Sunday, July 31, 2011

GE CEO Jeffrey Immelt, The Head Of Obama’s Jobs Council, Is Moving Jobs And Economic Infrastructure To China At A Blistering Pace

Earlier this month, Immelt made the following statement to a jobs summit at the U.S. Chamber of Commerce....

"There's no excuse today for lack of leadership. The truth is we all need to be part of the solution."Apparently Immelt's idea of being part of the solution is to ship as many jobs overseas as he possibly can.

A recent article on the Huffington Post documented how GE has been sending tens of thousands of good jobs out of the country....

As the administration struggles to prod businesses to create jobs at home, GE has been busy sending them abroad. Since Immelt took over in 2001, GE has shed 34,000 jobs in the U.S., according to its most recent annual filing with the Securities and Exchange Commission. But it's added 25,000 jobs overseas.GE is supposed to be creating the "jobs of tomorrow", but it seems that most of the "jobs of tomorrow" will not be located inside the United States.

At the end of 2009, GE employed 36,000 more people abroad than it did in the U.S. In 2000, it was nearly the opposite.

The last GE factory in the U.S. that made light bulbs closed last September. The transition to the new CFL light bulbs was supposed to create a whole bunch of those "green jobs" that Barack Obama keeps talking about, but as an article in the Washington Post noted, that simply is not happening....

Rather than setting off a boom in the U.S. manufacture of replacement lights, the leading replacement lights are compact fluorescents, or CFLs, which are made almost entirely overseas, mostly in China.But GE is far from alone in shipping jobs and economic infrastructure out of the United States. For example, big automakers such as Ford are being very aggressive in China. Ford is currently "building three factories in Chongqing as part of $1.6 billion investment that also includes another plant in Nanchang".

Today, China accounts for approximately one out of every four vehicles sold worldwide. The big automakers consider the future to be in China.

Just a few decades ago, China was an economic joke and the U.S. economy was absolutely unparalleled.

But disastrous trade policies have opened up the door for a mammoth transfer of jobs, factories and wealth from the United States to China.

China has become an absolute powerhouse and America is rapidly declining.

Beautiful new infrastructure is going up all over China even as U.S. infrastructure rots and decays right in front of our eyes.

You can see some amazing pictures of the stunning economic development that has been going on in China here, here, here and here.

America is being deindustrialized at lightning speed and very few of our politicians seem to care.

Back in 1979, there were 19.5 million manufacturing jobs in the United States.

Today, there are 11.6 million.

That represents a decline of 40 percent during a time period when our overall population experienced tremendous growth.

We used to have the greatest manufacturing cities on the entire globe. The rest of the world was in awe of us.

Today, most of those formerly great manufacturing cities are decaying, rotting hellholes.

The following is what one reporter from the UK saw during his visit to Detroit....

As you pass the city limits a blanket of gloom, neglect and cheapness descends. The buildings are shabbier, the paint is faded. The businesses, where they exist, are thrift shops and pawn shops or wretched groceries where the goods are old and tired. Finding somewhere to have breakfast, normally easy in any American city, involves a long hunt. ‘God bless Detroit’, says one billboard, just beside another offering the alternative solution: liquor.You can see some really shocking images of the decline of Detroit right here.

Our politicians insisted that globalism would not result in a "giant sucking sound" as millions of jobs left America.

But that is exactly what has happened.

Sadly, most American families still don't understand what has happened. Most of them are still waiting for things to get back to "normal".

Millions of unemployed Americans are dealing with incredible amounts of stress right now as they wait for jobs to start opening up again. But the jobs that have been shipped overseas are not coming back. In a globalized economy, it doesn't make sense to hire American workers when you can legally pay workers slave labor wages on the other side of the globe.

Millions of good middle class jobs have been replaced by low paying service jobs. Today there are huge numbers of Americans that are cutting hair or flipping burgers because that is all they can get right now.

Many others are only able to survive because of the safety net. One reader named David recently left a comment in which he shared his story. David did everything that the system asked him to do, but the promised rewards never materialized. Now David is broke, unemployed and he feels deeply frustrated....

A year ago I had a job, we were struggling, but bills were getting paid, and somehow we were getting by. Then I made the mistake of getting sick, one day before my company insurance kicked in. An auto-immune illness almost killed me, if it weren’t for the amazing efforts of my physicians and an emergency spleenectomy, I would not be here.As the United States continues to bleed good jobs, stories like the one you just read are going to become much more common.

My wife would have been a single mother,raising two young sons, one of which is autistic. Instead, I pulled through. The disease damaged my liver, leaving me with a chronic condition, and even after a year, it is hard to get up and go some days. My “employer” dumped me as soon as I left the hospital, and I haven’t worked since. It isn’t for lack of looking. There just isn’t anything.

Oh, I get my government cheese money. Here I am college educated, unable to find something that can pay the bills better than the money that we get from the government. It sickens me to be this dependent on the system like this. But the system de-incentivizes work, and makes living on the dole make a perverse economic sense.

I used to have dreams, but I have given up on them. My wife and I have no savings, we have no life raft and if it weren’t for the generosity of her parents and mine, things would have ground to a halt a long time ago.

I believed every thing adults told me. Work hard, I did. Get an education, I did. Find a nice girl and settle down, I did. Two cars, a dog, a cat and couple of kids, a nice townhouse…the american dream. Yep.

I love my country. My heart is broken, broken because I have been betrayed. I did what you asked, I played by the rules. I did what you said to do; I submitted, I conformed, I stopped dreaming. Now what?

