Popular culture is loaded with myths and half-truths. Most are harmless.

But when doctors start believing medical myths, perhaps it's time to

worry.

In the British Medical Journal this week, researchers looked into

several common misconceptions, from the belief that a person should

drink eight glasses of water per day to the notion that reading in low

light ruins your eyesight.

"We got fired up about this because we knew that physicians accepted

these beliefs and were passing this information along to their

patients," said Dr. Aaron Carroll, assistant professor of pediatrics at

the Indiana University School of Medicine. "And these beliefs are

frequently cited in the popular media."

And so here they are, so that you can inform your doctor:

Myth: We use only 10 percent of our brains.

Fact: Physicians and comedians alike, including Jerry Seinfeld, love to

cite this one. It's sometimes erroneously credited to Albert Einstein.

But MRI scans, PET scans and other imaging studies show no dormant areas

of the brain, and even viewing individual neurons or cells reveals no

inactive areas, the new paper points out. Metabolic studies of how brain

cells process chemicals show no nonfunctioning areas. The myth probably

originated with self-improvement hucksters in the early 1900s who

wanted to convince people that they had yet not reached their full

potential, Carroll figures. It also doesn't jibe with the fact that our

other organs run at full tilt.

Myth: You should drink at least eight glasses of water a day.

Fact: "There is no medical evidence to suggest that you need that much

water," said Dr. Rachel Vreeman, a pediatrics research fellow at the

university and co-author of the journal article. Vreeman thinks this

myth can be traced back to a 1945 recommendation from the Nutrition

Council that a person consume the equivalent of 8 glasses (64 ounces) of

fluid a day. Over the years, "fluid" turned to water. But fruits and

vegetables, plus coffee and other liquids, count.

Myth: Fingernails and hair grow after death.

Fact: Most physicians queried on this one initially thought it was

true. Upon further reflection, they realized it's impossible. Here's

what happens: "As the body’s skin is drying out, soft tissue, especially

skin, is retracting," Vreeman said. "The nails appear much more

prominent as the skin dries out. The same is true, but less obvious,

with hair. As the skin is shrinking back, the hair looks more prominent

or sticks up a bit."

Myth: Shaved hair grows back faster, coarser and darker.

Fact: A 1928 clinical trial compared hair growth in shaved patches to

growth in non-shaved patches. The hair which replaced the shaved hair

was no darker or thicker, and did not grow in faster. More recent

studies have confirmed that one. Here's the deal: When hair first comes

in after being shaved, it grows with a blunt edge on top, Carroll and

Vreeman explain. Over time, the blunt edge gets worn so it may seem

thicker than it actually is. Hair that's just emerging can be darker

too, because it hasn't been bleached by the sun.

Myth: Reading in dim light ruins your eyesight.

Fact: The researchers found no evidence that reading in dim light

causes permanent eye damage. It can cause eye strain and temporarily

decreased acuity, which subsides after rest.

Myth: Eating turkey makes you drowsy.

Fact: Even Carroll and Vreeman believed this one until they researched

it. The thing is, a chemical in turkey called tryptophan is known to

cause drowsiness. But turkey doesn't contain any more of it than does

chicken or beef. This myth is fueled by the fact that turkey is often

eaten with a colossal holiday meal, often accompanied by alcohol — both

things that will make you sleepy.

Myth: Mobile phones are dangerous in hospitals.

Fact: There are no known cases of death related to this one. Cases of

less-serious interference with hospital devices seem to be largely

anecdotal, the researchers found. In one real study, mobile phones were

found to interfere with 4 percent of devices, but only when the phone

was within 3 feet of the device. A more recent study, this year, found

no interference in 300 tests in 75 treatment rooms. To the contrary,

when doctors use mobile phones, the improved communication means they

make fewer mistakes.

"Whenever we talk about this work, doctors at first express disbelief

that these things are not true," said Vreeman said. "But after we

carefully lay out medical evidence, they are very willing to accept that

these beliefs are actually false."

Monday, March 25, 2013

Financial Strategist: “They Don’t Realize That They’re In a Bubble Yet… Until It Pops”

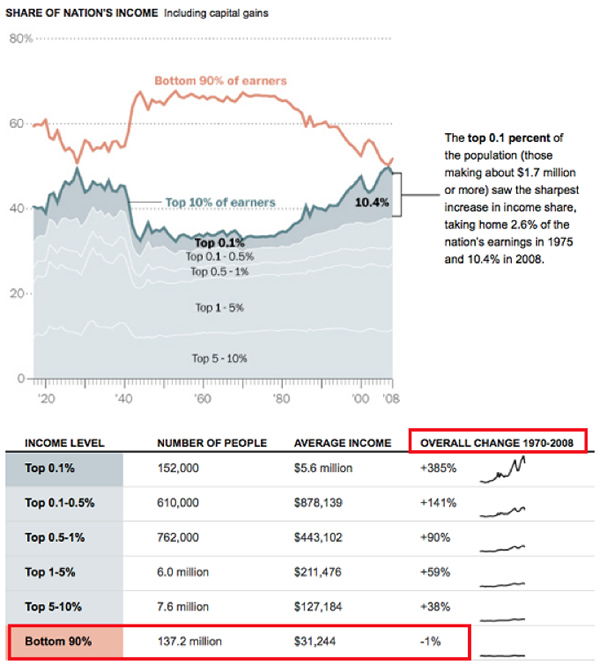

By all accounts, the mainstream media and corporate leaders would

have us believe that the world is in a new bull market. They’ll point us

to the stock market as evidence of their claims that the economy is

growing and life for the average citizen is returning to normal. Few

will discuss the fundamental issues facing financial markets, the least

of which is continued unemployment and less consumer spending. Even

fewer are willing to, or even capable of, explaining the monetary

machinations that have pumped up stock markets and left trillion dollar

deficits in their wake.

There are, however, analysts like Doug Casey and Marin Katusa of Casey Researchwho understand what’s really going on behind the scenes, where it will eventually lead, and how to thrive in a world of uncertainty where the only things of value when the illusion is exposed for what it really is, are hard assets.

Marin Katusa outlines some key strategies to consider for diversifying yourself ahead of another massive financial meltdown.

(Watch this interview at Youtube)

Every one of us has a different outlook and ability, and thus your strategy should focus on your specific needs.

For some, that may include owning hard assets exclusively – things like precious metals, or commodities like grains. For others, who may have twenty years of accumulated savings with major exposure to traditionally safe investments like bonds and popular stocks, owning shares of well managed firms in the international resource sector may provide the diversification and wealth preservation you require should broader stock markets slip back into oblivion or your government moves to ‘tax’ your domestic personal wealth.

Bubbles abound – in global stock markets, currencies, and society’s blissful outlook on it all.

They will invariably pop.

You have options – consider them all, do your research and act accordingly.

Also see: Future Money Trends

There are, however, analysts like Doug Casey and Marin Katusa of Casey Researchwho understand what’s really going on behind the scenes, where it will eventually lead, and how to thrive in a world of uncertainty where the only things of value when the illusion is exposed for what it really is, are hard assets.

Marin Katusa outlines some key strategies to consider for diversifying yourself ahead of another massive financial meltdown.

From the main markets, because we are in a currency crisis, the major markets… look at Apple, look at Samsung, look at Amazon… they are in a raging bull market. The major media, the big funds, the pension funds… they’re focusing on the bull market that they are in.Watch as Casey Research strategist Marin Katusa discuss how to Thrive in Today’s Economy via Future Money Trends:

A bubble is invisible when you’re inside the bubble.

They don’t realize that they’re in a bubble yet… until it pops.

…I don’t think this is a negative for gold at all. Gold’s held quite well during all of this. People have shied away from the resource sector. There have been nationalizations of resources globally.

And yet, gold is still holding because there is a true value to gold. It is the true currency globally.

And its time will come.

(Watch this interview at Youtube)

Every one of us has a different outlook and ability, and thus your strategy should focus on your specific needs.

