What are the true costs of War? Stefan Molyneux speaks at the Students

For Liberty Canadian Regional Conference at University of Toronto, St.

Michael’s College on November 16th, 2013.

Saturday, December 7, 2013

'I met a family who had broken up furniture in their home for firewood'

01 of 2

/>

/>

Laura Butler

– 06 December 2013

AFTER she saw fuel tanks upturned to drain that last drop and children going to bed fully clothed in order to keep warm, Patricia Gleeson knew she could never walk away from volunteering.

The 42-year-old is one of 18 volunteers for the Society of St Vincent de Paul in Roscrea, Co Tipperary, a town among the worst affected in the country since the recession hit.Between now and Christmas, the volunteers will visit 500 families in the area.

With four healthy children and a general feeling that life was going her way, Patricia decided it was time she gave back to the community, and went to her local SVP centre 10 years ago.

As time progressed and the circumstances of many around the country worsened, she devoted more and more time to the charity.

She now spends seven days a week making house calls to people in need of SVP's help.

"It's a commitment, but it would be so tough to step back from what I've encountered and return to a life without SVP," she says.

"You have to be on the ground and feel their cold; once you do that you know you can never step away again."

As Christmas approaches, the volunteers are working their way through local cases referred to them by the SVP, which has taken a record 200,000 calls so far this year.

The Irish Independent has partnered with the SVP and is appealing to our readers to give the charity whatever help they can. While times are tough for everybody, they are tougher yet for thousands of vulnerable families, some of whom cannot heat their homes or provide food for their children.

FRIGHTENING

"It's very frightening that the demands we face on a daily basis are only getting greater," Patricia says. "One family I came across had broken up the furniture in their home for firewood."

Patricia is one of the unsung 11,000 volunteers giving up their time and effort to make a difference. Though training is provided, she said nothing could have prepared her for the gut-wrenching feeling when she began visiting homes.

"You can't help but get emotionally involved, it's overwhelming. But there is no better reward than knowing you can make a difference in people's lives in a vital way, and that's why donations are so important – that we can go out in the community with food vouchers, fuel or clothing."

Hundreds of millions swindled from banks in past 5 years, mostly by staff, say police - Bernama

Fraud by bank employees is getting more serious as losses incurred by

banks due to money swindled by staff has increased to RM473.82 million

over the last five years.

Bukit Aman Commercial Crimes Department's Head of Unit for Banking and

Financial Crimes Supt Harjinder Kaur Gurdial Singh said overall the

banks suffered losses amounting to RM789,106,376 for various types of

fraud during the period.In 2008, it was RM10.1 million, RM27.1 million (2009), RM85.4 million (2010), RM84.5 million (2011), RM191.8 million (2012) and RM390 million (up to November 2013), she told reporters during a special interview on commercial crime in Kuala Lumpur today.

She said among fraud cases involving bank employees were withdrawing money from accounts that have been inactive for more than three years and not crediting cash deposits into customers' accounts.

Bank branch managers were also found abusing overdraft facilities by abusing accounts of customers.

"Our investigation found 60% of the bank fraud was committed by their own employees, 30% by the management while 10% were by the account holders themselves," she said.

Apart from cases of fraud involving bank employees, other fraud involved criminal breach of trust (CBT), document forging, misappropriation of properties and attempts to cheat through banks said Harjinder Kaur.

"What is more shocking is that 60% of bank fraud was committed by women compared with only 40% by men, while 70% of the victims in these fraud cases were men," she said.

She also said bank officers and employees were advised to comply with standard operating procedures (SOP) when processing loan applications from customers.

"Members of the public are advised to be cautious with their security details and personal documents which could be abused by third parties," she said. - Bernama, December 6, 2013.

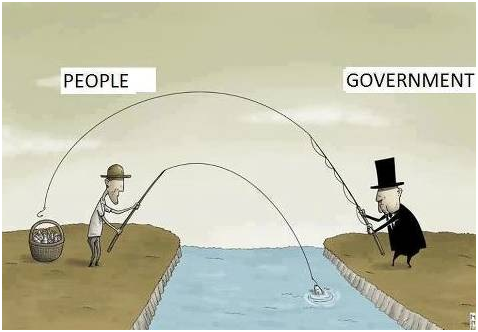

Michael Hudson – Oligarchs Will Never Cancel Debts We Owe Them

Published on Sep 16, 2013

The oligarchy would rather annul the right of the bottom 90 percent to live than to annul the money owed to them.They’d rather strip the planet and shrink the population than give up their claims.

That’s the political fight of the 21st century

Full documentary is here https://www.youtube.com/watch?v=RT9Ff…

Read more at http://investmentwatchblog.com/michael-hudson-oligarchs-will-never-cancel-debts-we-owe-them/#Kq9j6RsmDSdxOg1C.99

Published on Sep 16, 2013

The oligarchy would rather annul the right of the bottom 90 percent to live than to annul the money owed to them.

They’d rather strip the planet and shrink the population than give up their claims.

That’s the political fight of the 21st century

Full documentary is here https://www.youtube.com/watch?v=RT9Ff…They’d rather strip the planet and shrink the population than give up their claims.

That’s the political fight of the 21st century

Read more at http://investmentwatchblog.com/michael-hudson-oligarchs-will-never-cancel-debts-we-owe-them/#Kq9j6RsmDSdxOg1C.99

International Monetary Fund Rolls Out Dangerous “Wealth Tax” Proposal

The populist notion of taxing the rich once again turned up in the International Monetary Fund’s Fiscal Monitor Report

released in October, but scarcely anyone noticed. In an arcane

chart-laden 107-page-long report that was competing at the time with the

government shutdown, the failing rollout of ObamaCare, and other

concerns, crises, and disasters, why should they?

Here’s why. On page 49, the authors said, “The sharp deterioration of the public finances in many countries has revived interest in a ‘capital levy’ — a one-time tax on private wealth — as an exceptional measure to restore debt sustainability.”

Let’s be clear: That tax would apply to all private wealth on the planet. And it wouldn’t balance budgets but would only bring them down to a slightly more manageable level so that government borrowing and spending could continue without interruption. The levy would have to be implemented rapidly, before the wealthy could react and move their assets, or themselves, out of harm’s way: “The appeal is that such a tax, if it is implemented before avoidance is possible … [will not] distort behavior.”

If such a tax were delayed in implementation, governments that had borrowed and spent too much might not be able to confiscate enough money to escape short-term financial trouble and would have to default on their promises or inflate them away:

The conditions for success are strong, but also need to be weighed against the risks of the alternatives, which include repudiating public debt or inflating it away (these, in turn, are a particular form of wealth tax — on bondholders).

This is where the IMF’s interests really lie: Those bondholders,

including central banks, which have allowed governments to exceed their

borrowing capacity and are now facing the threat of severe haircuts

through either default or inflation.

Just how much would the IMF’s “capital levy” be? Say the authors:

The tax rates needed to bring down public debt to precrisis levels are sizable: reducing debt ratios to end-2007 levels would require … a tax rate of about 10 percent on households with positive net worth.

After reading the entire 107 pages, Forbes’ columnist Bill Frezza was livid:

[The IMF proposal] means that all households with positive net worth — everyone with retirement savings or home equity — would have their assets plundered….

It would merely “restore debt sustainability,” allowing free-spending sovereigns to keep tapping the bond markets until the next crisis comes along.

Romain Hatchuel, the managing partner of asset-manager Square Advisors, saw the same dangers but noted that the tax rate on everyone owning anything in the United States would be much higher than just 10 percent:

As the IMF calculates, the … revenue-maximizing [tax] rate … is around 60 percent, way above existing levels.

