Saturday, March 5, 2016

Jim Rogers: There’s a 100% Probability of a U.S. Recession Within a Year

Rogers Holdings Chairman Jim Rogers is certain that the U.S. economy will be in recession in the next 12 months.

During an interview on Bloomberg TV with Guy Johnson, the famous investor said that there was a 100 percent probability that the U.S. economy would be in a downturn within one year.

“It’s been seven years, eight years since we had the last recession in the U.S., and normally, historically we have them every four to seven years for whatever reason—at least we always have,” he said. “It doesn’t have to happen in four to seven years, but look at the debt, the debt is staggering.”

Most Wall Street economists see a much smaller chance of a U.S. recession within this span, with odds typically below 33 percent.

Rogers was not specific on what could trigger a disorderly deleveraging process and recession but claimed that sluggish or slowing economies in China, Japan, and the euro zone mean that there are many possible channels of contagion.The former partner of George Soros suggested that if investors focus on the right data, there are signs that the U.S. economy is already faltering.

“If you look at the … payroll tax figures [in the U.S.], you see they’re already flat,” he concluded. “Don’t pay attention to the government numbers, pay attention to the real numbers.”

In light of the economic turmoil envisioned by Rogers, he is long the U.S. dollar.

“It might even turn into a bubble,” he said of the greenback. “I mean, if markets around the world are crashing, let’s just say that scenario happens, everybody’s going to put their money in the U.S. dollar—it could turn into a bubble.”

Rogers added that a strengthening U.S. dollar has historically been negative for commodities—the asset class that the investor is best-known for.

While the yen is often designated as a risk-off currency, it won’t benefit in the event of a flight to safety due to the massive, continued expansion of the Bank of Japan’s balance sheet, according to Rogers, who said he exited his position in the yen last Friday.

SOURCE

Central Bank Governors Are Liars

Central Banks are complicit in the

manipulation of financial markets including stock markets, commodities,

gold and currency markets, not to mention the oil and energy markets

which have been the object of a carefully engineered “pump and dump”

speculative onslaught.

Who controls the central banks? Monetary policy does not serve the public interest.

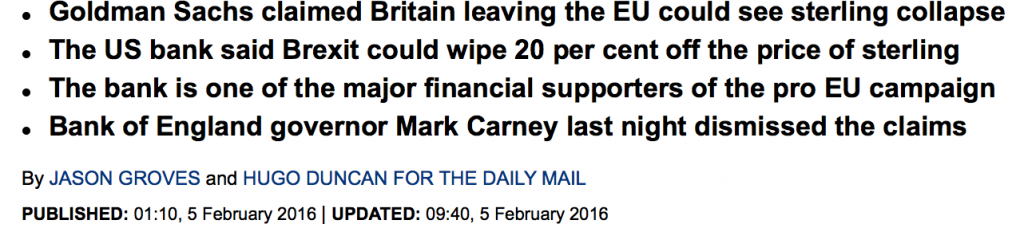

The article below by Washington Blog quotes three influential central bankers: Mark Carney, Meryl King and Alan Greenspan.

The current governor of the Bank of England Mark Carney (image right) is a former Goldman Sachs official.

He went from Goldman to heading the Bank of Canada before being appointed Governor of the Bank of England.

At the time of his appointment he was

not a citizen of the United Kingdom. A precedent was set: Mark Carney

was the first foreigner to occupy that position since the founding of

the Governor and Company of the Bank of England in 1694.

The issue was barely mentioned by the British media.

While Carney was appointed by Her Majesty, unofficially, he still has “links” to Goldman Sachs.

Is he in conflict of interest in

relation to Goldman Sachs’ recent insinuations regarding the stability

of the British Pound Sterling were the UK decide to exit the EU?

Insinuations of this nature combined with inside information are the basis for large scale speculative operations:

Daily Mail, February 2, 2016

Was Goldman Sachs’ claim really undermined by Bank of England Mark Carney as suggested by…

Continue reading

Video: How Precedent and Judicial Restraint Protect Elite Interests at SCOTUS

Dean of UNC-Irvine Law Erwin Chemerinsky discusses the history of the

Supreme Court aligning itself with business interests and why today’s

Court is the most …

Via Youtube

Via Youtube

Prosperity Not Austerity: New Progressive Budget ‘Prioritizes Well-Being of People and Planet’

Republicans’ “harmful cuts are a false prophecy for American economic success”

Andrea Germanos

The Congressional Progressive Caucus unveiled on Thursday what it calls “a down payment on a brighter future for all Americans”—a progressive budget for 2017 that offers a blueprint for tacking systemic injustices while creating over 3.5 million jobs.

The Caucus, headed by co-chairs Reps. Raúl M. Grijalva (D-Ariz) and Keith Ellison (D-Minn.), entitled the document The People’s Budget: Prosperity Not Austerity; Invest in America.

It “reverses harmful austerity cuts and fixes a system that for far too long has only benefited those at the top,” stated First-Vice Chair Rep. Pocan (D-Wis.). It’s also, according to Rep. Grijalva, a “true expression of progressive values.”

A summary of the budget states that it:

The budget’s climate proposals received accolades from environmental organization Friends of the Earth.

“This is the only budget in Washington that truly accepts the urgency of the climate crisis,” stated Lukas Ross, energy campaigner with the group. “From reining in Big Oil to investing in clean renewable energy, this is the policy vision we need to ensure a just and speedy end to the era of fossil fuels.”

But it’s not just “numbers and charts,” Grijalva said; instead, “our budget is a path forward for the American people who’ve had their wages flat line and savings erode.”

“It alleviates our overcrowded classrooms where kids struggle to learn, and makes higher education a reality for any student committed to earning a college degree. It ensures profit motives and systemic inequalities have no place in our criminal justice system or our immigration policies. The investments we detail will create jobs, protect the environment and promote growth by requiring the wealthiest among us, corporations and Wall Street to contribute their fair share to our society.

“The budget of the Congressional Progressive Caucus prioritizes the well-being of people and the planet.”

—Lukas Ross, Friends of the Earth

“While Republicans continue fighting over how much more seniors should sacrifice, The People’s Budget shows that their harmful cuts are a false prophecy for American economic success,” he continued.

Ross agreed, adding, “In the face of record inequality and looming climate disruption, debating between different shades of austerity is simply unacceptable. Budgets are about priorities, and the budget of the Congressional Progressive Caucus prioritizes the well-being of people and the planet.”

