By Marc Jones

LONDON (Reuters) - The dollar continued to power higher

on Monday, leaving oil and gold prices in its wake, after the Group of

Seven gave a green light to Japan's efforts to spur growth with

aggressive monetary easing.Comments from Italy's central bank governor that the ECB could push one of its key interest rates below zero also put pressure on the euro and lifted benchmark German Bunds as investors started to think about more profitable options.

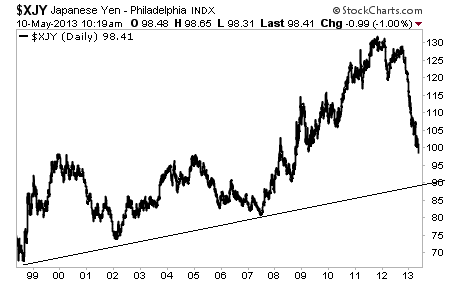

The dollar (.DXY) has risen 5 percent against a basket of top currencies since February and its strength looked unlikely to wane after top officials at a G7 meeting in the English countryside showed little concern about the yen's ongoing slump.

The greenback had hit a new 4-1/2 year high of 102.15 yen in Asian trading and but dipped back to 101.69 yen and $1.2964 against the euro by 0915 GMT as traders locked in some of the recent gains.

"Yen selling will have been encouraged by the outcome from the G7 meeting where officials reiterated that they will tolerate yen weakness as long as it results from the use of domestic instruments to stimulate the Japanese economy," said Bank of Toyko-Mitsubishi currency analyst Lee Hardman.

The dollar's strong performance also had a broad impact on commodity markets where raw materials are mainly priced in the currency and therefore its rise effectively makes them cheaper.

Brent oil prices slipped back below $103 a barrel (O/R), while spot gold fell as much as 1.5 percent to a low of $1,426.40. (GOL/)

London copper climbed, however, after China's April factory data fell short of expectations and raised hopes monetary authorities in the world's biggest metals consumer may embark on further easing, underpinning demand.

Annual industrial output grew 9.3 percent in April, up from a seven-month low of 8.9 percent hit in March but still missing market expectations for a 9.5 percent expansion.

POSITIVE TREND

European shares had started the week at five-year highs and their elevated levels gave investors a reason to cash in some gains ahead of key first quarter economic growth figures due on Tuesday and Wednesday.

The continent's top stocks on the FTSEurofirst 300 index (.FTEU3) were 0.3 percent lower by mid-morning as London's FTSE 100 (.FTSE), Paris's CAC-40 (.FCHI) and Frankfurt's DAX (.GDAXI) slipped 0.3 to 0.4 percent.

MSCI's global index <.miwd00000pus> was flat at 374.22 points, while futures prices (SPc1) pointed to some profit taking on Wall Street following its recent highs. (.N)(.L)(.EU)

Strategists at Deutsche Bank said the longer-term trend remained positive, citing stronger data from the United States and early signs of a turnaround in Europe. "We remain both strategically and tactically positive on euro area equities," they wrote in a note.

The comments from Italian Ignazio Visco, one of the ECB's top policymakers, lifted benchmark German Bund futures away from their lowest in more than a month after last week's sell-off on upbeat economic euro zone and U.S. data.

A 5 billion euro auction of Italian three- and 13-year debt created little noise as the backstop of promised ECB support continued to bolster demand for the bonds of the euro zone's more indebted members.

If the ECB compliments a cut to its 0.5 percent main rate by pushing its zero percent deposit rate into negative territory, banks would effectively be charged for parking any spare cash they don't lend.

Analysts believe that would prompt investors to look for other more profitable ultra-safe options such as Bunds.

"We all agreed in the council that we have to look with care and in that case we may reduce the rate," Visco told CNBC in an interview.

"We think that - and I personally think that, this is effective - the economy now is capable of taking it on board."

(Editing by Catherine Evans)