, $240.8 billion) it adds up to about 0.02% of these reserves. In this light the Treasury cannot really claim that this is too expensive.

So, what does all of this mean for the analysis we presented in our essay on gold and the dollar collapse? In short words, not much. Our price target for gold is to be treated as a general indication of where gold might go if the dollar collapses. If the value of the greenback is reduced to paper, we would expect gold to appreciate, but not exactly to $6,179.61. It could appreciate to $5,000 or to $10,000 (in today’s dollars). Nobody really knows that. The point is that if doubts about the amount of gold stored in Fort Knox are just that – unproven doubts – gold could be a lot more expensive (in dollar terms) than it is today. If, however, there’s any substance in these doubts and gold reserves in Fort Knox are lower than officially reported, gold could go even higher, and the price of $6,000 per ounce of gold could be viewed as the lower bound of where it might go.

The bottom line is that if the dollar collapses and the gold reported to be in Fort Knox is really there, gold could appreciate very strongly. If the dollar crashes and Fort Knox is (partially) empty, gold could go sky-high (in dollar terms).

For more information on how to structure your gold and silver portfolio to deal with both the possibility of the dollar collapsing and the possibility that it will endure in spite of the current U.S. debt levels

Thank you for reading. Have a great weekend and profitable week!

Related Tickers: SPDR Gold Trust (NYSEARCA:GLD), iShares Silver Trust (NYSEARCA:SLV), iShares Gold Trust (NYSEARCA:IAU), ETF Securities Swiss Gold Trust (NYSEARCA:SGOL), Ultra Gold Trust (NYSEARCA:UGL).

Geopolitics with Ryan Dawson- Episode 8: The Hype that Gave Us the ‘Crisis’

Ryan Dawson Presents Charlie McGrath

Charlie

McGrath joins us today to talk about the “fiscal cliff” deal, and clear

up the hype that gave us the ‘crisis’ as well as the deceptive so

called solution. We discuss how the neocons hijacked the tea-party,

making the tea-o-con party, and that all the talk of fiscal

responsibility or of fiscal conservatives was just that, all talk. What

did we really get in the fiscal cliff deal? What is the reality of the

US’s economic future, and how might that effect foreign policy

decisions?

Charlie

McGrath joins us today to talk about the “fiscal cliff” deal, and clear

up the hype that gave us the ‘crisis’ as well as the deceptive so

called solution. We discuss how the neocons hijacked the tea-party,

making the tea-o-con party, and that all the talk of fiscal

responsibility or of fiscal conservatives was just that, all talk. What

did we really get in the fiscal cliff deal? What is the reality of the

US’s economic future, and how might that effect foreign policy

decisions?Listen to the podcast show here (Subscribers Only):

This

Podcast is available to BFP subscription members only. If you are a

member, log in to listen. If you are not a member, you can subscribe by

clicking on ‘Subscribe' below.

This site depends exclusively on readers’ support. Please help us continue by SUBSCRIBING, and by ordering our EXCLUSIVE BFP DVD .

Pelosi, Reid Back Obama Raising Debt Ceiling via Executive Order

Senate Majority Leader Harry Reid (D-NV) has reportedly told President Barack Obama that he would back the president overriding congressional authority and unilaterally raising the debt ceiling.

Such a move would spark a constitutional crisis by running roughshod over the 14th Amendment, which states that “the validity of the public debt…shall not be questioned.”

White House Press Secretary Jay Carney has already taken the 14th Amendment option off the table; the Obama Administration, says Mr. Carney, “does not believe that the 14th Amendment gives the president the power to ignore the debt ceiling—period.”

But on Tuesday, Mr. Obama said, “I will not have another debate with this Congress over whether or not they should pay the bills that they’ve already racked up through the laws that they passed.”

On Monday, the United States hit the $16.4 trillion debt limit.

In Case There Was Any Confusion Just Who The Fed Works For...

Today, to little fanfare, the Fed announced a

major binding settlement with the banks over robosigning and

fraudclosure, which benefited the large banks, impaired the small ones

(which is great: room for even more consolidation, and even more

TBest-erTF, which benefits America's handful of remaining megabanks),

and was nothing but one minor slap on the banking sector's consolidated

wrist involving a laughable $3 billion cash payment. As part of the

settlement, the US public is expected to ignore how much money the banks

actually made in the primary and secondary market over

the years courtesy of countless Linda Greens and robosigning abuses. A

guess: the "settlement" represents an IRR of some 10,000% to 100,000%

for the settling banks. We are confident once the details are ironed

out, this will be an accurate range.