House Republicans, meanwhile, continue to wrangle over their own budget proposal. Roll Call reports:

His proposal, Jasmine Tucker and Lindsay Koshgarian wrote at National Priorities Project,

Via Common Dreams. This piece was reprinted by RINF Alternative News with permission or license.

The Congressional Progressive Caucus unveiled on Thursday what it calls “a down payment on a brighter future for all Americans”—a progressive budget for 2017 that offers a blueprint for tacking systemic injustices while creating over 3.5 million jobs.

The Caucus, headed by co-chairs Reps. Raúl M. Grijalva (D-Ariz) and Keith Ellison (D-Minn.), entitled the document The People’s Budget: Prosperity Not Austerity; Invest in America.

It “reverses harmful austerity cuts and fixes a system that for far too long has only benefited those at the top,” stated First-Vice Chair Rep. Pocan (D-Wis.). It’s also, according to Rep. Grijalva, a “true expression of progressive values.”

A summary of the budget states that it:

- Includes $1 trillion in infrastructure upgrades

- Provides a plan to reduce poverty by half in ten years

- Funds public financing of campaigns to curb the influence of special interests in politics

- Enacts a Financial Transaction Tax on Wall Street’s high-stakes trading

- Provides greater investments in K-12 education

- Allows states to transition to single-payer health care systems

- Introduces a carbon tax

- Increases funding for diplomacy and strategic humanitarian aid

The CPC Budget takes critical steps to strengthen women’s social and economic standing, including allowing women to make decisions about their own healthcare. The People’s Budget does not include the restrictive Hyde Amendment and it increases Title X funding so that at – risk women and children have comprehensive access to services. An investment in women and children is an investment in America’s future.And it addresses the water crisis afflicting Flint, Michigan, allocating $765 million for the city to upgrade its water infrastructure.

The budget’s climate proposals received accolades from environmental organization Friends of the Earth.

“This is the only budget in Washington that truly accepts the urgency of the climate crisis,” stated Lukas Ross, energy campaigner with the group. “From reining in Big Oil to investing in clean renewable energy, this is the policy vision we need to ensure a just and speedy end to the era of fossil fuels.”

But it’s not just “numbers and charts,” Grijalva said; instead, “our budget is a path forward for the American people who’ve had their wages flat line and savings erode.”

“It alleviates our overcrowded classrooms where kids struggle to learn, and makes higher education a reality for any student committed to earning a college degree. It ensures profit motives and systemic inequalities have no place in our criminal justice system or our immigration policies. The investments we detail will create jobs, protect the environment and promote growth by requiring the wealthiest among us, corporations and Wall Street to contribute their fair share to our society.

“The budget of the Congressional Progressive Caucus prioritizes the well-being of people and the planet.”

—Lukas Ross, Friends of the Earth

“While Republicans continue fighting over how much more seniors should sacrifice, The People’s Budget shows that their harmful cuts are a false prophecy for American economic success,” he continued.

Ross agreed, adding, “In the face of record inequality and looming climate disruption, debating between different shades of austerity is simply unacceptable. Budgets are about priorities, and the budget of the Congressional Progressive Caucus prioritizes the well-being of people and the planet.”

House Republicans, meanwhile, continue to wrangle over their own budget proposal. Roll Call reports:

A fiscal 2017 spending plan that can pass the House would be one that strikes a compromise between leadership and members who believe the budget needs to adhere to spending levels agreed to in last year’s budget deal, $1.07 trillion, and those who want to stick to the sequestration spending level, $1.04 trillion — a difference of $30 billion in discretionary spending.President Obama, for his part, offered his final budget proposal to Congress last month, which Republicans promptly declined to hear.

His proposal, Jasmine Tucker and Lindsay Koshgarian wrote at National Priorities Project,

calls for increased investment in education, the fight against climate change, and family-friendly tax policies, all of which enjoy broad popular support. However, it also calls for continued windfalls for the Pentagon that will benefit for-profit contractors without adding to our security.

Govt. review hints at age hikes for future British pensioners

A UK government review of the state pension system hints at increases in the official retirement age in the years and decades to come.

Cabinet ministers have announced a radical review of the UK pensions over government concerns that the current system may not be “affordable in the long term.”

Working Britons who are now under the age of about 55 might be targeted if the review becomes law.

If it is approved, those workers might still have to work if they turn 75 or even 81, according to the Telegraph. Millions of people will be affected in that case.

The government says the review would consider changes in life expectancy as well as wider changes in society and “make sure that the state pension is sustainable and affordable for future generations.”

The results of the government review will be published next May.

Read more

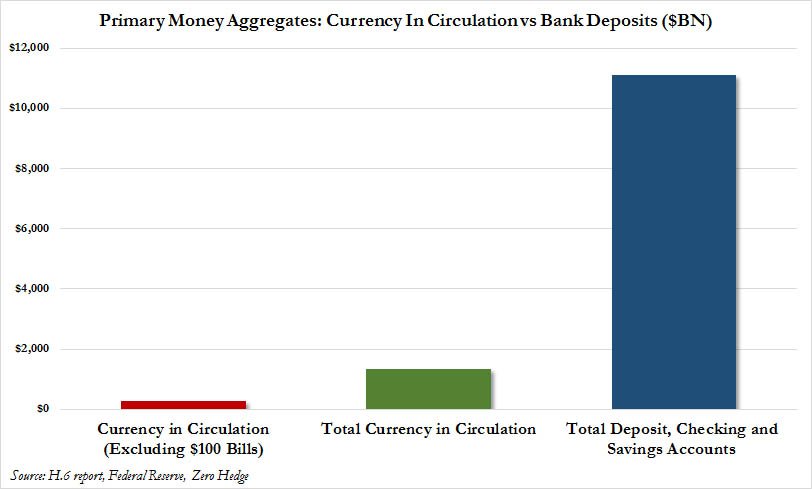

Got PHYSICAL Cash? Got PHYSICAL Silver & Gold? …Better Get It Fast.

Currency in circulation (incl/excl $100 bills) vs total deposit, checking and savings accounts

HOT BlackRock Suspends ETF Issuance Due To "Surging Demand For Gold"

BlackRock's Gold ETF has seen

fund inflows every day in 2016 (no outflows at all) and with the stock

trading above its NAV for most of the year, the world's largest asset

manager has made a significant decision: Issuance of New IAU (Gold

Trust) Shares Temporarily Suspended

As I have been advising in the EPJ Daily Alert we are in the early stages of a mjor spike in gold.

Here's BlackRock's statement:

-RW

As I have been advising in the EPJ Daily Alert we are in the early stages of a mjor spike in gold.

