Thursday, January 6, 2011

"There Won't Be ANY Significant Cuts Until We Have A Dollar Crisis" Ron Paul & Rand Paul Interview

« 'A Taxpayer Giveaway And Backdoor Bailout Of Bank Of America': Fannie Putback Deal Denounced by Waters »

Washington, Jan 4

Congresswoman Maxine Waters, a senior Democrat on the House Financial Services Committee, issued the following statement today after Bank of America settled with Fannie Mae and Freddie Mac for $2.8 billion over the misrepresentation of loans that the bank originally sold to the GSEs:

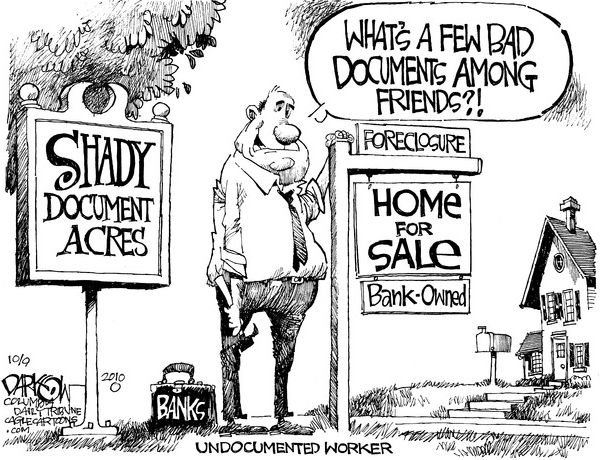

“I’m concerned that the settlement between Fannie Mae, Freddie Mac and Bank of America over misrepresentations in the mortgages BofA originated may amount to a backdoor bailout that props up the bank at the expense of taxpayers. Given the strong repurchase rights built into Fannie Mae and Freddie Mac’s contracts with banks, and the recent court setback for Bank of America in similar litigation with a private insurer, I’m fearful that this settlement may have been both premature and a giveaway. The fact that Bank of America’s stock surged after this deal was announced only serves to fuel my suspicion that this settlement was merely a slap on the wrist that sets a bad example for other negotiations in the future.

I understand that the questions raised by fraudulent servicing practices were not addressed in these settlements, and I hope that Fannie Mae and Freddie Mac, along with their conservator, are more aggressive in pursuing banks for the fraud I documented in my Subcommittee during the last Congress.”

---

More on this story...

Freddie Mac and Fannie Mae may have shortchanged taxpayers when the U.S.-owned firms settled loan disputes with Bank of America Corp. for $2.8 billion rather than demanding more funds, Representative Maxine Waters said.

“This settlement may have been both premature and a giveaway,” the California Democrat said today in an e-mailed statement. The deal, announced yesterday by the Charlotte, North Carolina-based lender, may “amount to a backdoor bailout that props up the bank at the expense of taxpayers.”

Bank of America gained 6.4 percent in New York trading yesterday after resolving disputes with the firms, which had said the lender sold them mortgages based on faulty data. The settlement was “clearly a gift” to Bank of America, Chris Whalen, a former Federal Reserve Bank of New York analyst said yesterday.

---

Maxine grills Geithner...

California Rep. Maxine Waters forces Geithner to listen while she recounts the litany of inappropriate Goldman Sachs influence at Treasury and on financial crisis policy. Finally, somebody had the sack to ask Tim about it publicly. She would have been better served to concentrate on Goldman's role in the AIG decision (why was Lloyd Blankfein at the AIG rescue meeting last Fall?).

Still one more question that Geithner and Bernanke need to answer publicly.

---

Maxine is no stranger to TARP scandal...

---

« Federal Reserve works to strip a key mortgage protection for homeowners - Rescission »

WASHINGTON — As Americans continue to lose their homes in record numbers, the Federal Reserve is considering making it much harder for homeowners to stop foreclosures and escape predatory home loans with onerous terms.

The Fed's proposal to amend a 42-year-old provision of the federal Truth in Lending Act has angered labor, civil rights and consumer advocacy groups along with a slew of foreclosure defense attorneys. They're not only asking the Fed to withdraw the proposal, they also want any future changes to the law to be handled by the new Consumer Financial Protection Bureau, which begins its work next year.

In a letter to the Fed's Board of Governors, dozens of groups that oppose the measure, including the National Consumer Law Center, the NAACP and the Service Employees International Union, say the proposal is bad medicine at the wrong time.

"At the depths of the worst foreclosure crisis since the Great Depression, we are surprised that the Fed has proposed rules that would eviscerate the primary protection homeowners currently have to escape abusive loans and avoid foreclosure: the extended right of rescission."

http://www.mcclatchydc.com/2010/12/01/104568/fed-wants-to-strip-a-key-protection.html#ixzz1ABdTsFMP

---

Fed moves to gut predatory lending protection

The Federal Reserve is pushing a new mortgage regulation that would effectively eliminate the most powerful federal remedy for predatory lending.

The regulation would severely limit a practice called "rescission," used to strike down demonstrably-illegal or fraudulent loan contracts and void a bank's ill-gotten gains from such predatory lending practices. When a mortgage borrower wins a rescission case in court, the bank loses the right to foreclose, and has to give up all profits from interest and fees on the loan. The borrower still has to repay the principal -- the original amount of money extended by the bank -- but can't be kicked out of the house.

Under the Fed's new proposal, however, borrowers would be required to pay off the balance of the loan before the bank loses its right to foreclose -- that means borrowers could still lose their homes, even in cases where banks have broken the law.

Unsurprisingly, banks support the move, but consumer advocates say this would essentially make rescission worthless to borrowers.