I am willing to pay for my faults and transgressions; my failures are my own, I get that. My children should not have to suffer for my failures, they did not do anything wrong. My youngest boy is autistic, we hope he will be able to integrate into society, but the fact is we may have to take care of him for the rest of his life. How do I do this with nothing, and no opportunity in the foreseeable future?

Depression, stress…yep, I’ve got all that. I used to be hopeful and optimistic about the future. Now all I am is afraid.

So what are our politicians doing about all of this?

They tell us that we need even more "free trade"!

Barack Obama says that we need more free trade.

The Republicans say that we need more free trade.

In Washington D.C. our politicians do not agree on much, but one thing they do agree on is that we need to keep shipping jobs out of the country.

Until the American people wake up and start demanding an end to the globalization of the U.S. economy, the job losses are just going to continue to get worse.

The United States has lost a staggering 32 percent of its manufacturing jobs since the year 2000. If this trend continues, millions more Americans will soon be surviving on food stamps or living in tent cities.

The American people are deeply concerned about the economy, but they still have not connected the dots on these issues. The mainstream media and most of our politicians keep telling them that the globalization of the economy is a wonderful thing.

It is so sad that people just do not understand what is going on right in front of their eyes.

Whether you are a conservative or a liberal or a libertarian, you should be against the deindustrialization of America.

Allowing our industrial base to be raped is not a good thing.

Allowing big corporations and foreign governments to pay slave labor wages to workers on the other side of the globe making things that will be sold inside the United States is not a good thing.

Allowing the destruction of our industrial capacity to threaten our national security is not a good thing.

Allowing millions of precious jobs to leave the country is not a good thing.

The biggest corporations are making some extra profits by exploiting cheap labor on the other side of the globe. Corporate executives love to shower themselves with larger and larger bonuses.

But our current trade policies are not working for American workers.

We need "fair trade", not "free trade".

The United States is being taken advantage of, and the Democrats and the Republicans are both laying down like doormats and letting it happen.

If you want to know where all the good jobs went, it is not a big mystery.

They have been shipped out of the country and they are not coming back.

Unless fundamental changes are made, things are going to get worse and worse and worse for American workers.

So what is going to happen next?

It is up to you America.

All charges dropped against Julie Bass, the Michigan gardener threatened with jail time for growing vegetables in her own yard

I just spoke with Julie and recorded a 20 minute interview that will be posted tomorrow here on NaturalNews. In that interview, Julie explained that she plans to continue growing her garden, and now even others in Oak Park, Michigan have decided to grow a few nice-looking food plants (peppers, zucchini, etc.) in their own yards in order to help reduce their food bills while increasing their own local food security.

Julie also explained that it was the power of the alternative media that really helped her bring scrutiny to the city planner's office and ultimately get the charges dropped. So this is a national health freedom victory of the People versus Big Government. Both Julie and NaturalNews thank all the NaturalNews readers who took action to apply pressure to the Oak Park, Michigan city administrators.

On her blog, Julie also related some of what she's learned about being an informed citizen and standing up for your freedoms:

"...the good news is that because of all the momentum that was generated, people's eyes were opened. lots of people, myself included, were sort of passive in the face of government before. I just went along, figuring that most rules had good reasons, and I was mostly happy to comply. but this entire experience has shown me that you have to be educated. you have to ask questions. you have to have a strong internal compass for morality, and you have to be willing to stand by your Self (capital S on purpose) even in the face of people standing against you." (http://oakparkhatesveggies.wordpres...)

Watch NaturalNews this weekend for the posting of the new audio interview with Julie Bass where we discuss food freedom, guerrilla gardening, taking a stand against local government tyranny, and dealing with the press. It's a really wonderful conclusion to this whole fiasco that originally had Julie threatened with 93 days in jail. She's now free, empowered and fully informed on the truth of how oppressive government can target innocent citizens for unreasonable prosecution.

Check NaturalNews.com this weekend for the full interview (and more details about this situation).

We love you, Julie! Keep gardening for freedom!

Big Brother is watching you: The town where EVERY car is tracked by police cameras

|

| Surveillance cams taking over England |

Read Full Article

Spanish Prime Minister Zapatero calls general elections in debt-ridden country four months earlier than expected

- Move is designed to give PM's Socialist Party candidate a better chance, analysts claim

- Comes as rating agency Moody's puts Spain on review for a possible downgrade

- Fears grow that Greek rescue package has done little to halt spread of Europe's debt crisis

Zapatero made the announcement in a move political analysts said was designed to give his Socialist Party candidate a better chance against the conservative frontrunner.

Socialist candidate Alfredo Perez Rubalcaba trails Popular Party candidate Mariano Rajoy in polls, but a new one released on Wednesday showed Rubalcaba closing the gap.

Today's declaration comes as rating agency Moody's put Spain on review for a possible downgrade, adding to concerns that a Greek rescue package has done little to halt the spread of Europe's debt crisis.

Moody's move to place the Aa2 government bond rating on review cited concerns over growth and said funding costs would continue to be high in the wake of the eurozone leaders' bolder moves to curb the Greek crisis last week.

Stock markets, already nervous about US debt crisis, dropped, with the FTSE 100 slipping 1per cent, Spain's Ibex 1.4per cent, Italy's FTSE MIB 1.5per cent, Germany's Dax 1pcx and France's CAC 1.1per cent.

That added to a sense that Spain - and Italy - are still firmly in the firing line, and the euro and Spanish bond prices fell in response.