Here's BlackRock's statement:

Issuance of New IAU (Gold Trust) Shares Temporarily Suspended; Existing Shares to Trade Normally for Retail and Institutional Investors on NYSE Arca and Other VenuesI have further discussion on this and what it means long-term in today's ALERT.

Suspension results from surging demand for gold, which requires registration of new shares

iShares Delaware Trust Sponsor LLC, in its capacity as the sponsor of iShares Gold Trust (IAU), has temporarily suspended the creation of new shares of IAU until additional shares are registered with the Securities and Exchange Commission (SEC).

This suspension does not affect the ability of retail and institutional investors to trade on stock exchanges. Retail and institutional investors will continue to be able to buy and sell shares in IAU.

IAU holds gold as a physical asset. IAU is an exchange-traded commodity (ETC), which therefore is not eligible for registration as an investment company under the ’40 Act. IAU may only be registered under the ’33 Act as a grantor trust. Under the ’33 Act, subscriptions for new shares in excess of those registered requires additional filings with the SEC.

Nearly all other U.S. iShares are exchange-traded funds (ETFs), registered as investment companies under the ’40 Act. The ’40 Act provides for the continuous offering of shares and does not require registration of additional shares as the fund grows due to investor demand in connection to new subscriptions.

Since the start of 2016, in response to global macroeconomic conditions, demand for gold and for IAU has surged among global investors. IAU has $8 billion in assets under management, and has expanded $1.4 billion year to date. February marked its largest creation activity in the last decade.

This surge in demand has led to the temporary exhaustion of IAU shares currently registered under the ’33 Act. We are registering new shares to accommodate future creations in the primary market by filing a Form 8-K to announce the resumption of the offering of new shares. The ability of authorized participants to redeem shares of IAU is not affected.

-RW

Death Of Paper Gold Picks Up Speed BIG TIME Today

by SRSrocco

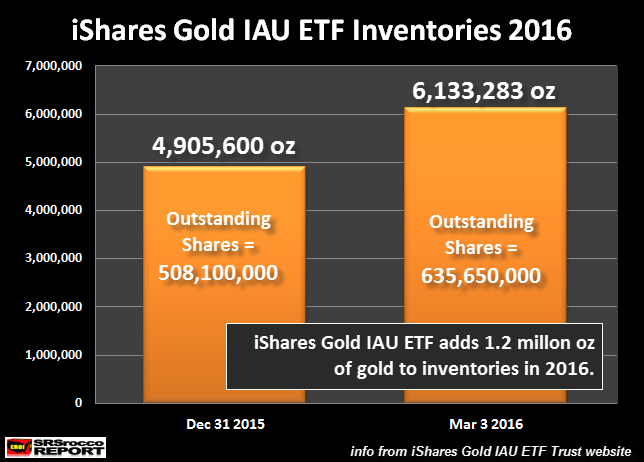

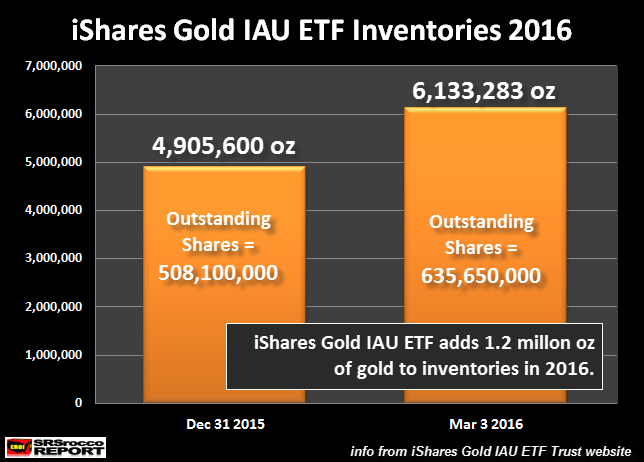

If we look at the increase in Blackrock’s iShares IAU ETF gold inventories, they have increased 1.2 million (Moz) in the first 2 months of the year:

The iShares IAU ETF held 4,905,600 oz of gold at the end of 2015, but this jumped 1.2 Moz to 6,133,283 oz presently. This is nearly a 25% increase in gold inventories in only two months. As we can see, the outstanding shares increased from 508.1 million Dec 31st 2015, to 635.6 million shares currently.

In order for Blackrock to issue more shares of its gold IAU ETF, it will need to acquire more physical gold. Blackrock’s news release also stated the following:

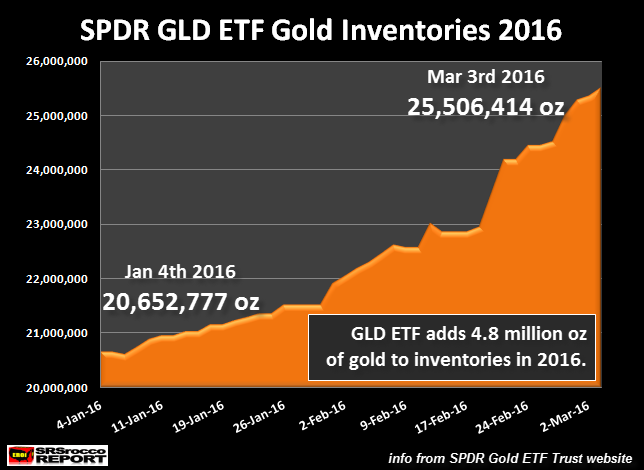

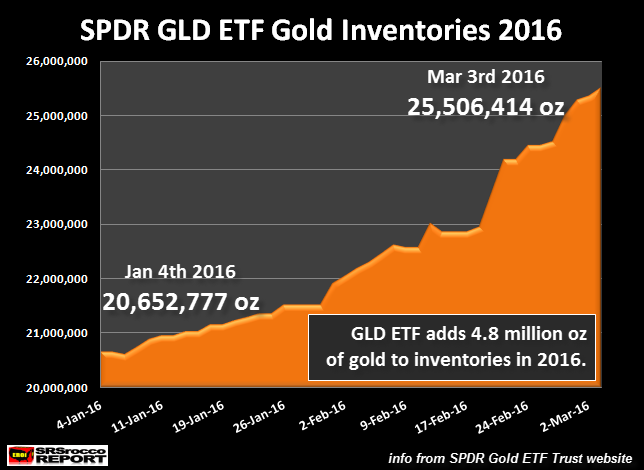

This is a good question because if we look at the SPDR’s Gold GLD ETF, they don’t seem to have a problem adding more physical gold to their inventories:

While Blackrock’s has suspended issuance of new shares of its IAU Gold ETF, SPDR’s GLD ETF doesn’t seem to be having a problem as it has added a whopping 4.8 Moz of gold to its inventories in the past two months–four times the rate of the IAU Gold ETF.

