Saturday, February 18, 2017

“Seriously Delinquent” Auto Loans Surge

Wolf Richter wolfstreet.com, www.amazon.com/author/wolfrichter

Bank regulators have been warning, now it’s happening.

The New York Fed, in its Household Debt and Credit Report for the fourth quarter 2016, put it this way today: “Household debt increases substantially, approaching previous peak.” It jumped by $226 billion in the quarter, or 1.8%, to the glorious level of $12.58 trillion, “only $99 billion shy of its 2008 third quarter peak.”

Yes! Almost there! Keep at it! There’s nothing like loading up consumers with debt to make central bankers outright giddy.

Auto loan balances in 2016 surged at the fastest pace in the 18-year history of the data series, the report said, driven by the highest originations of loans ever. Alas, what the auto industry has been dreading is now happening: Delinquencies have begun to surge.

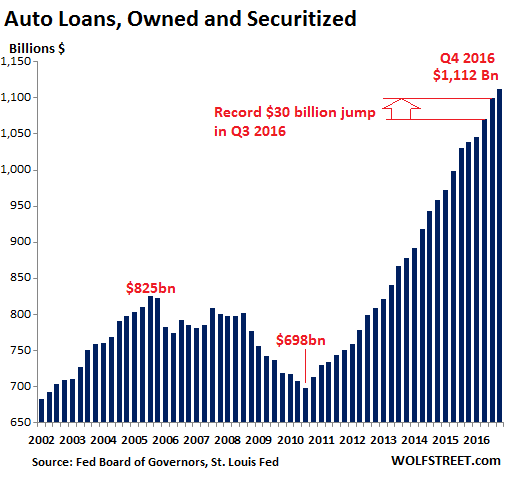

This chart – based on data from the Federal Reserve Board of Governors, which varies slightly from the New York Fed’s data – shows how rapidly auto loan balances have ballooned since the Great Recession. At $1.112 trillion (or $1.16 trillion according to the New York Fed), they’re now 35% higher than they’d been during the crazy peak of the prior bubble. Note that during the $93 billion increase in auto loan balances in 2016, new vehicle sales were essentially flat:

No way that this is an auto loan bubble. Not this time. It’s sustainable. Or at least containable when it’s not sustainable, or whatever. These ballooning loans have made the auto sales boom possible.

But despite record low interest rates, the bane of the automakers is now taking place relentlessly:

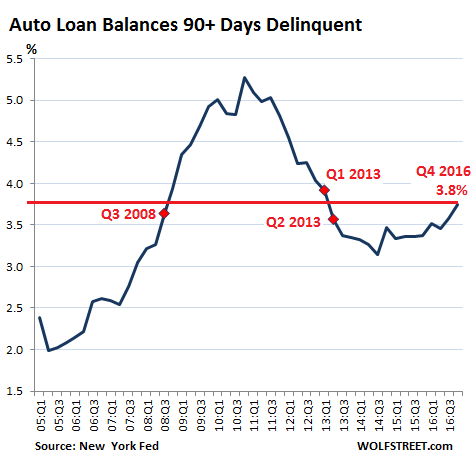

“Seriously delinquent” auto loan balances, composed of all loans that are 90+ days past due, rose in Q4 to 3.8% of total auto loan balances. That puts them right between Q1 and Q2 of 2013, as auto credit was recovering from the Financial Crisis. Last time auto loan delinquencies had surged to that level was after Q3 2008, as the Financial Crisis was tearing into the economy:

These seriously delinquent auto loans are an indication of what is next:

- Losses at auto lenders, particularly those specializing in lending to subprime borrowers, but also other lenders, including captives, such as Ford Motor Credit, which had already warned in its most recent outlook that “we continue to see credit losses increase.”

- Tightening auto credit for consumers, as those losses begin to exact their pound of flesh from the lenders.

Some specialized subprime lenders might keel over. Larger lenders with good quality loan portfolios will bleed but go on while tightening their underwriting standards in order to weather the storm. And that’s precisely what the auto industry is dreading: tightening credit.