It depends what type of investor you are.However you position yourself, as Katusa notes, will depend on the type of investor you are – and no matter what asset(s) you choose to buy with your hard-earned money, you should consider yourself an investor.

I believe that if you want serious, significant leverage to the price of gold,you don’t invest necessarily into gold for the appreciation in gold, you buy actual gold as an insurance policy for the rest of your portfolio…

That’s how Doug Casey and Rick Rule have built their fortunes. Not by necessarily investing in gold. They have exposure to gold as an insurance hedge, but where they’ve made their fortune is due to the successful leverage by exposure to the junior gold exploration companies.

…

I can mention one [company] that Rick Rule, Doug Casey and myself are large shareholders and have exposure to and it’s done quite well in this market because of the management, the exploration that they’ve done and the asset they’ve accumulated… It’s run by a very successful young entrepreneur who’s on our NexTen list, his name is Amir Adnani and the company is called Brazil Resources.

…the smart money follows the smart people. Any investor listening to you has to look at the management teams, and that is the most important thing…

For some, that may include owning hard assets exclusively – things like precious metals, or commodities like grains. For others, who may have twenty years of accumulated savings with major exposure to traditionally safe investments like bonds and popular stocks, owning shares of well managed firms in the international resource sector may provide the diversification and wealth preservation you require should broader stock markets slip back into oblivion or your government moves to ‘tax’ your domestic personal wealth.

Bubbles abound – in global stock markets, currencies, and society’s blissful outlook on it all.

They will invariably pop.

You have options – consider them all, do your research and act accordingly.

Also see: Future Money Trends

TIMELINE: Bailout deal reached

UPDATED 2.58am

UPDATED 02:11

Acting president Yiannakis Omirou has confirmed that a deal has been struck between Cyprus and international lenders.

Government sources suggest that the deal provides for a 30 per cent haircut on deposits of over €100,000 at Bank of Cyprus while reports said Popular Bank would be resolved.

Laiki deposits under 100,000 will be transferred to a ‘good bank,’ reports said.

--------------------------------------------------------------------------------------------------------

President Nicos Anastasiades, European Council President Herman van Rompuy and European Commission President Jose Manuel Barroso have met over a working dinner following a failed series of meetings between the Cypriot side and Nicosia’s international lenders earlier on Sunday.

Finance Minister Michalis Sarris and Government Spokesman Christos Stylianides also attended the working dinner.

Eurozone sources say that “deliberations with the Cypriot side continue”, adding that the Finance Ministers of the remaining Euro area member states were being briefed on developments by Eurogroup President Jeroen Dijsselbloem.

UPDATED 23:15

Latest reports say Eurogroup has not started. Members were just being briefed on developments

Widely reported that President Nicos Anastasiades has threatened to resign should the IMF insist in saddling the Bank of Cyprus some 9 billion euros in emergency liquidity assistance owed by the Popular Bank to the European Central Bank.

-------------------------------------------------------------------------------------------------------------------

Eurozone finance ministers delayed by two hours a Sunday evening meeting intended to help Cyprus meet a Monday deadline to avert collapse of its banking system and potential exit from the euro.

A euro zone official said the Eurogroup meeting of finance ministers had been rescheduled for about 1900 GMT – 9pm Cyprus time -- from 1700 GMT, because talks with Cypriot officials ahead of those discussions had overrun.

Ahead of the ministers' meeting Cypriot President Nicos Anastasiades held talks in Brussels on Sunday with EU, European Central Bank and IMF leaders.

President Nicos Anastasiades landed in Brussels earlier Sunday, heading straight for the European Council building to hold meetings with Presidents of the European Council and Commission Herman Van Rompuy and Jose Manuel Barroso.

At 4pm (Cyprus time), Anastasiades began a working lunch with the two top EU officials, joined by European Central Bank President Mario Draghi, IMF chief Christine Lagarde, Eurogroup head Jeroen Dijsselbloem and the EU’s commissioner for economic affairs Olli Rehn.

The Cypriot president is joined by Finance Minister Michalis Sarris, government spokesman Christos Stylianides, DISY’s number two Averof Neophytou and senior Central Bank and Finance Ministry officials George Syrichas, Andreas Trokkos and George Panteli.

According to Stylianides, Anastasiades has invited party leaders to the Presidential Palace at 5pm on Sunday, where they will be constantly updated by the president on the day’s crucial developments.

The Eurogroup will convene at 7pm in Brussels with Cyprus the only issue on the agenda.

The marathon meeting of party leaders chaired by Anastasiades on Saturday night ended at 1am with no conclusion on a sought-after agreement with the troika.

Cyprus

and international lenders reached a draft deal in the early hours of

this morning, which had to be approved by the Eurogroup.

Details of the deal were sketchy but involved heavy levies on both of Cyprus’ biggest banks.

Other

banks appeared to have been spared. And no charges will be incurred

against any Cypriot bank account with less than 100,000 euros in them,

the officials said.

Reuters reported that the

deal involves setting up a "good bank" and a "bad bank" and will mean

that Popular Bank of Cyprus, known as Laiki, will effectively be shut

down.

Deposits below 100,000 euros in Laiki

will be transferred to Bank of Cyprus. Deposits above 100,000 euros,

which under EU law are not insured, will be frozen and will be used to

resolve debt. It remains unclear how large the writedown on those funds

will be. Some reports suggested it might be as high as 40 per cent.

Sources told Reuters that the proposal involved shifting deposits below

100,000 euros from the Popular Bank of Cyprus (also known as Laiki) to

the Bank of Cyprus to create a "good bank".

"It

should be fairly easy for finance ministers to agree to this," the

official said. "We have been in close contact with all relevant euro

zone countries during this negotiation process and there is broad

agreement."

The plan is likely to mean very

heavy losses for uninsured deposits in Laiki, which has suffered since

writing down the value of its holdings of Greek government bonds last

year.

Around 35 billion euros is held in

Cypriot accounts with more than 100,000 euros in them, but it is not

clear how much of that total is held in Laiki bank.

If

sufficient funds can be found in Laiki to pay off debt and restructure

the Cypriot banking sector, uninsured depositors in Bank of Cyprus may

not incur any losses, although that remains to be seen.

One

of the officials said shareholders and bondholders in Bank of Cyprus

would be part of the "bail-in", with those investors receiving equity in

the bank in exchange.

The draft proposal was

agreed by Cypriot President Nicos Anastasiades in negotiation with

European Council President Herman Van Rompuy and European Commission

President Jose Manuel Barroso. The plan was presented to euro zone

finance ministers for discussion, a short time later.

Cyprus acting President Yiannakis Omirou confirmed in Nicosia that an initial agreement had been reached in Brussels.

According

to Cyprus News Agency (CNA) sources close to the government, the

agreement foresees a 30 per cent “haircut” on Bank of Cyprus deposits

over 100,000 euros. But crucially there would be no restructuring of the

Bank of Cyprus and it would not be forced to absorb the 9 billion euro

burden of emergency liquidity assistance (ELA) of LAiki. This idea, a

red line for Anastiasides, had been abandoned the sources said.

However, the details remained unclear.

Acting president Yiannakis Omirou has confirmed that a deal has been struck between Cyprus and international lenders.

Government sources suggest that the deal provides for a 30 per cent haircut on deposits of over €100,000 at Bank of Cyprus while reports said Popular Bank would be resolved.

Laiki deposits under 100,000 will be transferred to a ‘good bank,’ reports said.

--------------------------------------------------------------------------------------------------------

President Nicos Anastasiades, European Council President Herman van Rompuy and European Commission President Jose Manuel Barroso have met over a working dinner following a failed series of meetings between the Cypriot side and Nicosia’s international lenders earlier on Sunday.

Finance Minister Michalis Sarris and Government Spokesman Christos Stylianides also attended the working dinner.