For the U.S., it is [between] 56% and 71% — far more than the current 45% paid … by those in the top tax bracket…

From New York to London … powerful economic players are deciding that with an ever-deteriorating global fiscal outlook, conventional levels and methods of taxation will no longer suffice. That makes weapons of mass wealth destruction — such as the IMF’s one-off capital levy… — likelier by the day.

This is going to be a tough sell, which is why it must be mandated through international agreements. Back in 1999, Donald Trump, the perennial presidential candidate, unleashed his own “net worth tax” proposal, a 14.25 percent tax touted by him to be the complete solution to America‘s fiscal problems. At the time he estimated it would raise enough money to pay off the national debt, which was then less than $6 trillion. (It’s now at $17.2 trillion, nearly three times higher.) That would free up $200 billion in interest payments that the U.S. government paid annually, which Trump said he would, as president, use to shore up Social Security, giving the rest back to taxpayers. At the same time, Trump announced he was forming a committee to explore whether he should seek the presidential nomination from the Reform Party. His campaign sputtered and he dropped out a few months later.

When a wealth tax was installed in France, the wealthy moved away to more tax-friendly havens, such as Belgium. Denis Payre, a French citizen at the time, had built and sold a high-tech company for $110 million in stock, and decided to retire. French authorities imposed its 2.2 percent wealth tax on stock that he owned but couldn’t sell owing to regulations. When he got a bill from the French government for $2.5 million, he moved to Belgium. Said Payre: “They were asking me to pay taxes on money I didn’t have. I had no choice but to leave the country.” Payre explained, “France is penalizing success in a big way. The loss in income for the government is the smallest part. The big issue is the loss of all that creative energy this country is dying for.”

From its report the IMF admits that previous attempts to install wealth taxes have largely failed because the wealthy could move, but the IMF hopes to close any escape hatches via mutual governmental cooperation:

In principle, taxes on wealth … offer significant revenue potential at relatively low efficiency costs.

Their past performance is far from encouraging, but this could change as … stepped up international cooperation … reduces evasion opportunities….

[Such schemes must] address more fundamental aspects … and find better ways to realize mutual gains from closer cooperation in tax matters.

That’s why it’s called the “International Monetary Fund.”

A graduate of Cornell University and a former investment advisor, Bob is a regular contributor to The New American magazine and blogs frequently at www.LightFromTheRight.com, primarily on economics and politics. He can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.

With permissionHere’s why. On page 49, the authors said, “The sharp deterioration of the public finances in many countries has revived interest in a ‘capital levy’ — a one-time tax on private wealth — as an exceptional measure to restore debt sustainability.”

Let’s be clear: That tax would apply to all private wealth on the planet. And it wouldn’t balance budgets but would only bring them down to a slightly more manageable level so that government borrowing and spending could continue without interruption. The levy would have to be implemented rapidly, before the wealthy could react and move their assets, or themselves, out of harm’s way: “The appeal is that such a tax, if it is implemented before avoidance is possible … [will not] distort behavior.”

If such a tax were delayed in implementation, governments that had borrowed and spent too much might not be able to confiscate enough money to escape short-term financial trouble and would have to default on their promises or inflate them away:

The conditions for success are strong, but also need to be weighed against the risks of the alternatives, which include repudiating public debt or inflating it away (these, in turn, are a particular form of wealth tax — on bondholders).

Just how much would the IMF’s “capital levy” be? Say the authors:

The tax rates needed to bring down public debt to precrisis levels are sizable: reducing debt ratios to end-2007 levels would require … a tax rate of about 10 percent on households with positive net worth.

After reading the entire 107 pages, Forbes’ columnist Bill Frezza was livid:

[The IMF proposal] means that all households with positive net worth — everyone with retirement savings or home equity — would have their assets plundered….

It would merely “restore debt sustainability,” allowing free-spending sovereigns to keep tapping the bond markets until the next crisis comes along.

Romain Hatchuel, the managing partner of asset-manager Square Advisors, saw the same dangers but noted that the tax rate on everyone owning anything in the United States would be much higher than just 10 percent:

As the IMF calculates, the … revenue-maximizing [tax] rate … is around 60 percent, way above existing levels.

For the U.S., it is [between] 56% and 71% — far more than the current 45% paid … by those in the top tax bracket…

From New York to London … powerful economic players are deciding that with an ever-deteriorating global fiscal outlook, conventional levels and methods of taxation will no longer suffice. That makes weapons of mass wealth destruction — such as the IMF’s one-off capital levy… — likelier by the day.

This is going to be a tough sell, which is why it must be mandated through international agreements. Back in 1999, Donald Trump, the perennial presidential candidate, unleashed his own “net worth tax” proposal, a 14.25 percent tax touted by him to be the complete solution to America‘s fiscal problems. At the time he estimated it would raise enough money to pay off the national debt, which was then less than $6 trillion. (It’s now at $17.2 trillion, nearly three times higher.) That would free up $200 billion in interest payments that the U.S. government paid annually, which Trump said he would, as president, use to shore up Social Security, giving the rest back to taxpayers. At the same time, Trump announced he was forming a committee to explore whether he should seek the presidential nomination from the Reform Party. His campaign sputtered and he dropped out a few months later.

When a wealth tax was installed in France, the wealthy moved away to more tax-friendly havens, such as Belgium. Denis Payre, a French citizen at the time, had built and sold a high-tech company for $110 million in stock, and decided to retire. French authorities imposed its 2.2 percent wealth tax on stock that he owned but couldn’t sell owing to regulations. When he got a bill from the French government for $2.5 million, he moved to Belgium. Said Payre: “They were asking me to pay taxes on money I didn’t have. I had no choice but to leave the country.” Payre explained, “France is penalizing success in a big way. The loss in income for the government is the smallest part. The big issue is the loss of all that creative energy this country is dying for.”

From its report the IMF admits that previous attempts to install wealth taxes have largely failed because the wealthy could move, but the IMF hopes to close any escape hatches via mutual governmental cooperation:

In principle, taxes on wealth … offer significant revenue potential at relatively low efficiency costs.

Their past performance is far from encouraging, but this could change as … stepped up international cooperation … reduces evasion opportunities….

[Such schemes must] address more fundamental aspects … and find better ways to realize mutual gains from closer cooperation in tax matters.

That’s why it’s called the “International Monetary Fund.”

A graduate of Cornell University and a former investment advisor, Bob is a regular contributor to The New American magazine and blogs frequently at www.LightFromTheRight.com, primarily on economics and politics. He can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.

Source: The New American

Jim Willie: Forget a Taper, Fed to TRIPLE QE!

The true volume of QE bond

monetization purchases is much higher than reported. It is way over

$100 billion per month, probably closer to $200 billion per month.

The USFed recently relented, they blinked, and when they briefly told the truth, they admitted the QE volume would continue forever and a day. Given the political pressures, and some reflection in corner office lavatories, they toy with the concept of tapering again. They realize the hyper monetary inflation has turned into a deadly toxic dependence. It is useful for the mere mortals among the 99% crowd to absorb the realities behind QE and its true nature, better described as QE to Infinity. The sidebar is Zero Percent Forever. The USFed is stuck in the destructive monetary policy.