The auto boom over the past few years was funded by historically low interest rates and loosey-goosey underwriting, with long loan terms and high loan-to-value ratios, often over 120%. They made everything possible. But they infused the $1.1 trillion in auto loans with some very big risks.

The Office of the Comptroller of the Currency (OCC), one of the federal bank regulators, has once again warned about the risk-taking by auto lenders:

Auto lending risk has been increasing for several quarters because of notable and unprecedented growth across all types of lenders.As banks competed for market share, some banks responded with less stringent underwriting standards for direct and indirect auto loans. In addition to the eased underwriting standards, lenders also substantially layered risks (granted longer terms combined with higher advance rates resulting in higher LTV ratios).These factors increased the credit risk in auto loan portfolios…. This embedded risk is now being reflected in lower recoveries at charge-off (higher loss severities) for both bank loans and securitized auto loans despite relative stability in used auto values.Bank risk management practices and the ALLL [allowance for loan and lease losses] should reflect the elevated risk profile and higher probable credit loss severities.

So it’s all there – the ingredients for bigger losses among banks and investors, a few failures of smaller specialized subprime lenders, and belated credit tightening, both out of necessity and due to lower competition among lenders as some of the most aggressive ones will be busy licking their wounds.

And auto sales – not long ago the truly hot sector in the US economy – are now confronted with these tightening credit conditions as growth has already been stalling.

Despite what you might think, automakers did not “cut back” on fleet sales in January. But keep an eye on rideshare companies. Read… Car Sales Crash, But It’s Complicated

Around The Web

BILL GATES WANTS TO TAX ROBOTS JUST LIKE HUMANS

[2/17/17] Robots are coming for a lot of jobs. And while at first this may seem detrimental, it’s actually a good thing.

There will still be jobs for humans (in fact, job growth has been on the rise in the U.S.), but they will just be different jobs. If we leave jobs that can be automated to the robots, we’ll free up labor so humans can do more meaningful work like caring for the elderly, teaching kids with disabilities and other jobs that require empathy—something robots lack.

This notion has been discussed time and time again, but Bill Gates has taken it further with an extra step he says will help us get “net ahead.”

THE EU IS FINISHED! WHAT THESE ECONOMISTS PREDICT SPELLS CERTAIN DOOM FOR THE EURO

ZOIE O’BRIEN for express UK reports, European Union nations are plummeting further into debt, amid angry protests and calls for reform, but the Union continues to push for the joint monetary union. Now, economists have suggested it is already too late to save the failing monetary union – which will “almost surely fail”.

GNC to close 100 stores, reports $433 million fourth-quarter loss

GNC, who has now rebranded themselves as a health and wellness retailer has reported a $433 million dollar fourth quarter loss according to this Pittsburgh Post report.

The bad news doesn’t end there as GNC reported a 64% decline in sales and the closing of 100 stores.

GNC officials on Thursday took pains to distance the company from the “old” GNC after reporting a $433.4 million fourth-quarter loss, marking the end of a dismal 2016 that saw a 64 percent decline in the Pittsburgh health supplement retailer’s share price.

For the year, GNC Holdings Inc. recorded a net loss of $286.3 million, compared with a $219.3 million profit the year before, as sales declined 6.5 percent and 6.8 percent respectively in company-owned and franchise stores. GNC’s consolidated revenue of $2.54 billion was a 5.3 percent drop from 2015’s $2.68 billion. Its adjusted earnings per share was 7 cents, far off Wall Street’s estimate of 36 cents per share.

“This is certainly not what any one of us wanted to see,” said interim CEO Robert Moran of GNC’s fourth-quarter performance during the company’s quarterly financial briefing to analysts.

The losses, said Chief Financial Officer Tricia Toliver, “are not a good indication of where the business is headed,” adding later that, “We are building an entirely new business model.”

Ms. Toliver was referring to the “One New GNC” campaign, launched Dec. 29 to rebrand the health and wellness retailer. The “new” GNC now features simplified pricing, reduced prices on about half of its products, and a free customer loyalty program, with plans to offer new proprietary products.

Mr. Moran said company officials are encouraged by the campaign’s early results, with sales transactions up 7 percent among company-owned stores and an even more promising performance among the GNC stores that have been piloting the program.

