Average down payment dropped to 16.1% last month, one survey finds

Aside from rising home prices and reports of bidding wars, here’s one

sure sign the housing market is improving: banks seem to be loosening

standards for down payments.

The average down payment in purchases with a 30-year fixed rate mortgage

dropped to 16.1% nationwide in May from 17.6% two years ago, according

to a report released Monday by LendingTree, an online mortgage

marketplace. In some states, like Mississippi and West Virginia, the

average down payments are as low as 12%, the survey found.

Washington isn’t just neckties and politics anymore. Lauren Schuker Blum has an inside look at the D.C. real-estate boom. Photo: Eli Meir Kaplan for The Wall Street Journal

After sustaining huge losses during the financial crisis when borrowers —

many of whom put no money down — foreclosed, lenders raised credit

standards, with many requiring 20% down payments. But now that the

broader economic picture has improved, some banks are willing to approve

mortgages with much smaller down payments. “Lenders have increasing

confidence that the loans they’re originating today are less likely to

default,” says Doug Lebda, founder and chief executive of LendingTree.

For prospective home buyers, smaller down payments can make it easier to

take advantage of today’s lower interest rates and home prices, says

Lebda. Homeowners can also use any cash they’re not putting toward the

loan to cover other expenses like home improvements and furniture, he

says. They might also keep extra money on hand as a cash cushion to

cover emergencies, he says.

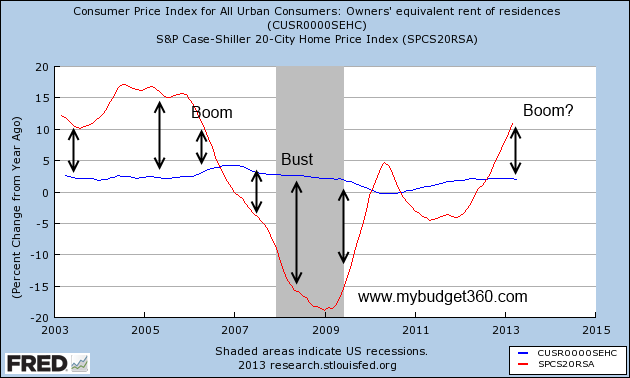

But the decision to buy a home with less money down could come with

consequences. Homeowners with little equity in their property could have

a hard time selling their homes down the line if home prices decline,

says Keith Gumbinger, vice president with HSH.com, a mortgage

information website. They could find themselves owing more than their

homes are worth, says Gumbinger, as many have in recent years. This

could force them to stay in the home longer than they would like while

they wait for home prices to rise.

Reuters

And even if their homes aren’t technically under water, some people with

slim equity stakes in their homes may still struggle to sell the house,

advisers caution. They may find that the size of their loan, combined

with the costs of selling the house, such as a broker commission and

property upgrades, could add up to more than the sale price, says Scott

Halliwell, a financial planner with USAA. “When you tell someone to put a

20% down payment you’re trying to help them prepare for the

unforeseen,” he says.

Borrowers who put down less than 20% are also typically required to make

larger monthly mortgage payments and may pay more in interest, says

Lebda. And in a competitive housing market, the buyer offering a smaller

down payment, say 5%, might lose out to a competing offer from a person

who is willing to pay 20% of the loan up front, says Lebda.

The shrinking down payments are partly due to the growth of mortgage

insurance, which is typically required for homebuyers who want to put

less than 20% down, says Gumbinger. Insurers became more willing to

offer the coverage as the credit quality of borrowers improved. Could

this eventually lead to a comeback of no-money down mortgages? “ I would

never say never,” says Gumbinger.