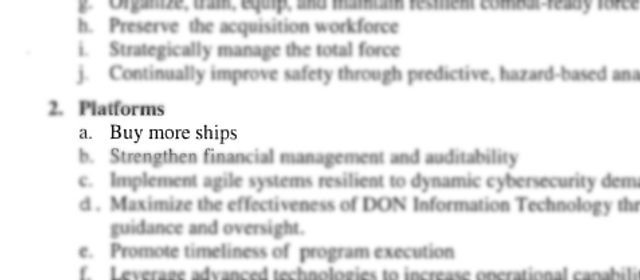

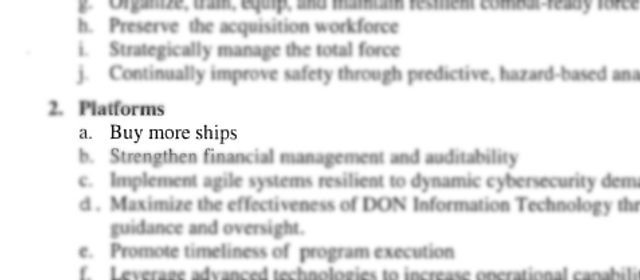

The US Navy’s “goals and objectives” outline for 2016, released

last week, does not mince words: the first goal listed in the second

subhead reads: “Buy more ships.”

And that is exactly what the world’s most powerful navy is doing. On

Wednesday, the Defense Department announced it was moving forward with

plans to replace its Ohio-class ballistic missile submarines, the most

lethal killing machines in the history of mankind, with a completely new

design beginning in 2021.

Each Ohio-class ballistic submarine is, by itself, the fifth most

powerful military in the world. The Navy operates 14 of them. Each

submarine carries 24 Trident II missiles, with each missile carrying

eight warheads with a yield six times greater than the “little boy” bomb

that killed over a hundred thousand people in the US bombing of

Nagasaki, Japan, in 1945.

Image: The Navy’s Goals and Objectives outline for 2016

With an effective range of more than 7,456 miles, a single Ohio-class

submarine in the waters outside of San Diego could obliterate 192

cities in western China, with a combined population of 400 million

people, if the commander-in-chief were so inclined.

Image: A comparison of the world’s aircraft and helicopter carriers

Image: A comparison of the world’s aircraft and helicopter carriers

But the Ohio class is apparently in need of an upgrade, and the White

House gave the Pentagon the go-ahead last Monday to send a “Request for

Proposal” to the ship’s contractor, General Dynamics Electric Boat,

approving funds for the building of a prototype. Each submarine, of

which there will be 12, will cost an estimated $6-8 billion—not

including research and development costs, the price of each submarine’s

nearly 200 nuclear warheads, and associated operating costs—up from $2

billion for the Ohio class.

The day after the White House gave the go-ahead for replacing the

Ohio-class submarines, the Center on Budget and Policy Priorities (CBPP)

reported Monday that up to a million people will lose food stamp

benefits in 2016.

Twenty-three states are expected this year to lift a moratorium on

one of the harshest austerity measures imposed by the Clinton

administration’s “welfare reform” program, which caps the amount of time

many people are eligible for food stamps at three months. The time

limits were halted during the recession, but under the pretense that

there is “no money,” to pay for food stamps, states all over the country

are re-imposing the time limits.

“The loss of this food assistance, which averages approximately $150

to $170 per person per month for this group, will cause serious hardship

among many,” reported the organization. The CBPP notes, “USDA data show

that the individuals likely to be cut off by the three-month limit have

average monthly income of approximately 17 percent of the poverty line,

and they typically qualify for no other income support.”

In announcing the food stamp cuts, Clinton pledged to “spend the

taxpayers’ money wisely and with discipline, that we can spend more

money on the future.” If he had been telling the truth, he would have

declared that he was proposing the cuts so that the Navy could “Buy more

ships.”

After all, the money has to come from somewhere. And it’s easiest to

take from those who are the least capable of defending themselves. In

addition to the poor people who depend on food stamps to survive,

working class children have been targeted.