Eurozone sources say that “deliberations with the Cypriot side continue”, adding that the Finance Ministers of the remaining Euro area member states were being briefed on developments by Eurogroup President Jeroen Dijsselbloem.

UPDATED 23:15

Latest reports say Eurogroup has not started. Members were just being briefed on developments

------------------------------------------------------------------------------------

Eurogroup meeting rescheduled for the second time due to ongoing discussions.New time is 10pm, the Cyprus News Agency said.

---------------------------------------------------------------------------------------------------------

President Nicos Anastasides told international lenders that their proposal to saddle the Bank of Cyprus with some €9 billion in emergency liquidity assistance owed by the Popular Bank to the European Central Bank, effectively meant the lender’s closure in six months, the Cyprus News Agency (CNA) reported.

“I

table one proposal, you don’t accept it; I table another, same thing.

What else do you want me to do? Do you want to force me to resign? If

that’s what you want, let me know,” CNA quoted Anastasiades as telling

international lenders.

----------------------------------------------------------------------------------------------------------------

Widely reported that President Nicos Anastasiades has threatened to resign should the IMF insist in saddling the Bank of Cyprus some 9 billion euros in emergency liquidity assistance owed by the Popular Bank to the European Central Bank.

-------------------------------------------------------------------------------------------------------------------

Eurozone finance ministers delayed by two hours a Sunday evening meeting intended to help Cyprus meet a Monday deadline to avert collapse of its banking system and potential exit from the euro.

A euro zone official said the Eurogroup meeting of finance ministers had been rescheduled for about 1900 GMT – 9pm Cyprus time -- from 1700 GMT, because talks with Cypriot officials ahead of those discussions had overrun.

Ahead of the ministers' meeting Cypriot President Nicos Anastasiades held talks in Brussels on Sunday with EU, European Central Bank and IMF leaders.

----------------------------------------------------------------------------------------------------------------------

President Nicos Anastasiades landed in Brussels earlier Sunday, heading straight for the European Council building to hold meetings with Presidents of the European Council and Commission Herman Van Rompuy and Jose Manuel Barroso.

At 4pm (Cyprus time), Anastasiades began a working lunch with the two top EU officials, joined by European Central Bank President Mario Draghi, IMF chief Christine Lagarde, Eurogroup head Jeroen Dijsselbloem and the EU’s commissioner for economic affairs Olli Rehn.

The Cypriot president is joined by Finance Minister Michalis Sarris, government spokesman Christos Stylianides, DISY’s number two Averof Neophytou and senior Central Bank and Finance Ministry officials George Syrichas, Andreas Trokkos and George Panteli.

According to Stylianides, Anastasiades has invited party leaders to the Presidential Palace at 5pm on Sunday, where they will be constantly updated by the president on the day’s crucial developments.

The Eurogroup will convene at 7pm in Brussels with Cyprus the only issue on the agenda.

The marathon meeting of party leaders chaired by Anastasiades on Saturday night ended at 1am with no conclusion on a sought-after agreement with the troika.

Gold Bank Run Begins? Dutch Bank ABN Amro Halts Physical Gold Delivery!

*Breaking

*BreakingThe Cyprus/ Eurozone crisis has just intensified, as Dutch Bank ABN Amro has sent a letter to clients this weekend informing them that they will halt extradition and physical delivery of their clients’ gold holdings effective April 1st!

No worries however, Amro ensures its clients that there is no need to panic or do anything rash (such as remove your phyzz prior to April 1st:

We ensure that we have your investments in precious metals now the new way to handle and administer

Forget traditional imminent deposit bank runs in Cyprus, has a physical gold bank run begun?

The release in English via Google Translate:

Changes in the handling of orders in bullionAnd the human English translation via an SD reader:

On 1 April 2013,. ABN AMRO to another custodian for the precious metals gold, silver, platinum and palladium. This we your investments in precious metals otherwise handle and administer. In this letter you can read more about it.

What will change?

With the transition to the new custodian will include the following from 1 April 2013 for you to change.

• You can have your precious metals to your investment account no longer physically let us extradite

• Gives you order in precious metals via the giro ABN AMRO? Then the settlement of orders that henceforth performed at bid prices or at the offer prices prevailing on the market for precious metals. No longer based on the mid-price, as you used to.

• The bid price is the price that merchants offer for precious metals that are offered for sale, so if you sell.

• The ask price is the price at which traders want to sell precious metals, so if you buy.

• We are the positions in these precious metals in your investment statements against future bid prices appreciate

You can read more about investing in precious metals in Chapter 4 (Supplementary conditions for investing in precious metals) of the Conditions Beleggersgiro. You can find these at abnamro.nl / Conditions invest

Should I do anything?

You need do nothing. We ensure that we have your investments in precious metals now the new way to handle and administer.

Changes in the handling of orders in bullion

As of 1 April 2013, ABN AMRO will switch over to another custodian for precious metals gold, silver, platinum and palladium.

Therefor we will handle and administer your investments in precious metals differently. In this letter you can read more about this.

What will change?

With the transition to the new custodian, the following will change for you as of 1 April 2013:

• You can no longer request physical delivery of your precious metals from us

• Do you execute orders for precious metals via the ABN AMRO account? Then the settlement of these orders are henceforth performed at bid price or ask price prevailing on the market for precious metals. No longer on the mid-price, as you are used to.

• The bid price is the price that merchants offer for precious metals that are put up for sale, when you sell.

• The ask price is the price at which traders want to sell precious metals, when you buy.

• From now on we will value the precious metals in your investment portofolio at bid prices

You can read more about investing in precious metals in Chapter 4 (Supplementary conditions for investing in precious metals) of the Investment Account Conditions. You can find these at abnamro.nl/voorwaardenbeleggen

Should I do anything?

You don’t need to do anything. We will make sure to handle your investments in precious metals in this new way from now on.

Any Questions?

If you have any questions about the contects of this letter, then you can call our Investment Service Desk op 0900-1474 (from abroad +31 76 5491755). Our employees can be reached monday to friday from 8am to 6pm.

Do you want to palce orders or do you have other questions about investing, then you can call your advisor or the Capital Hotline at 0900-9215 (from abroad +31 10 2407004). Our employees from the Capital Hotline can be reached monday to friday from 7am to 8pm and during the weekend from 9am to 5pm.

We are happy to assist you,

With kind regards,

ABN AMRO Bank N.V.

h/t ZH

boris berezovsky: the robber baron who tried to fix russia his way

Boris Berezovsky (RIA Novosti / Sergey Guneev)

Share on Tumblr

After centuries of oppression by a string of autocrats of varying cruelty, the collapse of the Soviet Union gave Russia an unprecedented chance to follow a different path. Unfortunately, that path was charted by Boris Berezovsky.

But that would be to take responsibility from Berezovsky himself, and to overlook just how profound and damaging the effect of his very specific brand of meddling was on new Russia’s incipient institutions.

Between Berezovsky first entering the Kremlin’s most hallowed offices in 1993 and his precautionary flight from the country six years later, there were few areas of public life that he did not try to bend to his will. At the height of his power, Boris Berezovsky was buying oil companies on the cheap, nominating senior officials, sponsoring awards ceremonies, and single-handedly conducting diplomatic missions in an armed conflict on the behalf of the entire country.

And for any short-term gains he achieved for himself and those he supported (his allegiances switched often), the long-term losses for Russia can still be felt.

Freed from the shackles of a control economy, Russia was supposed to deliver the consumer goods Soviet planners failed to. But Boris Berezovsky’s business dealings brought the country no perceptible economic benefit. He made his fortune buying Ladas at below-cost prices from the state-owned factory, before selling them at market prices – defrauding taxpayers who had to foot the bill for the money-leaking carmaker. He later repeated the trick at national air carrier Aeroflot, but also made that corporation take loans it did not need at unfavorable rates from his own financial services company. He purchased Sibneft, an oil company worth billions of dollars at fraction of the price in a series of insider auctions, due to his close links with President Boris Yeltsin.