It undoubtedly can’t come soon enough for investors who, shortly after the GNC financials were released early Thursday, learned the GNC board was suspending the company’s quarterly dividend. Shares briefly fell below $7 for the first time since the company went public in 2011.

The stock closed at $7.72 Thursday, down 7.21 percent.

Ms. Toliver said the fourth quarter had notable one-time expenses such as a $10 million investment to clear inventory and launch the One New GNC campaign. As part of its preparation, GNC closed all of its stores for the day on Dec. 28, which also cut into sales. She also said the company expects to close about 100 stores this year as leases expire.

CITY ERECTS PRISON CAMP TO DEAL WITH HOMELESS – CUTTING OFF FOOD & WATER

[2/16/17] The City of Santa Ana has come up with an innovative and despotic way of keeping their homeless population in check — imprison them. The city is now party to a federal lawsuit over unreasonable seizure, false imprisonment, and due process violations.

se the barriers have blocked parts of the sidewalks at Chapman Avenue and Orangewood Avenue where people used to come and go.If people living at the encampment cut holes in the fences with bolt cutters, Orange County Public Works employees repair it. For the elderly and disabled it is neither safe nor realistic to scale the fence or navigate the river to get to a steep, rocky embankment on the river’s west side, Diehl says.

“Children, people with severe disabilities, the elderly and others are deprived of food, water and access to restrooms,” said ACLU homelessness policy analyst Eve Garrow. “The county should take action to rectify this egregious violation of basic human rights.”

GERMANY REPATRIATES GOLD QUICKER THAN PLANNED – Global Chaos / Economic Collapse Coming?

An official announcement last week that the Bundesbank had pretty much repatriated half its gold reserves ahead of schedule has once again sent the rumor mill into overdrive.

Fans of the precious metal – not shy of a good conspiracy theory – have been deliberating over the move ever since Germany detailed it back in 2013. Initially, there was a sense that trust between central banks had broken down with claims that Berlin was effectively questioning the credentials of New York Federal Reserve.

But the talk has now stepped up a notch with the Bundesbank confirming Thursday that it has already moved 583 tons of gold out of New York and Paris. Its plan to hold half its gold in Frankfurt is now three years ahead of schedule.

Reporting the news, Reuters said that some argue the world’s second-biggest bullion reserve “may be needed to back a new deutsche mark, should the euro zone break up.” This seems pretty far-fetched, especially given that the Bretton Woods system of fixed exchange rates ended back in the 1970s. Could Berlin really be prepping for the fall of the euro? Germany Gold “Gold Bullion” Bullion “Buy Gold” “Sell Gold” “Cash 4 Gold” “Cash for gold” German USA America Europe “United States” Offshore “Gold Vault” 2017 2018 euro “european union” forex fx “forex trading” “euro zone” silver “silver coin” “gold trading” London Banking “Bank Account” Savings “Savings Account” “stock market” collapse dollar usd future prepare survival news media trends “elite nwo agenda” elite “gold sovereign” “gold bar” “999 silver” “999 gold” “fine gold” “scrap gold” “gold mine” alex jones gerald celente jsnip4 jim rogers mark faber george soros rothschild rothchilds end game global reset Then there’s the Donald Trump angle. On Thursday, Bundesbank board member Carl-Ludwig Thiele felt the need to speak about the new U.S. president at his press conference – presumably because someone asked him.

“Trump has not triggered a discussion about the storage facility in New York,” he said, according to reports. Trump scaring global central banks to repatriate their gold in case he confiscates it? Sounds equally unbelievable.

Then there’s the rumors coming from Russia. Sputnik News, which incidentally has strongly denied accusations from NATO that it’s a Kremlin propaganda machine, reported that Germany had been given the wrong gold. Quoting Russian economist Vladimir Katasonov, the news site said the U.S. may have sold Germany’s gold bars years ago and hurriedly bought some back as the Bundesbank came knocking.