"The ... proposal would eviscerate the single most effective tool that homeowners have to stop foreclosures and avoid predatory loans," reads a letter penned by Margot Saunders of the National Consumer Law Center and signed by 16 national public interest groups, along with 33 state housing and legal aid groups and 144 individual attorneys. "Passage of the proposed rule will considerably exacerbate foreclosure statistics in this nation."

Six Democratic senators, led by Sherrod Brown of Ohio, also urged the Fed to reconsider its rule in a Monday letter. "In this time of record foreclosures and reports of systemic problems with the operations of the largest mortgage servicers, the proposed revisions are unfortunate and unnecessary," the letter reads. "The mortgage market needs greater oversight and accountability to restore borrower confidence lost in the mortgage crisis. The proposed rules would undermine this goal." The signatories included outgoing Senate Banking Chairman Chris Dodd (Conn.), incoming Chairman Tim Johnson (S.D.), and Sens. Jack Reed (R.I.), Daniel Akaka (Hawaii) and Jeff Merkley (Ore.).

---

From the Fed's website...

The Federal Reserve Board has proposed enhanced consumer protections and disclosures for home mortgage transactions. The proposal includes significant changes to Regulation Z (Truth in Lending) and represents the second phase of the Board's comprehensive review and update of the mortgage lending rules in the regulation. The proposed changes reflect the results of consumer testing by the Board, which will begin accepting public comment.

Read comment letters for the Fed left by others

---

---

Dr. Pitchfork has covered it in the past...

The Fed Will Revoke the "Recission" Penalty for Predatory Lending

There is only one serious federal remedy for predatory lending, and the Fed is now knowingly trying to gut that remedy in order to help banks avoid losses from their own fraud. The remedy is called rescission, and it works like this:

If a bank failed to make key consumer protection disclosures about a mortgage, the borrower can demand that all of the interest and closing costs on the loan be refunded. Equally important, the bank must also stop all foreclosure proceedings and give up its right to foreclose. Once the bank gives up its right to foreclose, the full amount of the mortgage, minus interest and closing costs, becomes due. This isn't a free lunch for the borrower, especially when the value of her home has declined dramatically, but it's better than nothing, and it does impose real costs on banks.

As usual, the Bernanke Fed is doing everything it can to spare the banks from the consequences of their own actions:

Under the Fed's proposal, if you're the victim of illegal predatory lending, the bank will still get to foreclose on you unless you pony up hundreds of thousands of dollars all at once. And you'll have to pony up what the banksays you owe, which may be very different from what you actually owe. That eliminates the usefulness of rescission, making the new rule a bailout for predators.

But here's where the Fed's gutting of the recission penalty intersects with the deeper, underlying problems with Foreclosure-Gate:

The largest banks don't have enough capital to weather a bad housing market. And any process that sheds light on the documentation procedures at mortgage servicers will expose the big banks to investor lawsuits. But investors can't sue without those documents. Rescission judgments create a paper trail for illegal loans. In addition to creating immediate losses for banks, rescission documents that banks sold illegal loans, giving investors who bought mortgage-backed securities ammunition for well-founded lawsuits. Those lawsuits, in turn, could sink some of the biggest names on Wall Street, something the Fed has been trying to prevent at all costs since 2008.

---

Related reading - Matt Taibbi's most recent work...

---

The little red book that swept France

Take a book of just 13 pages, written by a relatively obscure 93-year-old man, which contains no sex, no jokes, no fine writing and no startlingly original message. A publishing disaster? No, a publishing phenomenon.

Indignez vous! (Cry out!), a slim pamphlet by a wartime French resistance hero, Stéphane Hessel, is smashing all publishing records in France. The book urges the French, and everyone else, to recapture the wartime spirit of resistance to the Nazis by rejecting the "insolent, selfish" power of money and markets and by defending the social "values of modern democracy".

The book, which costs €3, has sold 600,000 copies in three months and another 200,000 have just been printed. Its original print run was 8,000. In the run-up to Christmas, Mr Hessel's call for a "peaceful insurrection" not only topped the French bestsellers list, it sold eight times more copies than the second most popular book, a Goncourt prize-winning novel by Michel Houellebecq.

The extraordinary success of the book can be interpreted in several ways. Its low price and slender size – 29 pages including blurbs and notes but just 13 pages of text – has made it a popular stocking-filler among left-wing members of the French chattering classes. Bookshops report many instances of people buying a dozen copies for family and friends.

But Mr Hessel and his small left-wing publisher (which is used to print runs in the hundreds) say that he has evidently struck a national, and international nerve, at a time of market tyranny, bankers' bonuses and budget threats to the survival of the post-war welfare state. They also suggest that the success of the book could be an important straw in the wind as France enters a political cycle leading to the presidential elections of May 2012.

In a New Year message Mr Hessel, who survived Nazi concentration camps to become a French diplomat, said he was "profoundly touched" by the success of his book. Just as he "cried out" against Nazism in the 1940s, he said, young people today should "cry out against the complicity between politicians and economic and financial powers" and "defend our democratic rights acquired over two centuries".

In a party-political aside which might or might not undermine his new status as political prophet, Mr Hessel went on to imply that "resistance" should begin with a rejection of President Nicolas Sarkozy and a vote for the Parti Socialiste.

The book has not pleased everyone. It also contains a lengthy denunciation of Israeli government policies, especially in the Gaza Strip. Although the final chapter calls vaguely for a "non-violent" solution to the world's problems, the book also suggests that "non-violence" is not "sufficient" in the Middle East. Mr Hessel, whose father was a German jew who emigrated to France, has been accused by French jewish organisations of "anti-semitism".

Mr Hessel was born in Berlin in 1917. He emigrated to France with his family when he was seven. He joined General Charles de Gaulle in London in 1941 and was sent back to France to help organise the resistance. He was captured, tortured and sent to concentration camps in Germany. After the war, he helped to draft the UN's Universal Declaration of Human Rights in 1948.

