Alfred Woody's Kewl Blog [ 椼森 ]

Saturday, October 28, 2017

Saturday, September 23, 2017

站在未来看现在

关于 iBuddee/爱霸迪, 你不知道的事:

1. 一个没有围墙,没有国界,以“成功的经验比理论有用”为指导的财商教育平台。--你首先要成为爱霸迪的学员! [Smile]

2. 一个以分享经济理论出发,打造“Local Money” 自循环经济体,通过创造成本利润效应产生长期稳定投资回报的投资理财平台。--你同时也是爱霸迪公司的投资人和股东! [CoolGuy]

3. 一个国际化的第三方电子支付平台,现已进入全球36个国家,未来进入全球70个智能手机和4G网络覆盖最好的国家。全球旅游无需带现金! --得支付者得天下! [Fist]

4. 一个线上商城+线下实体商家异业联盟消费生态圈,会员用投资回报的“蜜点”流通交易,实现真正的免费消费![Drool] -- 你也是爱霸迪的消费者!

5. 自研推出聊天软件,手机游戏,新闻媒体,打车软件...服务好每一个人-- 你是爱霸迪最幸福的会员! [Joyful]

6. 一家入驻了英国伦敦金融科技城39楼的独角兽初创公司。在人工智能,区块链和分享经济三大领域融合创新,为人类探索各行业变革,进步之路!

7. 一家已取得2018年“Digital Leader 100”科技大赛亚洲举办权, 成为亚洲和欧美科技探索连接桥梁的公司!

8. 一家即将在2017年年底英国伦敦上市,后续会在纳斯达克,新加坡,香港...陆续上市的初创公司,以金融科技创新商业模式撬动全球资本市场!

站在未来看现在,你,准备好了吗?

https://m.youtube.com/watch?v=viAnSqqAbTQ&from=groupmessage

Saturday, February 18, 2017

“Seriously Delinquent” Auto Loans Surge

Wolf Richter wolfstreet.com, www.amazon.com/author/wolfrichter

Bank regulators have been warning, now it’s happening.

The New York Fed, in its Household Debt and Credit Report for the fourth quarter 2016, put it this way today: “Household debt increases substantially, approaching previous peak.” It jumped by $226 billion in the quarter, or 1.8%, to the glorious level of $12.58 trillion, “only $99 billion shy of its 2008 third quarter peak.”

Yes! Almost there! Keep at it! There’s nothing like loading up consumers with debt to make central bankers outright giddy.

Auto loan balances in 2016 surged at the fastest pace in the 18-year history of the data series, the report said, driven by the highest originations of loans ever. Alas, what the auto industry has been dreading is now happening: Delinquencies have begun to surge.

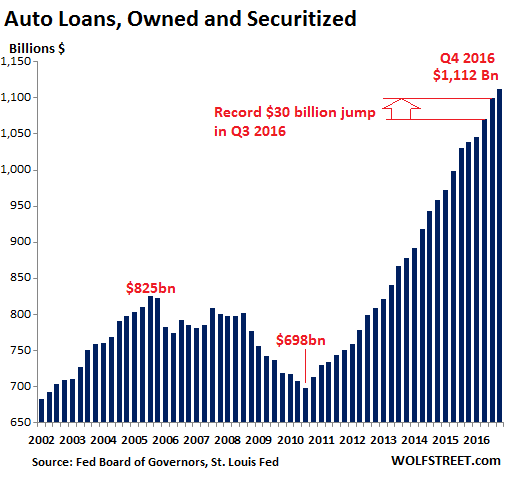

This chart – based on data from the Federal Reserve Board of Governors, which varies slightly from the New York Fed’s data – shows how rapidly auto loan balances have ballooned since the Great Recession. At $1.112 trillion (or $1.16 trillion according to the New York Fed), they’re now 35% higher than they’d been during the crazy peak of the prior bubble. Note that during the $93 billion increase in auto loan balances in 2016, new vehicle sales were essentially flat:

No way that this is an auto loan bubble. Not this time. It’s sustainable. Or at least containable when it’s not sustainable, or whatever. These ballooning loans have made the auto sales boom possible.

But despite record low interest rates, the bane of the automakers is now taking place relentlessly:

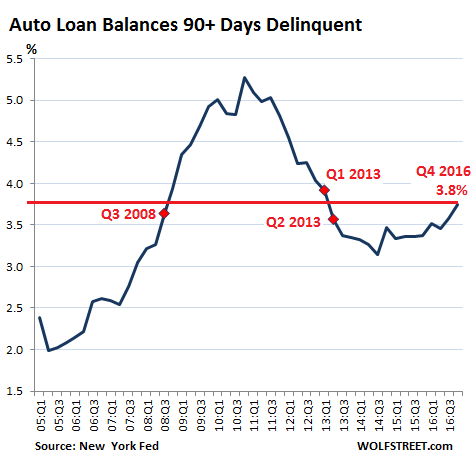

“Seriously delinquent” auto loan balances, composed of all loans that are 90+ days past due, rose in Q4 to 3.8% of total auto loan balances. That puts them right between Q1 and Q2 of 2013, as auto credit was recovering from the Financial Crisis. Last time auto loan delinquencies had surged to that level was after Q3 2008, as the Financial Crisis was tearing into the economy:

These seriously delinquent auto loans are an indication of what is next:

- Losses at auto lenders, particularly those specializing in lending to subprime borrowers, but also other lenders, including captives, such as Ford Motor Credit, which had already warned in its most recent outlook that “we continue to see credit losses increase.”