Yet what is most disturbing, or not at all, depending on one's level of naivete, is the response of Elijah Cummings, ranking member of the house Committee on Oversight and Government Reform. As a reminder, Congress had demanded that the settlement not be announced before there was a hearing on it. This did not even dent the Fed's plans to proceed with today's 11 am public announcement which can now not be revoked. It is Cummings' response which shows, yet again, just who is the true master of the Federal Reserve.

From The Committee on Oversight and Government Reform:

Yet what is most disturbing, or not at all, depending on one's level of naivete, is the response of Elijah Cummings, ranking member of the house Committee on Oversight and Government Reform. As a reminder, Congress had demanded that the settlement not be announced before there was a hearing on it. This did not even dent the Fed's plans to proceed with today's 11 am public announcement which can now not be revoked. It is Cummings' response which shows, yet again, just who is the true master of the Federal Reserve.

From The Committee on Oversight and Government Reform:

The statement concludes as follows:Today, Rep. Elijah E. Cummings, Ranking Member of the House Committee on Oversight and Government Reform, issued the following statement regarding the public announcement of a new settlement between the Office of the Comptroller of the Currency (OCC), the Federal Reserve Board, and 10 mortgage servicers without first briefing the Oversight Committee as requested on a bipartisan basis last week:

On Friday, Cummings and Oversight Committee Chairman Darrell Issa sent a bipartisan letter to Federal Reserve Chairman Ben Bernanke and Comptroller of the Currency Thomas Curry requesting a briefing before any new settlement was agreed to or announced publicly.“I am deeply disappointed that the OCC and the Federal Reserve finalized this settlement and effectively terminated the Independent Foreclosure Review process before providing Congress answers to serious questions about how this settlement amount was determined, who these funds will go to, and what will happen to other families who were abused by these mortgage servicing companies, but have not yet had their cases reviewed. I do not know what the rush was to make this settlement without answering these key questions, and although I look forward to obtaining information about how this deal may assist homeowners, I have serious concerns that this settlement may allow banks to skirt what they owe and sweep past abuses under the rug without determining the full harm borrowers have suffered.”

And that, folks, says it all, although it should not come as a surprise to anyone who has by now realized that the only goal the Fed has is to boost the Russell 2000 to new record highs, instead of giving any part of a rat's anatomy about the US public or the broader economy.In calls to the agencies this morning, agency officials stated that they

would not provide the briefing or answer additional questions before

going public with the announcement of the deal.

Pamplona's locksmiths join revolt as banks throw families from their homes

In the years of the housing boom, Spain's banks offered 100% mortgages.

Now, while receiving millions in public aid, they are throwing people

out of their homes. But there's a rebellion under way, report Monica Muñoz and Giles Tremlett

Locksmith Iker de

Carlos: 'It took us only 15 minutes to reach a decision. We all had

stories of jobs we had been on where families had been left on the

street.'

He is a locksmith who refuses to open locked doors; neither will

he replace their locks with new ones. What may seem a disastrous

strategy for Iker de Carlos, a 22-year-old Spaniard starting out in the

world of cylinders, pins, bolts and lock springs in his home city of

Pamplona, is actually part of a growing civic rebellion in support of

the biggest losers in Spain's

five-year story of failing, mismanaged banks – those being thrown out

of their homes after falling behind on mortgage payments.

Tired of accompanying court officials to evict unemployed people as banks foreclosed mortgages, De Carlos consulted his fellow Pamplona locksmiths before Christmas. In no time at all, they came to an agreement. They would not do the dirty work of banks whose rash lending pumped up a housing bubble and then, after it popped, helped bring the country to its knees.

"It only took us 15 minutes to reach a decision," says De Carlos amid the racks of keys in the family's shop in the centre of this small northern city best known for its annual bull-runs and the adoration heaped on it by Ernest Hemingway in The Sun Also Rises. "We all had stories of jobs we had been on where families had been left on the street. When you set out all you have is an address and the name of the bank, but I recall an elderly, sick man who was barely given time to put his trousers on."

The logic behind their decision was clear and simple. While Spain's banks mop up billions of euros in public aid, they are also busy reclaiming homes that in some cases they lent silly money for. At the height of Spain's housing madness, banks were, in effect, offering mortgages of more than 100%. They aggressively chased clients – especially among the immigrants who arrived from Latin America in their millions to build new homes – creating an uncontrolled spiral of self-fulfilling, but ultimately doomed, demand. Complex networks of guarantors were pieced together by middlemen among immigrants who often barely understood what they were doing.

