The PBOC seeks to reassure...

- *CHINA PBOC SAYS YUAN REMAINS STRONG CURRENCY IN LONG-TERM

- *PBOC SAYS THERE IS DEMAND FOR DEVALUATION OF YUAN VS USD

- *PBOC CHANGE OF YUAN MECHANISM RELATED TO JULY CREDIT: ZHANG

- *PBOC SAYS YUAN CHANGE IS BENEFICIAL TO LONG TERM STABILITY

- *PBOC SAYS YUAN EXCHANGE RATE ADJUSTMENT ALMOST COMPLETED

- *YUAN RATE ADJUSTMENT POSITIVE TO CONFIDENCE IN YUAN: PBOC'S YI

- *NEW YUAN MECHANISM `POSITIVE' TO INTERNATIONALIZATION: PBOC YI

- *PBOC SAYS NO BASIS FOR YUAN'S CONSTANT DEVALUATION: ZHANG

Having devalued the (onshore) Yuan fix by 3.5% in the last 2 days, China did it again... shifting Yuan to 4 year lows

- *CHINA SETS YUAN REFERENCE RATE AT 6.4010 AGAINST U.S. DOLLAR

Offshore Yuan dropped back to 6.50...

And China Stocks have opened lower...

- *CHINA'S CSI 300 STOCK-INDEX FUTURES FALL 1% TO 3,975.2

Some more liquidity needed...

- *PBOC TO INJECT 40B YUAN WITH 7-DAY REVERSE REPOS: TRADER

- *ABE ADVISER HAMADA SAYS CHINA'S FX MOVE WILL TEND TO BOOST YEN

- *HAMADA: JAPAN CAN OFFSET YUAN DEVALUATION BY MONETARY EASING

- *HAMADA:BOJ MAY EASE IF CHINA MOVE HITS EXTERNAL DEMAND TOO MUCH

Similarly, other macro activity data released in July worsened from a surprisingly strong June and disappointed the market. It suggests the foundation for a growth recovery is not solid, and economic growth faces more downward pressure as financial sector activity has slowed after the recent stock market slump.* * *

On the demand side, housing starts further declined to 16.4% yoy in July after dropping 14.3% in June. We think destocking could still be ongoing in tier 3-4 cities and the housing market recovery has yet to drive acceleration in housing starts. Auto sales growth slumped to -7.1% YoY from -2.3%, likely due to weakening consumer demand for some big-ticket items amid stock market turmoil while staple good sales remained resilient.

Production-side components were mixed, with weaker power and steel output growth but slightly better cement output growth. Power and steel output growth was particularly poor in July, likely due to plummet in commodity and raw material prices on a bearish growth outlook amid stock market turmoil.

Medium- to long-term loan growth edged down by 0.8pp, but if taking into account local government debt swap, the decline would be 0.3pp instead.

The fallout from China's decision is going global...

China’s devaluation couldn’t come at a worse time for Argentina.* * *

About a quarter of the country’s $33.7 billion of foreign reserves are now denominated in yuan, which suffered its biggest loss since 1994 on Tuesday.

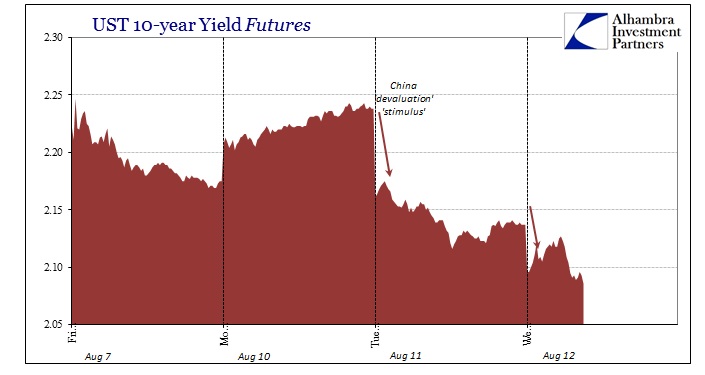

And finally, here is Jeffrey Snider of Alhambra Investment Partners discussing the other reality of what is occurring in China - as opposed to the paint-by-numbers version spun on TV - explaining why the PBOC would seemingly “allow” devaluation one day and then act against it the very next. They are just trying to hold on for dear life, managing imbalances that are beyond their grasp.

While everyone remains sure that the PBOC is actively trying to “allow” the yuan to depreciate as some kind of export catalyst, the “dollar” continues to show (not suggest) otherwise. Liquidity and “dollar” markets are still roiled rather than soothed, especially the US treasury market where the bid right at the open (what look very much like continued collateral calls) pushes more like a combination of October 15 and January 15.Another central bank has fallen prey to the decomposing “dollar”, as the global tremors of such central bank upsets ripple further and further.

