From mobile phone charges to nations' interests, these shadowy agitators are estimated to influence 75% of European legislation

When the Polish MEP Róża Thun was elected five years ago, she

thought the job would be fairly straightforward. She hadn't reckoned

with the lobbyists.

Take mobile phone charges. She saw the fact

that EU citizens pay eye-watering sums in other EU states as an anomaly

that needed fixing. But it wasn't that simple. "We had telephone

companies and lobbyists who started to invade us," she recalls. "They

obviously didn't want to reduce roaming charges because it would hit

them in the pocket."

To stroll around the vast, ugly and permanent

building site that is Brussels' European district is to brush up

against the power of the lobbies. Every office block, every glass and

steel construction within a kilometre of the

European commission, council and parliament is peopled by

Europe's biggest corporate names.

Thousands

of companies, banks, law firms, PR consultancies and trade associations

are there to bend ears and influence the regulations and laws that

shape Europe's single market, fix trade deals, and govern economic and

commercial behaviour in a union of 507 million.

Lobbying

is a billion-euro industry in Brussels. According to Corporate Europe

Observatory, a watchdog campaigning for greater transparency, there are

at least 30,000 lobbyists in Brussels, nearly matching the 31,000 staff

employed by the European commission and making it second only to

Washington in the concentration of those seeking to affect legislation.

Lobbyists sign a transparency register run by the parliament and the

commission, though it is not mandatory.

By some estimates, they

influence 75% of legislation. In principle, lobbyists give politicians

information and arguments during the decision-making process. In

practice, the corridors of the parliament often teem with individuals,

who meet MEPs in their offices or in open spaces such as the "Mickey

Mouse bar" (nicknamed so because of the shape of its seats) inside the

parliament.

They explain their concerns, provide a "position

paper", and send in suggestions for amendments to legislative proposals.

Of course, the final decision is taken by MEPs. But examples are legion

of the tail wagging the dog.

Lobbying is such a crucial part of

the climate in Brussels that it has spawned manuals, a documentary (Who

Really Runs the EU?) and even "the worst lobby awards". Not

surprisingly, the biggest movers and shakers agitate for the biggest

industries with the most to gain – and lose – from European legislation.

Energy

David Cameron visits the Total Oil shale drilling site in Gainsborough, Lincolnshire in January. Photograph: Getty Images

David Cameron visits the Total Oil shale drilling site in Gainsborough, Lincolnshire in January. Photograph: Getty Images

It is a fertile time to be an energy lobbyist in Brussels. Vladimir

Putin's stranglehold on Europe's gas supplies and campaign to dismember

Ukraine have thrust energy to the top of the international and European

agenda.

When Barack Obama visited EU headquarters in March, he had

stern words in public – and even stronger remarks in private, according

to senior diplomats – for Europe's leaders, telling them they had to

risk the wrath of their voters and go for fracking and shale gas to help

immunise Europe against Russian blackmail.

In a letter to Downing

St in November, Ivan Rogers, the UK's ambassador to the EU, laid out a

strategy for leaning on the commission to get it to adopt a minimalist

position on shale exploration, entailing no new EU legislation. A week

later David Cameron wrote to the commission chief, José Manuel Barroso,

insisting on the light-touch regulation.

America's shale

revolution, entrenching low energy prices in the US, is having a big

impact, leading to a bonanza for the fracking lobbies in Brussels.

From

shale to climate-change policies, from car exhaust rules to renewables,

from carbon-capture technologies to carbon-trading schemes, the energy

lobby is highly active and successful in Brussels, with companies such

as BP and Shell maintaining big operations aimed at shaping policy. "In a

nutshell the energy-intensive lobbies say they are not competitive,

especially vis-a-vis the US, because of shale and the low prices there,"

says an industry insider engaged in Brussels lobbying. "They argue that

we're much too focused on renewables and climate change and that we

should be much more open like the US."

The most effective lobbying

in Brussels centres on the gamekeepers-turned-poachers, the revolving

door of senior commission officials, diplomats, and MEPs who retire or

quit public office and instantly take up offers to translate their

contacts and inside knowledge into lucrative lobbying work, often by

moving to an office across the street.

Take Jean de Ruyt, a

Belgian who knows Brussels inside out. As ambassador to the EU, the

career diplomat in effect ran Belgium's EU presidency four years ago,

then retired, took up a job with a US law firm and is now a leading

figure in the shale lobby.