Power station blast may force Cyprus to seek euro bail-out

Embattled President Dimitris Christofias has been under pressure to act over the July 11 explosion of seized Iranian munitions being stored at a naval base near the power station.

On Wednesday, ratings agency Moody's downgraded Cyprus' credit rating by two notches from A2 to Baa1 over concerns about the economic fallout.

EU experts estimate the overall cost of the blast to the island's economy will be over 2billion euros ($2.89 billion).

A top banker last week warned the blast may result in the country becoming the fourth member of the euro to require a bail out.

Analysts fear the situation is slipping out of the central government's grasp.

Regional authorities will miss their collective budget deficit target by up to 0.75 per cent of gross domestic product (GDP), Moody's said, hampering the central government's programme of austerity to reduce the overall shortfall.

'Regional governments' finances may prove difficult to control due

to structural spending pressures, particularly in the healthcare sector,' Moody's said in a release.

International investors are concerned the eurozone's fourth-largest economy, hamstrung by anaemic growth rates and high unemployment, will fail to put

its fiscal house in order and

need a Greek-style bailout.

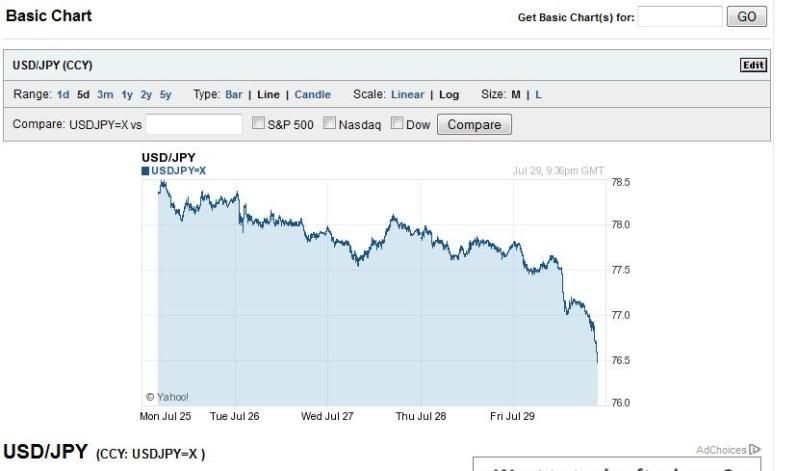

US dollar worth a whopping 76 cents

Study Japanese.

Because unlike China, Japan doesn't have this

Japan is also in third place in holding US debt

1 US

2 China

3 Japan

Can Eugenics Rear Its Ugly Head if Debt Ceiling is not Raised as Payback Against the People?

The mother of my children has a brother who is autistic and severely mentally handicapped. He is a ward of the state that gets a social security disability to take care of him. I am concerned for him because his sister has no say in her bothers care when she tried to stop him getting flu shots. What about the people, who are retarded, have severe handicaps, which rely on government disability to live, and survive to meet basic needs. Many totalitarian regimes have killed off the disabled and the infirm because they want us to see as a drain on society and an unnecessary burden to justify murder. This is why they are starting up death panels so the elderly and the disabled can die as an excuse so the government can pay for the bankers and fund Israel. It has nothing to do with saving money. This is so evil no matter how humane they may make it sound to sell to the public as a way to save social security and Medicare. We must not fall for that lie of bioethics from the mouths of eugenicists that this is our only solution to solve our debt problem, social security and Medicare. Killing off people is not the answer

I lived about 25 miles from were Terry Schiavo was starved to death by order of a probate judge. What was so appalling why I left Florida was one among many other reasons is the people's lack of moral conviction. They all were falling for the lie that she is a vegetable whose quality of life was not worth saving. Her life had no value to many people because it cost money to take care of her. If we are going to claim to be a moral and just society as we say we are. We must be willing to stand up and defend those who cannot defend or speak for themselves when they are in danger of murder by people who want to play God deciding who lives or dies in our government.

This lie calling the elderly and the disabled useless eaters by the elite is such hypocrisy. Most of these elderly people were the builders of our society and contributed to their retirement for many years being responsible. The politicians and bankers never produced anything. The government and the robber barons are the real useless eaters of our society; they steal the hard work and substance of the American people so the money junkies can squander it. To say they have to kill off the disabled and the elderly to pay of this debt, save social security ,Medicare ,fund the wars for Israel and to bailout the Wall Street fat cats is pure ruthlessness. We must be a moral and just society again. The people who cannot speak or defend themselves being the most vulnerable must not be the ones to sacrifice their life to pay the price for Washington’s recklessness and Israel's wars. If we are going to be the society that makes a country great again. We must start adhering to those principles and values again or we lose. We must not allow this happen.

Peter Shiff: Problem is the debt, not the ceiling

Rand Paul "A Balanced Budget Amendment Is The Only Way We'll Reform Things Up Here"

US Treasurys Now a ‘Toxic Asset,’ Debt Deal Won’t Fix It

Lawmakers are at an impasse on agreeing on terms to lift the government's $14.3 trillion debt ceiling and avoid an Aug. 2 default.

Republicans and Democrats want to lift the ceiling but disagree on how to reduce the deficit in exchange for lifting the White House's borrowing limit.

They will probably strike a deal and lift the ceiling, Wiedemer says, but they may not do it in time, and credit ratings agencies may strip the country of its AAA ratings.

Story Continues Below Video.

You don't get those back that easily, says Wiedemer, managing director of Absolute Investment Manager.