"Spain must be the only country in the world where banks were allowed to offer 100% mortgages," said Guillermo Perilla, a 31-year-old Colombian immigrant who bought a house on the outskirts of Pamplona for €240,000 in 2005. "Not only that, but in some cases they also offered further loans to the people taking out mortgages. The bank staff were on commission."

Seven years after buying his house Perilla, an unemployed painter whose wife works part-time, is fighting foreclosure. The bank has told him his house is now only worth €140,000 and refuses to accept it back in payment for the debt. "But it was their valuer who originally said it was worth a lot more," he said. "Banks inflated prices and now they are making ordinary people pay for them." The bank has now said he can just pay interest for three years: "But that still leaves me with the debt. These things crush you, both morally and physically."

Last month, Spain's banks began to receive what will eventually be more than €40bn (£32.5bn) in aid. The number of foreclosures, meanwhile, increased by 134% last year. "Social conflict is being created," said Gonzalo Moliner, head of Spain's higher judiciary council. Properties were often reclaimed through the courts on valuations well below levels at which the loans were given. Those unable to pay can be evicted while still saddled with ever-growing debt.

De Carlos believes that Pamplona's locksmiths have now lost 10% of their trade, but recovered their honour and dignity: "This summer we were doing two or three foreclosures a week."

The locksmiths' rebellion follows several widely reported suicides by people about to be evicted from their homes. Amaia Egaña, a 53-year-old former socialist councillor in the northern town of Barakaldo, threw herself out of a window just as the court authorities – and their locksmith – were about to evict her in November.

"It wasn't suicide," demonstrators who marched through her town later that day shouted. "It was murder."

The Roman Catholic bishop of Bilbao called for urgent action to prevent further suicides.

"We had a suicide in Santesteban, too, where someone threw themselves out of the window," said Perilla, who now helps to campaign to stop foreclosures. "Banks still don't want to do anything. As you stop paying you cease to exist for them – they don't care if you are sick or if you have children. But they can buckle under pressure. They hate the bad publicity."

As Spain enters yet another year of austerity and sky-high unemployment, people such as De Carlos are increasingly fed up with seeing the country's most vulnerable paying for the errors of its banks. Campaigners now regularly form human barricades at the front doors of those due to be evicted from their homes.

But things look unlikely to get better. Unemployment, already at 26%, is set to grow, creating still more people who cannot pay mortgages. Iker is one of the fortunate minority in his age bracket with a job. More than 50% of under-25s fail to find work. Spain lost some 800,000 jobs last year. Only Greece – Europe's worst disaster story – can rival the figures.

Even Pamplona, a relatively wealthy city at the centre of Navarra, one of Spain's richest and best-funded regions, is feeling the squeeze. Unemployment in the region is 15%, higher than in any other European country bar Greece, Croatia and Portugal – but the lowest in Spain. A quarter of those unemployed joined Navarra's dole queues last year as the region discovered that, despite the presence of major employers such as Volkswagen, it was not immune to the downturn.

Like Spaniards elsewhere, people here have almost stopped buying houses. In October only 250 new mortgages were signed in a region of 640,000 people – a sixth of the monthly rate five years ago. Prices have fallen 38% since Spain's housing bubble burst, but are expected to fall further. Loans no longer come from the once proud local savings bank, Caja Navarra. Like many of Spain's regional savings banks, it sank under the weight of its own toxic real estate assets, losing value rapidly and merging with two others before being taken over by a large Catalan bank, la Caixa.

In Madrid, the locksmiths of Pamplona are being held up as an example to follow. "You have to fight," said 75-year-old Luis Domínguez. Last year he called in campaigners to prevent court officials throwing him out of his house in the dormitory town of Parla. Now Luis is part of a group who have spent the past 77 days camped out at the doors of Bankia – Spain's fourth-largest bank, which has taken €20bn in rescue money. He is now negotiating a rental agreement with his bank and hopes to pay €250 a month in rent for the next five years.

Gladys Cerna, 49, is facing foreclosure on her small flat in Madrid's San Blas neighbourhood. Her bank gave her a 120% mortgage in 2007. "When you sign they turn up with lawyers and economists, and I didn't have any real idea what I was letting myself in for," she said.

Spooked by the suicides, prime minister Mariano Rajoy's reformist , pro-austerity government changed the law last year to allow those with large families or very sick dependents to stay longer in their homes. But campaigners say it is not enough.

"They have placed a tiny sticking plaster over the problem," said Perilla. "It only covers really extreme cases. Banks will still do whatever they can to evict people."

In Pamplona, however, they will now find it harder to find a locksmith to help them.