Could it be that the GLD ETF really doesn’t contain all the gold it says it has in its inventories? Or maybe the gold they say have in their inventories is over subscribed?

The GLD ETF had 20.6 Moz of gold in its inventory in the beginning of the year, but now holds 25.5 Moz. Just these two gold ETF’s have added 6 Moz of gold to their inventories in just the first two months of the year. This is an amazing feat when we realize total mine supply was likely only 14.5 Moz for January and February.

If the gold market suffered a 1.4 Moz deficit in Q4 2015 even with 2.2 Moz of supply coming from Gold ETF outflows, what kind of trouble is taking place now with just two Gold ETF’s added 6 Moz to their inventories in just two months??? Folks, this translates to 187 metric tons of additional physical gold demand during JAN-FEB compared to a 2.2 Moz outflow last quarter.

This is an amazing net 8.2 Moz change in Gold ETF demand in just the first two months of 2016 versus Q4 2015. No wonder Blackrock had to suspend issuance of new shares. We may be finally witnessing the READ ENDGAME TO PAPER GOLD MANIPULATION.

It will be interesting to see how things unfold over the next few months as more cracks continue to appear in the Greatest Financial Paper Ponzi Scheme In History.

The Death of the paper gold

market picked up speed today as Blackrock announced that issuance of new

Gold IAU ETF shares was suspended. However, it’s much worse than the

information in news release when we factor in the total supply and

demand situation.

According to the article on Zerohedge, BlackRock Suspends ETF Issuance Due To “Surging Demand For Gold”:BlackRock’s Gold ETF (IAU) has seen fund inflows every day in 2016 (no outflows at all) and with the stock trading above its NAV for most of the year, the world’s largest asset manager has made a significant decision:Now, why is this so interesting? Because, this now suggests a tightness in the paper gold market due to the last several years of surging physical gold demand…. especially now that China has recently become an “official” Central Bank buyer of gold.

•*BLACKROCK SAYS ISSUANCE OF GOLD TRUST SHARES SUSPENDED

• *BLACKROCK SAYS SUSPENSION DUE TO DEMAND FOR GOLD

If we look at the increase in Blackrock’s iShares IAU ETF gold inventories, they have increased 1.2 million (Moz) in the first 2 months of the year:

The iShares IAU ETF held 4,905,600 oz of gold at the end of 2015, but this jumped 1.2 Moz to 6,133,283 oz presently. This is nearly a 25% increase in gold inventories in only two months. As we can see, the outstanding shares increased from 508.1 million Dec 31st 2015, to 635.6 million shares currently.

In order for Blackrock to issue more shares of its gold IAU ETF, it will need to acquire more physical gold. Blackrock’s news release also stated the following:

February marked its largest creation activity in the last decade.Blackrock says they are registering new shares to accommodate future creations in the primary market. The question to ask is this….. why wait until shares are exhausted before filing a 8-K form to acquire additional shares? Is it just a matter of getting new paper shares, or is it a matter of acquiring the physical gold to back those shares?

This surge in demand has led to the temporary exhaustion of IAU shares currently registered under the ’33 Act. We are registering new shares to accommodate future creations in the primary market by filing a Form 8-K to announce the resumption of the offering of new shares.

This is a good question because if we look at the SPDR’s Gold GLD ETF, they don’t seem to have a problem adding more physical gold to their inventories:

While Blackrock’s has suspended issuance of new shares of its IAU Gold ETF, SPDR’s GLD ETF doesn’t seem to be having a problem as it has added a whopping 4.8 Moz of gold to its inventories in the past two months–four times the rate of the IAU Gold ETF.

Could it be that the GLD ETF really doesn’t contain all the gold it says it has in its inventories? Or maybe the gold they say have in their inventories is over subscribed?

The GLD ETF had 20.6 Moz of gold in its inventory in the beginning of the year, but now holds 25.5 Moz. Just these two gold ETF’s have added 6 Moz of gold to their inventories in just the first two months of the year. This is an amazing feat when we realize total mine supply was likely only 14.5 Moz for January and February.