By Jim Willie, GoldenJackass.com

The US Federal Reserve bond monetization support for government finance support, financial markets, banker welfare, economic props, redemption coverage, and liquidity fire hose functions will continue to expand and definitely not diminish. Only the brain-dead, the system wonks, and the deeply deluded believe the QE volume will taper down. They are paid to think that way in the public forum, their minds compromised, their hearts darkened, their paychecks dependent. As preface in order to properly comprehend the national situation, keep in mind that the USEconomy is stuck in a nightmarish quagmire, with growth steadily in decline at between minus 3% and minus 5% annually, when reality is required. The propaganda must be pushed off the road, the price inflation not labeled as growth, and the system perceived for what it is. The USEconomy is in grotesque deterioration with absent critical mass of industry, widespread debt defaults, retail liquidations, idle plant and equipment (including malls), and systemic capital destruction from the monetary hyper inflation and the imminent specter of ObamaCare tax. In queer fashion, the modern day US factories have become shopping malls. They suffer from at least a 25% vacancy rate nationally.

Therefore the USGovt deficits will rise, not fall. All economic forecasts offered from official podiums and stages are loaded with nonsense, deceptions, and propaganda at worst, but wishful thinking, delusion, and hope at best. None contain any accuracy required like in a business setting where competence is rewarded and excellence is expected. In the national offices, loyalty, marketing, and toeing the party line are rewarded, just like in a Central European nation in the 1930 decade. The Jackass prefers to call it Reich Economics laced with Soviet Central Planning. The United States has become an unsavory mix of fascism and marxism, the common threads being systemic decay during the eradication of civil liberties.

The major channels will force the USFed to turn up the volume. The May Taper Talk was definitive in its result. The entire financial markets, credit market, liquidity pipes, and economy depend upon the USFed funding. The system cannot sustain itself through vitality, and surely not through savings. So the USFed relented, they blinked, and when they briefly told the truth, they admitted the QE volume would continue forever and a day. Given the political pressures, and some reflection in corner office lavatories, they toy with the concept of tapering again. They realize the hyper monetary inflation has turned into a deadly toxic dependence. It is useful for the mere mortals among the 99% crowd to absorb the realities behind QE and its true nature, better described as QE to Infinity. The sidebar is Zero Percent Forever. The USFed is stuck in the destructive monetary policy, as the Jackass has described since early 2009. The ultra-low rate would not be temporary. The bond purchase plans with printed money would not be temporary. Many are the channels that must be covered by USFed bond monetization. They run parallel to the channels of USTreasury Bonds being returned to sender, listed in July. Regard this article as an update, required to counter the never ending propaganda and deception directed at the public with media scatterguns. It will be illegal someday before long to warn the masses.

PREFACE ON USECONOMY IN DETERIORATION

People must always bear in mind two concepts. When the USGovt, directed by its Wall Street handlers, marshaled the movement of industry to China, it delivered the nation a death sentence with a timer. The low cost solution was a legitimate income drain that led to deeper asset bubble dependence. The inevitable outcome of systemic failure motivated the launch of the Hat Trick Letter. The results are obvious to those with open eyes, which means only 10% of the masses. Secondly, the USFed monetary policy of hyper monetary inflation, directed at covering USGovt debt issuance and turnover, has a clear effect to kill capital. The rising cost structure from inflation hedging results in reduced profitability, followed bybusiness shutdown and retirement of equipment. This too is obvious to under 10% of the masses, including the crack corps of clueless economists. Review some features.

The October 2012 pre-election Non-Farm Jobs Report was falsified. Nothing new in following orders from the camp commandants in officialdom. The reduced jobless rate from 8.1% to 7.8% permitted the occupant of the White House to report the success of the economic recovery. With dark humor unintended, the new catch phrase has become the non-recovery recovery. Jack Welch was proved right in doubting the data, accusing in tweets that the Administration had altered the numbers. So the BLS, the Bureau Of Lies & Scatology, manipulated the most important jobs report in Obama’s career. At least Obama looked presidential as he reviewed the Hurricane Sandy damage, where no natural hurricane had ever hit in the NorthEast corridor so brutally, and where microwave patterns were detected from its August hatching. (Psst: microwaves are man-made and not natural.) In the most recent quarter, the Q3 Gross Domestic Product has been managed at 2.8% in a travesty of deception. The same tricks are used with hedonic adjustments and calling price inflation as growth. The king is dead, long live the king. The QE to Infinity will be needed in defense and support.

A tell-tale report came from California. The multi-unit properties in California are not being foreclosed, despite being in deep arrears. The banks seem unwilling to take on more REO property on their loaded portfolios. Perhaps private equity firms are only pursuing single family residence properties. The reporter has been in contact with numerous people not making payments and not making decisions, since no pressure. The dire signal is that 20% of all mortgages are delinquent but with no foreclosure activity. Even short sales are prevalent, meaning final sales below the equity level of the seller. Chase has not foreclosed and not responded to a short sale of a delinquent $3 million home in San Diego. The implication is that the bank suffers the loss, the difference. Rumor has it that the USFed is purchasing all the bad debt and will then sell it for deep discounts for other parties willing to take the risk with the courts in the foreclosure process. Think Wall Street cousins in private equity firms like Blackstone. The problem is so deep that foreclosures of condominium units are occurring, for failure to make payment of homeowner association fees. Reports are of HOA non-payment rate of 25% in the sketchy areas. The HOA entities are not dumping the properties. A gaggle of properties that the HOA foreclosed on three years ago are still owned by the HOAssns, many in Riverside and San Bernardino counties. The entire commercial trade has gone underground between the banks, private equity firms, and foreign buyers. A colleague in Los Angeles reports that the same is true with small strip malls, which sport 50 to 90% visible vacancies. The QE to Infinity will be needed in defense and support.

Ten US cities are almost totally out of cash. Their bankruptcy will soon be tested. Meredith Whitney was not wrong, just way too early to earn the acclaim. She will be back in the spotlight to take credit for a correct call. The report is that the ten cities have under ten days of cash on hand. The Detroit court ruling is also interesting. A judge ruled the city pensions and bonds can be reduced in value (called haircut) under legal applications. Next comes the outcome, as the percentages are to be decided. Some bold economists like Laurence Kotlikoff of Boston University have openly declared the USGovt finances worse than Detroit’s. The wave appears next to strike Chicago. The QE to Infinity will be needed in defense and support.

Recovery is nowhere as 4.6 million mortgages going unpaid in the United States. Either the people cannot pay under duress and pressure to make payment, or they scoff at the banks and dare them to take possession, even to locate the property title. At least a couple million Americans are living in soon-to-be bank owned homes for free. That aint recovery. Furthermore, the American consumers are going for the 7-year car loans, as the banks adopt a stupid lending policy. Within 18 months, the loans will have zero collateral from basic car depreciation. The important point is that the bank holds negative equity loans after 3 years or less, with false accounting on the bank books as well. The break to people is a curse for banks, a stupid desperate policy. That aint recovery. The QE to Infinity will be needed in defense and support.

A handy comatose meter is found in the Chicago Economic Diffusion index. It fell in October. The more representative three-month moving average improved to 0.06 from -0.02, indicating the economy has leveled off in its coma. The employment indicators fell, as the labor participation rate is at its most dismal level ever, working its way under the magic 60% level. No recovery is evident. The QE to Infinity will be needed in defense and support.

So conclude that with continued USEconomic deterioration, the tax revenues will be way short. The USGovt deficits will rise above $1 trillion per year again easily. The USFed will be forced to cover the deficits, since national savings is nowhere. The debt issuance will continue to from the capital dome, covered by phony money coming off the press running side by side. The Jackass has not even mentioned the wet blanket known as ObamaCare, with its forced membership, higher costs than advertised, deceptions in keeping other health plans, refusals of cancer treatment, refusals of joint replacement, and broken website done by Michele Obama’s classmate at Princeton. Remember in a fascist business model system, loyalty and crony win over competence and quality, always.

