by Zig Lambo of

The Energy Report (7/9/13)

The “Bernanke Put,” or promises of quantitative easing, has become

the standard government response to economic uncertainty. But while the

powers that be insist everything’s fine, Sprott Resource Corp. Founder

Kevin Bambrough and COO Paul Dimitriadis see financial deterioration

around the globe. Only one thing is for certain: Taking the contrarian

view provides the best opportunities to buy low and sell high. In this

interview with

The Energy Report,

they explain why they expect energy assets to perform better in the

long haul, cluing us in on a few names they are considering for big

returns.

The Energy Report: How would you characterize the current economic background? Are things really looking better in your view?

Kevin Bambrough: Markets typically peak when fear is low and

complacency is high, and bottom when fear is rampant and people are

extremely worried. The U.S. markets in general have performed quite well

this year, but the U.S. bond markets have started to see a lot of

hiccups. The European debt market still remains on very shaky ground.

The Chinese debt market is now showing major problems in the banking

system and the Japanese are still trying to find a solution to their

debt woes with increased monetization, and have started an aggressive

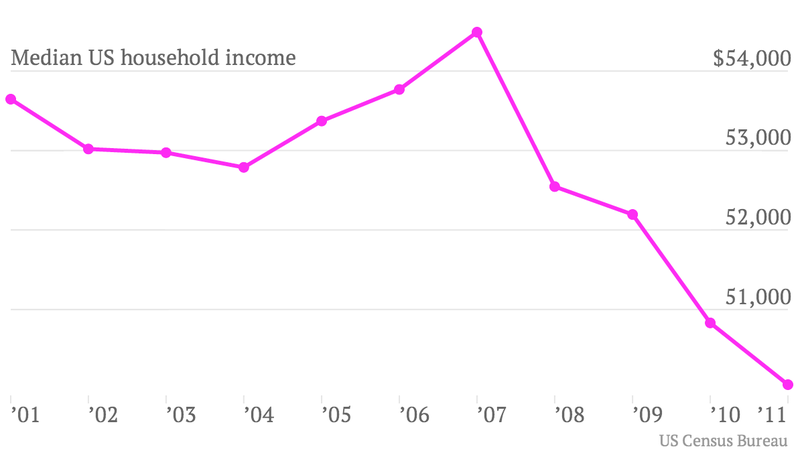

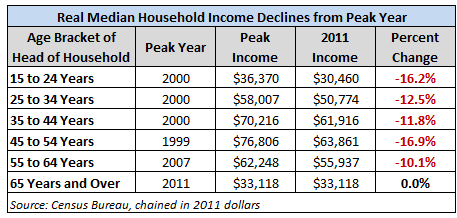

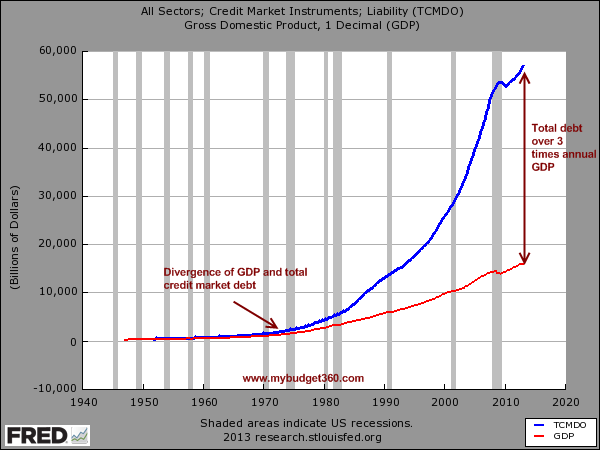

currency devaluation exercise. Debt levels for governments and

individuals around the world are still at unsustainably high levels

relative to GDP or individual incomes.

Bankers and governments continually lie to the public and pretend

that things are better than they are. If they told the truth, no one

would own a bond or keep money idle in cash. These days, the government

guarantees and what people have referred to as a “Bernanke put” are the

only reason rates are low and the bond market doesn’t crash. The Federal

Reserve must talk tough from time to time and pretend it’s going to

curtail its quantitative easing. The fact is it can’t.

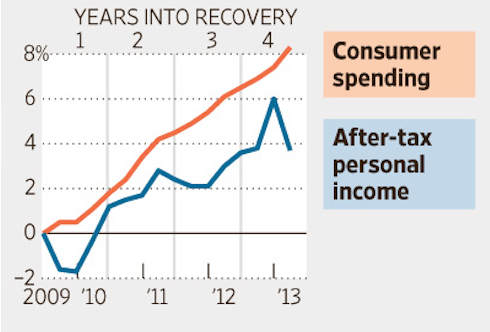

Curtailing quantitative easing would force interest rates back up

significantly, increase the government debt burden and raise the

deficit. At the same time, it would crush the housing market and

over-levered consumers already struggling to pay off their mortgages.