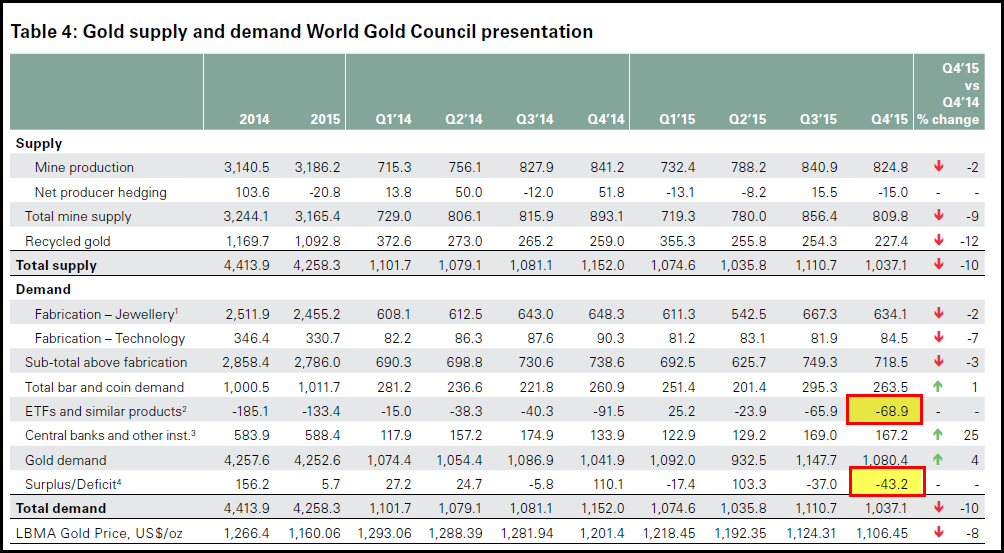

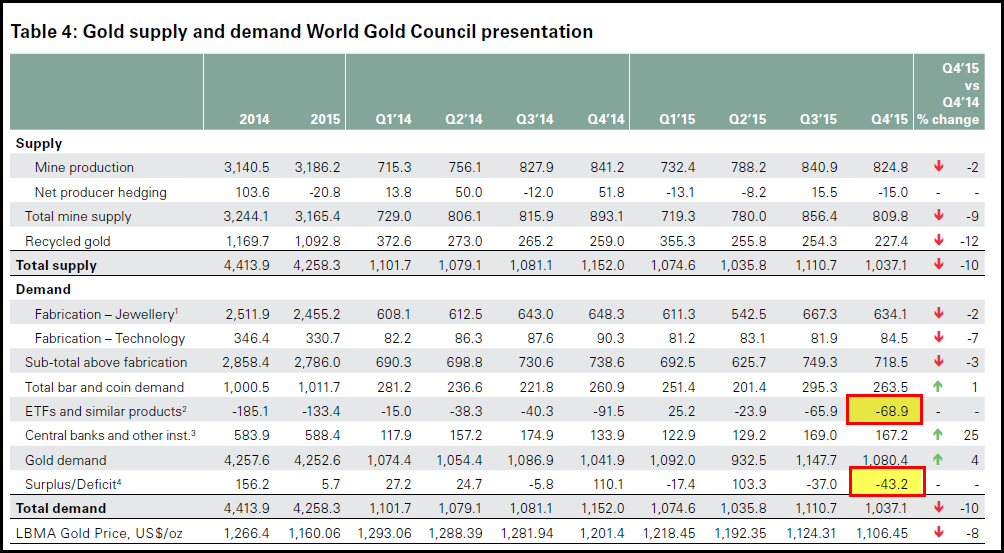

Surging Gold ETF Demand Destroys Supply & Demand Balance

According to the World Gold Council’s 2015 Full Year Demand Trends, the gold market suffered a 43 metric ton (1.4 Moz) deficit in Q4, even with a net outflow of Gold ETF’s of 69 metric tons (2.2 Moz):

If the gold market suffered a 1.4 Moz deficit in Q4 2015 even with 2.2 Moz of supply coming from Gold ETF outflows, what kind of trouble is taking place now with just two Gold ETF’s added 6 Moz to their inventories in just two months??? Folks, this translates to 187 metric tons of additional physical gold demand during JAN-FEB compared to a 2.2 Moz outflow last quarter.

This is an amazing net 8.2 Moz change in Gold ETF demand in just the first two months of 2016 versus Q4 2015. No wonder Blackrock had to suspend issuance of new shares. We may be finally witnessing the READ ENDGAME TO PAPER GOLD MANIPULATION.

It will be interesting to see how things unfold over the next few months as more cracks continue to appear in the Greatest Financial Paper Ponzi Scheme In History.

It’s a revolution: German banks told to start hoarding cash

Just stunning.

German newspaper Der Spiegel reported yesterday that the Bavarian Banking Association has recommended that its member banks start stockpiling PHYSICAL CASH.

Europe, of course, has been battling with negative interest rates for quite some time.

What this means is that commercial banks are being charged interest for holding wholesale deposits at the European Central Bank.

In order to generate artificial economic growth, the ECB wants banks to make as many loans as possible, no matter how stupid or idiotic.

They believe that economic growth is simply a function of loans. The more money that’s loaned out, the more the economy will grow.

This is the sort of theory that works really well in an economic textbook. But it doesn’t work so well in a history textbook.

Cheap money encourages risky behavior. It gives banks an incentive to give ‘no money down’ loans to homeless people with no employment history.

It creates bubbles (like the housing bubble from 10 years ago), and ultimately, financial panics (like the banking crisis from 8 years ago).

Banks are supposed to be conservative, responsible managers of other people’s money.

When central bank policies penalize that practice, bad things tend to happen.

Traditionally when a commercial bank in Europe wants to play it safe with its customers’ funds, they would hold excess reserves on deposit with the European Central Bank.

In the past, they might even have been paid interest on those excess reserves as an extra incentive to be conservative.

Now it’s the exact opposite. If a bank holds excess reserves on deposit at the ECB to ensure that they have a greater margin of safety, they must now pay 0.3% to the ECB.

That’s what it means to have negative interest rates. And for the bank, this eats into their profits, especially when they have tens of billions in excess reserves.

Talk about being between a rock and a hard place.

On one hand, banks stand to lose a ton of money in negative interest. On the other hand, they put their customers’ deposits at risk if they don’t hold extra reserves.

Well, the Bavarian Banking Association has had enough of this financial dictatorship.

Their new recommendation is for all member banks to ditch the ECB and instead start keeping their excess reserves in physical cash, stored in their own bank vaults.

This is officially an all-out revolution of the financial system where banks are now actively rebelling against the central bank.

(What’s even more amazing is that this concept of traditional banking– holding physical cash in a bank vault– is now considered revolutionary and radical.)

There’s just one teensy tiny problem: there simply is not enough physical cash in the entire financial system to support even a tiny fraction of the demand.

Total bank deposits exceed trillions of euros. Physical cash constitutes just a small percentage of that sum.

So if German banks do start hoarding physical currency, there won’t be any left in the financial system.

This will force the ECB to choose between two options:

1) Support this rebellion and authorize the issuance of more physical cash; or

2) Impose capital controls.

Given that just two weeks ago the President of the ECB spoke about the possibility of banning some higher denomination cash notes, it’s not hard to figure out what’s going to happen next.

German newspaper Der Spiegel reported yesterday that the Bavarian Banking Association has recommended that its member banks start stockpiling PHYSICAL CASH.

Europe, of course, has been battling with negative interest rates for quite some time.

What this means is that commercial banks are being charged interest for holding wholesale deposits at the European Central Bank.

In order to generate artificial economic growth, the ECB wants banks to make as many loans as possible, no matter how stupid or idiotic.

They believe that economic growth is simply a function of loans. The more money that’s loaned out, the more the economy will grow.

This is the sort of theory that works really well in an economic textbook. But it doesn’t work so well in a history textbook.

Cheap money encourages risky behavior. It gives banks an incentive to give ‘no money down’ loans to homeless people with no employment history.

It creates bubbles (like the housing bubble from 10 years ago), and ultimately, financial panics (like the banking crisis from 8 years ago).

Banks are supposed to be conservative, responsible managers of other people’s money.

When central bank policies penalize that practice, bad things tend to happen.

Traditionally when a commercial bank in Europe wants to play it safe with its customers’ funds, they would hold excess reserves on deposit with the European Central Bank.

In the past, they might even have been paid interest on those excess reserves as an extra incentive to be conservative.

Now it’s the exact opposite. If a bank holds excess reserves on deposit at the ECB to ensure that they have a greater margin of safety, they must now pay 0.3% to the ECB.