Tired of accompanying court officials to evict unemployed people as banks foreclosed mortgages, De Carlos consulted his fellow Pamplona locksmiths before Christmas. In no time at all, they came to an agreement. They would not do the dirty work of banks whose rash lending pumped up a housing bubble and then, after it popped, helped bring the country to its knees.

"It only took us 15 minutes to reach a decision," says De Carlos amid the racks of keys in the family's shop in the centre of this small northern city best known for its annual bull-runs and the adoration heaped on it by Ernest Hemingway in The Sun Also Rises. "We all had stories of jobs we had been on where families had been left on the street. When you set out all you have is an address and the name of the bank, but I recall an elderly, sick man who was barely given time to put his trousers on."

The logic behind their decision was clear and simple. While Spain's banks mop up billions of euros in public aid, they are also busy reclaiming homes that in some cases they lent silly money for. At the height of Spain's housing madness, banks were, in effect, offering mortgages of more than 100%. They aggressively chased clients – especially among the immigrants who arrived from Latin America in their millions to build new homes – creating an uncontrolled spiral of self-fulfilling, but ultimately doomed, demand. Complex networks of guarantors were pieced together by middlemen among immigrants who often barely understood what they were doing.

"Spain must be the only country in the world where banks were allowed to offer 100% mortgages," said Guillermo Perilla, a 31-year-old Colombian immigrant who bought a house on the outskirts of Pamplona for €240,000 in 2005. "Not only that, but in some cases they also offered further loans to the people taking out mortgages. The bank staff were on commission."

Seven years after buying his house Perilla, an unemployed painter whose wife works part-time, is fighting foreclosure. The bank has told him his house is now only worth €140,000 and refuses to accept it back in payment for the debt. "But it was their valuer who originally said it was worth a lot more," he said. "Banks inflated prices and now they are making ordinary people pay for them." The bank has now said he can just pay interest for three years: "But that still leaves me with the debt. These things crush you, both morally and physically."

Last month, Spain's banks began to receive what will eventually be more than €40bn (£32.5bn) in aid. The number of foreclosures, meanwhile, increased by 134% last year. "Social conflict is being created," said Gonzalo Moliner, head of Spain's higher judiciary council. Properties were often reclaimed through the courts on valuations well below levels at which the loans were given. Those unable to pay can be evicted while still saddled with ever-growing debt.

De Carlos believes that Pamplona's locksmiths have now lost 10% of their trade, but recovered their honour and dignity: "This summer we were doing two or three foreclosures a week."

The locksmiths' rebellion follows several widely reported suicides by people about to be evicted from their homes. Amaia Egaña, a 53-year-old former socialist councillor in the northern town of Barakaldo, threw herself out of a window just as the court authorities – and their locksmith – were about to evict her in November.

"It wasn't suicide," demonstrators who marched through her town later that day shouted. "It was murder."

The Roman Catholic bishop of Bilbao called for urgent action to prevent further suicides.

"We had a suicide in Santesteban, too, where someone threw themselves out of the window," said Perilla, who now helps to campaign to stop foreclosures. "Banks still don't want to do anything. As you stop paying you cease to exist for them – they don't care if you are sick or if you have children. But they can buckle under pressure. They hate the bad publicity."

As Spain enters yet another year of austerity and sky-high unemployment, people such as De Carlos are increasingly fed up with seeing the country's most vulnerable paying for the errors of its banks. Campaigners now regularly form human barricades at the front doors of those due to be evicted from their homes.

But things look unlikely to get better. Unemployment, already at 26%, is set to grow, creating still more people who cannot pay mortgages. Iker is one of the fortunate minority in his age bracket with a job. More than 50% of under-25s fail to find work. Spain lost some 800,000 jobs last year. Only Greece – Europe's worst disaster story – can rival the figures.

Even Pamplona, a relatively wealthy city at the centre of Navarra, one of Spain's richest and best-funded regions, is feeling the squeeze. Unemployment in the region is 15%, higher than in any other European country bar Greece, Croatia and Portugal – but the lowest in Spain. A quarter of those unemployed joined Navarra's dole queues last year as the region discovered that, despite the presence of major employers such as Volkswagen, it was not immune to the downturn.

Like Spaniards elsewhere, people here have almost stopped buying houses. In October only 250 new mortgages were signed in a region of 640,000 people – a sixth of the monthly rate five years ago. Prices have fallen 38% since Spain's housing bubble burst, but are expected to fall further. Loans no longer come from the once proud local savings bank, Caja Navarra. Like many of Spain's regional savings banks, it sank under the weight of its own toxic real estate assets, losing value rapidly and merging with two others before being taken over by a large Catalan bank, la Caixa.

