We have obviously crossed the threshold folks, things are falling

apart by the day and the game of Kick the Can has at long last gone as

far as it can. The rest of the World no longer has a choice, the United

States is no longer the big bully on the playground who won WWII and

their fingers are no longer so firmly around the throat of the planet.

The long lunatic nightmare of Bernanke monetary ponzi schemes cannot

continue.

It will be interesting to see what their plan is to try and switch

the U.S. (and possibly the World) to a new currency system. My take?

There will be an immediate bank holiday across the board, stopping

all transactions of any kind in all avenues of banking and stock

markets. This will likely happen on a Friday afternoon, and there will

be no warning. A temporary state of martial law will be instituted, in

which people are told to basically stay at home as though they are

taking a sudden ‘cheap holiday’ and things like trucking of supplies of

normal groceries and the like will be the only thing still going on

under strict military rules, keeping all emergency supplies of diesel

available to those lines of credit used for that infrastructure.

Military escorts of supply convoys will be the only thing moving on U.S.

highways for perhaps several weeks until they restart the engine under

the new rules. Police in all cities will be given total freedom to

‘shoot first, ask questions later’ for any deviation from total movement

restriction of citizens. Examples will be made, and the media will

carpet bomb the public with this message.

The U.S. will lock down the dollar (both digital and paper) to a

complicated SDR basket of currencies around the World, the Canadian

dollar will figure heavily in this. This will obviously include

devaluation across the board of many world currencies, and some of the

currencies (like our Canadian dollar) will also be strictly controlled

during this time (wanna know why we care so much? 90% of our economy is

still directly tied to you Yanks) The U.N. and IMF will be token heads

of an emergency council that all countries of the World will have no

choice but to agree to (barring a few examples in the Middle East and

North Korea, Cuba, a few South American countries, etc).

Debt restructuring will be performed from top to bottom. The 1.4

Quadrillion derivatives bubble will pop like the veritable tree falling

in the forest that no-one hears. The wage structure of the entire United

States will be chopped off at the knees when jobs are ‘started’ again,

and people are going to learn rather bluntly that their standard of

living is going to drop by a large margin. Even when financial markets

are loosened on the leash enough to make it look like things are

‘running’, foodstuffs and all energy (gas, diesel, natural gas, propane,

etc) will be price controlled from that point on. This could be seen as

an enforced Socialist military junta rule, which it is, but honestly

there really is no choice.

Production of goods will continue by force if necessary, people will

clamor to the new low wage positions because they won’t have a choice.

It is either that or starve.

Inner cities could collapse entirely during the transition period,

the military in all forms will setup blockades around zones in these

areas and food rations will be handed over in exchange for firearms and

ammunition. It doesn’t even bear mentioning the horrors that await some

areas during this period. Within two weeks of supply infrastructure

collapse things like rape, murder, and cannibalism will be commonplace.

People are exactly three square meals away from becoming savages, it is

as simple as that. In San Fransisco there are 17,500 people per square

mile, I won’t go into lurid details but let’s just say there will be

shoot-outs in the local 7/11 for the last bag of Doritos a lot sooner

than most people think.

Slowly but surely ‘zones’ will form, protected areas where people are

moved (perhaps forcibly) and live under what seems like a fairly free

system but is obviously locked down military camps. Again, is this a bad

thing? They aren’t necessarily trying to clamp down control, they have

known for many decades the collapse would happen under a fiat currency

system and have planned accordingly.

There will be a lot of hardship, a lot of deaths, in a lot of areas

of the World and United States things will collapse into ‘One Second

After’ conditions where attrition will reduce population drastically

over the next several years. The media will cover some of this, but not

the true horrors, and it goes without saying that ‘the revolution will

not be televised’. This means that the Internet will no longer be free,

and when and if an ‘Internet’ is brought back up and running it will be

the government sanctioned AOL style system with no freedom of any kind.

There will be no anonymous communication, any Internet Service Providers

will be under total government control and it will be technically

impossible to transmit encrypted packets. As a result communication can

be controlled, and when it gets to that point a smattering of free Ham

Radio will be the only true source of freedom.

There will be pockets of resistance, even entire States that balk at

the new way of things, at first they will be treated with hands off

respect but in time they will be forced with simple supply blockades to

conform to the new rules. They have the technology, and the patience,

and the means to cut off outside supply. There will obviously be a lot

of ‘free people’ out there, entire communities where they are self

sufficient in every way – but these will be small Colonial technology

areas that are visited by smiling officials on a regular basis to let

them know the limitations of such existence.

I obviously can’t say exactly when this banking holiday will happen,

but I think it is safe to say it is going to happen sometime in the next

18 months for sure, and possibly a LOT sooner than that. They simply

cannot keep pretending things are okay for much longer. Anyone who isn’t

a Prepper yet, there is still time as long as the stores are open and

your debit/credit card still works. Lay low, don’t brag about supplies,

and stockpile simple foodstuffs for the time when your family needs to

hunker down.

What do you guys think? I have spent my life as an Eschatological

High Priest, studying and preparing for the inevitable Crash of our soft

Western Civilization. We have lived the easiest life of any Humans in

our History, but that ride is about to come grinding to a halt. How do

you think the United States (and the rest of the World) will handle the

‘adjustment’ that is in the mail?

kaibosh

Saturday, February 23, 2013

Nine Pictures Of The Extreme IncomeWealth Gap

Many people don’t understand our country’s problem of concentration

of income and wealth because they don’t see it. People just don’t

understand how much wealth there is at the top now. The wealth at the top is so extreme that it is beyond most people’s ability to comprehend.

If people understood just how concentrated wealth has become in our country and the effect is has on our politics, our democracy and our people, they would demand our politicians do something about it.

How Much Is A Billion?

Some Wall Street types (and others) make over a billion dollars a year – each year. How much is a billion dollars? How can you visualize an amount of money so high? Here is one way to think about it: The median income in the US is around $29,000, meaning half of us make less and half make more. If you make $29,000 a year, and don’t spend a single penny of it, it will take you 34,482 years to save a billion dollars. . . . (Please come back and read the rest of this after you have recovered.)

What Do People Do With SO Much?

What do people do with all that money? Good question. After you own a stable of politicians who will cut your taxes, there are still a few more things you can buy. Let’s see what $1 billion will buy.

Cars

This is a Maybach. Most people don’t even know there is something called a Maybach. The one in the picture, the Landaulet model, costs $1 million. (Rush Limbaugh, who has 5 homes in Palm Beach, drives a cheaper Maybach 57 S — but makes up for it by owning 6 of them.)

Your $1 billion will only buy you a thousand Maybach Landaulets.

Here are pics of just some of Ralph Lauren’s collection of cars. This is not a museum, this is one person’s private collection. You don’t get to go look at them.

If people understood just how concentrated wealth has become in our country and the effect is has on our politics, our democracy and our people, they would demand our politicians do something about it.

How Much Is A Billion?

Some Wall Street types (and others) make over a billion dollars a year – each year. How much is a billion dollars? How can you visualize an amount of money so high? Here is one way to think about it: The median income in the US is around $29,000, meaning half of us make less and half make more. If you make $29,000 a year, and don’t spend a single penny of it, it will take you 34,482 years to save a billion dollars. . . . (Please come back and read the rest of this after you have recovered.)

What Do People Do With SO Much?

What do people do with all that money? Good question. After you own a stable of politicians who will cut your taxes, there are still a few more things you can buy. Let’s see what $1 billion will buy.

Cars

This is a Maybach. Most people don’t even know there is something called a Maybach. The one in the picture, the Landaulet model, costs $1 million. (Rush Limbaugh, who has 5 homes in Palm Beach, drives a cheaper Maybach 57 S — but makes up for it by owning 6 of them.)

Your $1 billion will only buy you a thousand Maybach Landaulets.

Here are pics of just some of Ralph Lauren’s collection of cars. This is not a museum, this is one person’s private collection. You don’t get to go look at them.

Credit Suisse Says Governments Are Discouraging Gold Holdings – And What It Misses

India and Vietnam: Taking the Glitter out of Gold … When

uncertainty reigns, investors all over the world turn to gold as a safe

haven. But some countries are starting to take issue with their

residents’ preference for storing wealth in gold bars, rather than bank

accounts.