As if to underscore the runaway nature, the PBOC apparently intervened against this “devaluation” just last night. From the Wall Street Journal:

Tuesday, the People’s Bank of China surprised global markets with what looked like a win-win currency depreciation for the country—appearing to cede more control of its exchange rate to market forces, which the International Monetary Fund and others have long urged it to do, while also helping Chinese exporters.

Its intervention only one day later raised questions about its commitment to an exchange rate driven more by supply and demand and less by government direction.

The Journal’s confusion here is demonstrated by what is a mistaken assumption in the first paragraph leading to the mystery of the second. The PBOC’s commitment isn’t to a devaluation for China’s exports, but undoubtedly its actions are directed toward trying to keep the wholesale finance interfaces somewhat orderly. When the yuan was trading exactly sideways for nearly five months, that was the same setup; the PBOC was keeping the yuan stable so that it wouldn’t devalue and thus signal the depth of the “dollar” financing strain.

That is the problem orthodox commentary and theory has with wholesale finance, they just don’t get it. Devaluation of currency doesn’t mean that in this context just as a “strong dollar” isn’t anything like the term. Both are forms of internal disruption, the direction of that is just an expression of what manner of wholesale finance is becoming most unruly. Credit-based “money” systems do not operate like the currency systems from before 1971. Floating currencies aren’t really that, so much as they are just another form of traded liabilities in global banking.

The Chinese have a “dollar” problem just the same as the Swiss, Brazilians and the rest (including the dollar). There is a global retreat in eurodollar funding that is wreaking havoc, expectedly, globally. And in China that is particularly true as the Chinese banks through external corporates joined the “dollar short” several years back. Joined now under PBOC “reform”, there has been an almost hostility if not at least disfavor over the “dollar” intrusion as it has been taken as one primary element of the bubbles (what mainstream mistakes for “hot money”). As a result, the PBOC has been almost chasing “dollars” out of the system in an attempted orderly purge.

That led to what looked like historic “outflows” in 2015 as “dollar” conditions for the Chinese “short”, so it is absolutely no surprise to see this occurring now. The only mystery has been, as I have been writing for some time, what the PBOC was doing to counteract it during those five months. That would tell us both how serious the turmoil was and how ineffective whatever intervention would ultimately be.

From July 22:

The yuan has suddenly, right at the March FOMC meeting, gone limp. Trading has been confined, except for very brief, intraday outbursts, to an increasingly narrow range. Given its behavior particularly as a full part of the reform agenda to that point, this amounts to what can only be hidden and inorganic factors. Whether that means PBOC intervention is unclear, though suggested by even TIC, but this is the most important and unexplained dynamic in the “dollar” world at present.

Perhaps the June TIC updates will help shed some light on what has been going on with China’s “dollar short”, but I doubt it. The nature and especially the scale of what might be happening in the money markets has global implications, and may (conjecture on my part) start to explain the reversal in the Chinese stock bubble and ultimately even relate to the “dollar’s” renewed disruption in July so far.

Earlier July 8:

It’s not enough to notice how this [zero yuan volatility] is odd, as it appears, given wider circumstances, to be almost odd with a purpose. Whenever uncertainties grew about China’s reform, especially “allowing” defaults, “dollar” supplies tightened significantly and the yuan devalued. Given the fragility of the current situation, you can understand why, possibly, the PBOC might not want too much to get so far out of hand and so they may be supplying “dollars” to maintain orderly money markets both onshore and off. Given the plunge in import activity they may not really need to supply all that much, particularly in combination with prior and intended outflows as they effectively tried to chase speculators out of the country. Perhaps they did too much?

Whatever the case may ultimately be, it bears close scrutiny for several reasons. First, if this is correct (a very big “if”) then the financial system in China is worse, far worse, than it appears. Second, central bank attempts such as this are extremely finite as they are, over time, hugely inefficient. The PBOC might just be throwing everything in its arsenal at the financial system short of open “flood” declarations (which are themselves destabilizing; declaring an open emergency is as much confirmation of how bad everything is) trying to calm everything down in order to reassess. [emphasis added]

That is why the PBOC would seemingly “allow” devaluation one day and then act against it the very next. They are just trying to hold on for dear life, managing imbalances that are beyond their grasp. That is what occurred last night, as the Wall Street Journal confirms that Chinese banks were “selling” dollars on the PBOC’s behalf; which is, in the wholesale context, supplying “dollars.” The currency translation is just the recognition of that imbalance, which is in many forms like this kind of convertibility almost a “run.”

The PBOC then instructed state-owned Chinese banks to sell dollars on its behalf in the last 15 minutes of Wednesday’s trading, according to people close to the state banks.

The central bank took it as far as it could and then the “dollar” dam just burst on really bad economic data that was expected instead to confirm the bottom. At this point, it looks like they are left only to try to mitigate the damage they had been for five months hoping would never occur as the global economy was supposed to have healed on its own long before then (which was nothing more than FOMC and orthodox pipe dreams).

China shocked the world markets overnight by devaluing their currency by the most in two decades.

China shocked the world markets overnight by devaluing their currency by the most in two decades.