Jean-Pierre Barou, the joint head of the small Montpellier-based publishing house Indigène, which commissioned the book, said Mr Hessel had revealed a "deep sense of indignation in France".

As a political tract, the book contains no especially original analysis of the world's problems.

"They dare to tell us that the State can no longer afford policies to support its citizens," Mr Hessel says. "But how can money be lacking ... when the production of wealth has enormously increased since the Liberation (of France), at a time when Europe was ruined? The only explanation is that the power of money ... has never been so great or so insolent or so selfish and that its servants are placed in the highest reaches of the State."

The originality of the book is the suggestion that an organised "Resistance" is now called for, just like in 1940. "We, veterans of the resistance ... call on young people to revive and pass on the heritage and ideals of the Resistance," the book says.

How people should resist the power of money and the markets – by peaceful means, the book insists – is not made entirely clear.

A message of resistance

* "I would like everyone – everyone of us – to find his or her own reason to cry out. That is a precious gift. When something makes you want to cry out, as I cried out against Nazism, you become a militant, tough and committed. You become part of the great stream of history ... and this stream leads us towards more justice and more freedom but not the uncontrolled freedom of the fox in the hen-house."

* "It's true that reasons to cry out can seem less obvious today. The world appears too complex. But in this world, there are things we should not tolerate... I say to the young, look around you a little and you will find them. The worst of all attitudes is indifference..."

* "The productivist obsession of the West has plunged the world into a crisis which can only be resolved by a radical shift away from the 'ever more', in the world of finance but also in science and technology. It is high time that ethics, justice and a sustainable balance prevailed..."

That 97% Solution, Again

How do we know there’s a scientific consensus on climate change? Pundits and the press tell us so. And how do the pundits and the press know? Until recently, they typically pointed to the number 2500 – that’s the number of scientists associated with the United Nations Intergovernmental Panel on Climate Change. Those 2500, the pundits and the press believed, had endorsed the IPCC position.

To their embarrassment, most of the pundits and press discovered that they were mistaken – those 2500 scientists hadn’t endorsed the IPCC’s conclusions, they had merely reviewed some part or other of the IPCC’s mammoth studies. To add to their embarrassment, many of those reviewers from within the IPCC establishment actually disagreed with the IPCC’s conclusions, sometimes vehemently.

The upshot? The punditry looked for and recently found an alternate number to tout — “97% of the world’s climate scientists” accept the consensus, articles in the Washington Post and elsewhere have begun to claim.

This number will prove a new embarrassment to the pundits and press who use it. The number stems from a 2009 online survey of 10,257 earth scientists, conducted by two researchers at the University of Illinois. The survey results must have deeply disappointed the researchers – in the end, they chose to highlight the views of a subgroup of just 77 scientists, 75 of whom thought humans contributed to climate change. The ratio 75/77 produces the 97% figure that pundits now tout.

The two researchers started by altogether excluding from their survey the thousands of scientists most likely to think that the Sun, or planetary movements, might have something to do with climate on Earth – out were the solar scientists, space scientists, cosmologists, physicists, meteorologists and astronomers. That left the 10,257 scientists in disciplines like geology, oceanography, paleontology, and geochemistry that were somehow deemed more worthy of being included in the consensus. The two researchers also decided that scientific accomplishment should not be a factor in who could answer – those surveyed were determined by their place of employment (an academic or a governmental institution). Neither was academic qualification a factor – about 1,000 of those surveyed did not have a PhD, some didn’t even have a master’s diploma.

To encourage a high participation among these remaining disciplines, the two researchers decided on a quickie survey that would take less than two minutes to complete, and would be done online, saving the respondents the hassle of mailing a reply. Nevertheless, most didn’t consider the quickie survey worthy of response –just 3146, or 30.7%, answered the two questions on the survey:

1. When compared with pre-1800s levels, do you think that mean global temperatures have generally risen, fallen, or remained relatively constant?

2. Do you think human activity is a significant contributing factor in changing mean global temperatures?

The questions were actually non-questions. From my discussions with literally hundreds of skeptical scientists over the past few years, I know of none who claims that the planet hasn’t warmed since the 1700s, and almost none who think that humans haven’t contributed in some way to the recent warming – quite apart from carbon dioxide emissions, few would doubt that the creation of cities and the clearing of forests for agricultural lands have affected the climate. When pressed for a figure, global warming skeptics might say that human are responsible for 10% or 15% of the warming; some skeptics place the upper bound of man’s contribution at 35%. The skeptics only deny that humans played a dominant role in Earth’s warming.

Surprisingly, just 90% of those who responded to the first question believed that temperatures had risen – I would have expected a figure closer to 100%, since Earth was in the Little Ice Age in the centuries immediately preceding 1800. But perhaps some of the responders interpreted the question to include the past 1000 years, when Earth was in the Medieval Warm Period, generally thought to be warmer than today.

As for the second question, 82% of the earth scientists replied that that human activity had significantly contributed to the warming. Here the vagueness of the question comes into play. Since skeptics believe that human activity been a contributing factor, their answer would have turned on whether they consider a 10% or 15% or 35% increase to be a significant contributing factor. Some would, some wouldn’t.

In any case, the two researchers must have feared that an 82% figure would fall short of a convincing consensus – almost one in five wasn’t blaming humans for global warming — so they looked for subsets that would yield a higher percentage. They found it – almost — in those whose recent published peer-reviewed research fell primarily in the climate change field. But the percentage still fell short of the researchers’ ideal. So they made another cut, allowing only the research conducted by those earth scientists who identified themselves as climate scientists.

Once all these cuts were made, 75 out of 77 scientists of unknown qualifications were left endorsing the global warming orthodoxy. The two researchers were then satisfied with their findings. Are you?