Large gold imports can throw of a country’s current account balance – the difference between what a country earns and what it spends on foreign trade.

Widespread investments in physical gold also mean that large pots of wealth sit idle, instead of being put to work in the broader economy. And in countries where gold is a popular investment, those financial institutions which carry large gold deposits, lend cash against gold or offer interest-bearing gold deposit accounts, can pose a risk to the financial system if commodity prices suddenly shift. – Thefinancialist.com

Dominant Social Theme: The nation is more important than the individual, at least when it comes to account balances.

Free-Market Analysis: The Financialist is published by the vast securities firm of Credit Suisse, and thus we are not surprised to find this sentiment being enunciated by officials in charge of this publication.

It is, of course, a kind of elite dominant social theme. The idea is that the state itself is the source of all authority – and when there is a choice between state power and the rights of the individual, the state reigns supreme. This is a kind of European meme, as well, for Europe, more than the US, is accustomed to this sort of reasoning.

It is a shame, nonetheless, to see it coming from Credit Suisse based in Switzerland. Switzerland is a republic, where power still flows from the citizen up to the leadership rather than vice versa. It is a direct democracy but with republican features and not everyone can vote on all issues – all of the time.

Credit Suisse in this article sees the problem as one of national account balances but this is antithetical to the country in which it is headquartered. The problem, in our view, is more apt to be Credit Suisse than gold storage.

That’s because Credit Suisse is an international bank subject to larger Western political pressure and regulations. The same goes for Switzerland’s other global bank, UBS, which has gotten the Swiss banking industry into terrible trouble.

By exposing itself to the banking laws of other countries, UBS was attacked over Swiss bank secrecy laws. The accusation was that UBS was actively abetting clients in tax avoidance schemes.

When UBS admitted to this, the US government – along with some others – demanded that Switzerland change its bank secrecy laws and become more transparent.

As a result, hundreds of years of tradition were overturned along with the customs of Swiss private banking itself. This is the unfortunate legacy of UBS – and Credit Suisse, which has avoided some of UBS’s troubles, has approximately the same business model.

Bad enough that Swiss private banking – mostly a modest, domestic exercise – has to be held hostage to the fortunes of these two giant firms. But to add insult to injury, we see that the mindset of Credit Suisse, as expressed in this article, remains relentlessly statist. It’s almost anti-Swiss. Here’s more from the article (paragraphing ours):

Governments in India, the largest gold importer in the world, and Vietnam, a country which imported 95% of its domestic gold consumption in 2011, have taken steps in the past year to discourage savers from hoarding gold.

The Indian government doubled import duties on gold bullion to 4 percent in March and with current account de?cits at record highs, recently announced another hike to 6 percent. Taxing Their Way Out of Gold?

“It is di?cult to establish the impact (of the tax) on CAD,” Indian Economic A?airs Secretary Arvind Mayaram said, according to Reuters. “But there will be some moderation in gold demand.”

Though Credit Suisse analysts say the higher taxes could weaken import demand by as much as 10 percent, they believe the health of the Indian economy and rupee strength will probably play a larger role in determining the country’s demand for gold this year.

Indian gold imports already appear to have slowed. After several years of acceleration, the Reserve Bank of India reported last month that gold imports between April and October 2012 dropped to 398 tons from 589 tons during the same period in 2011.

In a recent note, Credit Suisse analysts predicted that net imports were on track to drop to no more than 800 tons for the whole of last year from 2011′s approximately 970 tons. But analysts also note that it is di?cult to know how much of that slowdown can be aributed to tax increases since the rupee also depreciated sharply over the year.

This is written in an entirely technocratic way. It is, in fact, almost value-free. No attempt is made to determine the legitimacy of a government trying to discourage private holdings. And no mention is made of the political systems of either Viet Nam (quasi-communist) or India (socialist). These two countries, in fact, are used as examples of a larger trend.

Whatever pejoratives are in use tend to attack gold holdings, as people who own gold in quantity are called “hoarders.” While the article no doubt imparts useful information, a discussion of the legitimacy of the kinds of steps being taken by India and Vietnam might have been useful and even enlightening.

In our humble view, this highlights an increasing disconnect not just between Credit Suisse and the country of its origin, but between the financial industry generally and nation-states around the world. In a globalist, technocratic society, civil society arises as a kind of negotiation between the demands of the state and the desires of its citizens.

But in reality this is an entirely unequal discussion, as the state intends to impose its demands by force, while citizens can only utilize protest and civil disobedience.

What Credit Suisse and other firms are missing, however, is that the current arrangement is an unstable one that arrogates more and more power over time to the state.

If citizens in various repressive states are hoarding gold, it is because they don’t trust government-run currencies. Perhaps they hoard gold as well because taxes are continually rising and because price inflation is out of control.

Over time, the dissatisfaction of citizens with unequal negotiations will manifest itself in more and more discontent and social upheaval.

This is already happening today. The social compact is not a discussion between equals but a profound unequal contest between average citizens and elite-controlled agencies of government.

For this reason we regularly repeat the following point: What we call the Internet Reformation is making the social compact more and more suspect, as more are discovering the essential inequities between society and its secretive rulers.

Conclusion: The modern dialogue eschews a conversation based on freedom issues. Such discussions are considered naïve – almost embarrassing – in the modern technocratic era. But we would suggest a rethink. They may become timely again, and sooner rather than later.

Large gold imports can throw of a country’s current account balance – the difference between what a country earns and what it spends on foreign trade.

Widespread investments in physical gold also mean that large pots of wealth sit idle, instead of being put to work in the broader economy. And in countries where gold is a popular investment, those financial institutions which carry large gold deposits, lend cash against gold or offer interest-bearing gold deposit accounts, can pose a risk to the financial system if commodity prices suddenly shift. – Thefinancialist.com

Dominant Social Theme: The nation is more important than the individual, at least when it comes to account balances.

Free-Market Analysis: The Financialist is published by the vast securities firm of Credit Suisse, and thus we are not surprised to find this sentiment being enunciated by officials in charge of this publication.

It is, of course, a kind of elite dominant social theme. The idea is that the state itself is the source of all authority – and when there is a choice between state power and the rights of the individual, the state reigns supreme. This is a kind of European meme, as well, for Europe, more than the US, is accustomed to this sort of reasoning.

It is a shame, nonetheless, to see it coming from Credit Suisse based in Switzerland. Switzerland is a republic, where power still flows from the citizen up to the leadership rather than vice versa. It is a direct democracy but with republican features and not everyone can vote on all issues – all of the time.

Credit Suisse in this article sees the problem as one of national account balances but this is antithetical to the country in which it is headquartered. The problem, in our view, is more apt to be Credit Suisse than gold storage.

That’s because Credit Suisse is an international bank subject to larger Western political pressure and regulations. The same goes for Switzerland’s other global bank, UBS, which has gotten the Swiss banking industry into terrible trouble.

By exposing itself to the banking laws of other countries, UBS was attacked over Swiss bank secrecy laws. The accusation was that UBS was actively abetting clients in tax avoidance schemes.

When UBS admitted to this, the US government – along with some others – demanded that Switzerland change its bank secrecy laws and become more transparent.

As a result, hundreds of years of tradition were overturned along with the customs of Swiss private banking itself. This is the unfortunate legacy of UBS – and Credit Suisse, which has avoided some of UBS’s troubles, has approximately the same business model.

Bad enough that Swiss private banking – mostly a modest, domestic exercise – has to be held hostage to the fortunes of these two giant firms. But to add insult to injury, we see that the mindset of Credit Suisse, as expressed in this article, remains relentlessly statist. It’s almost anti-Swiss. Here’s more from the article (paragraphing ours):

Governments in India, the largest gold importer in the world, and Vietnam, a country which imported 95% of its domestic gold consumption in 2011, have taken steps in the past year to discourage savers from hoarding gold.

The Indian government doubled import duties on gold bullion to 4 percent in March and with current account de?cits at record highs, recently announced another hike to 6 percent. Taxing Their Way Out of Gold?

“It is di?cult to establish the impact (of the tax) on CAD,” Indian Economic A?airs Secretary Arvind Mayaram said, according to Reuters. “But there will be some moderation in gold demand.”

Though Credit Suisse analysts say the higher taxes could weaken import demand by as much as 10 percent, they believe the health of the Indian economy and rupee strength will probably play a larger role in determining the country’s demand for gold this year.