The Bundesbank held 1,619 tons of its gold reserves — 47.9 percent — in Frankfurt at the end of last year. That share will increase to 50.6 percent at the end of 2017. Some 1,236 tons of the metal will remain at the Federal Reserve Bank in New York, and 432 tons at the Bank of England in London.

Is This What They Mean By “Crack-Up Boom”?

by John Rubino

In 1980, the US government – along with pretty much all of its peers – began borrowing at an accelerating rate. Note on the following chart how the trend line steepened in the 2000s and then steepened again in this decade, with a sudden and unexpected pop in 2015 and early 2016, even as the current recovery entered its 8th year.

Also in the past year, stock prices have risen from “near-record, overvalued-by-every-historical-measure” levels, to “new-record, grossly-overvalued” levels – and show no signs of slowing down. Note the massive jump in S&P 500 trading volume that began in January and has persisted throughout the year.

Investors, meanwhile, are borrowing to snag more of those apparently-easy profits, with margin debt — money borrowed against stock portfolios to buy more shares — now above both 1999 and 2007 levels.

And now consumers are joining the party:

U.S. Households Ramp Up Borrowing Led by Mortgages, Credit Cards

(Bloomberg) – U.S. households increased their borrowing in the final three months of 2016 at the fastest pace in three years, according to the Federal Reserve Bank of New York.Consumer debt rose by $226 billion, or 1.8 percent, in the fourth quarter, led by a $130 billion increase in mortgage loan balances and a $32 billion increase in credit-card borrowings, the New York Fed said Thursday. The rise brought total consumer debt to $12.58 trillion, just shy of the $12.68 trillion peak in the third quarter of 2008.

New mortgages originated totaled $617 billion, marking the biggest three months for volumes since the third quarter of 2007.“Debt held by Americans is approaching its previous peak, yet its composition today is vastly different as the growth in balances has been driven by non-housing debt,” Wilbert van der Klaauw, a senior vice president at the New York Fed, said in a press release.Student loan balances rose to a new record high of $1.31 trillion, and auto loan debt also increased to a record $1.16 trillion in the 18-year history of this data series.

This is clearly a credit-driven boom of some sort. But is it the long-awaited Austrian School of Economics “crack-up boom”, the exclamation point at the end of especially-frenzied and broad-based financial bubbles? That may be a question answerable only in retrospect. But when the crack-up boom finally hits, this acceleration across multiple sectors is how it will look and feel.

Russia to clear entire Soviet debt by year-end

Celebrating the 69th anniversary of the Great October Socialist Revolution, 1989, Moscow © Sputnik

Moscow will pay off the balance of the debt inherited from the Soviet Union this year, Izvestia daily reports, quoting sources in the Russian Ministry of Finance.

Last week, the Finance Ministry said it had cleared the $60.6 million debt to Macedonia. This means that the last debt of the Soviet Union is $125.2 million to Bosnia and Herzegovina. Both countries were formed after the breakup of Yugoslavia and won the right to reclaim part of the Soviet debt.

“The agreement has taken a long time to get ready, a preliminary agreement has been signed. The final version just needs signing, it’s a matter of a few months. It will be a single tranche through VEB [Russian state bank of foreign economic affairs]. There are no difficulties there, the question will be resolved by the summer,” a source in the Russian Finance Ministry told Izvestia. The debt will be paid off within 45 days after the agreement is signed, the source said.

The USSR's foreign debt was accumulated in various ways. Obligations to Western countries accrued in the debt market after 1983. The money owed to the former Yugoslavia was as a result of trade.

“On the one hand, the USSR supplied Yugoslavia with products of the defense industry and energy. On the other, Yugoslavia sold consumer goods to the USSR. The debt was formed due to the difference in the value of imports and exports,” managing partner of law firm HEADS Consulting Aleksandr Bazykin told the daily.

According to Finance Professor at the Russian Presidential Academy of National Economy and Public Administration Yury Rudenkov, the question of the Soviet debt is more political than economic.Russia paid off the Soviet debt to the Paris Club [19 creditors mostly in the Western bloc including the US and the UK] in 2006, but could have delayed it until 2115, Bazykin said. At the fall of communism, the Paris Club debt was about $60 billion.