CHANNELS TO BE FUNDED BY Q.E. TO INFINITY

a) Government Finance Support

Axel Merk has concluded that the USFed is monetizing 50% more than the USGovt deficits. The key elements are USTreasury Bond issuance, refund activity of USTBonds, along with the ample coverage of USAgency Mortgage Bonds and some private label mortgage bonds. The printing press with Weimar nameplate is under heavy pressure. Those refundings (bond turnover at maturity) are a bitch, and rarely figure in the rosy analyses put out by the wonks, hacks, and stooges. One should really brace for a reality check. The USFed has announced repeatedly that it is executing on $85 billion in bond monetizations per month. The disclosed level represents a staggering volume of $1.02 trillion per year. Amazingly, few economists or bank analysts are troubled by the official steady unrelenting hyper monetary inflation. To be sure, some competent and responsible members of officialdom express their reservations, without much disgust, but with some courage. What would have passed as insanity and reckless policy in the 1990 decade, nowadays is accepted as the norm, the present reality, the exigent necessity, the urgent requirement, the responsible obligation. Focus on the true volume of the USFed bond purchases, the real QE volume when all items are added together. The reality is much worse than admitted reported. This is a banking crime syndicate, which should never be accepted for its word. They are the greatest bond fraud kings in modern history, the greatest thieves probably in world history. They steal the wealth of entire nations, if not from central bank gold bullion then from bonds and home equity, with a kicker in near zero interest loans to themselves.

Some hedge fund managers and bank analysts have come forward to share their privileged information from contacts deep within the USFed system, whether regional bank presidents or economists within the USFed marbled offices on Weimar Street. THE REALITY IS THE USFED IS MONETIZING AT LEAST $200 BILLION PER MONTH, MORE THAN DOUBLE THE OFFICIAL VOLUME STATED AND ADMITTED. The USFed is monetizing much more than basic USTreasurys and USAgency bonds to cover the USGovt deficits, their rollover refunding, and the raft of mortgage bonds. The USFed is monetizing a small mountain of Fannie Mae bonds and collateralized debt obligations with a mortgage core, which went bad, turned worthless. The USFed is monetizing a large mountain of interest rate derivatives that went deeply in the red in the last year, especially this past summer during the self-inflicted Taper Talk disaster. The mortgage debt and its leverage toxic vat amounts to a few $trillion yet to be fully monetized. Furthermore, the interest rate derivatives amount to hundreds of $trillion yet to be fully monetized. This hyper inflation output does not hit Main Street, which would result in price inflation for products and services. Worse, this hyper inflation output wrecks the USDollar and its primary vehicle the USTreasury Bond. It burns the King Dollar throne. The United States is Greece times one hundred.

b) Support for Financial Markets

During the Taper Talk trial balloon, the USTreasury 10-year yield rose to 2.95%, at which time some flash trading was moved from stocks to bonds. They halted the rise, but also put to use the IRS tax revenue tool, tied to Interest Rate derivatives. The Boyz wished to prevent a crease of the 3.0% mark. The damage done was colossal. The Interest Rate Derivative festered with leveraged outsized losses, all kept quiet. The JPMorgan headquarter complex was sold for half price to the Chinese property conglomerate, probably related to the derivative losses and a mandated requirement to manage the gold vaults from Beijing. Call it a hidden indirect margin call, a foreign managed inventory check. The emerging market national bourses took major hits. The Hot Money exited the United States, an early warning signal of the US showing symptoms of Third World.

c) Banker Welfare

The banker welfare, feeding at the trough, knows no end. It came into the open with the TARP Fund bait & switch tactic deployed to garner $700 billion. The funds were largely used to cover big bank bonds and preferred stock, a favorite asset holding by the bankers and their families. It has become a national priority to preserve the college funds for their children, not to mention their lunch accounts and many mistresses (see Jamie Dimon). The inside word has it that the QE3 includes a hidden chamber, to cover the toxic fraud-ridden mortgage bonds and collateralized debt obligations that clog the housing market itself.

d) Economic Props

To begin with, the housing market remains a key sector within the USEconomy. It requires ultra-low mortgage rates, not to stimulate the real estate market. Instead, it requires ultra-low mortgage rates in order to avoid collapse of the real estate market the rest of the way, and in rapid fashion in sudden manner. The car industry requires ultra-low loan rates in order to remain in intensive care, and not in the morgue. The retail industry requires ultra-low credit card rates in order to sustain itself without collapse also. The entire USEconomy could not function without the absurdly low rates. By the way, such harsh low rates provide the legitimate savers with almost nothing in return yields. They are victims to the steady consistent 7% to 9% price inflation year in and year out.

e) Redemption Coverage

Not only Wall Street and London big bank portfolios of impaired bonds must be redeemed and covered. The amplified and ever growing Indirect Exchange of USTBonds must be redeemed and covered as well. The foreign entities holding USTBonds from Chinese acquisitions, Russian energy deals, Brazilian bankruptcies, and other buyouts across the world have become center stage news. The sellers wish to cash in their currency from the big deals. The Eastern nations led by China are buying hard assets. The USFed and Bank of England cannot refuse the bond holders at the window of redemption, since their native sovereign debt. The USFed might ultimately be forced to print money to pay the bond holders. A couple $trillion could end up coming to the window.

GOLD MARKET EFFECT

The Gold Trade Settlement system is moving closer to reality each month. No amount of pressure and obstruction can prevent its progress, its development, and its evolution. The movement to create a non-USDollar alternative to trade, with serious banking reserves management system consequences, will not be deterred or halted. The Global Currency Reset is an extremely complicated undertaking for the major nations of the world. Most people, and many analysts, believe it involves the currency market and the banking systems. That is true enough. However, my informed sources indicate that the entire Reset initiative involves around 8 to 10 very complex, very thorny, very disruptive factors. The fallout from the reset will bring changes to the world order, changes to the balance of geopolitical power, changes to castle lords, changes to Third World residence, and great unclear threats to nuclear proliferation. To regard the main items as currency exchange rates and defaulting banks is painfully naive, but all too prevalent. The reset initiative must be done with respect to careful agreements forged and delicate recalibration of the global balance of power. Both sides possess nuclear weapons and other nefarious devices like electro-magnetic pulse weapons.

The winner will be the Gold Market. The loser will be the United States, the United Kingdom, and Western Europe. These regions will tiptoe into the Third World if lucky, and fall head first into the Third World if not careful. They should have thought more fully about the Chinese Most Favored Nation pact back in 1999. The low cost solution as center piece to globalization effectively destroyed the Western economies, by removing the industrial core. It was far more carefully planned than the great majority of people believe. The ultimate goal in my opinion was to wreck the cradle of capitalism in the United States. The compromise was to create the newly industrialized Chinese superpower, which will fall victim to fascism soon enough. It is the natural course, given human nature and the proclivity toward corruption, inefficiency, power, and greed. The winner will be Gold. It will reign over banks again. It will serve as arbiter over trade again. Its bright yellow lights and strong whips will emanate from the East.

FOOTNOTES

The Iran Talks should be better reported by the alternate press in the West. It was plain and simple a Petro-Dollar Surrender Summit. For the last several years, it has been clear that the primary defense of the USDollar has been military. Many major nations of the world are busy making plans and implementing them toward the creation of systems in bypass, as in Alternative Dollar systems for trade and settlement. The USDollar has turned toxic, widely confirmed by the QE to Infinity adopted policy by the USFed, the Euro Central Bank, and the Bank of England. The many major nations require assurance of not being attacked by the banks with SWIFT weapons, not being attacked with sanctions that hinder commerce to isolate their nations, not being strangled in economies to suffer from price inflation episodes, since their motive has become crystal clear of survival from the current interminable financial crisis. The designers and perpetrators of the crisis have no interest in pursuing solutions, only to defend the USDollar and their right to print themselves $trillions in wealth, the old self-dealing card to the extreme. The summit talks over Iran should be taken with a grain of salt on the detailed promulgated news releases, since loaded with propaganda and rubbish. They sound comical. Expect Iran to continue to make oil & gas sales, but to announce a top-line USDollar transaction which will be executed in gold. The trade settlements will continue in gold on a bilateral net basis, but the official lines (of bull) on ledgers will be etched from USD chisels. It is all about saving face for the dying King Dollar, and to protect the Eastern Alliance nations from retaliation, including potentially nuclear devices suddenly discharged in their home camps. Call the Iran Talks also the Petro-Dollar Surrender SALT Summit.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

“Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do.”