A

file picture dated 29 April 1998 in Moscow shows Russian President

Boris Yeltsin (L) as he votes for the candidacy of Boris Berezovsky (R)

for the post of executive secretary of the Commonwealth of Independent

States (CIS) (AFP Photo)

A state with no history of press freedom was ill-prepared to walk the fine line between maintaining editorial independence, answering to owners and reporting responsibly even before Berezovsky. But when the tycoon was allowed to take control of Channel One, Russia’s national broadcaster in 1995, he made it a propaganda weapon that would change editorial policies at his personal behest. Political and business rivals would be submerged under character assassinations and smear campaigns, with news broadcasts, documentaries and analytical programs all tailored on demand to fit the message. A typical broadcast ahead of the 1999 parliamentary elections showed a Swiss clinic where anti-Kremlin party leader Evgeniy Primakov was receiving hip surgery, with a voiceover insinuating that he was both decrepit and paid for the procedure with dirty money. The right to speak freely – one indisputable gain of the end of totalitarianism – became in the minds of many, the right of a rich oligarch to sling mud as he pleased. As independent journalism was squeezed in subsequent years, few bothered to defend it, and most did not believe such a thing ever existed.

Throughout the 1990s, Russia’s future as a democracy hung in the balance, as revanchist Communists dominated the parliament. When Berezovsky and six other tycoons banded together and used all their dubiously-acquired financial and media power to help the re-election of ailing Boris Yeltsin against the Communist challenger Gennady Zyuganov in 1996, they disregarded the sanctity of democratic choice. At the time, for many it seemed like there was no other option, but in going all out to manipulate the political process they (and the incumbent’s administrative machine, ordered to stop Zyuganov at all cost) mortgaged the future of Russian democracy. Inevitably, in the next political cycle, Berezovsky’s tampering became only more brazen. By multiple accounts, the previously low-profile security chief Vladimir Putin, who had never run in any previous election or engaged in overtly political activity, was handpicked personally by Berezovsky, who persuaded Boris Yeltsin to endorse him as a successor, and financed a party that would support his views, even as it had no ideology and barely had time to meet the candidate (the party Unity, later went on to become United Russia, which still holds the majority vote in the Russian Duma to this day).

Of course, little of this would have been possible if Boris Yeltsin hadn’t made Berezovsky his éminence grise. As the head of a weak, poor central authority flailing against the chaos and hostility of bureaucrats, rampant criminals and citizens who quickly lost appetite for reform, Yeltsin saw the tycoon as the only man who could help the government regain some control. But in blurring the lines between business, politics and media, Berezovsky hampered Russia’s chances of becoming a law-based state. The concept of conflict of interest was barely understood even by the oligarchs themselves, and the means appeared to justify the ends. But Russia’s corruption (it is ranked 133rd in the world according to Transparency International) lack of independent media (ranked 148th by Reporters without Borders) and political freedom (it is classified as Not Free by Freedom House) would suggest otherwise. Each of these developments can be attributed at least partly either to Berezovsky himself or those he helped push onto the national scene, and the exiled oligarch admitted as much in a mea culpa he published a year before his death.

The charm of a sociopath

Even those who disparage the historical role Berezovsky played, often cannot bring themselves to dislike him whole-heartedly. Even in his pomp he seemed more like a picaresque protagonist than a criminal, an impression helped by his demeanor of a busy, small-time schemer crossed with a university professor (which, of course, he was). As he was cut off from the real heart of action in exile in his Ascot mansion, his plotting grew more frantic and ineffectual, his fortune shrunk, and his search for attention more desperate, Berezovsky’s character acquired a more tragic hue. With his death, the fall appears complete, and much of the media coverage and words from those who knew him two decades ago have become tinged with a vague nostalgia and unmistakable sympathy.

Boris Berezovsky (center) in the High Court of London (RIA Novosti)

It has become fashionable for non-professionals to diagnose various ruthless and successful men – Lance Armstrong, Silvio Berlusconi – as sociopaths, but looking from the outside, perhaps this is a description that genuinely fit Berezovsky better than almost any public figure. Among the diagnostic criteria are superficial charm (that much is undeniable) a grandiose sense of self-worth (Berezovsky reportedly seriously considered that he might be awarded the Nobel Peace Prize for his work in Chechnya) manipulation (the essence of his political career) and pathological lying (the judge in his court case against Roman Abramovich last year called him “an unimpressive, and inherently unreliable, witness, who regarded truth as a transitory, flexible concept, which could be moulded to suit his current purposes").

In view of this, to reduce Boris Berezovsky to an innocuous caricature would be a disservice to his personality, not to mention the role he played in Russia’s history. In the aforementioned mea culpa Berezovsky apologizes for “greed that harmed Russian citizens”, “destroying democratic values” and “undermining freedom of speech”. That time Boris Berezovsky was telling the truth.

Igor Ogorodnev, RT

Ayalon: Israel will defend Greek oil drilling in Cyprus

ATHENS, Greece (JTA) -- Israeli Deputy Foreign Minister Danny Ayalon

said in Greece that Israel will defend Greek oil drilling in Cyprus.

Asked at a news briefing Tuesday what Israel's reaction is to a threat by Turkey regarding drilling in Cyprus, Ayalon said, “If anyone tries to challenge these drillings, we will meet those challenges.”

Ayalon, the first foreign official to visit Greece since the formation of its new government, added that he did not think that Turkey would challenge any drilling in the southeast Mediterranean. Turkey said last month it would send naval forces to protect its drilling rights.

The briefing was held at the residence of Israeli Ambassador to Greece Arie Mekel. Ayalon is on an official visit to Greece.

Greece's deputy foreign minister, Dimitris Dollis, stressed in his meeting with Ayalon that Israel-Greece relations upgraded in the past year would continue and be strengthened in the near future. Dollis said the ties would not be affected by the change of government in Greece.

“These are not meetings that are held just so we can get together," he said. "They are meetings that will help us to jointly promote the issues we are dealing with and, naturally, provide an institutional framework -- and thus continuity -- for this conference.”

The two officials agreed to convene in Greece members of the Jewish and Greek diasporas from countries such as the United States, Canada, Australia, France and Britain. The meeting is planned to take place in the spring in Salonika.

Ayalon and Dollis discussed cooperation among Israel, Greece and Cyprus concerning the subject of natural gas. A trilateral memorandum of understanding on the issue, as well as the management of water resources, has been drafted and is due to be signed soon.

The deputy foreign ministers noted that Greece and Israel have common strategic interests in energy and energy security, and immense prospects for collaboration in that area.

On Wednesday, Ayalon met with the new Greek foreign minister, Stavros Dimas, and defense minister, Dimitris Avramopoulos, to discuss strengthening relations between the two countries.

Next week, the Greek minister for the environment, energy and climate change, Giorgos Papakonstantinou, will visit Israel.

Asked at a news briefing Tuesday what Israel's reaction is to a threat by Turkey regarding drilling in Cyprus, Ayalon said, “If anyone tries to challenge these drillings, we will meet those challenges.”

Ayalon, the first foreign official to visit Greece since the formation of its new government, added that he did not think that Turkey would challenge any drilling in the southeast Mediterranean. Turkey said last month it would send naval forces to protect its drilling rights.

The briefing was held at the residence of Israeli Ambassador to Greece Arie Mekel. Ayalon is on an official visit to Greece.

Greece's deputy foreign minister, Dimitris Dollis, stressed in his meeting with Ayalon that Israel-Greece relations upgraded in the past year would continue and be strengthened in the near future. Dollis said the ties would not be affected by the change of government in Greece.

“These are not meetings that are held just so we can get together," he said. "They are meetings that will help us to jointly promote the issues we are dealing with and, naturally, provide an institutional framework -- and thus continuity -- for this conference.”