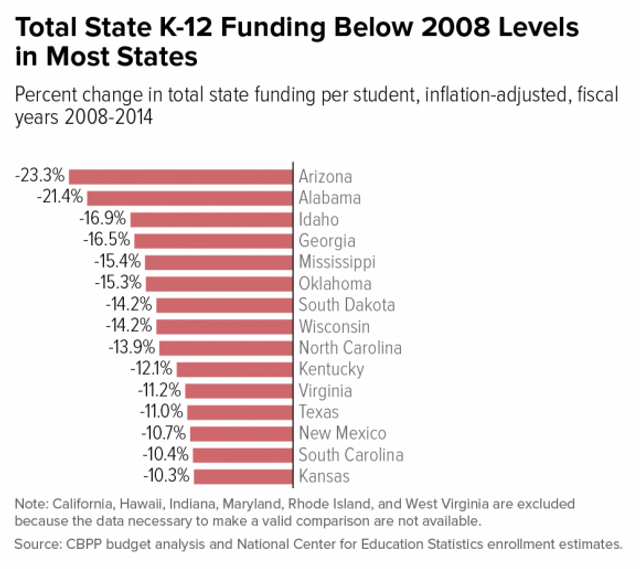

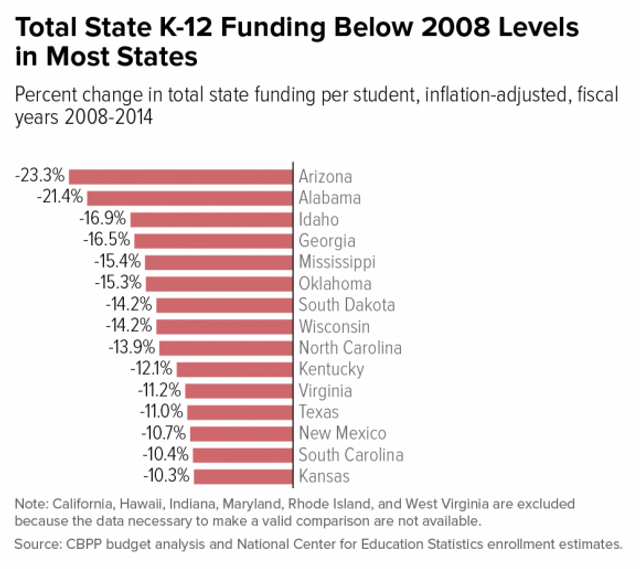

The same day that the White House gave the go-ahead for the design of

the new submarines, the CBPP released a report showing that funding for

schools has been slashed in most states since 2008, and in 15 states by

more than 10 percent. Arizona has cut education spending by 23.3

percent, Alabama by 21.4 percent, Idaho by 16.9 percent, and Georgia by

16.5 percent.

Image: States have slashed education spending since 2008

Image: States have slashed education spending since 2008

While there is, of course, no money for children and the poor,

defense contractors are licking their chops over the expected uptick in

global military spending resulting from the wars flaring out of control

in the Middle East and the growing standoff in Eastern Europe and the

Pacific.

Defense industry analyst Deloitte gleefully declared earlier this

month that military spending is “poised for a rebound” as a result of

“heightened tensions” around the world.

It notes,

“2015 was a pivotal year that saw heightened tensions

between China, its neighbors and the US over ‘island building’ in the

South and East China Seas, and the related claims of sovereign ocean

territory rights by China. In addition, Russia and the Ukraine are at

odds related to Russia’s takeover of Crimea and their military actions

in Eastern Ukraine,”

while “The recent tragic bombings in Paris, Beirut, Mali, the Sinai

Peninsula, and other places have emboldened nations to join in the fight

against terrorism.”

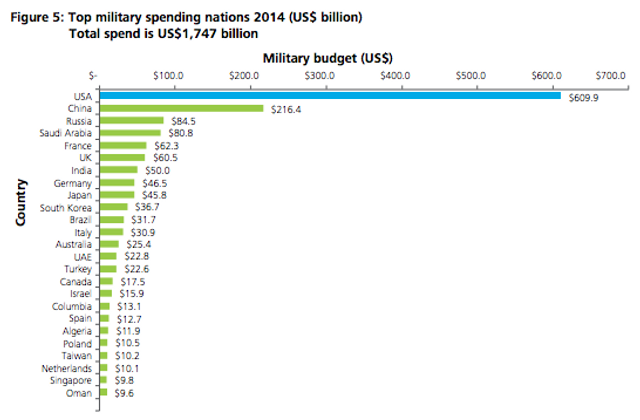

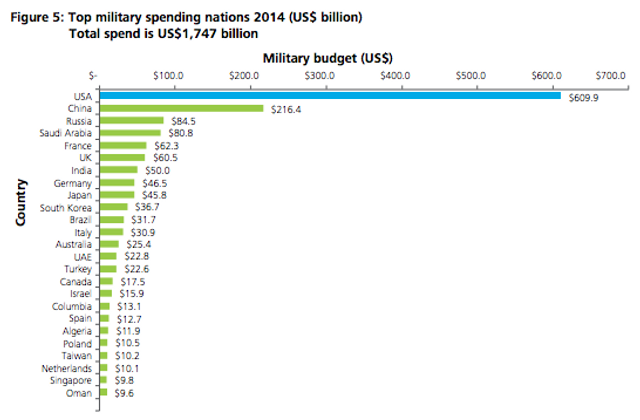

Image: The US spends more on its military than the next seven countries combined

Image: The US spends more on its military than the next seven countries combined

The report notes that “improved profitability” will result from

“renewed interest from buyers” in acquiring “armored ground vehicles,

ground attack munitions, light air support aircraft” and “maritime

patrol ships and aircraft,” as “the military operations tempo is likely

to increase and more missions are executed.”

The global uptick in military spending coincides with a major new

shopping spree by the United States, which spends as much money on its

military as the next seven countries—China, Russia, Saudi Arabia,

France, the UK, India and Germany—combined. The US expends $609.9

billion out of the $1.7 trillion spent worldwide by all countries each

year on war.

But this figure is slated to surge as “Many large, mainly US

[Department of Defense] programs representing billions of US dollars,

are likely to start soon, enter the engineering manufacturing design

phase, and reach low-rate or full-scale production over the next few

years. These programs include Ohio Class Submarine replacement, F-35

fighter jet, KC-46A aerial refueling tanker, and Long Range Strike

Bomber.”

Just one of these programs, the F-35 “Lightning II,” plagued with

delays and cost-overruns, will cost $1.45 trillion over its lifecycle,

more than twice the amount that state, federal, and local governments

spend educating 50 million children each year.