The current struggle to add jobs brings up bigger implications for the flailing housing market. The recent report on jobs reflects the underlying reality that the recession is still ongoing for many Americans. The recession officially ended in summer of 2009 but this is really only because of the expansion of GDP that was juiced by large investment banks leveraging cheap money from the Federal Reserve. Some of this money trickled into the housing market but here we are facing a double-dip in housing and a possible double-dip for the economy. The quality of jobs being added is also a hindrance to potential home price growth. The 54,000 added jobs fell well short of the 150,000 baseline figure just to keep steady with demographic growth. Then you have places like McDonald’s going on hiring sprees but how is this good for home values? The Great Recession is looking a lot of like the Great Depression in duration even though official GDP figures reflect a different story.

This is part 32 in our Lessons from the Great Depression series:

28. The Gospel of Economic Prosperity

29. New home sales fell 80 percent from 1929 to 1932 and fell 82 percent from 2005 to 2011.

30. Economic déjà vu from the 1937-38 recession

31. When government and financial institutions become one.

32. Housing prices continue to fall as other costs eat up disposable income.

The question of jobs

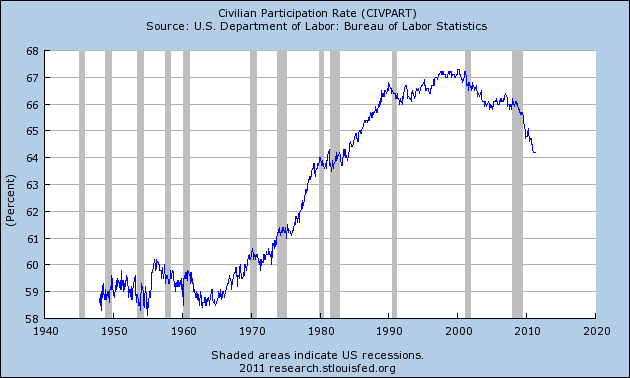

One of the better measures of employment health is the civilian participation rate. The above chart reflects the more than a decade long trend of doing more with fewer workers. This might seem good in terms of productivity but technology and banking thievery have allowed more workers to be shelved in the market. This might be good for the bottom line of a banking CEO but this reduces the number of households with adequate income to support the housing market. This is why home prices have now reached a new nominal post-bubble low:

By far this is the deepest housing crash on record. Home prices are falling lower even in the face of record low mortgage rates and the Federal Reserve eating up over $1 trillion in mortgage backed securities that the market wants nothing to do with. Again the question should be about jobs but also the quality of jobs being added. Simply adding tens of thousands of people working at McDonald’s or Wal-Mart does little for the growth in U.S. housing. So this pushes home values into the worse housing crash ever:

Source: Economy.com

One of the big issues of the Great Depression was creating jobs. People may forget that even after massive government intervention the unemployment rate remained in double digits for the entire 1930s. Government spending directly on hiring people did help but it was not the answer to the panic and market collapse of the 1920s. The 1920s was an era of graft and spectacular market speculation. It was a bubble market like the 1990s tech bubble or the 2000s real estate bubble. It seems that our economy is one of continuous bubbles when Wall Street is allowed to reign supreme. Only after World War II did we see long-term sustained growth for many Americans, not only the financial elite who were kept in check by adequate market enforcement.

When do we get back to normal?

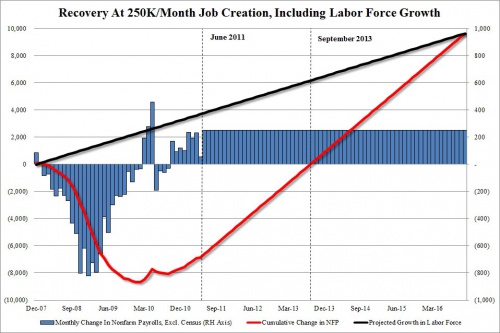

The question of back to normal for most people is one in which the unemployment rate is low. What use is it if a certain company is making billions of dollars in profits but employs people overseas while enjoying the laws and government structure of the U.S.? This is a new market in which unemployment is absurdly high yet profits are still decent for companies as they gouge local employees and off shore jobs to the cheapest markets possible to exploit workers abroad. Again, how is this good for housing values? Next, just to get back to pre-recession unemployment we would have to add 250,000 jobs for many months straight:

Source: Zero Hedge

66 months it would take. Does that even seem plausible with the current number of jobs being added? The Great Depression struggled for over a decade to add jobs. We are now four years away from the start of this recent recession and here we are with an official 9.1 percent unemployment rate. Much of the support was through trillions of dollars channeled into the financial system but also government investment into projects. What industries are hiring right now? If we look at the BLS report closely we see a good amount in service sector jobs (i.e., McDonald’s) and health care (i.e., hello old baby boomers). This is the big part of our growth. Both of those groups cannot support the over 6 million homes in the shadow inventory.