UPDATE: Man Found Frozen to Death

CHARLESTON, W.Va. (WSAZ) -- A homeless man was found frozen to death underneath the Quarrier Street bridge in Charleston, according to police.

Investigators say a worker at the Holiday Inn Express discovered the body of Robert Hissom under the bridge behind the Charleston Civic Center.

Police say the bitterly cold weather took Hissom's life.

"Emergency crews arrived and he had been deceased for some time," Lieutenant S.A. Cooper said. "Nothing could be done for him."

Many people without a home this time of year have found refuge at local shelters.

"I feel saddened because they do actually have places to come in out of the cold," Robert McKinnon said. "Why some choose not to, I don't know."

"Homeless people got to find warmth, keep bundled up and try to find the best way to sleep possible and it's hard in these horrible (weather) conditions," Michael Rizer said.

Police are still sorting out the details as to why Hissom was living on the streets when the shelters were open.

"Many times they don't make it to the shelter due to an overindulgence in alcohol or drugs," Cooper said. "In this case, we're not sure yet."

Cooper added, "It's not something that happens everyday, but it's not the first time."

Friends of Hissom say he was a caring person who just recently lost his home.

"He was very friendly and he would do anything for anyone even though he was one of the people that needed the most help of all," Jamie Martin said. "He would always lend a hand."

Martin says he was involved in an auto accident at a young age that caused him to have brain injuries.

"There are so many people who care about Robbie," Martin said. "If he would have let someone know that he was in trouble, I would have been right there."

The bridge, used as a shelter was no match for the brutal cold.

Police say they're waiting on toxicology and autopsy reports but so far there's no sign of foul play

Police also say it appears Hissom may have died several days before he was discovered.

Keep clicking WSAZ.com for the very latest.

ORIGINAL STORY

CHARLESTON, W.Va. (WSAZ) -- Charleston Police say it appears a man froze to death under the Quarrier Street bridge.

The body of Robert Hissom was found around 7:00 p.m. Wednesday.

Investigators say it appears Hissom died from being exposed to the brutally cold weather. Police say they believe he had died several days before he was found.

Investigators say Hissom had been homeless for the past several months.

Keep clicking WSAZ.com for more updates.

« David Faber: Bank Of America NOT Out Of The Woods, Still Faces MASSIVE Mortgage Liability Risk - Video »

Video - David Faber - Jan. 3, 2011

Yesterday's settlement...

---

Monday’s settlement does little to deal with a liability that could far exceed the settlement with the GSE’s - the so called “private put-back” of mortgage securities by their holders to Bank of America.

Some may take the settlement as a sign that BofA is more open to reaching a settlement with holders of private securitizations. That’s the hopeful position being taken by Talcott Franklin, an attorney leading the charge against mortgage securitizers such as BofA on behalf of holders of such mortgage securities.

The issue is complex and it remains far from clear that much can be gleamed from Monday’s action. Franklin, in an interview on The Strategy Session earlier today, told me he expects to become much more aggressive on this issue as the year progresses.

---

At Least 10 States Have Introduced Gold Coins-As-Currency Bills

TPM

Legislators in at least ten states have introduced bills in the past few years to allow state commerce to be conducted with gold and silver.

As we reported, Georgia state Rep. Bobby Franklin (R) recently reintroduced legislation to force his state to conduct all monetary transactions with U.S. gold or silver coins -- including the payment of taxes.

The Georgia bill has a long way to go before become law -- but it's by no means the only state that's considering a future in gold. Lawmakers in Montana, Missouri, Colorado, Idaho, Indiana, New Hampshire, South Carolina, Utah, and Washington have proposed legislation, mostly in 2009, to include gold and silver in its accepted currency forms.

Constitutionaltender.com, a site dedicated to tracking and promoting these bills, explains:

The United States Constitution declares, in Article I, Section 10, "No State shall... make any Thing but gold and silver Coin a Tender in Payment of Debts". But, in fact, EVERY state in the United States of America DOES make some other "Thing" besides gold and silver coin a "Tender in Payment of Debts" -- some "Thing" called "Federal Reserve Notes." Thus the need for the "Constitutional Tender Act" -- a bill template that can be introduced in every state legislature in the nation, returning each of them to adherence to the United States Constitution's actual legal tender provisions.

Read Full Article

Everything Is Falling Apart: 20 Facts That You Will Not Want To Read If You Still Want To Feel Good About America’s Decaying Infrastructure

Does anyone have an extra $2.2 trillion to spare?

If you get the feeling that America is decaying as you drive around this great country of ours, it is not just your imagination. It is literally happening.

You should not read the list of facts below if you want to keep feeling good about the condition of America's infrastructure. There really is no way to sugar-coat what is happening. Previous generations handed us the greatest national infrastructure that anyone in the world has ever seen and we have neglected it and have allowed it to badly deteriorate.

This first set of facts about America's decaying infrastructure was compiled from a fact sheet entitled "The Case For U.S. Infrastructure Investment" by an organization called Building America's Future....

*****

#1 One-third of America's major roads are in poor or mediocre condition.

#2 Traffic on more than half the miles of interstate highway exceeds 70 percent of capacity, and nearly 25 percent of the miles are strained at more than 95 percent of capacity.

#3 Americans waste 4.2 billion hours and 2.8 billion gallons fuel a year sitting in traffic – equal to nearly one full work week and three weeks’ worth of gas for every traveler.

#4 Over the next 30 years, our nation is expected to grow by 100 million and highway traffic will double again. Even if highway capacity grows no faster than in the last 25 years, Americans can expect to spend 160 hours – 4 work weeks – each year in traffic by 2035.

#5 Nearly a third of all highway fatalities are due to substandard road conditions, obsolete road designs, or roadside hazards.

