A restaurant server has filed a complaint with B.C.'s Employment Standards Branch against a high profile Vancouver restaurant group because management required her to hand over her tips at the end of shifts.

"The last night I worked I made $320 in cash tips, and I walked out of the restaurant with not a penny in my pocket," says Charlotte Zesati.

"The manager wouldn't let me go until I put [some cash from tips] in the envelope … faced this camera in the office and put it in the safe."

Zesati says that happened after she'd already cashed out and split some of her tips with the bartender and busser. She had given each of them cash equal to one per cent of her sales.

She says she was told the money she had to put in the safe would go to "the house."

"I asked [the manager] who was getting this ... I was pushed aside, told, this is how much you have to pay."

Zesati is a single mother who recently moved to Vancouver from California. She worked briefly at Black + Blue, a high-end steakhouse owned by the Glowbal Group, which runs seven prominent Vancouver restaurants, with the others being Glowbal Grill, Sanafir, Coast, Italian Kitchen, Trattoria and Society.

Server got less than half

Records show a manager later gave her $124 back — for her $320 night — which is less than half of what customers tipped her.

"I have never experienced that. And I have been working in this industry for over 20 years now," said Zesati. "For me, it's food on my daughter's plate. For me, it's clothes on her back. It's more than, you know, tips."

Zesati says after she quit, she learned all servers had to pay a "house charge," equal to 4.2 per cent of their net sales, on any given night. She said Black + Blue's general manager told her the money is later distributed to other staff, including managers.

To the customer, that means if they leave a $15 tip on a $100 restaurant bill, $4.20 of that tip goes to "the house," not to the staff member who served them.

"[The general manager] said the day before they did $47,000 in sales. If you times that by four per cent you've got yourself about $2,000 in one day going into that kitty," Zesati said.

After she complained to the owners, the Glowbal Group mailed her a cheque for the full amount she had handed over. "They actually just as quickly as possible sent a cheque in the mail," she said.

CBC News took a hidden camera into Black + Blue, and asked staff, as any customer might, what happens to the tips. We were also told servers must pay a percentage of their sales — out of their tips — to "the house."

Glowbal beverage manager Chris Ballas told us: "They tip us [the bar] out one per cent. They tip their busser out one per cent, and then 4.2% to be exact goes to the restaurant."

When asked where that money ends up, he said, "That goes to ... the house. Staff parties. Breakages. That kind of stuff. So that's to account for variable costs," he said.

He told us glass breakage costs at Black + Blue are $2,000 a month and "that's where that kind of stuff [tip money] goes."

Described as 'kickback'

Then he added: "It's a kickback. Let's be honest … kickback or grease … or whatever you want to call it … they [servers] have to give the restaurant for the entitlement or the privilege to work within that restaurant."

He told us the practice is industry standard, at least in B.C. "All Glowbal sites. And I'm pretty sure ... I'm pretty safe to say all of Vancouver."

Glowbal Group's high-end steakhouse, Black & Blue, is situated on Vancouver's toney Alberni St. (CBC)

Glowbal Group's high-end steakhouse, Black & Blue, is situated on Vancouver's toney Alberni St. (CBC)CBC News then sent a woman into several other prominent restaurants, posing as a server looking for work, to ask what happens to tips.

At the Keg, Cardero's and Joey's, managers said the money is pooled among staff based on a percentage of sales ranging from 2.5 to 5.5 per cent.

Unlike at Glowbal restaurants, though, we were told the business doesn't oversee the tip pool and managers don't take a cut.

B.C. employment standards law states restaurants can't use tip money for business expenses. Federal tax rules also dictate that if tips are "controlled" by the employer, if management collects and then redistributes the money, it is taxable and EI and CPP must be deducted.

Owner says all goes back to staff

Glowbal Group owner Emad Yacoub insisted none of the cash handed over by servers is kept by him or the company, so he does not report it as income.

"I don't keep a penny of it. We don't keep it … I have never, ever kept one penny of the tips for the restaurant."

He explained a manager, who is also a relative of his, picks up the cash from the restaurant safes every night. The cash manager then divides it up, according to set percentages, and distributes all of it later to hostesses, runners, kitchen staff and floor managers.

"We have one person that handles all the cash for all the restaurants," Yacoub said. "When it gets counted, we have on the record how much was the tip-out and how much goes back to everybody."

Yacoub said the restaurant handles the tip money on behalf of staff, simply to make sure everyone gets their fair share.

"What we do is we just take it and give it to them," he said.

Emad Yacoub says none of the tip money collected from his servers is kept by him or his restaurant. (CBC)

Emad Yacoub says none of the tip money collected from his servers is kept by him or his restaurant. (CBC)We then showed him the hidden camera tape of one of his managers calling the tip practice a "kickback" that goes to "variable costs," like breakage.

"We have never charged any of our staff for breakage or staff parties. We have never kept any of this money. I give it back again to all the staff that work that night," said Yacoub.

"I cannot explain [what the manager said] but I am telling you from the owner of this company … 100 per cent of it goes back to everybody."

Yacoub also insisted since the company doesn't "control" the tips, as tax rules prohibit, a server could refuse to pay the house charge if they wanted to.

"I would tell her, just tell the people you are working with that you don't want to share with them," he said. "I don't decide how it's divided up."