In Madrid, the locksmiths of Pamplona are being held up as an example to follow. "You have to fight," said 75-year-old Luis Domínguez. Last year he called in campaigners to prevent court officials throwing him out of his house in the dormitory town of Parla. Now Luis is part of a group who have spent the past 77 days camped out at the doors of Bankia – Spain's fourth-largest bank, which has taken €20bn in rescue money. He is now negotiating a rental agreement with his bank and hopes to pay €250 a month in rent for the next five years.

Gladys Cerna, 49, is facing foreclosure on her small flat in Madrid's San Blas neighbourhood. Her bank gave her a 120% mortgage in 2007. "When you sign they turn up with lawyers and economists, and I didn't have any real idea what I was letting myself in for," she said.

Spooked by the suicides, prime minister Mariano Rajoy's reformist , pro-austerity government changed the law last year to allow those with large families or very sick dependents to stay longer in their homes. But campaigners say it is not enough.

"They have placed a tiny sticking plaster over the problem," said Perilla. "It only covers really extreme cases. Banks will still do whatever they can to evict people."

In Pamplona, however, they will now find it harder to find a locksmith to help them.

Why Was a 2.3% ‘Medical Excise Tax’ Showing Up on Receipts from Sporting Goods Giant Cabela’s?

January 1, 2013 brought a host of new taxes, fees, and charges to the

American people. Some of them were anticipated. Others, like the Medical Device Excise Tax (MDET), were not — at least not in this way.

How so? Well, the MDET has started showing up on the receipts for purchases made at sporting goods giant Cabela’s. This receipt from one such store in Texas is making the rounds on the web. It shows an additional tax has been added to the purchase, after the local sales tax of nearly 10% was charged.

A series of phone calls to both the corporate offices of Cabela’s as

well as three Texas outlets where the taxes have been showing up yielded

what appears to be a satisfactory explanation and resolution.

A series of phone calls to both the corporate offices of Cabela’s as

well as three Texas outlets where the taxes have been showing up yielded

what appears to be a satisfactory explanation and resolution.

Customer service reps for Cabela’s stated the added tax was “a computer glitch that has been fixed.” In one case, a representative offered to take my receipt information over the phone and expedite a refund to my credit card. Cash purchases that were hit with the extra 2.3% tax must return to the store for a cash refund.

With that mystery solved, we couldn’t stop wondering about the tax. What is a Medical Excise Tax? Which devices will be affected by it?

TheBlaze asked the people responsible for collecting the tax — the Internal Revenue Service (IRS). There is much information about this new tax on the IRS website. Let’s start with the obvious question, “What is it?”

TheBlaze asked the people responsible for collecting the tax — the Internal Revenue Service (IRS). There is much information about this new tax on the IRS website. Let’s start with the obvious question, “What is it?”

“If our profit margin is 4%, and we’re hit with an added 2.3% charge by this tax, more than half of our profit is instantly gone,” the company source said.

Looking deeper into the IRS clarification on this, we wondered what qualifies as a “medical device?” The IRS has guidance on that topic — sort of. Here’s the slightly confusing answer to the question, What is a taxable medical device?

It appears that much of the $29 billion will be coming from the pockets of consumers.

(H/T: Twitchy.com)

How so? Well, the MDET has started showing up on the receipts for purchases made at sporting goods giant Cabela’s. This receipt from one such store in Texas is making the rounds on the web. It shows an additional tax has been added to the purchase, after the local sales tax of nearly 10% was charged.

Image: Twitchy.com

Customer service reps for Cabela’s stated the added tax was “a computer glitch that has been fixed.” In one case, a representative offered to take my receipt information over the phone and expedite a refund to my credit card. Cash purchases that were hit with the extra 2.3% tax must return to the store for a cash refund.

With that mystery solved, we couldn’t stop wondering about the tax. What is a Medical Excise Tax? Which devices will be affected by it?

Credit: AP

Section 4191 of the Internal Revenue Code imposes an excise tax on the sale of certain medical devices by the manufacturer or importer of the device.That’s the very first response from the IRS to the question about the tax. Based on that definition, it would seem that the mandated 2.3% tax should be charged to the manufacturer or importer and not the consumer. The IRS clearly states responsibility to pay the tax points to the maker and importer, but the word “generally” in their answer leaves wiggle room:

Generally, the manufacturer or importer of a taxable medical device is responsible for filing Form 720, Quarterly Federal Excise Tax Return, and paying the tax to the IRS.Some tax experts say that adding the word “generally” may allow for the manufacturers and importers to pass that same 2.3% tax on to consumers through elevated prices at the retail level. At least one source at a major American manufacturer — who asked to remain anonymous because they’re not authorized to speak publicly on the matter — said the company will be forced to increase prices.