"I don't think we are going to work our way back to AAA," Wiedemer tells Newsmax.TV.

"Any downgrade I think is ultimately going to be based more on fundamental issues. We have a huge debt now almost eight times our tax revenues. That's massive. It's fundamentally a toxic asset."

A downgrade won't mean the end of the world for the financial system, says Wiedemer, who recently released an updated edition of his best-selling book, "Aftershock."

Economists at the ratings agencies themselves have said that much.

But Americans will feel the pinch when investors demand higher interest rates in U.S. debt auctions, which will trickle down to loans like mortgages and student loans.

"Any kind of nick does do long-term harm to our credibility, but is the immediate impact catastrophic? No, of course not. But is the long-term blow to our reputation a problem especially if our economy sees more inflation and other problems? It just piles on," Wiedemer says.

"If it was the only problem, I wouldn't worry about it. But it's indicative of a much larger problem."

After default, the United States enjoys the unique position in that the Federal Reserve can print money and buy U.S. Treasurys to keep them as affordable for the government as possible.

The problem with such a move is that it would threaten to pump up inflation rates even if it does prevent ratings from falling too far below AAA.

"If we have any real trouble selling our bonds, Ben [Bernanke] will just step in and buy them with printed money. And there's really no limit to that other than when he does that, that's going to create inflation."

"But in the short term, that limits the amount of downgrades you can get. The longer-term problem is more insidious, and that's inflation."

China to Take a Hit

Political parties may suffer fresh beatings in popularity polls after the debt-ceiling impasse, and those that elected them will suffer as well in the form of a sluggish economy threatened by high debt levels and rising inflation rates.

The Chinese, meanwhile, may also take it across the chin if default occurs.

China has invested heavily in U.S. debt but has also manipulated its currency in such a way that it has gained an edge in global trade.

A weak Chinese yuan makes its exports more competitive.

But a disruption in global markets stemming from a U.S. default could mess up Beijing's plans.

"Anybody who invests in something that defaults, they get hit and they take a big loss. I think the Chinese could be in for a really big hit by betting so heavily on manipulating the dollar. It's not a smart bet, fundamentally, to manipulate foreign exchange," Wiedemer says.

"That's why few countries do it. Certainly our largest trading partner Canada doesn't do it. I think it's a dumb bet, and I think they are going to lose heavily on it."

Standard and Poor's, meanwhile, says it would like to see the country shave $4 trillion off of its deficits over the long term. "$4 trillion would be a good down payment," says John Chambers, chairman of the company’s sovereign rating committee, according to Bloomberg.

"A grand bargain of that nature would signal the seriousness of policy makers to address the fiscal situation in the U.S."

About Robert Wiedemer

Robert Wiedemer is a managing director of Absolute Investment Management, an investment-advisory firm for individuals with more than $120 million under management. He is a regular contributor to Financial Intelligence Report, the flagship investment newsletter of Newsmax Media. Click Here to read more of his articles. Discover more about his latest book, "Aftershock," by Clicking Here Now. © Moneynews. All rights reserved.

Read more: Wiedemer: US Treasurys Now a ‘Toxic Asset,’ Debt Deal Won’t Fix It

Important: Can you afford to Retire? Shocking Poll Results

No help with heating bills for poor next winter

Ruling July 21 in a suit filed by major utility customers and former Michigan Attorney General Mike Cox, the state Court of Appeals said the Michigan Public Service Commission, which regulates utilities, no longer has authority to maintain the fund and disburse money from it to agencies that assist the needy, such as The Salvation Army.

Since 2002, the PSC has paid out more than $500 million through the Low Income and Energy Efficiency Fund, most of it to help people pay heating bills, but also some for weatherizing homes and energy-saving projects.

The commission had committed to the distribution of $80 million to various agencies on Oct. 1, the start of the state fiscal year, but is now blocked by the court decision from using the money.

The LIEEF money has been built into rate-increase cases for the state’s largest utilities, which may now be entitled to a refund.

“The well-known and respected organizations that have received millions of dollars in grant money from the LIEEF — such as the Salvation Army, the Heat and Warmth Fund, Michigan Community Action Agencies, the Michigan Department of Human Services and others — will soon have to turn away people who come to them for help with utility bills,” PSC Chairman Orjiakor Isiagu writes in an opinion column that will appear in Sunday’s Free Press.

Coupled with a 46% cut in federal heating help for Michigan this winter, “the result will be unprecedented,” he said. “Thousands of low-income utility customers — some only recently considered low-income because of prolonged unemployment — will have their utility service shut off just before the heating season without much recourse.”

The Appeals Court ruling came in a Michigan Consolidated Gas Co. rate case. The court said that because utility legislation enacted in 2008 made no reference to the LIEEF program set up in a law passed in 2000, the Legislature implicitly intended to halt authorization for it.

PSC officials say the LIEEF program could be salvaged by legislation that specifically reauthorizes it, or through an appeal to the state Supreme Court. The PSC is seeking e-mail comments through Monday at mpscedockets@michigan.gov on possible courses of action. Writers should reference Case No. U-16418.

But if nothing changes and if the winter ahead is anything like last year’s, the PSC believes a lot of utility customers are going to face serious trouble paying bills — and staying warm. And winter will be too late to start worrying about it.