His No 2 as ambassador is now chief of staff to Herman Van Rompuy, the president of the European council steering EU summits.

For

the shale lobby, Ukraine and Putin may represent less of a crisis than a

huge opportunity. "The Ukraine crisis is seen as a blessing, giving the

shale-gas lobby the perfect chance to say if you want to get rid of

dependence on Russian gas…" said Antoine Simon, who analyses the

politics of the extractive industries for Friends of the Earth.

Tobacco

Lobbies in Brussels rushed to launch a counteroffensive against an EU tobacco directive. Photograph: Bernhard Classen/Alamy

Lobbies in Brussels rushed to launch a counteroffensive against an EU tobacco directive. Photograph: Bernhard Classen/Alamy

In February the EU approved a new

tobacco directive,

which is designed to make smoking less attractive, particularly to

young people. The lobbies in Brussels did not scrimp on resources as

they rushed to launch a counteroffensive. About 200 representatives of

three of the biggest tobacco companies, Philip Morris International,

British American Tobacco and Japan Tobacco, spent four weeks in the

city, hogging hotels and spending more than €3m (£2.5m) on an action

plan to weaken future regulation in two parts: persuading the European

commission, and trying to convince MEPs and national governments.

Juan

Páramo is a spokesman for Mesa del Tabaco, which represents the Spanish

tobacco industry. He says he met Spanish MEPs "on various occasions" to

explain the impact the directive would have on a "key" sector for

Spain.

"Lobbies aren't how they are depicted in the movies, but

you have to be careful with your strategies," says Andrés Perelló, a

veteran socialist MEP and a member of the environment, public health and

food safety committee. He is used to contending with industries

relating to cars, fuel or medicine – which are all heavily exposed to

regulatory changes – but he cannot think of a single industry that piles

as much pressure on as the tobacco sector. He has no problem with

lobbies when they stick to an "adequate" code of conduct. He has also

rejected many of their manoeuvres. "We are always ready to have a

dialogue, we don't feel pressurised by anybody," he says. Any time a

lobbyist comes to see him is "totally transparent", he says, and one of

his assistants always takes notes of these meetings. "To be clear," he

adds.

Another MEP felt pressurised by the visits, which he says

were "very cordial, and absolutely threatening". He says the lobbying

did not affect his final vote. "It didn't taste good, but all of these

procedures were legal," he says.

With something as sensitive as

tobacco regulation, health associations act as a sort of anti-lobby.

"Faced with the tremendous pressure of the tobacco monopolies, nurses

have had to do something they were not at all used to: lobby for public

health," says Francisco Rodríguez, president of Spain's national

committee for the prevention of smoking.

Nonetheless, far from the

influence of the ordinary channels, the map of pressures on an

oligopolistic market as important as tobacco brings with it all kinds of

intrigues behind the scenes.

Confidential documents published by the Guardian in September

shows how the giant of the sector, Philip Morris International, managed

to postpone a vote by MEPs on the anti-smoking directive. "It was quite

disgusting," says a high-level parliamentary source.

Diplomats

European Union flags outside the European commission headquarters in Brussels. Photograph: Yves Herman/Reuters

European Union flags outside the European commission headquarters in Brussels. Photograph: Yves Herman/Reuters

One of the principal instruments in Brussels is diplomatic lobbying

by member states. "The big embassies make a conscious effort to stay in

contact with the strongest national delegations in parliament," says

Florent Saint Martin, associate professor at Sciences Po, and a former

MEP assistant who founded his own lobby consultancy. French MEPs receive

detailed memos from the general secretariat of European affairs, an

intergovernmental structure in Paris. A European affairs minister acts

as the official correspondent with the European parliament.

"It's

not so much as explaining how a vote should go," says Jean-Paul Gauzès, a

French MEP and a financial specialist, "but about providing

explanations on the texts which will be voted upon, and on defending the

French interest in them."

"It's now possible for us to check in

with an MEP to counter or amend a text we consider to be against our

interests," says Alexis Dutertre, a permanent representative for France

to the EU. "However, having 28 member states today is more difficult

than having six, 12 or 15 to win a majority, or build a minority

blocking other states with." Colleagues are supposed to spend as much

time at the European parliament as in the European council, the

bread-and-butter work of the European diplomat.

But the relationship between diplomat and MEP could be under pressure if the far-right parties gain seats at the

European elections.