#6 Over 4,095 dams are "unsafe" and have deficiencies that leave them more susceptible to failure, especially during large flood events or earthquakes.

#7 Rolling blackouts and inefficiencies in the U.S. electrical grid cost an estimated $80 billion a year.

#8 By 2020, every major U.S. container port is projected to at least double the volume of cargo it was designed to handle. Some East Coast ports will triple in volume, and some West Coast ports will quadruple.

#9 Other countries are leapfrogging past us by investing in world-class ports. China is investing $6.9 billion; the port of Shanghai now has almost as much container capacity as all U.S. ports combined.

#10 By 2020, China plans to build 55,000 miles of highways, more than the total length of the U.S. interstate system.

*****

The rest of these facts were compiled from various sources around the Internet. The more research that you do into America's decaying infrastructure the more depressing it becomes....

#11 According to the U.S. Department of Transportation, more than 25 percent of America's nearly 600,000 bridges need significant repairs or are burdened with more traffic than they were designed to carry.

#12 More than a third of all dam failures or near failures since 1874 have happened in just the last decade.

#13 All across the United States, conditions at many state parks, recreation areas and historic sites are deplorable at best. Some states have backlogs of repair projects that are now over a billion dollars long. The following is a quote from a recent MSNBC article about these project backlogs....

More than a dozen states estimate that their backlogs are at least $100 million. Massachusetts and New York's are at least $1 billion. Hawaii officials called park conditions "deplorable" in a December report asking for $50 million per year for five years to tackle a $240 million backlog that covers parks, trails and harbors.

#14 Over the past year, approximately 100 of New York's state parks and historic sites have had to cut services and reduce hours.

#15 All over America, asphalt roads are being ground up and are being replaced with gravel because it is cheaper to maintain. The state of South Dakota has transformed over 100 miles of asphalt road into gravel over the past year, and 38 out of the 83 counties in the state of Michigan have transformed at least some of their asphalt roads into gravel roads.

So why don't our state and local governments just spend the money necessary to fix all of these problems?

Well, they can't spend the money because they are flat broke.

Just consider some of the financial problems that state and local governments around the nation are facing right now....

#16 One town in Michigan is so incredibly broke that it is literally begging the state to allow them to declare bankruptcy.

#17 One Alabama town is in such financial turmoil that it has decided to simply quit paying pension benefits.

#18 In Georgia, the county of Clayton recently eliminated its entire public bus system in order to save 8 million dollars.

#19 Major cities such as Philadelphia, Baltimore and Sacramento are so desperate to save money that they have instituted "rolling brownouts" in which various city fire stations are shut down on a rotating basis throughout the week.

#20 Detroit Mayor Dave Bing has come up with a unique way to save money. He wants to cut 20 percent of Detroit off from essential social services such as road repairs, police patrols, functioning street lights and garbage collection.

The truth is that there are dozens of cities across the United States that are on the brink of bankruptcy. To see a bunch of high profile examples of this, check out the following article from Business Insider: "16 US Cities Facing Bankruptcy If They Don't Make Deep Cuts In 2011".

But it just isn't local governments that are in deep trouble right now. In fact, there are quite a few state governments that are complete and total financial disaster zones at this point.

According to 60 Minutes, the state of Illinois is at least six months behind on their bill payments. 60 Minutes correspondent Steve Croft recently asked Illinois state Comptroller Dan Hynes how many people and organizations are waiting to be paid by the state, and this is how Hynes responded....

"It's fair to say that there are tens of thousands if not hundreds of thousands of people waiting to be paid by the state."

Investors across the globe are watching all this and they are starting to panic. In fact, investors are now pulling money out of municipal bonds at a rate that is absolutely staggering.

But if states get cut off from all the debt that they need to operate, things are going to get a lot worse very quickly.

Already we are seeing all kinds of troubling signs. For example, the state of Arizona recently decided to stop paying for many types of organ transplants for people enrolled in its Medicaid program.

Sadly, as much as our politicians try to "fix" our problems, things just only seem to keep getting worse.

One prominent illustration of this is our health care system. Our health care system is absolutely falling apart all around us. Thanks to the new health care reform law, doctors are flocking out of the profession in droves. According to an absolutely stunning new poll, 40 percent of all U.S. doctors plan to bail out of the profession over the next three years.

Our economy continues to fall apart as well. The number of personal bankruptcies in the United States continues to set stunning new highs. According to the American Bankruptcy Institute, more than 1.53 million Americans filed bankruptcy petitions in 2010. This was up 9 percent from 1.41 million in 2009.

Not only that, but the housing crisis shows no signs of abating. 382,000 new foreclosures were initiated during the third quarter of 2010. This was up 31.2 percent from the previous quarter and it was 3.7 percent higher than the third quarter of 2009.

The U.S. banking system is also falling apart. In 2006, no U.S. banks failed. In 2009, 140 U.S. banks failed. So did things get better in 2010? No. In 2010, 157 U.S. banks failed.

Unemployment continues to remain at depressingly high levels, and in many areas of the country it is getting even worse. According to the U.S. Labor Department, the unemployment rate rose in two-thirds of America's largest metro areas during November.

Millions of Americans have become so disgusted with the job market that they have given up altogether. The number of people who are so discouraged that they have completely given up searching for work now stands at an all-time high.

So who is doing a booming business during these hard times? Welfare agencies and food banks are. During this economic downturn, millions of American families have found themselves going to a food bank for the very first time ever.

It is getting harder and harder for average American families to feed themselves. A recent survey conducted by the Pew Research Center found that 29 percent of Americans say that it is hard to afford food, and 48 of Americans say that it is hard to afford their heating and electric bills.