The two officials agreed to convene in Greece members of the Jewish and Greek diasporas from countries such as the United States, Canada, Australia, France and Britain. The meeting is planned to take place in the spring in Salonika.

Ayalon and Dollis discussed cooperation among Israel, Greece and Cyprus concerning the subject of natural gas. A trilateral memorandum of understanding on the issue, as well as the management of water resources, has been drafted and is due to be signed soon.

The deputy foreign ministers noted that Greece and Israel have common strategic interests in energy and energy security, and immense prospects for collaboration in that area.

On Wednesday, Ayalon met with the new Greek foreign minister, Stavros Dimas, and defense minister, Dimitris Avramopoulos, to discuss strengthening relations between the two countries.

Next week, the Greek minister for the environment, energy and climate change, Giorgos Papakonstantinou, will visit Israel.

ADVERTISEMENT: Visit OneHappyCamper.org to find a Jewish camp and see if your child qualifies for a $1,000 grant.

Russian warning

The site said the Kremlin feared grow that both the European Union and United States were preparing for the largest theft of private wealth in modern history.

According to this “urgent bulletin,” this warning is being made at the behest of Prime Minister Medvedev who earlier today warned against the Western banking systems actions against EU Member Cyprus.

“All possible mistakes that could be made have been made by them, the measure that was proposed is of a confiscation nature, and unprecedented in its character. I can’t compare it with anything but ... decisions made by Soviet authorities ... when they didn’t think much about the savings of their population. But we are living in the 21st century, under market economic conditions. Everybody has been insisting that ownership rights should be respected.,” he said on Thursday.

The story on the site “What does it mean. com” was written by Sorcha Faal without further elaboration.

Cyprus Deposit Tax: A Hint At the Future For the U.S. and EU

The latest attempt by the desperate leaders of Europe

to contain the euro crisis and to insure the banks remain solvent was a

6.75%-9.9% tax on all bank deposits. This tax has now failed to pass the Cyprus parliament and the EU and Cyprus are looking for other solutions. The tax

was justified by saying that bank depositors must bear some of the

burden for recapitalizing Cypriot banks. While the burden was placed on

depositors, those who own bonds issued by either the banks or the

government of Cyprus would have been repaid in full. This is another

piece of evidence that the politicians and banksters will do whatever it takes to maintain their own financial dominance, including the direct looting of personal bank accounts.

Despite what many people believe, a bank deposit is a loan. When you deposit money in a bank, that money no longer belongs to you, it belongs to the bank. They can lend it out or use it to buy assets that they believe will generate a return. Their only obligation to the depositor is to repay the loan whenever the depositor requests his money, subject to legal limitations and the ever-present threat of a “bank holiday” or of the confiscation of a portion or the entire deposit by government action, as happened in Cyprus. As all fractional-reserve banks are by definition insolvent, all of the money loaned to them can never be paid back. When push comes to shove, someone has to lose, and what happened in Cyprus provides precedent on who the losers will be. The losers will not be those who loaned money to insolvent banks by buying their bonds, or those who bought the bonds of an insolvent government; they will be ordinary depositors and taxpayers, as usual.

The bailout of Cyprus that included the deposit tax was a creation of the International Monetary Fund (IMF). It is more proof, if more proof was needed, that the IMF is totally under the control of the international bankster oligarchy. Anything and everything will be done to insure the banks are paid back and their owners and creditors get to keep all of their money. The rest of us will not be so lucky. Cyprus is a small economy, so whatever happens to it will not have much of an impact on the larger economies of the U.S. and EU, but its very smallness indicates that economic problems effecting it today will affect the larger economies in the future. It is the proverbial “canary in the coal mine,” and what is happening in Cyprus will soon be happening in larger economies like the U.S., Europe, and Japan. The banksters control the governments of all the Western nations, and they will use that control to insure that they get their money, regardless of where that money has to come from. It will come from your bank account, your retirement plan, your investments, any source of money that is accessible to the state and the central banks.

What does this mean for the average person? It means any wealth you may have in paper assets of any kind, be they bank accounts, stocks, mutual funds, or retirement accounts, is not and cannot be safe from government confiscation. If they can prove you have it and control the means by which you access it, they can and will take it. The only protection that the average person has is to take their money out of these types of assets and buy hard assets that you personally control. Real estate is sometimes used as an example of a hard asset, and it is often a good investment, but it has the major problem of being very visible and completely immobile. Anyone who claims to “own” a piece of real estate can determine if they actually own it by refusing to pay property taxes on it. You will find out rather quickly that your “ownership” means nothing if you do not pay the state its rent. The only truly safe assets are those that you can possess without the state or anyone else knowing about it, such as gold and silver, guns and ammo, and food and water. These are the only assets that will mean anything when the larger states become as desperate as the small states are today.

In addition to protecting yourself from confiscation and expropriation, taking your money out of the financial system and transforming it into hard assets is a revolutionary act of defiance. It removes a few more grains of sand from beneath the castles of the banksters and politicians, helping to erode the system that they depend on for their power. If the people’s wealth is held in a form the rulers cannot access, their rule is that much weaker. At the very least it forces the rulers to show themselves as the brutal tyrants that they are by going after personal property held in people’s homes if they wish to confiscate their wealth, rather than being able to quietly and cleanly seize it from a bank account. Every dollar you have in the bank, especially the big international banks, is being used to prop up the banksters. If everyone removed their money from the banks, they would not only be safer, they would have struck a blow for freedom that the tyrants would never recover from. While it may be unrealistic for many people to remove all of their money from the bank, at least transfer to a local bank and hold any wealth you plan on keeping for a period of more than a few years in the form of gold and silver.

Another way of striking at the root of the bankster system is to refuse to buy into the consumerist mentality that you have to work as much as possible to earn money to buy the latest gadget. Simplify your life and work only as much as you need to in order to get by. Every dollar that you do not earn in the “above the table” economy is one more dollar that will not be taxed. Reduce your tax burden and you reduce the amount of money flowing into the state’s treasury, in addition to reducing stress on yourself and making more time for family or recreation. The modern system of control is built upon the belief that we all have to work 40 hours a week and try to make as much money as possible. The less you fit into this mold, the less control the state has over you and the fewer resources it has to exert control over others, so by rejecting the consumerist lifestyle you are not only freeing yourself, you are helping to free all the rest of the people who are caught up in the state’s web of evil by depriving the state of resources, or at least forcing it to obtain those resources by borrowing rather than taxation. The more the state has to borrow, the faster the final collapse of the expropriation model will come.

The harder it is for the state to fund itself, the more it will have to use extraordinary methods like the deposit tax in Cyprus. These methods, by their very strangeness and the fact that they affect everyone in an uncomfortable way, tend to wake up more people to the evils of statism. When enough of the population is awakened, we will have a chance for a true revolution.

Despite what many people believe, a bank deposit is a loan. When you deposit money in a bank, that money no longer belongs to you, it belongs to the bank. They can lend it out or use it to buy assets that they believe will generate a return. Their only obligation to the depositor is to repay the loan whenever the depositor requests his money, subject to legal limitations and the ever-present threat of a “bank holiday” or of the confiscation of a portion or the entire deposit by government action, as happened in Cyprus. As all fractional-reserve banks are by definition insolvent, all of the money loaned to them can never be paid back. When push comes to shove, someone has to lose, and what happened in Cyprus provides precedent on who the losers will be. The losers will not be those who loaned money to insolvent banks by buying their bonds, or those who bought the bonds of an insolvent government; they will be ordinary depositors and taxpayers, as usual.

The bailout of Cyprus that included the deposit tax was a creation of the International Monetary Fund (IMF). It is more proof, if more proof was needed, that the IMF is totally under the control of the international bankster oligarchy. Anything and everything will be done to insure the banks are paid back and their owners and creditors get to keep all of their money. The rest of us will not be so lucky. Cyprus is a small economy, so whatever happens to it will not have much of an impact on the larger economies of the U.S. and EU, but its very smallness indicates that economic problems effecting it today will affect the larger economies in the future. It is the proverbial “canary in the coal mine,” and what is happening in Cyprus will soon be happening in larger economies like the U.S., Europe, and Japan. The banksters control the governments of all the Western nations, and they will use that control to insure that they get their money, regardless of where that money has to come from. It will come from your bank account, your retirement plan, your investments, any source of money that is accessible to the state and the central banks.