Manager recants

After his boss saw him on the hidden camera tape, Ballas called CBC News and insisted that what he told us when we spoke to him as a customer in the restaurant was all lies. The manager said he was just "talking trash" from behind the bar.

He also said when he realized how much trouble he may have caused the business, he offered to resign, but Yacoub refused to accept the offer.

CBC News then contacted two former high-level Glowbal Group managers, who had invested in the company and worked there for a significant period of time. One left because he had a falling out with Yacoub, and the other just moved on.

They both agreed to talk about the tip system under the condition they would not be named. Both said they had firsthand knowledge that Yacoub "pocketed" some of the money.

The bar manager for Black & Blue, Chris Ballas, talks on hidden camera about the tip procedure at Glowbal. (CBC)

The bar manager for Black & Blue, Chris Ballas, talks on hidden camera about the tip procedure at Glowbal. (CBC)"Emad [Yacoub] does keep it. He would probably keep half," said the disgruntled former manager. "It never touches [restaurant] expenses. It is used as cash."

Both sources told CBC News some of the house charge is given back to floor staff, as Yacoub indicated. However, they said those staffers received set amounts no matter what sales were – like $40 per hostess, per day.

On a good week, the former managers said after staff got their cuts, there was a lot of cash left over.

"Emad's cut is determined by whatever the profit is in tips," said one.

They also said servers had no choice but to pay the house charge. "Even if they were short [on tips] they had to pay out of their own pocket," said one of the ex-managers.

Yacoub said Glowbal Group's restaurant income for 2011 was $26.7 million, so the 4.2 per cent house charge to servers would have been approximately $1.12 million that year.

The disgruntled former manager suggested Yacoub may have kept up to half a million of that, in cash.

"The tip thing is huge. It becomes huge money by the end of the year," he said.

Surplus kept for staff: owner

Yacoub responded to the allegation by explaining that during busy times, any extra cash left in the tip pool – after each employee got their set amount – is kept as cash on reserve. He said it is then drawn on later during slow periods to make sure staff still receive their set amounts.

"This system is set up to create stability and fairness to the all the support staff, regardless of the month or work week, so they know themselves the approximate tips they are to receive per shift worked. This also motivates them to work any shift per week without requesting only the busy shifts," Yacoub said.

B.C. Labour Minister Margaret MacDiarmid says it's illegal for an employer to use tips for business expenses. (CBC)

B.C. Labour Minister Margaret MacDiarmid says it's illegal for an employer to use tips for business expenses. (CBC)He said sometimes the business goes into a deficit to pay staff. For example, he said last week staff at Italian Kitchen received a total of $6,100 from the tip pool, but the average house charge collected from servers each week is $5,000.

Yacoub repeated he doesn't keep any of the tip money, regardless of how good the sales are, and he has records to prove that.

"This system was set up in a way that every single penny that comes in is accounted for and every penny that gets paid out is signed for by all the staff," said Yacoub.

One of the former managers said when he worked for Glowbal, slow times were quite rare. He said, the few times it was slow and there wasn't enough to pay staff out of the tip pool, Yacoub would hand over cash from his pocket to make up the difference.

"He had rolls of cash in his pocket and he always tried to pay for everything with cash," he said.

B.C Minister of Labour Margaret MacDiarmid said Zesati's complaint about Glowbal Group's tipping system will be investigated.

"Tips cannot be used for business expenses," said MacDiarmid. "If there's money owing an employee, they [investigators] will leave no stone unturned to get that money."

"I hope if there's anybody else out there that's suffering through this, that it comes out," said Zesati.

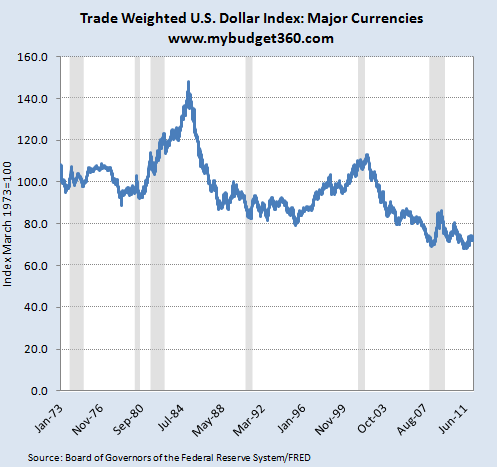

Cross Currency Table – (Bloomberg)

Cross Currency Table – (Bloomberg)

Glowbal Group's high-end steakhouse, Black & Blue, is situated on Vancouver's toney Alberni St. (CBC)

Glowbal Group's high-end steakhouse, Black & Blue, is situated on Vancouver's toney Alberni St. (CBC) Emad Yacoub says none of the tip money collected from his servers is kept by him or his restaurant. (CBC)

Emad Yacoub says none of the tip money collected from his servers is kept by him or his restaurant. (CBC) The bar manager for Black & Blue, Chris Ballas, talks on hidden camera about the tip procedure at Glowbal. (CBC)

The bar manager for Black & Blue, Chris Ballas, talks on hidden camera about the tip procedure at Glowbal. (CBC) B.C. Labour Minister Margaret MacDiarmid says it's illegal for an employer to use tips for business expenses. (CBC)

B.C. Labour Minister Margaret MacDiarmid says it's illegal for an employer to use tips for business expenses. (CBC)