“Believe me, the next step is a currency crisis because there will be a rejection of the dollar. The rejection of the dollar is a big, big event, and then your personal liberties are going to be severely threatened.”

Rep. & Presidential Candidate Ron Paul, R-TX

Rep. Paul rightly identifies Important and Impending Negative Consequences of The Fed’s Devaluation of the U.S. Dollar.

And Stanley Druckenmiller makes it clear why the Fed-facilitated Debt Crisis is not likely to be resolved favorably anytime soon, if at all, because Politicians and Treasury Officials are not seriously addressing, much less close to solving, one fundamental Problem: Excessive Spending.

“We hadn't heard much from legendary investor Stanley Druckenmiller since last August when he decided to shut down his Duquesne Capital hedge fund. Until today. In a must read interview, the man who took on the Bank of England in 1992 and won, says that he joins the camp of Bill Gross et al, making it all too clear that all the recent fearmongering about the lack of a debt ceiling hike by the likes of Tim Geithner, Ben Bernanke and, of course, all of Wall Street, is misplaced…

The real MAD, Druckenmiller says, is letting the debt spiral out of control. As anyone with half a working brain will realize.

Mr. Druckenmiller is puzzled that so many financial commentators see the possible failure to raise the debt ceiling as more serious than the possibility that the government will accumulate too much debt. "I'm just flabbergasted that we're getting all this commentary about catastrophic consequences, including from the chairman of the Federal Reserve, about this situation but none of these guys bothered to write letters or whatever about the real situation which is we're piling up trillions of dollars of debt."

He's particularly puzzled that Mr. Geithner and others keep arguing that spending shouldn't be cut, and yet the White House has ruled out reform of future entitlement liabilities—the one spending category Mr. Druckenmiller says you can cut without any near-term impact on the economy.

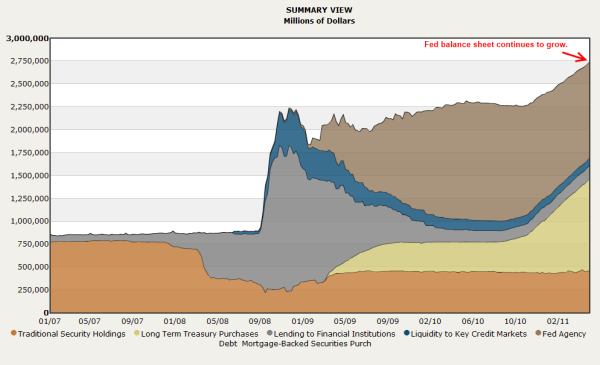

Next we move to the topic of the US ponzi and why the Fed is at its core.

Some have argued that since investors are still willing to lend to the Treasury at very low rates, the government's financial future can't really be that bad. "Complete nonsense," Mr. Druckenmiller responds. "It's not a free market. It's not a clean market." The Federal Reserve is doing much of the buying of Treasury bonds lately through its "quantitative easing" (QE) program, he points out. "The market isn't saying anything about the future. It's saying there's a phony buyer of $19 billion of Treasurys a week."

Warming to the topic, he asks, "When do you generally get action from governments? When their bond market blows up." But that isn't happening now, he says, because the Fed is "aiding and abetting" the politicians' "reckless behavior."

And blow up they will if nothing changes. Druckenmiller's conclusion:

"I think technical default would be horrible," he says from the 24th floor of his midtown Manhattan office, "but I don't think it's going to be the end of the world. It's not going to be catastrophic. What's going to be catastrophic is if we don't solve the real problem," meaning Washington's spending addiction.”

Druckenmiller Calls Out The Treasury Ponzi Scheme: "It's Not A Free Market, It's Not A Clean Market", Identifies The Real Bond Threat

Tyler Durden, zerohedge.com, 5/14/11

And John Williams pinpoints why the U.S. Economy is not in recovery (contrary to Mainstream Media Spin) and provides the Real Numbers (see note below**).

“The U.S. economy is not in recovery, and what ever upside bouncing there was in retail sales and industrial production increasingly appears to have been transient in nature. In this morning’s (May 17th) reporting, April 2011 housing starts continued their broad downtrend, bouncing downhill in renewed deterioration. More important than the statistically-insignificant monthly decline of 10.6%, the annual decline of 23.9% was significant, and the six-month moving-average has declined for the last three months, pushing the historic low level seen in April 2009…

In tandem with last week’s reporting of retail sales activity gaining less than 0.1%, net of higher prices (see Commentary No. 368), production activity appears to have stalled, with housing and consumer liquidity issues leading general economic activity into what eventually should be recognized as a double-dip recession…

April Housing Starts Were Consistent with a Deteriorating Economy.”

“Commentary No. 369: April Housing Starts, Industrial Production”

John Williams, shadowstats.com, 5/17/11

Faced with the Debt Crisis in Europe, Both The True Finn Party and Jim Willie identify a main cause of the Crisis – the Mega-Bankers, and offer a Solution – a Mega-Banker Haircut.