What does this mean for the average person? It means any wealth you may have in paper assets of any kind, be they bank accounts, stocks, mutual funds, or retirement accounts, is not and cannot be safe from government confiscation. If they can prove you have it and control the means by which you access it, they can and will take it. The only protection that the average person has is to take their money out of these types of assets and buy hard assets that you personally control. Real estate is sometimes used as an example of a hard asset, and it is often a good investment, but it has the major problem of being very visible and completely immobile. Anyone who claims to “own” a piece of real estate can determine if they actually own it by refusing to pay property taxes on it. You will find out rather quickly that your “ownership” means nothing if you do not pay the state its rent. The only truly safe assets are those that you can possess without the state or anyone else knowing about it, such as gold and silver, guns and ammo, and food and water. These are the only assets that will mean anything when the larger states become as desperate as the small states are today.

In addition to protecting yourself from confiscation and expropriation, taking your money out of the financial system and transforming it into hard assets is a revolutionary act of defiance. It removes a few more grains of sand from beneath the castles of the banksters and politicians, helping to erode the system that they depend on for their power. If the people’s wealth is held in a form the rulers cannot access, their rule is that much weaker. At the very least it forces the rulers to show themselves as the brutal tyrants that they are by going after personal property held in people’s homes if they wish to confiscate their wealth, rather than being able to quietly and cleanly seize it from a bank account. Every dollar you have in the bank, especially the big international banks, is being used to prop up the banksters. If everyone removed their money from the banks, they would not only be safer, they would have struck a blow for freedom that the tyrants would never recover from. While it may be unrealistic for many people to remove all of their money from the bank, at least transfer to a local bank and hold any wealth you plan on keeping for a period of more than a few years in the form of gold and silver.

Another way of striking at the root of the bankster system is to refuse to buy into the consumerist mentality that you have to work as much as possible to earn money to buy the latest gadget. Simplify your life and work only as much as you need to in order to get by. Every dollar that you do not earn in the “above the table” economy is one more dollar that will not be taxed. Reduce your tax burden and you reduce the amount of money flowing into the state’s treasury, in addition to reducing stress on yourself and making more time for family or recreation. The modern system of control is built upon the belief that we all have to work 40 hours a week and try to make as much money as possible. The less you fit into this mold, the less control the state has over you and the fewer resources it has to exert control over others, so by rejecting the consumerist lifestyle you are not only freeing yourself, you are helping to free all the rest of the people who are caught up in the state’s web of evil by depriving the state of resources, or at least forcing it to obtain those resources by borrowing rather than taxation. The more the state has to borrow, the faster the final collapse of the expropriation model will come.

The harder it is for the state to fund itself, the more it will have to use extraordinary methods like the deposit tax in Cyprus. These methods, by their very strangeness and the fact that they affect everyone in an uncomfortable way, tend to wake up more people to the evils of statism. When enough of the population is awakened, we will have a chance for a true revolution.

Thirteen jewish families effectively control the central banks

NEW WORLD ORDER

Thirteen jewish families effectively control the central banks of all the hard-currency countries. These "control banks" all practice FRACTIONAL RESERVE BANKING, which is perfectly legal in the US. Fractional reserve banking means that the bank is only required to hold on hand the small fraction of money (5%) that is needed to cover the fraction of deposits likely to be drawn upon and cashed. Moneys deposited in accounts go into a reserve upon which credit can be issued. In the US credit can be issued to seven times the reserve, in international banks (off shore establishments) twenty times the reserve can be issued as credit. It is imp[ortant to understand this concept in order to understand the larger picture.

In the mid 1970s, the final phase of System 2000, a "global creditors' unilateral totalitarian plan" was put into effect. A Pentagon official and three other US officials went to the Prime Minister of Nigeria and offered him fifty million dollars in cash to double the price of light crude oil. Nigeria is one of only two countries in the world that produce light crude, which is an extremely pure form of oil whose price sets the standard for all other forms of crude oil.

Armed with the knowledge that, because of their deal with Nigeria, the price of Mid-east oil was about the skyrocket, the international bankers went to the Arabs and said, "We will send the price of crude oil as high as you want if you will promise to invest some of the money you make in the United States."

Nigeria doubled the price of light crude, the price of oil from the Mid-east went up and the price of a gallon of gasoline in the United States jumped to $1.20. (My note: In Italy, where I was living at the time, it was costing $1 a LITRE after the oil price was sent through the roof.) Unwittingly, Americans began to finance System 2000 with every tank of gas they bought.

As the money began to pour into the Arabian countries, the sheiks fulfilled their promise to invest in the U.S. and began buying stocks, bonds, and real estate. More importantly, they put their money into thirty-year timed certificates (drawn up by the international bankers). Remember that Arabs went from camel-riding nomads to wealthy international investors in a very short period of time and they had no grasp of how the banking system worked; in particular, they did not know about the concept of fractional reserve banking.

The international bankers now had millions of dollars locked into timed deposits, and they took that money and loaned out TWENTY TIMES AS MUCH. In 1983, the international bankers created two groups of holding companies to handle all this Arab money. One of the groups took the funds coming in from the Arabs and loaned it out to Third World countries. The purpose of the holding companies, as you will see later, was to remove the responsibility for the money from the banks to a less accountable entity.

The international bankers were aware of the fact that most of the Third World countries knew nothing about running a country or allocating funds. Most had been colonies of some other nation and had only recently begun to govern themselves. The bankers were counting on the Third World countries to squander their money in a short time. They fully intended for these countries to go bankrupt and to be unable to pay back their loans.

The Phillipines is one example of what happened to Third World countries in the next stage of the plan. The international bankers went to President Marcos and presented him with a way out of the enormous debt his country faced. They said, "We will forgive your loans - you'll have to pay none of the principal, none of the interest - if you will just sign this agreement: 1) do away with its national currency, 2) go to a debit-card system where each person is assigned a number and his purchases are debited from his account on a computerised system and 3) sign over perpetual rights to all natural resources in the country.

The offer was tempting since it would put much of the labor force back to work and solve many of the country's economic problems. But Marcos realised that becasue of the word "perpetual", he was virtually giving away the sovereignty of his country. He refused to sign the agreement. Weeks later he wass deposed and his country was torn apart by riots which Jonathon May says were incited by the internal bankers.

Other countries decided to accept the agreement when it was offered to them. Recently Brasil, Argentina and other nations have announced that they do not plan to pay back their loans. They failed to mention that the loans had been excused in exchange for the rights to their natural resources.

At this point all the dominoes are in place and the international bankers are ready and waiting for their opportunity to topple them.

HERE IS THE PLAN. When enough of the Third World nations sign the agreement, saying they are not going to repay the loans they received from the holding company, the international bankers can declare the holding company insolvent. (This is where it becomes apparent why the money was put in holding companies instead of in banks. The holding companies were designed to go bankrupt.! Chase Manhattan or Chemical Bank would not have to be sacrified since there were not responsible for the loans.)

Once the holding companie is declared bankrupt, they can legally avoid payment to the Arab nations. The international bankers will say, "Sorry, Arabs. We lost your money. You are broke!" When the Arab nations realise that all their money is gone, they will immediately liquidate all of their other assets. They will dump billions and billions of stocks and Wall Street will collapse. They will put all of their farmland and real estate on the market and land values will plummet. Farmers will have no collateral to borrow against to plant next year's crops and food will become scarce in the grocery stores.