The FEMA list of Presidential Executive Orders

162 LOCAL GOVERNMENTS, 14 HOUSING FINANCE PROGRAMS, AND ONE UNIVERSITY WITH COMBINED $69 BILLION OF DEBT AFFECTED

These actions relate to Moody's July 13 decision to place the Aaa government bond rating of the United States under review for downgrade, and reflect the rating agency's assessment that some Aaa public finance ratings would likely be indirectly affected by potential credit deterioration of the sovereign.

In the event the U.S. government's Aaa rating is downgraded, Moody's will determine the outcome of each review by evaluating the strength of the sovereign linkages to each affected credit, including direct and indirect reliance on federal spending, sensitivity to deteriorating macroeconomic conditions and vulnerability to disruptions in the financial markets. Moody's will also consider positive credit attributes of each issuer such as financial position, operating flexibility and management responsiveness.

In a previous action on July 19, Moody's placed the ratings of five Aaa U.S. state governments under review for possible downgrade, affecting approximately $24 billion of general obligation and related debt. Those states are Maryland, New Mexico, South Carolina and Tennessee and the Commonwealth of Virginia.

Some 400 other Aaa-rated public finance credits have not been placed on review for possible downgrade. At this time, Moody's considers their ratings to be resilient to a one-notch downgrade of the U.S. government's bond rating. Should the sovereign rating be downgraded by more than one notch, Moody's would likely assess whether these remaining Aaa ratings should also be placed on review for downgrade.

LOCAL GOVERNMENTS

The review for possible downgrade affects 162 Aaa-rated local governments and $63 billion of debt. Factors weighing on specific credits include high federal employment and exposure to capital markets disruptions.

The 162 local governments include 66 cities, 53 counties, 29 school districts and 14 special tax districts. The local governments are located in 31 states, with the heaviest concentrations in Virginia (15 credits) and Massachusetts (14 credits).

"The ratings of these local governments, particularly those with a high economic dependence on federal activity, would be vulnerable to a downgrade of the U.S. government" said Moody's Senior Vice President Matt Jones, a team leader covering local government ratings. In addition to the risk of federal job reductions, Moody's review following a U.S. government downgrade would focus on a local government's reliance on capital markets, its dependence on federal revenues, its sensitivity to macroeconomic cycles, and its available financial resources to offset these risks.

HOUSING FINANCE PROGRAMS

Today's action affects 14 Aaa-rated housing finance programs and $4.3 billion of debt. Factors weighing on specific credits include high levels of government mortgage insurance, and high delinquency and foreclosure rates.

The programs are:

* The Colorado Housing and Finance Authority's Single Family Mortgage Bonds and the Single Family Program Bonds, 2009 Class I;

* Idaho Housing and Finance Association's Single Family Mortgage Senior Bonds, Series 1996B, Series 1996C, Series 1998D, Series 1999F, Series 1999-I*, Series 2000A, Series 2000C, and Series 2000D;

* Kentucky Housing Corporation's Housing Revenue Bonds; and

* Utah Housing Corporation's Single Family Mortgage Senior Bonds, Series 1998G, Series 2000A and NIBP.

"These 14 state HFA programs have above-average exposure to sovereign risk factors, including high levels of loans more than 90 days delinquent or in foreclosure, or high levels of government mortgage insurance breakdown relative to their program asset to debt ratio (PADR)," said Moody's Senior Vice President Florence Zeman, team leader of the housing rating team. Following a U.S. government downgrade, Moody's would conduct a stress test of each program in light of potentially higher loan losses, reduced liquidity and the diminished credit quality of government mortgage insurance.

* Idaho Housing and Finance Association's Series 1999-I is already on review for possible downgrade due to potential loan losses arising from delinquencies and foreclosures and the resulting decline in PADR. Moody's will now also consider the program's exposure to the U.S. government.

HIGHER EDUCATION AND NOT-FOR-PROFITS

The University of Washington (UW), with $1.3 billion of debt affected, is the only Aaa-rated university that Moody's placed on review for possible downgrade. This action primarily reflects UW's unusually large share of revenues derived from federal research grants and Medicare and Medicaid reimbursements.

"Our review in the event of a U.S. government downgrade would focus on UW's ability to maintain balance sheet reserves and operating cash flow while reducing expenses or increasing revenues in response to potentially significant federal funding cuts," said John Nelson, Managing Director for healthcare, higher education and not-for-profits.

Additionally, Moody's placed the Aaa rating of the Smithsonian Institution ($108 million debt affected) on review for possible downgrade on July 13 due to its high dependence on federal operating appropriations. The linkage of the Smithsonian rating to the sovereign U.S. rating, however, has been changed from direct to indirect, which means it will not automatically change if the U.S. government's rating changes.

Moody's outlined its approach to determining each sector's exposure to sovereign risk was outlined in a July 13 special comment, "Implications of a U.S. Rating Action for Aaa-rated Municipal Credits."

For a complete list of affected securities and additional analysis, please visit www.moodys.com/USRatingActions.

REGULATORY DISCLOSURES

Please see the rating methodologies tab on the Credit Policy page on moodys.com for the relevant methodology for each action.

Please see the ratings tab on the issuer / entity page on moodys.com for the last Credit Rating Action and the rating history.

New York

Anne Van Praagh

Vice President - Senior Analyst

Public Finance Group

Moody's Investors Service, Inc.

JOURNALISTS: 212-553-0376

SUBSCRIBERS: 212-553-1653

New York

Naomi Richman

MD - Public Finance

Public Finance Group

Moody's Investors Service, Inc.

JOURNALISTS: 212-553-0376

SUBSCRIBERS: 212-553-1653

Moody's Investors Service, Inc.

