By Michael Snyder | The Economic Collapse Blog | November 22, 2013

China just dropped an absolute bombshell, but it was almost entirely ignored by the mainstream media in the United States.

The central bank of China has decided that it is “no longer in China’s favor to accumulate foreign-exchange reserves”. During the third quarter of 2013, China’s foreign-exchange reserves were valued at approximately $3.66 trillion. And of course the biggest chunk of that was made up of U.S. dollars. For years, China has been accumulating dollars and working hard to keep the value of the dollar up and the value of the yuan down. One of the goals has been to make Chinese products less expensive in the international marketplace. But now China has announced that the time has come for it to stop stockpiling U.S. dollars. And if that does indeed turn out to be the case, than many U.S. analysts are suggesting that China could also soon stop buying any more U.S. debt. Needless to say, all of this would be very bad for the United States.

For years, China has been systematically propping up the value of the U.S. dollar and keeping the value of the yuan artificially low. This has resulted in a massive flood of super cheap products from across the Pacific that U.S. consumers have been eagerly gobbling up.

For example, have you ever gone into a dollar store and wondered how anyone could possibly make a profit by making those products and selling them for just one dollar?

Well, the truth is that when you flip those products over you will find that almost all of them have been made outside of the United States. In fact, the words “made in China” are probably the most common words in your entire household if you are anything like the typical American.

Thanks to the massively unbalanced trade that we have had with China, tens of thousands of our businesses, millions of our jobs and trillions of our dollars have left this country and gone over to China.

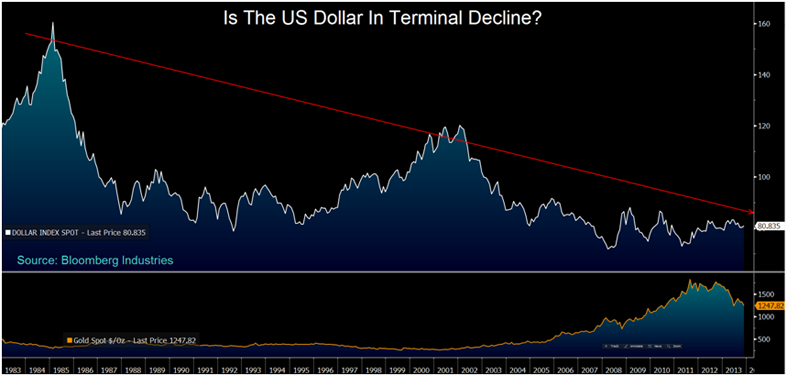

And now China has apparently decided that there is not much gutting of our economy left to do and that it is time to let the dollar collapse. As I mentioned above, China has announced that it is going to stop stockpiling foreign-exchange reserves…

The People’s Bank of China said the country does not benefit any more from increases in its foreign-currency holdings, adding to signs policy makers will rein in dollar purchases that limit the yuan’s appreciation.It isn’t going to happen overnight, but the value of the U.S. dollar is going to start to go down, and all of that cheap stuff that you are used to buying at Wal-Mart and the dollar store is going to become a lot more expensive.

“It’s no longer in China’s favor to accumulate foreign-exchange reserves,” Yi Gang, a deputy governor at the central bank, said in a speech organized by China Economists 50 Forum at Tsinghua University yesterday. The monetary authority will “basically” end normal intervention in the currency market and broaden the yuan’s daily trading range, Governor Zhou Xiaochuan wrote in an article in a guidebook explaining reforms outlined last week following a Communist Party meeting. Neither Yi nor Zhou gave a timeframe for any changes.

Analysts see this as the PBoC hinting that it will let its currency fluctuate, without intervention, thus negating the need for holding large reserves of the dollar. And if the dollar is no longer needed, then it could look to curb its purchases of dollar-denominated assets like U.S. Treasurys.So who is going to buy all of our debt?

“If they are looking to reduce these purchases going forward then, yes, you’d have to look at who the marginal buyer would be,” Richard McGuire, a senior rate strategist at Rabobank told CNBC in an interview.

“Together, with the Federal Reserve tapering its bond purchases, it has the potential to add to the bearish long-term outlook on U.S. Treasurys.”

That is a very good question.

If the Federal Reserve starts tapering bond purchases and China quits buying our debt, who is going to fill the void?

If there is significantly less demand for government bonds, that will cause interest rates to rise dramatically. And if interest rates rise dramatically from where they are now, that will set off the kind of nightmare scenario that I keep talking about.

In a previous article entitled “How China Can Cause The Death Of The Dollar And The Entire U.S. Financial System“, I described how China could single-handedly cause immense devastation to the U.S. economy.

China accounts for more global trade that anyone else does, and they also own more of our debt than any other nation does. If China starts dumping our dollars and our debt, much of the rest of the planet would likely follow suit and we would be in for a world of hurt.

And just this week there was another major announcement which indicates that China is getting ready to make a major move against the U.S. dollar. According to Reuters, crude oil futures may soon be pricedin yuan on the Shanghai Futures Exchange…

The Shanghai Futures Exchange (SHFE) may price its crude oil futures contract in yuan and use medium sour crude as its benchmark, its chairman said on Thursday, adding that the bourse is speeding up preparatory work to secure regulatory approvals.If that actually happens, that will be absolutely huge.

China, which overtook the United States as the world’s top oil importer in September, hopes the contract will become a benchmark in Asia and has said it would allow foreign investors to trade in the contract without setting up a local subsidiary.

China is the number one importer of oil in the world, and it was only a matter of time before they started to openly challenge the petrodollar.

But even I didn’t think that we would see anything like this so quickly.

The world is changing, and most Americans have absolutely no idea what this is going to mean for them. As demand for the U.S. dollar and U.S. debt goes down, the things that we buy at the store will cost a lot more, our standard of living will go down and it will become a lot more expensive for everyone (including the U.S. government) to borrow money.

Unfortunately, there isn’t much that can be done about any of this at this point. When it comes to economics, China has been playing chess while the United States has been playing checkers. And now decades of very, very foolish decisions are starting to catch up with us.

The false prosperity that most Americans are enjoying today will soon start disappearing, and most of them will have no idea why it is happening.

The years ahead are going to be very challenging, and so I hope that you are getting ready for them.