So is there any hope for the future? Well, our new college graduates are supposed to lead us into the future, but most of them are saddled with overwhelming amounts of student loan debt. Those who graduated during 2009 had an average of $24,000 in student loan debt. This represented a 6 percent increase from the previous year.

Not only that, but these new college grads are not finding jobs. According to the one recent report, the unemployment rate for recent college graduates was 8.7 percent in 2009. This was up from 5.8 percent in 2008, and it was the highest unemployment rate ever recorded for college graduates between the ages of 20 to 24.

As if all of this was not bad enough, now the Baby Boomers are starting to reach retirement age. Beginning January 1st, 2011 every single day more than 10,000 Baby Boomers will reach the age of 65. That is going to keep happening every single day for the next 19 years.

So where in the world are we going to come up with all of the money to give them the retirement benefits that they are due?

The truth is that we are flat broke as a nation and so America's decaying infrastructure is going to continue to decay. We don't have the money to repair what we already have, much less add desperately needed new infrastructure.

But perhaps it is only fitting. The decay of our roads and cities will match the deep social, moral and political decay that has already been going on in this country for decades.

So will the American people awaken soon enough to be able to recapture the legacy of greatness that previous generations tried to pass on to us?

Unfortunately, the vast majority of our politicians are completely incompetent. Posted below is a short video from Tim Hawkins that is absolutely hilarious but that also demonstrates just how incompetent our government really is....

It's Not Your Imagination: Your Juice Has Been Downsized

|

Where's the beef? Packages of ConAgra's Hebrew National franks are now being sold in package sizes that are about 8 percent smaller than before, according to a Consumer Reports study. |

According to research from Consumer Reports, many companies have been shrinking the size of the products you buy, while charging the same amount for the product.

The report, featured in the February issue of Consumer Reports and online on their Web site, says companies are attributing the downsizing to rising costs for ingredients and energy.

"They've got a point," says Tod Marks, a senior editor at the magazine, in a press release. "Higher commodity and fuel costs are expected to spike in food prices by as much as 3 percent in 2011. But if manufacturers are skimping when costs go up, why aren't they more generous when costs hold steady or fall?"

Good point.

But it's an age-old practice, not limited to any one company, that is often hidden by new package designs and other tactics. For example, a container bottom may be more indented than it was in the past. Companies may also try other ways to cut costs, such as making thinner bottles or plastic film.

Those methods may be a little more palatable than others that may actually affect the quality of a product, such as whipping more air into ice cream, another tactic that was mentioned in the Consumer Reports article.

But either way, it's all about protecting profit margins without an obvious price increase. In the wake of Clorox's [CLX 61.94  0.37 (+0.6%)

0.37 (+0.6%) ![]() ] Monday profit warning, many other consumer staples stocks, including Procter & Gamble [PG 64.80

] Monday profit warning, many other consumer staples stocks, including Procter & Gamble [PG 64.80  -0.15 (-0.23%)

-0.15 (-0.23%) ![]() ], Kraft [KFT 31.53

], Kraft [KFT 31.53  -0.07 (-0.22%)

-0.07 (-0.22%) ![]() ] and Coca-Cola [KO 63.49

] and Coca-Cola [KO 63.49  -0.38 (-0.59%)

-0.38 (-0.59%) ![]() ], have been trading lower.

], have been trading lower.

Moves like these should at least put investors on notice that the companies are anticipating higher costs and are attempting to deal with them.

What's noteworthy is that the study found that the latest reductions cut the size of some packages by as much as 20 percent.

Here's a table of some of the findings:

Shrinking Packages |

| Product | Old Size | New Size | Difference |

| PepsiCo's Tropicana orange juice | 64 oz. | 59 oz | -7.8% |

| Procter & Gamble's Ivory Dish Detergent | 30 oz. | 24 oz. | -20% |

| Kraft American cheese | 24 slices | 22 slices | -8.3% |

| Kirkland Signature (Costco) paper towels | 96.2 sq. ft. | 85 sq. ft. | -11.6% |

| General Mills' Haagen Dazs ice cream | 16 oz. | 14 oz. | -12.5% |

| Kimberly-Clark's Scott toilet tissue | 115.2 sq. ft. | 104.8 sq. ft. | -9% |

| Combe's Lanacane | 113 grams | 99 grams | -12.4% |

| Chicken of the Sea Salmon | 3 oz. | 2.6 oz. | -13.3% |

| Heinz's Classico Pesto | 10 oz. | 8.1 oz | -19% |

| ConAgra's Hebrew National Franks | 12 oz. | 11 oz. | -8.3% |

Consumer Reports offers shoppers some tips on how to deal with the practice, including comparing the unit price, rather than the price of the package, because the packages may be different sizes.

They also suggest shoppers contact the company. Often, the companies offered coupons as an apology.

« Must See: The Fed Is On Top Of The Situation »

Brilliance in oversight from the always reliable Federal Reserve...

Video - Senate Banking Committee hearings, probing mortgage services and foreclosure practices - Dec. 2, 2010

The Federal Reserve's Daniel Tarullo admits when he first learned of fraud probes at GMAC- Ally Bank, a company under the Fed's extra-diligent oversight.

Tarullo's bio page at the Fed...

---

Previously from Tarullo - Read this one...

Fed Governor Issues Warning on Bank Dividends and Mortgage Put-Back Risk

Beijing's 1st maglev light rail to run next week

Related staff indicated that the western section of the S1 Line starts from Shimenying of Mentougou district and ends at the Pingguoyuan station of Shijingshan district. The overall length will stretch over 10 kilometers.

The staff member also indicated that S1 Line is expected to fully completed by the end of 2013.