(Charles in New Mexico)

“I commend the Jackass for being the most accurate of all newsletter writers. Others called for the big move in Gold right away, but you understand that the enormous fraud in the system needs to play out before free market forces can begin to assert themselves. You seem to have the best sources and insights into the soap opera that is our global financial system. Most importantly, you have advised readers to be patient, stay safe, and avoid mining shares like the plague. Calling the top in the USTreasury Bond (10-yr yield at 1.4% yield) stands out as a recent fine accomplishment. The Jackass understands the markets, understands the fraud, and also has the sources to keep him the most up-to-date on the big geopolitical and financial events and scandals. Few or no other writers have all three of these resources.”

(Austin in California)

“A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one’s head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out.”

(The Voice, a European gold trader source)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com. For personal questions about subscriptions, contact him at JimWillieCB@aol.com

The USFed recently relented, they blinked, and when they briefly told the truth, they admitted the QE volume would continue forever and a day. Given the political pressures, and some reflection in corner office lavatories, they toy with the concept of tapering again. They realize the hyper monetary inflation has turned into a deadly toxic dependence. It is useful for the mere mortals among the 99% crowd to absorb the realities behind QE and its true nature, better described as QE to Infinity. The sidebar is Zero Percent Forever. The USFed is stuck in the destructive monetary policy.

The USEconomy is in steady deterioration, the recession dreadful and relentless. The USFed is monetizing an amount equal to 150% of the official USGovt deficit. The Global Currency Reset is extremely complicated, thorny, and dangerous.

The winner will be Gold.

By Jim Willie, GoldenJackass.com

The US Federal Reserve bond monetization support for government finance support, financial markets, banker welfare, economic props, redemption coverage, and liquidity fire hose functions will continue to expand and definitely not diminish. Only the brain-dead, the system wonks, and the deeply deluded believe the QE volume will taper down. They are paid to think that way in the public forum, their minds compromised, their hearts darkened, their paychecks dependent. As preface in order to properly comprehend the national situation, keep in mind that the USEconomy is stuck in a nightmarish quagmire, with growth steadily in decline at between minus 3% and minus 5% annually, when reality is required. The propaganda must be pushed off the road, the price inflation not labeled as growth, and the system perceived for what it is. The USEconomy is in grotesque deterioration with absent critical mass of industry, widespread debt defaults, retail liquidations, idle plant and equipment (including malls), and systemic capital destruction from the monetary hyper inflation and the imminent specter of ObamaCare tax. In queer fashion, the modern day US factories have become shopping malls. They suffer from at least a 25% vacancy rate nationally.

Therefore the USGovt deficits will rise, not fall. All economic forecasts offered from official podiums and stages are loaded with nonsense, deceptions, and propaganda at worst, but wishful thinking, delusion, and hope at best. None contain any accuracy required like in a business setting where competence is rewarded and excellence is expected. In the national offices, loyalty, marketing, and toeing the party line are rewarded, just like in a Central European nation in the 1930 decade. The Jackass prefers to call it Reich Economics laced with Soviet Central Planning. The United States has become an unsavory mix of fascism and marxism, the common threads being systemic decay during the eradication of civil liberties.

The major channels will force the USFed to turn up the volume. The May Taper Talk was definitive in its result. The entire financial markets, credit market, liquidity pipes, and economy depend upon the USFed funding. The system cannot sustain itself through vitality, and surely not through savings. So the USFed relented, they blinked, and when they briefly told the truth, they admitted the QE volume would continue forever and a day. Given the political pressures, and some reflection in corner office lavatories, they toy with the concept of tapering again. They realize the hyper monetary inflation has turned into a deadly toxic dependence. It is useful for the mere mortals among the 99% crowd to absorb the realities behind QE and its true nature, better described as QE to Infinity. The sidebar is Zero Percent Forever. The USFed is stuck in the destructive monetary policy, as the Jackass has described since early 2009. The ultra-low rate would not be temporary. The bond purchase plans with printed money would not be temporary. Many are the channels that must be covered by USFed bond monetization. They run parallel to the channels of USTreasury Bonds being returned to sender, listed in July. Regard this article as an update, required to counter the never ending propaganda and deception directed at the public with media scatterguns. It will be illegal someday before long to warn the masses.

PREFACE ON USECONOMY IN DETERIORATION

People must always bear in mind two concepts. When the USGovt, directed by its Wall Street handlers, marshaled the movement of industry to China, it delivered the nation a death sentence with a timer. The low cost solution was a legitimate income drain that led to deeper asset bubble dependence. The inevitable outcome of systemic failure motivated the launch of the Hat Trick Letter. The results are obvious to those with open eyes, which means only 10% of the masses. Secondly, the USFed monetary policy of hyper monetary inflation, directed at covering USGovt debt issuance and turnover, has a clear effect to kill capital. The rising cost structure from inflation hedging results in reduced profitability, followed bybusiness shutdown and retirement of equipment. This too is obvious to under 10% of the masses, including the crack corps of clueless economists. Review some features.

The October 2012 pre-election Non-Farm Jobs Report was falsified. Nothing new in following orders from the camp commandants in officialdom. The reduced jobless rate from 8.1% to 7.8% permitted the occupant of the White House to report the success of the economic recovery. With dark humor unintended, the new catch phrase has become the non-recovery recovery. Jack Welch was proved right in doubting the data, accusing in tweets that the Administration had altered the numbers. So the BLS, the Bureau Of Lies & Scatology, manipulated the most important jobs report in Obama’s career. At least Obama looked presidential as he reviewed the Hurricane Sandy damage, where no natural hurricane had ever hit in the NorthEast corridor so brutally, and where microwave patterns were detected from its August hatching. (Psst: microwaves are man-made and not natural.) In the most recent quarter, the Q3 Gross Domestic Product has been managed at 2.8% in a travesty of deception. The same tricks are used with hedonic adjustments and calling price inflation as growth. The king is dead, long live the king. The QE to Infinity will be needed in defense and support.

A tell-tale report came from California. The multi-unit properties in California are not being foreclosed, despite being in deep arrears. The banks seem unwilling to take on more REO property on their loaded portfolios. Perhaps private equity firms are only pursuing single family residence properties. The reporter has been in contact with numerous people not making payments and not making decisions, since no pressure. The dire signal is that 20% of all mortgages are delinquent but with no foreclosure activity. Even short sales are prevalent, meaning final sales below the equity level of the seller. Chase has not foreclosed and not responded to a short sale of a delinquent $3 million home in San Diego. The implication is that the bank suffers the loss, the difference. Rumor has it that the USFed is purchasing all the bad debt and will then sell it for deep discounts for other parties willing to take the risk with the courts in the foreclosure process. Think Wall Street cousins in private equity firms like Blackstone. The problem is so deep that foreclosures of condominium units are occurring, for failure to make payment of homeowner association fees. Reports are of HOA non-payment rate of 25% in the sketchy areas. The HOA entities are not dumping the properties. A gaggle of properties that the HOA foreclosed on three years ago are still owned by the HOAssns, many in Riverside and San Bernardino counties. The entire commercial trade has gone underground between the banks, private equity firms, and foreign buyers. A colleague in Los Angeles reports that the same is true with small strip malls, which sport 50 to 90% visible vacancies. The QE to Infinity will be needed in defense and support.