- Tightening auto credit for consumers, as those losses begin to exact their pound of flesh from the lenders.

Some specialized subprime lenders might keel over. Larger lenders with good quality loan portfolios will bleed but go on while tightening their underwriting standards in order to weather the storm. And that’s precisely what the auto industry is dreading: tightening credit.

The auto boom over the past few years was funded by historically low interest rates and loosey-goosey underwriting, with long loan terms and high loan-to-value ratios, often over 120%. They made everything possible. But they infused the $1.1 trillion in auto loans with some very big risks.

The Office of the Comptroller of the Currency (OCC), one of the federal bank regulators, has once again warned about the risk-taking by auto lenders:

Auto lending risk has been increasing for several quarters because of notable and unprecedented growth across all types of lenders.As banks competed for market share, some banks responded with less stringent underwriting standards for direct and indirect auto loans. In addition to the eased underwriting standards, lenders also substantially layered risks (granted longer terms combined with higher advance rates resulting in higher LTV ratios).These factors increased the credit risk in auto loan portfolios…. This embedded risk is now being reflected in lower recoveries at charge-off (higher loss severities) for both bank loans and securitized auto loans despite relative stability in used auto values.Bank risk management practices and the ALLL [allowance for loan and lease losses] should reflect the elevated risk profile and higher probable credit loss severities.

So it’s all there – the ingredients for bigger losses among banks and investors, a few failures of smaller specialized subprime lenders, and belated credit tightening, both out of necessity and due to lower competition among lenders as some of the most aggressive ones will be busy licking their wounds.

And auto sales – not long ago the truly hot sector in the US economy – are now confronted with these tightening credit conditions as growth has already been stalling.

Despite what you might think, automakers did not “cut back” on fleet sales in January. But keep an eye on rideshare companies. Read… Car Sales Crash, But It’s Complicated

Around The Web

BILL GATES WANTS TO TAX ROBOTS JUST LIKE HUMANS

[2/17/17] Robots are coming for a lot of jobs. And while at first this may seem detrimental, it’s actually a good thing.

There will still be jobs for humans (in fact, job growth has been on the rise in the U.S.), but they will just be different jobs. If we leave jobs that can be automated to the robots, we’ll free up labor so humans can do more meaningful work like caring for the elderly, teaching kids with disabilities and other jobs that require empathy—something robots lack.

This notion has been discussed time and time again, but Bill Gates has taken it further with an extra step he says will help us get “net ahead.”

THE EU IS FINISHED! WHAT THESE ECONOMISTS PREDICT SPELLS CERTAIN DOOM FOR THE EURO

ZOIE O’BRIEN for express UK reports, European Union nations are plummeting further into debt, amid angry protests and calls for reform, but the Union continues to push for the joint monetary union. Now, economists have suggested it is already too late to save the failing monetary union – which will “almost surely fail”.

GNC to close 100 stores, reports $433 million fourth-quarter loss

GNC, who has now rebranded themselves as a health and wellness retailer has reported a $433 million dollar fourth quarter loss according to this Pittsburgh Post report.

The bad news doesn’t end there as GNC reported a 64% decline in sales and the closing of 100 stores.

GNC officials on Thursday took pains to distance the company from the “old” GNC after reporting a $433.4 million fourth-quarter loss, marking the end of a dismal 2016 that saw a 64 percent decline in the Pittsburgh health supplement retailer’s share price.

For the year, GNC Holdings Inc. recorded a net loss of $286.3 million, compared with a $219.3 million profit the year before, as sales declined 6.5 percent and 6.8 percent respectively in company-owned and franchise stores. GNC’s consolidated revenue of $2.54 billion was a 5.3 percent drop from 2015’s $2.68 billion. Its adjusted earnings per share was 7 cents, far off Wall Street’s estimate of 36 cents per share.

“This is certainly not what any one of us wanted to see,” said interim CEO Robert Moran of GNC’s fourth-quarter performance during the company’s quarterly financial briefing to analysts.

The losses, said Chief Financial Officer Tricia Toliver, “are not a good indication of where the business is headed,” adding later that, “We are building an entirely new business model.”

Ms. Toliver was referring to the “One New GNC” campaign, launched Dec. 29 to rebrand the health and wellness retailer. The “new” GNC now features simplified pricing, reduced prices on about half of its products, and a free customer loyalty program, with plans to offer new proprietary products.

Mr. Moran said company officials are encouraged by the campaign’s early results, with sales transactions up 7 percent among company-owned stores and an even more promising performance among the GNC stores that have been piloting the program.

It undoubtedly can’t come soon enough for investors who, shortly after the GNC financials were released early Thursday, learned the GNC board was suspending the company’s quarterly dividend. Shares briefly fell below $7 for the first time since the company went public in 2011.

The stock closed at $7.72 Thursday, down 7.21 percent.

Ms. Toliver said the fourth quarter had notable one-time expenses such as a $10 million investment to clear inventory and launch the One New GNC campaign. As part of its preparation, GNC closed all of its stores for the day on Dec. 28, which also cut into sales. She also said the company expects to close about 100 stores this year as leases expire.

Subscribe to:

Posts (Atom)