Income

Tax is the Second plank of the Communist Manifesto. Income tax IS

communism. People thought Communism would never happen in America.

In

1799 Thomas Jefferson, while he was Vice-President, in the Kentucky

Resolves, reassured them that there are only three federal laws that

apply to a state citizen. The three mentioned in the Constitution: piracy, treason and counterfeiting. How about you?

A

right cannot be taxed. If your wages are taxed, then either: You

do not have a right to earn wages, or you waived your right to earn

wages. Let's try to find out which one.

Many

people insist that the 16th Amendment authorizes a tax on

everyone's wages. But does it?

Note:

Government employees have had their wages taxed since 1862, long before the

16th amendment. The comments here do not apply to government

wages.

Direct

taxes must be Constitutionally apportioned to your State by the proportion of

your State's representation (Art.1, Sect.2, Clause3 & Art1, Sect.9,

Clause4). -- And, NO. The 16th amendment did not change this, the

16th amendment did not alter, add or remove any words from the original

constitution, and the US Supreme Court confirmed in Stanton v. Baltic Mining

Co. 240

US 103 (1915) that "… the 16th amendment conferred no new powers

of taxation" - That's right! There is no such thing as

an unapportioned tax on the wages of state citizens.

If

state citizens' wages were not taxed before the 16th Amendment,

then the 16th amendment did not confer a new power of taxation.

|

AMENDMENT XVI.

The Congress shall have power to lay and collect taxes on

incomes, from whatever source derived, without apportionment among the

several States, and without regard to any census or enumeration.

|

|

This is very different from the original proposed amendment in

Senate Joint Resolution 39 as published in Congressional Record June 11,

1909 page 3377."The Congress shall

have power to lay and collect direct taxes on incomes without apportionment among the

several states according

to population"

[highlight added so you can spot the changes]

The Senate Finance Committee revised it as Senate Joint Resolution

40, to what we have today. (published on Page 3900 of the Congressional

Record of June 28, 1909)

The word "direct" was removed from the original

proposed amendment

The words "from whatever source derived" were added.

Nothing was changed by the 16th Amendment. There is no new taxing authority.

The amendment DID NOT eliminate apportionment, nor convert direct taxes

into indirect taxes.

The tax is still on the income, not on the source.

Since the word direct was deleted, it can never be

argued that there is a direct tax on incomes.

There is not now, nor can there ever be a direct tax on incomes. (except

for federal employees who are already subject to fed jurisdiction)

The Senators who swore oaths to uphold and perpetuate the

Constitution did not circumvent it.

Since tax collectors could always seize assets without regard to

their source, no new taxing authority was created.

|

The

income tax was to be a tax on the profits

earned from savings accounts. When the States ratified the 16th

Amendment, they did so only upon the assurance, over and over again, that salaries would not be taxed. Only profit

from savings was to be taxed, and only then as an indirect tax. Not as

a direct tax on people.

Here are proofs that the

16th Amendment was never intended to tax wages:

- New York Times

August 3, 1909 front page. Excerpt.

"The only interruption to his speech was a query by

Representative Glover… - who wanted to know if the amendment would affect

salaries." If you have the same question, then read the

response.

- Congressional

debates, Congressional Record, August 28 1913 Senator Lawrence Y.

Sherman on page 3843 debating the income tax amendment, insisted that

the word "income" referred only to earnings on savings

accounts: "The savings from the income by professional effort or

by any form of skilled labor or unskilled hand becomes property.

At the end of any given period that saving is a principal, and any

income derived from it is an income from property, not an income from the earning capacity or the personal

ability of the taxpayer in question… Those investments that

produce an income from a property I think are properly to be

distinguished from those arising from the earning capacity of the

individual."

- Also on page 3843

Senator Cummins :"I assume that every lawyer will agree with me

that we cannot legislatively interpret the meaning of the word 'income'.

That is purely a judicial matter. We cannot enlarge the meaning of

the word 'income'. The word 'income' had a well-defined meaning

before the amendment … If we could call anything income that we pleased,

we could obliterate all the distinction between income and

principal…. Congress can not

affect the meaning of the word 'income' by any legislation whatsoever….

obviously the people of this country did not intend to give to Congress

the power to levy a direct tax upon all the property of this country

without apportionment."

|

“None are so

hopelessly enslaved, as those who falsely believe that they are free.”

~ Goethe

|

And the courts agree:

- U.S.

v. Ballard 400 F2d 404:

"The general term 'income' is not defined

in the Internal Revenue Code."

- Wilby

v. Mississippi, 47 S 465:

"It certainly was not the intention of

the legislature to levy a tax upon honest toil and labor."