Ten US cities are almost totally out of cash. Their bankruptcy will soon be tested. Meredith Whitney was not wrong, just way too early to earn the acclaim. She will be back in the spotlight to take credit for a correct call. The report is that the ten cities have under ten days of cash on hand. The Detroit court ruling is also interesting. A judge ruled the city pensions and bonds can be reduced in value (called haircut) under legal applications. Next comes the outcome, as the percentages are to be decided. Some bold economists like Laurence Kotlikoff of Boston University have openly declared the USGovt finances worse than Detroit’s. The wave appears next to strike Chicago. The QE to Infinity will be needed in defense and support.

Recovery is nowhere as 4.6 million mortgages going unpaid in the United States. Either the people cannot pay under duress and pressure to make payment, or they scoff at the banks and dare them to take possession, even to locate the property title. At least a couple million Americans are living in soon-to-be bank owned homes for free. That aint recovery. Furthermore, the American consumers are going for the 7-year car loans, as the banks adopt a stupid lending policy. Within 18 months, the loans will have zero collateral from basic car depreciation. The important point is that the bank holds negative equity loans after 3 years or less, with false accounting on the bank books as well. The break to people is a curse for banks, a stupid desperate policy. That aint recovery. The QE to Infinity will be needed in defense and support.

A handy comatose meter is found in the Chicago Economic Diffusion index. It fell in October. The more representative three-month moving average improved to 0.06 from -0.02, indicating the economy has leveled off in its coma. The employment indicators fell, as the labor participation rate is at its most dismal level ever, working its way under the magic 60% level. No recovery is evident. The QE to Infinity will be needed in defense and support.

So conclude that with continued USEconomic deterioration, the tax revenues will be way short. The USGovt deficits will rise above $1 trillion per year again easily. The USFed will be forced to cover the deficits, since national savings is nowhere. The debt issuance will continue to from the capital dome, covered by phony money coming off the press running side by side. The Jackass has not even mentioned the wet blanket known as ObamaCare, with its forced membership, higher costs than advertised, deceptions in keeping other health plans, refusals of cancer treatment, refusals of joint replacement, and broken website done by Michele Obama’s classmate at Princeton. Remember in a fascist business model system, loyalty and crony win over competence and quality, always.

CHANNELS TO BE FUNDED BY Q.E. TO INFINITY

a) Government Finance Support

Axel Merk has concluded that the USFed is monetizing 50% more than the USGovt deficits. The key elements are USTreasury Bond issuance, refund activity of USTBonds, along with the ample coverage of USAgency Mortgage Bonds and some private label mortgage bonds. The printing press with Weimar nameplate is under heavy pressure. Those refundings (bond turnover at maturity) are a bitch, and rarely figure in the rosy analyses put out by the wonks, hacks, and stooges. One should really brace for a reality check. The USFed has announced repeatedly that it is executing on $85 billion in bond monetizations per month. The disclosed level represents a staggering volume of $1.02 trillion per year. Amazingly, few economists or bank analysts are troubled by the official steady unrelenting hyper monetary inflation. To be sure, some competent and responsible members of officialdom express their reservations, without much disgust, but with some courage. What would have passed as insanity and reckless policy in the 1990 decade, nowadays is accepted as the norm, the present reality, the exigent necessity, the urgent requirement, the responsible obligation. Focus on the true volume of the USFed bond purchases, the real QE volume when all items are added together. The reality is much worse than admitted reported. This is a banking crime syndicate, which should never be accepted for its word. They are the greatest bond fraud kings in modern history, the greatest thieves probably in world history. They steal the wealth of entire nations, if not from central bank gold bullion then from bonds and home equity, with a kicker in near zero interest loans to themselves.

Some hedge fund managers and bank analysts have come forward to share their privileged information from contacts deep within the USFed system, whether regional bank presidents or economists within the USFed marbled offices on Weimar Street. THE REALITY IS THE USFED IS MONETIZING AT LEAST $200 BILLION PER MONTH, MORE THAN DOUBLE THE OFFICIAL VOLUME STATED AND ADMITTED. The USFed is monetizing much more than basic USTreasurys and USAgency bonds to cover the USGovt deficits, their rollover refunding, and the raft of mortgage bonds. The USFed is monetizing a small mountain of Fannie Mae bonds and collateralized debt obligations with a mortgage core, which went bad, turned worthless. The USFed is monetizing a large mountain of interest rate derivatives that went deeply in the red in the last year, especially this past summer during the self-inflicted Taper Talk disaster. The mortgage debt and its leverage toxic vat amounts to a few $trillion yet to be fully monetized. Furthermore, the interest rate derivatives amount to hundreds of $trillion yet to be fully monetized. This hyper inflation output does not hit Main Street, which would result in price inflation for products and services. Worse, this hyper inflation output wrecks the USDollar and its primary vehicle the USTreasury Bond. It burns the King Dollar throne. The United States is Greece times one hundred.

b) Support for Financial Markets

During the Taper Talk trial balloon, the USTreasury 10-year yield rose to 2.95%, at which time some flash trading was moved from stocks to bonds. They halted the rise, but also put to use the IRS tax revenue tool, tied to Interest Rate derivatives. The Boyz wished to prevent a crease of the 3.0% mark. The damage done was colossal. The Interest Rate Derivative festered with leveraged outsized losses, all kept quiet. The JPMorgan headquarter complex was sold for half price to the Chinese property conglomerate, probably related to the derivative losses and a mandated requirement to manage the gold vaults from Beijing. Call it a hidden indirect margin call, a foreign managed inventory check. The emerging market national bourses took major hits. The Hot Money exited the United States, an early warning signal of the US showing symptoms of Third World.

c) Banker Welfare

The banker welfare, feeding at the trough, knows no end. It came into the open with the TARP Fund bait & switch tactic deployed to garner $700 billion. The funds were largely used to cover big bank bonds and preferred stock, a favorite asset holding by the bankers and their families. It has become a national priority to preserve the college funds for their children, not to mention their lunch accounts and many mistresses (see Jamie Dimon). The inside word has it that the QE3 includes a hidden chamber, to cover the toxic fraud-ridden mortgage bonds and collateralized debt obligations that clog the housing market itself.

d) Economic Props

To begin with, the housing market remains a key sector within the USEconomy. It requires ultra-low mortgage rates, not to stimulate the real estate market. Instead, it requires ultra-low mortgage rates in order to avoid collapse of the real estate market the rest of the way, and in rapid fashion in sudden manner. The car industry requires ultra-low loan rates in order to remain in intensive care, and not in the morgue. The retail industry requires ultra-low credit card rates in order to sustain itself without collapse also. The entire USEconomy could not function without the absurdly low rates. By the way, such harsh low rates provide the legitimate savers with almost nothing in return yields. They are victims to the steady consistent 7% to 9% price inflation year in and year out.

e) Redemption Coverage

Not only Wall Street and London big bank portfolios of impaired bonds must be redeemed and covered. The amplified and ever growing Indirect Exchange of USTBonds must be redeemed and covered as well. The foreign entities holding USTBonds from Chinese acquisitions, Russian energy deals, Brazilian bankruptcies, and other buyouts across the world have become center stage news. The sellers wish to cash in their currency from the big deals. The Eastern nations led by China are buying hard assets. The USFed and Bank of England cannot refuse the bond holders at the window of redemption, since their native sovereign debt. The USFed might ultimately be forced to print money to pay the bond holders. A couple $trillion could end up coming to the window.