The increased debt burden would bankrupt governments, individuals and

the entire financial system.

TER: So realistically we’re stuck with low interest rates for the foreseeable future?

Paul Dimitriadis: There’s no way that rates, in my view, are

going to rise anytime soon. The Federal Reserve knows it can’t allow

them to rise materially. Americans may have an egocentric view that

everything is fine because the S&P 500 is at a new high. Globally,

the situation is not that great. The emerging markets have performed

terribly this year and we’re starting to see unrest in a number of

places around the world as social situations deteriorate rapidly, mainly

in Brazil, Turkey, Egypt and such. All is certainly not well and I

don’t expect the situation to get better anytime soon.

TER: When will everybody realize this is all a big charade?

KB: I often try to predict the catalyst that breaks the bond

bubble. Government bonds are primarily held by mega funds, and sovereign

banks. The banks around the world do it because they can lever up and

play the

carry-trade game. Most governments do it to keep their currencies low and support their export economies.

If interest rates rose, banks would be bankrupt, so they have no

interest in seeding their demise. Governments try to pretend that

deficits are going to eventually be brought under control, and

continually make statements that there is no inflation, so they can

prevent their currencies and bond markets from collapsing. Whenever

economies slow as a result of higher interest rates, consumer confidence

drops and interest rate-sensitive sectors like housing slow. Central

bankers, or shall we say central planners, will become more aggressive

with quantitative easing and bring the rates down to try to kick-start

the economy again. That’s the delicate game they have to continue

playing.

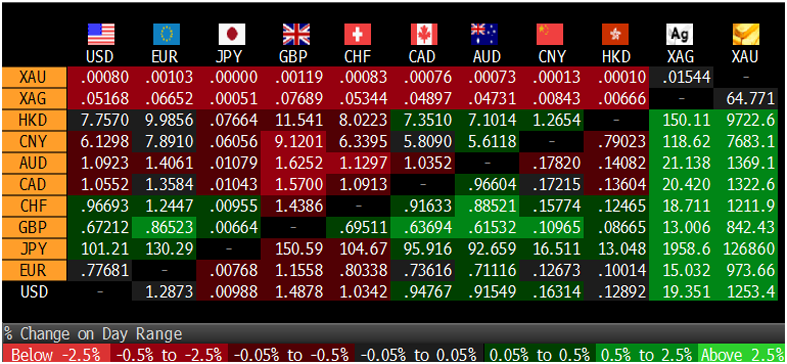

I expect this will continue for many years until the systemic U.S.

trade deficit stops being funded by foreigners. It could be a few months

from now or a few years, but eventually foreigners will come to

understand the stupidity of buying U.S. government bonds to try to help

their economies. I believe this is the Achilles heel of the system, and

the U.S. dollar reserve-based global financial system’s days are

numbered. The U.S. dollar will lose its reserve currency status when the

Chinese, Japanese, Koreans and other major purchasers of U.S. bonds

decide it’s not in their best interest to continue doing so. For the

longest time, China and other countries have viewed purchasing U.S.

bonds as an effective way to keep their currencies relatively stable.

But at some point they’re going to give up on the foolishness of

supporting the U.S. trade deficit and focus more on their domestic

economy, rather than on competitive devaluation to support exports. The

fact is, they collectively have been giving the U.S. over $500 billion

worth of goods and services per year for over a decade. They will recoup

little from these “loans” in the future. When they try to cash in their

bond holdings, they will find there is no buyer other than the Federal

Reserve, which will deliver them freshly printed currency that will only

be accepted in the U.S.A. because no foreigner will want to accumulate

more. When the trillions sent overseas come home to the U.S., inflation

will explode and trade restrictions will rise.

TER: So how do we convert this into an investment strategy from a contrarian viewpoint?

KB: It is difficult to try to determine the best asset class

to own. You also have to pick a time horizon and focus on what the world

is going to look like 10–20 years from now and evaluate the asset

classes that could give the best rate of return. Ultimately, we always

come back to what we believe—that food, energy and other base and

precious metals will do better in the long run. The key to investing in

cyclical resource sectors is buying when they’re depressed. Now we’ve

got a situation where they’re extremely depressed in many sectors.

TER: What are you doing at Sprott to deal with the current

market environment for energy-related investments? Has your approach

changed since your last

interview?

KB: Precious metal equity values have come down substantially

this year and we’re starting to see some very good value and

opportunities in that sector. As for base metals, we still think there’s

more potential downside.

We’re quite optimistic on developments in the natural gas market.