“It is important for the international status that we have recognized the USSR debts and paid them off. While doing so, we have forgiven debts from countries such as Vietnam and Algeria,” he said.

When the Soviet Union collapsed in 1991, the newly formed Russian Federation inherited a growing external debt of over $66 billion with barely a few billion dollars in net gold and foreign exchange reserves.

Every Citizen Should Own 3.5 Ounces of Gold Bullion – Central Bank

- Central bank governor has “dream” for every citizen to own at least 100 grams of gold bullion

- Governor of Central Bank of Kyrgyzstan said the central bank had sold around 140 kilos of gold bullion to the domestic population already

- Central Asian country’s central bank continues to diversify into gold bullion

- “Gold can be stored for a long time … doesn’t lose its value for the population as a means of savings”

- “I’ll try to turn the dream into reality faster…”

The Governor of the Central bank of Kyrgyzstan has told Bloomberg News in an interview that it is his “dream” for every citizen in his country to own at least 100 grams (3.5 ounces) of gold as a way to protect their savings.

Diversifying one’s savings so that they are not solely held in fiat paper or electronic currencies in frequently vulnerable banks in a vulnerable banking and financial system is prudent advice in these uncertain times.

Indeed, there is a strong case to be made that the policies of most central banks in recent years have led to a massive debt bubble and the risk of another financial crisis, currency wars and currency debasement on a grand scale.

Hence, it was very refreshing to hear the actual governor of a central bank passionately advocate and proactively helping his fellow citizens to protect their savings by diversifying and having an allocation to physical gold.

From Bloomberg:

One of the first post-Soviet republics to adopt a new currency and let it trade freely, Kyrgyzstan’s central bank wants every citizen to diversify into gold. Governor Tolkunbek Abdygulov says his “dream” is for every one of the 6 million citizens to own at least 100 grams (3.5 ounces) of the precious metal, the Central Asian country’s biggest export.

“Gold can be stored for a long time and, despite the price fluctuations on international markets, it doesn’t lose its value for the population as a means of savings,” he said in an interview. “I’ll try to turn the dream into reality faster.”

In the two years that the central bank has offered bars directly to the population, about 140 kilograms of bullion have been sold, Abdygulov, 40, said by phone from the capital, Bishkek.

“We are hopeful that our country’s population will learn to diversify its savings into assets that are more liquid and — more importantly — capable of retaining their value,” he said. In rural areas, cattle is still the asset of choice for investors and savers, according to Abdygulov.

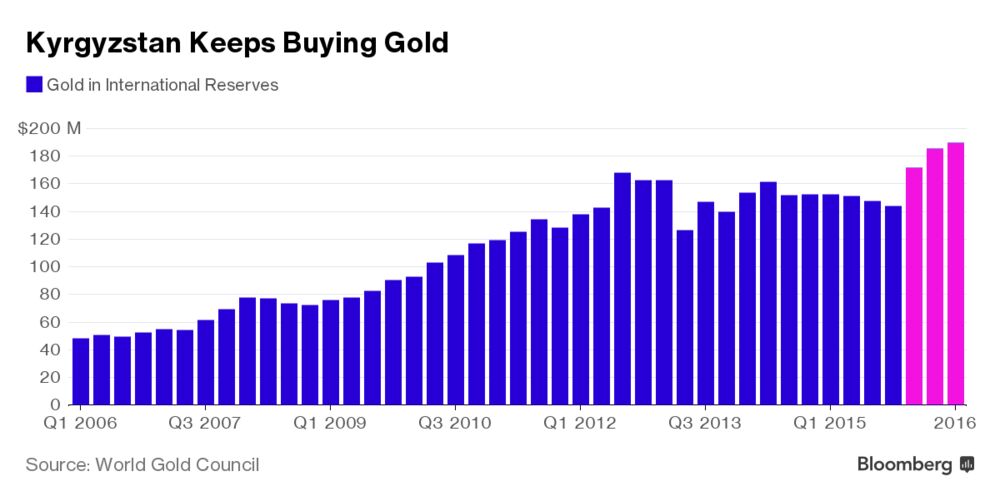

Kyrgyzstan has bucked a trend among central banks, the biggest owners of bullion, by stepping up buying even as its counterparts cut purchases in 2016 to a six-year low. Global combined bar and coin demand fell, according to the World Gold Council.