- Edwards

v. Keith, 231 Fed 1:

"One does not derive income by rendering

services and charging for them.... IRS cannot enlarge the scope

of the statute"

- US

Supreme Court in Evens v. Gore, 253 US 245 concerning a tax on salary:

“After further consideration, we adhere to that view and accordingly

hold that the Sixteenth Amendment does not authorize or support the tax in

question”.

"The claim that salaries, wages, and compensation

for personal services are to be taxed as an entirety… is without support

either in the language of the Act or in the decisions of the courts

construing it. Not only this but it is directly opposed to

provisions of the Act and to regulations of the Treasury Department… It is to

be noted that by the language of the Act it is not 'salaries, wages or

compensation for personal services' that are to be included in gross

income. That which is to be included is 'gains, profits and income

derived' from salaries… "

- US

Supreme Court in M.E. Blatt Co. v. U.S. 59 SCt190: "Treasury

regulations can add nothing to income as defined by Congress."

- Oliver

v. Halstead 86 SE 2d 859:

"Compensation for labor cannot be regarded as profit within the meaning

of the law."

- Olk

v. United States, Fed 18 (1975):

"Tips are gifts and therefore are not taxable."

- United

States v. Snider, Fed 645 (1974):

"Listing three billion dependents on his W-4 was ruled as proper. His

refusal to stand for judge was held legal by Fourth U.S. Court of

Appeals. Original action and conviction was under 26 USC 7205."

- Penn

Mutual Indemnity Co. v. Commissioner (32 Tax Court page 681):

"that which is not income in fact manifestly cannot be made such by the

legislative expedient of calling it income …"

- Spring

Valley Water Works v. Barber 33 P 735:

"A right common in every citizen such as the right to own property or to

engage in business of a character not requiring regulation CANNOT, however,

be taxed as a special franchise by first prohibiting its exercise and then

permitting its enjoyment upon the payment of a certain sum of money.”

- Tennessee

Supreme Court in Jack Cole v. Commissioner MacFarland 337 SW2d 453

(1960): "The right to receive income or earnings is a right belonging

to every person, and realization and receipt

of income is therefore not a "privilege that can be taxed."

[from:Taxation West Key 933]

In this 1960 case, the Tennessee Supreme Court also quoted prior decisions that

defined the term `privilege' in contradistinction to a right:

"Legislature ... cannot name something to be a taxable privilege unless

it is first a privilege." "Privileges are special rights, belonging

to the individual or class, and not to the mass; properly, an exemption from

some general burden, obligation or duty; a right peculiar to some individual

or body"

- US

Supreme Court in McCulloch v. Maryland, 4 Wheat 316:

"If it could be said that the state had the power to tax a right, this would

enable the state to destroy rights guaranteed by the constitutions through

the use of oppressive taxation. ... The power

to tax involves the power to destroy."

- U.S.

Supreme Court in Butcher's Union v. Crescent City 111US746:

"The property which every man has in his own labor, as it is the

original foundation of all other property, so it is the most sacred and

inviolable. ... to hinder his employing this strength and dexterity in what

manner he thinks proper without injury to his neighbor, is a plain violation

of this most sacred property."

- In

the 1959 Tax Court case Penn Mutual Indemnity Co. v. Commissioner (32

Tax Court page 681): “The rule of Eisner v. Macomber has been reaffirmed

on so many occasions that citation of the cases to this effect would be

unnecessarily burdensome... Moreover, that which is not income in fact manifestly cannot

be made such by the legislative expedient of calling it income....”

- Laureldale

Cemetery Assoc. v. Matthews, 345 A 239, and 47 A.2d 277 (1946):

“Reasonable compensation for labor or services rendered is not profit.”

- US

Supreme Court in Murdock v. Pennsylvania, 319 US 105, at 113

(1943): "A state may not... impose a charge for the enjoyment

of a right granted by the Federal constitution."

- U.S.

Supreme Court in Magnano Co. v. Hamilton 292 US 40 "The power to

tax the exercise of a [right] ... is the power to control or suppress

its enjoyment."

- President

Jefferson, concluding his first inaugural address, March 4, 1801:

"... a wise and frugal government, which shall restrain men from

injuring one another, which shall leave them otherwise free to regulate their

own pursuits of industry and improvement, and shall not take from the mouth

of labor the bread it has earned. This is the sum of good government… "

- Spreckels

Sugar Ref. Co. v. Mclain, 24 SCt 382 (1904):

"the citizen is exempt from taxation

unless the same is imposed by clear and unequivocal language".

- Oregon

Supreme Court in Redfield v. Fisher, 292 P 813, pg 819 (1930):

"The individual, unlike the corporation, cannot be taxed for the

mere privilege of existing. The corporation is an artificial

entity which owes its existence and charter powers to the state: but the

individuals' right to live and own property are natural rights for the

enjoyment of which an excise cannot be imposed."

