by

Michael Snyder

The pension nightmare that is at the heart of

the horrific financial crisis in Detroitis just the tip of the iceberg of the coming retirement crisis that will shake America to the core. Right now,

more than 10,000 Baby Boomers are

hitting the age of 65 every single day, and this will continue to

happen every single day until the year 2030. As a society, we have made

trillions of dollars of financial promises to these Baby Boomers, and

there is no way that we are going to be able to keep those promises.

The money simply is not there. Yes, I suppose that we could eventually

see a “super devaluation” of the U.S. dollar and keep our promises to

the Baby Boomers using currency that is not worth much more than

Monopoly money, but as it stands right now we simply do not have the

resources to do what we said that we were going to do. The number of

senior citizens in the United States is projected to more than double by

the middle of the century, and it would have been nearly impossible to

support them all even if we weren’t

in the midst of a long-term economic decline.

Tens of millions of Americans that are eagerly looking forward to

retirement are going to be in for a very rude awakening in the years

ahead. There is going to be a lot of heartache and a lot of broken

promises.

What is going on in Detroit right now is a perfect example of what

will soon be happening all over the nation. Many city workers stuck

with their jobs for decades because of the promise of a nice pension at

the end of the rainbow. But now those promises are going up in smoke.

There has even been talk that retirees will only end up getting about 10

cents for every dollar that they were promised.

Needless to say, many pensioners are extremely angry that the

promises that were made to them are not going to be kept. The following

is from a recent article

in the New York Times…

Many retirees see the plan to cut their pensions as a

betrayal, saying that they kept their end of a deal but that the city is

now reneging. Retired city workers, police officers and 911 operators

said in interviews that the promise of reliable retirement income had

helped draw them to work for the City of Detroit in the first place,

even if they sometimes had to accept smaller salaries or work nights or

weekends.

“Does Detroit have a problem?” asked William Shine, 76, a retired

police sergeant. “Absolutely. Did I create it? I don’t think so. They

made me some promises, and I made them some promises. I kept my

promises. They’re not going to keep theirs.”

But Detroit is far from an isolated case. As

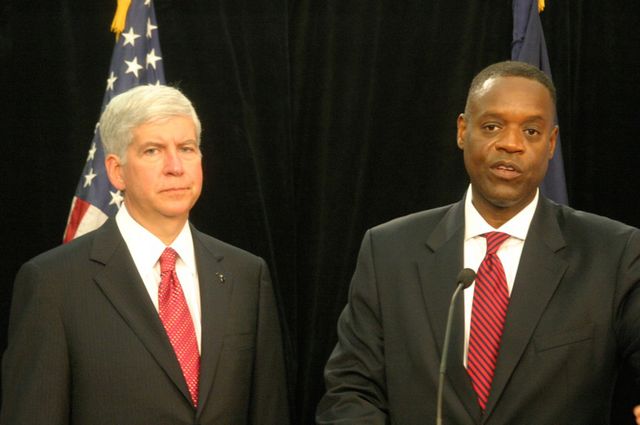

Detroit Mayor Dave Bingsaid the other day, many other cities are heading down the exact same path…

“We may be one of the first. We are the largest. But we absolutely will not be the last.”

Yes, Detroit’s financial problems are immense. But other major U.S.

cities are facing unfunded pension liabilities that are even worse.

For example, here are the unfunded pension liabilities for

four financially-troubled large U.S. cities…

Detroit: $3.5 billion

Baltimore: $680 million

Los Angeles: $9.4 billion

Chicago: $19 billion

When you break it down on a per citizen basis, Detroit is actually in better shape than the others…

Detroit: $7,145

Baltimore: $7,247

Los Angeles: $8,437

Chicago: $13,355

And many state governments are in similar shape. Right now, the

state of Illinois has unfunded pension liabilities that total

approximately

$100 billion.

There are some financial “journalists” out there that are attempting

to downplay this problem, but sticking our heads in the sand is not

going to make any of this go away.

According to Northwestern University Professor John Rauh, the total amount of

unfunded pension and healthcare obligations for retirees that state and local governments across the United States have accumulated is

4.4 trillion dollars.

So where are they going to get that money?

They are going to raise your taxes of course.

Just check out what is happening right now in

Scranton, Pennsylvania…

Scranton taxpayers could face a 117 percent increase in

taxes next year as the city’s finances continue to spiral out of

control.

A new analysis by the Pennsylvania Economy League projects an $18

million deficit for 2014, an amount so massive it outpaces the

approximate $17 million the struggling city collects annually

A 117 percent tax increase?

What would Dwight Schrute think of that?

Perhaps you are reading this and you are assuming that your retirement is secure because you work in the private sector.

Well, just remember what happened to your 401k during the financial

crisis of 2008. During the next major stock market crash, your 401k

will likely get absolutely shredded. Many Americans will probably see

the value of their 401k accounts go down by 50 percent or more.