Indian gold imports already appear to have slowed. After several years of acceleration, the Reserve Bank of India reported last month that gold imports between April and October 2012 dropped to 398 tons from 589 tons during the same period in 2011.

In a recent note, Credit Suisse analysts predicted that net imports were on track to drop to no more than 800 tons for the whole of last year from 2011′s approximately 970 tons. But analysts also note that it is di?cult to know how much of that slowdown can be aributed to tax increases since the rupee also depreciated sharply over the year.

This is written in an entirely technocratic way. It is, in fact, almost value-free. No attempt is made to determine the legitimacy of a government trying to discourage private holdings. And no mention is made of the political systems of either Viet Nam (quasi-communist) or India (socialist). These two countries, in fact, are used as examples of a larger trend.

Whatever pejoratives are in use tend to attack gold holdings, as people who own gold in quantity are called “hoarders.” While the article no doubt imparts useful information, a discussion of the legitimacy of the kinds of steps being taken by India and Vietnam might have been useful and even enlightening.

In our humble view, this highlights an increasing disconnect not just between Credit Suisse and the country of its origin, but between the financial industry generally and nation-states around the world. In a globalist, technocratic society, civil society arises as a kind of negotiation between the demands of the state and the desires of its citizens.

But in reality this is an entirely unequal discussion, as the state intends to impose its demands by force, while citizens can only utilize protest and civil disobedience.

What Credit Suisse and other firms are missing, however, is that the current arrangement is an unstable one that arrogates more and more power over time to the state.

If citizens in various repressive states are hoarding gold, it is because they don’t trust government-run currencies. Perhaps they hoard gold as well because taxes are continually rising and because price inflation is out of control.

Over time, the dissatisfaction of citizens with unequal negotiations will manifest itself in more and more discontent and social upheaval.

This is already happening today. The social compact is not a discussion between equals but a profound unequal contest between average citizens and elite-controlled agencies of government.

For this reason we regularly repeat the following point: What we call the Internet Reformation is making the social compact more and more suspect, as more are discovering the essential inequities between society and its secretive rulers.

Conclusion: The modern dialogue eschews a conversation based on freedom issues. Such discussions are considered naïve – almost embarrassing – in the modern technocratic era. But we would suggest a rethink. They may become timely again, and sooner rather than later.

Bank of England split on more QE as Governor Mervyn King over-ruled

The Bank of England’s fears for the health of the UK economy have been laid bare by a split among policymakers that saw the Governor over-ruled for only the fourth time after he voted for more quantitative easing.

Three MPC members voted to increase QE by £25bn to £400bn – including Sir Mervyn King Photo: PA

The pound fell sharply as the markets reacted in shock to minutes from this

month’s Monetary Policy Committee (MPC) meeting, which revealed that three

members voted to increase QE by £25bn to £400bn – including Sir Mervyn King.

Last month, only David Miles wanted to restart the printing presses.

The decision took traders by surprise as the Bank last week raised its

forecasts for inflation from those made in November, warning that inflation

would hit 3pc later this year and not fall back to the 2pc target until the

beginning of 2016. Under normal conditions, the Bank would be expected to

consider raising interest rates to offset such a rise.

The Bank has said it would tolerate the inflation overshoot, but few

economists expected the MPC to encourage it. They had expected Mr Miles to

be the only policymaker calling for more QE, so the decisions of both Sir

Mervyn and Paul Fisher, the Bank’s executive director for markets, to join

him raised the prospect of action next month.

George Buckley, UK economist at Deutsche Bank, said: “It would seem that the

bar to easier policy is somewhat lower than we had originally expected.” The

committee voted unanimously to hold rates at 0.5pc and to reinvest the

£6.6bn of QE gilts that mature in March.

The Bank’s apparent concerns about growth were echoed by Pier Carlo Padoan,

chief economist at the Organisation for Economic Co-operation and

Development. Writing in Prospect magazine, Mr Padoan said it was

“hard to foresee a strong rebound” this year.

He added that more QE “may be needed if growth fails to gather

momentum”, calling for more infrastructure spending – in particular on

energy and housebuilding – and to reform corporation tax “to stop

multinationals shifting their profits offshore”. He also urged business

“with support from government, to be more ambitious abroad, especially in

high-growth emerging countries”.

The minutes showed that the Bank had considered a wide variety of policies in the February meeting, including a possible extension of the Funding for Lending (FLS) cheap credit scheme to “non-bank lenders”. Using QE to buy assets other than gilts and a reduction in interest rates below 0.5pc were discussed and, once again, dismissed.

Other “potential policy measures” that would involve the Bank acting with either the Treasury, like the FLS, or the Financial Services Authority, such as current plans to strengthen banks’ capital positions, were countenanced as well.

The MPC also appeared to push the Treasury to do more for growth. “A number of more targeted interventions to boost demand and the supply capacity of the economy might be entertained, but many of these fell to other UK authorities,” the committee said.

Ed Balls, the shadow chancellor, said the words were “a clear message to George Osborne to act”.

The minutes showed that the Bank had considered a wide variety of policies in the February meeting, including a possible extension of the Funding for Lending (FLS) cheap credit scheme to “non-bank lenders”. Using QE to buy assets other than gilts and a reduction in interest rates below 0.5pc were discussed and, once again, dismissed.

Other “potential policy measures” that would involve the Bank acting with either the Treasury, like the FLS, or the Financial Services Authority, such as current plans to strengthen banks’ capital positions, were countenanced as well.

The MPC also appeared to push the Treasury to do more for growth. “A number of more targeted interventions to boost demand and the supply capacity of the economy might be entertained, but many of these fell to other UK authorities,” the committee said.

Ed Balls, the shadow chancellor, said the words were “a clear message to George Osborne to act”.

Why Giving Away 'Free Government Money' Is So Expensive

Rent seeking. May the best lobbyist win.

The hidden cost of giving away free government money.

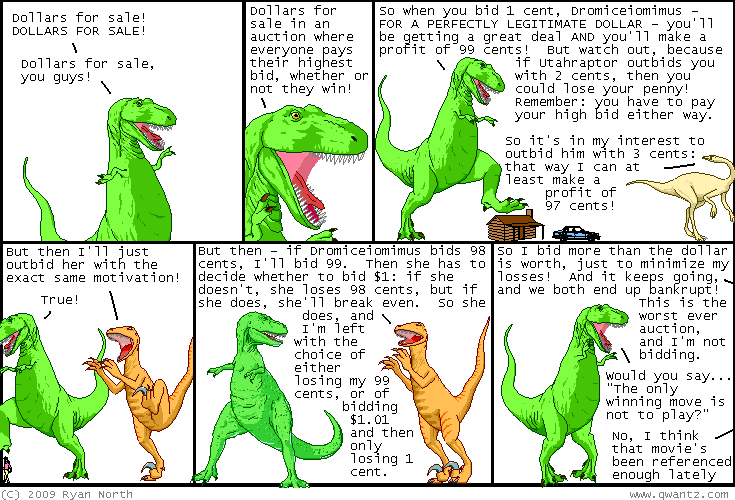

Dr. Michael Munger of Duke University explains why subsidies, grants and giveaways awarded by the government have substantial hidden costs in a phenomenon called rent seeking. The "rent" is the money being offered. When government gives money away, the people who compete for it incur costs—sometimes more money will be spent in total trying to compete for a grant than the amount of money being given away.

The end result is that governments give money to organizations with the best lobbyists, not those that provide the best services.

***

Further reading:

Cartoon courtesy of Qwartz.com

CORZINE: 'I Don't Know, I Don't Recall, I Know Nothing!'

Great clip. Jon Corzine has all the answers.

MF Global congressional testimony mashup from Reuters

Edith O'Brien is the key and Eric Holder won't offer her immunity because the Covington & Burling Department of Justice Criminal Defense has absolutely zero interest in hearing her implicate Obama bundler Jon Corzine for multiple felonies.