Across the emerging world, gold — often seen as the ultimate haven at times of upheaval — hardly needs any extra promotion. India, the world’s largest consumer after China, is in fact taking steps to curb imports of the precious metal by encouraging its citizens to deposit private gold holdings in banks.

In Turkey, where banks can use bullion as part of their reserve assets, President Recep Tayyip Erdogan last year called on people to convert their foreign-currency savings into liras and gold.

What makes Kyrgyzstan unique is the central bank’s effort to win converts by providing infrastructure for safe-keeping and investment. The central bank produces bars of different sizes, varying in weight from 1 to 100 grams.

The central bank governor believes his plan is realistic, even though it means the population would own about 600 tons of gold, equivalent to 30 times the nation’s current annual output. Abdygulov declined to specify the timeframe for when his goal of 100 grams per person can be met.

The options available for storage include safe deposit boxes at commercial lenders or with the central bank, he said. Some people opt to keep gold at home or possibly even bury it in the ground, according to Abdygulov.

With Kyrgyzstan enduring upheaval from economic crises in the early 1990s to bank failures during the last decade, gold is seen as a far safer bet than securities, he said.

“For Kyrgyzstan, gold is an alternative instrument of investment,” Abdygulov said. “The National Bank has ensured liquidity for gold — we aren’t only selling, but also buying back gold bars that we produced and sold.”

As Abdygulov took the reins of the central bank in 2014, Kyrgyz policy makers decided to raise gold’s share in its own reserves, now keeping about 10 percent of its $2 billion holdings in bullion. After years of capping the amount at 2.6 tons, the stockpile surged by more than 70 percent since 2012 to 4.5 tons at the end of the third quarter in 2016, according to the latest data compiled by the London-based World Gold Council.

With Kyrgyzstan’s output at about 20 tons a year, the central bank uses the national currency, the som, to buy gold mined locally, which can then be sold abroad if needed, according to Abdygulov. The governor said he’s counting on higher output in the future.

Abdygulov, who has masters degrees from Nagoya University in Japan and the University of North Texas, may be a gold enthusiast, but he’s no advocate for dislodging the dollar completely. His advice is based on the “rule of three” — splitting up savings between the som, foreign currency and gold.

As for the metal’s prospects, he’s upbeat, even after it surged the most in five years in 2016 and continued to post gains in 2017. Bullion has rallied more than 7 percent this year as concerns that Donald Trump’s policies on trade and immigration could derail U.S. growth boosted speculation that the Federal Reserve would be slow to raise borrowing costs.

End>

End>

“Common sense is not so common” as Voltaire said. Financial and monetary common sense regarding gold and the importance of diversifying ones savings and investments is even more uncommon.

As one of the larger gold bullion delivery and storage specialists in the world and a vested commercial interest, GoldCore would obviously greatly welcome the central bank governors of Ireland, UK, U.S. and all western nations to urge their citizens to diversify their savings and own a small amount of gold.

As a specialist in the logistics of delivery and storage of physical gold, we can of course work with them and help them in this regard and we look forward to hearing from them.

We have long been passionate advocates of owning physical gold and have spent a lot of time educating about gold’s safe haven characteristics. This has been seen clearly in history and during the recent global financial crisis and indeed in the large body of new academic and independent research on gold in recent years.

The Governor clearly understands gold’s value and is acting accordingly in the interests of his fellow citizens.

Bravo Governor and Happy Friday folks !

