Much like a perfect storm at sea is the consequence of three

converging bad weather fronts, three significant global economic trends

have begun to intensify and converge in recent months: (1) a slowing of

the China economy and a parallel growing financial instability in its

shadow banking system; (2) a collapse in emerging markets currencies

(India, Brazil, Turkey, South Africa, Indonesia, etc.) and their

economic slowdown; (3) a continued drift toward deflation in the

Eurozone economies, led by growing problems in Italy and economic

stagnation now spreading to France, the Eurozone’s second largest

economy. The problems in these three critical areas of the global

economy, moreover, have begun to feed off of each other.

Despite tens of trillions of dollars injected into the global economy since 2008 by central banks in the US, UK,

Europe,

and, most recently Japan, real job creating investment is slowing

everywhere globally. The massive liquidity (money) injections by central

banks have either flowed into global financial markets speculation

(stocks, bonds, derivatives, futures, options, foreign exchange, funds

and financial instruments of various kinds), hoarded as cash on bank and

non-bank corporate balance sheets, hidden away in dozens of offshore

tax shelters from Cayman islands to the Seychelles, or invested in

emerging markets like China, India, Brazil, Indonesia, Turkey, and

elsewhere.

The primary beneficiaries of these central bank money creation

policies have been global very high net worth investors, their financial

institutions, and global corporations in general. According to a study

in 2013 by Capgemini, a global business consultancy, Very High Net Worth

Investors increased their investable wealth by $4 trillion in 2012

alone, with projected further asset growth of $4 trillion a year in the

coming decade. The primary financial institutions which invest on their

behalf, what are called ‘shadow banks’ (i.e. hedge funds, private equity

firms, asset management companies, and dozens of other globally

unregulated financial institutions) more than doubled their total assets

from 2008 to 2013, and now hold more than $71 trillion in investible

assets globally.

This massive accrual of wealth by global finance capitalists and

their institutions occurred in speculating and investing in offshore

financial and emerging market opportunities—made possible in the final

analysis by the trillions of dollars, pounds, Euros, and Yen provided at

little or no cost by central banks’ policies since 2008. That is, until

2014.

That massive tens of trillions of dollars, diverted from the US,

Europe and Japan to the so-called ‘Emerging Markets’ and China is now beginning to flow back from the emerging markets to the ‘west’.

Consequently in turn, the locus of the global crisis that first erupted in 2008 in the U.S., then shifted to

Europe

between 2010-early 2013, is now shifting again, a third time. Financial

and economic instability is now emerging and deepening in offshore

markets and economies—and growing increasingly likely in China as well.

(The following analysis of China today is an excerpt from the

author’s forthcoming article “The Emerging Global Economic Perfect

Storm”, that will appear in the March print issue of ‘Z’ Magazine, where

the Eurozone and Emerging Markets’ economies are assessed as well. For

the complete article, see Z Magazine or the author’s website,www.kyklosproductions.com/articles/html.)

China’s Growing Financial and Economic Instability

Prior to the 2008 global financial crisis and recession, China’s

economy was growing at an annual rate of 14 percent. Today that rate is

7.5 percent, with the strong possibility of a still much slower rate of

growth in 2014.

China initially slowed economically in 2008 but quickly recovered and grew more rapidly by 2009—unlike the U.S. and

Europe.

A massive fiscal stimulus of about 15 percent of its GDP, or 3 times

the size of the comparable U.S. stimulus of 2009, was responsible for

China’s quick recovery. That fiscal stimulus focused on

government-direct investment in infrastructure, unlike the U.S. 2009

stimulus that largely focused on subsidies to states and tax cuts for

business and investors. In 2007-08 China also had no shadow banking

problem to speak of. So the expansionary monetary policies it

introduced, along with its stimulus, further aided its rapid recovery by

2010. Since 2012, however, China has been encountering a growing

problem with global shadow banks that have been destabilizing its

housing and local government debt markets. At the same time, beginning

in 2012, the China non-financial economy, including its manufacturing

and export sectors, has been showing distinct signs of slowing as well.

On the financial side, total debt (government and private) in China

has risen from 130 percent of GDP in 2008 to 230 percent of GDP, with

shadow banks share rising from 25 percent in 2008 to 90 percent of the

totals by 2013. So shadow banks share of total debt has almost

quadrupled and represents nearly all the debt as share of GDP increase

since 2008. Shadow banks have thus been the driving force behind China’s

growing local debt problem and emerging financial fragility.

Much of that debt increase has been directed into a local housing

bubble and an accompanying local government debt bubble, as local

governments have pushed housing, new enterprise lending, and local

infrastructure projects to the limit. Local government debt was

estimated in 2011 by China central government at $1.7 trillion. It has

grown in just 2 years to more than $5 trillion by some estimates. Much

of that debt is also short term. It is thus highly unstable, subject to

unpredictable defaults, and could spread and destabilize a broader

segment of the financial system in China—much like subprime mortgages

did in the U.S. before.

A run-up in private sector debt is now approaching critical

proportions in China. A major global instability event could easily

erupt there, in the event of a default of a bank or a financial product.

In some ways, China’s situation today increasingly appears like the

U.S. housing and U.S. state and local government debt markets circa

2006. China may, in other words, be approaching its own Lehman Moment.

That, in fact, almost occurred a few months ago with financial trusts in

China. Fearing a potential default by the China Credit Trust, and its

spread, investors were bailed out at the last moment by China central

government. According to the Wall St. Journal, the event “exposes the

weakness of the shadow banking system that has sprung up since 2009.