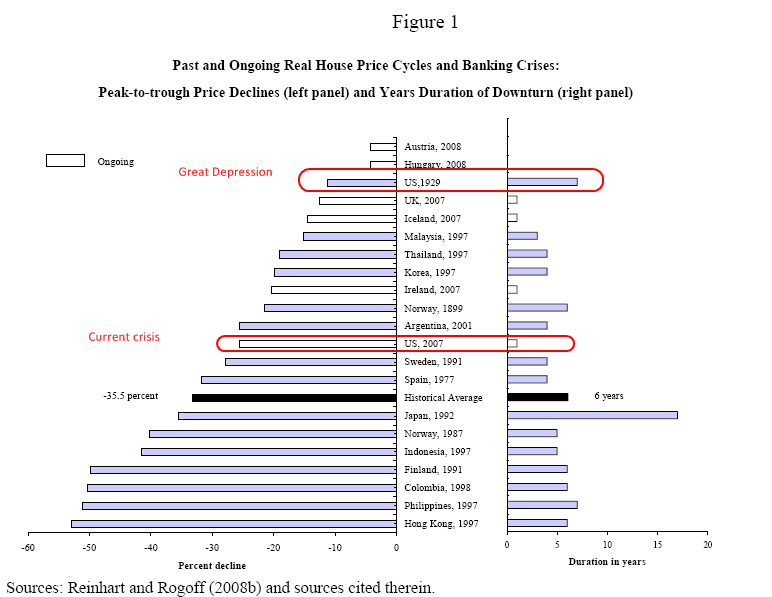

Price floors rarely work in the long-run but this is what the government and Wall Street have tried to do with the housing market. How can you keep prices inflated if incomes are falling? Keep in mind the data only reflects those who are working because if you are unemployed, your real income is actually zero. This is now becoming one of the longest downturns in U.S. history:

Home prices are now lower so this is an ongoing issue here. Yet we have seen markets fall much harder as well. U.S. home prices as measured by the Case-Shiller are down over 30 percent. Will our bottom be at 40 or 50 percent? I think this question will be answered not on the housing front but on the employment front. Many areas in the country now have ridiculously low housing prices like Arizona, Nevada, and Michigan. But there is reason for that and that involves lack of jobs. Investors have swarmed Nevada and Arizona but most of the selling after the fact has been to other eager investors. The underlying market is weak for those who actually live in those areas. The low prices simply reflect this new reality. To think prices will zoom back up is naïve at best but many of these people are coming in with cash so at least they are not borrowing government loans to speculate in their endeavors.

The end of worker protection

Source: Vote Now

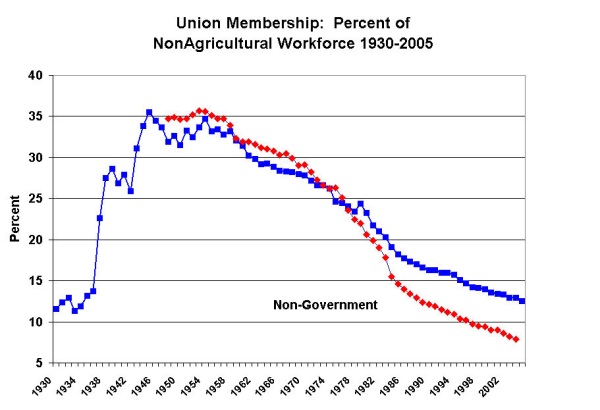

Some of the strongest growth our country has ever experienced came with a large portion of our economy being supported by unions. From 1945 to 1960 over 30 percent of non-agricultural workers worked under a union. No doubt there are serious issues with unions but here you have some protection for workers. Keep in mind prior to the Great Depression you have extreme worker exploitation and massive income inequality. Six or seven day work weeks, child labor, and unsafe working conditions and this was argued as being part of the “free market” so those that argue it today fail to parallel this massive predatory market with how the current de-regulated Wall Street ran roughshod on the American public. But guess what? The union apparatus is virtually non-existent today so you can’t blame that for our current demise.

The voice of the working and middle class American has been drowned out and ironically many keep voting for laws and regulations that keep the gig going for the predators. For example, last week extremely favorable regulations passed for the paper-mill for-profit colleges and guess what happened to their stock values?

“(Fast Company) It’s a heartening example of government working for you–if “you” means a team of lobbyists. Shares of Apollo Group (Phoenix U), the Washington Post Co (Kaplan U), and other publicly traded for-profit colleges rose sharply yesterday as the Department of Education released new regulations for the sector, significantly softened from a draft version published last July.

The original idea behind the “gainful employment” rules was to impose a little basic accountability on the kinds of colleges that advertise on the bus, by the crude measure of whether their graduates are able to pay back their student loans. Besides the obvious public interest, the federal government has significant skin in the game here: it underwrites these loans, to the tune of almost three quarters of a trillion dollars. And for-profit students, who make up only 12% of all college students, account for 46% of loan defaults.

Under the new rules, colleges with pretty crappy results will remain eligible for federal student aid. As long as at least 35% of grads are paying back their loans, the college is A-OK. It even counts if the former students are on an interest-only payment plan, which can keep students indebted for 25 years or more. No colleges will be kicked out of the program until at least 2016, and there’s a three-strikes rule, meaning they must fail three out of four years. Only 5% of for-profits are predicted to be put out of business by the new rules, compared to 55% that would have been in a marginal “yellow zone” under the draft rules.”

So there you have it folks. I would argue that instead of loaning money to these toxic institutions why not funnel the money into infrastructure jobs or aiding local state schools to re-train workers in a variety of job fields? Instead of funneling money into the banking system where they speculate in global stock markets and help other nations why not use that money to fund small businesses that have to be here in the U.S. and create jobs here? Wall Street likes to talk about the free market but they are nothing more than corporate socialists with welfare queen attitudes. With very little worker protection, a mainstream media controlled by corporate powers, you can expect any information like this to make it to the airwaves. So expect home values to fall lower and the working conditions of Americans to falter for years to come unless something drastically changes. The profits at big banks and American Idol ratings with no mass protests tell me people enjoy believing in this fantasy story as their economic prospects are washed away. Keep the bread and circus flowing.