Gold and Silver Bullion – News and Commentary

Gold Prices (LBMA AM)

17 Feb: USD 1,241.40, GBP 1000.57 & EUR 1,165.55 per ounce

16 Feb: USD 1,236.75, GBP 988.41 & EUR 1,163.29 per ounce

15 Feb: USD 1,225.15, GBP 985.27 & EUR 1,161.81 per ounce

14 Feb: USD 1,229.65, GBP 986.67 & EUR 1,157.84 per ounce

13 Feb: USD 1,229.40, GBP 982.04 & EUR 1,155.64 per ounce

10 Feb: USD 1,225.75, GBP 980.23 & EUR 1,151.35 per ounce

09 Feb: USD 1,241.75, GBP 988.18 & EUR 1,161.04 per ounce

08 Feb: USD 1,235.60, GBP 989.47 & EUR 1,160.10 per ounce

07 Feb: USD 1,231.00, GBP 995.14 & EUR 1,154.43 per ounce

16 Feb: USD 1,236.75, GBP 988.41 & EUR 1,163.29 per ounce

15 Feb: USD 1,225.15, GBP 985.27 & EUR 1,161.81 per ounce

14 Feb: USD 1,229.65, GBP 986.67 & EUR 1,157.84 per ounce

13 Feb: USD 1,229.40, GBP 982.04 & EUR 1,155.64 per ounce

10 Feb: USD 1,225.75, GBP 980.23 & EUR 1,151.35 per ounce

09 Feb: USD 1,241.75, GBP 988.18 & EUR 1,161.04 per ounce

08 Feb: USD 1,235.60, GBP 989.47 & EUR 1,160.10 per ounce

07 Feb: USD 1,231.00, GBP 995.14 & EUR 1,154.43 per ounce

Silver Prices (LBMA)

17 Feb: USD 18.00, GBP 14.50 & EUR 16.90 per ounce

16 Feb: USD 18.10, GBP 14.49 & EUR 17.02 per ounce

15 Feb: USD 17.88, GBP 14.38 & EUR 16.93 per ounce

14 Feb: USD 17.91, GBP 14.37 & EUR 16.85 per ounce

13 Feb: USD 17.97, GBP 14.34 & EUR 16.89 per ounce

10 Feb: USD 17.62, GBP 14.15 & EUR 16.55 per ounce

09 Feb: USD 17.71, GBP 14.10 & EUR 16.58 per ounce

08 Feb: USD 17.74, GBP 14.20 & EUR 16.66 per ounce

07 Feb: USD 17.60, GBP 14.21 & EUR 16.49 per ounce

16 Feb: USD 18.10, GBP 14.49 & EUR 17.02 per ounce

15 Feb: USD 17.88, GBP 14.38 & EUR 16.93 per ounce

14 Feb: USD 17.91, GBP 14.37 & EUR 16.85 per ounce

13 Feb: USD 17.97, GBP 14.34 & EUR 16.89 per ounce

10 Feb: USD 17.62, GBP 14.15 & EUR 16.55 per ounce

09 Feb: USD 17.71, GBP 14.10 & EUR 16.58 per ounce

08 Feb: USD 17.74, GBP 14.20 & EUR 16.66 per ounce

07 Feb: USD 17.60, GBP 14.21 & EUR 16.49 per ounce

Recent Market Updates

– Silver Price To Surge As “Investors and Users Fighting Over Available Physical Supplies”

– Jim Rogers Buying Gold Bullion On Dips

– French Election Could See Euro Break Up – New Global Crisis

– Gold Prices Up 5.8% YTD – Trump ‘Honeymoon’ Ends

– Gold Buying Russia To Intensify Diversification On Trump ‘Unpredictability’?

– Gold Prices Rising Mean “Impending Market Volatility”

– Gold Bullion Banks To “Open Vaults” In Transparency Push?

– Ignore Sabre-Rattling and Buy Gold

– Buy Gold Because of Uncertainty not Doomsday

– The Alternative Fact of the Cashless Society

– Silver, Platinum and Palladium As Safe Havens – Reassessing Their Role

– Why 2017 Could See the Collapse of the Euro

– Dow 20K … US Debt $20 Trillion … Trump and $15,000 Gold

– Switzerland’s Gold Exports To China Surge To 158 Tons In December

– Jim Rogers Buying Gold Bullion On Dips

– French Election Could See Euro Break Up – New Global Crisis

– Gold Prices Up 5.8% YTD – Trump ‘Honeymoon’ Ends

– Gold Buying Russia To Intensify Diversification On Trump ‘Unpredictability’?