Here's the truth about Corzine from Janet Tavakoli:

On October 28, JPMorgan didn't buy Corzine's story, either. Having been a risk manager myself, I believe Barry Zubrow, JPMorgan's chief risk officer, did exactly the right thing. He called Jon Corzine to get him to verify that the funds belonged to MF Global and that none of the money was customer money. Zubrow, an outsider, was well aware of the possibility that customer funds had been transferred. It's implausible that Corzine wasn't aware of the potential impermissible transfer of customer funds when he gave the authority to make the transfer. By doing its job, JPMorgan removed Corzine's ability to credibly deny knowledge of the potential problem.

As for JPMorgan, it asked Jon Corzine for a signed letter stating that the transfer was legitimate. He reportedly responded: "Send me the letter and we'll have our people look at it." It was disingenuous of Jon Corzine to pass JPMorgan's letter to Edith O'Brien to sign given that it asked for a sign-off that all "past, present and future" transfers complied with the law. Ms. O'Brien would have been asked to take responsibility for all transfers without having the authority over them. Jon Corzine had the broad authority to sign the letter, but by passing it on, he effectively stalled.

JPMorgan sent additional versions of this letter in response to MF Global's requests for revisions, but JPMorgan never received a signed letter back.

---

Corzine in a previous life:

Sgt. Schultz - I See Nothing

Photos by William Banzai7...

Why The Banking Elite Want Riots in America

Every indication clearly

suggests that authorities in the United States are preparing for

widespread civil unrest. This trend has not emerged by accident – it is

part of a tried and tested method used by the banking elite to seize

control of nations, strip them of their assets, and absorb them into the

new world order.

There is a crucial economic imperative as to why the elite is seeking to engineer and exploit social unrest.

As respected investigative reporter Greg Palast exposed in 2001,

the global banking elite, namely the World Bank and the IMF, have honed

a technique that has allowed them to asset-strip numerous other

countries in the past – that technique has come to be known at the “IMF

riot.”

In April 2001, Palast obtained leaked

World Bank documents that outlined a four step process on how to loot

nations of their wealth and infrastructure, placing control of resources

into the hands of the banking elite.

One of the final steps of the process,

the “IMF riot,” detailed how the elite would plan for mass civil unrest

ahead of time that would have the effect of scaring off investors and

causing government bankruptcies.

“This economic arson has its bright side

– for foreigners, who can then pick off remaining assets at fire sale

prices,” writes Palast, adding, “A pattern emerges. There are lots of

losers but the clear winners seem to be the western banks and US

Treasury.”

In other words, the banking elite

creates the very economic environment – soaring interest rates,

spiraling food prices, poverty, lower standards of living – that

precipitates civil unrest – and then like a vulture swoops down to

devour what remains of the country’s assets on the cheap.

We have already seen this process unfold

in places like Bolivia, Ecuador, Indonesia, Greece and Argentina. Next

on the chopping block are Spain, Italy, Britain and France – all of

which have seen widespread riots over the last two years.

As Ha-Joon Chang explains in the Guardian,

the roots of Europe’s riots were sparked by “governments inflicting an

old-IMF-style programme on their own populations,” namely the same

programs of “austerity, privatisation and deregulation,” that caused the

riots of the 80′s and 90′s in poorer countries.

Although the likes of the IMF and the

World Bank have pillaged half of the globe with their economic

terrorism, America remains the ultimate prize. The first step of the

four step process for bankster seizure of a country – privatization of

state-owned assets – is already well under way in America, with infrastructure being sold off to foreign corporations, with the aid of Goldman Sachs, at a frightening pace.

A key component of the banking elite’s

insidious agenda to bring about an economic collapse in America by

design also centers around the process of de-industrializing the

country, eviscerating the nation’s platform for self-sufficiency and

replacing it with dependence on banker bailouts. This has already been

largely achieved in Europe – with just about every major economy on the

continent run by Goldman Sachs-affiliated technocrats.

In the United States, 32 per cent of

manufacturing jobs have been lost since 2000, while 56,000 manufacturing

facilities have been mothballed since 2001. The Obama administration

has also declared war on the coal industry, with Obama himself promising to “bankrupt” anyone who tries to build a new coal plant. Meanwhile, China builds a new coal plant every two weeks.

Given the clear economic motive for

stirring unrest in the United States, we’d expect to see preparations

for domestic disorder in numerous different guises – and indeed the

signs are everywhere.

National Defense Authorization Act

The Obama administration’s passage of NDAA legislation

that authorizes kidnapping and indefinite detention without trial of

American citizens on U.S. soil serves to create the framework for mass

arrests of protesters and journalists in a time of declared national

emergency.

Obama’s War on Whistleblowers

The Obama administration’s brazen and aggressive prosecution of whistleblowers

for divulging government corruption in the public interest is clearly a

device designed to intimidate whistleblowers from speaking out when the

proverbial hits the fan.

Spying on Social Media for Signs of Unrest

The Department of Homeland Security and other federal agencies are actively engaged in spying on social media

as well as news websites to look for reports or comments that “reflect

adversely on the U.S. government and the DHS.” The government is on the

lookout for the ‘tipping point’ when heated online rhetoric spills onto

the streets in the form of unrest.

Building Huge Spy Centers to Track Unrest

The NSA is building the country’s biggest spy center

in the middle of the Utah desert. The purpose of the data facility is

to intercept, “all forms of communication, including the complete

contents of private emails, cell phone calls, and Google searches, as

well as all sorts of personal data trails—parking receipts, travel

itineraries, bookstore purchases, and other digital “pocket litter.”

By creating a gigantic database of every

communication imaginable, the NSA hopes to monitor and pre-empt the

spread of mass civil unrest in America.

Preparing Drones for Domestic Oppression

Last week, the Justice Department re-affirmed its position

that the Obama administration can use armed drones to assassinate

Americans. Under the NDAA, the whole of the United States has been declared a “battlefield,” meaning that drones may soon be used to execute American citizens on U.S. soil.

A government that resorts to killing its

own citizens without any legal process whatsoever is clearly a

dictatorship engaged in domestic oppression. The only imaginable

scenario under which this program would be justifiable was if the U.S.

was under a state of martial law and the government was on the verge of

collapse.

Preparing for Martial Law

The Department of Homeland Security has purchased over 1.6 billion rounds of ammunition

in the last 10 months alone. At the height of combat operations in

Iraq, the U.S. Army only used 5.5 million bullets a month. Why has the

DHS stockpiled enough bullets for a 30 year war if it is not preparing

for some form of domestic disorder?

Preparation for martial law can be seen in numerous different guises, but perhaps the most chilling is a nationwide FEMA program

which is training pastors and other religious representatives to become

secret police enforcers who teach their congregations to “obey the

government” in preparation for the implementation of martial law,

property and firearm seizures, mass vaccination programs and forced

relocation.

Characterizing the American People as the New Target of the War on Terror

The U.S. Army’s Operating Concept

2016-2028 dictates that the military’s “full spectrum operations” will

include “operations within American borders.” Scenarios where Americans

form into militia groups and become “insurrectionists” as a result of an

economic collapse and have to be eliminated by the U.S. Army have already been mapped out by military planners.

A leaked U.S. Army manual

also reveals plans for the military to carry out “Civil Disturbance

Operations” during which troops will be used domestically to quell

riots, confiscate firearms and even kill Americans on U.S. soil during

mass civil unrest.

The Department of Homeland Security’s ‘See Something, Say Something’ program habitually portrays middle class Americans as terrorists. In addition, numerous DHS-funded reports have characterized “liberty lovers” and other constitutionalists as domestic terrorists.

Every indication presents us with the

inescapable reality that the US government is preparing for mass civil

unrest at some point over the next five to ten years. When we look at

the recent history of nations that have suffered financial collapse,

domestic disorder is clearly a key component of a deliberate agenda on

behalf of the banking elite to undermine and loot economies –

confiscating national sovereignty in the process.

In Part 2, we’ll explore why the elite,

although keen on provoking mass social unrest and even civil war, are

destined to lose the battle.

The Feds Want Your Retirement Accounts

American Thinker – by John White

Quietly, behind the scenes, the groundwork is being laid for federal government confiscation of tax-deferred retirement accounts such as IRAs. Slowly, the cat is being let out of the bag.

Last January 18th, in a little noticed interview of Richard Cordray, acting head of the Consumer Financial Protection Bureau, Bloomberg reported “[t]he U.S. Consumer Financial Protection Bureau [CFPB] is weighing whether it should take on a role in helping Americans manage the $19.4 trillion they have put into retirement savings, a move that would be the agency’s first foray into consumer investments.” That thought generates some skepticism, as aptly expressed by the Richard Terrell cartoon published by American Thinker.