Last year’s injection season marked the smallest inventory increase in

the modern history of the natural gas market. The withdrawal season was

also the third largest on record, and that was with relatively average

winter weather. At around $4 per thousand cubic feet ($4/Mcf), demand is

going to continue to grow faster than supply and that price will

eventually be pushed higher. That will create value for companies like

Long Run Exploration Ltd. (LRE:TSX), which we own, and which has significant natural gas exposure as well as stable profitability from its oil production.

PD: Purely gas-focused drilling activity is almost down to

zero. We need to see higher prices to generate drilling demand from

producers, which I think we will begin to see this year.

KB: Another sector that’s been quite depressed is coal, mostly

as a result of low natural gas prices. A lot of mines have had to close

or go through a restructuring. It looks like we’re getting closer to a

historic bottom in coal equity valuations and so we’re looking around

for opportunities to get some long-term exposure to that sector.

PD: As an example,

Arch Coal Inc. (ACI:NYSE) is down from $28 to below $4 in the past two years. It was up over $70 around five years ago before the financial crisis.

KB: During a boom in any sector, a lot of the big companies

are tempted to take on debt and continue acquisitions. Arch Coal still

has a significant amount of debt. There are other coal companies that

will certainly survive. We may not be incentivized to bring a new coal

mine into production today, but there’s

great incentive for us to buy coal mines that have long life reserves and wait.

TER: You mentioned Long Run, which we talked about during your last interview. Where do you think that one’s going?

PD: The company merged last fall (Guide Exploration Ltd. and

WestFire Energy Ltd. combined to form Long Run) and recently completed

its first couple of quarters as a new entity. Production is going well

and cash flow is meeting expectations. It’s focusing on oil production

exclusively this year due to the oil and gas pricing environment.

There’s a lot of room to pay a dividend later this year or next perhaps,

which both we and the market would welcome seeing. Long Run’s gas

reserves are significant, so there is huge optionality on the gas side.

Overall, it’s a solid story and it’s discounted to its peers, probably

because it’s a new name and there’s currently a lack of fund flows into

the general Canadian energy market.

Looking at the various metrics relative to its peer group, you can

safely conclude that it’s trading at a 30–40% discount. If the sector

gets revalued because money starts flying back into it, things can go

higher from there. The optionality in the gas market could take the

stock even higher.

TER: Sprott Resource Corp. completed that nice deal on its

Waseca Energy Inc. holdings last year when it sold out to Twin Butte

Energy after four years.

KB: We were very pleased with the performance of that company.

Again, we stuck with our strategy of investing in a sector while it was

depressed. We bought into heavy oil when it was no bid in Canada,

formed the company and ultimately were able to monetize it when margins

were significant and the company had grown from zero production into a

+4,000 barrels per day company. That delivered another big win for our

shareholders with a nearly $70 million profit.

PD: Along that same vein, we’ve invested in a drilling company

based out of Houston, Texas called Independence Contract Drilling just

over a year ago. It drills shale formations and, again, we invested in

the sector when it was generally out of favor, and built the company up

from book value to probably having above 12 rigs in production by the

end of next year. I expect that at that time we will be able to

capitalize on its strong cash flow and look for some sort of

monetization, whether it’s an IPO or sale of the business.

TER: Another area we haven’t talked about yet is uranium. I know you’re into

Virginia Energy Resources Inc. (VUI:TSX.V; VEGYF:OTCQX). What’s the update on that name?

KB: The uranium market is similar to coal. Natural gas has

weakened valuations and demand in all energy sectors. Fukushima also

really upset the short-term demand and created a very negative sentiment

in the nuclear space. But demand for physical uranium for nuclear power

production is going to grow over the next decade or two and mine supply

will fall short with $40 per pound ($40/lb) uranium. When we look at

overall planned, permitted nuclear facility growth and as well as

extensions of the existing facilities, we see robust demand and we see

very little supply coming on the market.

PD: We will see large supply shortfalls emerging in the next

few years. The market’s going to have to catch up on funding mines,

because funding has been scarce over the last few years. We believe a

uranium price north of $75/lb is going to be required to balance supply.

Although the Commonwealth of Virginia has not yet passed legislation

that would provide a framework for permitting uranium mining projects,

we are hopeful it will in the near future. At that point the company

would be greatly positively revalued.

KB: Regardless of the uranium market, Virginia Energy

Resources is one of the largest undeveloped uranium projects in the

United States, and major producers will likely try to take out Virginia

Energy Resources when the permitting framework is in place.

TER: Where you see opportunities in the fertilizer/potash markets?

PD: Potash prices have softened a bit lately. We’ve invested in one potash company that produces SOP potash, called

Potash Ridge Corp. (PRK:TSX; POTRF:OTCQX).

It is developing a project in Utah, we think has very favorable

economics based on the preliminary economic assessment. A prefeasibility

study is expected in the next couple of months, which should give

greater clarity on that project. The project’s key benefits are the

byproducts in the deposit, which lower the production cost dramatically.