By Zhang Qian, People's Daily Online

« Need Your Student Loans Paid Off? Get A Job In Congress »

---

Scrutiny Grows as U.S. Pays Staffers' Student Loans

WASHINGTON -- Congress and federal agencies are expected to spend as much as $60 million in fiscal 2009 on a little-known taxpayer-funded perk: repaying government employees' college loans.

Paying off staffers' old student loans is rare in the private sector. And while total spending on the benefit in the federal government remains relatively small, it has multiplied since the program began seven years ago, according to federal records and government officials.

Mike Orenstein, spokesman for the Office of Personnel Management, which handles human-resources policy for the federal government, said the repayment program was adopted across all agencies in the 2002 fiscal year amid competition for professionals at the time. Now, he said, "agencies need to review their staffing levels, their overall needs and resources, and determine whether or not it makes sense to use this program at the current time."

In fiscal 2002, 690 federal government employees in the executive branch received a total of $3 million toward their college bills. By fiscal 2007, the most recent year for which figures are available, 6,600 employees -- most of them lawyers, Federal Bureau of Investigation agents and intelligence officials -- received more than $42 million toward their college bills, according to government records and officials.

Paying off staffers' old student loans is rare in the private sector. And while total spending on the benefit in the federal government remains relatively small, it has multiplied since the program began seven years ago, according to federal records and government officials.

Mike Orenstein, spokesman for the Office of Personnel Management, which handles human-resources policy for the federal government, said the repayment program was adopted across all agencies in the 2002 fiscal year amid competition for professionals at the time. Now, he said, "agencies need to review their staffing levels, their overall needs and resources, and determine whether or not it makes sense to use this program at the current time."

In fiscal 2002, 690 federal government employees in the executive branch received a total of $3 million toward their college bills. By fiscal 2007, the most recent year for which figures are available, 6,600 employees -- most of them lawyers, Federal Bureau of Investigation agents and intelligence officials -- received more than $42 million toward their college bills, according to government records and officials.

###

Related stories...

IRS Rules For Deducting The Cost Of Your MBA

Nurse Outduels IRS Over M.B.A. Tuition Deduction

---

« FISCAL MAYHEM: Illinois Has Days to Plug $13 Billion Deficit That Took Years to Produce »

Bloomberg Video - Jan. 3 - William Atwood, executive director of the Illinois State Board of Investments, talks about the possibility Illinois lawmakers may approve a plan to sell $3.7 billion of bonds to fund the state's pension contributions. Illinois State Board of Investments manages about one-fifth of the pension funds.

---

Illinois lawmakers will try this week to accomplish in a few days what they have been unable to do in the past two years -- resolve the state’s worst financial crisis.

The legislative session that began today as the House convened will take aim at a budget deficit of at least $13 billion, including a backlog of more than $6 billion in unpaid bills and almost $4 billion in missed payments to underfunded state pensions.

The fiscal mess is largely of the lawmakers’ own making, and failure to address the shortages threatens public schools, local governments and other public services, said Dan Hynes, the state’s outgoing comptroller.

“We’ve reached a very critical and concerning point,” Hynes said in an interview in his Chicago office, with packing boxes stacked in the corner. “What’s missing right now is a general understanding by the public of where we are, of how bad it is, and what the fallout would be if we don’t deal with it properly.”

What the public may not appreciate, Wall Street does. Illinois shares with California the lowest U.S. state credit rating from Moody’s Investors Service, which in September forecast possible “further financial deterioration.” Unlike California, Moody’s assigned Illinois a negative outlook.

Illinois’s deficit, about half its $26 billion general-fund budget, puts it among the U.S. states confronting $140 billion in shortfalls in the coming fiscal year after closing $160 billion in gaps this year, according to the Center on Budget and Policy Priorities, a Washington research group.

Hynes, 42, predicted the deficit might rise to $15 billion by midyear, and that prospect has come with a price tag. The cost of insuring Illinois debt against default rose to a five- month high last week as the state headed into this year without a plan to finance a $3.7 billion pension-fund contribution.

Insuring $10 million of Illinois debt against default cost $350,000 a year on Dec. 29, more than California’s $298,000, according to data compiled by Bloomberg. Illinois and Arizona were the weakest states in a Dec. 30 financial-strength index report from the Chicago office of BMO Capital Markets, a financial services company.

Lawmakers meeting in Springfield will consider spending cuts, an expansion of casino gambling and a proposal from Democratic Governor Pat Quinn to borrow $15 billion to pay overdue bills and help fill the budget hole. The bill before the House would create five new casinos, including one in Chicago, and authorize electronic gaming at horse-racing tracks and nine existing casinos. The measure has passed the Senate.

Bill Gross, who runs the world’s biggest bond fund at Pacific Investment Management Co. in Newport Beach, California, said Illinois was one of the states whose debt he would avoid. “Illinois is probably in the worst shape,” Gross said in a Dec. 28 interview on CNBC.

“The state was hoping for a quick recovery or inflation, and they didn’t get it,” Johnson said in a telephone interview. “And there was no appetite to reduce the escalating costs of spending.”

“I think they’re finally educated that all the one-time adjustments and shenanigans have been pulled, and they are now facing the fiscal abyss,” Nowlan said in a telephone interview. “But maybe I’m too hopeful.”

Continue reading at Bloomberg...

---

Illinois is broke.com...

Video: Illinois Is Broke, Bankrupt, Busted

The official website

Illinois budget truth...

Budget Doomsday Is Here For The State Of Illinois

Illinois $10 Billion Pension Spiking Timebomb

---

Honest Abe would be pissed.