Days later On January 24th President Obama renominated Cordray as CFPB director even though his recess appointment was not due to expire until the end of 2013.

One day later, in the first significant resistance to President Obama’s concentration of presidential power, a three judge panel of the U.S. Court of Appeals in Washington DC unanimously said that Obama’s Recess Appointments to the National Labor Relations Board are unconstitutional. Similar litigation testing the Cordray appointment to the CFPB is in the pipeline.

The Consumer Financial Protection Bureau (CFPB) created by the 2,319 page Dodd-Frank legislation is a new and little known bureau with wide-ranging powers. Placed within the Federal Reserve, a corporation privately owned by member banks, the CFPB is insulated from oversight by either the President or Congress, its budget not subject to legislative control. It is not even clear that a new President can replace the CFPB director on taking office.

Unusual legal and political environments have a significant impact on the CFPB. With Cordray’s recess appointment in doubt several questions remain unanswered.

1) What will become of the CFPB when Cordray’s appointment is found invalid? An indicator comes from the NRLB, which operated unconstitutionally for years without a quorum. In 2007 the Senate threatened no NLRB nominations reported out of committee.

The NLRB continued operating with two members. Then a Supreme Court ruling in June of 2010 invalidated the NLRB decisions for lack of a quorum. Fisher & Phillips give the details about what was done next.

2) What will the CFPB do with your money? The CFPB incursion into individual personal savings, in order to control how you invest your money, isn’t a new idea. Current proposals grew from a policy analysis as disclosed by Roger Hedgecock.

By 2010 Bloomberg published an article titled “US Government Takes Two More Steps Toward Nationalization of Private Retirement Account Assets.” In that article Patrick Heller observed that, with Democrat control of Congress and the Presidency:

Democrats had a blueprint for diverting people’s savings from private investment to government debt. Then in 2010 the Tea Party won the house…

3) Why should the Government intervene in people’s savings decisions? The justifications for Government intervention in private financial decisions are varied. Panic over the economy, Wall Street, mandating savings equity, eliminating investment risk, financial crisis losses, retirement security, much-needed oversight, your 401K becomes a 201K, shoddy financial products, and predatory investment bankers are just a few.

If the financial industry is so predatory, how is it possible that savers keep any money? More importantly, we have all those government agencies, FDIC, FINRA, SEC, Labor Department, Treasury Department, NCUA, Office of Thrift Supervision, FHFA, NCUSIF, Comptroller of the Currency, Office of Foreign Assets Control, Pension Benefit Guaranty Corporation, hundreds of criminal penalties, and state level regulators. Are we admitting the Government is incapable of policing criminal and predatory behavior? Do we have invincible predators plundering the people, or do politicians Cry Wolf?

And about that crisis in the economy. Former Congressman Barney Frank, one of the authors of Dodd-Frank, admitted to Larry Kudlow that Government was to blame for the housing crisis.

Professor Ghilarducci said ”humans often lack the foresight, discipline, and investing skills required to sustain a savings plan.” Professor Ghilarducci tells us that people are flawed, no argument there.

Her solution, substitute Government decisions for the judgment of the millions of people who actually earned and saved the money. She fails to mention the government bureaucrats wielding the power to compel you to comply are themselves imperfect. Which is preferable, one faulty Government solution or millions of individual free choices?

4) Are there other forces pushing Government to confiscate people’s savings? With $16 trillion in debt the short answer is yes. When governments embark on a path of spending money they don’t have, they resort to financial repression. According to Wikipedia:

An Investors Business Daily article, Banks Pressured to Buy Government Debts, notes that “[b]anks can’t say no. They fear the political fallout. So they meekly submit to the government’s dictates.”

Meanwhile the Wall Street Journal reports that “[i]n 2011, the Fed purchased a stunning 61% of Treasury issuance.” Then a CNS News article revealed that “[s]o far this calendar year [2013], the Federal Reserve has bought up more U.S. government debt than the U.S. Treasury has issued.”

5) Is the health of Social Security (SS) a factor? There are several potential measures of when Social Security retirement goes broke. One measure is when FICA tax income doesn’t cover the cost of retirement checks. We have passed that point already. Others say that SS is fine until the lock box runs out of special issue bonds (IOUs).

Even though the SS bonds in the lock box cannot be sold on the open market, the Treasury Department remains under political pressure to honor that obligation by borrowing real cash to redeem the IOUs. At least until the IOUs in the lock box are gone. How long is that? Based on a credible source, Bruce Krasting at Zerohedge suggests not long.

Krasting however omits another possible solution, politicians can raid private retirement savings to put more IOUs in the lock boxes and more real money in the Treasury. Other people’s money is a temptation and $19.4 Trillion is a very large temptation.

Social Security is the largest entitlement program with a trust fund of $2.8 Trillion IOUs, soon to be reduced by another $1 Trillion. Can any politician, addicted to spending, resist that temptation of $19.4 Trillion? That’s real people’s real money that will be spent by Government in exchange for IOUs given to the SS lock box.

Meanwhile newly minted Senator Elizabeth Warren has entered the debate. Conservatives and Republicans have challenged the CFPB in the wake of the unconstitutional recess appointment. Bloomberg speculates that Warren might agree to trim the CFPB powers in a compromise. Bloomberg reported:

Conservatives and Republicans challenge the surrender of legislative power to the bureau, the concentrated power of a single director, the unconstitutional recess appointments, and the violation of constitutional separation of powers. The Republican position is the constitutional questions and litigation presently underway should be resolved prior to approving a director of CFPB.

The constitutional issues surrounding Dodd — Frank and the CFPB are beyond the space for this article. For those interested in the legal issues, a good synopsis can be found at the Mark Levin Radio Show podcast for February 18th. Mark is an attorney and his Landmark Legal Foundation has argued many cases before the Supreme Court. He can explain complex legal issues in straightforward language.

Quietly, behind the scenes, the groundwork is being laid for federal government confiscation of tax-deferred retirement accounts such as IRAs. Slowly, the cat is being let out of the bag.

Last January 18th, in a little noticed interview of Richard Cordray, acting head of the Consumer Financial Protection Bureau, Bloomberg reported “[t]he U.S. Consumer Financial Protection Bureau [CFPB] is weighing whether it should take on a role in helping Americans manage the $19.4 trillion they have put into retirement savings, a move that would be the agency’s first foray into consumer investments.” That thought generates some skepticism, as aptly expressed by the Richard Terrell cartoon published by American Thinker.

Days later On January 24th President Obama renominated Cordray as CFPB director even though his recess appointment was not due to expire until the end of 2013.

One day later, in the first significant resistance to President Obama’s concentration of presidential power, a three judge panel of the U.S. Court of Appeals in Washington DC unanimously said that Obama’s Recess Appointments to the National Labor Relations Board are unconstitutional. Similar litigation testing the Cordray appointment to the CFPB is in the pipeline.

The Consumer Financial Protection Bureau (CFPB) created by the 2,319 page Dodd-Frank legislation is a new and little known bureau with wide-ranging powers. Placed within the Federal Reserve, a corporation privately owned by member banks, the CFPB is insulated from oversight by either the President or Congress, its budget not subject to legislative control. It is not even clear that a new President can replace the CFPB director on taking office.

Unusual legal and political environments have a significant impact on the CFPB. With Cordray’s recess appointment in doubt several questions remain unanswered.

1) What will become of the CFPB when Cordray’s appointment is found invalid? An indicator comes from the NRLB, which operated unconstitutionally for years without a quorum. In 2007 the Senate threatened no NLRB nominations reported out of committee.

The NLRB continued operating with two members. Then a Supreme Court ruling in June of 2010 invalidated the NLRB decisions for lack of a quorum. Fisher & Phillips give the details about what was done next.

But recovery from the Supreme Court’s sting was quick, with Liebman and Schaumber still on the Board and with two new Members confirmed, … the suddenly full-strength Board simply added a new Member to the “rump panel” of the original decisions and managed to rubber-stamp many of the disputed Orders – at a record-setting pace – with the same result…This may explain why President Obama renominated Cordray a year early. Once confirmed Cordray can rubber-stamp decisions made while he was unconstitutionally appointed. Otherwise those decisions will be invalidated.