"A Front National delegation will cause a really big problem because

they are absent, to the point of being incontrollable," predicts Olivier

Costa, director of political studies at the College of Europe in

Bruges. Costa believes France's position is coming to resemble that of

the UK, which has its fair share of Eurosceptic MPs.

"If the Front

National win 20 seats, we'll only be able to count on some 50 useful

MPs," says a French spokesman. "That will rank us alongside the next

level down of populated countries, such as Spain and Poland."

Big tech

A man walks past a logo created from pictures of Facebook users in

the company's data centre in Lulea, in Swedish Lapland. Photograph:

Jonathan Nackstrand/AFP/Getty Images

A man walks past a logo created from pictures of Facebook users in

the company's data centre in Lulea, in Swedish Lapland. Photograph:

Jonathan Nackstrand/AFP/Getty Images

One of the most prominent Brussels lobbyists is Erika Mann of

Facebook. She spent 15 years with the German Social Democrats before

walking through the "revolving door" to the lobbyists.

The latest

figures in the official EU lobby register reveal Facebook spent less

than €500,000 on lobbying in Brussels in 2012. That's surprisingly low:

Facebook invested about $2.8m (£1.7m) in the first quarter of 2014 alone

in the US. But US tech companies such Facebook, Google, Amazon and

Microsoft rarely work as individual companies but more in corporate

alliances. Jan-Philipp Albrecht, the German Green MEP responsible for

the data protection reform act in parliament, estimates that more than

half of companies that contact him are from the US. Other MEPs say the

pressure is unprecedented.

In February 2013 the

lobbyplag.eu website

found some MEPs were not only inspired to make amendments suggested by

US firms, but copied and pasted huge passages of text sent by lobbyists.

Understanding who is doing the lobbying is not always straightforward:

not all lobbyists are open about their allegiance – some even send their

"suggestions" on paper with no clear letterhead.

Mann is more

candid, always present in the debate, a regular on the public speaking

and debate circuit, even turning up to European parliament sessions.

It's hard to say how influential she has been after just a few months in

the job. But one thing is for sure: the longer negotiations run on, the

longer lobbyists kick about to try to influence proceedings. With data

protection, as with everything in Brussels, "nothing is approved until

everything is approved".

Consumer protection

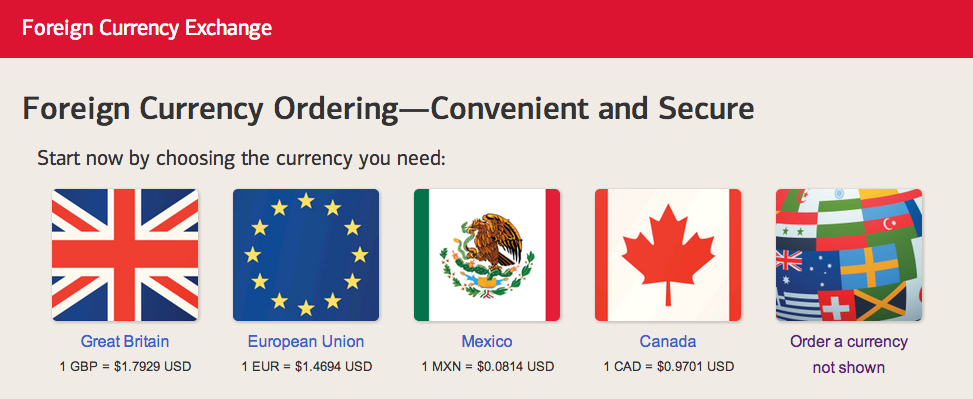

Compared

with these other formidable pressure groups, consumer protection is the

poor relation of the lobbying family. The only voice for consumers in

Brussels is Beuc, the Bureau of European Consumer Organisations. It has

35 employers and almost half its budget comes from the EU itself, making

negotiation tricky.

If, for example, a consumer is tricked by a

dodgy tour operator, there is little the EU can do. Beuc has acted in a

few cases for consumers, mobile phone roaming charges and food labelling

being among them. "Our task is to balance the industrial lobbies," says

Johannes Kleis, a spokesman for Beuc. But in terms of fighting industry

lobbies, it's David v Goliath. "One regret is that we have only

recently started looking into consumer issues in financial services,"

Kleis says. While this may be handled at a nation-state level, Kleis

says it's not enough "given that the market is global".