That’s what it means to have negative interest rates. And for the bank, this eats into their profits, especially when they have tens of billions in excess reserves.

Talk about being between a rock and a hard place.

On one hand, banks stand to lose a ton of money in negative interest. On the other hand, they put their customers’ deposits at risk if they don’t hold extra reserves.

Well, the Bavarian Banking Association has had enough of this financial dictatorship.

Their new recommendation is for all member banks to ditch the ECB and instead start keeping their excess reserves in physical cash, stored in their own bank vaults.

This is officially an all-out revolution of the financial system where banks are now actively rebelling against the central bank.

(What’s even more amazing is that this concept of traditional banking– holding physical cash in a bank vault– is now considered revolutionary and radical.)

There’s just one teensy tiny problem: there simply is not enough physical cash in the entire financial system to support even a tiny fraction of the demand.

Total bank deposits exceed trillions of euros. Physical cash constitutes just a small percentage of that sum.

So if German banks do start hoarding physical currency, there won’t be any left in the financial system.

This will force the ECB to choose between two options:

1) Support this rebellion and authorize the issuance of more physical cash; or

2) Impose capital controls.

Given that just two weeks ago the President of the ECB spoke about the possibility of banning some higher denomination cash notes, it’s not hard to figure out what’s going to happen next.

Our goal is simple: To help you achieve personal liberty and financial prosperity no matter what happens.

Multiple times every week, we help over 100,000 Sovereign Man subscribers who are taking their family's liberty and prosperity into their own hands with our free publication, Notes From The Field.

Activate your free subscription today, and get fresh intelligence delivered securely to your inbox as we travel the world discovering the biggest opportunities available to smart, enterprising individuals like you.

Multiple times every week, we help over 100,000 Sovereign Man subscribers who are taking their family's liberty and prosperity into their own hands with our free publication, Notes From The Field.

Activate your free subscription today, and get fresh intelligence delivered securely to your inbox as we travel the world discovering the biggest opportunities available to smart, enterprising individuals like you.

Waning Enthusiasm for Share Buybacks Signals Major Market Reversal

by elliottwave

Our evidence included the following headline from 2001: “Buybacks Hit a Wall of Fear.”

The 2008 version from The Wall Street Journal read, “[From] Buyback Boom To Buyer’s Remorse.”

Well, here are some more recent headlines:

Stock Buyback Deals Can Be Stinkers (USA Today, Nov. 5, 2015)

The Stock Market Has a Buyback Problem (Fortune, Nov. 18, 2015)

Surge In Stock Buybacks Good or Evil? (The Wall Street Journal, Nov. 22, 2015)

As the following chart shows, through the first three quarters of 2015, buybacks were the strongest since the record year of 2007, when stocks made a major top.

Until recently, share repurchases were considered a positive development for companies. But a widely circulated report from Research Affiliates says buybacks offer “little overall benefit. ‘Buybacks are simply a mirage.'” Fortune concludes, “Investors might soon regret the buyback binge.”

They always do, and the outbreak of skepticism is a sure sign that the falling share prices that invariably compounds those regrets is very close.

In the May 2008 issue of The Elliott Wave Financial Forecast,

three months before the infamous Lehman Brothers bankruptcy, we cited a

sudden loss of enthusiasm for company buybacks as another component of a

major market reversal.

We noted that for companies issuing buyback announcements “cheers

invariably turn to jeers” as the stock market reverses from up to down.Our evidence included the following headline from 2001: “Buybacks Hit a Wall of Fear.”

The 2008 version from The Wall Street Journal read, “[From] Buyback Boom To Buyer’s Remorse.”

Well, here are some more recent headlines:

Stock Buyback Deals Can Be Stinkers (USA Today, Nov. 5, 2015)

The Stock Market Has a Buyback Problem (Fortune, Nov. 18, 2015)

Surge In Stock Buybacks Good or Evil? (The Wall Street Journal, Nov. 22, 2015)

As the following chart shows, through the first three quarters of 2015, buybacks were the strongest since the record year of 2007, when stocks made a major top.

Until recently, share repurchases were considered a positive development for companies. But a widely circulated report from Research Affiliates says buybacks offer “little overall benefit. ‘Buybacks are simply a mirage.'” Fortune concludes, “Investors might soon regret the buyback binge.”

They always do, and the outbreak of skepticism is a sure sign that the falling share prices that invariably compounds those regrets is very close.

MUST READ: BRICS Bank Cause BARCLAYS to Retreat From Brazil, Russia, Asia and Africa

So far they have exited from Brazil, Russia, Asia and yesterday from South Africa…next move is India!

https://brazilportal.wordpress.com/2016/01/21/barclays-retreats-from-asia-brazil-and-russia/

http://www.enca.com/money/barclays-confirms-it-exiting-africa

http://www.cnbc.com/2016/02/28/barclays-set-to-exit-african-business.html

http://www.ft.com/intl/cms/s/0/b4430f6a-c032-11e5-846f-79b0e3d20eaf.html

BRICS Bank to Balance Global Order<<<

http://www.bdlive.co.za/opinion/2015/08/20/brics-bank-to-balance-global-order

And they WILL cover it up until it’s too late for you to realize; as this blast from the past article proves;

http://www.fin24.com/Companies/Financial-Services/absa-slams-barclays-sale-plans-as-speculation-20151217

AC

Everything is falling into plan and I postulate that the main cause is due to the New BRICS Development Bank.

This is what is happening and it WILL change the way you know the world so take heed.https://brazilportal.wordpress.com/2016/01/21/barclays-retreats-from-asia-brazil-and-russia/

http://www.enca.com/money/barclays-confirms-it-exiting-africa

http://www.cnbc.com/2016/02/28/barclays-set-to-exit-african-business.html

http://www.ft.com/intl/cms/s/0/b4430f6a-c032-11e5-846f-79b0e3d20eaf.html

BRICS Bank to Balance Global Order<<<

http://www.bdlive.co.za/opinion/2015/08/20/brics-bank-to-balance-global-order

And they WILL cover it up until it’s too late for you to realize; as this blast from the past article proves;

http://www.fin24.com/Companies/Financial-Services/absa-slams-barclays-sale-plans-as-speculation-20151217

AC

Gold ETF Market Breaks: BlackRock Suspends ETF Issuance Due To “Surging Demand For Gold”

From Tyler Durden, ZeroHedge:

BlackRock Statement:

As we previously concluded, the reality that there are just two tons of gold to satisfy delivery requsts based on accepted protocols should in itself be troubling, ignoring the latent question why so many owners of physical gold are de-warranting their holdings.