“If our profit margin is 4%, and we’re hit with an added 2.3% charge by this tax, more than half of our profit is instantly gone,” the company source said.

Looking deeper into the IRS clarification on this, we wondered what qualifies as a “medical device?” The IRS has guidance on that topic — sort of. Here’s the slightly confusing answer to the question, What is a taxable medical device?

In general, a taxable medical device is a device that is listed as a device with the Food and Drug Administration under section 510(j) of the Federal Food, Drug, and Cosmetic Act and 21 CFR part 807, unless the device falls within an exemption from the tax, such as the retail exemption.Section 501 is a 23 page document filled with language that would confuse most folks, but then again, it allegedly applies only to commercial sales and importation of medical devices. The aforementioned “retail exemption” is a bit easier to grasp. Clarification on this issue is courtesy of the legal eagles at JDsupra.com:

There are two main categories of devices exempt from the tax. First, eyeglasses, contact lenses and hearing aids are specifically listed as being exempt. The second and broader category, commonly referred to as the “Retail Exception,” exempts a device which is “of a type which is generally purchased by the general public at retail for individual use.”At the end of the day, the Medical Device Excise Tax was supposed to generate an additional $29 billion to help pay for Obamacare. During the deliberations of the 2009 law, the bill’s authors envisioned the $29 billion coming from “big companies” who made or imported the devices. More than one of the medical device manufacturers say that their operating profit margins are so thin, that they have no choice but to pass the cost on to consumers.

It appears that much of the $29 billion will be coming from the pockets of consumers.

(H/T: Twitchy.com)

Surprise, Surprise: The Banks Win

IF you were hoping that things might be different in 2013 — you know,

that bankers would be held responsible for bad behavior or that the

government might actually assist troubled homeowners — you can forget

it. A settlement reportedly in the works with big banks will soon end a

review into foreclosure abuses, and it means more of the same: no accountability for financial institutions and little help for borrowers.

Last week, The New York Times reported that regulators were close to

settling with 14 banks whose foreclosure practices had ridden roughshod

over borrowers and the rule of law. Although the deal has not been made

official and its terms are as yet unknown, the initial report said

borrowers who had lost their homes because of improprieties would

receive a total of $3.75 billion in cash. An additional $6.25 billion

would be put toward principal reduction for homeowners in distress.

The possible settlement will conclude a regulatory enforcement action brought in 2011 by the Comptroller of the Currency and the Federal Reserve. Regulators moved against 14 large home loan servicers after evidence emerged of rampant misdeeds marring the foreclosure process.

Under the enforcement action, the banks were required to review

foreclosures conducted in 2009 and 2010. They hired consultants to

analyze cases in which borrowers suspected that they had been injured by

bank practices, such as levying excessive and improper fees or

foreclosing when a borrower was undergoing a loan modification. Some 4.4 million borrowers journeyed through the foreclosure maze during the period.

Some back-of-the-envelope arithmetic on this deal is your first clue

that it is another gift to the banks. It’s not clear which borrowers

will receive what money, but divvying up $3.75 billion among millions of

people doesn’t amount to much per person. If, say, half of the 4.4

million borrowers were subject to foreclosure abuses, they would each

receive less than $2,000, on average. If 10 percent of the 4.4 million

were harmed, each would get roughly $8,500.

This is a far cry from the possible penalties outlined last year

by the federal regulators requiring these reviews. For instance,

regulators said that if a bank had foreclosed while a borrower was

making payments under a loan modification, it might have to pay $15,000

and rescind the foreclosure. And if it couldn’t be rescinded because the

house had been sold, the bank could have had to pay the borrower

$125,000 and any accrued equity.

Recall that the foreclosure exams came about because regulators had

found pervasive problems. A study by the Fed and the comptroller’s

office found “critical weaknesses in servicers’ foreclosure governance

processes, foreclosure document preparation processes, and oversight and

monitoring of third-party vendors, including foreclosure attorneys.”

The United States Trustee, which oversees the nation’s bankruptcy courts, also uncovered huge flaws in bank practices.

So if you start to hear rumbling that the reviews didn’t turn up many

misdeeds, you can discount it as nonsense. One could easily argue that

this reported settlement was pushed by the banks so they could limit the

damage they would have incurred if an aggressive review had continued.