GOLD MARKET EFFECT

The Gold Trade Settlement system is moving closer to reality each month. No amount of pressure and obstruction can prevent its progress, its development, and its evolution. The movement to create a non-USDollar alternative to trade, with serious banking reserves management system consequences, will not be deterred or halted. The Global Currency Reset is an extremely complicated undertaking for the major nations of the world. Most people, and many analysts, believe it involves the currency market and the banking systems. That is true enough. However, my informed sources indicate that the entire Reset initiative involves around 8 to 10 very complex, very thorny, very disruptive factors. The fallout from the reset will bring changes to the world order, changes to the balance of geopolitical power, changes to castle lords, changes to Third World residence, and great unclear threats to nuclear proliferation. To regard the main items as currency exchange rates and defaulting banks is painfully naive, but all too prevalent. The reset initiative must be done with respect to careful agreements forged and delicate recalibration of the global balance of power. Both sides possess nuclear weapons and other nefarious devices like electro-magnetic pulse weapons.

The winner will be the Gold Market. The loser will be the United States, the United Kingdom, and Western Europe. These regions will tiptoe into the Third World if lucky, and fall head first into the Third World if not careful. They should have thought more fully about the Chinese Most Favored Nation pact back in 1999. The low cost solution as center piece to globalization effectively destroyed the Western economies, by removing the industrial core. It was far more carefully planned than the great majority of people believe. The ultimate goal in my opinion was to wreck the cradle of capitalism in the United States. The compromise was to create the newly industrialized Chinese superpower, which will fall victim to fascism soon enough. It is the natural course, given human nature and the proclivity toward corruption, inefficiency, power, and greed. The winner will be Gold. It will reign over banks again. It will serve as arbiter over trade again. Its bright yellow lights and strong whips will emanate from the East.

FOOTNOTES

The Iran Talks should be better reported by the alternate press in the West. It was plain and simple a Petro-Dollar Surrender Summit. For the last several years, it has been clear that the primary defense of the USDollar has been military. Many major nations of the world are busy making plans and implementing them toward the creation of systems in bypass, as in Alternative Dollar systems for trade and settlement. The USDollar has turned toxic, widely confirmed by the QE to Infinity adopted policy by the USFed, the Euro Central Bank, and the Bank of England. The many major nations require assurance of not being attacked by the banks with SWIFT weapons, not being attacked with sanctions that hinder commerce to isolate their nations, not being strangled in economies to suffer from price inflation episodes, since their motive has become crystal clear of survival from the current interminable financial crisis. The designers and perpetrators of the crisis have no interest in pursuing solutions, only to defend the USDollar and their right to print themselves $trillions in wealth, the old self-dealing card to the extreme. The summit talks over Iran should be taken with a grain of salt on the detailed promulgated news releases, since loaded with propaganda and rubbish. They sound comical. Expect Iran to continue to make oil & gas sales, but to announce a top-line USDollar transaction which will be executed in gold. The trade settlements will continue in gold on a bilateral net basis, but the official lines (of bull) on ledgers will be etched from USD chisels. It is all about saving face for the dying King Dollar, and to protect the Eastern Alliance nations from retaliation, including potentially nuclear devices suddenly discharged in their home camps. Call the Iran Talks also the Petro-Dollar Surrender SALT Summit.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

“Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do.”

(Charles in New Mexico)

“I commend the Jackass for being the most accurate of all newsletter writers. Others called for the big move in Gold right away, but you understand that the enormous fraud in the system needs to play out before free market forces can begin to assert themselves. You seem to have the best sources and insights into the soap opera that is our global financial system. Most importantly, you have advised readers to be patient, stay safe, and avoid mining shares like the plague. Calling the top in the USTreasury Bond (10-yr yield at 1.4% yield) stands out as a recent fine accomplishment. The Jackass understands the markets, understands the fraud, and also has the sources to keep him the most up-to-date on the big geopolitical and financial events and scandals. Few or no other writers have all three of these resources.”

(Austin in California)

“A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one’s head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out.”

(The Voice, a European gold trader source)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com. For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Are Your Savings Safe From Bail-ins

Economists Warn Depositors May Be Burnt In Bail-Ins

On Tuesday we launched our in depth research report ‘From Bail-Outs to Bail-Ins: Risks and Ramifications’ in order to shed light on and foster debate on what we believe is one of the most significant risks facing investors, savers, all depositors and most western economies – bail-ins.

In it we detail, how bail-ins are a real risk not just to vulnerable countries like Greece, but to any countries in the EU, the UK, the U.S., Australia, New Zealand, Japan and most of the G20 countries.

Below some leading economists and financial commentators in Ireland give their perspective regarding the risks of bail-ins. If you manage money in any way, your own or others, it will be prudent to heed their warnings.

Dr Constantin Gurdgiev

“The recent abatement of the euro area crisis and the reduction in overall global financial uncertainty have led to a decline in the demand for gold as a safe haven instrument and speculative asset.

This is the good news. In line with more normalised demand for gold and the precious metals, the risk hedging properties of these assets remain intact and require continued and structured approach to their inclusion when building a diversified, long-term focused investment portfolios.

In addition, changes in the regulatory and policy responses to the financial crises, established in response to the Cypriot banking crisis, warrant longer-term re-weighting of optimal gold and other precious metals’ shares in defensive portfolios.

Given that the euro area is moving toward a pro-forma inclusion of the depositors bail-ins in the standard toolbox for dealing with the financially distressed national banking systems, the case for gradual cost-minimising increase in long term share of these instruments in individual investors portfolios is being made not only by the market forces, but also by regulatory changes.

Contrary to the short-term signals in the spot markets, gold and other precious metals role in delivering long-term risk management opportunities and tail risks hedging is becoming more important as the immediate volatility and short-term risks recede.”

Dr Constantin Gurdgiev lectures in Finance in Trinity College, Dublin and in the Smurfit School of Business, UCD. He serves as the Chairman of Ireland Russia Business Association. In the past, he served as non-executive member on the Investment Committee of Goldcore.

Cormac Lucey

“In November 2012, it was reported by RTÉ’s David Murphy that CRH, the building materials maker and the biggest company on the benchmark Irish stock index, “was mandated by its board not to leave cash in a bank in the euro zone during any weekend”.

The logic of CRH’s stance only became fully clear after weekend decisions taken by Eurozone finance ministers had a severe and adverse effect on the financial claims of depositors in Cypriot banks in March 2013.

Had ordinary retail and SME depositors in Cyprus’s banks known in February of CRH’s stance and of the logic behind it, does anyone seriously think that they would have left themselves so vulnerable in March?

The lesson from Cyprus is that individual and business depositors (small, medium and large) need to show at least as much care in making their deposit decisions as large corporations such as CRH.

Depositors should seriously consider two questions when putting money into a bank:

(i) is there is a serious possibility of the bank failing?

(ii) if the bank fails, is there then a serious possibility that the government would be unable to honour deposit guarantees in full?

If there is a significant possibility, even small, of capital loss, depositors should ask themselves the same question that corporate treasurers regularly ask themselves: am I being adequately compensated by the deposit rate for the risk I am now exposing my money to?”

Cormac Lucey is a chartered accountant, financial analyst & lecturer at the Irish Management Institute (IMI). He was special advisor to Michael McDowell, former Attorney General of Ireland, from 2003 to 2007. He is a commentator on economics and politics.