2) What will the CFPB do with your money? The CFPB incursion into individual personal savings, in order to control how you invest your money, isn’t a new idea. Current proposals grew from a policy analysis as disclosed by Roger Hedgecock.

On Nov. 20, 2007, Theresa Ghilarducci, professor of economic policy analysis at the New School for Social Research in New York, presented a paper proposing that the feds eliminate the tax deferral for private retirement accounts, confiscate the balance of those accounts, give each worker a $600 annual “contribution,” assess a mandatory savings tax on every worker and guarantee a 3 percent rate of return on the newly titled “Guaranteed Retirement Accounts,” or GRAs.How would that be accomplished? The Carolina Journal reported Ghilarducci’s 2008 testimony to Nancy Pelosi’s House.

Democrats in the U.S. House have been conducting hearings on proposals to confiscate workers’ personal retirement accounts “including 401(k)s and IRAs” and convert them to accounts managed by the Social Security Administration.Your Government universal GRA investment savings account is an annuity managed by Social Security. Hedgecock noted ‘[m]ake no mistake here: Obama is after your retirement money. The “annuities” will “invest” not in the familiar packages of bond and stock mutual funds but in the Treasury debt!’

By 2010 Bloomberg published an article titled “US Government Takes Two More Steps Toward Nationalization of Private Retirement Account Assets.” In that article Patrick Heller observed that, with Democrat control of Congress and the Presidency:

[I]n mid-September 2010 the Departments of Labor and Treasury held hearings on the next step toward achieving Ghilarducci’s goals. The stated purpose was to require all private plans to offer retirees an option to elect an annuity. The “behind-the-scenes” purpose for this step was to get people used to the idea that the retirement assets they had accumulated would no longer be part of their estate when they died.So the Government would get the money, not the estate or family of the people who saved the money during a lifetime of work. That’s a one hundred percent death tax on savings. Worse, the most responsible and poorest families will be penalized.

Democrats had a blueprint for diverting people’s savings from private investment to government debt. Then in 2010 the Tea Party won the house…

3) Why should the Government intervene in people’s savings decisions? The justifications for Government intervention in private financial decisions are varied. Panic over the economy, Wall Street, mandating savings equity, eliminating investment risk, financial crisis losses, retirement security, much-needed oversight, your 401K becomes a 201K, shoddy financial products, and predatory investment bankers are just a few.

If the financial industry is so predatory, how is it possible that savers keep any money? More importantly, we have all those government agencies, FDIC, FINRA, SEC, Labor Department, Treasury Department, NCUA, Office of Thrift Supervision, FHFA, NCUSIF, Comptroller of the Currency, Office of Foreign Assets Control, Pension Benefit Guaranty Corporation, hundreds of criminal penalties, and state level regulators. Are we admitting the Government is incapable of policing criminal and predatory behavior? Do we have invincible predators plundering the people, or do politicians Cry Wolf?

And about that crisis in the economy. Former Congressman Barney Frank, one of the authors of Dodd-Frank, admitted to Larry Kudlow that Government was to blame for the housing crisis.

Professor Ghilarducci said ”humans often lack the foresight, discipline, and investing skills required to sustain a savings plan.” Professor Ghilarducci tells us that people are flawed, no argument there.

Her solution, substitute Government decisions for the judgment of the millions of people who actually earned and saved the money. She fails to mention the government bureaucrats wielding the power to compel you to comply are themselves imperfect. Which is preferable, one faulty Government solution or millions of individual free choices?

4) Are there other forces pushing Government to confiscate people’s savings? With $16 trillion in debt the short answer is yes. When governments embark on a path of spending money they don’t have, they resort to financial repression. According to Wikipedia:

Financial repression is any of the measures that governments employ to channel funds to themselves, that, in a deregulated market, would go elsewhere. Financial repression can be particularly effective at liquidating debt.Do we have any evidence that the US Government is pursuing financial repression? Yes we do. Jeff Cox at CNBC. “US and European regulators are essentially forcing banks to buy up their own government’s debt-a move that could end up making the debt crisis even worse, a Citigroup analysis says.”

An Investors Business Daily article, Banks Pressured to Buy Government Debts, notes that “[b]anks can’t say no. They fear the political fallout. So they meekly submit to the government’s dictates.”

Meanwhile the Wall Street Journal reports that “[i]n 2011, the Fed purchased a stunning 61% of Treasury issuance.” Then a CNS News article revealed that “[s]o far this calendar year [2013], the Federal Reserve has bought up more U.S. government debt than the U.S. Treasury has issued.”

5) Is the health of Social Security (SS) a factor? There are several potential measures of when Social Security retirement goes broke. One measure is when FICA tax income doesn’t cover the cost of retirement checks. We have passed that point already. Others say that SS is fine until the lock box runs out of special issue bonds (IOUs).

Even though the SS bonds in the lock box cannot be sold on the open market, the Treasury Department remains under political pressure to honor that obligation by borrowing real cash to redeem the IOUs. At least until the IOUs in the lock box are gone. How long is that? Based on a credible source, Bruce Krasting at Zerohedge suggests not long.

SS consists of two different pieces. The Old Age and Survivors Insurance (OASI) and Disability Insurance (DI). Both entities have their own Trust Funds (TF). OASI has a big TF that will, in theory, allow for SS retirement benefits to be paid for another 15+ years. On the other hand, the DI fund will run completely dry during the 1stQ of 2016.So Krasting expects the President and Congress will soon be forced to choose between 4 solutions:

1 Increase Income TaxesKrasting predicts Congress and Obama will be behind door number four. His credible source is the Congressional Budget Office report Social Security Trust Fund–February 2013 Baseline. In the footnotes it projects a $1 Trillion drain on the retirement fund which currently holds $2.8 Trillion. That’s a loss of approximately one third of the retirement IOUs.

2 Increase Payroll Taxes

3 Cut disability benefits by 30%

4 Kick the can down the road and raid the retirement fund to pay for disability shortfalls.

Krasting however omits another possible solution, politicians can raid private retirement savings to put more IOUs in the lock boxes and more real money in the Treasury. Other people’s money is a temptation and $19.4 Trillion is a very large temptation.

Social Security is the largest entitlement program with a trust fund of $2.8 Trillion IOUs, soon to be reduced by another $1 Trillion. Can any politician, addicted to spending, resist that temptation of $19.4 Trillion? That’s real people’s real money that will be spent by Government in exchange for IOUs given to the SS lock box.

Meanwhile newly minted Senator Elizabeth Warren has entered the debate. Conservatives and Republicans have challenged the CFPB in the wake of the unconstitutional recess appointment. Bloomberg speculates that Warren might agree to trim the CFPB powers in a compromise. Bloomberg reported:

“A strong independent consumer agency is good for families and lenders that follow the rules and good for the economy as a whole,” Warren said yesterday in an interview. “I will keep fighting for that.” [snip]Bloomberg also notes that soon “the Senate will have to decide whether to vote to confirm director Richard Cordray in his post, which would make a legal challenge pointless.”

Some observers have suggested that Warren’s original support for a commission-led bureau might mean she would be amenable to compromise on that issue. Warren spokesman Dan Geldon said such speculation is mistaken.

“Senator Warren thinks the single director structure makes sense and that CFPB should continue to be able to operate, like every other banking regulator, without relying on appropriations for its funding,” Geldon said.

Conservatives and Republicans challenge the surrender of legislative power to the bureau, the concentrated power of a single director, the unconstitutional recess appointments, and the violation of constitutional separation of powers. The Republican position is the constitutional questions and litigation presently underway should be resolved prior to approving a director of CFPB.

The constitutional issues surrounding Dodd — Frank and the CFPB are beyond the space for this article. For those interested in the legal issues, a good synopsis can be found at the Mark Levin Radio Show podcast for February 18th. Mark is an attorney and his Landmark Legal Foundation has argued many cases before the Supreme Court. He can explain complex legal issues in straightforward language.

Walmart Saw $17 Billion Profit in 2012

Latino Daily News

Latino Daily NewsWalmart Stores, Inc., the world’s largest retailer, said Thursday it posted income from continuing operations of $17 billion in the fiscal year ended Jan. 31, up 7.8 percent from the comparable prior period, thanks to higher sales and lower financing costs.