“The insolvent European big banks must be purged and liquidated in an orderly manner, according to Timo Soini writing in the Wall Street Journal Europe. The True Finn party leader was aggressive and almost hostile in his words, describing the banks as suffering from gangrene, both public and private. He urged amputations to save the body. He called the repairable potential of the sovereign debt condition in Greece, Ireland, and Portugal a grand lie, whose official version takes the people of Europe for idiots. In a remarkable display, the Wall Street Journal [US] edited, censored, and republished the article, scrubbing all negative comments by Soini. He must have ruffled some important bankers who do not favor liquidation and prefer to mold the citizenry into placid idiots.”

Jim Willie, Global Money War Report, May 2011

And a Correspondent Comments:

“The True Finn Party is one to watch. Leaders advocate an end to mass immigration into Finland as well as responsible fiscal policy that does not entail sacrifice of the people's well-being in order to shore up international banking interests.

Although the comments apply to European countries/banks primarily, the points apply generally.”

First one must understand the Hyperstagflation which increasingly threatens to leap out of the Econo-Financial ‘Pandora’s’ Box we face, to understand how to Profit and Protect from it. Consider the following Thumbnail Sketch of the Challenges, which we and others have described in detail elsewhere.

Key Sovereign Nations’ and Other Debts are Unpayable unless the Fiat Currencies in which they are denominated continue to be depreciated by Fed and other Central Banks, or the mega-Bankers get a Haircut.

Moreover, the Prices of Equities-in-General are not justified by the aforementioned Econo-Financial Conditions.

Indeed, given that the Equities Rally since March, 2009 was induced by QE (see Graham Summers’ September 30, 2010 article – “The Only Reason Stocks Have Rallied This Month” quoted in Deepcaster article “Surmounting the Wealth Destruction Juggernaut (09/30/10)”) and the fact that when QE was withdrawn (e.g. in July/August 2010) the Equities Markets fell, more QE (as in QE 3 and 4) will likely be necessary, eventually.

But QE wildly in excess of GDP which has been and is ongoing (see Real Numbers from Shadowstats.com** below) entails Massive Monetary and therefore Price Inflation, as we have seen already with Food and Energy.

Importantly, QE has not significantly aided Economic Recovery if at all (we emphasize, Real U.S. GDP is now a negative 2.6% -- see Shadowstats.com note below – and Real U.S. Unemployment is 22.3%).

But ongoing QE has resulted in piling more debt on unpayable Debt helping to further fatten the Mega-Bank owners of the private for-profit Fed among others. The private for-profit Fed has been creating $19 Trillion out of thin air (as Druckenmiller pointedly notes) for free per week to buy U.S. Treasuries on which Taxpayers must pay interest.

Unfortunately, like a Drug Addict, the Markets and Economy have come to rely on QE and other Stimulus.

Consequently, if QE is Withdrawn, the Markets and Economy Weaken even More.

If QE Continues, Hyperstagflation becomes Inevitable. (Already Real CPI in the USA is 10.69% and Rising - see Note below.)

Since Collapse is not a Palatable Option for Politicians, Central Banks and Governments with continue Vast Monetary Inflation. This will entail Vast Price Inflation i.e. a dramatic Erosion of the Purchasing Power of Fiat Currencies in Countries around the World, at the same time it depresses Economic Growth.

Credit-induced Price Inflation is not the arguably healthy inflation created by savings and investment-generated growth.

So, what to do to preserve Capital and Profit?

Sectors To Buy and NOT to Buy

NOT!

“Saving” in the traditional sense of Cash in Bank Accounts, is futile at this time because of the Depreciating Purchasing Power of Fiat Currencies and Because of Fed’s QE has kept Rates artificially low. Qualifiers: Some Currencies, such as the Swiss Franc, Canadian and Australian Dollars will perform relatively better than the Currencies heavily Indebted Countries like the USA. Moreover, there are times of which it makes sense to hold cash (albeit depreciating) for a few months, to be able to timely take advantage of Opportunities.

“Investment” in Equities-in-General is likely to generate massive losses over the Next few Years because Economic and Financial Headwinds are quite daunting. It is critically important to note several characteristics of this now-ongoing Equities rally:

- It is on record low volume

- It has been fueled in part by a weaker Dollar. Since January 1, 2011 on a dollar adjusted trade-weighted basis the S&P has actually dropped more than half a percent. The Fed has in effect recommitted to continuing U.S. Dollar Weakness.

- In other words, one could argue that virtually all the S&P strengthening this year is properly attributed to U.S. Dollar Weakening.

- But now that the US Dollar has very recently begun strengthening as we earlier forecast, look out below for Equities

- But of course, it is more complicated. The Dollar Weakening is mainly a function of the Fed’s Money-Printing (QE 2, etc.)

- It has been fueled in part by Fed Stimulus and POMO-pumping

Thus, virtually all the Rally since March, 2009 is an Artificial (i.e. Fed Money-printing-and-POMO-pumping-induced) Rally.

WARNING: Thus beware, Artificial Highs do not end well and Deepcaster has thus Forecast a Reversal.

Qualifier: There are always a few Special Situations with Profitable Prospects. Certain Individual Stocks with excellent Alpha and Beta Potential are among these.