Considering there are now less than 74,000 ounces of Registered gold at the Comex, or just over 2 tonnes, we may be about to find out how right, or wrong, the skeptics are, because at this rate the combined Registered vault gold could be depleted as soon as the next delivery request is satisfied. Or isn’t.

Meanwhile, this is how gold is taking the news – it would appear that some gold is still available… one just has to pay up for it.

BlackRock’s Gold ETF (IAU) has

seen fund inflows every day in 2016 (no outflows at all) and with the

stock trading above its NAV for most of the year, the world’s largest

asset manager has made a significant decision: It has suspended issuance of Gold Trust shares due to “surging demand for gold.”

It appears the huge demand for physical gold (and lack of supply) is

finally catching up with the manipulation of paper prices.

BlackRock’s Gold ETF (IAU) has seen fund inflows every day in 2016

(no outflows at all) and with the stock trading above its NAV for most

of the year, the world’s largest asset manager has made a significant

decision:- *BLACKROCK SAYS ISSUANCE OF GOLD TRUST SHARES SUSPENDED

- *BLACKROCK SAYS SUSPENSION DUE TO DEMAND FOR GOLD

BlackRock Statement:

Issuance of New IAU (Gold Trust) Shares Temporarily Suspended; Existing Shares to Trade Normally for Retail and Institutional Investors on NYSE Arca and Other Venues

Suspension results from surging demand for gold, which requires registration of new shares

iShares Delaware Trust Sponsor LLC, in its capacity as the sponsor of iShares Gold Trust (IAU), has temporarily suspended the creation of new shares of IAU until additional shares are registered with the Securities and Exchange Commission (SEC).

This suspension does not affect the ability of retail and institutional investors to trade on stock exchanges. Retail and institutional investors will continue to be able to buy and sell shares in IAU.

IAU holds gold as a physical asset. IAU is an exchange-traded commodity (ETC), which therefore is not eligible for registration as an investment company under the ’40 Act. IAU may only be registered under the ’33 Act as a grantor trust. Under the ’33 Act, subscriptions for new shares in excess of those registered requires additional filings with the SEC.

Nearly all other U.S. iShares are exchange-traded funds (ETFs), registered as investment companies under the ’40 Act. The ’40 Act provides for the continuous offering of shares and does not require registration of additional shares as the fund grows due to investor demand in connection to new subscriptions.

Since the start of 2016, in response to global macroeconomic conditions, demand for gold and for IAU has surged among global investors. IAU has $8 billion in assets under management, and has expanded $1.4 billion year to date. February marked its largest creation activity in the last decade.

This surge in demand has led to the temporary exhaustion of IAU shares currently registered under the ’33 Act. We are registering new shares to accommodate future creations in the primary market by filing a Form 8-K to announce the resumption of the offering of new shares. The ability of authorized participants to redeem shares of IAU is not affected.

It appears the huge demand for physical gold (and lack of supply) is finally catching up with the manipulation of paper prices.

If this is anything other than a brief technical suspension, it could well unleash panic-buying as we already pointed out – there is no physical gold!

As we previously concluded, the reality that there are just two tons of gold to satisfy delivery requsts based on accepted protocols should in itself be troubling, ignoring the latent question why so many owners of physical gold are de-warranting their holdings.

Considering there are now less than 74,000 ounces of Registered gold at the Comex, or just over 2 tonnes, we may be about to find out how right, or wrong, the skeptics are, because at this rate the combined Registered vault gold could be depleted as soon as the next delivery request is satisfied. Or isn’t.

Meanwhile, this is how gold is taking the news – it would appear that some gold is still available… one just has to pay up for it.

LinkedIn’s CEO Is Giving His Entire $14 Million Bonus to His Employees

He's not the only CEO who's tried to appease employees hit hard by falling stock prices.

With his company’s stock price in the doldrums, LinkedIn

CEO Jeff Weiner is trying to boost employee morale — and keep talent

from jumping ship — by giving them his annual $14 million stock bonus,Re/code reported.

“Jeff decided

to ask the Compensation Committee to forgo his annual equity grant, and

to instead put those shares back in the pool for LinkedIn employees,”

Joe Roualdes, a spokesperson for LinkedIn, told MONEY.

Weiner’s

decision follows LinkedIn’s dismal earnings report last month, which

caused the company’s market value to plummet by about 43% in just one

day. Still, the chief executive maintained in a meeting later that daythat “we are the same company we were the day before our earnings announcement.”

Be that as it

may, LinkedIn is definitely feeling the heat from skittish investors

with decreasing tolerance for weakness from high-valued tech companies.

As Facebook’s star continues to rise, Weiner likely worried about losing employees to better-performing competitors in Silicon Valley.

Weiner is

hardly the only chief executive of a struggling tech company to delve

into his own earnings to try to appease anxious employees. After

Twitter’s stock plummeted in October, CEO Jack Dorsey announced that he

would give a third of his stock award—worth about $200 million—to

employees. Plum Creek Timber Co. CEO Rick Holley also gave back his $2 million bonus in

2014, because he did not feel he should receive it unless shareholders

saw a return on their investment, Business Insider reported.

Though Weiner’s

gift is an impressive gesture, he isn’t feeling the same financial

pinch as other LinkedIn employees. He owns about $12.7 million in

company stock, with another $57.5 million in vested options that he can

buy for about 2% of LinkedIn’s current stock price.

Mass privatisation masks Britain’s failed economic policies

There is no doubt that throughout the last forty years or so neoliberalism has dominated government, housing, transport, energy and the financial sector in Britain and subsequently impacted on society in highly destructive ways. The peak of which is demonstrated no better than by the financial crisis that followed 2008 and the lingering state of recession in its aftermath.

At one point, just after the financial crisis started the government was on the hook for £1.16 trillion to save the banking industry from collapse. That fell to £456 billion in cash, loans and guarantees by March 2011.

You could point to many reasons for it, but there is one moment, a seminal moment of blame. Following the election of Margaret Thatcher in 1979 and subsequent meetings with US president Ronald Reagan, the financial markets experienced a transformation, more like a corporate coup d’état that effectively protected the banking industry from accountability. Financial protections imposed after the Great Depression were repealed. Financial crimes soared, it’s pinnacle reached in 2008 with a great unraveling, yet to be fully experienced.