And if you have stashed your retirement funds with the wrong firm, you could end up losing

everything. Just ask anyone that had their nest eggs invested with

MF Global.

But of course most Americans are woefully behind on saving for

retirement anyway. A study conducted by Boston College’s Center for

Retirement Research found that American workers

are $6.6 trillion short of what they need to retire comfortably.

That certainly isn’t good news.

On top of everything else, the federal government has been recklessly

irresponsible as far as planning for the retirement of the Baby Boomers

is concerned.

As I noted

yesterday, the U.S. government is facing a total of

222 trillion dollars in unfunded liabilities. Social Security and Medicare make up the bulk of that.

At this point, the number of Americans on Medicare is projected to grow from a little bit more than 50 million today to

73.2 million in 2025.

The number of Americans collecting Social Security benefits is projected to grow from about 56 million today to

91 million in 2035.

How is a society with a steadily declining economy going to care for them all adequately?

Yes, we truly are careening toward disaster.

If you are not convinced yet, here are some more numbers. The following stats are from one of my previous articles entitled “

Do You Want To Scare A Baby Boomer?“…

1. Right now, there are somewhere around 40 million

senior citizens in the United States. By 2050 that number is projected

to skyrocket to

89 million.

2. According to one recent poll,

25 percent of all Americans in the 46 to 64-year-old age bracket have no retirement savings at all.

3. 26 percent of all Americans in the 46 to 64-year-old age bracket have no personal savings whatsoever.

4. One survey that covered all American workers found that

46 percentof them have less than $10,000 saved for retirement.

5. According to a survey conducted

by the Employee Benefit Research Institute, “60 percent of American workers said the total value of their savings and investments is less than $25,000″.

6. A Pew Research survey found that

half of all Baby Boomers say that their household financial situations have deteriorated over the past year.

7. 67 percent of all American workers believe that they “are a little or a lot behind schedule on saving for retirement”.

8. Today,

one out of every six elderly Americans lives below the federal poverty line.

9. More elderly Americans than ever are finding that

they must continue working once they reach their retirement years.

Between 1985 and 2010, the percentage of Americans in the 65 to

69-year-old age bracket that were still working increased

from 18 percent to 32 percent.

10. Back in 1991, half of all American workers

planned to retire before they reached the age of 65. Today, that number

has declined to

23 percent.

11. According to one recent survey,

70 percent of all American workers expect to continue working once they are “retired”.

12. According to a poll conducted by AARP,

40 percent of all Baby Boomers plan to work “until they drop”.

13. A poll conducted by CESI Debt Solutions found that

56 percent of American retirees still had outstanding debts when they retired.

14. Elderly Americans tend to carry much higher

balances on their credit cards than younger Americans do. The following

is from a recent

CNBC article…

New research from the AARP also shows that those ages 50

and over are carrying higher balances on their credit cards — $8,278 in

2012 compared to $6,258 for the under-50 population.

15. A study by a law professor at the University of

Michigan found that Americans that are 55 years of age or older now

account for

20 percentof all bankruptcies in the United States. Back in 2001, they only accounted for 12 percent of all bankruptcies.

16. Between 1991 and 2007 the number of Americans between the ages of 65 and 74 that filed for bankruptcy rose by a staggering

178 percent.

17. What is causing most of these bankruptcies among

the elderly? The number one cause is medical bills. According to a

report published in The American Journal of Medicine, medical bills are a

major factor in

more than 60 percent of

the personal bankruptcies in the United States. Of those bankruptcies

that were caused by medical bills, approximately 75 percent of them

involved individuals that actually did have health insurance.

18. In 1945, there were

42 workers for every retiree receiving Social Security benefits. Today, that number has fallen to

2.5 workers,

and if you eliminate all government workers, that leaves only 1.6

private sector workers for every retiree receiving Social Security

benefits.

19. Millions of elderly Americans these days are

finding it very difficult to survive on just a Social Security check.

The truth is that most Social Security checks simply are not that

large. The following comes directly from

the Social Security Administration website…

The average monthly Social Security benefit for a retired

worker was about $1,230 at the beginning of 2012. This amount changes

monthly based upon the total amount of all benefits paid and the total

number of people receiving benefits.

You can view the rest of the statistics

right here.

Sadly, most Americans are not aware of these things.

The mainstream media keeps most of the population entertained with distractions. This week it is

the birth of the royal baby, and next week it will be something else.

Meanwhile, our problems just continue to get worse and worse.

There is no way in the world that we are going to be able to keep all

of the financial promises that we have made to the Baby Boomers. A lot

of them are going to end up bitterly disappointed.

All of this could have been avoided if we would have planned ahead as a society.

But that did not happen, and now we are all going to pay the price for it.