It should be one of the lowest-cost producers of SOP potash, which is a

growing market globally. We’re optimistic that someone is going to have

an interest in an offtake agreement and perhaps assist with the

financing in the next 12–18 months.

The phosphate market has been more stable than the potash side. In

the U.S., there is some risk for domestic producers due to potential

shortfalls in their mines over the coming year. The phosphate market

could be in very good shape over the next five years as those companies

seek to replace their production. We’re quite optimistic about one of

our investments in a company called

Stonegate Agricom Ltd. (ST:TSX, SNRCF:OTCPK), which is developing its potash project in Idaho. That should come into production in late 2014 or 2015.

TER: Do you have any final thoughts you’d like to leave with us?

PD: The resource sector, generally, is probably the most

out-of-favor it has been in a long, long time. If you’re ever going to

put money to work in this sector, right around now would probably be an

opportune time to do so.

KB: This is the kind of market that really allows those who are willing to step up and invest to make a lot of money.

TER: Thank you gentlemen, for your updates and insights today.

Kevin Bambrough

founded Sprott Resource Corp. in September 2007. He is a seasoned

financial executive with more than a decade of investment industry

experience and is a recognized leader in the commodity investing space.

Since 2009, he also has served as president of Sprott Inc., one of

Canada’s leading asset managers, which has more than $8 billion in

assets under management. Between 2003 and 2009, he held a number of

positions with Sprott Asset Management, including market strategist, a

role in which he devoted a significant portion of his time to examining

global economic activity, geopolitics and commodity markets in order to

identify new trends and investment opportunities for Sprott Asset

Management’s team of portfolio managers.

Paul Dimitriadis

is Chief Operating Officer for Sprott Consulting and Sprott Resource

Corp., where he evaluates and structures transactions, coordinates and

conducts due diligence and is involved in the oversight of subsidiaries

and managed companies. He serves on the board of directors of two of

Sprott Resource Corp.’s subsidiaries, Stonegate Agricom Ltd. and Long

Run Exploration Ltd. Prior to joining the Sprott group of companies, he

practiced law at Blake, Cassels & Graydon LLP. Dimitriadis holds a

Bachelor of Laws degree from the University of British Columbia and a

Bachelor of Arts degree from Concordia University.

Want to read more

Energy Report interviews like this?

Sign up

for our free e-newsletter, and you’ll learn when new articles have been

published. To see a list of recent interviews with industry analysts

and commentators, visit our

Interviews page.

DISCLOSURE:

1) Zig Lambo conducted this interview for

The Energy Report and provides services to

The Energy Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of

The Energy Report: Virginia Energy Resources Inc. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Kevin Bambrough: I or my family own shares of the following

companies mentioned in this interview: Sprott Resource Corp. I

personally am or my family is paid by the following companies mentioned

in this interview: Sprott Resource Corp. My company has a financial

relationship with the following companies mentioned in this interview:

Sprott Resource Corp. I was not paid by Streetwise Reports for

participating in this interview. Comments and opinions expressed are my

own comments and opinions. I had the opportunity to review the interview

for accuracy as of the date of the interview and am responsible for the

content of the interview.

4) Paul Dimitriadis: I or my family own shares of the following

companies mentioned in this interview: Sprott Resource Corp. I

personally am or my family is paid by the following companies mentioned

in this interview: Sprott Resource Corp. My company has a financial

relationship with the following companies mentioned in this interview:

Sprott Resource Corp. I was not paid by Streetwise Reports for

participating in this interview. Comments and opinions expressed are my

own comments and opinions. I had the opportunity to review the interview

for accuracy as of the date of the interview and am responsible for the

content of the interview.

5) Interviews are edited for clarity. Streetwise Reports does not

make editorial comments or change experts’ statements without their

consent.

6) The interview does not constitute investment advice. Each reader

is encouraged to consult with his or her individual financial

professional and any action a reader takes as a result of information

presented here is his or her own responsibility. By opening this page,

each reader accepts and agrees to Streetwise Reports’ terms of use and

full legal disclaimer.

7) From time to time, Streetwise Reports LLC and its directors,

officers, employees or members of their families, as well as persons

interviewed for articles and interviews on the site, may have a long or

short position in securities mentioned and may make purchases and/or

sales of those securities in the open market or otherwise.

Streetwise –

The Energy Report

is Copyright © 2013 by Streetwise Reports LLC. All rights are reserved.

Streetwise Reports LLC hereby grants an unrestricted license to use or

disseminate this copyrighted material (i) only in whole (and always

including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed

on the home page in the In This Issue section. Their sponsor pages may

be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in

The Energy Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8204

Fax: (707) 981-8998

Email:

jluther@streetwisereports.com