“Investments” in Bonds-in-general is likely to be a loser because, over the mid-term bonds-in-general should fall in value (because of the Increasing Risk to Principal because of the aforementioned Econo-Financial Crises) and, therefore, yields rise. That is because many Nations, States and Municipalities are or will soon be, as Meredith Whitney and others correctly Point out, insolvent, and face, or could face, Bankruptcy. We are both amused and concerned at the U.S. T-Notes & T-Bonds strengthening which began the second week of April and which we earlier Forecast.

Amused, because THE ONLY REASON U.S. Treasuries have rallied is because the Fed has been buying $19 Trillion/Week via QE, as legendary Investor Stanley Druckenmiller Notes above – at least 70% of the total Auctioned and probably more (though given Fed-led-Cartel Covert Buying, we cannot know for sure).

Concerned, because continued Fed Buying is Unsustainable, and because it is Hyperinflationary and thus in the long run Worsens Outcomes.

If the Fed Continues, Real CPI (as e.g. Food and Energy) will continue to Rise.

If the Fed stops or slows appreciably, then Treasury Yields Vault up, giving the Housing Market specifically, and Equities Markets in General another kick in the teeth.

Qualifier: There are a few promising Issues out there, but intensive research is required to discover “Buy” Sectors at the Right Time. One must be Very Selective.

That leaves Gold, Silver, Food, and Water as “BUY” Sectors.

BUY!

Gold & Silver

Gold and Silver prices have begun to Bottom after the brutal Takedowns, which we earlier forecast, of the past few days.

Given all the foregoing Fundamentals, Gold and Silver will Rally again, but there is a caveat:

A Fed-led Cartel* still actively intervenes to Suppress Precious Metal Prices as recent weeks have shown. Although (due in part to revelations that Major Metal Repositories do not have all the Metal they claim), The Cartel has been weakened recently, They are still Potent.

*We encourage those who doubt the scope and power of Overt and Covert Interventions by a Fed-led Cartel of Key Central Bankers and Favored Financial Institutions to read Deepcaster’s December, 2009, Special Alert containing a summary overview of Intervention entitled “Forecasts and December, 2009 Special Alert: Profiting From The Cartel’s Dark Interventions - III” and Deepcaster’s July, 2010 Letter entitled "Profit from a Weakening Cartel; Buy Reco; Forecasts: Gold, Silver, Equities, Crude Oil, U.S. Dollar & U.S. T-Notes & T-Bonds" in the ‘Alerts Cache’ and ‘Latest Letter’ Cache at www.deepcaster.com. Also consider the substantial evidence collected by the Gold AntiTrust Action Committee at www.gata.org, including testimony before the CFTC, for information on precious metals price manipulation. Virtually all of the evidence for Intervention has been gleaned from publicly available records. Deepcaster’s profitable recommendations displayed at www.deepcaster.com have been facilitated by attention to these “Interventionals.” Attention to The Interventionals facilitated Deepcaster’s recommending five short positions prior to the Fall, 2008 Market Crash all of which were subsequently liquidated profitably.

Thus, Timing the purchase of Precious Metal is crucial. For example, around the time of our forecast Equities Takedown launch, we expect The Cartel to launch another Greatly Intensified Attack on these Precious Metals.

What a magnificent buying opportunity such a Takedown would be! Encouragingly, recent periodic Cartel Takedown Attempts get rapidly bought.

After the aforementioned anticipated Takedown and into the Medium and Long-Term, this Precious Metal Bull will almost surely continue and Intensify.

In sum for the Precious Metals (and though silver has already declined nearly 30%), the next Test will likely come (especially for Silver) when the Next Equities Takedown begins in earnest (see below).

Warning! We repeat: Precious Metal Miner and Explorer shares are stocks, and thus tend to mimic overall Equities Market Movements to a degree as they have on several recent trading days (Result: on the days Equities were down, the HUI typically dropped significantly). In other words, an Equities Takedown tends to take down Precious Metals shares prices also, but Bullion tends to be less affected.

Food (and Water)

Another Sector offers a considerable Measure of Protection and Profit Potential. That Sector is Food, including Food Producers and Processors. Food Prices have a Floor under them (due in large part to annual 80 Million/ Year World Population Growth) which even the Energy Sector does not have, because Energy Prices are vulnerable to Economic Slowdowns.

Therefore, even more than Energy or Even Precious Metals, Food and Potable Water must be at the top of Consumer Shopping lists everywhere around the world. With demand increasing from the 80 million plus annual world population increase, and increased resources of a growing Middle Class, especially in BRIC countries, to buy more and better Food, Food Producers and Processors are in the Catbird Seat. The Problem (and Profit Opportunity for Investors!) is exacerbated by the facts that most of the World’s best arable land is already under cultivation, and the fact that Modern Agriculture is very Fossil-Fuel-Energy-Intensive, and thus sensitive to energy price increases.

Bottom Line: Gold and Silver Investors should also invest in selected Food Producers and those Involved in the Water Treatment/Supply Business***. at the Right Time, because the Factors which help cause Gold, Silver and Crude Oil Prices increases, will also continue to impel Food Price increases, almost regardless of Economic Conditions.

Best regards,

Deepcaster LLC

The only thing

The only thing