The effect this will have on the American economy will be chaotic. This catastrophic collapse has been purposely designed to throw the American people into a state of confusion. Then the benevolent bankers will step forward saying, "Look what these dirty Arabs have done to you!" and offer a solution to our problems.

Their solution will be to abolish our currency and institute a new form of money. Each person then would be issued a government ID number and would need a debit card to do any business transactions.

Perhaps the biggest shock in May's story is that the "Star Wars" system is only 40% concerned with defense and 60% concerned with banking! These "Star Wars" satellites would link the debit system to a central computer base - a superbank. Transfer of funds between accounts would be instantaneous and the internal bankers would finally have complete financial control. May says the debate over "Star Wars" is all show because the satellites are already in place!

(snip)

Perhaps the best defense the international bankers have against protesters is influencing the publics' opinion through the media!!! In his book, "The Naked Capitalist" Cleon Skousen says that, "Nothing panics the international establishment like the possibility of a threatened exposure. Whenever the public has become dangerously aware of the conspiratorial processes operating around them, the vast inter-locking power structure of the entire London-Wall Street combine has immediately shifted into high gear and raced to the rescue. Radio, TV, newspaper, magazines, government policy makers, college officials and other opinion molders in high places have all commenced a recitation of a carefully prepared line designed to pacify the public and put them back to sleep".

Who actually controls the Federal Reserve? Who are the stockholders of this private corporation? In a legislative session regarding abolishing the Fed, the following eight family banks were named as the owners of the Federal Reserve:

Rothschild Banks of London and Berlin

Lazares Brothers Banks of Paris

Israel Moses Seif Bank of Italy

Warburg Bank of Hamburg and Amsterdam

Lehman Brothers Bank of New York

Chase Manhattan Bank of New York

Kuhn, Loeb Bank of New York

Goldman, Sachs Bank of New York

Any muslim banks you see muslims??nooo

Thirteen jewish families effectively control the central banks of all the hard-currency countries. These "control banks" all practice FRACTIONAL RESERVE BANKING, which is perfectly legal in the US. Fractional reserve banking means that the bank is only required to hold on hand the small fraction of money (5%) that is needed to cover the fraction of deposits likely to be drawn upon and cashed. Moneys deposited in accounts go into a reserve upon which credit can be issued. In the US credit can be issued to seven times the reserve, in international banks (off shore establishments) twenty times the reserve can be issued as credit. It is imp[ortant to understand this concept in order to understand the larger picture.

In the mid 1970s, the final phase of System 2000, a "global creditors' unilateral totalitarian plan" was put into effect. A Pentagon official and three other US officials went to the Prime Minister of Nigeria and offered him fifty million dollars in cash to double the price of light crude oil. Nigeria is one of only two countries in the world that produce light crude, which is an extremely pure form of oil whose price sets the standard for all other forms of crude oil.

Armed with the knowledge that, because of their deal with Nigeria, the price of Mid-east oil was about the skyrocket, the international bankers went to the Arabs and said, "We will send the price of crude oil as high as you want if you will promise to invest some of the money you make in the United States."

Nigeria doubled the price of light crude, the price of oil from the Mid-east went up and the price of a gallon of gasoline in the United States jumped to $1.20. (My note: In Italy, where I was living at the time, it was costing $1 a LITRE after the oil price was sent through the roof.) Unwittingly, Americans began to finance System 2000 with every tank of gas they bought.

As the money began to pour into the Arabian countries, the sheiks fulfilled their promise to invest in the U.S. and began buying stocks, bonds, and real estate. More importantly, they put their money into thirty-year timed certificates (drawn up by the international bankers). Remember that Arabs went from camel-riding nomads to wealthy international investors in a very short period of time and they had no grasp of how the banking system worked; in particular, they did not know about the concept of fractional reserve banking.

The international bankers now had millions of dollars locked into timed deposits, and they took that money and loaned out TWENTY TIMES AS MUCH. In 1983, the international bankers created two groups of holding companies to handle all this Arab money. One of the groups took the funds coming in from the Arabs and loaned it out to Third World countries. The purpose of the holding companies, as you will see later, was to remove the responsibility for the money from the banks to a less accountable entity.

The international bankers were aware of the fact that most of the Third World countries knew nothing about running a country or allocating funds. Most had been colonies of some other nation and had only recently begun to govern themselves. The bankers were counting on the Third World countries to squander their money in a short time. They fully intended for these countries to go bankrupt and to be unable to pay back their loans.

The Phillipines is one example of what happened to Third World countries in the next stage of the plan. The international bankers went to President Marcos and presented him with a way out of the enormous debt his country faced. They said, "We will forgive your loans - you'll have to pay none of the principal, none of the interest - if you will just sign this agreement: 1) do away with its national currency, 2) go to a debit-card system where each person is assigned a number and his purchases are debited from his account on a computerised system and 3) sign over perpetual rights to all natural resources in the country.

The offer was tempting since it would put much of the labor force back to work and solve many of the country's economic problems. But Marcos realised that becasue of the word "perpetual", he was virtually giving away the sovereignty of his country. He refused to sign the agreement. Weeks later he wass deposed and his country was torn apart by riots which Jonathon May says were incited by the internal bankers.

Other countries decided to accept the agreement when it was offered to them. Recently Brasil, Argentina and other nations have announced that they do not plan to pay back their loans. They failed to mention that the loans had been excused in exchange for the rights to their natural resources.

At this point all the dominoes are in place and the international bankers are ready and waiting for their opportunity to topple them.

HERE IS THE PLAN. When enough of the Third World nations sign the agreement, saying they are not going to repay the loans they received from the holding company, the international bankers can declare the holding company insolvent. (This is where it becomes apparent why the money was put in holding companies instead of in banks. The holding companies were designed to go bankrupt.! Chase Manhattan or Chemical Bank would not have to be sacrified since there were not responsible for the loans.)

Once the holding companie is declared bankrupt, they can legally avoid payment to the Arab nations. The international bankers will say, "Sorry, Arabs. We lost your money. You are broke!" When the Arab nations realise that all their money is gone, they will immediately liquidate all of their other assets. They will dump billions and billions of stocks and Wall Street will collapse. They will put all of their farmland and real estate on the market and land values will plummet. Farmers will have no collateral to borrow against to plant next year's crops and food will become scarce in the grocery stores.

The effect this will have on the American economy will be chaotic. This catastrophic collapse has been purposely designed to throw the American people into a state of confusion. Then the benevolent bankers will step forward saying, "Look what these dirty Arabs have done to you!" and offer a solution to our problems.

Their solution will be to abolish our currency and institute a new form of money. Each person then would be issued a government ID number and would need a debit card to do any business transactions.

Perhaps the biggest shock in May's story is that the "Star Wars" system is only 40% concerned with defense and 60% concerned with banking! These "Star Wars" satellites would link the debit system to a central computer base - a superbank. Transfer of funds between accounts would be instantaneous and the internal bankers would finally have complete financial control. May says the debate over "Star Wars" is all show because the satellites are already in place!

(snip)

Perhaps the best defense the international bankers have against protesters is influencing the publics' opinion through the media!!! In his book, "The Naked Capitalist" Cleon Skousen says that, "Nothing panics the international establishment like the possibility of a threatened exposure. Whenever the public has become dangerously aware of the conspiratorial processes operating around them, the vast inter-locking power structure of the entire London-Wall Street combine has immediately shifted into high gear and raced to the rescue. Radio, TV, newspaper, magazines, government policy makers, college officials and other opinion molders in high places have all commenced a recitation of a carefully prepared line designed to pacify the public and put them back to sleep".

Who actually controls the Federal Reserve? Who are the stockholders of this private corporation? In a legislative session regarding abolishing the Fed, the following eight family banks were named as the owners of the Federal Reserve:

Rothschild Banks of London and Berlin

Lazares Brothers Banks of Paris

Israel Moses Seif Bank of Italy

Warburg Bank of Hamburg and Amsterdam

Lehman Brothers Bank of New York

Chase Manhattan Bank of New York

Kuhn, Loeb Bank of New York

Goldman, Sachs Bank of New York

Any muslim banks you see muslims??nooo

Nearly 200 students detained in Quebec protest

Thousands

of student protesters march through downtown streets of Montreal on

July 22, 2012 in a demonstration against bill 78 and the tuition hike

fees in Quebec province.