– Gold Prices Rising Mean “Impending Market Volatility”

– Gold Bullion Banks To “Open Vaults” In Transparency Push?

– Ignore Sabre-Rattling and Buy Gold

– Buy Gold Because of Uncertainty not Doomsday

– The Alternative Fact of the Cashless Society

– Silver, Platinum and Palladium As Safe Havens – Reassessing Their Role

– Why 2017 Could See the Collapse of the Euro

– Dow 20K … US Debt $20 Trillion … Trump and $15,000 Gold

– Switzerland’s Gold Exports To China Surge To 158 Tons In December

Interested in learning more about physical gold and silver?

Call GoldCore and speak with a Gold and Silver Specialist today!

Call GoldCore and speak with a Gold and Silver Specialist today!

Are We In For A Stock Market Correction As The Euphoria Is Reaching Its Peak Ahead Of A Market Top

by Umar Farooq

Ever since President Trump has taken oath of the office, investors have been pushing major stock indexes to record highs on the bet that new administration will roll back financial regulations, cut taxes, and increase fiscal spending, all of which could help boost profits in corporate America. However, many investors are getting worried that high expectations could lead to major disappointment.

The share of newsletter writers who are optimistic on the stock market climbed to 62.7% this week, the highest level since 2004, according to Investors Intelligence, which surveys more than 100 newsletter writers each week for its Sentiment Index.

The gauge has become something of a contrarian indicator. It tends to reach peak euphoria ahead of a market top, and pessimism typically peaks at market bottoms. It’s one of a number of sentiment measures, including ones for consumers and small businesses that have shown optimism spiking since the election. The surge in positive sentiment is increasingly out of step with an economy that is improving slowly.

A reading above 55% suggests a trading top is forming, while topping 60% means “it is time to start taking defensive measures,” according to Investors Intelligence. The measure has been above 55% for 11 straight weeks, and above 60% for four of them.

But the firm warns that as a contrarian indicator, it’s more useful in calling market bottoms than market tops, particularly since market tops can form over time. The market bottom worked at the beginning of last year. Bearishness was elevated far above bullishness in mid-February, when the S&P 500 bottomed after falling more than 10% to start the year.

Investors look at it as a useful signal. Ed Yardeni, chief investment strategist at Yardeni Research Inc, said he looks at the ratio of bulls to bears in the survey, and noted that the reading of 3.75 this week was well above the level of 3 that’s generally seen as a sell signal. Back in February of 2016, the reading of 0.63 had been a useful buy signal.

“We are due for a correction,” Mr Yardeni wrote in a Thursday report. “Such panic attacks followed by relief rallies have been the modus operandi of this bull market since 2009.”

Jeff Deist: President Trump Facing Historically Unprecedented Challenges

Jeff Deist is president of the Mises Institute. He previously worked as a longtime advisor and chief of staff to Congressman Ron Paul. In the past, Jeff was also an attorney for private equity.

During this 30+ minute interview, Jason first asks Jeff if in his opinion President Trump has done anything positive?

Jason and Jeff discuss some of the things President Trump has done so far and how he is fighting globalism and the deep state.

Jason asks Jeff about the history of protectionism and tariffs in the US and if Trump’s economic policies mean a lot more inflation or stagflation is coming during his presidency?

Gold & Silver; Testing 6-year breakout level again

by Chris Kimble

From a buy and hold perspective, owning Gold & Silver since the highs in 2011, has not been a high returning strategy.

Is this trend of lower highs and lower lows about to end? Is the Bear about to break free from years of frustration? Below looks at the Silver (SLV)/Gold (GLD) ratio over the past decade.

CLICK ON CHART TO ENLARGE

Historically both Gold & Silver have done very well when the ratio above is heading higher. The opposite is also true, that both Gold & Silver have struggled when this ratio is heading south.

The ratio has remained inside of falling channel (1), since 2011.

The ratio is testing breakout levels again at (2) this week. If the ratio can breakout above falling channel (1), it would send the first risk on message in years. If the ratio breaks out of falling channel (1) and can clear last summer highs, it would be sending the first bullish message in years!

Subscribe to:

Posts (Atom)