Revenues totaled $466.1 billion in fiscal 2013, up 5 percent over fiscal 2012, the company said.

“Walmart topped off a really good year with a solid fourth quarter, and I’m proud of what we accomplished as a team,” Walmart Stores, Inc. president and CEO Mike Duke said.

The giant retailer earned $5.02 per share in fiscal 2013, up 10.6 percent from the $4.54 it earned in the previous fiscal year.

“Every day, our associates around the world deliver on our mission to help customers save money so they can live better. Together, we added $22 billion in sales to top $466 billion. Walmart U.S. was a key driver of our 5 percent net sales increase,” Duke said.

Bentonville, Arkansas-based Walmart had income from continuing operations of $5.6 billion in the fourth quarter, a figure that was up 7.9 percent.

“We have high expectations for fiscal 2014, and I’m optimistic as I look ahead,” Duke said. “Walmart is operating in markets that offer continued opportunity for growth, both in our stores and online. With our core Walmart U.S. business operating so well, our investments in e-commerce and our international markets focused on growth and improving returns, we are truly the best positioned global retailer.”

Wall Street analysts had been anxiously awaiting the retailer’s results following a leak of internal Walmart e-mails last week in which one high-level executive described the company’s February month-to-date sales as “a total disaster.”

“For fiscal 2014, we expect EPS to range between $5.20 and $5.40, which includes increased fiscal 2014 costs of around $0.09 per share for our e-commerce operations. We are excited about the opportunities these investments will provide,” chief financial officer Charles Holley said.

Shares of Walmart, a Dow Jones industrial average component, were trading up $1.16, or 1.68 percent, at $70.33 near the close on the New York Stock Exchange.

Inequality Is Much Worse Than You Think

In 2010, the top hedge fund manager earned as much in one HOUR as the average (median) family earned in 47 YEARS.

• The top 25 hedge fund managers in 2010 earned as much as 658,000 entry level teachers.

• In 1970 the top 100 CEOs made $40 for every dollar earned by the average worker. By 2006, the CEOs received $1,723 for every worker dollar.

As the administration and Congress argue over cuts in social programs, inequality in America grows more extreme each day. Even the great financial crash didn't derail this trend. The richest 400 Americans, for example, increased their wealth by 54 percent between 2005 and 2010, while the median middle-class family saw its wealth decline by 35 percent.

None of this is accidental.

It's not the result of mysterious global forces, or technology, or China, or structural problems concerning the skills and education of our workforce. Rather, it is the direct result of policy choices made by Democrats and Republicans alike. Together, they swallowed the Kool-Aid of unregulated market mania, and now we are paying the price.

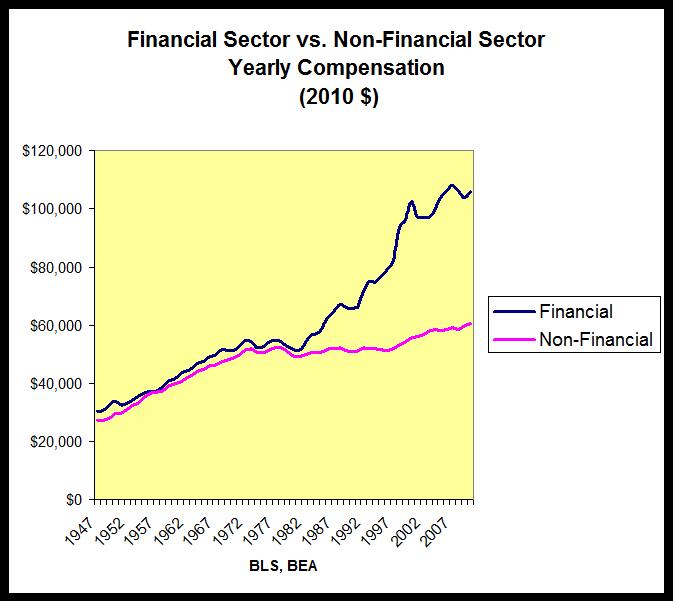

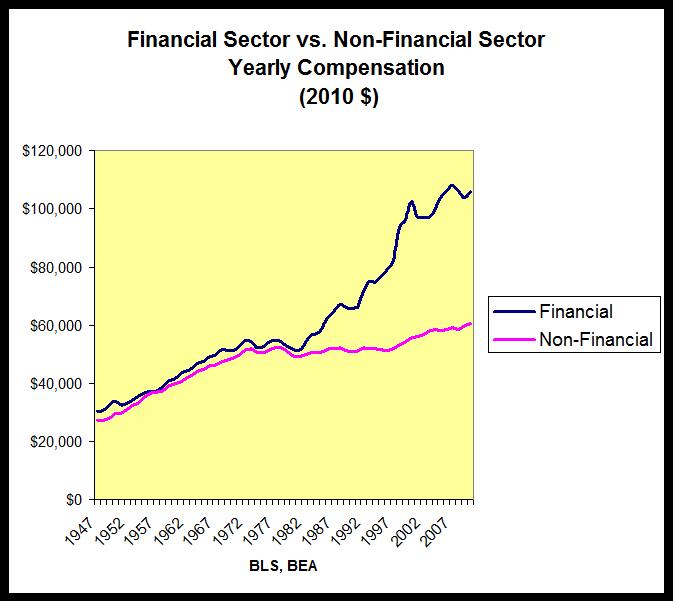

In exploring this story for my new book, How to Make a Million Dollars an Hour: Why Hedge Funds Get Away with Siphoning Off America's Wealth , it became clear that New Deal policy makers shared a deep fear that democratic capitalism could not function unless Wall Street was tightly controlled. After all, Europe was sinking into the fascist camp while the new Soviet Union seemed invulnerable to the global depression. As a result, to put it crudely, the New Dealers quickly regulated the hell out of high finance through a myriad of programs including the formation of the S.E.C and Glass-Steagall. The goal was to turn Wall Street into a sleepy place to work, rather than an adrenalin-fueled arena of stock manipulation and fraud. At the same time income tax rates on the wealthy sky-rocketed with top marginal rates reaching over 90 percent. The results were nothing short of stupendous.

• For more than a quarter of a century there were no financial crises anywhere in the globe (except Brazil in 1964).

• The average wage in the financial sector collapsed so that its compensation was similar to the average wage of non-financial jobs.

• Inequality fell rapidly -- the top one percent accounted for more than 23 percent of all income in 1928. By the 1970s it had fallen to less than 9 percent.

These policies gave birth to middle-class America, as the average income of working families grew steadily during the WWII period. This was the new America that would out-compete world communism for the support of working people all over the world.

Then we forgot.

After a series of economic mishaps, (largely due, but not limited, to the excessive costs of the Vietnam War and the Cold War), both inflation and unemployment rose simultaneously. This led many economists and policy makers to believe that Keynesian economics no longer applied (meaning that you could not successfully use government spending to combat rising unemployment without triggering excessive inflation.) Neo-liberal economists, led by Milton Friedman, filled the breach by arguing that less government and more free enterprise were desperately needed. In fact, they claimed that the determined pursuit of profit invariable created the most wealth (and freedom) for all.

The message was well received, especially by the Reagan administration. Taxes were slashed for the super-rich, (with the blessing of the Democrats, as well.) Unions were suppressed. Regulations, especially on Wall Street, vanished. A boom was to follow to make all boats rise.

It didn't happen as planned.

The income of the average worker stalled and the top 1 percent flourished. Inequality rose as financial gambling became a way of life. (In fact, after accounting for inflation, real average weekly wages in 1977 were higher than they are today.)

Wall Street, however, sprung to life. As deregulation increased, so did Wall Street incomes compared to the rest of the economy.

With the financial sector leading the charge, non-financial CEOs climbed on board. If 30-year-old traders could make tens of millions of dollars playing financial roulette with other people's money, then why shouldn't CEOs get paid more... and more... and more? "Greed is good" became more than a memorable phrase from a movie. It became a badge of honor -- a sign of recognition among the highest-paid players who knew precisely how to game the system.

And then we paid the price with another crash. Not quite as bad as 1929, but close. But this post-crash period is remarkably different. Rather than constraining inequality, the bailouts resurrected high finance and the inequality it inevitably spawns. Instead of putting our foot back on the neck of finance, we're talking about slashing social programs. Rather than dramatically increasing taxes on the super-rich through a wealth tax, we're debating how to slash Social Security and Medicare benefits.