- Long

v. Ramussen, 281 F 236, 238 (1922):"The revenue laws are a code or

system in regulation of tax assessment and collection. They relate

to taxpayers, and not to non-taxpayers. The later are without

their scope. No procedure is prescribed for non-taxpayers, and no

attempt is made to annul any of their rights and remedies in due course

of law. With them Congress does not assume to deal, and they are

neither of the subject nor of the object of the revenue law."

Reaffirmed in Gerth v. US, 132 F Supp 894 (1955) and in Economy Heating

Co. v. US, 470 F2d 585 (1972)

- Regal

Drug Co v. Wardell, 260 US 386: ”Congress may not, under the taxing

power, assert a power not delegated to it by the

Constitution."

- US

Supreme Court in Hurtado v. California 110 US 516:

"The state cannot diminish the rights of the people."

- Sherar

v. Cullen, 481 F2d 946(1973)

"... there can be no sanction or penalty imposed upon one because of his

exercise of constitutional rights"

- Miller

v. US, 230 F2d 489

"The claim and

exercise of a Constitutional right cannot be converted into a crime."

The

current income tax law has been amended over the years, but it all started

with one sentence written by congress to implement the Income Tax

Amendment. This is the first

paragraph of the 1913 Income Tax law 38 Stat 166. This is the ONLY law that

the government says applies to federal citizens.

It is only one sentence. The

rest of the 37 pages are for income tax of corporations. As you study this sentence, remember that

Congressmen cannot and do not impose direct taxation contrary to the

Constitution Article 1, Section 9 -- which did not change with the 16th

Amendment -- "… the 16th amendment conferred no new powers of

taxation" Stanton v. Baltic Mining Co.

240 US 103 (1915).

" That there shall be

levied, assessed, collected and paid annually upon the entire net income arising or accruing from all sources in the preceding calendar

year to every citizen of the United

States , whether residing

at home or

abroad, and to every person residing

in the United States

, though not a

citizen thereof , a tax of 1 per centum per annum upon such

income, EXCEPT as

herein after provided; and a like

tax shall be assessed, levied, collected, and paid annually

upon the entire net income from all property owned and of every business,

trade or profession carried on in the

United States by persons residing elsewhere."

Thomas Jefferson said “That to compel a man to furnish contributions of money

for the propagation of opinions which he disbelieves and abhors, is sinful

and tyrannical.” -- The

Papers of Thomas Jefferson, vol. 2, p.

545

|

Quote from Frederic Bastiat in 1850:

“When plunder becomes a way of life for a group of

men living together in a society, they create for themselves in the course

of time, a legal system that authorizes it and a moral code that glorifies

it.”

|

Back in 1988 I wrote a letter to my congressman asking what made me liable

for income tax, and documenting my search of the tax laws. I never got

an answer. Warning: do not try this at home unless you want to get on

the IRS hit list. By 1989 I was writing letters to tax experts trying

to get answers to most of my tax

questions. Do not try this at home

The slaves under Pharaoh only

had a 20% tax on income. Genesis 47:24.

They got to keep 80% of what they made as a living allowance. God considered this to be slavery and

freed them.

The opinions expressed on

this web site are solely those of the author

here

is no point in mincing words: UBS AG, the Swiss global bank, has been

disgracing the banking profession for years and needs to be shut down.

here

is no point in mincing words: UBS AG, the Swiss global bank, has been

disgracing the banking profession for years and needs to be shut down.

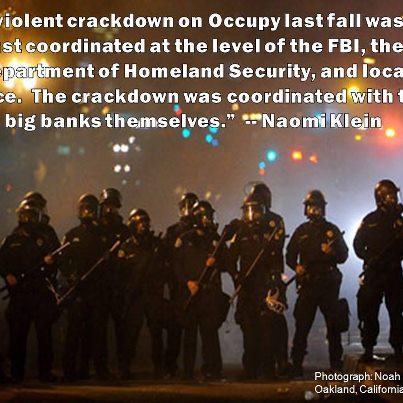

t

was more sophisticated than we had imagined: new documents show that

the violent crackdown on Occupy last fall – so mystifying at the time –

was not just coordinated at the level of the FBI, the Department of

Homeland Security, and local police. The crackdown, which involved, as

you may recall, violent arrests, group disruption, canister missiles to

the skulls of protesters, people held in handcuffs so tight they were

injured, people held in bondage till they were forced to wet or soil

themselves -was coordinated with the big banks themselves.

t

was more sophisticated than we had imagined: new documents show that

the violent crackdown on Occupy last fall – so mystifying at the time –

was not just coordinated at the level of the FBI, the Department of

Homeland Security, and local police. The crackdown, which involved, as

you may recall, violent arrests, group disruption, canister missiles to

the skulls of protesters, people held in handcuffs so tight they were

injured, people held in bondage till they were forced to wet or soil

themselves -was coordinated with the big banks themselves.