250 Greenwich Street

New York, NY 10007

U.S.A.

JOURNALISTS: 212-553-0376

SUBSCRIBERS: 212-553-1653

Can Obama Raise the Debt Ceiling Alone?

Video - Judge Andrew Napolitano - July 25, 2011

Solid discussion. Runs approximately 2 minutes.

---

What's missing from the debt-ceiling discussion, albeit nothing new to DB readers, is spending on wars and the pentagon. It's not even being mentioned as a possibility in any of the competing debt plans, despite the following undeniably depressing and disgusting facts:

From Reddit:

I thought this kind of puts things in perspective. In 2010, the US government collected $898 billion in federal income tax revenues. The same year, we spent $847 billion on useless wars and national defense. That means that 94% of all federal income tax revenue is equivalent to what we spend on the Pentagon. Who out there thinks it was money well spent?

Also, just to piss you off a little bit more - defense spending is equivalent to 443% of what we collect in total corporate taxes.

One more link you need to see:

---

Paul Ryan gets booed for supporting wealthy tax breaks

Video - Paul Ryan in Wisconsin

CONSTITUENT: The middle class is disappearing right now. During this time of prosperity, the top 1 percent was taking about 10 percent of the total annual income, but yet today we are fighting to not let the tax breaks for the wealthy expire? And we’re fighting to not raise the Social Security cap from $87,000? I think we’re wrong.

RYAN: A couple things. I don’t disagree with the premise of what you’re saying. The question is what’s the best way to do this. Is it to redistribute… (Crosstalk)

CONSTITUENT: You have to lower spending. But it’s a matter of there’s nothing wrong with taxing the top because it does not trickle down.

RYAN: We do tax the top. (Audience boos). Let’s remember, most of our jobs come from successful small businesses. Two-thirds of our jobs do. You got to remember, businesses pay taxes individually. So when you raise their tax rates to 44.8 percent, which is what the president is proposing, I would just fundamentally disagree. That is going to hurt job creation.

---

Food, Control and the Growing Police State

|

| Dees Illustration |

Blitz

Food has always been a tool the elite have used to control the masses. When you control the food supply, you control everything, even life and death. A starving man is more likely to sell his soul for a potato then someone with a full tummy. The relatively free market of food production and distribution that has been in place in this nation for a few centuries now has led to unrivaled prosperity. Food can, in fact, be grown for practically nothing if you have the land, the time and can afford to buy just a few heirloom seeds to grow the organic vegetables necessary for good health. This will save you money, is better for you than grocery store vegetables which may be genetically modified or may contain unwanted chemicals, and helps you to become less dependent on the state for your survival.

It is the last part of the above statement that frightens government officials. They want you dependent on them. For some, it makes them feel important. Others may just want to feel needed or helpful. Still others may just want the paycheck. Whatever the case, they don't seem to just want to leave you alone to your own devices. Perhaps that's why they're attempting to pass laws making it illegal to grow your own garden. Perhaps that's why they want to make sure you're a compliant grass farmer just like your neighbors. Perhaps that's why they're trying to control the food necessary for life.

Read Full Article

The Buzz Around Gold is Growing Louder

|

| Dees Illustration |

BIG GOLD

I outlined last week the increasingly bullish consensus among analysts about gold stocks. The same pattern exists with gold itself; growing numbers of analysts have either joined the movement or have upped their bullish outlook.

The following comments and developments have all been reported just this month. It presents quite a convincing case when one strings them together like this. Keep in mind that this is what these analysts and managers are telling their clients.

SICA Wealth Management’s Jeffrey Sica: “Right now, I think gold looks better than ever.” He sees a “painfully high probability” of troubling events occurring in the months ahead. “There has been a general loss of confidence in the ability of central banks and governments to manage the economy. That will continue to give gold and other precious metals a boost.”

Empire Economics chief economist Clifford Bennett expects gold to come close to $2,000 an ounce this year and $2,200 an ounce within 18 months. “There is risk in the second half of the year of a bit of a ‘panic spike,’ if you like, as everyone thinks there isn’t enough to go around and starts to hoard. That’s when you’ll really see gold take off towards $2,000 an ounce.”

Franco-Nevada Chairman Pierre Lassonde said the coming mania in gold will make the 1970s run look like child’s play. “In 1980, the only players, or the dominant players, were the Americans. Today the dominant players are China and India; 58% of all the gold sold this year will be sold in these two countries. When we reach that mania phase… watch out, because it will truly make your head spin.”

Antaike analyst Shi Heqing had this to say about Chinese investors: “Record high prices won’t scare away investors… they are likely to chase the rally and continue to buy gold because paper money feels increasingly worthless and they are worried about inflation.” Shi expects China’s gold demand to rise about 20%, due in no small part to the country’s 6.4% inflation rate.

Reuters: “The case for gold in the longer term is still very strong,” said a Singapore-based trader. “Gold may appeal to new classes of investors who previously avoided the market in favor of more mainstream investments like bank deposits, bonds, and equities. Potentially there’s a whole new market for small-sized gold bars if these investors lose faith in paper.”

Newedge USA predicted gold will hit $1,800 and silver $70 by year-end due to investors seeking a haven asset and physical demand from Asia. “Gold is an excellent hedge in troubled times” said Mike Frawley. “Demand will be very strong long-term from Asia, and the economic trend in the West is improving.”

FX Concepts founder John Taylor: “Gold will climb to $1,900 by October.”

SMC Global: “Evidence of sluggish U.S. growth has shaken investor confidence. Concerns about rising inflation here have also boosted appetite for gold ETFs. Demand is high from small players.”

Minerals and Metals Trading Corp’s Ved Kumar Prakash reported “skyrocketing” demand for gold in India. He predicted that given the company’s brisk sales, gold imports would jump by more than 40% this fiscal year.

The Swiss Parliament is expected later this year to discuss the creation of a gold franc. “I want Swiss people to have the freedom to choose a completely different currency,” said Thomas Jacob, the man behind the gold franc concept. “Today’s monetary system is all backed by debt – all backed by nothing – and I want people to realize this.”

An “Iranian gold rush” is under way, according to an article by Reuters. “Usually as the price of an item increases, demand will decrease – but in the case of gold, it seems that higher prices are creating more demand,” said an unnamed Tehran gold retailer. “The reasons that people are drawn to these safe assets – gold coins and hard currency – are firstly a limited choice of investment opportunities, and secondly a fear from the weakness of the national currency,” said an economist who asked not to be named.

The Utah Legal Tender Act was signed into law by Governor Herbert last month. “Good monetary policy is an important part of a healthy and prosperous economy,” said Senator Mike Lee. He and other Republicans also introduced legislation to eliminate federal capital gains taxes on gold and silver coins. “Since the Federal Reserve Act of 1913, the dollar has lost approximately 98% of its value. This bill is an important step towards a stable and sound currency whose value is protected from the Fed’s printing press.”

CIBC World Markets’ Peter Buchanan remains bullish even if the debt ceiling talks resolve. “Even in the likely event Congress agrees to a debt ceiling rise, recent uncertainties are likely to reinforce central banks’ ongoing efforts to diversify from the dollar into gold and other assets.”

Citigroup Global Markets reported that silver may more than double to $100 an ounce if the current bull market follows similar patterns seen between 1971 and 1980. “If the final rally in the last bull market repeated, then we can expect $100 over the long term… While the high so far this year was at the same level as the peak in January 1980, we are not convinced that the long-term trend is over yet.”

Gold Forecaster analyst Julian Phillips: “This is not typical of a ‘bull’ market that will eventually fall back from whence it came. We believe gold is not in a ‘bull’ market, because it is changing its shape and nature permanently. Our reasoning is not academic posturing, but a reflection of the realities that have taken place over time and those that confront us now. Because it is perceived to be an alternative wealth-preserving asset, a counter to a failing monetary system, it is not a simple commodity moving up and down with the flows and ebbs of economic cycles; it is a valid measure of monetary values.”

American Precious Metals Advisors Managing Director Jeffrey Nichols: “A recent survey of 80 central bank reserve managers predicted that the most significant change in their official reserve holdings in the next 10 years will be their intentional build up in gold reserves. They also predicted that gold will be their best performing asset class over the next year, and sovereign debt defaults will be their principal risk.”

Gloom Boom and Doom editor Marc Faber: “I just calculated that if we take an average gold price of say around $350 in the 1980s and compare that to the average monetary base and the average U.S. government debt in the 1980s...and then if I compare this to the price of gold to today’s government debts and monetary base, gold hasn’t gone up at all. It’s actually gone against these monetary aggregates, and against debt it’s actually gone down. So I could make the case that gold is today probably very inexpensive.”

GoldMoney founder James Turk: “In reality there are very few participants currently in the gold market… when I look at the price action, it suggests to me that a lot of this big money on the sidelines wants to be in. Therefore we are seeing some aggressive bidding on any pullbacks.”

Reuters Money reports that eBay’s “gold and silver outpost” has seen gold bullion sales jump more than 60% from 2007 through 2010. More significantly, “almost half of the silver and gold buyers in the first quarter of 2011 never purchased these items on eBay before.”

Sprott Asset Management chief investment strategist John Embry: “I think it will be really exciting when silver clears $50, because then it will be in absolutely new ground. There is, without question, major physical shortages of physical silver, and demand is robust. Once silver gets rolling, it’s going to levels people cannot imagine.”

It’s hard to go one day without seeing comments like these. The chorus is growing, and as these bullish views spread further and further into the mainstream, the number of investors attracted to precious metals will swell and continue to drive prices higher.

Is this growing consensus the sign of a top? As I said about gold stocks, taking the contrarian view in response to this information would be the wrong move. Fiscal and monetary issues are getting worse, not better, and I think we’re simply seeing more investors recognize the inevitable. We’ll worry about exiting this sector when real interest rates are positive and the dollar is once again a revered currency. Until then, it’s hard to imagine a scenario that isn’t bullish for gold. Any pullback should thus be viewed as a sale price.

Is the impetus for a mania building? I don’t know if we’re on the doorstep of that phase or not, but the fundamental reasons to hold gold are as strong as they’ve ever been. Indeed, it’s getting more critical to have meaningful exposure to precious metals. Keep in mind that when the debt ceiling talks reach a resolution – whatever it may be – the fundamental problems of excessive debt and further deficits will still be unresolved.

Will gold correct if agreements are reached on the debt talks? Probably, but I think the more appropriate question to ask is this: If these analysts are correct, do I own enough ounces?

The double standard of American banking and opaque Federal Reserve policy.