Are Americans Socialists?

One reason our priorities are so favorable to inequality is because most Americans have no idea how skewed our income distribution really is. As Michael Norton and Dan Ariely have demonstrated through their research, over 90 percent of Americans prefer to live in a country with an income distribution like Sweden's. That doesn't mean, of course, that Americans are closet social democrats. Rather, it reflects that they believe America is much more egalitarian than it really is.

The Norton/Ariely study builds from an idea developed by philosopher John Rawls in his book, A Theory of Justice. Rawls argues that to create the principles for a fair and just social order we need to take part in a rational but imaginary exercise. We need to imagine ourselves coming together as free and equal individuals to form a compact to create a society. But to engage in our imaginary negotiations, we must do so behind a "veil of ignorance" -- we must have no idea where we would end up in the new society we would be creating. We have to make our choices about the principles of social justice without knowing our individual talents or health or financial resources. So given that "veil of ignorance," what would be our principles of justice? Rawls argues convincingly that we would select two. First, we would only agree to enter a new society if it protected as many of our basic freedoms as possible. And second, we would only permit inequality if it also benefited those with the least incomes and resources in society.

For the last generation, our free market ideologues have argued that inequality would trickle down and, in effect, fulfill Rawls' second condition for justice. However their real-time experiment failed. Increasing inequality has not increased the well-being of the poor, or even the middle class. It is by and for the well-to-do. In short, we are unlikely to find a rational or moral justification for increasing inequality.

For a brief moment, Occupy Wall Street changed the national discourse away from the insanity of belt-tightening and towards inequality and Wall Street. If we care about justice, we need to find ways to do so again.

• The top 25 hedge fund managers in 2010 earned as much as 658,000 entry level teachers.

• In 1970 the top 100 CEOs made $40 for every dollar earned by the average worker. By 2006, the CEOs received $1,723 for every worker dollar.

As the administration and Congress argue over cuts in social programs, inequality in America grows more extreme each day. Even the great financial crash didn't derail this trend. The richest 400 Americans, for example, increased their wealth by 54 percent between 2005 and 2010, while the median middle-class family saw its wealth decline by 35 percent.

None of this is accidental.

It's not the result of mysterious global forces, or technology, or China, or structural problems concerning the skills and education of our workforce. Rather, it is the direct result of policy choices made by Democrats and Republicans alike. Together, they swallowed the Kool-Aid of unregulated market mania, and now we are paying the price.

In exploring this story for my new book, How to Make a Million Dollars an Hour: Why Hedge Funds Get Away with Siphoning Off America's Wealth , it became clear that New Deal policy makers shared a deep fear that democratic capitalism could not function unless Wall Street was tightly controlled. After all, Europe was sinking into the fascist camp while the new Soviet Union seemed invulnerable to the global depression. As a result, to put it crudely, the New Dealers quickly regulated the hell out of high finance through a myriad of programs including the formation of the S.E.C and Glass-Steagall. The goal was to turn Wall Street into a sleepy place to work, rather than an adrenalin-fueled arena of stock manipulation and fraud. At the same time income tax rates on the wealthy sky-rocketed with top marginal rates reaching over 90 percent. The results were nothing short of stupendous.

• For more than a quarter of a century there were no financial crises anywhere in the globe (except Brazil in 1964).

• The average wage in the financial sector collapsed so that its compensation was similar to the average wage of non-financial jobs.

• Inequality fell rapidly -- the top one percent accounted for more than 23 percent of all income in 1928. By the 1970s it had fallen to less than 9 percent.

These policies gave birth to middle-class America, as the average income of working families grew steadily during the WWII period. This was the new America that would out-compete world communism for the support of working people all over the world.

Then we forgot.

After a series of economic mishaps, (largely due, but not limited, to the excessive costs of the Vietnam War and the Cold War), both inflation and unemployment rose simultaneously. This led many economists and policy makers to believe that Keynesian economics no longer applied (meaning that you could not successfully use government spending to combat rising unemployment without triggering excessive inflation.) Neo-liberal economists, led by Milton Friedman, filled the breach by arguing that less government and more free enterprise were desperately needed. In fact, they claimed that the determined pursuit of profit invariable created the most wealth (and freedom) for all.

The message was well received, especially by the Reagan administration. Taxes were slashed for the super-rich, (with the blessing of the Democrats, as well.) Unions were suppressed. Regulations, especially on Wall Street, vanished. A boom was to follow to make all boats rise.

It didn't happen as planned.

The income of the average worker stalled and the top 1 percent flourished. Inequality rose as financial gambling became a way of life. (In fact, after accounting for inflation, real average weekly wages in 1977 were higher than they are today.)

Wall Street, however, sprung to life. As deregulation increased, so did Wall Street incomes compared to the rest of the economy.

With the financial sector leading the charge, non-financial CEOs climbed on board. If 30-year-old traders could make tens of millions of dollars playing financial roulette with other people's money, then why shouldn't CEOs get paid more... and more... and more? "Greed is good" became more than a memorable phrase from a movie. It became a badge of honor -- a sign of recognition among the highest-paid players who knew precisely how to game the system.

And then we paid the price with another crash. Not quite as bad as 1929, but close. But this post-crash period is remarkably different. Rather than constraining inequality, the bailouts resurrected high finance and the inequality it inevitably spawns. Instead of putting our foot back on the neck of finance, we're talking about slashing social programs. Rather than dramatically increasing taxes on the super-rich through a wealth tax, we're debating how to slash Social Security and Medicare benefits.

Are Americans Socialists?

One reason our priorities are so favorable to inequality is because most Americans have no idea how skewed our income distribution really is. As Michael Norton and Dan Ariely have demonstrated through their research, over 90 percent of Americans prefer to live in a country with an income distribution like Sweden's. That doesn't mean, of course, that Americans are closet social democrats. Rather, it reflects that they believe America is much more egalitarian than it really is.

The Norton/Ariely study builds from an idea developed by philosopher John Rawls in his book, A Theory of Justice. Rawls argues that to create the principles for a fair and just social order we need to take part in a rational but imaginary exercise. We need to imagine ourselves coming together as free and equal individuals to form a compact to create a society. But to engage in our imaginary negotiations, we must do so behind a "veil of ignorance" -- we must have no idea where we would end up in the new society we would be creating. We have to make our choices about the principles of social justice without knowing our individual talents or health or financial resources. So given that "veil of ignorance," what would be our principles of justice? Rawls argues convincingly that we would select two. First, we would only agree to enter a new society if it protected as many of our basic freedoms as possible. And second, we would only permit inequality if it also benefited those with the least incomes and resources in society.

For the last generation, our free market ideologues have argued that inequality would trickle down and, in effect, fulfill Rawls' second condition for justice. However their real-time experiment failed. Increasing inequality has not increased the well-being of the poor, or even the middle class. It is by and for the well-to-do. In short, we are unlikely to find a rational or moral justification for increasing inequality.

For a brief moment, Occupy Wall Street changed the national discourse away from the insanity of belt-tightening and towards inequality and Wall Street. If we care about justice, we need to find ways to do so again.

SANTELLI: 'We Need A Debt Alarm Clock!'

'We can't even cut 1/3 of one percent of our budget!'

'That's the alarm clock we need in this country. One that will wake young people up to their diminishing future.'

Rick Santelli yesterday on Squawk Box. Great clip. Runs 90 seconds.

---

In case you missed it:

SANTELLI: "When A Spending Cut Isn't Really A Cut"

Virtually ALL of the Big Banks’ Profits Come from Taxpayer Bailouts and Subsidies

The Big Banks “Would Just About Break Even In the Absence of Corporate Welfare”

The government has propped up the big banks for years through massive, never-ending bailouts and subsidies.Bloomberg noted last year that 77% of JP Morgan’s net income comes from government subsidies.

Bloomberg reported yesterday:

What if we told you that, by our calculations, the largest U.S. banks aren’t really profitable at all? What if the billions of dollars they allegedly earn for their shareholders were almost entirely a gift from U.S. taxpayers?The money hasn’t just gone to the banks shareholders … It has also gone to line the pockets of bank management:

***