Security forces have

arrested some 200 students marking the first anniversary of massive

protests against tuition increases in Canada's eastern province of

Quebec.

Police spokesman Jean-Bruno Latour said on Saturday that the protesters had been detained during a protest rally in downtown Montreal late on Friday.

The demonstrators demanded forming a commission to investigate the performance of police forces during last year's unrest that involved thousands of people against tuition hikes in the French-speaking province.

Some of the demonstrations turned violent, with many students detained during clashes with police.

The demonstrators eventually succeeded in persuading the Quebec government to cancel the tuition increases.

DB/MA

Now Banks Can Legally Steal Retirement Accounts

By Dominique de Kevelioc de Bailleul

“If you don’t understand what ‘get the hell out’ means, there’s not much I can do for you,” Ann Barnhardt passionately told blogger Warren Pollock, as she warned viewers of systemic failure in the U.S. financial system, as well as the certainty that American savers will be robbed of their retirement, brokerage and savings accounts in the process.

Barnhardt, the former commodities broker, cites the latest and hushed court ruling in the 2007 case of a failed Chicago-based futures brokerage firm Sentinel Management Group—another Ponzi bankruptcy, according to her, totaling $600 million of segregated customer funds tied up in bankruptcy awaiting determination of whether those segregated funds will be used to pay off a “secured position” of a $312 million loan held by Bank of NY Mellon.

According to a federal appeals court ruling,

Thursday, Bank of New York Mellon’s secured loan will be put ahead of

customer segregated accounts held by Sentinel—a landmark ruling that

turns individual segregated accounts into the property of a third party

under circumstances of duress. In other words, if a financial

institution fails, clients, depositors and pension funds may not get

some or all of their money back in a bankruptcy.

In essence, under the ruling, Securities Investor Protection Corporation (SPIC), Federal Deposit Insurance Corporation (FDIC) and other insurance programs no longer will/can protect customer funds, leaving millions of investors, depositors and retirees unaware that they are no longer account holders of their own funds, per se, but, instead, have suddenly become stockholders of the institution with which they have deposited their money.

Copy of the Sentinel Ruling from the U.S. Court of Appeals, Seventh Circuit.

Barnhardt goes on to say that many emails she receives from readers of her blog mock her as a Cassandra, but the woman who warned last year of the coming failures and the government’s disregard of the basics of Common Law have been proved correct. Customers who thought their money was insured with MF Global, PFGBest and, now, Sentinel, were not insured after all, and will lose some or all of their money due to a bankruptcy of the firm in which they’ve placed faith.

She reiterates from numerous previous interviews: run for the hills with your money. The federal appeals court ruling in the case of Sentinel demonstrates that financial institutions have suddenly taken precedence over segregated customer funds, including their largest customers of all—pension funds.

Few know that the game has changed, and the lack of mainstream media coverage of the shock ruling from the seventh circuit court highly suggests fears within the Fed of a full-blown bank run if the news of Sentinel’s case were to become a front-page headline, underscoring the fragility of the banking system of the United States.

“Insurance is designed to cover discreet, individual catastrophes. Okay? If one bank fails, the FDIC can come in and backstop that one bank, no problem,” Barnhardt explains.

“What do you think is going to happen if the entire system collapses? What happens, do you think, if, even, let’s say 25 percent of the banks or the banking capacity in the United States fails?” she asks, rhetorically. “We are now talking trillions and trillions of dollars in deposits.”

In fact, the FDIC shows $15.3 billion (Q1 2012) available to insure approximately $4.7 trillion of deposits (last reported, Q4 2008), or an insurance pool equivalent to one-third of one cent (0.0033) held at the FDIC for each dollar insured within the banking system.

Presently, the FDIC cannot make whole on even one percent of bank deposits covered under its insurance program, though it claims to cover up to $250,000 for each account, a promise that surely will be broken (at least when compared with today’s purchasing power of one dollar) during a systemic banking system failure, according to Barnhardt.

“The analogy is to the fire department,” she adds. “The fire department work great if one house is on fire. What happens if the entire city, if every structure in the city is on fire?”

Barnhardt concludes her interview with two thoughts:

Firstly, in a democratic republic, collectively, Americans are ultimately responsible for the financial system by voting for “psychopaths” to guard against allowing other psychopaths to run the banking system. The coming financial collapse would not be possible with an informed and vigilant electorate, according to her.

Secondly, Barnhardt, a devout Christian, prays for people to wake up in time to protect themselves before the collapse takes place, which she says could be tomorrow, or as far out as two years from now.

Source: Barnhardt.biz

“If you don’t understand what ‘get the hell out’ means, there’s not much I can do for you,” Ann Barnhardt passionately told blogger Warren Pollock, as she warned viewers of systemic failure in the U.S. financial system, as well as the certainty that American savers will be robbed of their retirement, brokerage and savings accounts in the process.

Barnhardt, the former commodities broker, cites the latest and hushed court ruling in the 2007 case of a failed Chicago-based futures brokerage firm Sentinel Management Group—another Ponzi bankruptcy, according to her, totaling $600 million of segregated customer funds tied up in bankruptcy awaiting determination of whether those segregated funds will be used to pay off a “secured position” of a $312 million loan held by Bank of NY Mellon.

In essence, under the ruling, Securities Investor Protection Corporation (SPIC), Federal Deposit Insurance Corporation (FDIC) and other insurance programs no longer will/can protect customer funds, leaving millions of investors, depositors and retirees unaware that they are no longer account holders of their own funds, per se, but, instead, have suddenly become stockholders of the institution with which they have deposited their money.

Copy of the Sentinel Ruling from the U.S. Court of Appeals, Seventh Circuit.

Barnhardt goes on to say that many emails she receives from readers of her blog mock her as a Cassandra, but the woman who warned last year of the coming failures and the government’s disregard of the basics of Common Law have been proved correct. Customers who thought their money was insured with MF Global, PFGBest and, now, Sentinel, were not insured after all, and will lose some or all of their money due to a bankruptcy of the firm in which they’ve placed faith.

She reiterates from numerous previous interviews: run for the hills with your money. The federal appeals court ruling in the case of Sentinel demonstrates that financial institutions have suddenly taken precedence over segregated customer funds, including their largest customers of all—pension funds.

Few know that the game has changed, and the lack of mainstream media coverage of the shock ruling from the seventh circuit court highly suggests fears within the Fed of a full-blown bank run if the news of Sentinel’s case were to become a front-page headline, underscoring the fragility of the banking system of the United States.

“Insurance is designed to cover discreet, individual catastrophes. Okay? If one bank fails, the FDIC can come in and backstop that one bank, no problem,” Barnhardt explains.

“What do you think is going to happen if the entire system collapses? What happens, do you think, if, even, let’s say 25 percent of the banks or the banking capacity in the United States fails?” she asks, rhetorically. “We are now talking trillions and trillions of dollars in deposits.”

In fact, the FDIC shows $15.3 billion (Q1 2012) available to insure approximately $4.7 trillion of deposits (last reported, Q4 2008), or an insurance pool equivalent to one-third of one cent (0.0033) held at the FDIC for each dollar insured within the banking system.

Presently, the FDIC cannot make whole on even one percent of bank deposits covered under its insurance program, though it claims to cover up to $250,000 for each account, a promise that surely will be broken (at least when compared with today’s purchasing power of one dollar) during a systemic banking system failure, according to Barnhardt.

“The analogy is to the fire department,” she adds. “The fire department work great if one house is on fire. What happens if the entire city, if every structure in the city is on fire?”

Barnhardt concludes her interview with two thoughts: