“And the great owners, who must lose their land in an upheaval, the great owners with access to history, with eyes to read history and to know the great fact: when property accumulates in too few hands it is taken away. And that companion fact: when a majority of the people are hungry and cold they will take by force what they need. And the little screaming fact that sounds through all history: repression works only to strengthen and knit the repressed.” – John Steinbeck – Grapes of Wrath

John Steinbeck wrote his masterpiece The Grapes of Wrath at the age of 37 in 1939, at the tail end of the Great Depression. Steinbeck won the Nobel Prize and Pulitzer Prize for literature. John Ford then made a classic film adaption in 1941, starring Henry Fonda. It is considered one of the top 25 films in American history. The book was also one of the most banned in US history. Steinbeck was ridiculed as a communist and anti-capitalist by showing support for the working poor. Some things never change, as the moneyed interests that control the media message have attempted to deflect the blame for our current Depression away from their fraudulent deeds. The novel stands as a chronicle of the Great Depression and as a commentary on the economic and social system that gave rise to it. Steinbeck’s opus to the working poor reverberates across the decades. He wrote the novel in the midst of the last Fourth Turning Crisis. His themes of man’s inhumanity to man, the dignity and rage of the working class, and the selfishness and greed of the moneyed class ring true today.

Steinbeck became the champion of the working class. When he decided to write a novel about the plight of migrant farm workers, he took his task very seriously. To prepare, he lived with an Oklahoma farm family and made the journey with them to California. Seventy years later the plight of the working class is the same. If Steinbeck were alive today he would live with a Michigan auto manufacturing family making a journey to fantasyland of green energy, where automobiles ran on corn and sunshine. The working class bore the brunt of the Great Depression in the 1930s and they are bearing the burden during our current Greater Depression. Steinbeck knew who the culprits were seventy years ago. We know who the culprits are today. They are one in the same. The moneyed banking interests caused the Great Depression and they created the disastrous collapse that has thus far destroyed 7 million middle class jobs. Steinbeck understood that the poor working class of this country had more dignity and compassion for their fellow man than any Wall Street banker out for enrichment at the expense of the working class.

Okies and the Land of Milk & Honey

“How can you frighten a man whose hunger is not only in his own cramped stomach but in the wretched bellies of his children? You can’t scare him–he has known a fear beyond every other.” - John Steinbeck – Grapes of Wrath

The America of 1930 was different in many aspects from the America of 2011. The population of the U.S. was 123 million, living in 26 million households, or 4.7 people per household. Today the population of the U.S. is 310 million, living in 118 million households, or 2.6 people per household. The living and working structure of the country was dramatically different in 1930. The percentage of the population that lived in rural areas exceeded 40%, down from 60% in 1900, as the country rapidly industrialized. One quarter of the population still worked on farms. Today, less than 20% of Americans live in rural areas, while less than 2% live on farms. In 1935, there were 6.8 million farms in the U.S. Today there are 2.1 million farms. The family farm has been slowly but surely displaced by corporate mega-farms since the 1920s, with 46,000 farms now accounting for 50% of all farm production today.

The sad plight of the American working farmer did not begin with the Stock Market Crash of 1929. The seeds of destruction were planted prior to and during World War I. Automation through technology allowed for more cultivation of land. Agricultural prices rose due to strong worldwide demand, leading farmers to dramatically increase cultivation. With food commodity prices soaring, farmers fell into the classic trap that McMansion buyers fell into from 2000 through 2006. Farmers took on huge amounts of debt to acquire more land and farming equipment as local banks were willing to feed their illusions with loans. It was a can’t miss proposition. Jim Grant in his book Money of the Mind: Borrowing and Lending from the Civil War to Michael Milken described the end result:

Like bull markets in stocks, the bull market in farmland engendered the belief that prices would rise forever. “Speculators who had no interest whatever in farming bought land for the 6 percent or 8 percent annual rise that seemed a certainty throughout the early years of the century…” The rise in farm prices had only begun. The price of wheat was 62 cents a bushel in 1900. It was 99 cents in 1909, $1.43 in 1916, and $2.19 at the peak in 1919. To put $2.19 in perspective, it was not a price seen again until 1947.

The collapse of prices in the early 1920s would have been devastating enough, but the damage was compounded by debt. By the summer of 1921, crop prices were down by no less than 85 percent from the postwar peak. Nebraskans, finding that corn had become cheaper than coal, burned it. As it does in every market, the fall in prices revealed the weaknesses in the structure of credit that had financed the rise.

Between 1919 and 1921, the number of banks that failed totaled 724, with only one of the largest, National City Bank, being bailed out by Washington DC. The heartland, where more than 40% of the population lived, did not participate in the Roaring Twenties. Wall Street and the urbanized Northeast experienced the rapid wealth accumulation during the 1920s. The working poor of the farm belt struggled to subsist. Land under cultivation continued to rise even after the bust of the early 1920s, tripling between 1925 and 1930. The land was over farmed and not properly cared for, depriving the soil of organic nutrients and increasing exposure to erosion. Then Mother Nature took her pound of flesh, much like she is doing today across the globe.

The Dust Bowl was a period of severe dust storms causing major ecological and agricultural damage to Midwest prairie lands from 1930 to 1936. The phenomenon was caused by severe drought coupled with decades of extensive farming without crop rotation, fallow fields, cover crops or other techniques to prevent erosion. Deep plowing of the virgin topsoil of the Great Plains had displaced the natural deep-rooted grasses that normally kept the soil in place and trapped moisture even during periods of drought and high winds. These immense dust storms—given names such as “Black Blizzards” and “Black Rollers”—often reduced visibility to a few feet. The Dust Bowl affected 100,000,000 acres, centered on the panhandles of Texas and Oklahoma.

Small farmers were hit especially hard. Even before the dust storms hit, the invention of the tractor drastically cut the need for manpower on farms. These small farmers were usually already in debt, borrowing money for seed and paying it back when their crops came in. When the dust storms damaged the crops, not only could the small farmer not feed himself and his family, he could not pay back his debt. Banks would then foreclose on the small farms and the farmer’s family would be both homeless and unemployed. Between 1930 and 1935, nearly 750,000 farms were lost through bankruptcy or sheriff sales.

Millions of acres of farmland became useless, and hundreds of thousands of people were forced to leave their lifelong homes. They set out on Route 66 toward the land of milk and honey – California. Hundreds of thousands of families traveled this lonely road during the 1930s.

Many of these families, often known as “Okies”, since so many came from Oklahoma migrated to California and other states, where they found economic conditions little better during the Great Depression than those they had left. Owning no land, many became migrant workers who traveled from farm to farm to pick fruit and other crops at starvation wages. While the Great Depression affected all Americans, about 40% of the population was relatively unscathed. Not so for the “Okies”.

Californians tried to stop migrants from moving into their state by creating checkpoints on main highways called “bum blockades.” California even initiated an “anti-Okie” law which punished anyone bringing in “indigents” with jail time. While Steinbeck highlights the plight of migrant farm families in The Grapes of Wrath, in reality, less than half (43%) of the migrants were farmers. Most migrants came from east of the Dust Bowl and did not work on farms. By 1940, 2.5 million people had moved out of the Plains states; of those, 200,000 moved to California.

Man’s Inhumanity to Man

“It has always seemed strange to me… the things we admire in men, kindness and generosity, openness, honesty, understanding and feeling, are the concomitants of failure in our system. And those traits we detest, sharpness, greed, acquisitiveness, meanness, egotism and self-interest, are the traits of success. And while men admire the quality of the first they love the produce of the second.” – John Steinbeck

Steinbeck’s novel was a national phenomenon. The book won Steinbeck the admiration of the working class, due to the book’s sympathy to the common man and its accessible prose style. It also got him branded a communist by the large California land barons and the non-stop harassment by J. Edgar Hoover and the IRS for most of his life. The book was lauded, debated, banned and burned. A book can only generate that amount of heat by getting too close to a truth that those in power do not want revealed. The Grapes of Wrath did just that. Steinbeck meant to pin the blame where it belonged:

“I want to put a tag of shame on the greedy bastards who are responsible for this [the Great Depression and its effects].”

The bankers who took their farms and cast them aside like a piece of trash, the Wall Street speculators who got rich by peddling debt to the working class, and the wealthy land barons who treated the migrant farm workers like criminals, were to blame for the suffering of millions. The pyramid of wealth was as unequal in 1929 as it is today.  The 1% of the population at the very top of the pyramid had incomes 650% greater than those 11% of Americans at the bottom of the pyramid. The tremendous concentration of wealth in the hands of a few meant that continued economic prosperity was dependent on the high investment and luxury spending of the wealthy.

The 1% of the population at the very top of the pyramid had incomes 650% greater than those 11% of Americans at the bottom of the pyramid. The tremendous concentration of wealth in the hands of a few meant that continued economic prosperity was dependent on the high investment and luxury spending of the wealthy.

By 1929, the richest 1% owned 40% of the nation’s wealth. The top 5% earned 33% of the income in the country. The bottom 93% experienced a 4% drop in real disposable income between 1923 and 1929. The middle class comprised only 20% of all Americans. Society was skewed heavily towards the haves. By 1929, more than half of all Americans were living below a minimum subsistence level. Those with means were taking advantage of low interest rates by using margin to invest in stocks. The margin requirement was only 10%, so you could buy $10,000 worth of stock for $1,000 and borrow the rest. With artificially low interest rates and a booming economy, companies extrapolated the good times and invested in huge expansions. During the 1920s there were 1,200 mergers that swallowed up more than 6,000 companies. By 1929, only 200 mega-corporations controlled over half of all American industry. The few were enriched, while the many wallowed in poverty and despair.

When self proclaimed experts on the Great Depression, like Ben Bernanke, proclaim that the Federal Reserve contributed to the Depression by not expanding the monetary supply fast enough, they practice the art of the Big Lie. The Great Depression was mainly caused by the expansion of the money supply by the Federal Reserve in the 1920’s that led to an unsustainable credit driven boom. Both Friedrich Hayek and Ludwig von Mises predicted an economic collapse in early 1929. In the Austrian view it was this inflation of the money supply that led to an unsustainable boom in both asset prices (stocks and bonds) and capital goods. Ben Strong, the head of the Federal Reserve, attempted to help Britain by keeping interest rates low and the USD weak versus the Pound. The artificially low interest rates led to over investment in textiles, farming and autos. In 1927 he lowered rates yet again leading to a speculative frenzy leading up to the Great Crash. The ruling elite of society were the Wall Street speculators. Only 1.5 million people out of an entire population of 127 million invested in the stock market. Margin loans increased from $3.5 billion in 1927 to $8.5 billion in 1929. Stock prices rose 40% between May 1928 and September 1929, while daily trading rose from 2 million shares to 5 million shares per day. By the time the Federal Reserve belatedly tightened in 1928, it was far too late to avoid a stock market crash and depression.

The Federal Reserve was created by bankers to benefit bankers. The Federal Reserve purchased $1.1 billion of government securities from February to July 1932, which raised its total holding to $1.8 billion. Total bank reserves only rose by $212 million, but this was because the American populace lost faith in the banking system and began hoarding more cash, a factor very much beyond the control of the Central Bank. The potential for a run on the banks caused local bankers to be more conservative in lending out their reserves, and was the cause of the Federal Reserve’s inability to inflate. From its backroom middle of the night creation in 1913, the bank owned Federal Reserve has sought to benefit its owners, the large Wall Street banking interests and its politician protectors in Congress. The working class has always been nothing more than hosts used by the parasites to tax and peddle debt to.

Income and wealth inequality reached a new peak in 2007, the highest level of inequality since 1929. William Domhoff details this inequality in the following terms:

In the United States, wealth is highly concentrated in a relatively few hands. As of 2007, the top 1% of households (the upper class) owned 34.6% of all privately held wealth, and the next 19% (the managerial, professional, and small business stratum) had 50.5%, which means that just 20% of the people owned a remarkable 85%, leaving only 15% of the wealth for the bottom 80% (wage and salary workers). In terms of financial wealth (total net worth minus the value of one’s home), the top 1% of households had an even greater share: 42.7%.

Source: Domhoff

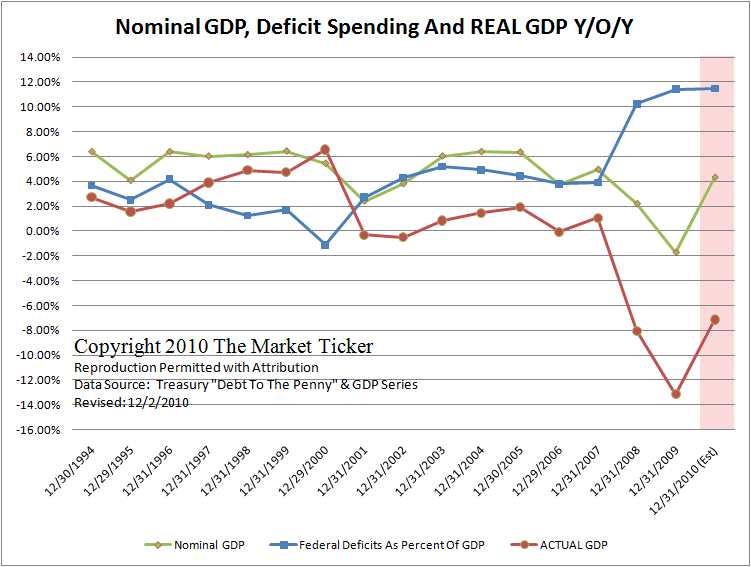

Real median household income in the U.S. is $49,777 today. It was $52,388 in 1999 before George Bush took office. This is a 5% decline over ten years. Even more disturbing is the fact that the top 20% of households showed real increases in income. The bottom 50% lost income during the last ten years, with the bottom 20% losing 8% of income over this time frame. No wonder there is so much anger among the working middle class in the country regarding the bailout for the top 1%. Sixty million households make less today than they made 10 years ago. The policies of the Federal Reserve over the last ten years have benefitted speculators and punished seniors, savers and the working middle class. Every policy, program and regulation rolled out by the Federal Reserve in the last three years has been to prop up, enrich, and support their Too Big To Fail Wall Street owners. The middle class American working family is Too Small To Matter.

Steinbeck presciently realized that the suffering of the working class was not due to bad weather, bad luck, or the actions of the working class. It was caused by the rich ruling elite wielding their power and influence across the land in their effort to enrich themselves by any means necessary. Historical, social, and economic circumstances separate people into rich and poor, landowner and tenant, and the people in the dominant roles struggle viciously to preserve their positions. During the Great Depression it was the brokers, bankers and businessmen who maintained a dominant role, while farmers, workers, and the common man were treated like dogs. Steinbeck used this symbolism by having the Joad’s family dog be run over by a rich person driving a fancy roadster early in the novel. Steinbeck saw the large California landowners as the epitome of the evil Haves. The landowners created a system in which the migrants were treated like animals, shuffled from one filthy roadside camp to the next, denied livable wages, and forced to turn against their brethren simply to survive.

Steinbeck’s world was black and white, good and evil, rich and poor. Today, the corporate mainstream media would brand him a anti-capitalist, socialist crackpot. Those in control want to keep the masses lost in shades of grey. In the 1930s it was clearer regarding who was to blame. The social safety net of New Deal programs from FDR had just begun. At the time, I’m sure they seemed like a good idea to ease the suffering of the poor. In reality, they did little to help, as the unemployment rate was still 18% in 1939, ten years after the Depression began. These programs, along with hundreds implemented since the 1930s, have created a dependent underclassand have left America with unfunded liabilities in excess of $100 trillion. The rich use the 70,000 page IRS tax code to avoid taxes. They use their wealth to buy influence in Washington DC, rigging the game in their favor. The bottom 50% of the population pays no income taxes. The working middle class, with declining real incomes, foot the bill. They are bamboozled into believing they can live like the rich by a financial industry willing to lie, obfuscate and defraud them. Corporate superstar CEOs, fawned over by the corporate media, outsourced their good paying middle class jobs to foreign lands, boosting EPS, their stock price and their mega-million bonuses. This may not look like the 1930s, but it is worse for millions of American working middle class families.

The Dignity of Wrath

“…and in the eyes of the people there is the failure; and in the eyes of the hungry there is a growing wrath. In the souls of the people the grapes of wrath are filling and growing heavy, growing heavy for the vintage.” - John Steinbeck - Grapes of Wrath

Steinbeck’s feelings about the people he was writing about can be summed up in this passage:

“If you’re in trouble, or hurt or need – go to the poor people. They’re the only ones that’ll help – the only ones.”

The Joads refuse to be broken by their circumstances. They maintain their dignity, honor and self respect, despite the trials and tribulations that befall them. Hunger, tragic death, and maltreatment by the authorities do not break their spirit. Their dignity in the face of tragedy stands in contrast to the vileness of the rich landowners and the cops that treated the migrant workers like criminals.

No matter how much misfortune and degradation are heaped upon the Joads, their sense of justice, family, and honor never waver. Steinbeck believed that as long as people maintained a sense of injustice—a sense of anger against those who sought to undercut their pride in themselves—they would never lose their dignity. Tom Joad is the symbol of all the mistreated working poor who refuse to be beaten down. The landowners and the police are the oppressors. Tom kills a policeman in a struggle for the dignity of the workers. Tom’s farewell to his Ma, captures the essence of the struggle:

“Wherever they’s a fight so hungry people can eat, I’ll be there. Wherever they’s a cop beatin’ up a guy, I’ll be there. If Casy knowed, why, I’ll be in the way guys yell when they’re mad an’—I’ll be in the way kids laugh when they’re hungry n’ they know supper’s ready. An’ when our folks eat the stuff they raise an’ live in the houses they build—why, I’ll be there.” – Tom Joad – Grapes of Wrath

Steinbeck’s wrath was directed towards the bankers who stole the farms, the California landowners that treated the workers like vermin, and the police who sided with the wealthy and carried out the brutality on the workers. Tom Joad’s anger and wrath toward those who meant to make them cower is portrayed powerfully in this passage:

“I know, Ma. I’m a-tryin’. But them deputies- Did you ever see a deputy that didn’t have a fat ass? An’ they waggle their ass an’ flop their gun aroun’. Ma”, he said, “if it was the law they was workin’ with, why we could take it. But it ain’t the law. They’re a-working away at our spirits. They’re a-tryin’ to make us cringe an’ crawl like a whipped bitch. They’re tryin’ to break us. Why, Jesus Christ, Ma, they comes a time when the on’y way a fella can keep his decency is by takin’ a sock at a cop. They’re working on our decency”.”

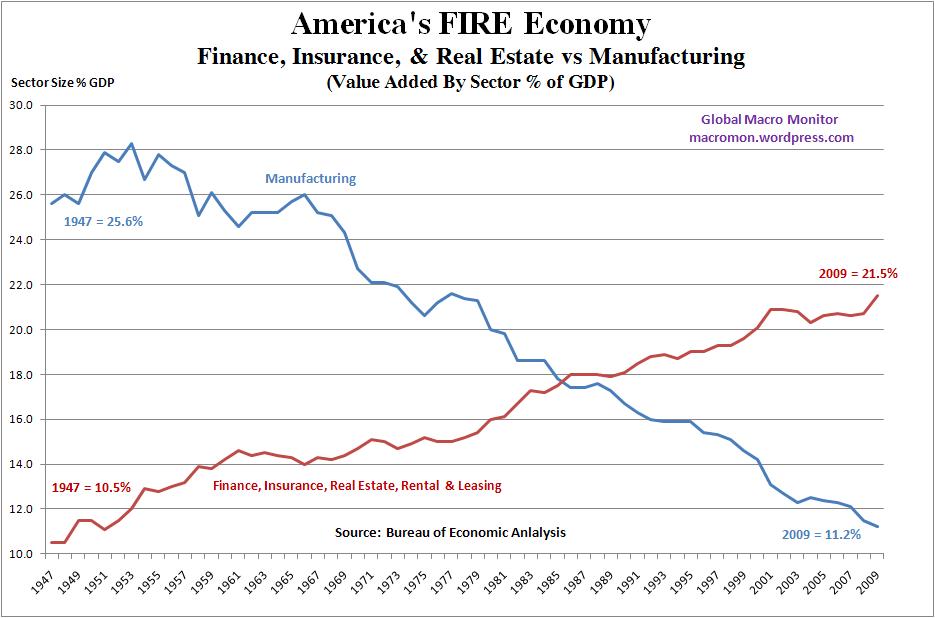

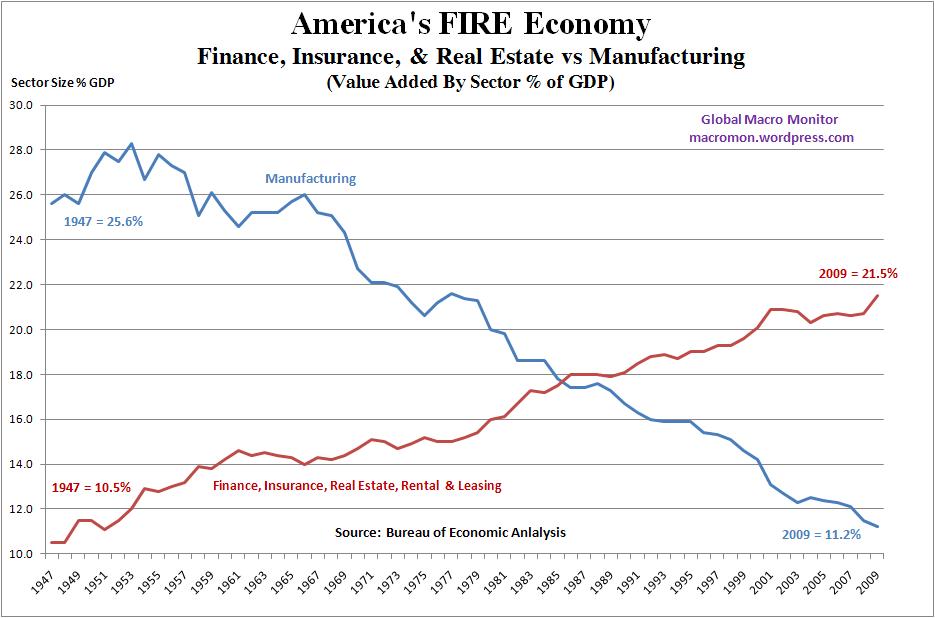

Today, Steinbeck’s wrath would be focused upon Wall Street Mega-Banks, Mega-Corporations and the politicians that allow them to pillage the wealth of the nation. Droughts, foreclosures and technology drove millions of farmers into the cities during the 1930s and it accelerated with the onset of World War II. America became manufacturer to the world, with manufacturing accounting for over 28% of GDP in the mid-1950s. The business of banking, insurance and real estate accounted for less than 11% of GDP.

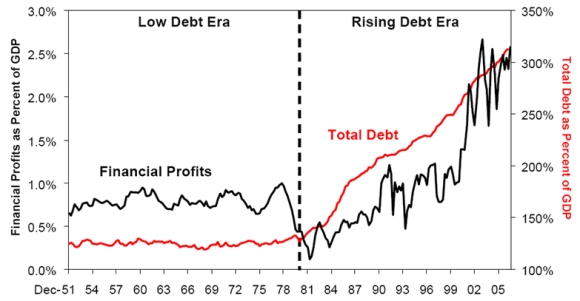

Since the adoption of the credit card on a large scale in the late 1960′s, the role of bankers and debt in our society has grown relentlessly and recklessly. The point of no return occurred in the mid-1980′s when the financial sector passed the manufacturing sector in relative importance for our economy. Today, banker generated profits from peddling debt to the middle class, creating derivatives to defraud widows and pension funds, and running their institutions like leveraged casinos on steroids account for 21.5% of GDP. Manufacturing profits now account for a pitiful 11.2% of GDP, as the CEO titans of industry at General Electric, Hewlett Packard, Intel, and Apple shipped the manufacturing jobs to Asia in a noble effort to boost earnings per share and reward themselves with $30 million pay packages.

Source: www.mybudget360.com

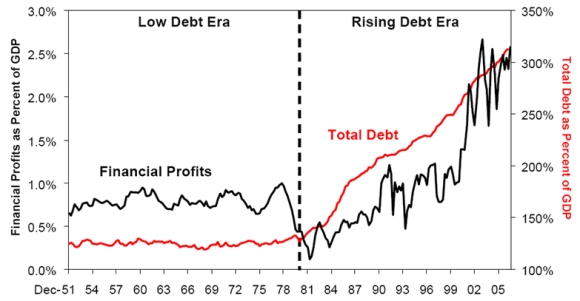

Total U.S. debt as a percentage of GDP was remarkably stable at approximately 130% for three decades, while financial profits as a percentage of GDP consistently ranged just below 1%. The ascension of Alan Greenspan to the throne of the Federal Reserve unleashed a dust storm of debt and banking profits over the last 25 years. Total credit and financial industry profits each grew by more than 250%. Real wages of middle class workers are lower today than they were in 1971. Since the higher paying manufacturing jobs were shipped overseas, Wall Street stepped into the breach by providing trillions of debt to the average American so they could buy stuff being produced in China by people who took their jobs. Wall Street and the corporate media convinced middle class Americans that their standard of living was increasing upon the waves of debt. The godfather, Greenspan, watched over and protected the big banks. When they screwed up in their efforts to pillage and plunder on a grand scale, the godfather would reduce interest rates and flood the system with liquidity. Heads they win, tails America loses.

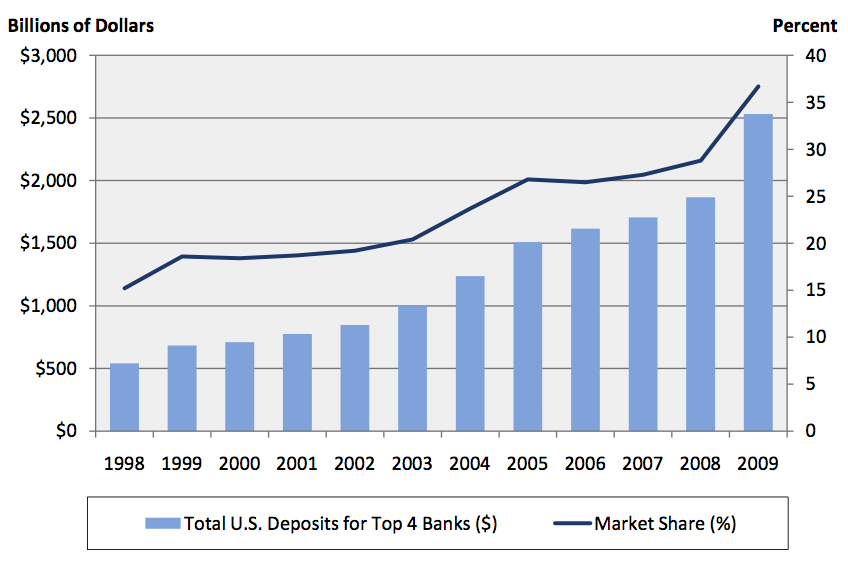

Source: Barry Ritholtz

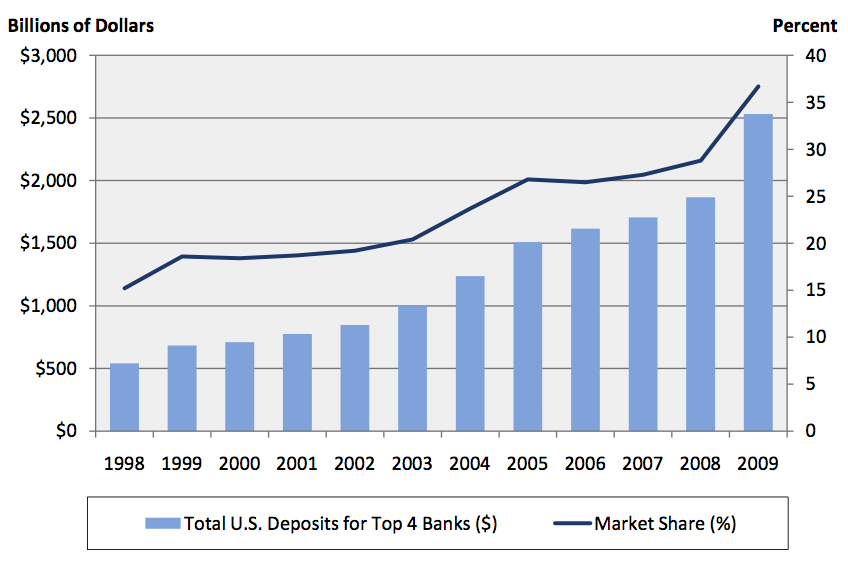

The powerful Wall Street banks were un-refrained, unregulated and unscrupulous in their unquenchable looting and ransacking of the wealth of the American public. The Federal Reserve provided the fuel and Congress lit the fuse with the repeal of Glass-Steagall, ultimately leading to the biggest financial explosion in world financial history in 2008. The financial crisis was created by the biggest Wall Street banks and the policies of the Federal Reserve. It is a tribute to their monetary power, complete capture of the mainstream media, and total ensnarement of the corrupt politicians in Washington DC, that somehow the Too Big To Fail banks are bigger than they were before the crisis. The working middle class has footed the bill for the trillions that have been shoveled into the coffers of these criminal enterprises. As a reward, the savers receive .25% on their savings. These men have put 8.5 million people out of work in the last three years. Steinbeck understood that bankers who foreclosed on the homes of poor farmers and fed the speculation that led to the Great Crash were nothing more than extensions of an evil monster:

“No, you’re wrong there—quite wrong there. The bank is something else than men. It happens that every man in a bank hates what the bank does, and yet the bank does it. The bank is something more than men, I tell you. It’s the monster. Men made it, but they can’t control it.”

The bankers that control our economy today deserve the same scorn and wrath that Steinbeck heaped on bankers and California landowners in the 1930′s. Jesse, from Jesse’s Café Americain captures the wrath in this assessment of our current state of affairs:

“The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery. All else is looting and folly, with apathy and complacent self-interest as their accomplices.”

Selfishness & Altruism

I ain’t never gonna be scared no more. I was, though. For a while it looked as though we was beat. Good and beat. Looked like we didn’t have nobody in the whole wide world but enemies. Like nobody was friendly no more. Made me feel kinda bad and scared too, like we was lost and nobody cared…. Rich fellas come up and they die, and their kids ain’t no good and they die out, but we keep on coming. We’re the people that live. They can’t wipe us out, they can’t lick us. We’ll go on forever, Pa, cos we’re the people. – Ma Joad - Grapes of Wrath

The power elite that believe they can control the masses as puppet master commands a puppet should beware. The wrath of the masses can be fierce and sudden. Ask Hosni Mubarak. As Steinbeck realized many decades ago, selfishness run amok, supported and encouraged by the authorities lead to poverty, despair and sometimes revolution. The false mantra of an economy based on self-interest and free markets is a smokescreen blown by the few with wealth and power to obscure the truth that they have used their wealth and power to rig the game in their favor. The have-nots can dream about becoming a have, but the chances of achieving that dream today are miniscule. Steinbeck pointedly distinguishes between the selfishness of the moneyed class and the altruism of the working poor. In contrast to and in conflict with this policy of selfishness stands the migrants’ behavior toward one another. Aware that their livelihood and survival depend upon their devotion to the collective good, the migrants unite—sharing their dreams as well as their burdens—in order to survive.

Those in control need to keep the masses divided. They need Americans to be distracted by phantom terrorist threats, inconsequential political differences, American Idol, Charlie Sheen, Lindsey Lohan and Lady Gaga. They need Americans to be focused on “I”. Their greatest fear is that the American people realize that “We” can change the direction of this country and bring the perpetrators of crimes against the people of this country to justice. John Steinbeck saw the potential power of the common man if they became “We”:

One man, one family driven from the land; this rusty car creaking along the highway to the west. I lost my land, a single tractor took my land. I am alone and bewildered. And in the night one family camps in a ditch and another family pulls in and the tents come out. The two men squat on their hams and the women and children listen. Here is the node, you who hate change and fear revolution. Keep these two squatting men apart; make them hate, fear, suspect each other. Here is the anlarge of the thing you fear. This is the zygote. For here “I lost my land” is changed; a cell is split and from its splitting grows the thing you hate–”We lost our land.” The danger is here, for two men are not as lonely and perplexed as one. And from this first “we” there grows a still more dangerous thing: “I have a little food” plus “I have none.” If from this problem the sum is “We have a little food,” the thing is on its way, the movement has direction. Only a little multiplication now, and this land, this tractor are ours. The two men squatting in a ditch, the little fire, the side-meat stewing in a single pot, the silent, stone-eyed women; behind, the children listening with their souls to words their minds do not understand. The night draws down. The baby has a cold. Here, take this blanket. It’s wool. It was my mother’s blanket–take it for the baby. This is the thing to bomb. This is the beginning–from “I” to “we.” - John Steinbeck - Grapes of Wrath

The American people have a choice. They can continue on a course of apathy, selfishness and worship of mammon, or they can rally together with selflessness and concern for the welfare of their fellow man and future unborn generations. The current path, forged by a minority of privileged wealthy elite, will lead to the destruction of this country and misery on an unprecedented scale. It is up to each of us to show the courage of John Steinbeck, who without a thought for himself, stood up against the stones of condemnation, and spoke for those who were given no real voice in the halls of justice, or the halls of government. By doing so he became an enemy of the political status quo. Are you prepared to incur the wrath of the vested interests and meet their lies and propaganda with the fury of your own wrath in search for the truth? These men are sure you don’t have the courage, fortitude and wrath to defeat them.

Mine eyes have seen the glory of the coming of the Lord:

He is trampling out the vintage where the grapes of wrath are stored;

He hath loosed the fateful lightning of His terrible swift sword:

His truth is marching on.

- Battle Hymn of the Republic

The 1% of the population at the very top of the pyramid had incomes 650% greater than those 11% of Americans at the bottom of the pyramid. The tremendous concentration of wealth in the hands of a few meant that continued economic prosperity was dependent on the high investment and luxury spending of the wealthy.

The 1% of the population at the very top of the pyramid had incomes 650% greater than those 11% of Americans at the bottom of the pyramid. The tremendous concentration of wealth in the hands of a few meant that continued economic prosperity was dependent on the high investment and luxury spending of the wealthy.