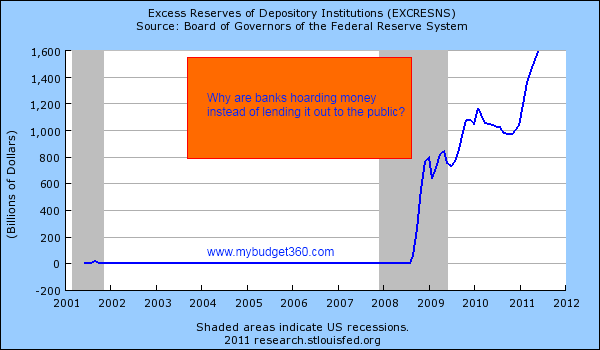

Growing those excess reserves

While we continue to hear about how we are running out of money, it would appear that banks in the United States are flush with funds. These excess reserves are ready for lending to the American public and can go into small businesses to revive the economy. The issue of course is that banks understand how toxic their balance sheets have become and they would rather keep this money under lock and key. Plus, these banks earn interest at the Federal Reserve for an absolute risk free bet. Did we also mention this only occurred because of the bailouts that were funded by taxpayers? So you see, taxpayers are essentially allowing the too big to fail to have absolutely no debt ceiling yet somehow our politicians are trying to convince the public that they now need to tighten their belts. This is the twisted world we now live in.

Aside from this, we already know that many working and middle class Americans have smaller household incomes. Now that banks are using some due diligence they realize that they are unable to make too many loans without risking future damage yet again. What I would argue is that banks knew this all along but the trillion dollar bailouts were predicated on the assumption that credit would dry up and banks needed this money to continue making loans. The opposite occurred. Banks are hoarding the money, taking on a taxpayer risk free bet, and are now lambasting the public for not being fiscally responsible. There is no bigger double standard than the current American banking system.

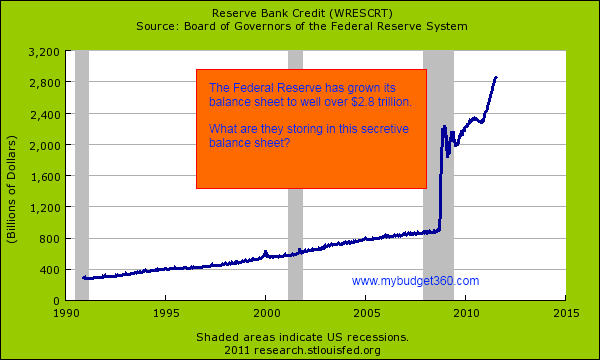

The Federal Reserve has no debt ceiling

While you were sleeping the Federal Reserve has grown its balance sheet to well over $2.84 trillion. No public scrutiny, no media investigations, no deeper analysis, yet this has all occurred in the matter of a few years. Keep in mind the Fed has taken on mortgage backed securities, luxury hotel loans, strip mall loans, and other dubious debt that is hidden from public analysis. So while you and I need to operate within the fiscal laws of reality and not spend more than we earn, the Fed in conjunction with the U.S. Treasury can digitally print up as much money as is needed to protect the too big to fail banks. Where does the average American have the option to dump onerous student loans, insane credit card debt, or other payday loans for that matter? There is no mechanism for this outside of bankruptcy (and student loans are still with you even after that). Many of the too big to fail banks have simply shifted toxic assets to the Federal Reserve. And then people wonder why the U.S. dollar is plunging.

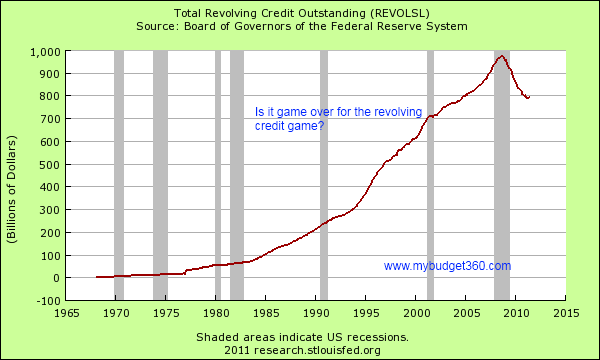

Peak credit?

The credit card is a fascinating device. People are able to spend today with the promise of paying tomorrow. This peaked in 2007 where we were quickly approaching $1 trillion in revolving debt in the American public. As the chart shows, since 1965 credit card debt has only grown. Through every recession and dip this movement never changed. That is until this crisis hit. Credit card debt has now fallen into the $700 billion range and has been surpassed by student loan debt that is quickly approaching $1 trillion itself.

It is clear that the American public does have a debt ceiling. We have reached it for credit card debt, mortgage debt, and other forms of loans. Ultimately incomes need to service this debt and with the economy losing steam this is harder to sustain. The Federal government finds itself in a similar situation and needs to cut back as well. Yet it is amazing that the first things on the table are programs that directly hit the working and middle class.

“Why not have the Fed charge banks for keeping funds in excess reserves so more money is used to start businesses even if they are small and local? Why don’t we actually audit the Fed and see what is really going on? Why not have hedge fund managers pay taxes just like every other middle class American? Instead of these measures we get fear and mind games trying to stiff an old retiree with a $1,000 a month Social Security check. The politicians want to game the CPI system to chop down COLAs and other forms of keeping up. People need to wake up before the middle class is completely gone.”There is no debt ceiling with the Fed or the too big to fail banks yet the public is being blamed for all of this. Why not use those trillions of dollars to actually pay down our debt? How about banks face the music and realize many of their hyper-inflated loans are actually worth less? Of course that would be problematic for the financial banking elite so you will rarely hear about that in the press. Remember this, debt ceiling for you, yes, debt ceiling for too big to fail banks, no.

If you enjoyed this post click he