Jim Power

“The attempted bail-in of all deposits in the Cypriot banking crisis and the eventual decision to bail-in deposits in excess of €100,000 has drawn a line in the sand and has created a very dangerous and damaging precedent. A banking system has to be based on trust and confidence; the Cypriot decision and subsequent statements from European policy makers suggest that trust and confidence have been seriously, and possibly irredeemably, damaged.

Any individual or any corporate treasurer would be taking an unacceptable risk in making a decision to leave deposits in excess of €100,000 in any single bank, unless one is convinced that the institution is 100% sound. The events of the past 5 years should have taught us that such a conviction would be dangerous.

For investors, bank diversification is essential, but more broadly, asset diversification has to be the priority for anybody with any wealth. We still live in very dangerous and uncertain times and investors should do whatever it takes to manage risk and ensure that all of their eggs are not in a single basket that may be badly holed.”

On Tuesday we launched our in depth research report ‘From Bail-Outs to Bail-Ins: Risks and Ramifications’ in order to shed light on and foster debate on what we believe is one of the most significant risks facing investors, savers, all depositors and most western economies – bail-ins.

In it we detail, how bail-ins are a real risk not just to vulnerable countries like Greece, but to any countries in the EU, the UK, the U.S., Australia, New Zealand, Japan and most of the G20 countries.

Below some leading economists and financial commentators in Ireland give their perspective regarding the risks of bail-ins. If you manage money in any way, your own or others, it will be prudent to heed their warnings.

Dr Constantin Gurdgiev

“The recent abatement of the euro area crisis and the reduction in overall global financial uncertainty have led to a decline in the demand for gold as a safe haven instrument and speculative asset.

This is the good news. In line with more normalised demand for gold and the precious metals, the risk hedging properties of these assets remain intact and require continued and structured approach to their inclusion when building a diversified, long-term focused investment portfolios.

In addition, changes in the regulatory and policy responses to the financial crises, established in response to the Cypriot banking crisis, warrant longer-term re-weighting of optimal gold and other precious metals’ shares in defensive portfolios.

Given that the euro area is moving toward a pro-forma inclusion of the depositors bail-ins in the standard toolbox for dealing with the financially distressed national banking systems, the case for gradual cost-minimising increase in long term share of these instruments in individual investors portfolios is being made not only by the market forces, but also by regulatory changes.

Contrary to the short-term signals in the spot markets, gold and other precious metals role in delivering long-term risk management opportunities and tail risks hedging is becoming more important as the immediate volatility and short-term risks recede.”

Dr Constantin Gurdgiev lectures in Finance in Trinity College, Dublin and in the Smurfit School of Business, UCD. He serves as the Chairman of Ireland Russia Business Association. In the past, he served as non-executive member on the Investment Committee of Goldcore.

Cormac Lucey

“In November 2012, it was reported by RTÉ’s David Murphy that CRH, the building materials maker and the biggest company on the benchmark Irish stock index, “was mandated by its board not to leave cash in a bank in the euro zone during any weekend”.

The logic of CRH’s stance only became fully clear after weekend decisions taken by Eurozone finance ministers had a severe and adverse effect on the financial claims of depositors in Cypriot banks in March 2013.

Had ordinary retail and SME depositors in Cyprus’s banks known in February of CRH’s stance and of the logic behind it, does anyone seriously think that they would have left themselves so vulnerable in March?

The lesson from Cyprus is that individual and business depositors (small, medium and large) need to show at least as much care in making their deposit decisions as large corporations such as CRH.

Depositors should seriously consider two questions when putting money into a bank:

(i) is there is a serious possibility of the bank failing?

(ii) if the bank fails, is there then a serious possibility that the government would be unable to honour deposit guarantees in full?

If there is a significant possibility, even small, of capital loss, depositors should ask themselves the same question that corporate treasurers regularly ask themselves: am I being adequately compensated by the deposit rate for the risk I am now exposing my money to?”

Cormac Lucey is a chartered accountant, financial analyst & lecturer at the Irish Management Institute (IMI). He was special advisor to Michael McDowell, former Attorney General of Ireland, from 2003 to 2007. He is a commentator on economics and politics.

Jim Power

“The attempted bail-in of all deposits in the Cypriot banking crisis and the eventual decision to bail-in deposits in excess of €100,000 has drawn a line in the sand and has created a very dangerous and damaging precedent. A banking system has to be based on trust and confidence; the Cypriot decision and subsequent statements from European policy makers suggest that trust and confidence have been seriously, and possibly irredeemably, damaged.

Any individual or any corporate treasurer would be taking an unacceptable risk in making a decision to leave deposits in excess of €100,000 in any single bank, unless one is convinced that the institution is 100% sound. The events of the past 5 years should have taught us that such a conviction would be dangerous.

For investors, bank diversification is essential, but more broadly, asset diversification has to be the priority for anybody with any wealth. We still live in very dangerous and uncertain times and investors should do whatever it takes to manage risk and ensure that all of their eggs are not in a single basket that may be badly holed.”

Primped and preened to perfection: The ladies of Beverley Hills caught unaware as they sit in their cars on Rodeo Drive

With snapshots furtively taken through the windows of cars parked on Rodeo Drive, photographer Michael Butler has offered viewers a glimpse into the privileged lives of California’s elite.

The Los-Angeles based photographer staked out the iconic four-block shopping destination in the heart of Beverly Hills, taking pictures of glamorous, perfectly coiffed and extravagantly attired women - and a few men - as they sat in their cars.

The series of photos allows the spectators to peek into the private lives of wealthy strangers as the drive by, separated from us mere mortals both physically - by steel and glass - and metaphorically – by an aura of unapproachability.

More than one of the alluring motorists, middle aged and more mature, bear the unmistakable marks of plastic surgeries past, such as artificially smooth cheeks and collagen-enhanced painted lips.

On his website, Mr Butler explained that his exalted subjects distance themselves from the plebeians as they sit cloistered in their plush vehicles, which represent their moneyed microcosm of privilege.

'We have been given a momentary glimpse into a world we are not supposed to see,' he writes. ‘We are not neutral observers here... nor are we supposed to be.'

The Los-Angeles based photographer staked out the iconic four-block shopping destination in the heart of Beverly Hills, taking pictures of glamorous, perfectly coiffed and extravagantly attired women - and a few men - as they sat in their cars.

The series of photos allows the spectators to peek into the private lives of wealthy strangers as the drive by, separated from us mere mortals both physically - by steel and glass - and metaphorically – by an aura of unapproachability.

Ready for close-up: Los Angeles-based

photographer Michael Butler staked out Rodeo Drive in Beverly Hills,

taking pictures of privileged and well-dressed women - and some men- as

they drove by

Drinking it all in: Butler stealthy took pictures of more than a dozen women as they sat in their cars

Grand dames: Butler's immaculately coiffed and accessorized subjects look aloof, unsmilingly staring at the road

One percenters: Both women and men making their

way along the 4-block stretch of Rodeo Drive appear distant and in no

way connected to the general public - the 99 per cent

Fired up: This stranger in oversize sunglasses puffing on a cigarette caught Butler's eye on Rodeo Drive

Most

of the women in Butler's poignant snapshots are bleached blondes

sporting oversize designer sunglasses that hide their eyes from view,

their manicured digits gleaming with diamonds and precious metals.

More than one of the alluring motorists, middle aged and more mature, bear the unmistakable marks of plastic surgeries past, such as artificially smooth cheeks and collagen-enhanced painted lips.

Guarded: Mr Butler explained that the wealthy women distance themselves from the public as they sit cloistered in their vehicles

Smooch: This fabulous Beverly Hills dweller

apparently decided to acknowledge the photographer by bestowing an air

kiss upon him

Forever young: Some of the women of Beverly Hills bear the marks of plastic surgeries past

Odd man out: This middle-aged gentleman who