B of A Settlement, Another Taxpayer Rip-off

USA Watchdog

In case you have not heard, Fannie and Freddie (also known as Government-Sponsored Enterprises or GSE’s) settled a big lawsuit with Bank of America Monday. The case was settled for cents on the dollar, even though the GSE’s had had a strong case to force B of A to buy back billions in sour mortgage-backed securities (MBS.) I wrote about some of this in a December 1 post called “Foreclosure Bombshell.” The post was about some of the legal trouble Bank of America was having with the mortgage debacle and the possibility of the banks being forced to buy back billions in sour MBS. Here’s part of what I wrote back then, “Mortgage-backed securities have to meet what is called “contractual representation and warranties.” That basically means the MBS are required to be free of fraud and be exactly what the seller says they are. Do you think mortgage-backed securities are free of fraud? Do you think these securities are the triple-A rated risk free investment the big Wall Street banks claim?—NO WAY! The banks are going to be forced to buy back all the toxic mortgage junk they sold. (Click here to read the entire post.)

On Monday, after news of the Fannie and Freddie settlement, I got a gloating comment from a reader named “Rick.” Rick tells me he’s retired from the “finance industry.” Here’s some of what he wrote, “I told this would be nowhere as bad as most made out. Hope you read about the settlement with the GSE’s With BofA, 1.3b, this makes BofA total exposure probably around 3b going forward, not the 50B+, everyone thought. Additionally, B of A audit by Moody’s and others has been complete and found that Loan doc’s were delivered. PIMCO will settle for very little in the coming weeks and AG’s to follow. NO Conspiracy and Fraud as you have promoted on your blogs, just very bad process. As stated in our last exchange, I hope you man up and write a new blog retracted and admitting you got a little carried away with you statements. This is what happens when you repeat from others and do not do your own homework. Just remember the fraud was committed buy the rating agencies not the Banks.” (You can read the entire exchange at the end of the Foreclosure Bombshell post.)

I’ll “man up”alright. Yes, Rick you were right, the American taxpayer got ripped-off once again. It was not that bad for B of A because it is another back door bailout for the banks that caused the mortgage mess in the first place. The headline over at Fortune/ CNNMoney.com says it all “Is Fannie bailing out the banks?” Of course, the answer is YES! The report goes on to say, “Monday’s arrangement, according to this view, will keep the banks standing — but leave taxpayers on the hook for an even bigger tab should a weak economic recovery falter. Sound familiar? ‘The administration is trying to weave a path between two bad alternatives,’ said Edward Pinto, a resident scholar at the American Enterprise Institute. “They want to bail out the big banks without doing apparent damage’ to the sagging U.S. budget position.” (Click here to read the entire Fortune/CNN report.)

This is an outrage, especially when you consider what kind of a sweet deal B of A got. Investing expert and owner of a blog called The Big Picture, Barry Ritholtz framed the B of A settlement this way, “Bank of America settled numerous claims with Fannie Mae for an astonishingly cheap rate, according to a Bloomberg report. A premium of $1.28 billion was paid to Freddie Mac to resolve $1 billion in claims currently outstanding. But the kicker is that the deal also covers potential future claims on $127 billion in loans sold by Countrywide through 2008. That amounts to 1 cent on the dollar to Freddie Mac. Imagine if you had a $500,000 mortgage, and you got to settle it for $5,000 — that is the deal B of A appears to have gotten from Freddie Mac.” Click here for the complete Ritholtz post.)

Read Full Article

China media report mystery stealth fighter photos

|

| photo source: China Defense Blog |

Associated Press

Photos leaked online that appear to show a prototype of China's first stealth fighter jet were discussed in state media Wednesday — a move that supports claims the country's military aviation program is advancing faster than expected.

Both the English and Chinese language editions of the Global Times ran front-page articles on the photos of what appears to be a future J-20 fighter, along with extensive reports on the buzz the pictures have generated overseas.

Photos of the plane appeared on unofficial military news websites and hobbyist blogs last week and were still viewable Wednesday.

The Global Times did not comment on the authenticity of the pictures, but since the government wields extensive control over state media, the report's appearance and the fact that censors have not removed images from websites suggest a calculated move to leak the information into the public sphere.

That in turn would reflect the growing confidence of the traditionally secretive People's Liberation Army, which is pushing for greater influence and bigger budgets.

Read Full Article

CORRECTED - UPDATE 2-BJ's to close 5 stores; Dec comp sales up 3.8 pct

(Corrects December same-store sales estimates in 1st bulletpoint and in paragraphs 6 and 7)

* Dec comp sales ex-gas up 1.4 pct vs Street view 3.4 pct

* Sees restructuring charge of $0.78-$0.82/share in Q4

* Names new CFO

NEW YORK, Jan 5 (Reuters) - BJ's Wholesale Club Inc (BJ.N), which is on the auction block, said it would close five stores due to weak sales and take a charge for restructuring.

BJ's, which operates 194 stores that sell goods at a discount to its members, said on Wednesday it was closing three stores in Atlanta, one in Sunrise, Florida, and another in Charlotte, North Carolina.

In November, BJ's hired Morgan Stanley (MS.N) to run an auction of the company and explore other strategic options. Leonard Green & Partners LP announced a 9.5 percent stake in the company in July and said it might propose taking it private.

BJ's could not be reached immediately for comment.

The company said it plans to restructure its home office and some field operations, and estimated it would take a charge of 78 cents to 82 cents a share in its fourth quarter, which ends Jan. 29, for those projects and the store closings.

The retailer said comparable-store sales, including gasoline sales, rose 3.8 percent in December, hurt in part by a snowstorm that hit the U.S. East Coast late in the month. That missed Wall Street forecasts for a 4.4 percent increase, according to Thomson Reuters.

Excluding gasoline, comparable sales were up 1.4 percent, well below the 3.4 percent analysts were expecting.

BJ's also said Robert Eddy would succeed Frank Forward as chief financial officer, effective Jan. 30. (Reporting by Helen Chernikoff and Phil Wahba; Editing by Derek Caney, John Wallace, Dave Zimmerman)