“We think if the reviews were done right, the payouts would have been

significantly higher than they appear to be under this settlement,” said

Alys Cohen, staff attorney at the National Consumer Law Center. “The regulators will have abdicated their responsibility if the banks end up getting off the hook easily and cheaply.”

Let’s not forget that this looming settlement will also conclude the

foreclosure reviews that were supposed to provide regulators with

chapter and verse on how banks abused their customers. Stopping the

reviews before they are finished means that the banks will be allowed to

claim that abuses were rare and that $10 billion is an adequate

penalty.

A spokesman at the Office of the Comptroller of the Currency declined to

comment on whether a settlement was imminent or what it might look

like. But with no clear details about its terms, many questions remain.

First, of course, is how many borrowers will receive the $3.75 billion,

and how will that money be shared? And who will ensure that the funds go

to the right people? The fact is, most people will not be hiring a

lawyer to pursue their cases further against servicers, so this money is

all that they will receive.

Another problem is that the money will be doled out to wronged borrowers

based on work done by consultants hired by the banks responsible for

the improprieties. How can their findings be trusted? What’s more, the

reviews’ conclusions about harm are based on the servicers’ side of the

story, not homeowners’.

Because the consultants work for the banks, it is also possible that

these institutions may use the information gleaned from the foreclosure

reviews to profit once again on troubled borrowers. If foreclosed

borrowers left a property while owing the difference between the amount

of the loan and what the bank received in a sale of the home, the bank

may not have known the borrowers’ whereabouts until that information was

reported in a request for review.

Finally, what if victims of an improper foreclosure didn’t receive a

review because they didn’t know about the program? Letters about the

program sent to 5.3 percent of targeted borrowers were returned as

undeliverable, regulators said.

And many of those who did receive the mailings may not have understood them. In a study last June,

the Government Accountability Office concluded that the initial letter,

the request-for-review form and foreclosure review Web site were

“written above the average reading level of the U.S. population.” What’s

more, the study said, the materials did not include specifics about

what borrowers might receive as a remedy, possibly affecting their

motivation to respond.

In any case, as of Dec. 6, 2012, only 322,771 borrowers had requested an independent review, according to the Fed.

That’s 7.3 percent of the affected borrowers during the period, a

figure that does not mirror the widespread problems regulators said they

had identified in the foreclosure system.

“The O.C.C.-Fed review is just another flawed outreach program designed

to fail,” said Ned Brown, a legislative strategist at the marketing

consultant Prairie Strategies in Washington. “The servicers rolled the

regulators.”

New year, same story.

A version of this article appeared in print on January 6, 2013, on page BU1 of the New York edition with the headline: Surprise, Surprise: The Banks Win.

IRS Looks to Force Obamacare on Employers Who Cut Staff

A few months ago I predicted here that Obamacare would result in a

“great chase,” by which I meant that smaller employers would react to

the health insurance mandate by reducing staffing to under 50 full time

employees to escape the requirement. This will, I predicted, set off a ”great chase:” From my post, “Obamacare and the ‘Great Chase’:

Faster than I thought, the government has proved me right. (I am pretty good at this predicting business.) The IRS has just published proposed rules that will, if finalized, require coverage in some cases when an employer has only 40 full timers. From the New York Times story:Businesses will try to cut their losses by reducing employee hours or by keeping their workforce under 50. The technocrats will respond by changing the rules, say, by lowering the full-time employment requirement to 40 and/or reducing the number of hours worked that qualify as “full time employment.” Businesses will react again, and the government will respond. The chase will be on.

Under the rules, employers must offer coverage to employees in 2014 and must offer coverage to dependents as well, starting in 2015. The new rules apply to employers that have at least 50 full-time employees or an equivalent combination of full-time and part-time employees. A full-time employee is a person employed on average at least 30 hours a week. And 100 half-time employees are considered equivalent to 50 full-time employees. Thus, the government said, an employer will be subject to the new requirement if it has 40 full-time employees working 30 hours a week and 20 half-time employees working 15 hours a week.CLICK LIKE IF YOU’RE PRO-LIFE!

US 'seriously' considering $1 trillion coin to pay off debt

The US is "seriously" considering creating a $1 trillion platinum coin to write down part of its debt to stop the world's largest economy defaulting as early as next month, according to financial analyst Cullen Roche.

A legal loophole means the US Treasury is able to mint a platinum coin and assign any value to it. Photo: Peter Macdiarmid/Getty Images

Speaking to the BBC's Today programme, Mr Roche, founder of Orcam Financial

Group and blogger

at Pragmatic Capitalism, said the idea was being taken "somewhat

seriously" in Washington.