This agreement on both sides of the pond made finance more important than manufacturing. Union powers were quashed and the Reagan/Thatcher theory of so-called ‘trickle down economics’ from that moment failed to trickle down as the middle classes embarked upon an unrelenting contraction. Higher corporate profits came at the expense of stagnating real wages for everyone else.

Gargantuan bank bailouts, quantitative easing and privatisation is the smoking gun of this failed project. The result today is that the current Conservative government has focused on austerity and ‘selling the silver’ in its battle for economic resurrection.

In 2013, George Osborne withheld £30 billion from the National Insurance fund that taxpayers contribute towards to be used only for social welfare. At the same time, poverty, increasing at an unprecedented rate drove millions into malnutrition with child poverty alone expecting to reach a Dickensian five million by 2020. Varying statistics puts around one quarter of Briton’s living in poverty.

Read More..

Gold breaks through USD1267, making a new high for the year.

#Gold breaks through USD1267, making a new high for the year.

Staples Is Closing Another 50 Stores

(Phil Wahba) Sales keep slipping.

Office supplies retailer Staples SPLS -1.42% is planning to keep closing more North American stores in 2016, adding to the hundreds of locations it has shuttered in recent years.

Staples, which is in the midst of a battle to win government approval to buy rival Office Depot op , said on Friday it would close 50 of its 1,607 North American stores this year, as it looks to slow declining sales. In the last two fiscal years, Staples closed 242 locations in the U.S. and Canada.

The retailer also reported another disappointing quarter: Same-store sales fell 5%, while Staples’ massive online business provided little relief, rising only 1%. Its services to business segment fell 1.4%. Staples forecast overall sales would again drop in this current quarter, getting the year off to a weak start.

More than a year ago, Staples said it would buy Office Depot in a cash-and-stock deal valued at $5.5 billion. But by December, the Federal Trade Commission sued to block the buyout, prompting Staples to take the government to court. The FTC has said the combined company would create an overly dominant player, cornering some 70% of the corporate services market. Staples countered in court documents that it “competes vigorously” with the likes of Amazon AMZN -0.09% and Amazon Business. A trial is set to start this month.

To mollify the FTC’s and European Commission’s anti-trust concerns, Staples has offered to sell off a huge chunk of its commercial contracts business. It recently won E.C. approval for the deal and sold off $550 million worth of contracts to Essendant.

Office supplies retailer Staples SPLS -1.42% is planning to keep closing more North American stores in 2016, adding to the hundreds of locations it has shuttered in recent years.

Staples, which is in the midst of a battle to win government approval to buy rival Office Depot op , said on Friday it would close 50 of its 1,607 North American stores this year, as it looks to slow declining sales. In the last two fiscal years, Staples closed 242 locations in the U.S. and Canada.

The retailer also reported another disappointing quarter: Same-store sales fell 5%, while Staples’ massive online business provided little relief, rising only 1%. Its services to business segment fell 1.4%. Staples forecast overall sales would again drop in this current quarter, getting the year off to a weak start.

More than a year ago, Staples said it would buy Office Depot in a cash-and-stock deal valued at $5.5 billion. But by December, the Federal Trade Commission sued to block the buyout, prompting Staples to take the government to court. The FTC has said the combined company would create an overly dominant player, cornering some 70% of the corporate services market. Staples countered in court documents that it “competes vigorously” with the likes of Amazon AMZN -0.09% and Amazon Business. A trial is set to start this month.

To mollify the FTC’s and European Commission’s anti-trust concerns, Staples has offered to sell off a huge chunk of its commercial contracts business. It recently won E.C. approval for the deal and sold off $550 million worth of contracts to Essendant.

How to buy gold without the government tracking you

From E.B. Tucker, Editor, Casey Research:

If you’re buying gold right now…the government could be tracking you.

If you’re buying gold, you’re likely not doing it to make money. You’re buying it to make sure you don’t wake up poor one day.

Gold has been used as money for thousands of years because it is

easily divisible, easily transportable, has intrinsic value, is durable,

and has consistent form around the world. And, as Doug Casey reminds

us, it’s a good form of money because governments can’t print it on a

whim. You can’t “Bernanke your way” to wealth with gold.When today’s dramatic central banking experiment blows up, gold will hold its value… unlike paper currencies such as the dollar.

That’s exactly why the government will try to take it from you.

The last time the government confiscated gold was during the Great Depression. In 1933, President Roosevelt outlawed owning most forms of gold. He claimed that people “hoarding” gold were making the Great Depression worse. The penalty for not turning your gold in to the government was a $10,000 fine and 10 years in jail.

Of course, Roosevelt gave his closest supporters notice before issuing the ban. They had time to move their gold to another country. Most folks weren’t that lucky.

This time around, the confiscation will be digital.

Most people own gold through a fund like Sprott Physical Gold Trust (PHYS) or Central Fund of Canada (CEF). The former will give you physical gold in exchange for your shares, once a month, if you own enough shares. The latter won’t give you the physical gold.

Because this gold is owned through a brokerage account, it will be easy for the government to confiscate.

What about physical gold? If you bought it from a dealer and paid with a wire transfer, the banking regulators have plenty of documentation. They’ll likely let you keep the gold. But it will be illegal to trade. If you don’t obey, you’ll be subject to a 99% tax on its value.

But there’s one way to buy gold so the government can’t track you. I’ve been doing it for years. You can do it, too. It’s buying at a locally owned jewelry store. These stores get a few common gold coins in every week. If you know what you’re looking for, it’s a great way to buy gold with cash.

However, the window of opportunity is closing quickly. In fact, I went to buy gold today…and saw this new sign.

It says, “CASH transactions are limited to $6,000 within a 48-hour period.”

$6,000 seems like an arbitrary number. And 48 hours seems even more contrived. This is a sign of the times.Governments are cracking down on cash. They want to know every detail of your financial life. They want to know what you buy and what you sell.

Paper cash is hard to track. So, little by little, governments are getting rid of it. Notice the $500 bill featuring President McKinley to the left of the sign. Years ago, $500 bought you a brand new car. Today, it barely buys a steak dinner for a family of five.

Cash is on its way out of existence. The government stopped issuing $500 bills in 1969. Last week, Harvard professor Larry Summers wrote an article titled “It’s time to kill the $100 bill.” The New York Times published an article arguing the same thing. Their reasoning is, big bills make it easier for criminals to commit crimes. If you’re not a criminal, you shouldn’t have a problem with the government knowing everything you buy and sell.

The $6,000 limit will soon be $1,000. The local jewelry shop is the last place you can buy gold without the government tracking you. Take advantage of it while you can.

Subscribe to:

Comments (Atom)