Growing financial instability in China in its local markets is thus a

major potential problem for China, and for the global economy as well,

as both China and the world economy begin to slow in 2014.

Early in 2013, China policymakers recognized the growing problem of

shadow banks and bubbles in its local housing and investment markets.

Speculators had driven housing prices up by more than 20 percent in its

major cities by 2013, from a more or less stable 3-5 percent annual

housing market inflation rate in 2010. China leaders therefore attempted

to rein in the shadow banks in May-June 2013 by reducing credit

throughout the economy. But that provoked a serious slowdown of the rest

of the economy in the spring of 2013. Politicians then returned on the

money spigot quickly again by summer 2013 and added another mini-fiscal

stimulus package to boost the faltering economy. That stimulus targeted

government spending on transport infrastructure, on reducing costs of

exports for businesses, and reducing taxes for smaller businesses. The

economy recovered in the second half of 2013.

By early 2014, the housing bubble has again appeared to gather steam,

while the real economy shows signs once again of slowing as well. In

early 2014 it appears once again that China policymakers intend to go

after its shadow bank-housing bubble this spring 2014. That will most

likely mean another policy-initiated slowing of the China economy, as

occurred in the spring of 2013 a year earlier. But that’s not all.

Overlaid on the financial instability, and the economic slowdown that

confronting that instability will provoke, are a number of other factors

contributing to still further slowing of the China economy in 2014.

Apart from the economy’s recent fiscal stimulus and its overheated

housing markets, China’s other major source of economic growth is its

manufacturing sector, and manufacturing exports in particular. And that,

too, is slowing. The reasons for the slowing in manufacturing and

exports lie in both internal developments within the Chinese economy as

well as problems growing in the Euro and Emerging market economies.

China is experiencing rising wages and a worsening exchange rate for

its currency, the Yuan. Both are raising its manufacturing costs of

production and in turn making its exports less competitive. Rising costs

of production are even leading to an exodus of global multinational

corporations from China, headed for even cheaper cost economies like

Vietnam, Thailand, and elsewhere.

The majority of China’s exports go to

Europe

and to emerging markets, not just to the U.S. And as emerging market

economies slow, their demand for China manufactured goods and exports

declines. Conversely, as China itself slows economically, it reduces its

imports of commodities, semi-finished goods, and raw materials from the

emerging market world (as well as from key markets like

Australia and Korea).

Similar trade-related effects exist between China and the Eurozone.

China in fact is Germany’s largest source for its exports, larger even

than German exports to the rest of

Europe. So if China slows, it will require fewer exports from

Europe, which will slow the already stagnant Eurozone economies even further. Similarly, as

Europe

stagnates, it means less demand for China goods—and thus a further

slowing of China’s manufacturing. In other words, China’s internal

slowdown will exacerbate stagnation and deflation in

Europe, as well as contribute to an even faster economic slowing now underway in the emerging market world.

Slowing will result as well from government policies designed to

structurally shift the economy to a more consumption driven focus. That

shift to consumption will begin in earnest following the Community

Party’s March 2014 meeting. But consumption in China represents only 35%

percent of the economy (unlike 70 percent in the U.S.), while China

government investment is well over 40 percent of GDP. And it is not

likely that consumption can grow faster enough to offset the reduction

in investment, at least not initially.

So a long list of imminent major developments and trends in China

point to a slowing of growth in that key global economy of almost $10

trillion a year. What happens in China, the second largest economy in

the world, has and will continue to have a major negative impact on an

already slowing Emerging Markets and a chronically stagnant Eurozone.

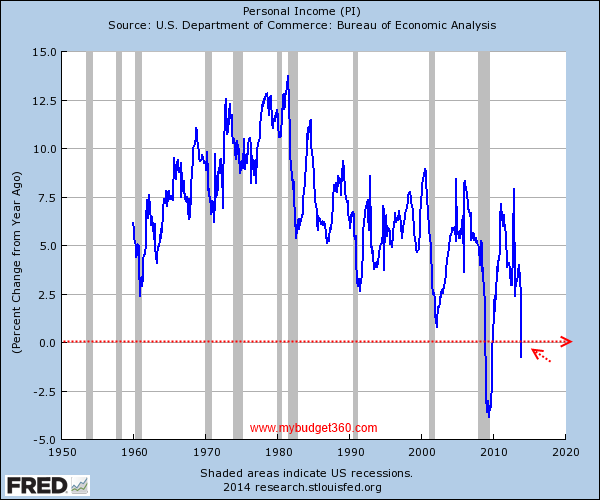

How the U.S. economy responds to the emerging global perfect storm

will prove interesting, to say the least. But with evidence of US

slowing in housing, manufacturing, job creation, auto and other retail

sales, and with real family median income in decline and the real

likelihood of further spikes in food and gasoline prices in the months

immediately ahead, the ‘perfect storm’ emerging offshore do not portend

well for the still fragile US economy now in its fifth year of below

average, ‘stop-go’ economic recovery.

Jack Rasmus is the author of the book, ‘Obama’s

Economy: Recovery for the Few’, Pluto press, 2012 and ‘Epic Recession:

Prelude to Global Depression’, Pluto, 2010. He is the host of the weekly

radio show, ‘Alternative Visions’, on the Progressive Radio Network.

His website is www.kyklosproductions.com, his blog, jackrasmus.com, and twitter handle, @drjackrasmus.

People around the world often complain about the “

People around the world often complain about the “