"I know it’s been spoken about at the White House and a number of

prominent people, including congressman, are talking about it," he

said.

In theory the US Treasury would mint the coin and deposit it into its own

account at the Federal Reserve, which would allow the government to write

down or cancel $1 trillion of its $16.4 trillion debt pile.

The Treasury began shuffling funds in order to pay government bills after the

country hit its $16 trillion debt limit on December 31. However, the

Treasury's accounting maneouvres will last only until around the end of

February as the latest fiscal

cliff deal gives US

politicians two months to raise the debt limit before the country

defaults.

The idea, which was raised last year, has been floated by several financial

analysts in the States over recent days as Congress and the government

approach the key fiscal vote.

Mr Roche said the idea was an "accounting gimmick", but noted it was

just "one really silly idea [being used] to fight another silly idea".

"The idea of the US willingly defaulting on debt is beyond crazy," he said.

"We started kicking the idea around a year ago and it was really a joke and the fact it’s become something sort of serious, well it’s a sad state of affairs that it’s become so dysfunctional in Congress that this is something we’re having to resort to."

Writing in his New York Times blog, economist Paul Krugman, said that while he did not expect the Treasury to go ahead with this "gimmick", there could be a case for it.

"This is all a gimmick — but since the debt ceiling itself is crazy, allowing Congress to tell the president to spend money then tell him that he can’t raise the money he’s supposed to spend, there’s a pretty good case for using whatever gimmicks come to hand," he said.

Mr Roche also did not expect the Treasury to go ahead and mint a $1trillion coin, but said President Obama could use it as threat.

"I don’t think it’s something that will end up being used but I think that if it comes down to it we could potentially see the President use this as something where he says, 'look if you’re going to threaten to default on debt then I’m going to threaten to use the coin loophole'."

There are limits on how much paper money the US can circulate and rules that govern coinage on gold, silver, and copper.

But, the Treasury has broad discretion on coins made from platinum, and in theory, it is allowed to mint a platinum coin and assign any value to it.

However, it is worth noting that this was intended to issue commemorative coins and not as a fiscal measure, Mr Krugman said.

"The idea of the US willingly defaulting on debt is beyond crazy," he said.

"We started kicking the idea around a year ago and it was really a joke and the fact it’s become something sort of serious, well it’s a sad state of affairs that it’s become so dysfunctional in Congress that this is something we’re having to resort to."

Writing in his New York Times blog, economist Paul Krugman, said that while he did not expect the Treasury to go ahead with this "gimmick", there could be a case for it.

"This is all a gimmick — but since the debt ceiling itself is crazy, allowing Congress to tell the president to spend money then tell him that he can’t raise the money he’s supposed to spend, there’s a pretty good case for using whatever gimmicks come to hand," he said.

Mr Roche also did not expect the Treasury to go ahead and mint a $1trillion coin, but said President Obama could use it as threat.

"I don’t think it’s something that will end up being used but I think that if it comes down to it we could potentially see the President use this as something where he says, 'look if you’re going to threaten to default on debt then I’m going to threaten to use the coin loophole'."

There are limits on how much paper money the US can circulate and rules that govern coinage on gold, silver, and copper.

But, the Treasury has broad discretion on coins made from platinum, and in theory, it is allowed to mint a platinum coin and assign any value to it.

However, it is worth noting that this was intended to issue commemorative coins and not as a fiscal measure, Mr Krugman said.

Down and Out in 'America's Finest City'

Vic Pittman Salem-News.com

How bad does it have to get before we say "Enough!"

Streets of San Diego. Photo: ucsdiv.org

|

(SAN BLAS, Mexico) - I saw a sign once that read "Bad

ideas make for the best stories", and thinking how true that was. My bad

idea for June 2012 was thinking I could hitchhike through California,

from the Mexican border up to Oregon. I had done it 40 years earlier

with no problems, so why not?

I crossed the border and began hitchhiking, only to

have a State Trooper pull up almost immediately. He told me that

hitchhiking was illegal on the freeways, which I already knew. I went

through the motions of walking off the freeway, and as soon as he pulled

away, went back down and started hitchhiking again.

Five minutes later, another State Police car, same

story. This scenario repeated itself five times with the last officer

asking me in frustration "Why do you keep doing this?"

I told him it was the only option I had, and I knew

that it was illegal, but didn't know what else to do. He told me that

every time I got out on the freeway, their switchboard was jammed with

people calling to report me and that I could expect to be arrested if I

continued.